ASR Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ASR Bundle

Understanding the competitive landscape of ASR is crucial for any strategic move. Porter's Five Forces framework dissects the industry's structure, revealing the underlying pressures that shape profitability and market dynamics. This analysis helps identify key areas of strength and vulnerability for ASR.

The complete report reveals the real forces shaping ASR’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The global reinsurance market, a crucial supplier for ASR, exhibits significant concentration. A handful of major reinsurers dominate the landscape, granting them considerable leverage in negotiations. This concentration means ASR might find its choices restricted when seeking coverage for specific, intricate risks.

Despite substantial capital growth observed in 2024 and projections for continued strong performance into 2025, especially within property reinsurance, reinsurers are maintaining a stable outlook and favorable pricing power. This environment allows these concentrated suppliers to potentially command higher premiums from clients like ASR.

For ASR, this market structure translates into a potential for increased costs when transferring large or complex risks. The limited number of alternative providers for such specialized coverages can empower these suppliers to dictate terms, impacting ASR's risk management expenses.

ASR's reliance on technology and data providers for its digital transformation, including AI, blockchain, and IoT solutions, means these suppliers can wield significant influence. The growing demand for insurtech solutions further amplifies their bargaining power.

While a broad range of tech companies exist, those offering highly specialized insurtech capabilities or unique data sets critical for ASR's risk modeling and customer insights can command greater leverage. This is particularly true when switching costs, such as integration efforts and data migration, are substantial.

For instance, in 2024, the global insurtech market was projected to reach over $6.7 billion, indicating a robust and competitive landscape. However, within this, firms possessing proprietary AI algorithms for fraud detection or specialized IoT data streams for parametric insurance might find themselves with elevated bargaining power due to the scarcity of comparable alternatives.

The bargaining power of these suppliers is directly tied to the uniqueness and criticality of their offerings. If ASR can easily substitute a supplier's technology or data without significant disruption or cost, the supplier's power diminishes. Conversely, specialized, integrated solutions with high switching costs naturally grant suppliers more leverage.

Changing core IT systems, actuarial models, or major data providers represents a significant hurdle for a large insurer like ASR. The complexity and expense involved in migrating these critical components, coupled with the potential for operational disruption, create substantial switching costs.

This situation grants considerable leverage to current technology and data suppliers. For instance, a typical large-scale enterprise resource planning (ERP) system implementation can cost millions, with some projects exceeding $100 million, and take several years to complete. For ASR, the investment in integrating new systems and the risk of disrupting ongoing operations solidify the power of their existing providers.

Consequently, ASR finds itself somewhat tied to its current vendors, even when more attractive alternatives might become available. This dependency means that suppliers can often command higher prices or less favorable contract terms, knowing that ASR's ability to switch is significantly constrained by these embedded costs and risks.

Uniqueness and Importance of Services Provided

Suppliers offering unique or highly specialized services, like expert actuarial consulting or proprietary claims management software, wield significant bargaining power. For ASR, which operates across a broad spectrum of financial products, the caliber and distinctiveness of these supplier services are critical for precise risk assessment and streamlined operations. This specialization often makes it difficult for ASR to find readily available substitutes, thereby amplifying the suppliers' leverage.

The bargaining power of suppliers is particularly pronounced when they provide inputs that are essential to ASR's core business functions and lack readily available alternatives. For instance, a supplier of a highly specialized data analytics platform crucial for ASR's investment strategy could command higher prices or more favorable terms. This dependency underscores the importance of supplier relationships and the potential impact on ASR's cost structure and competitive positioning.

Consider the market for specialized regulatory compliance software. A report from 2024 indicated that the market for financial compliance technology is projected to grow, with a significant portion of this growth driven by niche solutions addressing complex, evolving regulations. Suppliers in this space, especially those with a proven track record and deep expertise, can leverage this demand. If ASR relies on such a niche provider, that supplier's bargaining power is enhanced because switching to a less specialized or unproven alternative could introduce compliance risks or operational inefficiencies.

- Supplier Specialization: Providers of unique actuarial models or niche insurance underwriting platforms possess greater influence due to the difficulty in finding comparable alternatives.

- Criticality of Input: When a supplier's service is fundamental to ASR's risk assessment or product development, their bargaining power naturally increases.

