Atrys Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Atrys Bundle

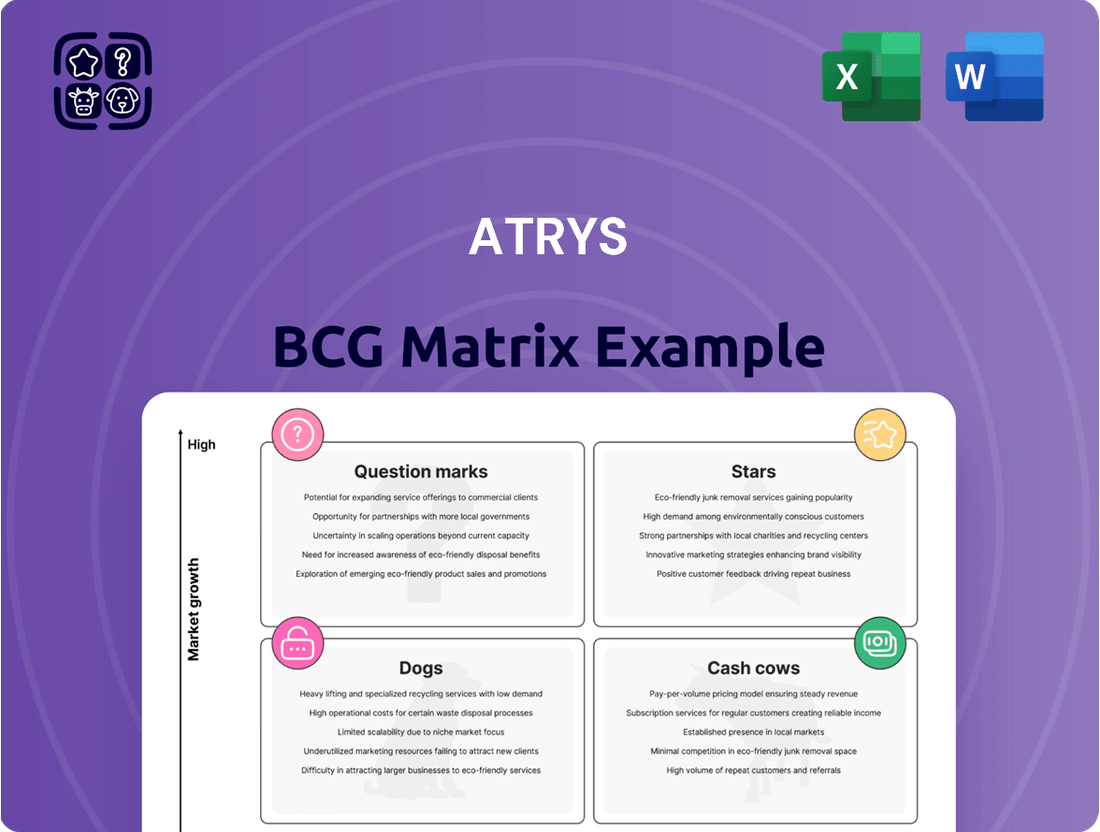

Understand how Atrys strategically positions its products within the market, identifying potential Stars, Cash Cows, Dogs, and Question Marks. This glimpse offers a foundational understanding of their portfolio's health. Purchase the full BCG Matrix report for a comprehensive breakdown of each product's quadrant placement, actionable insights, and a clear path for optimizing resource allocation and future investments.

Stars

Atrys' oncology treatment services, especially in Latin America, represent a significant star in its BCG matrix. The global radiation oncology market is expected to see robust expansion, with projections indicating a compound annual growth rate of over 7% leading up to 2028. Atrys' strong presence and growth in Mexico's oncology sector, coupled with its leading position in Spain, highlight its high market share within these high-growth regions.

Atrys' business-to-business telediagnosis services, particularly in Chile and Colombia, are firmly positioned as Stars within the BCG matrix. These markets are experiencing robust growth, fueled by a global surge in demand for accessible remote healthcare solutions.

