Asure Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Asure Bundle

Unlock the secrets to a company's product portfolio with the Asure BCG Matrix. See at a glance which products are poised for growth, which are generating steady income, and which might be holding the business back. Ready to transform this snapshot into a powerful strategic advantage?

Dive into the full Asure BCG Matrix for a comprehensive analysis that goes beyond the basics. You'll get detailed quadrant placements, actionable insights, and a clear roadmap for optimizing your investments and product development. Don't just understand your market; dominate it.

The complete Asure BCG Matrix is your essential guide to navigating market dynamics and making informed decisions. Purchase the full report to gain a competitive edge and ensure your business is positioned for sustainable success.

Stars

Asure Software's core cloud-based HCM platform, a robust suite covering payroll, HR, time, and benefits, is firmly positioned as a Star in the BCG matrix. This classification stems from its dominant presence in the small and mid-sized business (SMB) sector, a market experiencing significant growth in cloud HCM adoption.

The SMB cloud HCM market is projected to grow at a healthy 9.8% compound annual growth rate (CAGR), and Asure's platform is capturing a substantial share of this expansion. Its recurring revenue model, which consistently exceeds 95% of the company's total revenue, underscores exceptional customer loyalty and a solidified leadership position within its chosen market segments.

Asure's Payroll Tax Management solution, especially its recent expansion to serve large Canadian and global enterprises, is a prime example of a Star in the BCG matrix. This offering tackles crucial compliance requirements in an expanding international landscape, signaling substantial potential for increased market penetration.

The solution's ability to integrate smoothly with prominent platforms such as Workday, Oracle, and SAP solidifies its leading position within a high-growth segment of the Human Capital Management (HCM) sector. For instance, the global payroll market was valued at approximately $30 billion in 2023 and is projected to grow significantly, with international payroll tax management being a key driver.

Following the July 2025 acquisition of Lathem Time, Asure's integrated time and attendance solutions are positioned as a Star in the BCG matrix. This move is projected to boost Asure's presence in a rapidly expanding market, bringing in high-margin recurring revenue. For instance, the time and attendance software market alone was valued at over $2.5 billion globally in 2023 and is expected to grow at a CAGR of 7.5% through 2030.

The integration is designed to unlock significant cross-selling opportunities within Asure's comprehensive Human Capital Management (HCM) offerings. This strategic synergy is anticipated to accelerate payroll sales and improve the 'attach rates' for their existing customer base, further solidifying their market share.

Strategic Cross-Selling and Expanded Product Suite

Asure's strategic focus on increasing 'attach rates' is a key driver for its growth. By leveraging its expanded product suite, bolstered by acquisitions like Lathem Time and Hireclick in August 2024, Asure aims to become a comprehensive, one-stop shop for small and medium-sized businesses (SMBs).

This integrated approach is designed to deepen client engagement and capture greater market share. Bundling solutions allows Asure to capitalize on the increasing demand for all-encompassing HR and payroll services, a trend that saw the HR tech market grow significantly in 2024.

- Increased Attach Rates: Asure aims to boost the percentage of clients using multiple Asure products.

- Expanded Product Suite: Acquisitions like Lathem Time and Hireclick broaden the service offering.

- One-Stop Shop for SMBs: The strategy targets providing a consolidated platform for HR and payroll needs.

- Market Share Expansion: Bundling is intended to attract new clients and retain existing ones more effectively.

AI-Enhanced HR Compliance Services

Asure's AI-Enhanced HR Compliance Services are a burgeoning Star within its portfolio. The integration of artificial intelligence into these offerings signifies a significant leap forward, addressing the growing market demand for automated and intelligent HR solutions. This strategic focus on AI for compliance is positioning Asure to secure a substantial portion of a high-growth market.

Businesses are increasingly seeking sophisticated tools to navigate complex regulatory landscapes, making Asure's AI-driven approach highly attractive. For instance, in 2024, the global HR tech market was valued at approximately $35 billion, with compliance software being a major driver of this growth. Asure's investment in AI is designed to enhance scalability and efficiency, offering clients a competitive edge.