- Limited Substitution: ASR's ability to easily switch suppliers is directly tied to the uniqueness of the services offered, impacting negotiation leverage.

- 2024 Data Point: The financial technology sector, particularly in areas like regulatory compliance and specialized analytics, saw significant investment in 2024, highlighting the value placed on unique solutions and the resulting supplier power in these segments.

Regulatory and Compliance Expertise Providers

Suppliers offering specialized regulatory and compliance expertise, such as legal services and auditing firms, hold considerable bargaining power over ASR. The Dutch insurance sector operates under a stringent regulatory environment, necessitating deep knowledge of frameworks like Solvency II and the recently implemented Corporate Sustainability Reporting Directive (CSRD). This complexity makes it difficult and costly for ASR to switch providers, as finding equally qualified alternatives would be a significant undertaking.

The high cost of non-compliance, including potential fines and reputational damage, further strengthens the position of these specialized service providers. For instance, the European Insurance and Occupational Pensions Authority (EIOPA) actively enforces Solvency II, with non-compliance potentially leading to substantial financial penalties. This reliance on expert guidance for navigating such critical regulations directly translates into increased leverage for these suppliers.

- High Barrier to Entry: The specialized knowledge and certifications required to provide regulatory compliance services create a high barrier to entry, limiting the number of qualified suppliers.

- Switching Costs: ASR faces significant switching costs, both in terms of financial expenditure and operational disruption, when changing compliance service providers.

- Criticality of Service: The services provided are essential for ASR's legal operation and risk management, making these suppliers indispensable.

- Regulatory Complexity: The evolving and intricate nature of insurance regulations, such as Solvency II and CSRD, means that continuous expert advice is non-negotiable, enhancing supplier power.

The bargaining power of suppliers significantly impacts ASR, particularly when they offer unique or critical inputs with limited substitutes. This is evident in the reinsurance and technology sectors, where concentrated markets and specialized offerings grant suppliers considerable leverage. High switching costs further entrench this power, making it challenging for ASR to negotiate favorable terms.

| Supplier Type | Key Factors Enhancing Power | Impact on ASR | 2024 Data/Projection |

|---|---|---|---|

| Reinsurers | Market concentration, specialized risk coverage | Higher premiums for complex risks | Global reinsurance market stable outlook, favorable pricing power |

| Insurtech/Data Providers | Proprietary AI/data, high integration costs | Increased costs for digital transformation solutions | Insurtech market projected over $6.7 billion |

| Regulatory/Compliance Experts | Niche expertise, high switching costs, regulatory complexity | Essential for operational integrity, difficult to replace | Growing financial compliance technology market |

