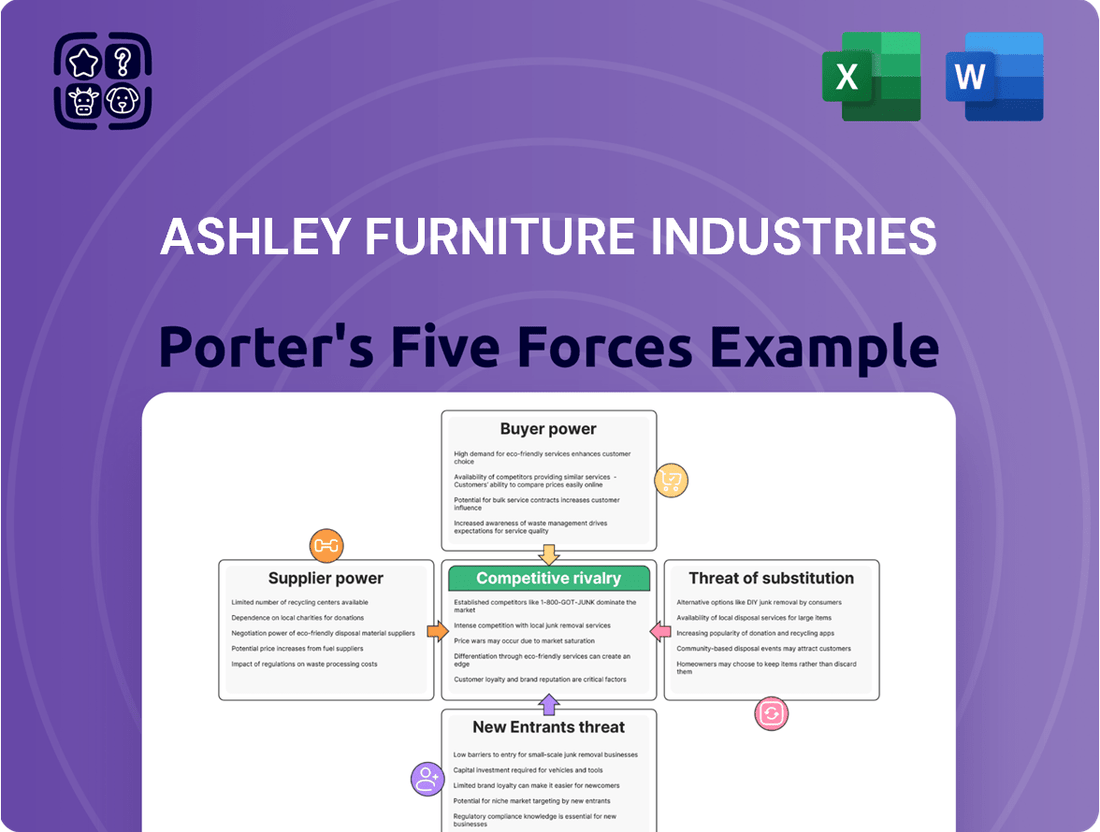

Ashley Furniture Industries Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ashley Furniture Industries Bundle

Ashley Furniture Industries navigates a competitive landscape shaped by moderate buyer power and intense rivalry among existing players. The threat of new entrants is somewhat mitigated by capital requirements, but the availability of substitutes presents a persistent challenge.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Ashley Furniture Industries’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The furniture industry's heavy reliance on raw materials like wood, metal, plastic, and fabrics means that price volatility directly impacts companies like Ashley Furniture. In 2024, lumber prices, a key component, saw significant swings, with futures contracts for framing lumber trading around $400-$500 per thousand board feet at various points, a notable decrease from earlier peaks but still a concern for cost management.

Disruptions in the supply chain, often exacerbated by geopolitical events or shifts in trade policy, can further squeeze profit margins. For instance, tariffs on imported goods, including furniture components or finished products from countries like China, can increase the landed cost of materials, forcing manufacturers to absorb those costs or pass them on to consumers.

When only a few companies supply essential components or highly specialized materials, those suppliers wield significant influence. Ashley Furniture's immense purchasing volume can offer some negotiation strength, but if they rely on unique or patented materials, suppliers can command higher prices.

