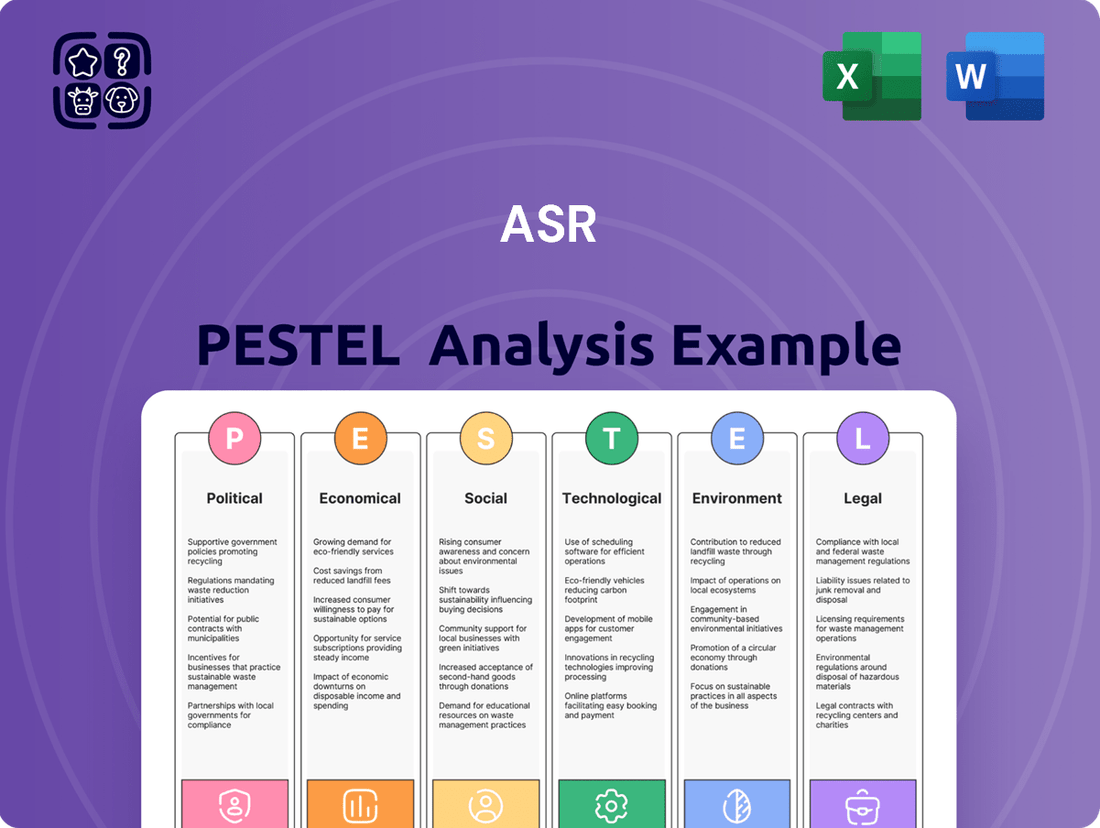

ASR PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ASR Bundle

Navigate the complex external forces shaping ASR's trajectory with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, and technological advancements are creating opportunities and challenges. This detailed report offers actionable insights to inform your strategic planning and investment decisions. Don't get left behind; download the full PESTLE analysis today and gain a critical competitive advantage.

Political factors

The stability of the Dutch government and its policy direction are crucial for ASR. A stable government typically means a more predictable regulatory environment, which is vital for financial services firms. Conversely, frequent political shifts can lead to uncertainty regarding future financial regulations.

Changes in government policy directly affect ASR's operations. For instance, increased consumer protection measures or stricter financial oversight can raise compliance costs and alter business strategies. The Dutch government's commitment to financial sector stability, as evidenced by ongoing reviews of capital requirements, will shape ASR's strategic planning.

Looking ahead, potential legislative initiatives are key. Reforms aimed at enhancing policyholder protection or bolstering the resilience of the financial sector could introduce new compliance burdens or opportunities for insurers like ASR. The Dutch Parliament's focus on sustainable finance, for example, is likely to influence investment strategies and product development.

The Netherlands boasts a generally stable political landscape, offering ASR a predictable environment for its operations. This stability is crucial for long-term strategic planning and fostering investor confidence. For instance, the Dutch government's commitment to fiscal prudence, as evidenced by its consistently low debt-to-GDP ratio, which stood at approximately 44% in early 2024, underpins economic predictability.

However, potential shifts in political power or significant policy alterations could impact ASR. Changes affecting social welfare programs or economic regulations might influence consumer demand for insurance and pension products. The Dutch coalition governments, while typically stable, can introduce policy nuances that require ASR to adapt its offerings and risk assessments.

Policy continuity, particularly in areas related to financial services and pensions, is a significant advantage for ASR. The long-standing Dutch pension system, known for its robustness and adaptability, demonstrates the benefits of consistent policy frameworks. This continuity allows ASR to confidently invest in product development and market expansion, knowing that the underlying regulatory environment is unlikely to undergo drastic, unforeseen changes.

Government decisions on corporate tax rates, such as potential increases in Australia's company tax from 30% to 33% or changes in New Zealand's corporate tax, directly impact ASR's net profits. Premium taxes and specific incentives for savings and pensions, like the Australian government's superannuation contribution caps which were adjusted in the 2024-25 financial year, influence the appeal and profitability of ASR's insurance and pension products.