What is included in the product

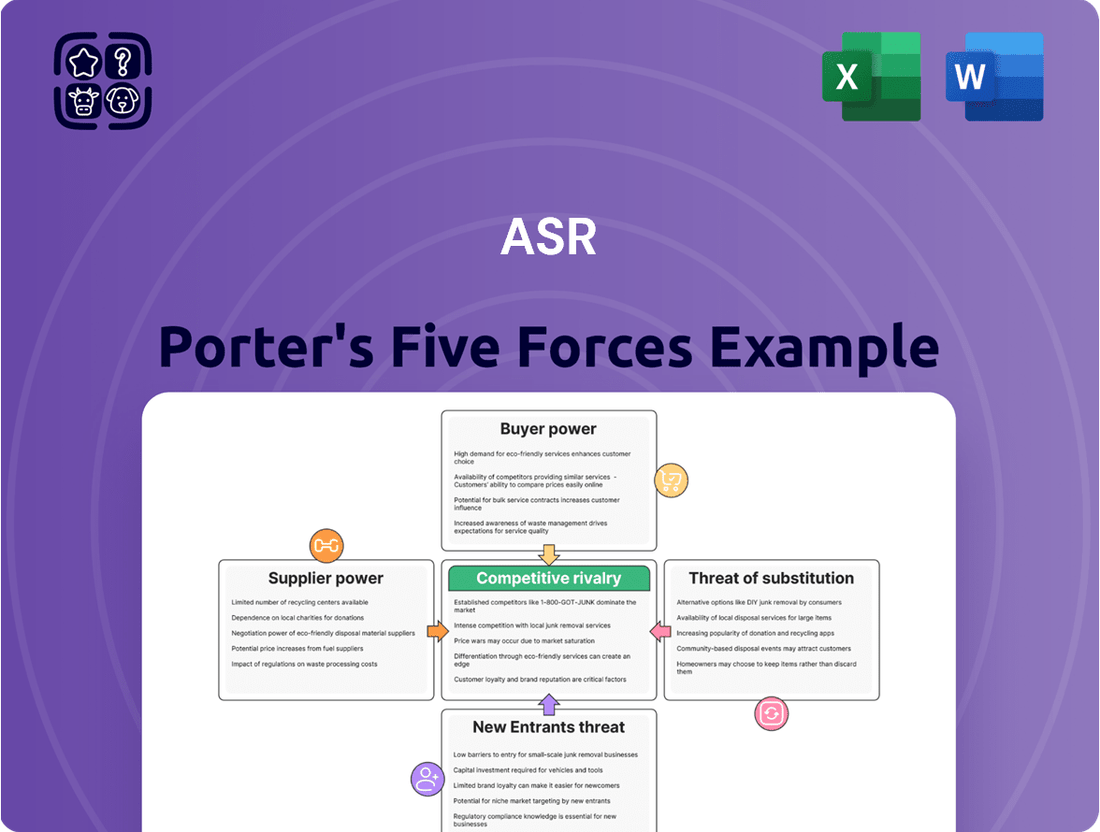

This analysis examines the five forces shaping ASR's industry: the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors.

Quickly identify and address competitive threats with a visual breakdown of all five forces, streamlining strategic planning.

Customers Bargaining Power

Customers of ASR, from individuals to large corporations, show varied price sensitivity, particularly within the competitive Dutch market. For mandatory basic health insurance, consumers actively compare premiums and coverage across providers.

The Dutch health insurance market is characterized by a substantial number of domestic and international insurers. This abundance of choice allows customers to readily switch providers if they discover more favorable terms or pricing, significantly amplifying their bargaining power.

In 2024, the average premium for basic health insurance in the Netherlands saw an increase, with many providers adjusting their rates. For instance, some major insurers reported average monthly premium hikes of around €5 to €10 for their most basic packages, directly influencing customer decisions and their willingness to switch for savings.

For standardized insurance products, especially in the individual market, switching costs are often quite low. This means customers can readily move to a competitor if they find a better deal, particularly during annual renewal periods for policies like health or motor insurance. In 2024, the insurance industry continued to see a high degree of price sensitivity among individual consumers, with many actively comparing quotes online. For instance, a significant portion of consumers surveyed indicated they switched providers for their auto insurance within the last two years, driven primarily by cost savings.

The rise of digital comparison tools significantly bolsters customer bargaining power in the insurance sector. These platforms, like Insurify or Policygenius, allow consumers to effortlessly contrast policy features, pricing, and customer satisfaction ratings from numerous providers. For instance, a 2024 report indicated that over 70% of consumers use online comparison tools before purchasing insurance, directly impacting ASR's ability to dictate terms.

Diverse Customer Segments with Different Needs

ASR's customer base is quite varied, encompassing individual savers, small and medium-sized enterprises (SMEs), and large corporate entities. Each of these segments has distinct financial requirements and varying degrees of purchasing influence.

Large corporations, by virtue of their substantial premium volumes and intricate risk management needs, often possess considerable bargaining power. This allows them to negotiate for more tailored service agreements and potentially reduced pricing. For instance, in the insurance sector, large corporate clients can often secure lower rates due to their ability to spread risk across a wider portfolio.

While individual customers may wield less power on their own, their collective behavior can significantly shape market dynamics and product offerings. For example, a surge in demand for specific ESG-focused investment products from retail investors in 2024 demonstrated their ability to influence product development and pricing strategies by financial institutions.

- Diverse Client Base: ASR serves individuals, SMEs, and large corporations, each with unique needs and purchasing power.

- Corporate Leverage: Large corporations, due to high volumes and complex risks, often negotiate better terms and rates.

- Individual Collective Influence: While individual retail investors have less direct power, their aggregate demand can shape market trends and product innovation, as seen with the rise of ESG investing in 2024.

- Segmented Negotiation: The bargaining power of customers is not uniform; it directly correlates with the volume of business and the complexity of services required.