The global telehealth and telemedicine markets are projected for substantial expansion, with some forecasts indicating a compound annual growth rate (CAGR) exceeding 20% in the coming years, reaching hundreds of billions of dollars by the late 2020s. Atrys' strong market share in these dynamic Latin American regions, coupled with the telemedicine sector's rapid ascent, solidifies its Star status, indicating high growth and a strong competitive position.

Atrys' commitment to embedding AI within its precision medicine offerings, particularly in diagnostics and genomics, places these solutions in a strong position for future expansion. The global precision medicine market is projected for significant growth, with forecasts indicating a compound annual growth rate (CAGR) that could reach over 12% by 2027.

While precise market share figures for AI-integrated precision medicine are still emerging, Atrys' proactive investment in this technologically advanced segment signals considerable growth potential. This strategic focus allows Atrys to cultivate a competitive advantage by being at the forefront of innovation in a rapidly evolving healthcare landscape.

New Radiotherapy Units and Oncology Partnerships

Atrys is strategically expanding its oncology services, evidenced by the planned establishment of a new radiotherapy unit at Valdebebas Hospital, slated for June 2025. This expansion directly addresses the increasing demand within the oncology treatment sector.

Furthermore, Atrys is forging new partnerships, such as its collaboration with AXA Keralty in Mexico. These alliances are designed to penetrate high-growth markets and leverage Atrys' established reputation and specialized knowledge in cancer care.

- Expansion into new radiotherapy units: The Valdebebas Hospital unit is set to open in June 2025, increasing Atrys' capacity.

- Strategic oncology partnerships: The collaboration with AXA Keralty in Mexico aims to capture market share in a growing region.

- Market focus: These initiatives target the expanding global oncology treatment market, a segment projected for significant growth.

- Investment strategy: Atrys is investing in these areas to capitalize on its expertise and brand recognition, aiming for increased market penetration.

Expansion of Pathology and Genetics Laboratory Activities

The expansion of pathology and genetics laboratory activities, particularly in Spain and Portugal, highlights a strategic move into a high-growth area. Atrys' Madrid laboratory ramp-up signifies a commitment to specialized diagnostic services.

The Diagnostics segment, showing robust growth at constant exchange rates, is a key driver for Atrys. Within this segment, the laboratory area has experienced significant revenue increases, reflecting successful market share capture in the burgeoning field of high-value diagnostics.

- Genetics activity surge in Spain and Portugal.

- Madrid laboratory expansion fuels specialized diagnostics.

- Diagnostics segment demonstrates strong constant currency growth.

- Laboratory revenue increases indicate successful market share capture.

Atrys' oncology treatment services, particularly its operations in Latin America, are prime examples of Stars within the BCG matrix. The global radiation oncology market is expected to grow substantially, with projections indicating a compound annual growth rate exceeding 7% through 2028. Atrys' strong foothold in Mexico's oncology sector and its leading position in Spain underscore its high market share within these rapidly expanding regions.

Atrys' telediagnosis services for businesses, especially in Chile and Colombia, are also firmly established as Stars. These markets are experiencing significant expansion, driven by the increasing global demand for accessible remote healthcare solutions. The global telehealth market is anticipated to grow at a CAGR of over 20% in the coming years, reaching hundreds of billions of dollars by the late 2020s. Atrys' substantial market share in these dynamic Latin American markets, combined with the telemedicine sector's rapid growth, solidifies its Star status, indicating both high growth and a strong competitive standing.

| Business Unit | BCG Category | Market Growth | Market Share | Key Drivers |

|---|---|---|---|---|

| Oncology Treatment Services (Latin America) | Star | High (Global Radiation Oncology Market >7% CAGR to 2028) | High (Leading position in Spain, strong presence in Mexico) | Increasing demand for cancer care, expansion of services |

| B2B Telediagnosis Services (Chile, Colombia) | Star | Very High (Global Telehealth Market >20% CAGR) | High (Strong market share in dynamic regions) | Demand for remote healthcare, digital transformation in healthcare |

What is included in the product

The Atrys BCG Matrix categorizes business units by market share and growth rate, guiding investment decisions.

