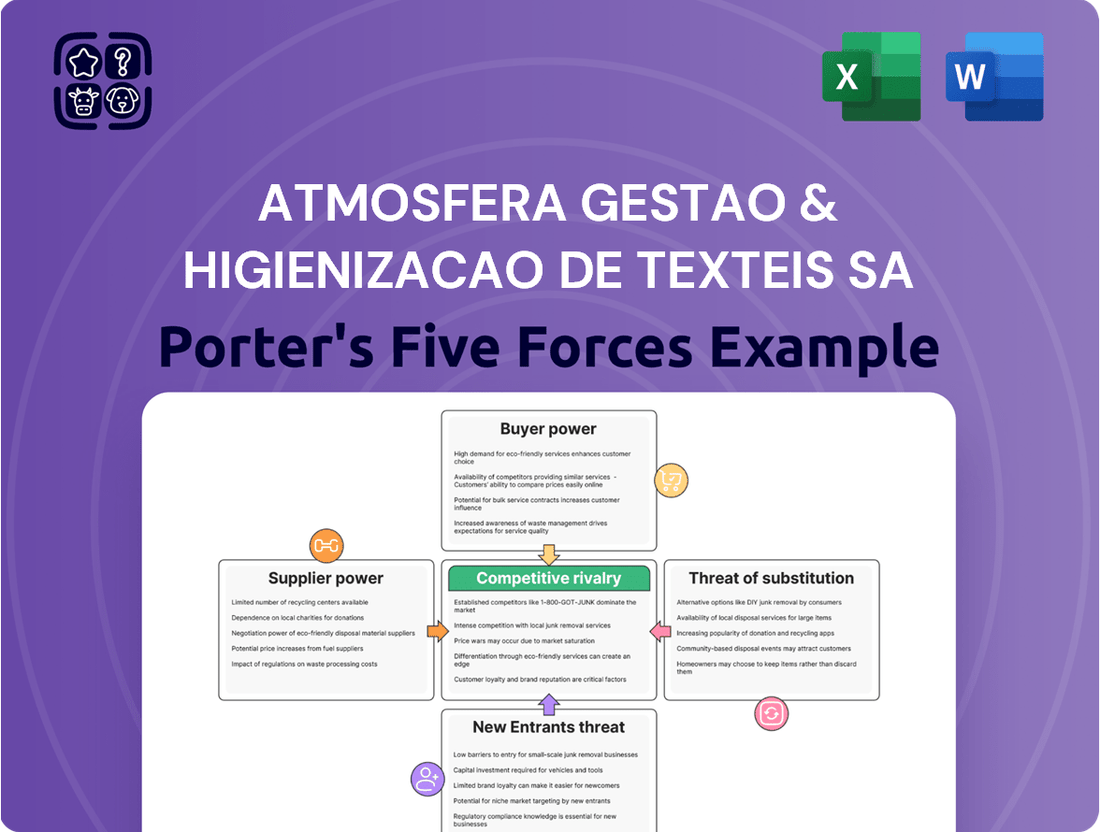

Atmosfera Gestao & Higienizacao de Texteis SA Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Atmosfera Gestao & Higienizacao de Texteis SA Bundle

Atmosfera Gestao & Higienizacao de Texteis SA operates in an industry where the bargaining power of buyers is moderate, as clients often have alternative textile hygiene providers. The threat of new entrants is also moderate, requiring significant capital investment in specialized equipment and trained personnel, creating a barrier to entry. The intensity of rivalry among existing players is high, driven by price competition and service differentiation.

The threat of substitutes is relatively low, as specialized textile hygiene services are difficult to replace with generic cleaning methods. However, suppliers of specialized chemicals and equipment can exert some bargaining power, impacting Atmosfera's operational costs. Understanding these forces is crucial for strategic planning.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Atmosfera Gestao & Higienizacao de Texteis SA’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The market for specialized commercial laundry equipment, crucial for operations like Atmosfera Gestao & Higienizacao de Texteis SA, is highly concentrated. Major global manufacturers such as Alliance Laundry System, Whirlpool, and Miele dominate this sector, wielding considerable influence over buyers.

