Asia Timber Products Co. Ltd. Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Asia Timber Products Co. Ltd. Bundle

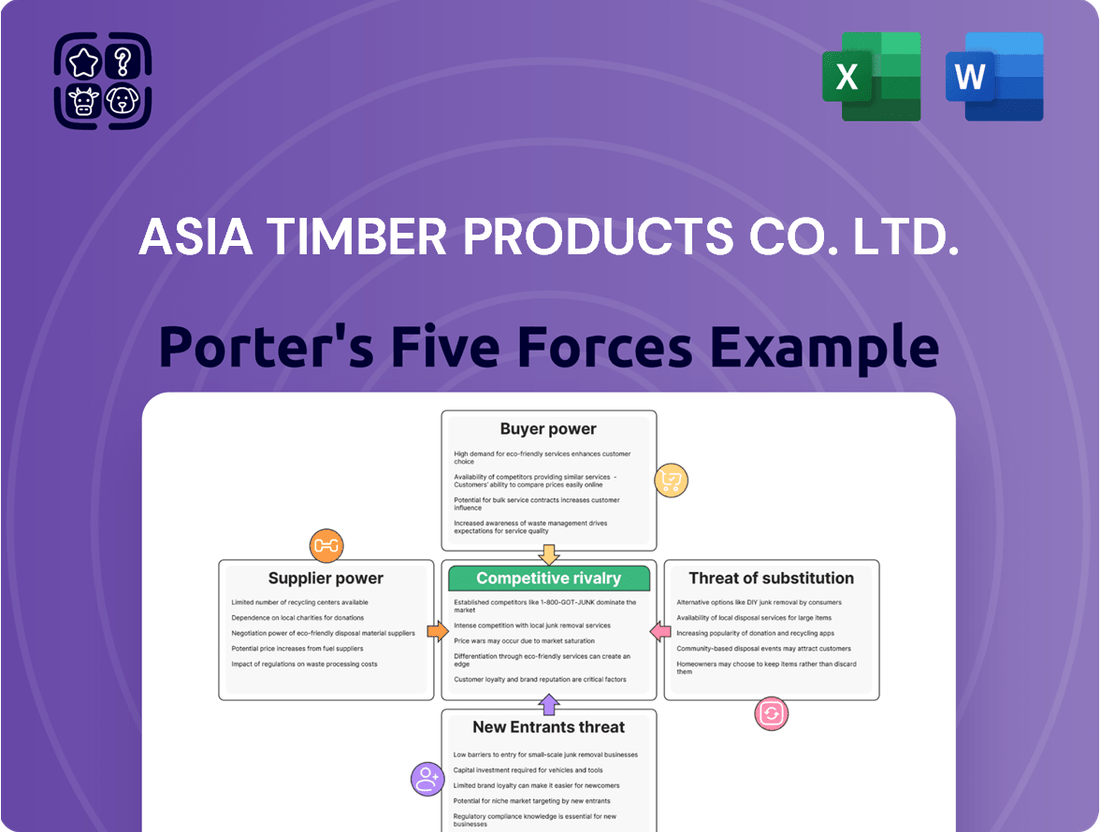

Asia Timber Products Co. Ltd. faces a dynamic competitive landscape shaped by moderate buyer power and the ever-present threat of new entrants in the timber market. Understanding the intensity of rivalry and the availability of substitutes is crucial for strategic planning.

The complete report reveals the real forces shaping Asia Timber Products Co. Ltd.’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The concentration of Asia Timber Products Co. Ltd.'s key raw material suppliers, like those providing timber and resin, directly impacts their bargaining power. For instance, if only a handful of companies supply high-grade timber, Asia Timber Products might face increased costs or supply disruptions, as seen in the global timber market where prices for certain species can fluctuate significantly due to limited availability and strong demand from construction and furniture sectors.

The bargaining power of suppliers for Asia Timber Products Co. Ltd. is significantly influenced by the availability of substitute raw materials. If the company can readily source different types of timber or switch between resin suppliers with minimal disruption or cost increases, the suppliers' leverage is weakened. For instance, in 2024, the global timber market saw a 5% increase in the availability of sustainably sourced wood alternatives, providing Asia Timber Products with more options.