- AI Integration: Asure is actively incorporating AI to streamline HR compliance processes, improving accuracy and speed.

- Market Demand: There's a clear trend towards automated and intelligent HR tools, especially for compliance management.

- Growth Potential: The AI in HR compliance sector is experiencing rapid expansion, offering significant market share opportunities.

- Strategic Investment: Asure's commitment to AI development in this area is a forward-thinking strategy to meet evolving business needs.

Asure's core HCM platform, particularly its strong foothold in the growing SMB cloud market, is a clear Star. This is further bolstered by its Payroll Tax Management solution, which is expanding internationally and integrating with major platforms like Workday and Oracle. The acquisition of Lathem Time in July 2025 positions its integrated time and attendance solutions as Stars, driving cross-selling opportunities and increasing attach rates.

The company's AI-Enhanced HR Compliance Services are also emerging Stars, capitalizing on the demand for automated and intelligent HR solutions in a market valued at approximately $35 billion in 2024. Asure's strategy to become a one-stop shop for SMBs, driven by acquisitions and product bundling, reinforces its Star positioning across multiple HCM segments.

| Asure Offering | BCG Category | Key Growth Drivers | Market Context (2024/2025 Data) |

|---|---|---|---|

| Cloud HCM Platform (SMB) | Star | High adoption in SMB sector, recurring revenue model (>95%) | SMB cloud HCM market CAGR: 9.8% |

| Payroll Tax Management (Global) | Star | International expansion, integration with Workday/Oracle/SAP | Global Payroll Market Value: ~$30 billion (2023) |

| Time & Attendance Solutions | Star | Post-Lathem Time acquisition (July 2025), cross-selling | Time & Attendance Software Market Value: >$2.5 billion (2023), CAGR: 7.5% (to 2030) |

| AI-Enhanced HR Compliance | Star | AI integration, demand for automated compliance | HR Tech Market Value: ~$35 billion (2024) |