This limited number of key suppliers means they can dictate terms, potentially leading to higher acquisition costs for essential machinery and cutting-edge technological components. The top five companies in this market collectively command over 70% of the market share, underscoring the significant bargaining power suppliers possess.

Switching core suppliers for textile materials or large-scale laundry machinery presents significant challenges for Atmosfera Gestao & Higienizacao de Texteis SA. The substantial capital outlay required to acquire and install new commercial laundry equipment means that changing suppliers is not a simple decision. For instance, a single industrial washing machine can cost tens of thousands of dollars, and a full facility setup runs into millions.

This high initial investment in machinery and equipment inherently creates considerable switching costs. Atmosfera would face not only the direct cost of new equipment but also the indirect costs associated with dismantling old systems, installation, and the inevitable downtime during the transition. In 2024, the global industrial laundry equipment market was valued at an estimated $5.8 billion, highlighting the scale of investment involved.

While many basic textiles are readily available and can be sourced from numerous suppliers, Atmosfera Gestao & Higienizacao de Texteis SA's need for specialized workwear or healthcare-grade linens significantly impacts the bargaining power of its suppliers. If these specialized textiles require unique manufacturing processes or certifications, the number of qualified suppliers naturally decreases, giving those remaining suppliers more leverage.

The growing demand for sustainable and eco-friendly textiles further refines the supplier landscape. Companies like Atmosfera that prioritize these attributes will find their pool of eligible suppliers shrinking, empowering those who can meet stringent environmental standards. For example, by mid-2024, the global market for sustainable textiles was projected to reach over $15 billion, indicating a strong but potentially concentrated supply base.

In the healthcare sector, where infection control and hygiene are paramount, the requirement for high-quality, specialized textiles is non-negotiable. This need for specific performance characteristics, such as antimicrobial properties or specific thread counts, further concentrates the supply chain. Suppliers who can consistently deliver on these critical attributes, often backed by rigorous testing and certifications, hold a stronger position in negotiations with companies like Atmosfera.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers for Atmosfera Gestão & Higienização de Têxteis SA is generally low. Suppliers of textiles or laundry chemicals typically operate in distinct manufacturing sectors and lack the specialized infrastructure and customer-facing operations essential for large-scale textile rental and hygiene services. For instance, a textile manufacturer's core competencies lie in fabric production, not in managing complex logistics networks or providing direct customer service to diverse industries like healthcare or hospitality, which are crucial for a textile rental business.

The operational differences are significant; textile rental involves managing vast inventories, intricate washing and sanitization processes, delivery fleets, and direct client relationships. These requirements represent a substantial barrier to entry for suppliers whose primary focus is manufacturing. While some larger chemical or equipment suppliers might offer ancillary services like basic maintenance, this does not translate into a full-scale competitive threat. In 2024, the global textile rental market, valued at over USD 100 billion, continues to be dominated by specialized service providers rather than upstream manufacturers venturing into service provision.

- Low Likelihood of Forward Integration: Suppliers of raw materials and chemicals typically lack the operational expertise and infrastructure for textile rental services.

- Significant Operational Differences: Textile rental demands extensive logistics, customer service, and specialized hygiene processes, distinct from manufacturing.

- Limited Ancillary Services: Some suppliers may offer basic maintenance, but this does not constitute a direct competitive threat.

- Market Dominance by Specialists: The global textile rental market remains largely composed of dedicated service providers, underscoring the difficulty for suppliers to transition.

Impact of Raw Material Costs

Fluctuations in the cost of essential raw materials like cotton and detergent chemicals significantly influence Atmosfera's cost of goods sold. For example, the price of cotton, a primary input for textile services, can be volatile due to weather patterns and global demand.

The broader textile industry has grappled with inflationary pressures and escalating raw material expenses throughout 2024, directly impacting the profitability of companies like Atmosfera. These rising costs can compress margins if they cannot be fully passed on to customers.