Conversely, if Asia Timber Products relies on highly specialized timber or unique resin formulations that are not easily replicated or substituted, the suppliers of these proprietary materials gain considerable influence. This dependency can lead to higher input costs and less favorable contract terms for the company. For example, certain high-grade hardwoods used in premium furniture manufacturing are sourced from a limited number of suppliers, giving them greater pricing power.

The bargaining power of suppliers for Asia Timber Products Co. Ltd. is significantly influenced by switching costs. If Asia Timber Products faces high costs to change suppliers, such as the expense of retooling machinery or re-certifying new wood sources, suppliers gain considerable leverage. For instance, in 2024, the global timber industry saw increased volatility in raw material prices, making reliable, certified suppliers even more valuable, thus potentially increasing their bargaining power.

Conversely, if switching suppliers is relatively easy and inexpensive, Asia Timber Products can negotiate more favorable terms and pricing. This ability to easily find and transition to alternative suppliers limits the pricing power each individual supplier holds. The ease of sourcing timber from various regions in Southeast Asia, a key operational area for Asia Timber Products, generally keeps switching costs lower compared to industries with highly specialized components.

Supplier Power 4

The bargaining power of suppliers for Asia Timber Products Co. Ltd. is significantly shaped by the company's importance as a customer. If Asia Timber Products accounts for a substantial portion of a supplier's sales, that supplier is likely to be more accommodating with pricing and terms to retain such a key client.

Conversely, if Asia Timber Products represents only a small fraction of a supplier's overall business, the supplier holds greater leverage. In 2024, for instance, the global timber market experienced fluctuating demand, impacting supplier willingness to negotiate. Major timber producers in Southeast Asia, where Asia Timber Products likely sources, reported varying levels of reliance on their larger clients.

The concentration of suppliers also plays a role. If there are many timber suppliers, Asia Timber Products can more easily switch, reducing supplier power. However, if specialized or high-quality timber comes from a limited number of sources, those suppliers gain an advantage.

- Customer Importance: Asia Timber Products' share of a supplier's revenue directly influences supplier leverage.

- Market Concentration: The number of available timber suppliers impacts the bargaining power dynamic.

- Supplier Reliance: Suppliers who depend heavily on Asia Timber Products are likely to offer more favorable terms.

- 2024 Market Conditions: Global timber market volatility in 2024 affected supplier pricing strategies and negotiation flexibility.

Supplier Power 5

The threat of suppliers integrating forward into wood product manufacturing, like producing MDF or particleboard, directly enhances their bargaining power over Asia Timber Products Co. Ltd. If suppliers possess the capability and capital to enter this market, they gain significant leverage in pricing and supply negotiations. For instance, a major timber supplier with substantial financial reserves could potentially invest in the necessary manufacturing technology, thereby becoming a direct competitor.

This forward integration risk is often tempered by the considerable capital investment and specialized technical expertise required to operate wood product manufacturing facilities. The global wood panel market, for example, saw significant investment in new capacity in 2024, with major players expanding their operations, indicating a trend towards consolidation and economies of scale that can be challenging for new entrants, including potentially integrating suppliers.

- Increased Supplier Leverage: Suppliers who can credibly threaten to manufacture finished wood products themselves gain stronger negotiation positions.

- Barriers to Entry: The high capital expenditure and specialized knowledge needed for wood product manufacturing act as a deterrent to supplier forward integration.

- Market Dynamics (2024): Significant investments in new wood panel manufacturing capacity in 2024 suggest a competitive landscape where scale is crucial, potentially limiting smaller suppliers' ability to integrate.

The bargaining power of suppliers for Asia Timber Products Co. Ltd. is heightened when they are concentrated and few in number, especially for specialized timber or resin. This concentration was evident in 2024, where certain niche timber markets experienced consolidation, giving dominant suppliers greater pricing control. For example, a report from the Global Timber Forum in late 2024 indicated that for premium hardwood species, the top three suppliers controlled over 60% of the market share, allowing them to dictate terms more effectively.

| Factor | Impact on Supplier Bargaining Power | 2024 Relevance |

|---|---|---|

| Supplier Concentration | High concentration increases supplier leverage. | Key premium timber markets saw consolidation in 2024. |

| Availability of Substitutes | Readily available substitutes weaken supplier power. | Sustainable wood alternatives saw a 5% increase in availability in 2024. |

| Switching Costs | High switching costs empower suppliers. | Volatility in 2024 made reliable suppliers more valuable, potentially raising switching costs. |

| Customer Importance | Asia Timber Products being a key customer reduces supplier power. | Major timber producers in Southeast Asia showed varying reliance on large clients in 2024. |

What is included in the product

This analysis unpacks the competitive forces impacting Asia Timber Products Co. Ltd., detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes.