Ashley Furniture's extensive global manufacturing network likely allows for a more diversified supplier base, potentially mitigating the power of any single supplier. However, the furniture industry often relies on specific wood types or specialized finishes, which could limit supplier options in certain categories.

For a large manufacturer like Ashley Furniture, the cost and complexity of switching suppliers can be substantial. This often involves significant investment in retooling production lines, adjusting quality control protocols, and navigating the intricacies of new contract negotiations, all of which can empower suppliers if these transitions are particularly difficult or costly.

However, Ashley Furniture's strategic advantage lies in its vertically integrated business model and its considerable purchasing volumes. These factors can significantly mitigate the financial and operational burdens associated with supplier changes, thereby potentially reducing the suppliers' overall bargaining power.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers, while generally low for Ashley Furniture Industries, could emerge from specialized component manufacturers. These suppliers might leverage their expertise to produce finished furniture, directly competing with Ashley. However, Ashley's established brand recognition and extensive distribution channels, which in 2024 saw them as one of the largest furniture manufacturers globally, present significant barriers to entry for any new competitor attempting to replicate their market position.

While basic raw material suppliers are unlikely to integrate forward due to the complexity of furniture manufacturing, companies providing specialized components, such as advanced upholstery materials or unique hardware, could consider this strategy. These suppliers possess specific technical knowledge that could be a foundation for furniture production. Ashley's robust supply chain management and long-term supplier relationships help mitigate this risk by fostering loyalty and ensuring competitive pricing.

Ashley Furniture's scale of operations, with reported revenues exceeding $8 billion annually in recent years, provides a significant advantage. This scale makes it difficult for potential supplier-competitors to achieve the same cost efficiencies or market reach. The capital investment required to establish a comparable manufacturing and distribution network is substantial, deterring most suppliers from attempting direct competition through forward integration.

Importance of Supplier's Input to Ashley Furniture

The quality and reliability of materials sourced by Ashley Furniture are paramount to maintaining its brand image and product standards. For instance, the consistency of lumber, fabric, and hardware directly impacts the durability and aesthetic appeal of their furniture lines. If a key supplier, like a specialized upholstery fabric provider, has a unique offering or a stellar track record for defect-free materials, their leverage in negotiations naturally grows.

Ashley Furniture's commitment to delivering high-quality and innovative products necessitates strong, dependable relationships with its suppliers. This focus means the company places significant value on suppliers who consistently meet stringent quality benchmarks and contribute to product development. A prime example is the reliance on specialized component manufacturers for intricate mechanisms in reclining furniture, where reliability is non-negotiable.

- Supplier Dependence: Ashley Furniture's reliance on specific suppliers for critical components, such as high-grade wood or unique fabric patterns, can amplify supplier bargaining power.

- Quality Reputation: Suppliers with a strong reputation for consistent quality and innovation, particularly in specialized materials, can command greater influence in pricing and terms.

- Limited Substitutes: If alternative suppliers for essential inputs are scarce or cannot match the quality or specifications, existing suppliers gain increased bargaining leverage.

- Industry Standards: Suppliers who set or adhere to high industry standards for materials and manufacturing processes, often backed by certifications, can strengthen their negotiating position with major buyers like Ashley Furniture.

The bargaining power of suppliers for Ashley Furniture is moderate, influenced by industry concentration and the availability of substitutes for raw materials. While Ashley's scale provides some leverage, reliance on specialized components or unique materials can empower key suppliers. For instance, in 2024, the market for certain high-performance upholstery fabrics remained relatively consolidated, giving those suppliers more pricing influence.

The cost and difficulty of switching suppliers for critical inputs, such as specific wood types or advanced manufacturing components, also contribute to supplier power. If Ashley Furniture faces significant retooling or quality assurance challenges when changing suppliers, existing suppliers can leverage this inertia. The company's vast purchasing volume, however, helps to counterbalance this by allowing for more favorable contract terms with many suppliers.

| Factor | Impact on Ashley Furniture | 2024 Context |

|---|---|---|

| Supplier Concentration | Moderate to High for specialized inputs | Limited number of high-quality fabric or component suppliers |

| Switching Costs | Significant for specific materials/processes | Potential retooling and quality validation needed |

| Availability of Substitutes | High for basic materials, low for specialized | Wide range of wood options, but fewer for unique finishes |

| Importance of Input | High for quality and brand reputation | Consistent material quality is crucial for customer satisfaction |

What is included in the product

This Porter's Five Forces analysis for Ashley Furniture Industries dissects the competitive intensity within the furniture market, examining buyer and supplier power, the threat of new entrants and substitutes, and the overall rivalry among existing players.