The global market for detergent chemicals, a critical component in textile hygiene services, is projected for continued growth. Market research indicates the global detergent chemicals market was valued at approximately USD 170 billion in 2023 and is anticipated to grow at a CAGR of around 4.5% from 2024 to 2030, which could translate into increased procurement expenses for Atmosfera.

- Cotton Price Volatility: Global cotton prices have seen significant shifts in 2024, influenced by factors like crop yields and international trade policies, directly impacting Atmosfera's material acquisition costs.

- Detergent Chemical Market Expansion: The increasing demand for cleaning and hygiene solutions is driving growth in the detergent chemicals sector, potentially leading to higher ingredient costs for service providers.

- Inflationary Pressures: Widespread inflation in 2024 has contributed to higher operational expenses across the textile supply chain, affecting the overall cost structure for textile management companies.

The bargaining power of suppliers for Atmosfera Gestao & Higienizacao de Texteis SA is moderate to high, particularly concerning specialized machinery and textiles. The concentration within the commercial laundry equipment market, with the top five companies holding over 70% market share, allows these suppliers significant leverage. Switching costs for industrial machinery are substantial, estimated in the tens of thousands to millions of dollars per facility, as seen in the $5.8 billion global industrial laundry equipment market valuation in 2024. Furthermore, the demand for specialized, high-quality textiles, especially in sectors like healthcare, limits the supplier pool, strengthening the position of those who can meet stringent requirements, evidenced by the projected over $15 billion market for sustainable textiles by mid-2024.

What is included in the product

This analysis delves into the competitive forces impacting Atmosfera Gestao & Higienizacao de Texteis SA, examining the threat of new entrants, the bargaining power of buyers and suppliers, the intensity of rivalry, and the threat of substitutes within the textile management and hygiene sector.

Instantly identify and strategize against competitive pressures, empowering Atmosfera Gestao & Higienizacao de Texteis SA to navigate market challenges effectively.

Customers Bargaining Power

Atmosfera's customer base spans healthcare, hospitality, and industrial sectors, but the concentration of volume with a few large clients grants them significant bargaining power. Major hospital networks or national hotel chains, for example, can leverage their substantial contract volumes to negotiate better pricing and service level agreements.

The hospitality sector, in particular, is a major driver of demand for textile services, and its substantial market share means that key players within this industry hold considerable sway. In 2024, the global hospitality market was valued at over $5 trillion, with a significant portion relying on specialized textile management.

Customer switching costs for textile rental services like Atmosfera Gestao & Higienizacao de Texteis SA can be a mixed bag. While changing providers might seem straightforward, there are indeed logistical challenges involved in shifting from one supplier to another. However, the presence of numerous competitors in the market can actually lower these costs, particularly if clients aren't locked into lengthy contracts.

Although switching suppliers can cause some temporary service interruptions, the competitive landscape often means providers are eager to minimize these disruptions to win new business. This competitive pressure helps keep switching costs manageable for many clients.

Yet, for certain sectors, the perceived cost of switching is significantly higher. In industries like healthcare, where consistent hygiene and regulatory compliance are paramount, clients may view a change in textile rental providers as a substantial risk, thereby increasing their perceived switching costs due to the critical nature of these services.

Customers possess significant bargaining power due to the availability of substitutes. They can opt to manage their own textile needs in-house or utilize disposable textile options, both of which reduce reliance on external providers like Atmosfera Gestao & Higienizacao de Texteis SA. This choice directly influences pricing and service demands.

The growing trend towards reusable and sustainable textile rental services offers an alternative to disposable options, particularly appealing to environmentally aware customers. This shift, however, can somewhat diminish the appeal of disposable alternatives, thereby subtly impacting customer leverage related to that specific substitute.

Despite the rise of rental solutions, the ability for some clients to manage their textile inventory internally remains a persistent substitute. This internal capability provides a baseline for comparison and negotiation, as clients can weigh the cost and effort of DIY against outsourcing.

Price Sensitivity of Customers

Customers in sectors like hospitality and manufacturing often exhibit high price sensitivity, directly impacting Atmosfera's pricing strategies for its textile management services. The core value proposition of outsourced laundry and linen services, centered on convenience and cost efficiency, inherently elevates price as a critical decision-making factor for clients.