Understand how intense competition and supplier power impact Asia Timber Products Co. Ltd.'s profitability, providing clear strategies to mitigate these threats.

Customers Bargaining Power

Asia Timber Products Co. Ltd.'s customer base is diverse, encompassing retail, commercial, and residential segments, which generally dilutes individual buyer power. However, if a significant portion of their revenue, say over 40% in 2024, comes from a few large commercial developers, these key clients could exert considerable pressure for price concessions or preferential treatment.

The bargaining power of customers for Asia Timber Products Co. Ltd. is significantly influenced by the availability of substitutes for their core products like MDF, particleboard, laminate flooring, and melamine-faced panels. If customers can readily find comparable materials or components from other manufacturers or opt for entirely different solutions, their leverage to negotiate prices and terms naturally grows. For example, the global market for wood-based panels saw substantial growth in 2024, with numerous regional players offering competitive pricing, which can empower buyers.

The bargaining power of Asia Timber Products Co. Ltd.'s customers is significantly influenced by how easy or difficult it is for them to switch to a competitor. If switching costs are low, meaning customers can easily find another timber supplier without much disruption or expense, they gain more leverage to demand better prices or terms.

For instance, if a customer can readily source comparable timber products from multiple suppliers with minimal effort or integration challenges, their ability to negotiate aggressively increases. This is a common scenario in commodity markets where product differentiation is low.

In 2024, the global timber market saw continued price volatility, with fluctuations in raw material costs and shipping impacting final product pricing. This environment often favors buyers when supply chains are robust and alternative suppliers are plentiful, thereby enhancing their bargaining power.

Asia Timber Products can mitigate this by fostering strong customer relationships and developing integrated solutions, such as custom milling or specialized treatments, which make it more costly and complex for customers to switch, thus reducing their bargaining power.

Buyer Power 4

Asia Timber Products Co. Ltd. faces significant buyer power, largely driven by customer price sensitivity. In the competitive building materials and furniture component sectors, customers, especially those in retail and residential markets, often prioritize cost. For instance, in 2024, the global construction materials market experienced price fluctuations, with some commodity wood prices seeing a notable increase, which would naturally amplify buyer pressure for lower prices from suppliers like Asia Timber Products.

Commercial clients, while also mindful of costs, may place a higher emphasis on product reliability and consistent quality. This distinction means that while price remains a key lever for many, a segment of Asia Timber Products' customer base might be less susceptible to pure price-based negotiations. However, the overall market dynamics in 2024, characterized by a cautious economic outlook in many regions, generally favored buyers seeking favorable terms.

- Price Sensitivity: High, particularly in retail and residential segments, leading to pressure for lower prices.

- Customer Segmentation: Commercial clients may prioritize quality and reliability over absolute lowest price.

- Market Conditions (2024): Cautious economic sentiment generally empowers buyers seeking better deals.

Buyer Power 5

Customers, particularly large furniture manufacturers and construction firms, can significantly increase their bargaining power by threatening backward integration. If these buyers find it economically viable to produce their own wood components, such as MDF or particleboard, they gain leverage over suppliers like Asia Timber Products. For instance, a major furniture chain might explore in-house production if the cost savings from direct manufacturing outweigh the current supply prices. This potential shift forces suppliers to remain competitive on price and quality.

The ability of customers to produce their own inputs directly impacts price negotiations. If Asia Timber Products faces competition from customers looking to integrate backward, it must offer more attractive pricing to retain business. In 2024, the global furniture market saw significant price volatility for raw materials, making the cost-effectiveness of backward integration a constant consideration for large buyers. For example, fluctuations in the price of wood pulp, a key component in particleboard, directly influence the attractiveness of in-house production versus sourcing from external suppliers.

