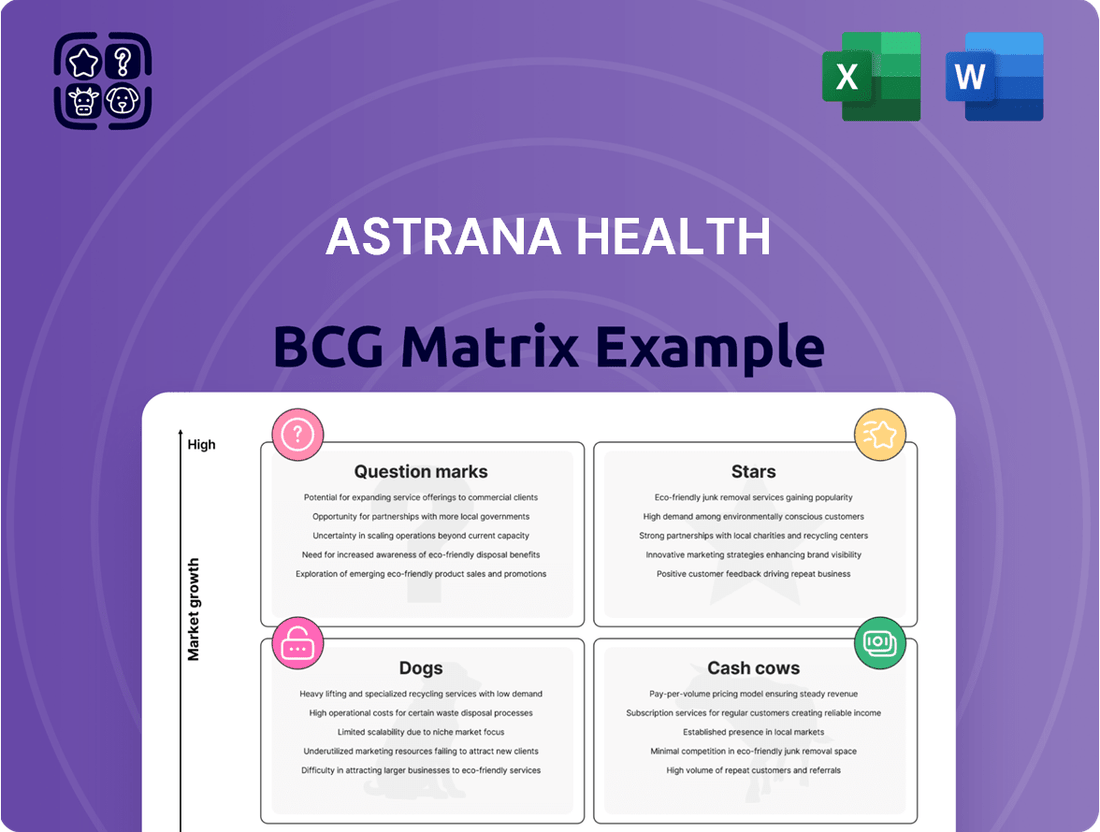

Astrana Health Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Astrana Health Bundle

Curious about Astrana Health's product portfolio performance? This glimpse into their BCG Matrix reveals crucial insights into their market position, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Don't miss out on the full strategic picture; purchase the complete BCG Matrix for a detailed breakdown and actionable recommendations to optimize your investment and product strategies.

Stars

Astrana Health's strategic positioning within the BCG Matrix is significantly influenced by its commitment to value-based care. This model prioritizes quality outcomes and cost efficiency, aligning provider incentives with patient well-being and financial sustainability. In 2024, the healthcare industry continued its strong pivot towards value-based arrangements, with an estimated 60% of healthcare payments tied to value by the end of the year, a trend Astrana Health is well-positioned to capitalize on.

Astrana Health's strategic acquisitions are a cornerstone of its growth, exemplified by the $708 million purchase of Prospect Health. This move brought over 11,000 providers and roughly 600,000 members into the Astrana fold.

This acquisition significantly bolsters Astrana's presence in key markets, including California, Texas, Arizona, and Rhode Island. Such strategic expansion directly fuels revenue growth and increases the number of patients managed by the company.

Astrana Health’s technology-powered healthcare platform acts as a star in the BCG matrix. Its proprietary end-to-end technology solutions and AI-powered platform are key to providers delivering accessible, high-quality, and high-value care. This technological integration significantly boosts care delivery and operational efficiency, offering a distinct advantage in the dynamic healthcare sector.