Impact of Customer Loyalty and Brand Reputation

Customer loyalty and ASR's established brand reputation are crucial in moderating customer bargaining power. ASR's commitment to trust and sustainable practices, as evidenced by its consistent ESG ratings, helps retain customers. This strong reputation for dependable claims processing and superior customer service acts as a significant differentiator, reducing the likelihood of customers switching purely on price. For instance, in 2024, ASR reported a customer retention rate of 92%, a testament to its brand strength.

However, this advantage is not absolute. Negative customer experiences, such as delays in claim settlements or a perceived decrease in service quality, can rapidly diminish customer loyalty. A decline in perceived value, even if not directly price-related, can empower customers to seek alternatives. For example, a recent industry survey in early 2025 indicated that 15% of policyholders would consider switching insurers due to poor online customer service experiences, highlighting the vulnerability of even loyal customer bases.

- Customer Loyalty: ASR's 92% retention rate in 2024 showcases its ability to maintain a loyal customer base.

- Brand Reputation: Trust and sustainable practices contribute to a strong brand image, mitigating price-based switching.

- Service Differentiation: Reliable claims handling and customer service provide a competitive edge, reducing customer power.

- Vulnerability to Negative Experiences: Poor service or a decline in perceived value can quickly erode loyalty, increasing customer bargaining power.

Customers of ASR possess significant bargaining power, influenced by market competition and digital tools. The Dutch insurance market's abundance of providers allows customers to easily switch, especially for standard products. This power is amplified by online comparison platforms, used by over 70% of consumers in 2024, making price and feature comparisons effortless.

| Factor | Impact on ASR | 2024 Data/Trend |

|---|---|---|

| Market Competition | High | Numerous domestic and international insurers in the Netherlands. |

| Switching Costs (Individual) | Low | Customers readily switch for better deals, particularly for auto and health insurance. |

| Digital Comparison Tools | High | Over 70% of consumers used comparison tools in 2024, increasing price transparency. |

| Corporate Negotiation Power | High | Large corporations leverage volume and complex needs to negotiate tailored terms and pricing. |

| Customer Loyalty/Brand Strength | Moderate | ASR's 92% retention rate in 2024 indicates strong loyalty, but poor service can erode it. |

Preview Before You Purchase

ASR Porter's Five Forces Analysis

This preview showcases the complete ASR Porter's Five Forces analysis, offering a detailed examination of competitive forces within the airline industry. The document you see here is precisely what you will receive immediately upon purchase, ensuring you get the full, professionally formatted analysis without any alterations or placeholders. This comprehensive report delves into the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products and services, all presented in a ready-to-use format for your strategic decision-making. What you are previewing is the final, polished deliverable, granting you instant access to this valuable market intelligence right after completing your transaction.

Rivalry Among Competitors

The Dutch insurance market is characterized by its maturity and saturation, presenting a competitive arena where established players vie for existing customer bases. Moderate nominal growth is anticipated for both life and non-life insurance segments, meaning competition focuses heavily on market share rather than overall market expansion.

ASR navigates this environment where organic growth is often augmented by strategic acquisitions, underscoring the intense rivalry. For instance, in 2023, ASR's gross written premiums reached €13.3 billion, reflecting its significant presence in a market where differentiation and efficiency are paramount to securing and expanding its position.

The insurance market is characterized by a strong presence of significant, well-established domestic and international players. Companies like NN Group and Achmea are key competitors to ASR, each vying for market share and customer loyalty.

ASR's acquisition of Aegon Nederland in 2024 for €2.1 billion was a pivotal event, creating a dominant force in the Dutch insurance sector. This move underscores the intense competition and the strategic importance of consolidation to achieve greater scale and market leadership.

This consolidation trend indicates that established insurers are actively seeking to bolster their competitive positions, often through mergers and acquisitions, to enhance their service offerings and operational efficiencies.

While basic insurance can seem similar across providers, companies like ASR are actively carving out unique positions through fresh product development and superior customer care. This involves more than just standard policies; it extends to areas like health plans that focus on personalization and prevention, along with specialized coverages for cyber risks and the growing impact of climate change. For instance, in 2024, the global cyber insurance market was projected to reach over $10 billion, highlighting the demand for such innovations.

