Asia Timber Products Co. Ltd. PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Asia Timber Products Co. Ltd. Bundle

Uncover the critical political and economic factors shaping Asia Timber Products Co. Ltd.'s operations, from evolving trade policies to global market fluctuations. Our PESTLE analysis delves into these external forces, providing you with the foresight needed to navigate the competitive landscape. Gain a strategic advantage – download the full report now for actionable intelligence.

Political factors

Global geopolitical instabilities, such as the ongoing Red Sea conflict which began in late 2023, continue to disrupt timber supply chains and elevate shipping costs. This directly impacts Asia Timber Products Co., Ltd.'s import and export operations, as evidenced by the significant increase in freight rates observed throughout 2024. For instance, container shipping rates from Asia to Europe saw a surge of over 100% in early 2024 compared to the previous year.

Furthermore, trade disputes and the potential imposition of tariffs, like the proposed U.S. reciprocal tariff on certain Indonesian and Vietnamese wood products, can alter market access and competitiveness. While specific tariff percentages are still under discussion as of mid-2025, such measures could increase the cost of Asian timber products for U.S. consumers, potentially impacting demand and forcing companies like Asia Timber Products Co., Ltd. to re-evaluate sourcing and sales strategies.

Governments across Asia are increasingly focusing on deregulating export and import processes for wood-based products. This initiative aims to simplify trade and boost the competitiveness of local industries. For instance, Indonesia is working towards removing the requirement for V-Legal documents for furniture exports to nations outside the European Union. This policy shift, expected to be fully implemented by late 2024, could significantly reduce administrative hurdles for companies like Asia Timber Products Co. Ltd.

Changes in foreign investment regulations significantly impact Asia Timber Products Co. Ltd. For instance, Thailand is considering easing foreign equity thresholds, a move that could attract more foreign capital into the timber sector. This could lead to increased competition but also offer new avenues for partnerships and technology transfer.

National Forestry Policies and Pledges

National forestry policies across Asia are increasingly focused on conservation and sustainable resource management, directly impacting timber availability. For instance, Malaysia has committed to maintaining over 50% forest cover, a significant pledge that influences how much timber can be legally harvested.

These stringent national policies, including regulations on allowable cut rates, create a more challenging environment for companies like Asia Timber Products Co. Ltd. when sourcing raw materials. The emphasis on sustainability often translates to higher costs for responsibly managed timber, affecting production expenses.

Key policy impacts include:

- Increased demand for certified sustainable timber: Policies promoting forest conservation drive up demand for wood products sourced from certified forests, potentially raising prices.

- Restrictions on harvesting: Stricter allowable cut rates limit the volume of timber available from national forests, requiring companies to explore alternative sourcing or invest in forest management.

- Focus on reforestation and afforestation: Government initiatives aimed at increasing forest cover may create long-term opportunities but also involve compliance costs for businesses.

Regional Trade Agreements and Integration

Ongoing discussions within ASEAN, particularly concerning the ASEAN Economic Community (AEC) blueprint, aim to foster a single market and production base. This integration seeks to reduce trade barriers and streamline customs procedures, potentially creating a more predictable and accessible market for Asia Timber Products Co., Ltd. For instance, by 2023, intra-ASEAN trade had grown significantly, with the bloc aiming for further liberalization.

The potential expansion of economic groups like BRICS, which includes major emerging economies, could also offer new avenues for trade and investment. As these blocs evolve, they may establish preferential trade agreements that benefit member nations, potentially opening up larger consumer bases and diversifying supply chains for timber products.

These regional integrations can lead to:

- Increased market access: Reduced tariffs and non-tariff barriers within blocs like ASEAN can boost export volumes for Asia Timber Products Co., Ltd.

- Supply chain stability: Greater economic cooperation can foster more resilient and predictable supply chains for raw materials and finished goods.

- Investment opportunities: Integrated markets often attract foreign direct investment, which could benefit Asia Timber Products Co., Ltd. through partnerships or expanded operations.

Government policies on trade liberalization, such as Indonesia's move to simplify export documentation for furniture by late 2024, directly benefit Asia Timber Products Co., Ltd. by reducing administrative burdens. Conversely, potential U.S. tariffs on certain Southeast Asian wood products, still under discussion as of mid-2025, could increase costs and necessitate strategic adjustments in market focus.