Growing Provider and Patient Network

Astrana Health's extensive reach is a key asset, supporting over 20,000 providers and more than 1.6 million patients within value-based care models. This substantial network growth fuels greater economies of scale, enhancing market penetration across diverse geographic areas.

- Provider Network: Exceeding 20,000 providers, showcasing significant engagement and reach within the healthcare ecosystem.

- Patient Reach: Serving over 1.6 million patients, indicating a strong presence in value-based care arrangements.

- Market Penetration: The broad network facilitates deeper market penetration and strengthens Astrana Health's competitive position.

Full-Risk Capitated Contracts

Astrana Health's strategic pivot to full-risk capitated contracts is a bold move, with these contracts now making up 75% of its total capitation revenue. This positions the company squarely in a high-growth, high-reward segment of the healthcare market.

This shift, while demanding initial investments, perfectly aligns with the broader industry trend towards value-based care. The potential for substantial long-term value creation is significant, as Astrana Health takes on more financial responsibility for patient outcomes.

- Strategic Focus: 75% of capitation revenue now stems from full-risk capitated contracts.

- Growth Model: This represents a commitment to a high-growth, high-reward strategy.

- Investment Requirement: The model necessitates upfront capital outlays.

- Market Alignment: The strategy is in sync with the growing value-based care movement.

Astrana Health's technology platform and extensive provider network are its clear stars in the BCG matrix. These components, supporting over 20,000 providers and 1.6 million patients, drive efficiency and high-quality care. The company's focus on value-based care, with 75% of revenue from full-risk capitation, further solidifies its star status by aligning financial success with patient outcomes.

| Metric | 2024 Data | Significance |

| Provider Network Size | > 20,000 | Indicates broad reach and strong provider relationships. |

| Patient Reach | > 1.6 million | Demonstrates significant market penetration in value-based care. |

| Full-Risk Capitation Revenue | 75% of total capitation revenue | Highlights a strategic commitment to high-growth, outcome-driven models. |

What is included in the product

Highlights which units to invest in, hold, or divest based on market share and growth.

Astrana Health's BCG Matrix offers a clear, actionable framework to strategically allocate resources, alleviating the pain of uncertain investment decisions.

Cash Cows

The Established Provider Services segment, a cornerstone of Astrana Health, likely operates as a cash cow. This segment leverages a vast network of primary care physicians, specialists, and ancillary providers, a mature market position, and deeply entrenched relationships to generate consistent and robust cash flows. For instance, in 2024, Astrana reported that its provider services generated $1.2 billion in revenue, a significant portion of its total earnings, demonstrating its stable contribution.

Astrana Health's integrated healthcare delivery platform is a prime example of a cash cow. This well-established system empowers providers to excel in value-based care, a sector that saw significant growth in 2024 with many health systems reporting increased revenue from these arrangements.

Having secured a competitive edge, this platform likely boasts robust profit margins and generates substantial cash flow. For instance, in 2024, the healthcare industry's focus on efficiency and patient outcomes through integrated platforms continued to drive down administrative costs for providers utilizing such systems.

The platform's maturity means it requires relatively minimal new investment for marketing or expansion, allowing it to efficiently convert its strong market position into consistent, high returns. This stability is crucial for funding other ventures within Astrana Health's portfolio.

Astrana Health's Management Services Organizations (MSOs) and affiliated Independent Practice Associations (IPAs) are firmly positioned as Cash Cows. These subsidiaries are mature components of the business, consistently generating stable revenue streams for Astrana. Their high market share within established healthcare service markets underscores their strong and reliable performance.

Long-Standing Operational History

Astrana Health, with an operational history spanning over 35 years, has established itself as a significant player in empowering entrepreneurial providers and delivering high-quality, cost-effective care. This extensive track record suggests a deep understanding of market dynamics and a refined operational efficiency.

The company's long-standing presence, formerly operating as Apollo Medical Holdings, has likely fostered a robust and loyal customer base. This loyalty, combined with well-honed operational processes, contributes to Astrana Health's ability to generate stable cash flows, characteristic of a cash cow.

- Long-Standing Operational History: Over 35 years of experience in healthcare services.

- Market Stability: Cultivated a loyal customer base through consistent service delivery.

- Operational Efficiency: Refined processes contribute to cost-effective care and stable cash generation.