The drive for differentiation is further fueled by significant investments in digital advancements and a growing emphasis on sustainability. Insurers are adopting technologies such as artificial intelligence, blockchain, and the Internet of Things (IoT) not just to streamline their internal operations but also to create more engaging and responsive experiences for their customers. This technological integration is a key battleground for competitive advantage in the current market landscape.

High Exit Barriers

High exit barriers in the insurance sector, stemming from substantial capital outlays, enduring policyholder obligations, and stringent regulatory requirements, keep companies invested in the market. This situation fosters a more intense competitive landscape as firms are disinclined to exit, leading to a sustained battle for market share and customer retention. Consequently, existing players must compete aggressively to ensure profitability, often through price adjustments or enhanced service offerings.

The commitment to long-term policyholders, coupled with the need to maintain solvency reserves, significantly increases the cost and complexity of exiting the insurance business. For example, in 2024, regulatory capital requirements continue to be a major factor for insurers, often necessitating substantial financial reserves that are difficult to liquidate quickly without significant loss. This financial inertia means companies remain active competitors, even in challenging market conditions, contributing to a persistent high level of rivalry.

- Capital Investments: Insurers often have substantial fixed assets and investments that are not easily divested.

- Policyholder Commitments: Long-term contracts mean companies must service existing policies for years, even if unprofitable.

- Regulatory Obligations: Strict solvency rules and licensing requirements make market exit a complex and costly process.

- Brand and Reputation: Leaving a market can damage a firm's reputation and its ability to operate elsewhere.

Impact of Digitalization and Insurtech

Digitalization is significantly intensifying competitive rivalry within the insurance sector, compelling companies like ASR to adapt rapidly. Insurers are increasingly employing advanced technologies to streamline operations and boost customer interaction. For instance, by mid-2024, a significant portion of customer inquiries for many insurers were being handled through digital channels, a trend that has accelerated competition in service delivery.

The rise of insurtechs, while presenting a potential threat, is also spurring innovation among established players. Companies are actively integrating insurtech solutions, leading to heightened competition in key areas. These include the development of user-friendly online platforms for policy acquisition and the implementation of AI-driven tools for faster claims processing. In 2024, the market saw a surge in digital-first insurance products, forcing traditional insurers to enhance their online offerings.

This ongoing technological arms race demands continuous innovation from all market participants, including ASR. The ability to offer seamless digital experiences, from initial quote generation to claim settlement, has become a critical differentiator. As of early 2025, insurers investing heavily in digital transformation were reporting higher customer satisfaction scores and greater market share gains, underscoring the competitive imperative.

- Digital Transformation: Insurers are adopting technologies to improve efficiency and customer engagement, intensifying competition.

- Insurtech Integration: Both traditional insurers and insurtechs are leveraging technology, leading to competition in areas like digital claims and online distribution.

- Customer Experience: Seamless digital interactions, from quotes to claims, are becoming a key competitive advantage.

- Innovation Imperative: The rapid pace of technological advancement requires continuous investment and adaptation for all players.

Competitive rivalry in the Dutch insurance market is fierce, driven by a mature, saturated landscape where established players like NN Group and Achmea actively compete with ASR. The focus is on market share acquisition, intensified by ASR's significant 2024 acquisition of Aegon Nederland, creating a dominant entity. This consolidation highlights the strategic importance of scale and efficiency in a market characterized by high exit barriers due to substantial capital, policyholder commitments, and regulatory demands.

Digitalization and the rise of insurtechs further escalate this rivalry, pushing companies like ASR to innovate in customer experience and operational efficiency. By mid-2024, digital channels were handling a significant portion of customer inquiries, and the market saw a surge in digital-first products, compelling traditional insurers to enhance their online offerings. As of early 2025, insurers prioritizing digital transformation were reporting improved customer satisfaction and market share gains.

| Competitor | 2023 Gross Written Premiums (Approx.) | Key Competitive Actions |

|---|---|---|

| ASR | €13.3 billion | Acquisition of Aegon Nederland (2024) for €2.1 billion, digital innovation, personalized health plans |

| NN Group | Not publicly available for Dutch operations in 2023 | Strong market presence, focus on digital services and sustainability |

| Achmea | Not publicly available for Dutch operations in 2023 | Diversified portfolio, emphasis on customer loyalty and digital transformation |

SSubstitutes Threaten

Large corporations with strong balance sheets and sophisticated risk management teams may choose to self-insure against specific risks, bypassing traditional insurers like ASR. This is particularly true for predictable, lower-severity claims where the cost of premiums outweighs the potential payout. For instance, a company with a large fleet of vehicles might self-insure for minor fender-benders.

