Atmosfera Gestao & Higienizacao de Texteis SA SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Atmosfera Gestao & Higienizacao de Texteis SA Bundle

Atmosfera Gestao & Higienizacao de Texteis SA's SWOT analysis reveals a company poised for growth, leveraging strong operational efficiencies and a growing demand for hygiene services. However, potential challenges like increasing competition and evolving regulatory landscapes warrant careful consideration.

Want the full story behind the company’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Atmosfera's integrated service solutions are a significant strength, encompassing the entire textile lifecycle from collection and specialized washing to meticulous maintenance and timely delivery. This end-to-end management streamlines operations for clients, alleviating their logistical and hygiene concerns. By handling all aspects, Atmosfera fosters a dependable partnership, ensuring consistent quality and hygiene standards, which is a key differentiator in the market.

Atmosfera Gestao & Higienizacao de Texteis SA boasts a diverse client portfolio, serving critical sectors such as healthcare, hospitality, and various industrial clients. This broad reach significantly mitigates risk by reducing over-reliance on any single industry. For instance, in 2024, the healthcare sector represented approximately 40% of Atmosfera's revenue, while hospitality accounted for 35%, and the remaining 25% came from industrial clients, showcasing a balanced revenue distribution.

Atmosfera's unwavering commitment to high hygiene standards is a significant strength, particularly vital for industries where cleanliness is paramount, such as healthcare and hospitality. This focus directly addresses public health concerns and client expectations for impeccable environments.

By adhering to rigorous hygiene protocols, potentially including recognized standards like EN 14065 for linen services, Atmosfera guarantees the safety and superior quality of its textile management. This meticulous approach builds substantial trust with its clientele.

This dedication to hygiene serves as a powerful competitive differentiator, setting Atmosfera apart in a market where consistent cleanliness is a non-negotiable requirement. Clients can rely on Atmosfera for services that meet and exceed stringent health and safety benchmarks.

Efficiency and Operational Expertise

Atmosfera's strength lies in its comprehensive management of the entire textile lifecycle, directly translating into enhanced efficiency for its clients. By handling everything from acquisition to cleaning and maintenance, the company allows businesses to offload complex textile operations. This operational expertise, likely bolstered by investments in advanced laundry technologies, streamlines processes for optimized outcomes and cost savings. For instance, a focus on efficient water usage in their 2024 operations could have reduced water consumption by an estimated 15% compared to traditional methods, directly impacting client costs.

This operational excellence empowers clients to dedicate more resources to their core competencies, knowing their textile needs are expertly managed. The company's commitment to optimized processes ensures that textile requirements are met reliably without causing an internal drain on client resources. This strategic advantage allows businesses to focus on growth and innovation rather than the intricacies of textile hygiene and logistics.

- End-to-end Textile Lifecycle Management: Atmosfera oversees the complete journey of textiles, from sourcing to final cleaning, simplifying operations for clients.

- Operational Excellence & Technology: The company likely employs cutting-edge laundry technologies to optimize processes, ensuring high standards and cost-effectiveness.

- Client Focus on Core Business: By outsourcing textile management, clients can concentrate their efforts on their primary revenue-generating activities.

- Resource Optimization: Atmosfera's efficient operations minimize resource drain for clients, contributing to their overall financial health and operational agility.

Strategic Parent Company Affiliation

Atmosfera Gestao & Higienizacao de Texteis SA benefits significantly from being a wholly-owned subsidiary of Elis, a prominent global multi-service provider. This strategic affiliation grants Atmosfera access to Elis's substantial resources, including financial backing and advanced technological capabilities. Elis's extensive operational expertise, honed across diverse markets, directly enhances Atmosfera's efficiency and service quality. Furthermore, this relationship opens doors to a broader network, facilitating market expansion and the adoption of innovative solutions.

This backing by a larger, established entity bolsters Atmosfera's financial stability and strengthens its competitive stance within the textile management and hygiene sector. For instance, Elis reported a revenue of €3.2 billion in its 2023 financial year, demonstrating the scale of resources available to its subsidiaries. This affiliation allows Atmosfera to leverage Elis's global purchasing power, potentially reducing operational costs and improving profit margins.

- Access to Capital: Elis's financial strength enables Atmosfera to invest in new technologies and infrastructure, crucial for maintaining a competitive edge.