What is included in the product

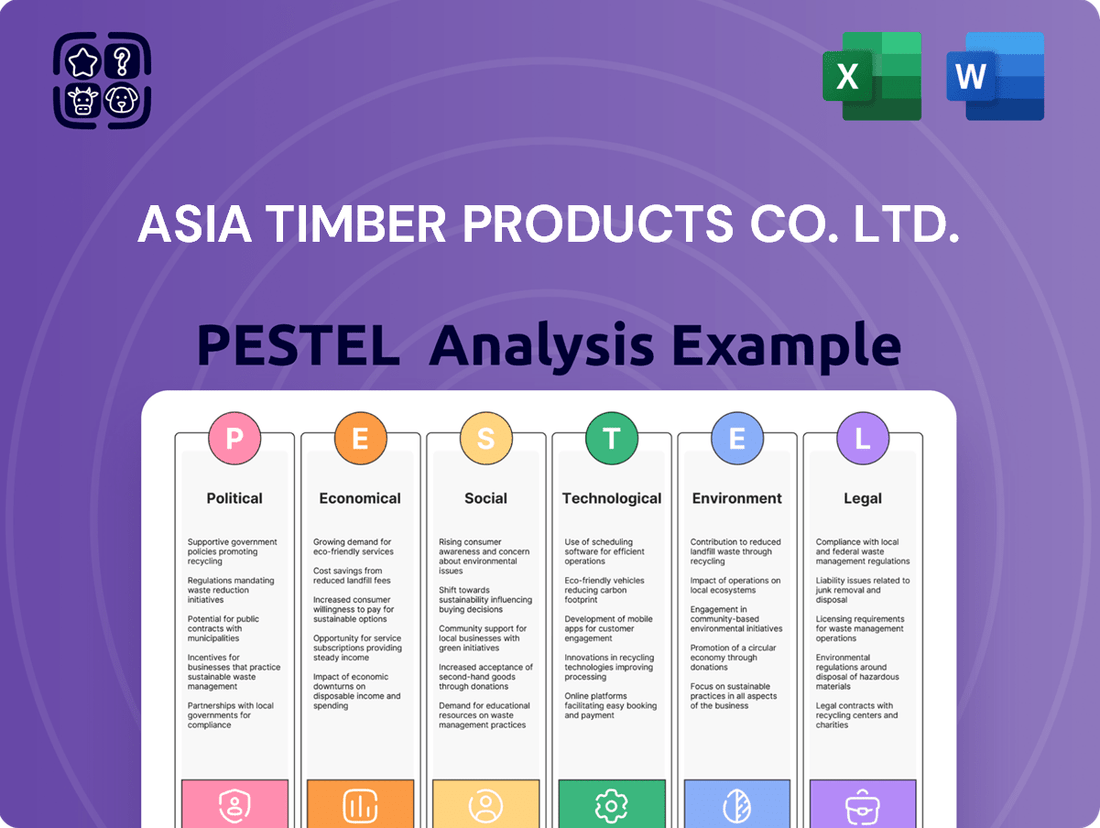

This PESTLE analysis offers a comprehensive overview of the external macro-environmental factors influencing Asia Timber Products Co. Ltd., examining Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights into how these forces shape the company's operational landscape, identifying potential threats and strategic opportunities for growth.

This PESTLE analysis for Asia Timber Products Co. Ltd. offers a clear, summarized version of external factors, relieving the pain point of information overload for quick referencing during meetings and strategic planning.

Economic factors

The post-pandemic economic landscape is showing signs of recovery, with global wood production expected to grow by 2-3% in 2025. This rebound is significantly influenced by a resurgence in the construction industry, a key consumer of timber products like MDF and laminate flooring.

Lower interest rates, a potential trend in 2025, are also expected to encourage new investments, further bolstering demand for wood-based materials. This improved market sentiment suggests a more favorable environment for companies like Asia Timber Products Co. Ltd.

The Asia-Pacific region remains the powerhouse for timber products, experiencing the most significant growth globally. This expansion is directly linked to ongoing urbanization and a surge in construction projects across countries like China and India. For Asia Timber Products Co., Ltd., this translates into a substantial and expanding customer base.

In 2024, the Asia-Pacific region is projected to account for over 60% of global timber consumption, a trend expected to continue through 2025. Rising disposable incomes in emerging economies within the region are further stimulating demand for housing and furniture, directly benefiting companies like Asia Timber Products Co., Ltd. by creating both domestic sales opportunities and strong export potential.

Rising disposable incomes across many Asian nations, projected to see continued growth through 2025, are fueling a significant uptick in consumer spending on home improvement. For instance, in Southeast Asia, per capita disposable income saw an average increase of 5% year-over-year in 2023, a trend expected to persist.