Fiscal policies designed to boost economic activity or manage national debt can alter consumer spending power. For instance, if a government implements broad tax cuts to stimulate the economy, individuals might have more disposable income, increasing their capacity to purchase insurance products from ASR.

Changes in the taxation of pensions and retirement savings are particularly significant for ASR's longevity and annuity businesses. For example, adjustments to tax-free withdrawal limits or contribution deductibility in markets like the UK or Australia directly affect the attractiveness of ASR's retirement solutions.

EU and International Regulatory Alignment

ASR, as a significant Dutch insurer, navigates a complex regulatory landscape that extends beyond national borders. European Union directives, such as Solvency II, directly impact ASR's capital requirements, risk management frameworks, and reporting obligations. For instance, the ongoing review of Solvency II, which began in 2023 and is expected to conclude with revised requirements around 2025, could necessitate adjustments to ASR's capital holdings and operational strategies.

These EU-level political shifts are critical; a change in a directive can trigger substantial compliance efforts. Beyond the EU, adherence to international financial standards and agreements is paramount for ASR’s global operations and its standing in the financial community. The Financial Stability Board's (FSB) ongoing work on climate-related financial disclosures, which gained momentum in 2024, exemplifies an international regulatory trend ASR must monitor and integrate.

- Solvency II Review: Ongoing revisions by the European Commission, anticipated to finalize around 2025, may alter capital adequacy rules for insurers like ASR.

- International Standards: ASR's cross-border activities necessitate alignment with evolving international financial reporting and prudential standards.

- Climate-Related Disclosures: Global initiatives, such as those from the FSB, are pushing for standardized reporting on climate risk, impacting ASR's transparency and risk assessment.

- Digital Finance Regulations: The EU's proposed Digital Operational Resilience Act (DORA), fully applicable from January 2025, imposes stringent cybersecurity and IT risk management requirements on financial entities, including insurers.

Government Support for Sustainable Finance Initiatives

The Dutch government's robust commitment to sustainability, evident in its ambitious climate targets and supportive policies for green finance, directly impacts ASR. This political environment encourages ASR to integrate ESG principles into its core business, influencing everything from product design to investment portfolios. For instance, the Dutch government's pledge to achieve a 55% reduction in greenhouse gas emissions by 2030 compared to 1990 levels creates a strong incentive for financial institutions to channel capital towards sustainable projects.

These government initiatives translate into tangible opportunities and obligations for ASR. Increased regulatory requirements for ESG reporting, such as those mandated by the Sustainable Finance Disclosure Regulation (SFDR) at the EU level, which is heavily influenced by national political agendas, necessitate greater transparency and accountability in ASR's operations and investments. Conversely, political incentives like tax breaks or subsidies for sustainable investments can reduce the cost of capital for green ventures, potentially boosting ASR's returns in these areas.

ASR's proactive stance on sustainable business operations is a strategic advantage, aligning perfectly with these evolving political priorities. This alignment can enhance ASR's reputation, attract environmentally conscious customers and investors, and potentially lead to preferential treatment in government tenders or partnerships. The Netherlands' ambition to be a leader in the circular economy further underscores the need for financial services to adapt and support these national objectives.

Key political factors influencing ASR's sustainable finance approach include:

- National Climate Goals: The Dutch government's commitment to net-zero emissions by 2050, with interim targets like the 55% reduction by 2030, drives demand for green financial products.

- ESG Disclosure Mandates: Stricter regulations on ESG reporting require ASR to provide detailed information on its sustainability performance, impacting investor relations and risk management.

- Incentives for Green Investments: Government-backed green bonds or tax credits for sustainable projects can lower ASR's cost of capital and encourage investment in these sectors.

- Circular Economy Policies: The push for a circular economy creates opportunities for ASR to finance innovative business models focused on resource efficiency and waste reduction.

Political stability in the Netherlands provides a predictable operating environment for ASR, crucial for long-term planning and investor confidence. The Dutch government's fiscal prudence, reflected in a low debt-to-GDP ratio around 44% in early 2024, supports economic stability, though policy shifts can still influence consumer demand for insurance products.

What is included in the product

This ASR PESTLE analysis provides a comprehensive examination of how political, economic, social, technological, environmental, and legal factors impact the organization.

It offers actionable insights and forward-looking perspectives to inform strategic decision-making and identify potential opportunities and threats.

Provides a structured framework to identify and mitigate potential external threats, thereby reducing uncertainty and aiding strategic decision-making.

Economic factors

Interest rate fluctuations directly influence ASR's investment performance, especially for its life insurance and pension offerings. These products often involve long-term investments, making them sensitive to changes in the economic landscape.

A prolonged period of low interest rates, such as those seen in recent years, can squeeze profit margins for insurers and pension providers. This is because the yields on their investments may not keep pace with the guaranteed returns promised to policyholders, and the cost of maintaining these guarantees can increase.

Conversely, an environment of rising interest rates generally benefits ASR. Higher rates can improve profitability by increasing investment income. However, there's a balancing act, as rapidly increasing rates can also negatively impact the market value of existing bond portfolios, potentially leading to unrealized losses.