A clear, visual representation of your portfolio, simplifying complex strategic decisions.

Cash Cows

Atrys' preventive medicine division in Spain is a clear Cash Cow. This segment diligently monitors the health of over a million individuals, operating through an extensive network of more than 200 delegations across the country.

As the largest contributor to Atrys' revenue, this business unit solidifies its position as a top 3 player in the Spanish market for preventive healthcare services. While its growth trajectory might be less steep than newer ventures, its robust market presence ensures consistent and reliable cash generation.

Atrys' established B2B telediagnosis services in Spain are a prime example of a Cash Cow within the BCG matrix. This segment benefits from Spain's mature telemedicine market, where Atrys commands a leading position. The company's strong client relationships and optimized operations in this area likely translate to consistent, high-margin cash generation, requiring minimal additional investment to maintain its market share.

Atrys's nuclear medicine diagnosis segment in Spain and Portugal represents a significant cash cow. This mature business has a robust market presence, contributing reliably to the company's financial health.

In 2024, this segment is expected to continue its strong performance, bolstering Atrys's gross margin and adjusted EBITDA. Its stable cash generation requires minimal reinvestment, freeing up capital for other strategic initiatives.

Core Medical Imaging Services

Atrys' core medical imaging services, particularly within Spain, are positioned as a Cash Cow. While the overall Spanish medical imaging market experiences moderate growth, these established services, bolstered by integration with Atrys' telemedicine capabilities, generate stable and predictable revenue streams. Their strong market share in specific niches, coupled with existing infrastructure, ensures consistent profitability.

The company's focus on these core services allows for efficient operations and reliable cash flow generation. This stability is crucial for funding investments in other, higher-growth areas of the business. In 2024, Atrys reported a significant portion of its revenue stemming from diagnostic services, underscoring the importance of its imaging segment.

- Established Market Presence: Atrys holds a solid position in the Spanish medical imaging sector, benefiting from long-term client relationships and a recognized brand.

- Integrated Telemedicine: The synergy between imaging services and telemedicine platforms enhances efficiency and broadens service reach, contributing to consistent demand.

- Revenue Stability: These services provide a dependable source of income, characterized by high utilization rates and well-defined cost structures.

- Profitability Driver: Due to economies of scale and operational maturity, the imaging segment likely exhibits healthy profit margins, acting as a key contributor to Atrys' overall financial performance.

Existing Diagnostic Support Services

Existing diagnostic support services, particularly in pathological and molecular anatomy, form the bedrock of Atrys' precision medicine capabilities. These are mature, essential services with a predictable demand, leveraging Atrys' established infrastructure and expertise. They are expected to function as cash cows, providing a consistent and reliable income stream with manageable operational costs within the healthcare diagnostics sector.

- High Demand: Pathological and molecular anatomy services are fundamental to patient diagnosis and treatment planning across a wide range of medical conditions.

- Established Expertise: Atrys' existing network and specialized knowledge in these areas ensure efficient and high-quality service delivery.

- Stable Revenue: The consistent need for these diagnostic tests translates into a reliable revenue stream, contributing significantly to Atrys' financial stability.

- Mature Market: Operating in a well-established segment of the healthcare market allows for predictable cost structures and operational efficiencies.

Atrys' preventive medicine division in Spain, a cornerstone of its operations, functions as a robust Cash Cow. This segment, serving over a million individuals through more than 200 delegations, is a top 3 player in the Spanish preventive healthcare market. Its substantial revenue contribution, though not experiencing explosive growth, ensures a steady and reliable cash flow, requiring minimal additional investment to maintain its strong market standing.

The company's established B2B telediagnosis services in Spain also exemplify a Cash Cow. Benefiting from a mature telemedicine market where Atrys holds a leading position, these services generate consistent, high-margin cash. Strong client relationships and optimized operations contribute to this predictable profitability, allowing for sustained market share with limited need for further capital infusion.