This economic shift is directly translating into increased demand for materials used in home renovation and DIY projects. Consumers are increasingly prioritizing quality and aesthetic appeal in their living spaces, creating a favorable market for companies like Asia Timber Products Co., Ltd. that offer solutions like laminate flooring and interior panels.

Raw Material Price Volatility

The timber industry, including the production of Medium Density Fibreboard (MDF), is significantly affected by the unpredictable nature of raw material costs. Prices for essential inputs like wood fibers and adhesives can swing considerably, directly influencing manufacturing expenses for companies such as Asia Timber Products Co., Ltd.

These price fluctuations create a challenging environment for cost management and can squeeze profit margins. For instance, the cost of wood pulp, a primary component in MDF, saw notable increases in late 2023 and early 2024 due to global supply chain disruptions and demand shifts. Similarly, adhesive prices, often linked to petrochemical markets, have experienced their own volatility.

- Wood Fiber Costs: Global wood pulp prices, a key input for MDF, experienced a surge in late 2023, with some benchmarks rising by over 15% compared to the previous year, impacting production costs.

- Adhesive Price Fluctuations: The cost of resins and adhesives, critical for binding wood fibers, has been sensitive to oil price movements, with potential increases of 5-10% observed in specific periods during 2024.

- Impact on Profitability: Unforeseen spikes in raw material expenses can reduce Asia Timber Products Co., Ltd.'s gross profit margins by an estimated 2-4% if not effectively hedged or passed on to consumers.

- Supply Chain Dependencies: The availability and cost of these raw materials are often tied to broader economic and geopolitical factors, creating ongoing uncertainty for manufacturers.

Growth in Engineered Wood Products

The market for engineered wood products, including MDF and laminate flooring, is poised for significant expansion. MDF is anticipated to grow at a compound annual growth rate ranging from 3.18% to 7% between 2025 and 2034. Laminate flooring is also set for robust growth, with projections indicating a CAGR of 5.5% to 6% from 2025 to 2030.

This upward trend translates directly into expanding opportunities for Asia Timber Products Co., Ltd.'s primary product lines. The increasing demand for these materials suggests a favorable market environment for the company's strategic focus.

- MDF Market Growth: Projected CAGR of 3.18-7% (2025-2034).

- Laminate Flooring Market Growth: Projected CAGR of 5.5-6% (2025-2030).

- Opportunity for Asia Timber Products: Sustained growth supports core business offerings.

The global economic recovery is bolstering demand for timber products, with the Asia-Pacific region leading the charge. Projected growth in construction and rising disposable incomes in emerging economies, like China and India, are key drivers, with the region expected to consume over 60% of global timber products through 2025. This creates a substantial market for Asia Timber Products Co., Ltd.

However, companies like Asia Timber Products Co., Ltd. face challenges from volatile raw material costs. For instance, wood pulp prices saw increases of over 15% in late 2023, and adhesive costs, linked to oil prices, could rise by 5-10% in 2024, potentially impacting profit margins by 2-4%.

The market for engineered wood products shows strong potential, with MDF projected to grow at a CAGR of 3.18-7% and laminate flooring at 5.5-6% between 2025 and 2030. This sustained expansion offers significant opportunities for Asia Timber Products Co., Ltd.'s core product lines.

| Economic Factor | 2024/2025 Projection/Data | Impact on Asia Timber Products Co., Ltd. |

|---|---|---|

| Global Wood Production Growth | 2-3% in 2025 | Increased overall market availability and potential demand. |

| Asia-Pacific Timber Consumption Share | Over 60% through 2025 | Dominant market for the company's products. |

| Wood Pulp Price Change (Late 2023) | Up over 15% | Increased raw material costs, potential margin pressure. |

| Adhesive Cost Projection (2024) | Potential 5-10% increase | Further upward pressure on manufacturing expenses. |

| MDF Market CAGR | 3.18-7% (2025-2034) | Sustained demand for a key product line. |

| Laminate Flooring Market CAGR | 5.5-6% (2025-2030) | Robust growth in another core product area. |

What You See Is What You Get

Asia Timber Products Co. Ltd. PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Asia Timber Products Co. Ltd. covers all key external factors influencing the company's operations. You'll gain insights into Political, Economic, Social, Technological, Legal, and Environmental aspects crucial for strategic planning.

Sociological factors

Asia's rapid urbanization is a major driver for Asia Timber Products Co., Ltd. In 2024, over 60% of the continent's population resided in urban areas, a figure projected to reach 65% by 2025. This demographic shift fuels a robust demand for housing and commercial spaces, directly benefiting timber product suppliers.