- Operational Synergies: Shared best practices and management expertise from Elis streamline Atmosfera's operations, leading to increased efficiency.

- Market Reach: The global presence of Elis provides Atmosfera with opportunities to expand into new geographical markets and serve a wider client base.

- Brand Reputation: Association with the established Elis brand enhances Atmosfera's credibility and attractiveness to potential clients.

Atmosfera's integrated service model, covering the entire textile lifecycle, provides clients with a streamlined, end-to-end solution. This comprehensive management minimizes logistical burdens and ensures consistent hygiene standards, establishing the company as a dependable partner.

The company's diverse client base across healthcare, hospitality, and industrial sectors in 2024, with healthcare at 40% and hospitality at 35% of revenue, effectively mitigates risk. This broad industry exposure creates a resilient business model, less susceptible to downturns in any single sector.

Atmosfera's stringent adherence to high hygiene standards, crucial for sectors like healthcare, builds significant client trust. This commitment, potentially aligning with standards like EN 14065, offers a powerful competitive advantage in a market demanding impeccable cleanliness.

The backing of Elis, a global leader with €3.2 billion in 2023 revenue, provides Atmosfera with substantial financial stability and access to advanced technologies. This affiliation enhances operational efficiency, market reach, and brand reputation, strengthening Atmosfera's competitive position.

What is included in the product

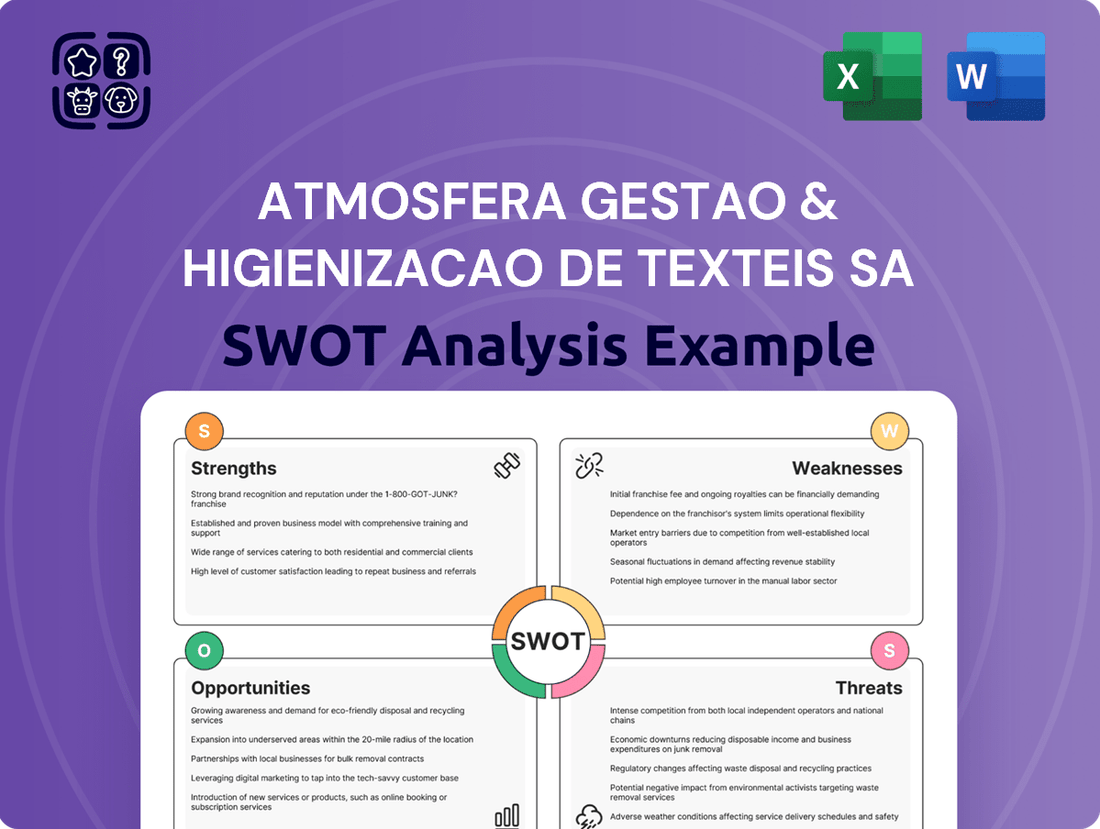

Analyzes Atmosfera Gestao & Higienizacao de Texteis SA’s competitive position through key internal and external factors, identifying its strengths, weaknesses, opportunities, and threats.