What is included in the product

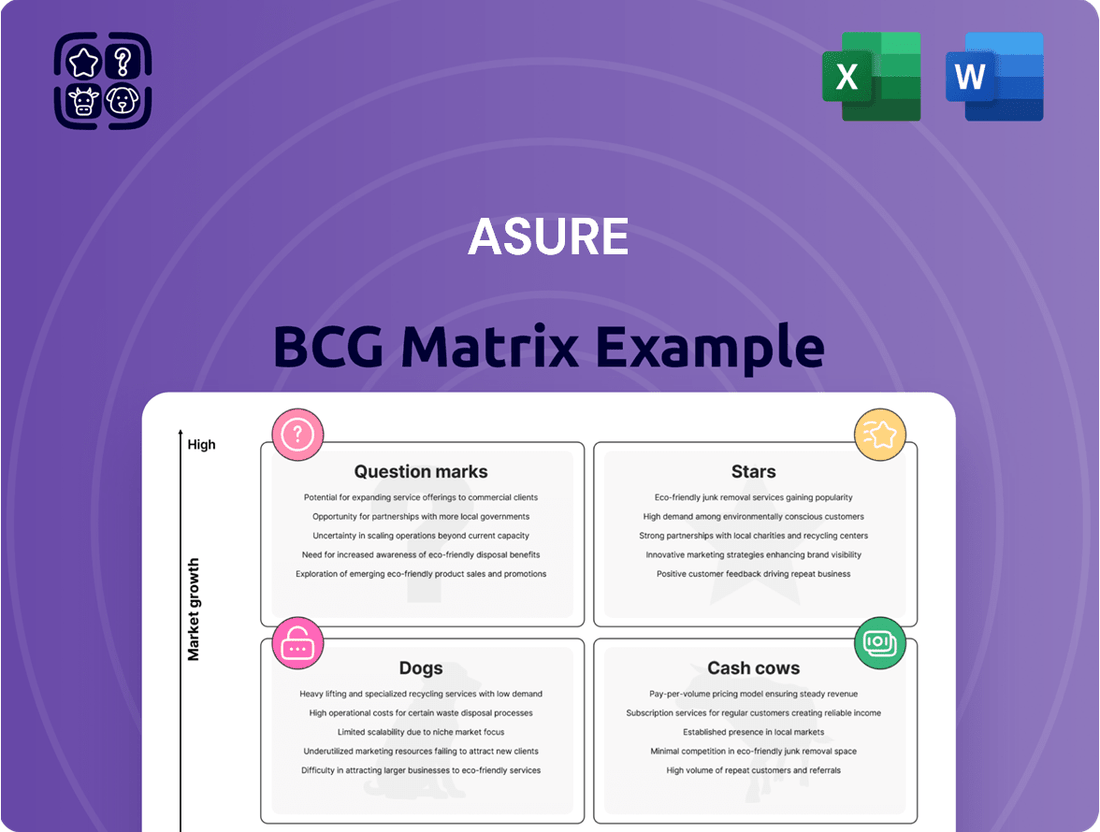

The Asure BCG Matrix provides a strategic overview of a company's product portfolio, categorizing units into Stars, Cash Cows, Question Marks, and Dogs to guide investment decisions.

A clear visual map of your portfolio, instantly highlighting areas needing investment or divestment.

Cash Cows

Asure's established SMB payroll and tax services are prime examples of Cash Cows within the BCG Matrix. These offerings represent a mature, stable revenue stream, benefiting from Asure's deep-rooted client relationships and extensive compliance expertise in a well-established market.

The company's payroll and tax solutions consistently generate substantial cash flow with minimal need for aggressive marketing or investment. This reliable financial output is crucial, as it provides the necessary capital to support Asure's other business units and strategic growth endeavors.

Core HR management solutions, encompassing employee data management and basic reporting, represent Asure's foundational offerings. These are essential, widely adopted services for small and medium-sized businesses (SMBs), demonstrating high retention rates and generating predictable revenue.

While not experiencing rapid expansion, their substantial market penetration and efficient operations contribute a consistent and reliable cash flow to Asure. For instance, in 2024, Asure reported that its core HR platform continued to be a significant driver of recurring revenue, with a notable percentage of its customer base utilizing these fundamental services.

Asure's benefits administration solutions are a cornerstone of their Human Capital Management (HCM) platform, acting as a stable, revenue-generating engine. These services address the perpetual business requirement for streamlined employee benefits management, contributing significantly to the company's financial stability.

The mature client base actively using these offerings ensures a predictable stream of recurring revenue. This stability means Asure can allocate fewer resources to aggressive growth initiatives for this segment, unlike their more nascent product lines.

In 2024, Asure reported that its benefits administration segment consistently demonstrated strong performance, contributing to a significant portion of their overall revenue. This segment’s reliability is a key factor in Asure’s overall business strategy, providing a solid foundation for expanding other service areas.

Legacy Client Base and Reseller Network

Asure's extensive legacy client base and robust reseller network function as significant Cash Cows. These established relationships offer a predictable and consistent stream of recurring revenue, minimizing the need for costly new customer acquisition efforts. In 2024, Asure reported that its recurring revenue streams, largely driven by these long-term contracts and network partnerships, continued to be a primary contributor to its financial stability.

The company's 'Centers of Excellence' strategy further strengthens these Cash Cow segments by providing localized, high-quality support. This approach deepens client loyalty and encourages repeat business and referrals, ensuring sustained cash flow. For instance, Asure's focus on customer retention, a key benefit of this model, saw a strong performance in its client renewal rates throughout 2024, underscoring the value of these established channels.

- Legacy Client Base: Represents a stable and predictable revenue source.

- Reseller Network: Provides cost-effective client acquisition and ongoing revenue.

- Recurring Revenue: A significant portion of Asure's income is derived from these established relationships.

- Customer Retention: The 'Centers of Excellence' model enhances loyalty and reduces churn in these segments.

Recurring Revenue Model (Overall Stability)

Asure's recurring revenue model is the bedrock of its financial stability, acting as a powerful Cash Cow. This model accounts for an impressive 95% of Asure's total revenue, providing a consistent and predictable stream of income. This financial predictability is crucial for Asure, enabling the company to confidently invest in innovation, pursue strategic growth opportunities, and manage its operational expenses effectively, even when the broader market experiences volatility.