The ongoing construction boom across major Asian cities, spurred by this urbanization, translates into a greater need for flooring, furniture, and other timber-based components. For instance, infrastructure spending in Southeast Asia alone was estimated to be over $200 billion in 2024, much of which supports new urban development.

Asia's burgeoning middle class is a significant driver for Asia Timber Products Co., Ltd. This demographic expansion, particularly evident in countries like India and Vietnam, translates directly into increased spending power. For instance, by 2024, the Asian Development Bank projected that the middle class in developing Asia would comprise over 60% of the region's population, a substantial increase from previous decades.

This rise in disposable income is fueling a greater willingness among consumers to invest in their homes. Home improvement projects and the desire for more aesthetically pleasing and durable furnishings are becoming increasingly common. This trend directly benefits Asia Timber Products Co., Ltd. by boosting demand for their premium offerings, such as high-end Medium Density Fiberboard (MDF) and laminate flooring, which cater to these evolving consumer preferences.

The surge in DIY and home renovation projects directly fuels demand for wood products. In 2024, the global home improvement market was valued at over $1.2 trillion, with a significant portion attributed to consumer spending on materials. This trend benefits Asia Timber Products Co., Ltd. by increasing the market for easy-to-install items like laminate flooring and MDF panels, which are popular choices for homeowners undertaking renovations themselves.

Shift Towards Eco-Conscious Consumption

Consumers are increasingly prioritizing environmental impact, leading to a greater demand for sustainable building materials. This trend is particularly strong in developed Asian markets, with a growing number of consumers willing to pay a premium for eco-certified products. For instance, a 2024 survey indicated that over 60% of urban dwellers in major Southeast Asian cities consider sustainability a key factor in their purchasing decisions for home renovation and construction.

Asia Timber Products Co., Ltd. can capitalize on this by emphasizing the responsible sourcing and production of its timber. Highlighting certifications like the Forest Stewardship Council (FSC) can resonate with this eco-conscious segment. The company's adherence to green building standards, such as those promoted by the Green Building Council Singapore, further positions its products as desirable alternatives to less sustainable options.

The market for green building materials in Asia is projected for robust growth. By 2025, the global green building materials market is expected to reach $294.4 billion, with Asia-Pacific being a significant contributor. This presents a clear opportunity for Asia Timber Products Co., Ltd. to expand its market share by aligning its product offerings with evolving consumer values.

- Growing Consumer Demand: Over 60% of urban Asian consumers consider sustainability in purchasing decisions (2024 data).

- Market Opportunity: The global green building materials market is set to reach $294.4 billion by 2025, with Asia a key growth region.

- Competitive Advantage: Highlighting FSC certification and adherence to green building standards can differentiate Asia Timber Products Co., Ltd.

- Brand Reputation: Demonstrating commitment to eco-friendly practices enhances brand image and consumer trust.

Demand for Aesthetic and Customizable Designs

Consumers are increasingly drawn to flooring and furniture that offers a wide array of designs, colors, and visual textures. This includes a growing demand for hyper-realistic effects mimicking natural materials like wood and stone. This trend presents a significant opportunity for Asia Timber Products Co., Ltd. to expand its product lines, particularly in areas like laminate flooring and melamine-faced panels, by focusing on customizable and on-trend aesthetics.

The global market for wood-based panels, including laminate and melamine products, saw robust growth leading up to 2024. For instance, the laminate flooring market alone was projected to reach over $12 billion by 2025, driven by consumer demand for durable and aesthetically pleasing options. This indicates a strong market appetite for the types of customizable designs Asia Timber Products can offer.

- Growing consumer preference for personalized home décor solutions.

- Increased demand for realistic wood and stone visual effects in interior design.

- Market expansion opportunities in laminate flooring and melamine-faced panels due to customization trends.

- The global wood panel market continues to expand, with decorative surfaces being a key growth driver.

Asia's increasing focus on health and well-being is shaping consumer preferences for interior environments. This translates to a demand for products that contribute to better indoor air quality and overall comfort. For instance, by 2024, many Asian countries were strengthening regulations around volatile organic compound (VOC) emissions in building materials, pushing manufacturers towards healthier options.

This growing awareness of healthy living directly impacts the demand for timber products that are perceived as natural and non-toxic. Asia Timber Products Co., Ltd. can leverage this by highlighting the low-VOC or zero-VOC properties of its engineered wood products, such as Medium Density Fiberboard (MDF) and particleboard, which are often used in furniture and cabinetry.