Atrys's nuclear medicine diagnosis segment in Spain and Portugal is another significant Cash Cow. This mature business unit boasts a strong market presence, consistently contributing to the company's financial health. In 2024, this segment is projected to continue its robust performance, positively impacting Atrys's gross margin and adjusted EBITDA, with its stable cash generation requiring minimal reinvestment.

Atrys' core medical imaging services, especially within Spain, operate as a Cash Cow. Despite moderate market growth, these established services, enhanced by telemedicine integration, provide stable and predictable revenue streams. Their strong niche market share and existing infrastructure ensure consistent profitability, freeing up capital for higher-growth ventures. In 2024, diagnostic services represented a significant portion of Atrys's revenue, highlighting the imaging segment's importance.

Existing diagnostic support services, such as pathological and molecular anatomy, are vital Cash Cows for Atrys's precision medicine. These mature services have predictable demand, supported by Atrys's established infrastructure and expertise. They offer a consistent income stream with manageable costs, contributing significantly to the company's financial stability.

| Segment | Market Position | Cash Flow Generation | Investment Need |

|---|---|---|---|

| Preventive Medicine (Spain) | Top 3 Player | High & Stable | Low |

| B2B Telediagnosis (Spain) | Leading Position | High & Consistent | Low |

| Nuclear Medicine Diagnosis (Spain & Portugal) | Strong Presence | Reliable & Significant | Minimal |

| Core Medical Imaging (Spain) | Strong Niche Share | Stable & Predictable | Low |

| Pathological & Molecular Anatomy | Established Expertise | Consistent & Reliable | Manageable |

Delivered as Shown

Atrys BCG Matrix

The Atrys BCG Matrix document you are currently previewing is the identical, fully formatted file you will receive immediately after completing your purchase. This means no watermarks, no altered content, and no hidden surprises – just a professionally crafted strategic tool ready for your immediate use. You can confidently rely on this preview as a true representation of the comprehensive analysis and actionable insights the purchased document will provide for your business planning. This is the exact, uncompromised report designed to offer clarity and drive informed decision-making within your organization.

Dogs

Legacy IT systems and outdated diagnostic equipment within Atrys could be categorized as Dogs in the BCG Matrix. These assets, while perhaps functional, are likely characterized by high maintenance expenses and low operational efficiency, especially when compared to the company's forward-looking AI and telemedicine initiatives.

Such underperforming assets offer little to no competitive edge and may even hinder Atrys's strategic growth. For instance, if a significant portion of their diagnostic fleet remains analog rather than digital, it would struggle to integrate with advanced data analytics crucial for AI-driven insights. The cost of maintaining older hardware often outweighs its utility, consuming resources that could be better allocated to modernizing operations.

Underperforming acquired entities that haven't integrated well into Atrys's precision or preventive medicine focus, or that are stuck in slow-growing, fragmented markets where they hold little sway, would be classified as Dogs. These acquisitions drain valuable resources and management attention without yielding significant returns, mirroring the situation with past divestments like Conversia.

Niche services in highly saturated local markets, where Atrys has a minimal presence, would likely fall into the Dogs category of the BCG Matrix. These offerings are characterized by low growth potential and a small market share, often struggling to generate significant revenue. For instance, if Atrys offers specialized IT support for a single small town with numerous established competitors, this service might be considered a Dog. In 2024, such a niche service might only capture 0.5% of a local market estimated at $1 million annually, yielding just $5,000 in revenue, barely covering operational costs.

Non-Core Business Ventures from Past Diversification

Atrys' past diversification efforts may have included ventures outside its core focus on precision medicine and advanced diagnostics. If these legacy businesses exhibit low market share and minimal growth, they would be classified as Dogs within the BCG matrix. For instance, if Atrys previously invested in a traditional laboratory services division that has since been overshadowed by its advanced genomic sequencing capabilities, this division could represent a Dog. Such ventures often drain resources without contributing significantly to overall growth or profitability.