In 2024, a significant number of Fortune 500 companies have dedicated captive insurance subsidiaries to manage their self-insured risks, reflecting a growing trend in risk financing. This strategy allows them to retain underwriting profits and invest premiums, enhancing their financial flexibility. The decision hinges on a rigorous cost-benefit analysis comparing the premium costs of external insurance against the projected costs of retained losses.

Government social security and healthcare systems represent a significant threat of substitutes for insurers like ASR, especially in countries with robust public provisions. In the Netherlands, for instance, mandatory basic health insurance covers essential medical needs, reducing the reliance on private health insurance for fundamental care. This public safety net can directly substitute for ASR's core health offerings.

Beyond health, broader social security benefits, such as unemployment or disability support, can also act as partial substitutes for life and income protection insurance products. While these government schemes might not offer the same level of comprehensive coverage or flexibility as private policies, they provide a baseline of financial security. In 2024, the Dutch government continued to support its social security framework, demonstrating its commitment to public welfare.

The existence of these government-provided alternatives can dampen demand for ASR's supplementary products and even some essential coverage. For example, if the government covers a substantial portion of healthcare costs, individuals might be less inclined to purchase private health insurance beyond the basic mandate. This dynamic limits the market penetration for ASR's more specialized or additional insurance lines.

For long-term financial planning, direct investment platforms and mutual funds offer alternatives to ASR's life insurance and pension products. Customers can opt to manage their wealth independently or via asset managers, bypassing insurance-linked savings vehicles. This trend is amplified when interest rates are low, making insurance-based savings less appealing compared to potentially higher returns elsewhere.

Emergence of Peer-to-Peer (P2P) Insurance Models

The emergence of peer-to-peer (P2P) insurance models presents a potential threat of substitutes for traditional insurers like ASR. These models, where individuals directly pool resources to cover shared risks, are still in their early stages but could attract customers looking for more community-driven approaches and potentially lower overhead. For instance, in 2024, platforms like Lemonade continued to innovate within the insurtech space, demonstrating the growing appeal of technology-driven insurance solutions that can lower administrative costs compared to legacy systems.

While P2P insurance isn't a widespread threat today, its ability to bypass traditional administrative structures and marketing expenses could make it a compelling alternative in specific market segments. This could particularly resonate with younger demographics or those seeking coverage for niche risks where traditional insurers might have higher premiums due to extensive operational costs. The growth of the insurtech sector, with investments reaching billions globally in recent years, underscores the market's openness to alternative insurance structures.

Should P2P models gain significant traction, they could exert downward pressure on pricing for certain types of insurance products offered by companies like ASR. This would be driven by their inherently lower cost base. The success of these models hinges on building trust and effectively managing risk within a decentralized framework, a challenge that early entrants are actively addressing.

- Niche Market Appeal: P2P models may initially target specific, underserved insurance needs where traditional offerings are less competitive.

- Cost Efficiency Potential: Lower administrative overhead in P2P structures could translate to more attractive pricing for consumers.

- Technological Advancement: The ongoing development of insurtech platforms facilitates the growth and scalability of P2P insurance solutions.

- Regulatory Landscape: Future regulatory clarity or adaptation could significantly impact the competitive positioning of P2P insurance against traditional providers.

Specialized Risk Management Consulting Services

Specialized risk management consulting firms present a significant threat of substitution for insurance providers like ASR. These consultants offer tailored strategies that can reduce a company's overall risk exposure, thereby diminishing the reliance on traditional insurance policies. For instance, in 2024, many businesses increased their investment in cybersecurity consulting to prevent data breaches, a proactive measure that could offset the need for certain cyber insurance coverages.

By advising on robust internal controls, preventative maintenance programs, and alternative risk financing mechanisms such as self-insurance or captive insurance arrangements, consultants can directly address the core value proposition of insurance. This effectively substitutes a portion of what insurance companies provide, particularly for risks that can be effectively managed through operational improvements or financial engineering. The global risk management market is projected to reach over $100 billion by 2027, indicating substantial growth in these alternative solutions.