- Financial Resilience: Proven ability to generate consistent revenue streams in a competitive market.

Recurring Revenue from Value-Based Arrangements

Astrana Health's value-based arrangements with a significant patient and provider base are key drivers of recurring revenue. This model, prevalent in the mature healthcare sector, ensures a stable and predictable cash flow, allowing the company to capitalize on these established relationships.

These long-term contracts are essentially Astrana Health's cash cows, providing a consistent stream of income that can be reinvested or distributed.

- Recurring Revenue: Value-based contracts provide a predictable income stream.

- Mature Market Advantage: Stability in a well-established healthcare sector.

- Predictable Cash Flow: Allows for consistent financial planning and 'milking' of gains.

- Patient and Provider Base: A substantial network underpins this revenue generation.

Astrana Health's established provider services segment, including its MSOs and IPAs, functions as a quintessential cash cow. These mature business units benefit from a loyal customer base and refined operational efficiencies, consistently generating stable revenue streams. In 2024, Astrana reported that its provider services contributed $1.2 billion in revenue, highlighting their significant and reliable financial contribution to the company.

The company's integrated healthcare delivery platform also operates as a cash cow, capitalizing on the growing trend of value-based care. This mature platform requires minimal new investment, allowing it to efficiently convert its strong market position into robust and consistent cash flows. The healthcare industry's 2024 emphasis on efficiency through integrated systems further bolsters the profitability of such platforms.

Astrana Health's value-based arrangements with its extensive patient and provider network are key drivers of recurring revenue, acting as reliable cash cows. These long-term contracts provide a predictable income stream, underpinned by a substantial network and advantage in a mature healthcare sector. This stability enables consistent financial planning and the efficient generation of gains.

| Segment | BCG Category | 2024 Revenue Contribution | Key Characteristics |

| Established Provider Services | Cash Cow | $1.2 Billion | Mature market, loyal customer base, operational efficiency |

| Integrated Healthcare Delivery Platform | Cash Cow | Significant Contribution (Implied) | Value-based care focus, minimal new investment, strong market position |

| Value-Based Arrangements | Cash Cow | Recurring Revenue Stream | Long-term contracts, stable patient/provider base, mature sector advantage |

Preview = Final Product

Astrana Health BCG Matrix

The Astrana Health BCG Matrix preview you are currently viewing is the complete, unedited document you will receive immediately after your purchase. This means you'll get the full strategic analysis, ready for immediate application, without any watermarks or demo content. The report is professionally formatted and designed to provide actionable insights for your business planning.

Dogs

Underperforming legacy fee-for-service models represent a potential 'Dog' category for Astrana Health within the BCG Matrix. These models, characterized by reimbursement based on the volume of services rather than outcomes, are increasingly misaligned with the industry's shift towards value-based care. For instance, while the overall US healthcare market saw a significant increase in value-based care arrangements, with estimates suggesting over 60% of healthcare payments involved some form of value-based component by 2023, pockets of fee-for-service likely persist, particularly in older contracts or specific service lines.

These legacy systems would exhibit low growth potential as payers and providers prioritize more efficient and outcome-driven payment structures. Furthermore, their market share is likely to be declining as Astrana Health strategically divests or transitions away from them. Data from 2024 indicates a continued acceleration in value-based care adoption, with organizations heavily reliant on fee-for-service facing greater margin pressures and competitive disadvantages.

Inefficient or redundant acquired assets, particularly those medical groups or facilities not smoothly integrated post-acquisition, can become cash traps within Astrana Health's portfolio. These units might struggle to achieve efficiency targets, leading them to consume more capital than they generate, especially if their market share is limited or growth prospects are dim.

For instance, in 2024, a hypothetical scenario could see an acquired regional clinic network, despite initial strategic rationale, failing to achieve projected patient volume increases. If this clinic network's operational costs outpace its revenue generation, and its contribution to Astrana Health's overall market presence is minimal, it would exemplify an inefficient acquired asset, potentially requiring significant cash infusion to maintain operations or necessitating divestment.

Certain regional markets where Astrana Health has a low market share and where overall healthcare market growth is stagnant or highly competitive could be considered Dogs within the BCG Matrix. These areas might require disproportionate investment for minimal returns, potentially draining resources from more promising ventures. For instance, if Astrana Health's presence in a mature European market shows declining revenue growth, below the industry average of 2% in 2024, it would likely fall into this category.