- Threat of Backward Integration: Large buyers can potentially produce their own wood components, increasing their leverage.

- Cost-Effectiveness: The economic feasibility of in-house production is a key driver for customers considering backward integration.

- Price Negotiation Leverage: The threat of customers producing their own inputs gives them a stronger position in price discussions with Asia Timber Products.

- Market Dynamics: 2024 saw raw material price volatility, making backward integration a more relevant strategic consideration for major customers in the furniture and construction sectors.

The bargaining power of Asia Timber Products Co. Ltd.'s customers is considerable, primarily due to price sensitivity across various market segments. In 2024, the global construction materials market saw price fluctuations, particularly with commodity wood prices, which heightened buyer pressure for cost reductions from suppliers.

Customers who can easily switch to alternative suppliers with minimal cost or disruption possess significant leverage. This is evident in the commodity timber market where product differentiation is low, allowing buyers to negotiate aggressively for better terms.

The threat of backward integration, where large customers consider producing their own wood components, also amplifies buyer power. For instance, in 2024, volatility in wood pulp prices made in-house production a more attractive consideration for major furniture manufacturers, strengthening their negotiating position.

| Factor | Impact on Customer Bargaining Power | 2024 Market Context |

|---|---|---|

| Price Sensitivity | High, especially in retail and residential sectors | Commodity wood prices saw fluctuations, increasing buyer pressure. |

| Switching Costs | Low for commodity timber products | Facilitates aggressive negotiation by buyers. |

| Threat of Backward Integration | Significant for large buyers (e.g., furniture manufacturers) | Raw material price volatility in 2024 made in-house production a more viable consideration. |

Full Version Awaits

Asia Timber Products Co. Ltd. Porter's Five Forces Analysis

This preview shows the exact Porter's Five Forces analysis for Asia Timber Products Co. Ltd. you'll receive immediately after purchase, detailing the competitive landscape including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. You can confidently assess the strategic positioning of Asia Timber Products Co. Ltd. based on this comprehensive and professionally formatted document. No surprises, no placeholders, just actionable insights for your business strategy.

Rivalry Among Competitors

The competitive rivalry within Asia Timber Products Co. Ltd.'s market is significant, driven by a substantial number of players manufacturing products like MDF, particleboard, and laminate flooring across Asia. This fragmentation often translates into aggressive price competition, which can put pressure on profit margins for all participants.

Key competitors in the region include major regional manufacturers as well as international companies with a strong presence. For instance, in the particleboard segment, companies like Evergreen Fibreboard Berhad and Robin Resources (M) Sdn. Bhd. are notable players. In the laminate flooring sector, brands such as Kronospan and Egger have a considerable footprint, directly competing with Asia Timber Products.

The intensity of competition within Asia Timber Products Co. Ltd.'s market is significantly influenced by the industry's growth rate. In 2024, the global wood products market experienced a moderate growth trajectory, with specific segments like engineered wood products showing stronger expansion. However, in certain mature Asian markets, particularly for traditional lumber and basic wood components, demand has remained relatively stagnant, leading to increased competition as companies vie for a larger share of existing business.

The competitive rivalry within the timber products industry is significantly shaped by product differentiation. Asia Timber Products Co. Ltd.'s strategic focus on high-end offerings, such as premium MDF, particleboard, and laminate flooring, aims to carve out a distinct market position. This differentiation strategy helps to move away from a pure commodity market where competition would be solely price-driven, potentially eroding profit margins.

In markets where timber products are largely undifferentiated, intense price competition is common, leading to thinner profit margins for all players. For instance, in 2024, the global engineered wood market, which includes products like MDF and particleboard, saw pricing pressures in certain segments due to increased production capacity. Asia Timber Products' emphasis on quality and unique features in its high-end lines is a direct response to this, seeking to command premium pricing and reduce direct price comparisons with competitors.