The dominance of recurring revenue in Asure's business model offers significant advantages:

- Predictable Cash Flow: Over 95% of Asure's revenue is recurring, ensuring a steady and reliable income stream.

- Funding for Growth: This stable cash flow allows for robust investment in research and development, as well as strategic acquisitions.

- Resilience in Markets: The high percentage of recurring revenue provides a strong foundation, maintaining business stability through market fluctuations.

Asure's established payroll and tax services, along with its core HR management and benefits administration solutions, are prime examples of Cash Cows within the BCG Matrix. These offerings represent mature, stable revenue streams benefiting from deep client relationships and extensive compliance expertise in a well-established market. In 2024, Asure reported that its core HR platform and benefits administration segment continued to be significant drivers of recurring revenue, with a notable percentage of its customer base utilizing these fundamental services.

The company's recurring revenue model, accounting for over 95% of total income, is the bedrock of its financial stability. This predictable cash flow, driven by a legacy client base and a robust reseller network, enables Asure to confidently invest in innovation and manage operational expenses effectively. Asure's focus on customer retention, bolstered by its Centers of Excellence, saw strong client renewal rates throughout 2024, underscoring the value of these established channels.

| Asure Business Segment | BCG Matrix Category | Key Characteristics | 2024 Relevance |

|---|---|---|---|

| Payroll & Tax Services | Cash Cow | Mature, stable revenue, low investment needs | Consistent driver of recurring revenue |

| Core HR Management | Cash Cow | High retention, predictable revenue, essential for SMBs | Significant portion of customer base utilizes |

| Benefits Administration | Cash Cow | Stable revenue engine, addresses perpetual business need | Strong performance, key contributor to overall revenue |

| Legacy Clients & Reseller Network | Cash Cow | Predictable recurring revenue, cost-effective acquisition | Primary contributor to financial stability |

Delivered as Shown

Asure BCG Matrix

The Asure BCG Matrix preview you're seeing is the complete, unwatermarked document you will receive immediately after purchase. This means you're evaluating the exact strategic tool you'll be implementing, ready for immediate application in your business planning. It’s a fully formatted, analysis-ready report designed to provide clear insights into your product portfolio's performance and guide your strategic decisions.

Dogs

Older, non-integrated acquired technologies often become cash traps within a company's portfolio, especially if they were niche software solutions from past acquisitions. These systems, if not successfully integrated into the core cloud platform or modernized, can drain resources through high maintenance and support costs. For instance, a company might find that a legacy CRM system, acquired years ago and never fully updated, now accounts for 15% of its IT budget but only serves 3% of its customer base, failing to drive significant revenue growth.

Within a professional services firm, segments experiencing stagnant or declining revenue alongside low profit margins are classified as Dogs in the BCG Matrix. For instance, a legacy IT consulting service that hasn't adapted to cloud technologies might see its revenue flatline while costs remain high, leading to minimal profitability. In 2024, such a segment might represent only 5% of total revenue but consume 15% of operational resources, yielding a negative return on investment.

Certain components of a 'Smart Office' offering, like advanced asset tracking or detailed occupancy sensors, might fall into the Dogs category if adoption rates are low. For instance, if a company's workplace occupancy sensor solution saw only a 5% uptake among its client base in 2024, and the market for such niche sensors is projected to grow at a meager 2% annually, it indicates a weak market position and limited future potential.

Services Dependent on Fading Regulatory Incentives

Services that depend heavily on temporary government programs, like the Employee Retention Tax Credit (ERTC), can be categorized as Dogs in the Asure BCG Matrix. Asure itself has noted that ERTC revenue is not included in its core growth discussions, highlighting its temporary nature.

These types of services, while potentially offering a short-term revenue boost, do not represent sustainable long-term growth. Their reliance on fading incentives means they can obscure the true performance of Asure's fundamental business operations.