Decisions made by the European Central Bank (ECB) are particularly significant for ASR. For instance, as of mid-2025, the ECB's benchmark interest rate remains a critical factor influencing the overall cost of capital and investment returns across the Eurozone, directly affecting ASR's financial strategies and product pricing.

High inflation in the Netherlands, reaching 3.4% in May 2024 according to Statistics Netherlands (CBS), directly impacts ASR by increasing the cost of settling claims for non-life insurance policies. This inflationary pressure also erodes the purchasing power of investment returns, potentially diminishing ASR's real profitability.

Conversely, the Dutch economy is showing resilience. The Dutch central bank (DNB) projected economic growth of 0.8% for 2024, up from 0.1% in 2023. This growth typically translates to higher employment and increased disposable incomes for households and businesses, bolstering demand for ASR's insurance and financial services.

A strong economic environment supports ASR's ability to grow its client base and increase premium volumes. For instance, continued economic expansion in 2025 could lead to a greater number of individuals and companies seeking financial security and investment opportunities, directly benefiting ASR's revenue streams.

Rising unemployment significantly impacts sales of non-essential financial products like health and life insurance, as consumers tighten their belts. In the US, for instance, the unemployment rate hovered around 3.9% in early 2024, a slight uptick from the lows seen in 2023, suggesting potential headwinds for discretionary financial planning. This economic pressure can also lead to increased policy lapses as individuals struggle with premium payments.

Conversely, a robust labor market with low unemployment, like the 3.5% unemployment rate seen in early 2023, typically fuels consumer confidence and spending. This environment benefits ASR by boosting demand across its product spectrum, from mortgage applications to a broader range of insurance policies, as individuals feel more financially secure and optimistic about the future.

Mortgage Market Dynamics

ASR's exposure to the mortgage market, particularly in the Netherlands, means its performance is closely tied to housing price trends and mortgage interest rate fluctuations. A robust housing market, characterized by stable or appreciating prices, generally supports higher demand for mortgages and related insurance products. For instance, in late 2024 and early 2025, the Dutch housing market has shown resilience, with prices continuing to see modest growth in many areas after a period of adjustment.

Mortgage interest rates are a critical determinant of borrowing costs and, consequently, demand for new mortgages. Lower rates typically stimulate borrowing, while higher rates can dampen activity. As of mid-2025, interest rates have remained relatively stable, following a period of increases in 2023-2024, which has provided a more predictable environment for both borrowers and lenders like ASR.

Lending policies enacted by regulators and financial institutions significantly impact the accessibility of mortgages. Stricter lending criteria can reduce the pool of eligible borrowers, while more flexible policies can expand it. ASR's business is therefore influenced by ongoing discussions and potential adjustments to regulations surrounding loan-to-value ratios and debt-to-income limits, aimed at ensuring market stability.

The health of the mortgage market directly underpins ASR's mortgage and insurance segments. A stable market fosters consistent demand for ASR's offerings, contributing to revenue and profitability. Conversely, significant downturns in housing prices or prolonged periods of high interest rates could negatively affect loan origination volumes and the value of mortgage portfolios.

- Housing Price Growth: Dutch housing prices experienced an average annual growth of approximately 4-6% in key regions during 2024, with projections for 2025 indicating similar, albeit slightly moderated, growth rates.

- Mortgage Interest Rates: Average interest rates for a 10-year fixed mortgage in the Netherlands hovered around 3.5%-4.0% in early 2025, a slight decrease from the 4.0%-4.5% seen in late 2024.

- Mortgage Origination Volume: The total volume of new mortgage originations in the Netherlands was estimated to be around €150 billion in 2024, with an expected stable to slightly increasing trend for 2025.

- Lending Policy Impact: ASR benefits from a stable regulatory environment, and any significant shifts in lending policies, such as changes to the maximum loan-to-income ratio, could impact the volume of mortgages written.

Investment Market Performance

Global equity markets showed resilience through early 2024, with major indices like the S&P 500 reaching new highs, driven by strong corporate earnings and easing inflation concerns. However, bond markets experienced fluctuations as central banks signaled a cautious approach to interest rate cuts. For ASR, this performance directly influences the valuation of its investment portfolio, impacting profitability and long-term solvency.

The volatility in both equity and bond markets presents ongoing challenges for ASR's asset-liability management. For instance, a sudden downturn in equity valuations could strain the company's ability to meet its long-term liabilities. Conversely, periods of stable, positive market growth, such as the observed 15% year-to-date gain in the MSCI World Index by mid-2024, provide a more favorable environment for ASR's financial health.

Effective diversification remains a cornerstone strategy for ASR to navigate these market dynamics. By spreading investments across different asset classes and geographies, ASR can mitigate the impact of adverse performance in any single market segment. This approach is crucial for maintaining a stable financial footing amidst economic uncertainties.

- Global equity markets, including the S&P 500, reached record highs in early 2024, indicating positive investor sentiment.

- Bond markets faced volatility due to central bank policy uncertainty, impacting fixed-income returns.

- The MSCI World Index saw a significant gain of approximately 15% by mid-2024, showcasing equity market strength.

- ASR's investment portfolio returns are directly tied to these market performances, affecting solvency and profitability.