The trend towards smaller living spaces in urban areas also drives demand for multi-functional and space-saving furniture. This creates an opportunity for Asia Timber Products Co., Ltd. to develop innovative designs using their materials that cater to these specific needs. For example, the company could focus on modular furniture solutions or integrated storage systems manufactured from their wood panels.

The increasing adoption of smart home technologies also presents a sociological shift that can influence furniture and interior design choices. Consumers are looking for integrated solutions that blend aesthetics with functionality, potentially incorporating charging ports or smart lighting into wooden furniture. Asia Timber Products Co., Ltd. can explore partnerships or product development to meet these evolving lifestyle demands.

| Sociological Factor | Impact on Asia Timber Products Co., Ltd. | Supporting Data/Trend (2024-2025) |

|---|---|---|

| Health & Well-being Focus | Increased demand for low-VOC and healthier building materials. | Stricter VOC emission regulations in several Asian countries by 2024. |

| Urbanization & Smaller Living Spaces | Demand for multi-functional and space-saving furniture. | Continued trend of decreasing average household size in major Asian metropolises. |

| Smart Home Integration | Opportunity for furniture with integrated technology features. | Growing consumer adoption of smart home devices across Asia, projected to increase by 15% in 2025. |

Technological factors

Technological advancements, especially in digital printing, are revolutionizing how laminate flooring and panels are made. These innovations allow for incredibly realistic wood and stone finishes, giving consumers more choices and better aesthetics. This means Asia Timber Products Co., Ltd. can create a broader selection of visually appealing and customizable products, directly responding to what customers want in 2024 and beyond.

The global digital printing market for packaging and decor, which includes flooring, was valued at approximately $15.5 billion in 2023 and is projected to grow significantly. This growth highlights the increasing demand for customized and high-quality finishes, a trend Asia Timber Products Co., Ltd. can leverage by adopting these advanced manufacturing techniques to enhance its product offerings and market competitiveness.

The increasing adoption of engineered wood products like cross-laminated timber (CLT) and glulam is significantly broadening wood's potential in construction, even for high-rise structures. These innovations are making wood a more viable and sustainable alternative to traditional materials.

While Asia Timber Products Co., Ltd. does not directly produce CLT, its established proficiency in MDF and particleboard manufacturing positions it well to integrate into or support the expanding engineered wood ecosystem. This synergy could involve supplying components or leveraging shared manufacturing expertise.

The global engineered wood market was valued at approximately $14.5 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 6% through 2030, indicating a robust demand for these innovative wood-based materials.

The timber industry is seeing significant gains from automation and AI. For instance, advanced robotic systems in sawmills, operational since late 2023, have demonstrated up to a 15% increase in processing speed and a 10% reduction in material waste. This surge in efficiency directly translates to improved product consistency and lower operational costs for companies like Asia Timber Products Co., Ltd., making them more competitive in the global market.

Enhanced Wood Treatment Techniques

Innovative wood treatment techniques, such as thermal modification and acetylation, are significantly boosting timber's resilience against decay and insect infestation. These processes, often involving heat or chemical alteration, enhance durability without relying on traditional, potentially less environmentally friendly preservatives. For Asia Timber Products Co., Ltd., this translates to a stronger value proposition.

These advancements are opening new markets for wood products, moving them into applications previously dominated by more synthetic materials. For instance, thermally modified wood can now be used in exterior cladding and decking, areas demanding high weather resistance. The global market for modified wood is projected to grow substantially, with some estimates suggesting a compound annual growth rate (CAGR) of over 6% between 2024 and 2030, indicating strong demand for these enhanced materials.

- Enhanced Durability: Treatments like Accoya and Thermowood offer extended lifespans, reducing replacement cycles and associated costs for end-users.

- Environmental Benefits: Many new techniques reduce or eliminate the need for toxic chemicals, aligning with growing sustainability demands.

- Market Expansion: Increased performance characteristics allow timber to compete in demanding sectors like construction and infrastructure.

- Innovation Drive: Continued research in wood science promises even more advanced treatments, potentially creating new product lines and revenue streams for Asia Timber Products Co., Ltd.

Traceability and Supply Chain Technologies

The global push for timber legality is driving the adoption of sophisticated traceability technologies. Blockchain, for instance, is emerging as a key tool for verifying product origin, offering an immutable record of a timber's journey from forest to finished product. For Asia Timber Products Co., Ltd., integrating such systems is crucial for navigating increasingly stringent international regulations and demonstrating a commitment to responsible sourcing.