- ERTC Reliance: Services tied to programs like ERTC are vulnerable to discontinuation.

- Non-Recurring Revenue: These offerings generate revenue that is not expected to repeat.

- Masked Core Performance: Temporary boosts can hide underlying issues in core business segments.

- Strategic Re-evaluation: Businesses must consider divesting or re-strategizing such offerings once incentives expire.

Inefficient or High-Cost Operational Overhead

Inefficient or high-cost operational overheads, while not a direct product, can function similarly to a Dog in the BCG matrix. These are areas within a company that drain resources without generating sufficient returns, widening net losses even if overall revenue is growing. For example, a company might have an outdated IT infrastructure that requires significant maintenance and upgrade costs, but doesn't offer a competitive advantage or support new revenue streams.

Such operational inefficiencies consume valuable cash flow that could otherwise be invested in growth areas or more profitable ventures. Consider a large retail chain in 2024 that reported a 15% increase in revenue but also a 25% rise in operating expenses, largely attributed to aging warehouse management systems and inefficient logistics. This widening gap between revenue and costs directly impacts profitability.

- High Maintenance Costs: Legacy systems or outdated processes often incur disproportionately high maintenance and repair expenses.

- Low Productivity: Inefficient operations lead to lower output per employee or asset, increasing the cost per unit of production or service.

- Resource Misallocation: Cash spent on inefficient overheads diverts funds from potentially high-return investments or innovation.

- Negative Impact on Margins: These costs directly erode profit margins, making it harder to achieve profitability even with sales growth.

Dogs represent business segments with low market share and low growth potential. These offerings often consume more resources than they generate, leading to poor profitability. For example, a niche software product acquired years ago that hasn't evolved with market trends might represent a Dog. In 2024, such a product could show minimal revenue growth while its support costs remain substantial.

For Asure, services tied to temporary government programs, like the Employee Retention Tax Credit (ERTC), are considered Dogs. These do not contribute to sustainable, long-term growth and can mask the performance of core business areas. Asure has indicated that ERTC revenue is not part of its core growth metrics, underscoring its non-recurring nature.

Inefficient operational overheads can also act as Dogs, draining resources without providing a competitive edge. An example is an outdated IT infrastructure that incurs high maintenance costs. In 2024, a company might see operating expenses rise faster than revenue due to such inefficiencies, directly impacting profitability.

These segments require careful strategic consideration, often involving divestment or significant restructuring to improve their viability or eliminate their drain on resources.

| Business Segment Example | Market Share | Market Growth | Profitability | Strategic Implication |

| Legacy CRM System | Low | Low | Negative | Divest or Integrate |

| ERTC Services | N/A (Temporary) | Declining | Variable (Program Dependent) | Phase Out |

| Outdated Warehouse Management System | N/A (Internal) | N/A (Internal) | Negative (Cost Driver) | Upgrade or Replace |

Question Marks

The new Canadian Payroll Tax Management solution for large enterprises fits the Question Mark category within the Asure BCG Matrix. This is because it operates in a high-growth market with strong potential, indicated by the increasing complexity of Canadian payroll regulations and the growing number of multinational corporations operating in Canada. However, its future success is uncertain, as it's a recent offering with unproven market traction.

Asure must strategically invest in marketing and sales efforts to drive adoption and build market share for this new solution. The goal is to move it from a Question Mark to a Star, a position characterized by high growth and high market share. Without significant promotional push and successful integration with key enterprise systems, it risks remaining a Question Mark with uncertain future returns.

The acquisition of Lathem Time in July 2025 positions it as a Question Mark for Asure. While the move is intended to bolster time and attendance offerings and unlock cross-selling opportunities, its ultimate success is uncertain and depends heavily on seamless integration and market acceptance of combined solutions.

Asure's strategic objective is to leverage Lathem Time to enhance its existing product suite and generate new revenue streams through bundled offerings. However, the realization of these cross-selling synergies is not guaranteed and requires substantial effort in integration and market penetration. For instance, if Asure can successfully bundle Lathem's advanced time tracking with its payroll services, it could significantly increase customer lifetime value.