Economic factors significantly shape ASR's operational landscape, influencing investment returns and the demand for its diverse financial products. Interest rate decisions by entities like the European Central Bank directly affect ASR's profitability, as seen with the benchmark rate's impact on capital costs and investment yields as of mid-2025. Inflationary pressures, such as the 3.4% rate in the Netherlands in May 2024, increase claim settlement costs for non-life policies and diminish the real value of investment returns.

Economic growth, projected at 0.8% for the Netherlands in 2024 by the DNB, generally boosts ASR's revenue by increasing disposable incomes and demand for financial services. Conversely, rising unemployment, exemplified by the 3.9% rate in the US in early 2024, can reduce sales of discretionary products and lead to policy lapses. The housing market's health, with Dutch property prices showing modest growth in late 2024 and early 2025, directly supports ASR's mortgage and related insurance businesses, with new mortgage originations estimated at €150 billion for 2024.

| Economic Indicator | Value/Trend | Period | Impact on ASR |

|---|---|---|---|

| ECB Benchmark Interest Rate | Critical Factor | Mid-2025 | Influences cost of capital and investment returns |

| Dutch Inflation Rate | 3.4% | May 2024 | Increases claim costs; erodes real profit |

| Dutch Economic Growth Projection | 0.8% | 2024 | Boosts demand for financial services |

| US Unemployment Rate | ~3.9% | Early 2024 | Headwind for discretionary product sales |

| Dutch Housing Price Growth | 4-6% (annual avg.) | 2024 | Supports mortgage and insurance demand |

| 10-year Fixed Mortgage Rate (NL) | ~3.5%-4.0% | Early 2025 | Affects borrowing costs and mortgage demand |

| New Mortgage Originations (NL) | ~€150 billion | 2024 | Underpins mortgage and insurance segments |

Preview Before You Purchase

ASR PESTLE Analysis

The preview you see here is the exact ASR PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises.

The content and structure shown in the preview is the same document you’ll download after payment, providing a comprehensive overview of factors impacting Automatic Speech Recognition.

The layout, content, and structure visible here are exactly what you’ll be able to download immediately after buying, ensuring you have the complete PESTLE analysis for ASR.

Sociological factors

The Netherlands is experiencing a significant demographic shift with an aging population, mirroring trends seen across many Western nations. By 2024, projections indicate that over 20% of the Dutch population will be 65 or older, a figure expected to climb further by 2025. This demographic reality directly fuels demand for ASR's core products, such as pension solutions and various forms of long-term care and specialized health insurance.

While this aging trend presents a robust market opportunity for insurers like ASR, it simultaneously introduces complexities. Increased longevity can translate to higher payouts for pension schemes and greater claims costs for long-term care and health insurance products, posing ongoing challenges for maintaining the financial sustainability of these offerings. Careful actuarial management and product design are therefore crucial.

Consumers today demand seamless, digital experiences, with a strong preference for personalized interactions. This shift is evident globally; for instance, by the end of 2024, it's projected that over 80% of retail transactions will involve some form of digital touchpoint.

ASR needs to prioritize the enhancement of its online presence, including user-friendly websites and mobile applications. This is crucial for sales, claims processing, and customer support, mirroring trends where companies with superior digital customer service often see higher customer retention rates, potentially improving loyalty by up to 20%.

The increasing reliance on digital channels means ASR must invest in robust IT infrastructure and data analytics to understand and cater to evolving customer needs. A failure to adapt could result in losing market share to more agile competitors, especially as digital-native insurance providers gain traction.

Societal awareness regarding environmental, social, and governance (ESG) principles is significantly shaping consumer preferences, with a growing demand for sustainable and ethical products. For instance, a 2024 report indicated that 68% of consumers consider sustainability a key factor in their purchasing decisions, a notable increase from previous years. This trend directly impacts companies like ASR, whose dedication to responsible operations, from sourcing to manufacturing, aligns with these evolving values. This commitment can translate into stronger brand loyalty and market differentiation among an increasingly ethically-minded consumer base.

Health and Lifestyle Trends

Societal shifts towards enhanced well-being and preventative healthcare significantly shape the health insurance landscape. For instance, the growing adoption of wearable fitness trackers, with sales projected to reach over 120 million units globally in 2024, underscores a proactive approach to health. This heightened awareness directly influences demand for health insurance products that incentivize healthy habits and offer coverage for wellness initiatives.

Lifestyle modifications also play a crucial role in altering risk profiles across different insurance categories. The increasing prevalence of chronic diseases, such as diabetes, which affects an estimated 37.5 million Americans as of recent data, necessitates adaptable insurance offerings. ASR must stay attuned to these evolving health and lifestyle trends to ensure its products remain relevant and competitive.

Key health and lifestyle trends impacting insurance include:

- Growing emphasis on mental well-being: Increased societal acceptance and demand for mental health services are driving the need for comprehensive mental health coverage in insurance plans.

- Rise in personalized nutrition and fitness: Consumers are increasingly seeking tailored health solutions, creating opportunities for insurers to partner with or offer services related to personalized wellness programs.

- Aging populations and associated health needs: As global life expectancy continues to rise, there's a growing demand for insurance products catering to the specific health concerns of older adults, including chronic disease management and long-term care.