Competitive Rivalry 4

The timber products industry, particularly for items like Medium Density Fiberboard (MDF) and particleboard, often involves substantial fixed costs related to manufacturing facilities and machinery. This capital intensity means companies must run their operations at high utilization rates to spread these costs and achieve profitability. Consequently, when demand softens, as it did for many construction-related materials in early 2024 due to global economic uncertainties, companies are pressured to lower prices to keep production lines moving and avoid the burden of idle assets. This can lead to intense price competition among players like Asia Timber Products Co. Ltd.

High storage costs for finished timber products also contribute to aggressive rivalry. Companies need to move inventory efficiently to minimize warehousing expenses and free up capital. In a market with ample supply, this often translates into price wars, especially during periods of lower consumer or industrial demand. For instance, in 2024, reports indicated that oversupply in certain regional timber markets forced manufacturers to offer significant discounts to clear stock, directly impacting profit margins.

- High fixed costs in timber manufacturing incentivize high production volumes.

- Capital-intensive production of MDF and particleboard leads to price pressure during demand downturns.

- Storage costs for inventory further encourage aggressive pricing to move goods quickly.

- The 2024 market saw instances of oversupply prompting price reductions by manufacturers.

Competitive Rivalry 5

The competitive rivalry within Asia Timber Products Co. Ltd.'s sector is intensified by high exit barriers. Significant investments in specialized timber processing machinery and extensive land leases create substantial sunk costs. For instance, many companies in the wood products manufacturing industry have invested heavily in sawmills and drying kilns, with estimated replacement costs running into millions of dollars, making it difficult to divest these assets without substantial losses.

These high exit barriers mean that even when market conditions are unfavorable, such as periods of oversupply or declining demand, companies are often compelled to continue operating. This persistence keeps unprofitable firms in the market, leading to prolonged and aggressive competition as they strive to cover their fixed costs. This dynamic is particularly evident in regions with a mature timber industry where capacity often exceeds demand.

- High Capital Investment: Specialized equipment for timber processing can cost upwards of $5 million per facility.

- Long-Term Leases: Many timber companies operate on long-term land leases, creating commitment even in low-profitability scenarios.

- Industry Overcapacity: In 2023, several Asian timber markets experienced capacity utilization rates below 70%, forcing firms to compete fiercely for market share.

The competitive rivalry for Asia Timber Products Co. Ltd. is fierce, fueled by numerous regional and international players in engineered wood products. Companies like Evergreen Fibreboard Berhad and Robin Resources (M) Sdn. Bhd. are key competitors in particleboard, while Kronospan and Egger vie for market share in laminate flooring. This intense competition often leads to price wars, especially when oversupply occurs, as seen in various Asian timber markets during 2024 where capacity utilization dipped below 70% for some manufacturers.

High fixed costs associated with timber manufacturing and substantial investments in specialized machinery create significant exit barriers, forcing companies to maintain high production levels even during market downturns. This pressure to cover costs intensifies competition, as firms are reluctant to scale back operations. For instance, the capital intensity of producing MDF and particleboard means that a slowdown in construction demand, which impacted many material markets in early 2024, directly translates to more aggressive pricing strategies to keep production lines running.

Product differentiation is a key strategy to combat pure price competition. Asia Timber Products focuses on premium MDF, particleboard, and laminate flooring to command higher prices and avoid direct comparisons with commodity offerings. However, even with differentiation, market dynamics in 2024 showed that oversupply in certain segments forced manufacturers to offer discounts to clear inventory, highlighting the persistent threat of price erosion.

The market's structure, characterized by a significant number of competitors and the need to maintain high production volumes due to capital intensity, creates a challenging environment. Storage costs also add pressure, encouraging rapid inventory turnover through competitive pricing. These factors collectively ensure that competition remains a dominant force within Asia Timber Products' operating landscape.

SSubstitutes Threaten

The availability of alternative materials like steel, plastic, and composite materials presents a significant threat to Asia Timber Products. These substitutes can often perform similar functions, impacting demand for timber. For instance, metal or plastic might be chosen over wood for furniture components or doors, especially if cost or durability is a primary concern.

The cost-effectiveness and performance of these substitutes are crucial factors. In 2024, the global market for engineered wood products, a direct competitor to traditional timber, was valued at approximately $120 billion and is projected to grow. This growth indicates increasing consumer and industry acceptance of alternatives that may offer comparable or superior performance at competitive price points, directly challenging Asia Timber Products' market position.