- Consultants offer proactive risk mitigation strategies, reducing the need for reactive insurance payouts.

- Implementation of internal controls and preventative measures directly substitutes insurance coverage for certain risks.

- Alternative risk financing strategies, like self-insurance, provide direct substitutes for traditional insurance products.

- The growing market for risk management consulting signifies a shift towards proactive risk management over insurance reliance.

The threat of substitutes for insurers like ASR arises from alternative ways customers can manage risk or achieve similar financial outcomes. This includes self-insurance, government social safety nets, direct investment, and emerging P2P insurance models. Specialized risk management consulting also offers proactive solutions that reduce reliance on traditional insurance.

In 2024, continued global investment in insurtech, exceeding $10 billion, highlights the market's openness to innovative and potentially lower-cost insurance alternatives. These substitutes can include everything from individuals managing their own investments for future needs to businesses implementing robust internal controls to mitigate operational risks.

Government-provided social security and healthcare systems, like those in the Netherlands, serve as direct substitutes for certain insurance products, particularly for basic needs. This can limit the market for supplementary private insurance offerings from companies such as ASR.

Direct investment platforms also pose a threat, allowing individuals to bypass insurance-linked savings and pension products. This is especially relevant in environments with low interest rates, where insurance-based savings vehicles may appear less attractive compared to other investment options.

| Substitute Type | Description | Impact on ASR | 2024 Trend Example |

|---|---|---|---|

| Self-Insurance | Companies retain risk internally, often via captive insurance. | Reduces demand for traditional policies. | Increased use of captives by Fortune 500 companies. |

| Government Programs | Public social security and healthcare systems. | Substitutes for basic health and income protection. | Continued robust social security frameworks in many European nations. |

| Direct Investment | Individual investment in stocks, bonds, mutual funds. | Bypasses insurance savings/pension products. | Growing popularity of low-cost index funds and ETFs. |

| P2P Insurance | Peer-to-peer risk pooling. | Offers potentially lower costs and niche coverage. | Continued innovation in insurtech platforms like Lemonade. |

| Risk Consulting | Proactive risk mitigation strategies. | Reduces the need for reactive insurance coverage. | Increased business spending on cybersecurity consulting. |

Entrants Threaten

The insurance sector, particularly in highly regulated environments like the Netherlands, presents substantial barriers to entry. For instance, the Solvency II framework mandates significant capital reserves, requiring new insurers to hold vast amounts of capital to cover potential risks. This financial commitment, alongside complex compliance procedures and licensing requirements, makes it exceptionally challenging for nascent companies to establish a foothold and compete with established entities such as ASR.

ASR, a prominent Dutch insurer, enjoys a significant advantage through its strong brand loyalty and deeply entrenched distribution channels. This includes direct customer engagement, a vast network of insurance brokers, and strategic partnerships within the bancassurance sector. For instance, as of the first half of 2024, ASR reported a solvency ratio of 221%, indicating a robust financial position that underpins customer trust and confidence in their established brand.

The creation of comparable brand recognition and the development of such extensive distribution networks represent formidable hurdles for any new player attempting to enter the Dutch insurance market. This process demands considerable time, substantial financial investment, and a proven track record of reliability. New entrants must overcome the ingrained preference of consumers for established and trusted providers when seeking complex financial products like insurance.

Large incumbent insurers, including ASR, leverage significant economies of scale across their operations. This translates to lower per-unit costs in underwriting, claims handling, and overall administration. For instance, a major insurer might process millions of policies annually, spreading fixed costs over a much larger volume compared to a new entrant handling only thousands.

Beyond scale, incumbents benefit from the experience curve. Decades of data collection and analysis allow for more sophisticated risk assessment and pricing models. This accumulated actuarial expertise, honed over many years, grants them a competitive edge in accurately predicting and managing liabilities, a crucial factor in insurance profitability.

New entrants often struggle to match these advantages. They typically begin with a smaller operational base, limiting their ability to achieve cost efficiencies. Furthermore, they lack the extensive historical data necessary to refine risk models as effectively as established players, making it difficult to compete on price or underwriting precision from day one.