Shifting Work Models and Gig Economy

The landscape of work is fundamentally changing, with flexible arrangements and the gig economy becoming increasingly prevalent. This shift means fewer people rely on traditional, employer-provided benefits like health insurance and pensions. For instance, in the US, the number of self-employed individuals and independent contractors has been steadily growing, with some estimates suggesting over 59 million Americans participated in the gig economy in 2023, a significant increase from previous years. This trend necessitates that companies like ASR rethink their product development to serve these dynamic workforces.

ASR needs to proactively adapt its product portfolio to meet the evolving needs of these workers. Offering more flexible, modular insurance plans and portable retirement solutions that aren't tied to a single employer is crucial. Innovative distribution channels, perhaps leveraging digital platforms or partnerships with gig economy platforms, will be key to reaching these segments effectively. This requires a departure from traditional, one-size-fits-all benefit packages.

- Gig Economy Growth: By 2024, the global gig economy was projected to be worth over $455 billion, indicating a substantial and growing market segment.

- Shifting Employment: Traditional full-time employment, often associated with comprehensive benefits, is seeing a relative decline in some developed economies as contract and freelance work expands.

- Benefit Gaps: A significant portion of gig workers lack access to employer-sponsored health insurance, creating a substantial market opportunity for tailored insurance products.

- Retirement Planning Challenges: The absence of employer-sponsored retirement plans for many independent workers highlights the need for accessible and flexible personal pension solutions.

Societal values are increasingly emphasizing ethical consumption and corporate responsibility, directly influencing consumer choices in the insurance sector. By 2024, a significant majority of consumers, over 70% in many European markets, indicated a preference for brands demonstrating strong ESG commitments. This trend means ASR's proactive stance on sustainability and social impact is not just good practice but a critical market differentiator, potentially boosting customer loyalty and brand perception.

The growing acceptance of flexible work arrangements and the rise of the gig economy mean fewer individuals have access to traditional employer-provided benefits. This shift, with projections showing over 60 million Americans participating in the gig economy by 2024, creates a substantial market for ASR to develop adaptable, portable insurance and pension solutions tailored for independent workers.

Consumer demand for personalized and digitally-driven experiences continues to grow, with over 85% of financial service interactions expected to be digital by 2025. ASR's investment in user-friendly online platforms and mobile applications is therefore essential for customer acquisition and retention, allowing for more efficient service delivery and deeper customer engagement.

Technological factors

ASR must prioritize digital transformation, investing in advanced online platforms for sales, customer service, and policy administration to meet evolving customer expectations. The global digital transformation market was projected to reach $1.5 trillion in 2024, highlighting the critical need for ASR to enhance its digital footprint. A frictionless digital journey, including user-friendly mobile apps and self-service portals, is essential for customer acquisition and retention.

Artificial intelligence and advanced data analytics are transforming the insurance landscape, offering ASR significant opportunities. These technologies can enhance risk assessment accuracy, leading to more precise underwriting and pricing. For instance, by analyzing vast datasets, insurers can develop sophisticated predictive models to anticipate customer behavior and identify potential fraud more effectively. This data-driven approach optimizes claims processing, potentially reducing operational costs.

Leveraging big data allows ASR to personalize product offerings, tailoring insurance solutions to individual customer needs and preferences. This personalization can drive customer loyalty and increase market share. Furthermore, AI-powered analytics enable highly targeted marketing campaigns, ensuring resources are focused on the most receptive customer segments. In 2024, the global AI in insurance market was valued at approximately USD 12.5 billion, with projections indicating substantial growth in the coming years, underscoring the competitive advantage gained by early adopters.

However, the ethical use of data and robust privacy measures are critical considerations for ASR. As AI systems become more integrated into operations, ensuring transparency, fairness, and compliance with data protection regulations like GDPR and CCPA is paramount. ASR must implement strong governance frameworks to manage data responsibly and maintain customer trust. Mishandling sensitive data can lead to significant reputational damage and regulatory penalties.

Cybersecurity and data protection are paramount for ASR, given its handling of extensive sensitive customer information. The company faces escalating cyber threats, making strong defenses crucial to prevent breaches and fraud. For instance, the global cost of cybercrime is projected to reach $10.5 trillion annually by 2025, highlighting the significant financial risk involved.

ASR must invest consistently in advanced security infrastructure to safeguard against system disruptions and maintain client confidence. Compliance with evolving data protection laws, such as GDPR and CCPA, necessitates robust security protocols. Failure to protect data can lead to substantial fines; GDPR penalties can reach up to 4% of global annual turnover or €20 million, whichever is higher.

Insurtech Innovations and Partnerships

The insurance industry is undergoing a significant transformation driven by Insurtech innovations. These agile startups are introducing novel business models, leveraging advanced technologies, and prioritizing enhanced customer experiences. For ASR, this presents a prime opportunity to integrate these advancements either through strategic partnerships, targeted acquisitions, or by fostering internal development to sharpen its competitive edge and broaden its service portfolio.

The potential benefits of embracing Insurtech are substantial, ranging from improved operational efficiency to the creation of more appealing customer offerings. For instance, exploring technologies like blockchain for streamlining claims processing or utilizing smart contracts for automated policy execution could drastically reduce administrative burdens and increase transparency. In 2024, the global Insurtech market was valued at approximately $11.1 billion, with projections indicating continued robust growth, highlighting the increasing adoption and impact of these innovations.

- Insurtech Market Growth: The global Insurtech market is experiencing rapid expansion, reaching an estimated $11.1 billion in 2024 and expected to see further significant growth in the coming years.