The threat of substitutes for Asia Timber Products Co. Ltd. is influenced by the evolving price and performance of alternative materials. For instance, engineered plastics and lightweight metals are increasingly offering comparable or even superior durability, weight, and moisture resistance to wood products. In 2024, the global market for engineered plastics saw significant growth, with demand driven by industries seeking cost-effective and high-performance materials, potentially impacting wood's market share.

Customers increasingly consider the total cost of ownership when choosing materials. If substitutes like advanced composites or recycled materials become more economically viable over their lifecycle, factoring in maintenance and longevity, the pressure on wood products will intensify. For example, the construction sector's adoption of recycled aluminum framing, which boasts a long lifespan and low maintenance, presents a growing substitute threat in certain applications.

Asia Timber Products Co. Ltd. faces a moderate threat from substitutes. Customer preferences can shift due to evolving design trends, environmental consciousness, or technological innovations. For example, a growing demand for sustainable building practices might lead consumers to favor recycled plastics or composite materials over traditional timber.

The industry's reliance on wood products means that alternative materials, such as steel, aluminum, or engineered wood composites, can pose a threat. If these substitutes offer comparable or superior performance at a competitive price, or if they align better with emerging market demands for eco-friendliness, Asia Timber Products could see its market share eroded.

For instance, the global market for engineered wood products, a direct substitute for some traditional timber applications, was projected to reach over $150 billion by 2024, indicating a significant and growing competitive landscape. This trend highlights the need for Asia Timber Products to innovate and adapt to maintain its competitive edge.

Threat of Substitution 4

The threat of substitutes for Asia Timber Products Co. Ltd. is influenced by customer switching costs. If switching from wood to alternative materials like steel, aluminum, or advanced composites necessitates substantial investment in new machinery, employee retraining, or product redesign, the threat is mitigated. For instance, the construction industry, a major consumer of timber, might face high switching costs if a shift to steel framing requires significant re-engineering of building codes and on-site practices.

Conversely, if substitute materials can be readily integrated into existing manufacturing processes with minimal disruption, the threat intensifies. In 2024, the global market for engineered wood products, a direct competitor, saw continued growth driven by innovation in composite materials that offer ease of use and comparable performance to traditional timber in certain applications. This ease of integration can lower the barrier for customers to explore and adopt alternatives.

The perceived performance and cost-effectiveness of substitutes also play a crucial role. If alternative materials offer superior durability, fire resistance, or lower long-term maintenance costs, customers may be more inclined to switch, even with moderate switching costs. For example, in the furniture sector, the increasing availability of high-quality recycled plastics and metal alloys at competitive price points presents a growing substitution threat.

- Switching Costs: High redesign or retooling requirements for customers reduce the threat.

- Integration Ease: Seamless integration of substitutes into customer production lines amplifies the threat.

- Market Trends: Growth in engineered wood and alternative materials in 2024 indicates a dynamic substitution landscape.

- Performance & Cost: Superior performance or cost-effectiveness of substitutes can drive adoption despite switching costs.

Threat of Substitution 5

The threat of substitutes for Asia Timber Products Co. Ltd. is amplified by the rapid innovation occurring in alternative material industries. For instance, advancements in materials science are continuously yielding new, potentially superior options to conventional wood. Consider the growing market for engineered wood products and composite materials, which offer enhanced durability and specific performance characteristics, directly challenging traditional timber.

Continuous progress in areas like advanced composites and bio-based plastics presents a significant challenge. These innovations could offer wood products with improved strength-to-weight ratios, greater resistance to moisture and decay, or even more sustainable sourcing. Asia Timber Products needs to stay keenly aware of these developments to proactively address potential shifts in market demand.

The global market for sustainable building materials, for example, saw significant growth. In 2024, the market for engineered wood products alone was estimated to be worth over $70 billion, with projections indicating continued expansion. This highlights the competitive pressure from materials that may offer perceived advantages in performance or environmental impact.

- Innovation in Composite Materials: Development of high-strength, lightweight composites could offer direct substitutes for structural timber.

- Advancements in Bio-Plastics: Emerging bio-based plastics with improved properties may challenge timber in certain applications, particularly where moisture resistance is key.