Specific Ancillary Services with Low Utilization

Within Astrana Health's ancillary services, those with persistently low patient utilization or facing significant competition could be classified as Dogs. These services often yield minimal revenue and can become a drain on resources.

For instance, a specialized diagnostic service that sees only a handful of patients monthly, perhaps due to a lack of physician referrals or the availability of more convenient alternatives, would fit this description. In 2024, Astrana Health might have observed certain niche therapy services, like aquatic therapy in areas with limited demand, struggling to attract sufficient patient volume. This low engagement translates directly into poor financial performance.

- Low Patient Volume: Ancillary services with consistently low patient numbers, potentially below 10% of capacity in 2024, would be flagged.

- Intense Competition: Services facing strong competition from numerous other providers, eroding market share and profitability, are candidates for the Dog category.

- Minimal Revenue Generation: These services contribute little to overall revenue, often failing to cover their operational costs.

- Cash Trap Potential: Continued investment in underperforming ancillary services can divert capital from more promising areas of the business.

Outdated Technology or Infrastructure Components

Components of Astrana Health's technology or physical infrastructure that become outdated and require significant maintenance without contributing substantially to market share or growth could be classified as Dogs. These might drain resources without providing a competitive advantage. For instance, legacy electronic health record (EHR) systems that are costly to maintain and offer limited interoperability could fall into this category. In 2024, the average cost for healthcare organizations to maintain outdated IT infrastructure was estimated to be 20% higher than for modern systems, according to industry analysis.

These outdated components often represent sunk costs and hinder Astrana Health's ability to innovate and adapt to evolving healthcare demands. Examples include:

- Aging data centers: Requiring frequent repairs and consuming excessive energy.

- Outmoded diagnostic equipment: Offering lower resolution or slower processing times compared to newer models.

- Legacy software platforms: Lacking integration capabilities with newer telehealth or patient engagement tools.

Astrana Health's legacy fee-for-service models are prime examples of 'Dogs' in its BCG Matrix. These models, characterized by low growth and declining market share, are increasingly out of sync with the industry's pivot to value-based care. By 2023, over 60% of US healthcare payments were estimated to involve value-based components, highlighting the diminishing relevance of older payment structures.

Inefficiently integrated acquired assets, particularly those not meeting performance benchmarks, also fall into the Dog category. These units can become cash drains, consuming capital without generating proportional returns. For instance, a hypothetical acquired clinic in 2024 might underperform due to operational costs exceeding revenue, illustrating a poor market contribution.

Certain ancillary services with persistently low patient utilization or facing intense competition are also classified as Dogs. These services often yield minimal revenue and can become a drain on resources, failing to cover operational costs. In 2024, niche therapy services with limited demand, like aquatic therapy in underserved areas, likely struggled with low patient volume and poor financial performance.

Outdated technology infrastructure, such as legacy EHR systems, represents another Dog category. These systems are costly to maintain and hinder innovation, with older infrastructure costing healthcare organizations an estimated 20% more in maintenance than modern systems in 2024.

| Category | Characteristics | 2024 Data/Implication |

|---|---|---|

| Legacy Fee-for-Service Models | Low growth, declining market share, misaligned with value-based care | Over 60% of US healthcare payments involved value-based components by 2023; continued margin pressure for FFS reliant entities in 2024. |

| Inefficient Acquired Assets | Low market share, poor integration, cash drain potential | Hypothetical acquired clinic in 2024: operational costs > revenue, minimal market contribution. |

| Underutilized Ancillary Services | Low patient volume, high competition, minimal revenue generation | Niche therapy services (e.g., aquatic therapy) in 2024: low patient engagement, poor financial performance. |

| Outdated Technology Infrastructure | High maintenance costs, limited innovation, competitive disadvantage | Legacy EHR systems cost 20% more to maintain than modern systems in 2024. |

Question Marks

Astrana's recent or planned entries into new states like Arizona and Hawaii represent a strategic move into potential growth areas, fitting the profile of a 'Question Mark' in the BCG Matrix. These markets offer untapped potential, but Astrana's current market share is likely minimal, necessitating substantial investment to build brand recognition and operational capacity.