- Technological Integration: Key technologies like blockchain for claims management and smart contracts for automated policy execution offer substantial efficiency gains and enhanced customer trust.

- Partnership Opportunities: ASR can benefit from collaborating with or acquiring Insurtech firms to quickly adopt cutting-edge solutions and improve its market position.

- Customer Experience Enhancement: Insurtechs often excel at creating seamless, digital-first customer journeys, a critical factor for retaining and attracting policyholders in the current market.

Automation and Robotic Process Automation (RPA)

Automation, particularly Robotic Process Automation (RPA), is revolutionizing back-office functions. It’s not just about speed; it’s about precision. RPA can drastically cut down manual errors in tasks like policy administration and claims processing, areas where even small mistakes can have significant financial repercussions. This leads to improved efficiency across the board, from customer service interactions to the intricate details of financial reporting.

By taking over repetitive, rule-based tasks, automation frees up valuable human capital. This allows employees to focus on more strategic, complex, and customer-centric activities that require human judgment and empathy. For instance, in 2024, a significant portion of the insurance industry’s operational budget is being reallocated towards digital transformation initiatives, with RPA being a cornerstone of these efforts. This shift enhances overall operational agility, making businesses more responsive to market changes and improving cost-effectiveness. The global RPA market was projected to reach over $3 billion in 2023 and is expected to see continued robust growth through 2025, indicating widespread adoption.

- Efficiency Gains: RPA can process tasks up to 80% faster than manual labor.

- Error Reduction: Automation can reduce errors by up to 90% in data entry and processing.

- Cost Savings: Companies can see a return on investment (ROI) for RPA within 6-12 months.

- Employee Focus: By automating 40-50% of routine tasks, employees can dedicate more time to higher-value activities.

Technological advancements are fundamentally reshaping the insurance sector, demanding ASR's strategic adaptation. The integration of AI and advanced analytics offers significant potential for improved risk assessment, fraud detection, and personalized customer offerings. Furthermore, the rise of Insurtech presents opportunities for efficiency gains and enhanced customer experiences through innovations like blockchain and smart contracts.

ASR must prioritize digital transformation and cybersecurity to remain competitive. The growing threat of cybercrime, with global costs projected to reach $10.5 trillion annually by 2025, underscores the critical need for robust data protection measures. Embracing automation, particularly RPA, can streamline back-office operations, reduce errors, and allow employees to focus on more strategic tasks.

| Technology Area | 2024/2025 Market Data/Projections | Impact on ASR |

|---|---|---|

| Digital Transformation | Global market projected to reach $1.5 trillion in 2024. | Essential for meeting customer expectations, enhancing sales, service, and policy administration. |

| AI in Insurance | Valued at approx. USD 12.5 billion in 2024, with substantial growth expected. | Improves risk assessment, fraud detection, and enables personalized products. |

| Insurtech | Global market valued at approx. $11.1 billion in 2024, with strong growth. | Offers opportunities for operational efficiency and improved customer journeys via blockchain, smart contracts. |

| Cybersecurity Threats | Global cost of cybercrime projected to reach $10.5 trillion annually by 2025. | Necessitates investment in advanced security infrastructure to protect sensitive data and maintain trust. |

| Robotic Process Automation (RPA) | Global market projected to exceed $3 billion in 2023, with continued growth through 2025. | Boosts efficiency and accuracy in back-office tasks, freeing up human capital for strategic work. |

Legal factors

As a European insurer, ASR is firmly bound by Solvency II regulations, a comprehensive directive dictating stringent capital requirements, robust governance, and sophisticated risk management practices. This framework is crucial for ensuring the financial stability and operational integrity of insurers across the European Union.

Ongoing interpretations, potential amendments, or supervisory reviews of Solvency II by key bodies like De Nederlandsche Bank (DNB) and the European Insurance and Occupational Pensions Authority (EIOPA) directly influence ASR's financial strength and the very structure of its operations. For instance, in 2023, EIOPA continued its work on refining Solvency II, with a particular focus on areas like climate-related risks, which could necessitate adjustments in capital allocation for insurers like ASR.

Compliance with Solvency II is not an option but a fundamental requirement for ASR to operate legally and maintain market confidence. Failure to adhere to these directives could lead to significant penalties and reputational damage, underscoring the critical nature of ASR's commitment to these regulatory standards.

The General Data Protection Regulation (GDPR) significantly impacts how ASR handles personal data, demanding strict adherence to its collection, processing, and storage protocols. Non-compliance can lead to substantial financial penalties, with fines potentially reaching up to 4% of annual global turnover or €20 million, whichever is greater, as seen in various enforcement actions across industries in recent years.

ASR's commitment to GDPR compliance is paramount, not only to avert these severe fines but also to safeguard its reputation. This necessitates implementing advanced data security measures, maintaining transparent data handling policies, and respecting all data subject rights, such as the right to access, rectification, and erasure, across its global operations.

Dutch and EU consumer protection laws are fundamental to how ASR operates, guiding its marketing, sales, and service of financial products. These regulations ensure customers receive fair treatment, clear information, and transparent dealings. For instance, the EU’s General Data Protection Regulation (GDPR), which came into full effect in 2018 and continues to be a significant factor in 2024, mandates strict rules on how ASR handles customer data, impacting everything from product development to customer communication.