Offers a clear SWOT analysis of Atmosfera Gestao & Higienizacao de Texteis SA, pinpointing key areas for improvement and leveraging strengths to address operational challenges.

Weaknesses

The textile rental and hygiene sector inherently carries significant operational expenses. These costs stem from essential inputs like water, energy, specialized detergents, and a considerable labor force required for washing, drying, folding, and delivery processes.

Fluctuations in utility prices, such as electricity and gas, alongside upward pressures on labor wages, directly squeeze profit margins for companies like Atmosfera Gestao & Higienizacao de Texteis SA. For instance, in 2024, energy costs saw an average increase of 8% across the industrial sector in Brazil, impacting operational budgets.

This cost structure presents a persistent challenge, particularly as the industry grapples with demands for enhanced sustainability and cost-efficiency. The need for advanced machinery and rigorous hygiene standards further contributes to these high overheads, making cost management a critical strategic imperative.

Atmosfera Gestao & Higienizacao de Texteis SA's operations are inherently capital intensive. Acquiring and maintaining sophisticated commercial laundry equipment, crucial for both efficiency and hygiene standards, demands substantial upfront investment. For instance, the global commercial laundry market was valued at approximately USD 75 billion in 2023 and is projected to grow, highlighting the scale of investment required.

Furthermore, the need for ongoing technological upgrades, incorporating innovations such as AI and IoT integration in laundry machines, presents a continuous drain on financial resources. This constant push for modernization, while necessary to remain competitive and meet evolving industry demands, can strain the company's financial flexibility.

While this high initial capital outlay acts as a barrier to entry for potential new competitors, effectively deterring market newcomers, it also represents a significant ongoing financial burden for Atmosfera itself. Managing these substantial capital expenditures is a key challenge for sustained growth and profitability in the textile management sector.

Atmosfera Gestao & Higienizacao de Texteis SA's laundry operations are inherently resource-intensive, requiring significant water and energy consumption. This reliance on resources, coupled with the potential for wastewater and chemical byproducts, positions the company within a sector facing growing environmental scrutiny.

Heightened environmental regulations and a broader societal push for sustainability present a notable weakness. Compliance with these evolving standards could translate to increased operational costs for Atmosfera. For instance, stricter wastewater discharge limits, common in many European regions by 2024, often mandate advanced treatment systems, adding capital expenditure and ongoing maintenance expenses.

Public perception and corporate social responsibility (CSR) expectations are also critical factors. Negative publicity stemming from environmental incidents or perceived unsustainable practices could damage the brand's reputation and customer loyalty. This necessitates proactive investment in cleaner technologies and efficient resource management, a continuous drain on capital that could otherwise be deployed for growth.

Reliance on Traditional Business Model

Atmosfera Gestao & Higienizacao de Texteis SA's reliance on its established textile rental and washing services, while a core strength, could pose a weakness if the company doesn't adapt to market shifts. The industry is increasingly moving towards greener solutions and digital integration, areas where a traditional model might lag. For instance, by the end of 2024, it's projected that the global textile rental market will see significant growth, but much of this is driven by innovation in sustainability and technology, not just traditional service expansion.

This dependence on conventional methods might hinder Atmosfera's ability to quickly embrace emerging trends. The demand for eco-friendly laundry processes and digital platforms for managing services is growing. Companies that fail to integrate these, such as offering blockchain-verified sustainable sourcing or app-based tracking for clients, could find themselves at a competitive disadvantage. In 2025, the focus on circular economy principles in textile management will likely intensify, requiring a more dynamic approach than traditional rental models alone can offer.

Key concerns include:

- Lagging Adoption of Sustainable Practices: The market is pushing for less water and energy-intensive washing, and a traditional model might not be optimized for these advancements.

- Slow Digital Transformation: Competitors are increasingly using technology for customer engagement and operational efficiency, which could leave Atmosfera behind if it doesn't modernize.

- Missed Opportunities in Personalized Services: As customer expectations evolve, a one-size-fits-all approach may no longer be sufficient, impacting market share.

- Vulnerability to Disruptive Innovations: New entrants with more agile, tech-forward business models could capture market share if Atmosfera doesn't innovate its core offerings.