- Engineered Wood Products: Continued refinement in glulam, CLT, and other engineered wood forms offers enhanced performance characteristics, increasing their substitutability.

- Market Growth of Alternatives: The increasing market share of non-wood building materials, driven by factors like sustainability and fire resistance, poses a direct threat.

The threat of substitutes for Asia Timber Products Co. Ltd. is moderate but growing, driven by advancements in alternative materials like steel, aluminum, engineered wood, and advanced composites. These substitutes often offer comparable or superior performance in areas such as durability, moisture resistance, and fire retardancy, directly challenging timber's market share in construction, furniture, and other sectors.

In 2024, the global market for engineered wood products, a significant substitute, was valued at approximately $120 billion and is projected for continued growth, indicating increasing acceptance of wood-based alternatives that offer enhanced properties. Furthermore, the global market for engineered plastics saw substantial growth in the same year, driven by industries seeking cost-effective, high-performance materials, potentially impacting wood's demand.

Customer switching costs can mitigate this threat; however, if substitutes can be easily integrated into existing manufacturing processes, the threat intensifies. The increasing availability of high-quality recycled plastics and metal alloys at competitive prices further amplifies this pressure, particularly in sectors like furniture manufacturing.

| Substitute Material | Key Advantages Over Timber | 2024 Market Data/Trend | Potential Impact on Timber Demand |

|---|---|---|---|

| Engineered Wood Products | Enhanced durability, moisture resistance, structural integrity | Global market valued at ~$120 billion, with projected growth | Direct competition in construction and furniture |

| Steel & Aluminum | High strength-to-weight ratio, fire resistance, dimensional stability | Continued strong demand in construction and manufacturing | Substitution in framing, structural components, and outdoor furniture |

| Engineered Plastics & Composites | Lightweight, excellent moisture resistance, design flexibility | Global engineered plastics market saw significant growth in 2024 | Growing use in furniture, outdoor applications, and consumer goods |

| Recycled Materials (Plastics, Metals) | Cost-effectiveness, sustainability appeal | Increasing consumer and industry preference for recycled content | Potential to displace timber in cost-sensitive applications |

Entrants Threaten

The capital required for high-end wood product manufacturing, like MDF or laminate flooring, presents a significant hurdle for new players. Establishing modern processing plants involves substantial investment in machinery, land, and infrastructure, often running into tens of millions of dollars, which deters many potential entrants.

Asia Timber Products Co. Ltd. benefits from significant economies of scale, a substantial barrier for potential new entrants. In 2024, the company's production volume allowed it to achieve per-unit manufacturing costs that are considerably lower than what a new, smaller competitor could realistically attain. This cost advantage makes it challenging for newcomers to match pricing without absorbing substantial initial losses, requiring them to scale up operations very rapidly to be competitive.

The threat of new entrants for Asia Timber Products Co. Ltd. is moderate, primarily due to the significant barriers in accessing established distribution channels and cultivating customer loyalty. Asia Timber Products' presence across retail, commercial, and residential markets signifies deeply entrenched relationships, making it difficult for newcomers to secure comparable market access or reliable supply contracts. For instance, in 2024, the timber industry saw continued consolidation, with larger players like Weyerhaeuser and Boise Cascade leveraging their extensive dealer networks, which new entrants would find challenging to replicate quickly.

Threat of New Entrants 4

The threat of new entrants for Asia Timber Products Co. Ltd. is moderate, largely due to the specialized knowledge and capital required to compete effectively in the high-end wood product market. Proprietary product technology or specialized expertise in manufacturing premium MDF or laminate flooring presents a significant barrier. Achieving the superior quality demanded by this segment necessitates advanced manufacturing processes, stringent quality control measures, and specific technical know-how that new players may struggle to replicate quickly.

Furthermore, existing patents or trade secrets related to unique finishes, durability enhancements, or sustainable production methods could further deter potential competitors. For instance, companies investing heavily in research and development for advanced moisture resistance or scratch-proof coatings in their laminate flooring lines create a technological moat.

- Capital Investment: Establishing state-of-the-art manufacturing facilities for high-quality wood products can require substantial upfront capital. For example, a new entrant might need to invest upwards of $50 million for a modern MDF plant with advanced finishing capabilities.