Converting this acquisition from a Question Mark to a Star will necessitate significant investment in technology integration and a targeted go-to-market strategy. The company must demonstrate tangible benefits to customers, such as improved efficiency and cost savings, to drive adoption. Asure's ability to execute this integration effectively will be a key determinant of its success in the market.

Asure's acquisition of Hireclick, an applicant tracking system (ATS), in August 2024 places it squarely in the Question Mark category of the BCG Matrix. The ATS market is highly competitive, with numerous established players and emerging solutions vying for market share. While Hireclick broadens Asure's Human Capital Management (HCM) offerings, it requires significant investment to gain traction.

The success of Hireclick hinges on its ability to capture a meaningful share of the ATS market. This will necessitate robust marketing campaigns and continuous product development to differentiate itself from competitors. The total addressable market for ATS solutions is projected to grow, offering a significant opportunity if Asure can effectively position and enhance Hireclick.

For Hireclick to transition from a Question Mark to a Star, Asure must focus on successful integration with its existing HCM suite and drive strong market adoption. Achieving a high market share will depend on factors like user experience, feature set, and competitive pricing. The company's ability to execute its go-to-market strategy will be critical in determining Hireclick's future performance.

Expansion into Larger Enterprise Markets

Asure's expansion into larger enterprise markets, exemplified by their Canadian Payroll Tax Management solution, positions them as a Question Mark on the BCG Matrix. This strategic pivot targets a segment with substantial growth prospects, a departure from their established Small and Medium-sized Business (SMB) focus.

Successfully penetrating these larger markets presents a challenge, as Asure will face intense competition from entrenched Human Capital Management (HCM) providers. Significant investment in product development, sales infrastructure, and marketing will be crucial to capture meaningful market share.

- High Growth Potential: The enterprise market offers considerable revenue expansion opportunities, attracting companies with complex payroll and HR needs.

- Competitive Landscape: Asure must contend with established players with deep market penetration and extensive enterprise solution portfolios.

- Investment Requirements: Gaining traction will necessitate substantial capital allocation for tailored solutions, robust support, and aggressive market entry strategies.

- Strategic Execution: Success hinges on Asure's ability to effectively adapt its offerings and go-to-market approach to meet the demands of larger organizations.

Advanced AI/Machine Learning Features Beyond Compliance

Beyond basic compliance, Asure's exploration into advanced AI/ML for broader Human Capital Management (HCM) functions like predictive talent analytics and enhanced employee engagement signifies a move into potentially high-growth but competitive segments. These deeper AI integrations require substantial research and development to carve out a distinct market share.

While the HCM market is projected to reach $53.7 billion by 2027, with AI-driven solutions being a key growth driver, Asure's current positioning in these advanced AI features is still nascent. Significant investment is needed to develop proprietary algorithms and data sets that can truly differentiate them.

- Talent Analytics: Leveraging AI to predict employee turnover and identify high-potential candidates.

- Employee Engagement: Utilizing machine learning to analyze sentiment and personalize employee experiences.

- R&D Investment: Focus on developing unique AI capabilities to gain a competitive edge.

- Market Differentiation: Building a strong brand presence in cutting-edge AI-powered HCM solutions.

Question Marks represent business units or products in high-growth markets but with low market share. For Asure, this often relates to new product launches or acquisitions where future success is not yet guaranteed. For example, the Canadian Payroll Tax Management solution, while entering a growing market, needs significant investment to gain traction against established competitors.

Similarly, the acquisition of Hireclick in August 2024, an applicant tracking system, is a Question Mark. The applicant tracking system market is competitive, and Hireclick needs substantial marketing and product development to carve out its niche within Asure's Human Capital Management (HCM) suite.

The key challenge for Question Marks is determining which ones to invest in to potentially become Stars and which ones to divest from if they fail to gain momentum. Asure's strategic focus on integrating Lathem Time, acquired in July 2025, into its offerings also places it in this category, requiring careful management to unlock cross-selling opportunities and avoid becoming a Dog.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, customer surveys, and competitive analysis, to provide a clear strategic roadmap.