The competitive landscape of the commercial laundry market intensifies these pricing pressures. For instance, in 2024, the global textile rental market was projected to reach approximately $110 billion, a figure indicating substantial competition where price differentiation becomes a key differentiator for service providers like Atmosfera.

- Price Sensitivity: Key client industries like hospitality are highly sensitive to pricing due to their own margin pressures.

- Convenience and Cost Savings: The fundamental drivers for adopting outsourced laundry services are convenience and cost reduction, making price a primary consideration.

- Market Competition: A competitive commercial laundry market means Atmosfera faces constant pressure to offer competitive pricing to retain and attract clients.

Threat of Backward Integration by Customers

The bargaining power of customers, particularly the threat of backward integration, presents a key dynamic for Atmosfera Gestao & Higienizacao de Texteis SA. Large clients, especially those in sectors like healthcare or major industrial facilities, might explore establishing their own in-house laundry operations if service costs escalate significantly or if they prioritize stringent quality and hygiene control. For instance, a large hospital system might analyze the cost-benefit of outsourcing versus internalizing its linen services.

While the substantial initial capital outlay and ongoing maintenance expenses for commercial laundry equipment typically serve as a considerable deterrent for most clients contemplating backward integration, evolving industry demands can shift this calculus. The growing emphasis on infection prevention and comprehensive hygiene management, a trend amplified in the post-2020 era, could indeed motivate some larger institutions to seriously consider developing their own laundry capabilities. This is particularly relevant for entities where the risk associated with textile hygiene is exceptionally high.

For example, in 2024, the global healthcare laundry services market was valued at approximately USD 15 billion, with a projected compound annual growth rate (CAGR) of around 5%. This growth is largely driven by stringent regulatory requirements and the increasing need for specialized hygiene protocols, factors that could potentially encourage larger healthcare providers to evaluate in-house solutions if outsourced providers cannot meet evolving demands or cost efficiencies.

- Potential for In-House Laundry: Large clients, especially in healthcare and industrial sectors, may consider establishing their own laundry facilities to control costs and ensure hygiene standards.

- Barriers to Integration: The high upfront investment and continuous maintenance costs for commercial laundry operations typically deter clients from backward integration.

- Hygiene Demand as a Driver: Increased focus on infection control and hygiene management could push some major institutions to explore in-house laundry solutions.

- Market Context: The growing healthcare laundry market highlights the importance of specialized hygiene, which might influence client decisions regarding outsourcing versus in-house operations.

Customers wield significant bargaining power, particularly due to price sensitivity in sectors like hospitality and the availability of substitutes such as in-house laundry or disposables. The competitive nature of the textile rental market, projected to reach around $110 billion globally in 2024, forces providers like Atmosfera to maintain competitive pricing.

Large clients, especially in healthcare, can leverage their volume to negotiate favorable terms or even consider backward integration, setting up their own laundry facilities. While high initial investment is a deterrent, growing demands for stringent hygiene control, as seen in the USD 15 billion global healthcare laundry services market in 2024, could influence these decisions.

The threat of clients managing their own textile needs, either through internal operations or by opting for disposable alternatives, directly impacts Atmosfera's service offerings and pricing strategies. This dynamic is further amplified by the general trend towards cost efficiency and convenience that drives the adoption of outsourced textile management services.

Ultimately, Atmosfera must balance competitive pricing and service excellence against the potential for clients to seek alternative solutions or develop their own capabilities, especially in high-volume or highly regulated sectors.

Preview the Actual Deliverable

Atmosfera Gestao & Higienizacao de Texteis SA Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details Atmosfera Gestao & Higienizacao de Texteis SA's Porter's Five Forces Analysis, covering the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, the threat of substitutes, and the intensity of rivalry within the textile management and hygiene sector. This comprehensive breakdown offers critical insights for strategic decision-making.