Embracing these advancements directly addresses the growing demand for transparency in supply chains. Companies that can provide verifiable proof of legal and sustainable timber sourcing gain a significant competitive advantage. This is particularly relevant as many importing nations, including the EU and US, have robust due diligence requirements that necessitate detailed origin information.

The benefits extend beyond compliance:

- Enhanced Market Access: Meeting traceability standards can open doors to markets with strict import controls.

- Improved Brand Reputation: Demonstrating ethical sourcing builds trust with consumers and stakeholders.

- Risk Mitigation: Reduces the risk of inadvertently trading in illegally harvested timber, which can lead to severe penalties.

- Operational Efficiency: Streamlined tracking can optimize inventory management and reduce losses.

By 2024, the global market for supply chain traceability solutions was projected to reach significant figures, underscoring the widespread adoption and investment in these technologies across various sectors, including forestry and timber. Asia Timber Products Co., Ltd. can leverage this trend to bolster its operational integrity and market positioning.

Technological shifts in digital printing are enabling highly realistic wood and stone finishes, expanding product customization for Asia Timber Products Co., Ltd. The global digital printing market for decor was valued at approximately $15.5 billion in 2023, indicating strong potential for companies adopting these innovations.

The rise of engineered wood products like CLT and glulam, with a global market valued at $14.5 billion in 2023, presents opportunities for Asia Timber Products Co., Ltd. to support this growing sector, potentially through component supply or shared expertise.

Automation and AI are boosting efficiency in timber processing, with advanced robotics increasing processing speed by up to 15% and reducing waste by 10% in sawmills as of late 2023. This enhances competitiveness through improved consistency and lower costs.

Innovative wood treatments, such as thermal modification, are enhancing timber durability and expanding its use in demanding applications like exterior cladding. The modified wood market is projected for strong growth, with a CAGR exceeding 6% from 2024 to 2030.

Traceability technologies, including blockchain, are becoming critical for verifying timber legality and origin, a trend Asia Timber Products Co., Ltd. can leverage to meet stringent international regulations and enhance its brand reputation.

| Technology Area | Market Data/Impact | Relevance for Asia Timber Products Co., Ltd. |

|---|---|---|

| Digital Printing | Global decor digital printing market ~$15.5B (2023) | Enhance product aesthetics, customization, and market appeal. |

| Engineered Wood | Global market ~$14.5B (2023), 6%+ CAGR projected | Potential to supply components or integrate into the growing engineered wood ecosystem. |

| Automation & AI | Up to 15% speed increase, 10% waste reduction in sawmills (late 2023) | Improve operational efficiency, product consistency, and reduce costs. |

| Wood Treatments | Modified wood market 6%+ CAGR (2024-2030) | Increase product durability, expand market applications, and strengthen value proposition. |

| Traceability Tech | Growing adoption for supply chain verification | Ensure regulatory compliance, enhance market access, and build brand trust through responsible sourcing. |

Legal factors

Major export markets like the U.S. and EU are tightening rules on timber legality and traceability. For instance, the EU Deforestation Regulation (EUDR) and Vietnam's Timber Legality Assurance System (TLAS) require rigorous documentation. Asia Timber Products Co., Ltd. needs strong supply chain monitoring to meet these demands.

Governments across Asia are actively reshaping their trade policies, directly affecting the timber industry. These revisions frequently involve adjustments to tariffs and the complex web of documentation required for both importing and exporting wood products. For example, Indonesia has been in discussions with the U.S. regarding the potential elimination of reciprocal tariffs on furniture exports, a move that could substantially alter trade flows and profitability for regional timber businesses.

Asia Timber Products Co., Ltd. must navigate an evolving landscape of Occupational Safety and Health (OSH) standards. Indonesia, for instance, has been actively integrating International Labour Organization (ILO) OSH codes into its forestry sector regulations. This signifies a global trend towards more rigorous worker protection.

Compliance with these international benchmarks is not merely a legal obligation but a strategic imperative for Asia Timber Products. It directly impacts operational continuity and the company's reputation. For example, a significant workplace accident could lead to production halts and substantial fines, as seen in other industries where safety breaches resulted in millions in damages and lost workdays.

Changes in Foreign Business Laws

Several Asian nations are re-evaluating their foreign business ownership regulations. For instance, Thailand is actively considering relaxing restrictions on foreign investment, a move that could significantly alter the landscape for international companies. This legislative flexibility might present new avenues for growth and collaboration for companies like Asia Timber Products Co., Ltd.

These potential legal shifts are crucial for Asia Timber Products Co., Ltd. as they could directly impact decisions regarding market entry strategies and the formation of strategic alliances. For example, if Thailand eases its foreign ownership limits to, say, 100% in certain sectors, it would dramatically lower the barrier for foreign direct investment.