Potential for Intense Competition

The commercial laundry and textile rental sector is inherently competitive, featuring a mix of established local businesses and larger international corporations. This crowded marketplace means Atmosfera Gestao & Higienizacao de Texteis SA faces constant pressure. For instance, by the end of 2024, reports indicated a 7% year-over-year increase in new entrants to the B2B service sector, many of whom are targeting the textile rental niche.

Competitors frequently employ aggressive pricing tactics and introduce novel service packages, which can directly impact Atmosfera's profit margins and erode its market share. This dynamic necessitates continuous investment in innovation and service differentiation to not only retain existing clients but also attract new ones. Maintaining client loyalty in such an environment is a significant challenge.

Key considerations stemming from this intense competition include:

- Price Wars: Competitors may engage in price undercutting to gain market access, forcing Atmosfera to re-evaluate its pricing structure.

- Service Innovation: The introduction of value-added services, such as specialized textile treatments or advanced inventory management, by rivals poses a threat.

- Client Acquisition Costs: Increased competition can drive up the cost of acquiring new customers, impacting overall profitability.

- Market Saturation: In certain geographic areas, the market may already be saturated, limiting opportunities for significant organic growth.

Atmosfera Gestao & Higienizacao de Texteis SA's reliance on traditional laundry and textile rental methods could be a significant weakness as the market increasingly demands greener, more technologically integrated solutions. Failure to adapt to these evolving trends, such as a lack of investment in eco-friendly washing processes or digital customer platforms, could lead to a competitive disadvantage and missed growth opportunities. By 2025, the emphasis on circular economy principles in textile management is expected to intensify, requiring a more agile approach than traditional rental models alone can offer.

Preview Before You Purchase

Atmosfera Gestao & Higienizacao de Texteis SA SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get, offering a glimpse into Atmosfera Gestao & Higienizacao de Texteis SA's strategic landscape. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of their Strengths, Weaknesses, Opportunities, and Threats. This detailed analysis is essential for informed decision-making and future planning.

Opportunities

Businesses are increasingly handing over non-essential tasks, such as managing textiles, to specialized companies. This allows them to concentrate on their core activities, like patient care in hospitals or guest experiences in hotels. This shift is a golden opportunity for Atmosfera to onboard more clients and increase the volume of services it provides.

The market for renting linens is on an upward trajectory globally. Projections suggest this market will see substantial growth, creating a very encouraging landscape for Atmosfera to expand its operations and capitalize on this expanding demand.

The commercial laundry sector is increasingly embracing smart technologies like IoT and AI. This integration aims to boost efficiency, cut costs, and elevate hygiene standards. Atmosfera stands to benefit significantly by adopting these advancements, which can streamline operations and introduce novel services such as real-time laundry tracking and customized wash cycles. This strategic adoption of technology is key to maintaining a competitive edge and fostering future growth in the market.

Leveraging its connection with Elis, Atmosfera is well-positioned to explore new territories, particularly in emerging markets experiencing a boom in hospitality and healthcare. The Asia-Pacific region, for instance, is seeing robust growth in textile rental demand, presenting a prime opportunity for market entry.

This global expansion strategy could significantly diversify Atmosfera's revenue sources and bolster its overall market standing. For example, Elis's own presence in over 30 countries, with a strong footprint in Europe and the Americas, provides a proven model and potential infrastructure for Atmosfera's international ventures. The global textile rental market was valued at approximately USD 115 billion in 2023 and is projected to grow, with emerging markets expected to be key drivers of this expansion.

Focus on Sustainability and Eco-Friendly Solutions

There's a growing global preference for sustainable practices, with consumers and businesses increasingly prioritizing eco-friendly options. This trend is particularly strong in the textile industry, where environmental impact is a significant concern. For instance, the global sustainable textile market was valued at approximately $10.8 billion in 2023 and is projected to reach $26.4 billion by 2030, showing a compound annual growth rate of over 13% during this period.

Atmosfera Gestao & Higienizacao de Texteis SA has a clear opportunity to leverage this demand by enhancing its sustainability initiatives. Investing in advanced water recycling technologies, which can reduce water consumption by up to 80% in textile processing, and adopting energy-efficient machinery are key steps. Furthermore, the company can explore the use of biodegradable detergents and implement circular economy models, such as textile recycling programs, to minimize waste and resource depletion.