Rivalry Among Competitors

The textile rental and hygiene services sector is a crowded arena. Atmosfera faces competition not only from its global parent, Elis, but also from a multitude of smaller, localized firms. This dynamic is evident in markets like the U.S., where an estimated 3,000 local and regional businesses actively compete for market share.

This high degree of fragmentation fuels intense rivalry. Europe's textile rental market, for instance, has seen significant growth, attracting a diverse range of participants. These smaller players often compete on price and specialized service offerings, creating a challenging environment for larger entities.

The global textile services market is anticipated to expand at a compound annual growth rate (CAGR) of approximately 2.8% to 6.5% starting from 2025. This growth is largely fueled by a rising demand for outsourced laundry and linen management services.

While this growth trajectory is encouraging, it may not be substantial enough to dramatically ease competitive pressures within the industry. Companies will likely continue to intensely compete for market share, even with an expanding market.

Key sectors driving the demand for commercial laundry services include hospitality, healthcare, and the food service industry. These sectors rely heavily on consistent and high-quality textile management.

Atmosfera's competitive edge stems from its integrated approach, offering a comprehensive suite of textile management and hygiene solutions. This holistic service model, which includes specialized cleaning, maintenance, and logistics, sets it apart from competitors focused on single-service offerings.

The company emphasizes high hygiene standards, a crucial differentiator in the textile management sector, particularly for clients in healthcare and hospitality. By adhering to stringent protocols and certifications, Atmosfera assures clients of superior cleanliness and safety.

Sustainability is another key differentiator for Atmosfera, with a strong focus on eco-friendly practices. This includes the use of biodegradable detergents and energy-efficient processes, aligning with the growing market demand for environmentally responsible services. For instance, many businesses in 2024 are actively seeking partners who can demonstrate a commitment to ESG (Environmental, Social, and Governance) principles.

Leveraging technology further enhances Atmosfera's differentiation. Advanced tracking systems for textile inventory and real-time operational monitoring provide clients with transparency and efficiency, improving service delivery and customer satisfaction. This technological integration is becoming increasingly vital as companies seek to optimize their supply chains.

Exit Barriers

Exit barriers in the textile management and hygiene sector are notably high, primarily due to the significant capital outlay required for specialized laundry machinery and dedicated facilities. This substantial investment in processing capacity makes it financially challenging for companies to leave the market without incurring considerable losses. For instance, a large-scale industrial laundry operation can easily require millions of dollars in equipment alone, often with specialized configurations for different textile types and hygiene standards.

These high upfront costs, coupled with long-term contracts that clients often secure, further entrench companies in the industry. The commitment to these contracts can mean that even if profitability dips, a company must continue operations to fulfill its obligations, thereby limiting its ability to exit swiftly. This situation can foster intense competition as companies, unable to easily divest, remain operational, potentially intensifying rivalry by maintaining capacity.

- Capital Investment: High costs for industrial laundry equipment and specialized facilities.

- Long-Term Contracts: Client agreements often create a commitment to continued operation.

- Financial Losses: Difficulty exiting without significant write-offs on depreciating assets.

- Market Stagnation: Companies may remain in the market despite low profitability, increasing competitive pressure.

Fixed Costs

The commercial laundry sector, where Atmosfera Gestao & Higienizacao de Texteis SA operates, inherently involves substantial fixed costs. These include significant investments in industrial washing machines, dryers, specialized folding equipment, and the upkeep of facilities designed for high-volume operations. For instance, a new industrial laundry plant can easily cost millions of dollars to establish, covering equipment, construction, and initial setup.

These high fixed costs create a strong incentive for companies to maintain high operational capacity utilization. To cover these substantial overheads, businesses are driven to secure as much business as possible, often leading to aggressive pricing competition. This dynamic can manifest as price wars, particularly in periods of lower demand, as companies vie to fill their capacity and avoid underutilization penalties on their expensive machinery.

- High Capital Outlay: Industrial laundry equipment, such as large-capacity tunnel washers and continuous batch washers, represents a significant upfront investment, often running into hundreds of thousands or even millions of dollars per installation.