Divesting these non-core Dog businesses is a strategic imperative. By shedding these underperforming assets, Atrys can reallocate capital and management attention to its promising Stars and Question Marks, particularly those in the rapidly expanding precision medicine sector. In 2024, the global precision medicine market was valued at approximately $67.5 billion and is projected to grow significantly, making the focus on this area crucial for Atrys' future success.

- Legacy Ventures: Businesses from past diversification that are no longer central to Atrys' precision medicine and advanced diagnostics strategy.

- Low Growth, Low Share: These ventures typically demonstrate minimal market growth and hold a small market share.

- Divestment Opportunity: Prime candidates for divestment to unlock capital for high-potential strategic areas.

- Resource Reallocation: Selling off Dogs allows Atrys to focus resources on its Stars and Question Marks, aligning with market trends in precision medicine.

Inefficient Internal Processes or Underutilized Facilities

Inefficient internal processes or underutilized physical facilities can act as 'Dogs' within a company's resource allocation, draining capital without yielding proportionate returns. For Atrys, this could manifest as underperforming clinics or administrative functions that consume significant operational expenditure.

The company's strategic focus on enhancing productivity and efficiency is a direct attempt to address these potential 'internal dogs.' This includes optimizing its network of healthcare centers and implementing process automation to streamline operations.

For instance, Atrys has been actively working on consolidating and optimizing its physical footprint. While specific figures for 2024 are still emerging, the company's ongoing efforts in prior years have aimed at improving the utilization rates of its facilities.

- Resource Drain: Inefficient processes and underused facilities represent a significant drain on Atrys' operational expenditure.

- Strategic Focus: Atrys is actively working to improve productivity and efficiency across its operations.

- Optimization Efforts: This includes optimizing its network of healthcare centers and automating key processes.

- Value Creation: The goal is to eliminate these 'internal dogs' by ensuring resources generate proportional value.

Dogs in Atrys' portfolio represent ventures with low market share in low-growth sectors, often requiring significant resources without substantial returns. These could include legacy IT systems or niche services in saturated markets, as exemplified by a hypothetical small-town IT support service in 2024 generating only $5,000 in revenue from a $1 million market. Divesting these underperforming assets is crucial to reallocate capital towards high-growth areas like precision medicine, a market valued at approximately $67.5 billion in 2024.

| Category | Description | Example for Atrys | 2024 Market Context | Strategic Implication |

| Dogs | Low market share, low market growth | Legacy IT systems, niche local services | Precision Medicine Market: $67.5 billion (2024) | Divestment, resource reallocation |

| Underperforming acquired entities | ||||

| Inefficient internal processes |

Question Marks

Atrys' strategic move into new geographic territories outside its core Latin American and Spanish markets represents a bold step into question mark territory on the BCG matrix. These expansions target regions with significant growth potential, but as new entrants, Atrys faces the challenge of establishing a market presence from a low initial share.

For instance, Atrys has been actively exploring opportunities in markets like the United States and other European countries. These ventures require considerable capital investment for market entry, brand building, and developing local partnerships, mirroring the characteristics of question mark businesses needing significant resources to cultivate future stars.

Atrys' dedication to specialized clinical trials, especially in cutting-edge fields like nuclear medicine for neurodegenerative and oncological conditions, positions them as a key player in future therapeutic development. These initiatives, while demanding substantial investment and currently yielding low immediate returns, represent a significant long-term growth opportunity.

For instance, Atrys' ongoing Phase II trial for a novel radiotracer in Alzheimer's disease, initiated in 2023, exemplifies this strategy. Such ventures require considerable upfront capital, mirroring the characteristics of question marks in the BCG matrix, where high market growth potential is offset by low current market share and profitability.

While Atrys excels in established genetics, venturing into advanced genomic and molecular diagnostics beyond current scale presents a significant opportunity. These cutting-edge areas, like liquid biopsy for early cancer detection or complex gene sequencing for rare diseases, are still in early adoption but hold immense growth potential, driven by the personalized medicine revolution. For instance, the global liquid biopsy market was projected to reach $11.9 billion by 2028, showcasing this burgeoning demand.