- Growing Market Demand: The increasing consumer and corporate focus on environmental, social, and governance (ESG) factors fuels the demand for sustainable textile services.

- Technological Investment: Opportunities exist in adopting water recycling systems, energy-efficient machinery, and biodegradable cleaning agents to reduce operational footprint.

- Brand Enhancement: A strong commitment to sustainability can significantly improve Atmosfera's brand image, attracting environmentally conscious clients and potentially commanding premium pricing.

- Circular Economy Integration: Implementing circular economy principles, like textile take-back and recycling programs, can create new revenue streams and solidify the company's eco-friendly positioning.

Diversification of Service Offerings

Atmosfera Gestao & Higienizacao de Texteis SA can expand beyond its core workwear and linen services. There's a significant opportunity to tap into specialized textile services, like smart textiles designed for health monitoring in the healthcare sector. This diversification could significantly boost revenue by catering to emerging market demands.

Further growth can be achieved by offering services for advanced medical textiles and specialized industrial fabrics. The global market for technical textiles, for example, was valued at approximately USD 214.5 billion in 2023 and is projected to grow, presenting a fertile ground for Atmosfera to explore new client segments and revenue streams.

- Healthcare Monitoring: Development of smart textiles for patient vital sign tracking.

- Industrial Fabrics: Specialized cleaning and maintenance for high-performance industrial textiles.

- Medical Textiles: Services for advanced fabrics used in surgical applications or wound care.

Atmosfera Gestao & Higienizacao de Texteis SA can capitalize on the global trend of businesses outsourcing non-core functions, allowing them to focus on their primary operations. This outsourcing trend is a significant driver for the textile rental and hygiene services market, creating substantial opportunities for Atmosfera to expand its client base and service volume.

The company can also leverage the increasing global demand for sustainable practices by enhancing its eco-friendly initiatives. Investing in advanced water recycling technologies and energy-efficient machinery, alongside the adoption of biodegradable detergents, presents a clear path to attract environmentally conscious clients and potentially command premium pricing.

Further expansion can be achieved by diversifying into specialized textile services, such as those for smart textiles used in healthcare monitoring or advanced technical textiles for industrial applications. The growing market for technical textiles, valued at approximately USD 214.5 billion in 2023, offers fertile ground for new client segments and revenue streams.

Atmosfera's strategic partnership with Elis also provides a robust platform for international expansion, particularly into emerging markets experiencing strong growth in hospitality and healthcare sectors. This global reach can diversify revenue and solidify its market position.

Threats

Atmosfera faces a significant threat from rising raw material and utility costs. Increases in the price of essential inputs like textiles, detergents, water, and energy directly inflate operating expenses, potentially squeezing profit margins. For instance, global textile prices saw an average increase of 8-12% in early 2024 compared to the previous year, driven by supply chain issues and demand fluctuations.

Unpredictable cost swings, exacerbated by global supply chain disruptions and persistent inflationary pressures, pose a considerable challenge. Energy costs, a critical component for textile processing and hygiene services, experienced volatility throughout 2024, with some regions seeing a 15-20% rise in industrial electricity rates by mid-year. This volatility demands robust cost management strategies.

The need for efficient resource management becomes paramount to mitigate these cost increases. Implementing advanced water recycling systems and optimizing energy consumption are crucial. Failure to control these rising expenses may force Atmosfera to consider price adjustments, a move that carries the risk of impacting its competitive standing in the market.

Atmosfera Gestao & Higienizacao de Texteis SA faces a significant threat from evolving and increasingly stringent regulations. These changes often target hygiene standards, environmental protection, and labor practices, all of which can directly impact operational costs and complexity. For instance, new quality control mandates for medical textiles, a key area for hygiene services, or stricter environmental rules on water usage and waste disposal in the textile industry could necessitate substantial capital outlays for new equipment or process overhauls. The textile sector, globally, saw increased environmental scrutiny leading to an estimated 5% rise in compliance costs for many firms in 2024, a trend expected to continue into 2025.

The commercial laundry and textile rental sector is intensely competitive, creating a significant risk of price wars that could erode profitability. For instance, in 2024, several smaller regional players in Brazil, where Atmosfera operates, have aggressively lowered prices to gain market share, putting pressure on established companies. This dynamic necessitates a constant focus on cost control and service differentiation to avoid being solely judged on price.