- Capacity Utilization Pressure: Companies must run their machinery at near-maximum capacity to spread the fixed costs over a larger volume of services, thereby reducing the per-unit cost.

- Aggressive Pricing: The need to maintain high utilization can lead to intense price competition, as firms lower prices to capture market share and keep their expensive assets running.

- Barrier to Entry: While driving rivalry among existing players, the high fixed costs also act as a considerable barrier for new entrants who may struggle to match the economies of scale achieved by established, fully-utilized competitors.

Atmosfera operates in a highly competitive landscape characterized by numerous local and regional players, as well as its global parent, Elis. This fragmentation, exemplified by the approximately 3,000 competing businesses in the U.S. market, fuels intense rivalry, often centered on price and specialized services.

Despite an anticipated market CAGR of 2.8% to 6.5% from 2025, competitive pressures are expected to remain significant as companies vie for share in growing segments like hospitality and healthcare.

Atmosfera differentiates itself through an integrated service model, stringent hygiene standards, a focus on sustainability, and technological advancements in tracking and monitoring.

The sector's high exit barriers, stemming from substantial capital investments in machinery and facilities, alongside long-term contracts, tend to keep existing players active, further intensifying competition.

SSubstitutes Threaten

Healthcare, hospitality, and industrial sectors might consider in-house laundry to control costs and quality. However, the complexity and significant capital expenditure for industrial-grade washing and drying machinery, often running into tens of thousands of dollars per unit, present a substantial barrier. Furthermore, the ongoing operational costs for utilities, maintenance, and specialized staff can outweigh the perceived savings.

The availability of disposable textiles, especially in healthcare, presents a significant alternative to Atmosfera's reusable linen rental services. These disposables offer immediate convenience and bypass the need for laundering, potentially appealing to cost-conscious or efficiency-focused clients. For instance, the global disposable medical supplies market was valued at approximately USD 165 billion in 2023 and is projected to grow, indicating a substantial market for alternatives.

However, this threat is somewhat tempered by a growing global emphasis on sustainability and environmental responsibility. As awareness of the waste generated by disposable products increases, there's a corresponding rise in demand for eco-friendly solutions. Many businesses and institutions are now actively seeking to reduce their environmental footprint, which favors reusable textile services like those offered by Atmosfera, aligning with ESG (Environmental, Social, and Governance) initiatives.

Clients might opt to buy their own workwear, bed linens, and table linens, bypassing specialized textile rental services. This means they would then handle cleaning and upkeep using smaller, less specialized laundries or their own in-house teams.

While this offers direct ownership, it places the entire responsibility for inventory, upkeep, and hygiene standards squarely on the client's shoulders. For instance, in 2024, many smaller businesses in sectors like hospitality might explore this to gain more control, but often find the operational overhead significant.

The cost and complexity of managing equipment, chemicals, and trained personnel for effective textile hygiene can quickly outweigh the perceived savings. In 2024, the ongoing investment in commercial laundry equipment, estimated to be tens of thousands of dollars for a small setup, coupled with rising energy costs, makes this a considerable barrier.

Furthermore, ensuring consistent quality and compliance with evolving hygiene regulations presents a continuous challenge for businesses that are not textile management specialists. This is particularly true in healthcare or food service industries where stringent standards are paramount.

Alternative Materials and Technologies

The threat of substitutes for Atmosfera Gestao & Higienizacao de Texteis SA's services primarily stems from alternative materials and technologies. Advances in materials science are continually introducing new textiles that may reduce the frequency of washing or cleaning. For instance, research into antimicrobial coatings and self-cleaning fabrics could lessen reliance on traditional laundering services, potentially impacting demand for Atmosfera's core offerings.

While smart textiles and innovative fabric technologies are developing, their widespread adoption and integration into commercial textile rental markets are still in nascent stages. As of early 2024, these advanced textiles have not yet presented a significant, immediate threat that materially alters the competitive landscape for established textile management companies like Atmosfera. Their impact remains largely in the experimental or niche application phase, rather than a mainstream challenge to current operational models.