Integration of New Digital Health Technologies (e.g., Self-Management Tools)

Integrating new digital health technologies, like self-management tools for clients and specialized worker apps, positions Atrys as a potential star in the BCG matrix. These offerings aim to tap into the burgeoning digital health market, which saw global revenue reach an estimated $211 billion in 2023, with projections suggesting continued strong growth.

While these innovations enhance operational efficiency, their success hinges on achieving substantial user adoption and market penetration. For instance, the digital health market is expected to grow at a compound annual growth rate (CAGR) of over 15% through 2030, indicating significant opportunity but also intense competition.

- Market Opportunity: The global digital health market is experiencing rapid expansion, driven by increasing demand for remote patient monitoring and personalized healthcare solutions.

- Investment Required: Significant investment in technology development, marketing, and user onboarding is necessary to gain traction in this competitive landscape.

- Adoption Challenges: User adoption rates for new digital health tools can be a bottleneck, requiring effective strategies to demonstrate value and build trust among both clients and healthcare professionals.

- Path to Profitability: Achieving profitability requires transitioning from high initial investment and demand generation to sustained user engagement and revenue generation through these new digital offerings.

Emerging Partnerships and Business Lines in Nascent Markets

Atrys is actively exploring emerging partnerships and business lines in nascent markets, particularly within high-growth sectors where its current market share is minimal. These ventures are strategically positioned to capitalize on future industry trends, demanding significant investment to cultivate them into potential Stars. For instance, Atrys's recent expansion into the AI-driven diagnostics sector, a market projected for substantial growth, exemplifies this strategy.

- AI-driven diagnostics: Atrys is investing in partnerships to develop and deploy AI-powered diagnostic tools, targeting areas with unmet medical needs and high potential for technological disruption.

- Telemedicine platforms: The company is also exploring collaborations to build out its telemedicine offerings, aiming to capture market share in the rapidly expanding remote healthcare services industry.

- Personalized medicine solutions: Atrys is evaluating opportunities in personalized medicine, seeking partnerships that can leverage genetic data and advanced analytics for tailored patient treatments.

- Biotechnology research: Investments are being made in early-stage biotechnology research, focusing on novel therapeutic areas with the potential for significant future market penetration.

Atrys' strategic ventures into new geographic markets and advanced diagnostic areas, such as AI-driven diagnostics and liquid biopsy, firmly place them in the Question Mark category of the BCG matrix. These initiatives require substantial investment due to their nascent market share and high growth potential.

The company's expansion into the United States and other European countries, alongside its commitment to specialized clinical trials in nuclear medicine, exemplifies this. These areas demand significant capital for market entry and research, mirroring the resource-intensive nature of Question Marks needing to build market share.

For instance, Atrys' Phase II trial for an Alzheimer's radiotracer, initiated in 2023, requires considerable upfront capital. Similarly, the global liquid biopsy market, projected to reach $11.9 billion by 2028, represents a high-growth but currently low-share opportunity for Atrys.

The integration of digital health technologies, targeting a market that reached an estimated $211 billion in 2023, also falls into this category. While holding immense growth potential, these ventures necessitate significant investment to achieve widespread user adoption and market penetration in a competitive landscape.

| Strategic Area | Market Growth Potential | Current Market Share | Investment Needs | BCG Category |

| New Geographic Markets (e.g., US, Europe) | High | Low | High | Question Mark |

| Nuclear Medicine Trials (e.g., Alzheimer's) | High | Low | High | Question Mark |

| Advanced Genomic Diagnostics (e.g., Liquid Biopsy) | High (projected $11.9B by 2028) | Low | High | Question Mark |

| Digital Health Technologies | High (estimated $211B in 2023) | Low | High | Question Mark |

| AI-driven Diagnostics | High | Low | High | Question Mark |

BCG Matrix Data Sources

Our BCG Matrix is constructed using comprehensive data from financial statements, market research reports, and industry growth forecasts to provide a clear strategic overview.