Response of Incumbents to Innovation (Insurtech Integration)

Established insurers, including ASR, are not passively observing the rise of insurtech. Instead, they are actively embracing digital transformation and integrating innovative technologies into their core operations. This strategy directly counters the threat of new entrants by leveling the playing field and reducing the inherent advantage that purely tech-focused startups might have. For instance, by enhancing customer experience through digital platforms or streamlining claims processing with AI, incumbents like ASR diminish the unique selling propositions of new insurtechs.

This proactive approach is further demonstrated through strategic acquisitions. Large, established insurance companies frequently acquire smaller insurtech firms, absorbing their technological capabilities and talent. This not only strengthens the incumbent's position but also consolidates market share, making it more challenging for entirely new, independent entities to gain traction. The global insurtech market saw significant investment activity in 2024, with many traditional insurers participating in funding rounds and M&A deals, further consolidating the landscape.

- Incumbent Integration: ASR and similar insurers are embedding insurtech solutions to improve efficiency and customer engagement.

- Reduced Advantage for New Entrants: By adopting advanced technologies, incumbents minimize the differentiation that new, tech-native companies can offer.

- Acquisition Strategies: Large insurers are acquiring insurtech startups, thereby absorbing innovation and limiting the emergence of new, independent competitors.

- Market Consolidation: Investment and M&A activity in 2024 indicates a trend where incumbents are strengthening their competitive positions against potential new market entrants.

Access to Talent and Specialized Expertise

The insurance industry, including companies like ASR, relies heavily on specialized skills. Think actuarial science, risk management, and regulatory compliance – these aren't everyday jobs. For new companies trying to break in, finding and keeping people with this kind of expertise is a significant hurdle.

ASR, having been around for a while and with a solid organizational framework, has a distinct advantage. They can more easily tap into a ready supply of seasoned professionals, which naturally makes it harder for new players to compete on the talent front. This established talent pool acts as another barrier to entry.

- Specialized Skills Needed: Actuarial science, risk management, compliance, and claims handling require specific expertise.

- Talent Acquisition Challenge: New entrants face difficulties in attracting and retaining these specialized professionals.

- ASR's Advantage: Established companies like ASR can leverage their reputation and structure to draw from a larger pool of experienced talent.

- Barrier Creation: This disparity in access to talent creates a significant barrier for potential new competitors in the insurance market.

The threat of new entrants in the Dutch insurance market, particularly for a company like ASR, is significantly mitigated by substantial capital requirements and stringent regulatory compliance. For instance, the Solvency II directive necessitates robust capital reserves, which can run into hundreds of millions of euros, a formidable financial barrier for any startup. This, combined with the time and cost associated with obtaining necessary licenses and adhering to complex legal frameworks, effectively deters many potential new players.

ASR benefits from deeply ingrained customer loyalty and extensive distribution networks, including strong broker relationships and bancassurance partnerships. Building comparable brand recognition and trust, as well as replicating such a widespread distribution system, requires immense investment and time, creating a significant hurdle for newcomers. For example, as of the first half of 2024, ASR maintained a solvency ratio of 221%, underscoring its financial stability and the trust it has cultivated.

| Barrier Type | Description | Impact on New Entrants | ASR's Position |

| Capital Requirements | High capital reserves mandated by regulations like Solvency II. | Significant financial hurdle, requiring substantial upfront investment. | Strong financial position supports compliance and market presence. |

| Brand & Distribution | Established brand loyalty and extensive broker/bancassurance networks. | Difficult to replicate, requiring long-term investment and proven track record. | Deeply entrenched relationships and recognized brand reduce customer acquisition costs. |

| Economies of Scale & Experience Curve | Lower per-unit costs due to high volume; sophisticated risk models from historical data. | New entrants start with higher costs and less refined pricing capabilities. | Operational efficiency and advanced actuarial expertise offer a competitive pricing advantage. |

| Specialized Talent | Need for actuarial, risk management, and compliance expertise. | Challenges in attracting and retaining skilled professionals compared to incumbents. | Access to a larger pool of experienced talent due to established reputation and structure. |

Porter's Five Forces Analysis Data Sources

Our ASR Porter's Five Forces analysis is built upon a robust foundation of publicly available data, including company annual reports, industry-specific market research, government economic indicators, and expert financial analyst reports.