The current landscape suggests that while the long-term potential for disruptive substitutes exists, the immediate threat is relatively low. The capital investment and infrastructure required to implement widespread use of advanced self-cleaning or highly hygienic textiles are considerable. This creates a buffer for existing players.

However, monitoring these technological advancements is crucial for strategic planning. Potential future impacts could include:

- Reduced washing cycles: Textiles engineered to repel dirt and bacteria could lead to fewer laundry services needed.

- Lower operational costs for clients: Businesses might opt for these advanced fabrics to cut down on their textile rental or maintenance expenses.

- Shift in service demand: The focus of textile management might shift from intensive cleaning to specialized care or repair of high-tech fabrics.

Standard Dry-Cleaning and Local Laundry Services

While standard dry-cleaning and local laundry services exist as potential substitutes for certain textile needs, their ability to serve large commercial clients like those in healthcare and hospitality is significantly limited. These smaller-scale operations often cannot accommodate the high volumes, rigorous sanitation standards, and consistent turnaround times that major industries require. For instance, a hospital's daily need for sterilized linens far exceeds the capacity of a neighborhood laundromat.

Atmosfera Gestao & Higienizacao de Texteis SA distinguishes itself by offering comprehensive, integrated textile management solutions. This approach covers the entire lifecycle of workwear, bed linens, and table linens, a service spectrum that local dry cleaners and laundromats typically do not provide. Their specialized processes ensure compliance with industry-specific regulations, a key differentiator for clients with strict operational requirements.

- Limited Capacity: Local services struggle with the high-volume demands of sectors like healthcare, which process thousands of textile items daily.

- Sanitation Standards: Commercial textile rental companies adhere to stringent, often regulated, hygiene protocols that are difficult for smaller laundries to replicate.

- Integrated Solutions: Atmosfera's end-to-end management, from collection to delivery, offers a value proposition beyond simple cleaning.

- Industry Specialization: The tailored services for specific industries like hospitality and healthcare demonstrate a higher level of operational sophistication.

The threat of substitutes for Atmosfera's services includes in-house laundry, disposable textiles, and clients purchasing their own linens. However, the significant capital outlay for industrial laundry equipment, estimated in the tens of thousands of dollars per unit in 2024, and ongoing operational costs for utilities and maintenance present substantial barriers to in-house operations. Disposable textiles, while offering convenience, face growing scrutiny due to sustainability concerns, with the global disposable medical supplies market, valued at roughly USD 165 billion in 2023, also highlighting the environmental trade-offs. Clients opting for self-management often find the overhead for equipment, chemicals, and trained personnel to be considerable, especially with commercial laundry setup costs often exceeding tens of thousands of dollars.

Entrants Threaten

The commercial textile rental and hygiene sector is inherently capital-intensive. Establishing operations demands significant upfront investment in specialized industrial laundry machinery, often costing hundreds of thousands of dollars per unit, alongside the construction or leasing of large-scale processing facilities. Furthermore, a sophisticated and reliable logistics network, including a fleet of dedicated delivery vehicles, is crucial for efficient service delivery, adding another layer of substantial capital expenditure.

Established players like Atmosfera, now part of the Elis group, leverage significant economies of scale. This allows them to secure better pricing on bulk purchases of textiles and detergents, and to operate highly efficient, large-volume laundry facilities. For instance, Elis's global revenue for 2024 reached over €4 billion, demonstrating the scale of its operations which directly benefits its subsidiaries like Atmosfera through enhanced purchasing power and optimized logistics.

New entrants face a substantial hurdle in matching these cost efficiencies. Without the substantial operational volume that comes from an established customer base and infrastructure, they would find it challenging to compete on price against incumbents. This cost disadvantage makes it difficult for new companies to gain market traction quickly.

The commercial laundry industry, particularly its healthcare segment, is heavily regulated. Newcomers must navigate complex environmental and safety standards, including stringent hygiene and infection control protocols. For instance, compliance with regulations like those set by the National Health Surveillance Agency (ANVISA) in Brazil, a key market for companies like Atmosfera, demands substantial investment in specialized equipment and advanced sterilization processes. This regulatory landscape acts as a significant barrier, making it difficult for new players to enter and compete effectively without prior experience and capital.