- Thailand's Ministry of Commerce reported a 15% increase in foreign business registrations in early 2024 compared to the previous year, signaling a potential shift in investment climate.

- Proposed amendments in Vietnam aim to streamline foreign investment approval processes, potentially reducing the time for new business establishment by up to 20%.

- In Indonesia, discussions are underway to revise the Negative Investment List, which could open up previously restricted sectors to foreign participation.

National Forestry Development Strategies

Many Asian nations are implementing national forestry development strategies, focusing on strengthening legal frameworks and institutional structures for land use and forest management. These initiatives are crucial for companies like Asia Timber Products Co. Ltd., as they directly shape the environment for sustainable timber sourcing and production.

These national plans often include provisions for enhancing forest governance, promoting community involvement, and ensuring the legal compliance of timber harvesting and trade. For instance, Vietnam's National Forest Development Strategy for 2021-2030 aims to increase forest cover to 45% and improve the livelihoods of forest-dependent communities, underscoring the legal and policy shifts impacting the industry.

- Legal Frameworks: National strategies often mandate updated laws and regulations regarding forest concessions, land tenure, and environmental protection.

- Sustainable Sourcing: Companies must align their operations with government policies promoting certified sustainable timber and responsible forest management practices.

- Institutional Strengthening: Government efforts to improve the capacity of forestry agencies and enforcement bodies directly influence compliance requirements for timber businesses.

- International Agreements: Adherence to international timber trade regulations and agreements, often integrated into national laws, is also a key legal factor.

Asia Timber Products Co., Ltd. faces a complex legal environment, particularly concerning international timber legality and traceability regulations. The EU Deforestation Regulation (EUDR) and Vietnam's Timber Legality Assurance System (TLAS) necessitate stringent documentation, impacting sourcing and export processes. Furthermore, evolving national forestry development strategies across Asia, like Vietnam's 2021-2030 plan aiming for 45% forest cover, introduce new legal requirements for sustainable sourcing and forest governance.

Governments are also adjusting trade policies and foreign investment rules. For instance, Thailand saw a 15% rise in foreign business registrations in early 2024, suggesting potential shifts in investment accessibility. These legal changes directly influence market entry and strategic partnerships for companies operating in the region.

The company must also adapt to increasingly rigorous Occupational Safety and Health (OSH) standards, as seen in Indonesia's integration of International Labour Organization (ILO) codes into its forestry sector. Non-compliance can lead to severe consequences, including production halts and substantial fines.

Environmental factors

Consumers are increasingly seeking out sustainable and eco-friendly flooring and wood products, a trend that gained significant momentum leading up to 2024. This heightened environmental awareness translates into a growing market preference for responsibly sourced materials and manufacturing practices.

Asia Timber Products Co., Ltd. is well-positioned to capitalize on this shift. By highlighting its commitment to environmentally sound operations and showcasing the eco-credentials of its product lines, the company can attract a larger segment of this conscious consumer base. For instance, in 2023, the global sustainable building materials market was valued at approximately $260 billion and is projected to grow significantly, indicating a strong market appetite for companies with genuine green credentials.

Asia Timber Products Co. Ltd. faces increasing pressure to adopt Sustainable Forest Management (SFM) practices across tropical Asia. This focus is driven by a global push to balance ecological preservation, economic sustainability, and social benefits in timber harvesting. Companies like Asia Timber Products are finding that compliance with SFM principles is no longer optional but a prerequisite for accessing key international markets and maintaining a positive corporate image.

The market is clearly signaling a preference for sustainably sourced timber. For instance, by early 2025, the demand for certified wood products in major export markets like the EU and North America is projected to continue its upward trend, with reports indicating an average annual growth rate of 4-6% for certified timber over the past five years. This trend directly impacts Asia Timber Products' revenue potential and operational strategy, making SFM a critical component of its long-term viability.

New regulations like the EU Deforestation Regulation (EUDR), which came into effect in late 2024, are significantly altering the landscape for timber and wood product trading. This legislation mandates rigorous due diligence to ensure that products entering the EU market are not linked to deforestation.

Asia Timber Products Co., Ltd. must therefore adapt its sourcing and traceability systems to meet these global environmental standards. Failure to comply could result in market access restrictions, impacting sales and profitability, particularly for exports to the EU which represented over 15% of the company's revenue in 2024.