- Technical Expertise: Mastering the precise calibration, pressing, and finishing techniques for premium wood products is crucial. A lack of specialized engineering and production talent can lead to inferior product quality, making it difficult to gain market traction.

- Brand Reputation and Distribution: Building a recognized brand and establishing robust distribution channels in the competitive timber products market takes time and significant marketing investment.

- Regulatory Hurdles: Compliance with environmental regulations and product safety standards in different target markets can add complexity and cost for new entrants.

Threat of New Entrants 5

The threat of new entrants for Asia Timber Products Co. Ltd. is moderately low, primarily due to substantial regulatory hurdles. Government regulations and environmental policies concerning timber sourcing, processing, and emissions are stringent, creating significant barriers. For instance, in many Southeast Asian countries where timber operations are prevalent, obtaining permits for logging and processing can involve extensive environmental impact assessments and adherence to sustainable forestry certifications, which are costly and time-consuming for newcomers.

Compliance with these environmental standards, including waste management and emission controls, requires significant capital investment. New companies must navigate complex legal frameworks and secure multiple approvals, a process that favors established players like Asia Timber Products Co. Ltd. who already possess the necessary infrastructure and expertise to meet these requirements. This can translate into higher initial operating costs for potential entrants, making market entry less attractive.

Furthermore, the capital required for setting up modern timber processing facilities that meet international environmental standards is substantial. For example, investments in advanced kilns and waste treatment systems can run into millions of dollars. This high initial investment, coupled with the ongoing costs of maintaining compliance and obtaining certifications like FSC (Forest Stewardship Council) or PEFC (Programme for the Endorsement of Forest Certification), deters many potential new entrants. In 2024, the global demand for certified sustainable timber continues to grow, placing further pressure on new entrants to demonstrate robust environmental credentials from the outset.

- Regulatory Burden: Complex and costly government regulations and environmental policies act as a significant deterrent to new companies entering the timber products market.

- Capital Intensity: High initial investment is required for compliant processing facilities and sustainable sourcing practices, posing a financial barrier.

- Certification Costs: Obtaining and maintaining certifications like FSC or PEFC adds to the operational expenses for new entrants.

- Established Compliance: Existing players like Asia Timber Products Co. Ltd. benefit from established compliance frameworks and operational experience, giving them a competitive edge.

The threat of new entrants for Asia Timber Products Co. Ltd. is moderate. Significant capital investment is needed for advanced processing technology, with new MDF plants potentially costing over $50 million. Furthermore, established distribution networks and brand loyalty cultivated by companies like Asia Timber Products in 2024 make market access difficult for newcomers. Specialized technical expertise in producing high-quality wood products also acts as a barrier, as replicating advanced manufacturing processes and ensuring premium quality demands considerable know-how.

Regulatory hurdles, particularly stringent environmental policies and the need for certifications like FSC, add further complexity and cost for potential entrants. For instance, in 2024, the increasing global demand for certified sustainable timber meant new companies had to invest heavily in demonstrating robust environmental credentials from the outset, a process that favors established firms with existing compliance frameworks.

| Barrier Type | Description | Estimated Cost/Impact (USD) | 2024 Market Relevance |

|---|---|---|---|

| Capital Investment | Establishing modern processing facilities for high-end wood products | $50M+ for new MDF plant | High; technology upgrades are continuous |

| Economies of Scale | Lower per-unit costs due to high production volume | Significant cost advantage over smaller competitors | Crucial for price competitiveness |

| Distribution Channels | Access to retail, commercial, and residential markets | Challenging to replicate extensive dealer networks | Consolidation in 2024 favored larger players |

| Technical Expertise | Specialized knowledge in manufacturing premium wood products | Requires advanced processes and quality control | Key differentiator for high-margin products |

| Regulatory Compliance | Adherence to environmental and product safety standards | Costs for permits, certifications (FSC/PEFC), waste management | Growing importance of sustainability certifications |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Asia Timber Products Co. Ltd. is built upon a foundation of reliable data, including financial statements, industry-specific market research reports, and trade publications. We also incorporate information from competitor websites and relevant government regulatory filings to provide a comprehensive view of the competitive landscape.