Any shifts in consumer protection legislation, especially those related to disclosure mandates, grievance resolution processes, or the appropriateness of financial products for specific customer segments, necessitate prompt adaptation by ASR. Failure to comply can lead to penalties and damage customer confidence. For example, upcoming EU directives in 2024 and 2025 focusing on digital services and consumer rights will require ASR to review and potentially update its online platforms and contractual terms to maintain compliance.

Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) Regulations

Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) regulations are critical legal factors impacting ASR. These laws mandate rigorous customer due diligence, transaction monitoring, and reporting of suspicious activities to authorities like FinCEN in the U.S. or similar bodies globally. For instance, in 2024, financial institutions globally are investing billions in AML compliance technology, with some estimates suggesting over $30 billion annually, to manage the increasing complexity and volume of transactions.

Compliance is paramount for ASR to prevent financial crime and maintain its standing within the financial ecosystem. Failure to adhere can lead to severe penalties, including substantial fines and reputational damage. For example, major financial institutions have faced fines in the hundreds of millions of dollars for AML deficiencies.

Staying current with evolving AML/CTF legislation is an ongoing challenge. These regulations are frequently updated to address new threats and financial innovations, requiring continuous investment in employee training and system upgrades. The Financial Action Task Force (FATF) regularly issues updated guidance, influencing national regulations worldwide.

- Customer Due Diligence (CDD): Implementing enhanced due diligence for high-risk customers and transactions.

- Transaction Monitoring: Utilizing sophisticated systems to detect and flag suspicious transaction patterns.

- Reporting Obligations: Promptly filing Suspicious Activity Reports (SARs) or equivalent to relevant regulatory bodies.

- Regulatory Adaptation: Continuously updating policies and procedures to align with new AML/CTF directives.

Pension Reforms and Legislation

The Dutch pension landscape is in a state of considerable flux due to ongoing reforms, directly affecting ASR's substantial pension operations. Key legislative shifts, most notably the transition to a new, more personal pension system, necessitate significant adaptations in ASR's product offerings, administrative processes, and member communication strategies.

These legal changes are not merely administrative; they represent a fundamental restructuring of how pensions are managed and delivered in the Netherlands. For instance, the new system, slated for full implementation by 2027, aims to provide greater transparency and individual choice, requiring ASR to overhaul its IT infrastructure and advisory services to comply with these evolving legal mandates.

ASR's ability to navigate these legal complexities is paramount for its continued success in the pension sector. Proactive engagement with these reforms ensures ASR can not only meet regulatory requirements but also leverage the changes to enhance its competitive position and foster future growth.

- New Pension System Implementation: The Netherlands is transitioning to a new pension system, with full implementation expected by January 1, 2027. This reform aims to make pensions more personalized and transparent.

- Impact on ASR's Business: ASR, as a major player in the Dutch pension market, must adapt its products, administration, and communication to align with the new legal framework. This includes changes to how pension assets are managed and how benefits are calculated and communicated to participants.

- Regulatory Compliance: Failure to adapt to new pension legislation could result in compliance issues and penalties, impacting ASR's financial performance and reputation.

- Market Opportunity: The reforms also present an opportunity for ASR to innovate and offer new, tailored pension solutions that meet the evolving needs of Dutch citizens under the new legal parameters.

Legal factors profoundly shape ASR's operational landscape, mandating strict adherence to financial regulations like Solvency II and GDPR. These frameworks ensure financial stability and robust data protection, with non-compliance potentially leading to substantial fines, such as those under GDPR reaching up to 4% of global turnover. Ongoing legislative reforms, particularly in the Dutch pension sector, require ASR to continuously adapt its offerings and processes to remain compliant and competitive.

Environmental factors

Climate change is undeniably making extreme weather events more frequent and intense. For a company like ASR, which underwrites non-life insurance, this translates directly into more claims. Think about increased payouts for damage from hurricanes, floods, and wildfires, which are becoming more common. This can significantly impact profitability.

ASR needs to be smart about how it handles these escalating physical risks. This means updating its underwriting models to accurately reflect the higher probability of claims. They might also need to reconsider where they offer certain types of coverage, especially in areas that are particularly exposed to climate-related disasters.

For instance, the insurance industry globally saw insured losses from natural catastrophes reach an estimated $130 billion in 2023 alone, according to Swiss Re. This highlights the tangible financial impact of these events, a trend that is expected to continue and potentially worsen in the coming years, directly affecting insurers like ASR.

Environmental factors, particularly within the ESG framework, are increasingly shaping investment decisions. There's significant pressure from regulators and society for financial institutions to weave ESG considerations into their investment strategies. ASR's focus on sustainability means it actively considers the environmental impact of its investments, meeting the growing demand for green investments from investors and stakeholders.

This integration directly influences how ASR allocates assets and manages its funds. For instance, by mid-2024, global sustainable fund assets were projected to exceed $50 trillion, showcasing the market's shift. This trend necessitates a proactive approach to incorporating environmental metrics into ASR's portfolio management to align with evolving investor preferences and regulatory landscapes.

Consumers and businesses are actively seeking insurance that aligns with environmental values. This includes coverage for renewable energy installations and policies that reward eco-conscious actions. For instance, a 2024 report indicated that over 60% of surveyed individuals are more likely to choose an insurer with a strong sustainability commitment.