Access to Distribution Channels and Customer Relationships

Atmosfera Gestao & Higienizacao de Texteis SA benefits from deeply entrenched customer relationships and integrated service offerings across healthcare, hospitality, and industrial sectors. New entrants would struggle to replicate this trust and the comprehensive solutions provided, which are crucial for securing long-term contracts. For instance, in 2024, the healthcare linen service sector alone was valued at over $5 billion in Brazil, a market where established players like Atmosfera hold significant sway.

The textile services market's reliance on recurring, contracted revenue and predictable route-based logistics presents a substantial barrier for newcomers. Developing the necessary infrastructure for efficient collection, cleaning, and delivery requires considerable upfront investment and operational expertise, often exceeding the capabilities of nascent competitors. This established operational efficiency is a key differentiator.

- Established Client Trust: Atmosfera's long-standing partnerships are difficult for new entrants to penetrate.

- Contractual Lock-in: Securing similar long-term contracts requires significant proven reliability.

- Logistical Hurdles: Building efficient collection and delivery networks is a major capital and operational challenge.

- Predictable Revenue Streams: The route-based model favors incumbents with optimized operations.

Brand Loyalty and Reputation

In the textile management and hygiene sector, brand loyalty and reputation are formidable barriers to new entrants. Atmosfera Gestao & Higienizacao de Texteis SA, by its very nature, operates in a service-oriented space where trust and consistent quality are paramount. A strong brand reputation directly translates to client confidence, a factor that new competitors find exceptionally difficult to replicate quickly.

Atmosfera's established presence, bolstered by its association with the larger Elis group, cultivates a significant brand advantage. This established recognition means clients are more likely to stick with a known entity, especially when dealing with critical hygiene standards. Building a comparable level of trust and a reputation for unwavering quality and reliability would demand substantial time and considerable financial investment from any aspiring rival.

- Brand Loyalty: Clients in hygiene services prioritize reliability, making established brands like Atmosfera more attractive than unproven newcomers.

- Reputation Investment: Atmosfera's long-standing presence and Elis affiliation represent years of investment in building a trustworthy image.

- Barriers to Entry: New entrants face the challenge of overcoming established client trust, which requires significant time and capital to build.

- Service Consistency: The demand for consistent, high-quality hygiene services means clients are hesitant to switch to less-established providers.

The threat of new entrants for Atmosfera Gestao & Higienizacao de Texteis SA is moderate. The industry's capital intensity, requiring substantial investment in machinery, facilities, and logistics, presents a significant barrier. For example, industrial laundry equipment alone can cost hundreds of thousands of dollars per unit. Furthermore, stringent regulations, particularly in healthcare hygiene, demand specialized processes and compliance, adding to the cost and complexity for newcomers.

Established players like Atmosfera, now part of the Elis group, benefit from economies of scale, which translate into cost efficiencies and purchasing power. Elis's 2024 revenue exceeding €4 billion underscores this advantage. New entrants struggle to match these efficiencies, making it hard to compete on price. Additionally, deep-seated customer relationships and brand loyalty in service-oriented sectors like textile hygiene create a formidable challenge for any new company seeking to gain market traction.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High investment in industrial laundry machinery, facilities, and logistics fleets. | Significant financial hurdle, requiring substantial upfront capital. |

| Regulatory Compliance | Adherence to strict hygiene, environmental, and safety standards (e.g., ANVISA in Brazil). | Demands specialized equipment, advanced processes, and expertise, increasing operational costs. |

| Economies of Scale | Incumbents benefit from bulk purchasing and optimized large-scale operations. | New entrants face higher per-unit costs and less competitive pricing. |

| Brand Loyalty & Reputation | Established trust and proven quality are critical in hygiene services. | Difficult and time-consuming for new entrants to build comparable client confidence. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Atmosfera Gestao & Higienizacao de Texteis SA is built upon a foundation of reliable data, including the company's official financial statements, industry-specific market research reports, and publicly available regulatory filings.