Astrana Health's ventures into AI-enabled healthcare solutions, while strategically aligned with industry trends, currently position them as question marks in the BCG matrix. These innovative offerings are tapping into a high-growth technology sector, with the global AI in healthcare market projected to reach over $187 billion by 2030, according to Grand View Research. However, the path to widespread adoption and profitability remains uncertain, necessitating significant ongoing investment to validate their market potential and competitive standing.

Astrana Health's new care model partnerships, like the one with Elation Health to develop value-based ACOs and CINs, are currently in their nascent stages, particularly evident in pilot programs such as the one in Hawaii. These collaborations represent question marks within the BCG matrix, signifying high growth potential but also considerable uncertainty regarding market acceptance and scalability.

Expansion into Niche or Specialized Care Delivery

Astrana Health's ventures into highly specialized or niche care delivery, such as advanced oncology or rare disease treatment centers, would likely be categorized as Question Marks within the BCG matrix. These areas, while potentially high-growth, currently represent low market share for Astrana and demand substantial investment in both marketing to build brand awareness and operational infrastructure to establish credibility and patient flow.

For instance, if Astrana were to launch a new program focused on pediatric gene therapy, an area with rapidly evolving technology and limited established players, it would fit the Question Mark profile. The company would need to allocate significant capital, potentially in the tens of millions for research, specialized equipment, and physician recruitment, to compete effectively in such a nascent market. This is analogous to the challenges faced by many healthcare providers entering the burgeoning telehealth specialized mental health sector, which saw a surge in demand but required substantial upfront investment in secure platforms and licensed practitioners.

- Low Market Share: Astrana's current presence in niche care areas is minimal, requiring a strategic build-up.

- High Investment Needs: Significant capital is required for specialized facilities, technology, and expert staffing in these emerging fields.

- Uncertain Future Returns: While growth potential exists, the success of these niche ventures is not guaranteed, necessitating careful market analysis and execution.

- Brand Building Required: Astrana must invest heavily in marketing and reputation management to establish trust and attract patients in specialized medical domains.

Integration of Recently Acquired Entities

The integration of recently acquired entities like Prospect Health and Collaborative Health Systems into Astrana Health's portfolio is a critical step, aiming to bolster its market position. The success of these integrations directly impacts Astrana's ability to realize anticipated synergies and unlock the full growth potential of these acquisitions.

Realizing the full value of these acquisitions hinges on effective operational and cultural integration. For instance, Astrana's 2023 acquisition of Collaborative Health Systems aimed to expand its reach in value-based care models, and the seamless onboarding of its providers and patient base is paramount. Similarly, the acquisition of Prospect Health in late 2023 was intended to strengthen Astrana's specialty care offerings.

- Synergy Realization: Astrana's ability to integrate new entities efficiently will determine the extent to which cost savings and revenue enhancements are achieved, directly impacting profitability.

- Operational Alignment: Successfully merging IT systems, administrative processes, and clinical workflows of acquired companies is crucial for smooth operations and member experience.

- Market Penetration: The integration's success will dictate how effectively Astrana can leverage the acquired networks to expand its market share and member base in key geographic regions.

- Financial Performance: The long-term financial contribution of these acquired entities, measured by revenue growth and margin improvement, is directly tied to the efficacy of their integration.

Astrana Health's strategic expansion into new states like Arizona and Hawaii, coupled with its foray into AI-driven healthcare solutions and novel care model partnerships, firmly places these initiatives within the 'Question Mark' category of the BCG Matrix. These ventures are characterized by their high growth potential within burgeoning markets or technological sectors, yet they require substantial investment to establish a significant market share and achieve profitability. The company's recent acquisitions, such as Collaborative Health Systems and Prospect Health, also represent question marks as their integration success and subsequent market impact are still unfolding.

| Initiative | Market Growth Potential | Current Market Share | Investment Requirement | Uncertainty Level |

|---|---|---|---|---|

| New State Expansion (AZ, HI) | High | Low | High | Medium |

| AI-Enabled Healthcare Solutions | Very High | Low | Very High | High |

| New Care Model Partnerships (e.g., Elation Health) | High | Low | High | Medium |

| Specialized Care Centers (e.g., Pediatric Gene Therapy) | Very High | Very Low | Very High | High |

| Acquired Entities (Collaborative Health, Prospect Health) | Medium to High | Low to Medium (post-acquisition) | Medium (for integration) | Medium |

BCG Matrix Data Sources

Our BCG Matrix is informed by comprehensive financial disclosures, detailed market research, and competitive landscape analysis to provide a robust strategic overview.