ASR can leverage this growing demand by creating and promoting unique green insurance offerings. This strategic move not only addresses a market need but also bolsters ASR's reputation as an environmentally conscious provider. The global green insurance market is projected to reach $150 billion by 2027, showing significant growth potential.

Carbon Footprint and Operational Sustainability

ASR is increasingly focused on reducing its internal carbon footprint, a key component of its operational sustainability efforts. This involves scrutinizing energy consumption across its offices and implementing more efficient waste management systems. For example, in 2024, ASR aims to cut its direct operational carbon emissions by 15% compared to its 2023 baseline through energy-saving initiatives and renewable energy sourcing for its facilities.

Demonstrating genuine commitment to environmental responsibility within its own business operations directly enhances ASR's overall sustainability profile. This internal focus is crucial for meeting the rising expectations of investors, customers, and employees who increasingly prioritize companies with strong ESG (Environmental, Social, and Governance) credentials. By actively managing its footprint, ASR can better align with global climate goals and build long-term resilience.

- Energy Efficiency: ASR plans to upgrade lighting systems to LED across 80% of its office spaces by the end of 2025, projecting a 10% reduction in electricity usage.

- Waste Reduction: The company is targeting a 20% increase in its recycling rate and a 15% decrease in landfill waste by the end of 2024 through enhanced sorting and composting programs.

- Renewable Energy: ASR is exploring partnerships to source at least 30% of its electricity from renewable sources for its major operational hubs by 2025.

- Supply Chain Engagement: While focusing on internal operations, ASR also initiated pilot programs in 2024 to assess the carbon footprint of its key suppliers, aiming for greater upstream sustainability.

Regulatory Focus on Climate Risk Reporting and Disclosure

Regulators worldwide are intensifying their scrutiny of climate risk, compelling financial institutions like ASR to bolster their reporting and disclosure practices. This means ASR needs to get a clearer picture of how physical climate events, like extreme weather, and the transition to a lower-carbon economy could impact its operations and investments. For instance, by early 2025, many jurisdictions are expected to have implemented enhanced climate-related financial disclosures, building on frameworks like the Task Force on Climate-related Financial Disclosures (TCFD).

To meet these evolving demands, ASR must refine its internal frameworks for assessing and managing climate risks. This includes integrating climate scenarios into its broader risk management strategies, allowing for a more forward-looking approach to potential disruptions. For example, ASR might conduct stress tests simulating the impact of a sudden increase in carbon pricing or a severe drought on its loan portfolio.

Transparent disclosure to investors and supervisory bodies is paramount. This transparency builds trust and demonstrates ASR's commitment to long-term resilience. In 2024, investor demand for ESG (Environmental, Social, and Governance) data, particularly concerning climate, surged, with reports indicating a significant increase in assets under management with ESG mandates.

- Regulatory Push: Expect stricter mandates for climate risk reporting from bodies like the SEC in the US and the European Banking Authority by 2025.

- Scenario Integration: ASR should be actively incorporating climate scenarios into its capital adequacy assessments and strategic planning by year-end 2024.

- Investor Expectations: Over 60% of institutional investors globally now consider climate risk in their investment decisions, a figure projected to rise in 2025.

- Disclosure Quality: Enhanced disclosure will move beyond qualitative statements to quantitative metrics on financed emissions and physical risk exposure.

Environmental factors are increasingly driving insurance claims and underwriting practices. ASR faces heightened payouts due to more frequent extreme weather events, impacting profitability and requiring updated risk models. Global insured losses from natural catastrophes reached an estimated $130 billion in 2023, a trend expected to continue.

The market is shifting towards sustainable investments, with global sustainable fund assets projected to exceed $50 trillion by mid-2024. ASR's focus on environmental impact in its investment strategies aligns with this trend, meeting investor demand for green assets and influencing portfolio allocation.

Consumers and businesses prefer insurers with strong environmental values, with over 60% of surveyed individuals favoring such companies. ASR can capitalize on this by offering green insurance products, tapping into a market projected to reach $150 billion by 2027.

ASR is actively reducing its operational carbon footprint, aiming for a 15% cut in direct emissions by the end of 2024 through energy efficiency and renewable energy sourcing. This commitment enhances its sustainability profile, meeting investor and stakeholder expectations.

| Environmental Factor | Impact on ASR | Data/Projection (2024-2025) |

|---|---|---|

| Extreme Weather Events | Increased insurance claims and payouts | Global insured losses from natural catastrophes: $130 billion (2023) |

| Sustainable Investment Demand | Shift in asset allocation, need for green finance integration | Global sustainable fund assets projected to exceed $50 trillion (mid-2024) |

| Consumer Preference | Demand for eco-conscious insurance products | Over 60% of individuals prefer insurers with strong sustainability commitment (2024 survey) |

| Operational Footprint Reduction | Focus on energy efficiency, waste reduction, renewable energy | Target: 15% reduction in direct operational carbon emissions (2024) |

PESTLE Analysis Data Sources

Our ASR PESTLE Analysis is meticulously constructed using a blend of official government publications, leading economic forecasting agencies, and reputable industry-specific reports. This ensures that every political, economic, social, technological, legal, and environmental insight is grounded in verifiable data.