Environmental Regulations and Sustainability Concerns

Asia Timber Products Co. Ltd. faces growing pressure from environmental regulations and sustainability concerns, significantly influencing market expansion, especially in the Medium Density Fibreboard (MDF) sector. The global push for greener alternatives to conventional wood products is intensifying, pushing companies like Asia Timber to innovate.

The company is responding by prioritizing the production of MDF incorporating recycled content and utilizing low-emission adhesives. This strategic shift is crucial for meeting increasingly stringent environmental standards and consumer expectations for sustainable building materials. For instance, by 2024, the global demand for sustainable building materials is projected to reach USD 255.7 billion, highlighting the market’s direction.

- Regulatory Landscape: Stricter emissions standards and waste management policies are becoming commonplace across key Asian markets, impacting production costs and operational flexibility.

- Consumer Demand: A growing segment of consumers and business clients are actively seeking products with certified sustainable sourcing and lower environmental footprints, influencing purchasing decisions.

- Innovation Focus: Investment in research and development for eco-friendly adhesives and increased use of recycled wood fiber in MDF production are key strategies to align with sustainability trends.

- Market Opportunity: Companies that successfully navigate these environmental challenges can gain a competitive advantage and access new market segments focused on green construction and design.

Forest Restoration and Biodiversity Protection Initiatives

Asia Timber Products Co., Ltd. operates within an environmental landscape increasingly shaped by proactive forest restoration and biodiversity protection efforts across the region. These initiatives are crucial for long-term forest health and ecosystem resilience.

Many Asian nations are actively promoting reforestation and the restoration of degraded lands. For instance, China's "Grain for Green" program, initiated in 1999, has converted millions of hectares of farmland back to forest and grassland, significantly boosting forest cover. Similarly, initiatives in countries like Vietnam and Indonesia are focusing on mangrove restoration and the protection of vital habitats for endangered species.

Asia Timber Products Co., Ltd. can strategically align its operations with these trends to foster sustainability and gain competitive advantages. By actively participating in or supporting these environmental programs, the company can enhance its reputation, secure its supply chain, and potentially access new markets that prioritize sustainably sourced timber.

- Reforestation Targets: Many Asian countries have set ambitious reforestation targets, with some aiming to increase forest cover by several percentage points by 2030.

- Biodiversity Hotspots: Asia is home to numerous biodiversity hotspots, and initiatives are underway to protect these areas, which often overlap with timber-producing regions.

- Sustainable Forestry Certifications: Growing demand for certified sustainable timber products, such as those certified by the Forest Stewardship Council (FSC), reflects a market shift towards environmentally responsible sourcing.

Asia Timber Products Co., Ltd. must navigate evolving environmental regulations and consumer demand for sustainability. The EU Deforestation Regulation (EUDR), effective late 2024, mandates stringent due diligence for timber entering the EU, impacting companies like Asia Timber, where EU exports were over 15% of revenue in 2024. This underscores the critical need for robust traceability systems to maintain market access.

The company is also responding to the growing market for eco-friendly products, particularly in the MDF sector, by incorporating recycled content and low-emission adhesives. By 2024, the global sustainable building materials market was valued at approximately $255.7 billion, indicating a strong consumer preference for greener alternatives.

Furthermore, Asia Timber Products Co., Ltd. is aligning with regional reforestation and biodiversity protection efforts. Many Asian nations have set ambitious reforestation targets, aiming to increase forest cover by several percentage points by 2030. This strategic alignment can enhance the company's reputation and secure its supply chain in an increasingly environmentally conscious market.

| Environmental Factor | Impact on Asia Timber Products Co., Ltd. | Key Data/Trend (2024/2025) |

| Regulatory Compliance (e.g., EUDR) | Mandatory due diligence, potential market access restrictions if non-compliant. | EUDR effective late 2024; EU exports represented >15% of company revenue in 2024. |

| Consumer Demand for Sustainability | Increased preference for certified, eco-friendly products; drives innovation in materials. | Global sustainable building materials market projected to reach $255.7 billion by 2024. |

| Sustainable Forest Management (SFM) | Prerequisite for key international markets; enhances corporate image. | Demand for certified wood products in EU/North America growing at 4-6% annually (past 5 years). |

| Reforestation & Biodiversity Initiatives | Opportunities for strategic alignment, reputation enhancement, and supply chain security. | Asian nations setting ambitious reforestation targets, aiming for increased forest cover by 2030. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Asia Timber Products Co. Ltd. is informed by a comprehensive review of official government publications, international trade statistics, and reputable industry-specific research. We meticulously gather data on economic indicators, environmental regulations, technological advancements, and socio-political trends impacting the timber sector across Asia.