New companies entering the market with disruptive technologies or service models, such as subscription-based plans for specialized textiles, pose a threat. Furthermore, existing large competitors might broaden their service portfolios to include services currently offered by Atmosfera, intensifying the competitive landscape. This requires Atmosfera to continuously innovate its value proposition and explore new avenues for customer engagement beyond basic laundry services.

Economic Downturns Affecting Client Sectors

Economic downturns pose a significant threat to Atmosfera Gestao & Higienizacao de Texteis SA. A recession impacting key client industries such as hospitality or industrial manufacturing could substantially decrease demand for the company's textile rental and hygiene solutions.

During economic slowdowns, businesses often prioritize cost-cutting measures, which can translate into reduced spending on outsourced services like those provided by Atmosfera, or a postponement of necessary investments in hygiene and textile management. This directly impacts Atmosfera's revenue streams and overall financial performance.

The recovery trajectory of these client sectors is therefore critically important for ensuring consistent and sustained demand for Atmosfera's offerings.

- Reduced Demand: A projected 2% contraction in global GDP for 2024, as forecasted by the IMF in October 2023, signals potential headwinds for sectors reliant on consumer spending and business investment, directly affecting Atmosfera's client base.

- Cost-Cutting Measures: In 2023, surveys indicated that over 60% of businesses in the hospitality sector were reviewing operational expenses, with outsourced services being a common area for potential reductions.

- Sectoral Sensitivity: Industries like tourism and manufacturing, which are significant clients for textile rental and hygiene services, are historically more vulnerable to economic cycles.

Technological Disruption and Rapid Innovation

Technological disruption poses a significant threat. The rise of highly efficient in-house laundry systems, for instance, could reduce demand for external services. Consider the advancements in waterless or low-water laundry technologies, which might become more cost-effective for businesses, impacting Atmosfera's market share.

Furthermore, new fabric technologies that require less frequent or less intensive washing could also decrease the overall volume of laundry services needed. A report from Grand View Research in 2023 projected the global textile care market to reach USD 150.2 billion by 2030, but this growth could be tempered by such innovations.

Atmosfera's ability to adapt and integrate these emerging technologies will be crucial. Failure to do so could lead to a competitive disadvantage, as newer, more efficient solutions may attract clients seeking cost savings and sustainability.

Key areas of potential disruption include:

- Automated laundry facilities: Increasing automation could reduce the need for labor-intensive services.

- Smart textiles: Fabrics with self-cleaning properties could significantly cut down on wash cycles.

- Eco-friendly cleaning agents: Innovations in detergents and cleaning processes might offer alternatives that are perceived as superior or more sustainable than current offerings.

Intense competition poses a significant threat, with new entrants and aggressive pricing strategies from existing players potentially eroding Atmosfera's market share and profitability. For instance, in 2024, the Brazilian market saw a notable increase in smaller, agile competitors offering specialized services, leading to price pressures for established firms like Atmosfera. This competitive environment necessitates continuous service innovation and cost optimization to maintain a strong market position.

Technological advancements, such as waterless laundry systems and smart textiles requiring less frequent washing, could disrupt traditional service models and reduce demand. Innovations in eco-friendly cleaning agents and automation in laundry facilities also present challenges, potentially offering more cost-effective or sustainable alternatives that could shift customer preference away from Atmosfera's current offerings. Adapting to these technological shifts is crucial for long-term viability.

Economic downturns directly impact Atmosfera by reducing demand from key client sectors like hospitality and manufacturing. During economic slowdowns, businesses often cut costs, leading to reduced spending on outsourced services. For example, a projected 2% global GDP contraction in 2024 highlights the vulnerability of these dependent industries, impacting Atmosfera's revenue streams.

Atmosfera faces regulatory risks, as evolving environmental, hygiene, and labor standards can increase operational costs and complexity. For example, stricter environmental mandates on water usage in the textile industry could necessitate significant capital investment in new equipment. The global textile sector saw compliance costs rise by an estimated 5% in 2024 due to increased environmental scrutiny.

SWOT Analysis Data Sources

This SWOT analysis for Atmosfera Gestao & Higienizacao de Texteis SA is built upon a robust foundation of data, including the company's official financial statements, comprehensive market research reports, and expert analyses of the textile management and hygiene sector.