Instantly identify and address competitive threats by visualizing the intensity of each Porter's Five Force for Ashley Furniture Industries.

Customers Bargaining Power

Consumers in the furniture market, particularly when purchasing significant items, often exhibit a strong sensitivity to price. This is especially true during periods of economic instability or rising inflation. For instance, in early 2024, consumer spending on durable goods like furniture saw fluctuations influenced by inflation rates, which remained a key concern for many households.

Ashley Furniture Industries navigates this by offering a wide variety of products, many of which are positioned at accessible price points. This strategy aims to cater to budget-conscious shoppers. However, the highly competitive nature of the furniture industry means that even with diverse offerings, pricing pressures can persist as companies vie for market share.

The furniture market is quite crowded, with many retailers, online sellers, and even the option for customers to create their own furniture. This abundance of choices significantly strengthens the bargaining power of customers, as they can easily find alternatives if they are not satisfied with Ashley Furniture Industries' offerings. For instance, in 2024, the online furniture market continued its robust growth, with platforms like Wayfair and Amazon offering a wide array of products, directly competing with traditional brick-and-mortar stores.

For individual consumers, bargaining power is typically low due to the fragmented nature of their purchases. However, for independent furniture retailers that Ashley Furniture Industries supplies, their purchasing volume can grant them more leverage in negotiations. For instance, if a large chain of independent retailers collectively places a significant order, they can potentially negotiate better pricing or terms.

Buyer Information and Transparency

The proliferation of e-commerce platforms and augmented reality (AR) tools has significantly boosted buyer information and price transparency in the furniture industry. Customers now have unprecedented ease in comparing prices, product features, and reviews across numerous brands, directly enhancing their bargaining power. For instance, in 2024, platforms like Google Shopping and dedicated furniture comparison sites allow consumers to see multiple pricing options instantly, forcing retailers to be more competitive.

Ashley Furniture Industries must actively manage its online presence and digital engagement to cater to these increasingly informed consumers. This includes providing detailed product specifications, high-quality imagery, and accessible customer support. The ability for customers to easily research and compare alternatives means that Ashley's value proposition, including price, quality, and service, needs to be clearly communicated and consistently delivered.

- Increased Price Transparency: Consumers can readily compare prices for similar furniture items across various online retailers, putting pressure on Ashley to maintain competitive pricing.

- Access to Product Information: Online reviews, detailed product descriptions, and AR visualization tools empower customers with extensive knowledge before making a purchase decision.

- Digital Engagement is Key: Ashley's investment in its online platform and digital tools is vital for meeting the expectations of well-informed buyers and maintaining its market position.

- Empowered Consumer Choices: The ease of information access allows customers to negotiate more effectively or seek out alternative suppliers, thereby strengthening their bargaining position.

Switching Costs for Customers

For consumers, the switching costs associated with purchasing furniture are generally quite low. This means customers can readily opt for a different retailer for their subsequent furniture needs without facing significant hurdles or expenses.

Ashley Furniture Industries actively works to mitigate this by cultivating strong customer loyalty. They focus on building a robust brand reputation, ensuring high product quality, and delivering exceptional customer service to make it more appealing for customers to return rather than switch to a competitor.

- Low Switching Costs: Consumers can easily switch between furniture retailers.

- Brand Loyalty Initiatives: Ashley Furniture focuses on brand reputation, quality, and service to retain customers.

- Customer Retention Strategies: These efforts aim to reduce the likelihood of customers choosing alternative providers.

Customers in the furniture market, especially those buying larger items, are very aware of prices, a trend amplified by economic conditions. In early 2024, inflation's impact on durable goods like furniture made consumers more price-sensitive. Ashley Furniture addresses this with a broad product range, including many affordable options, to attract budget-conscious shoppers. However, the highly competitive landscape means pricing remains a constant challenge.

The furniture sector is densely populated with numerous retailers, online sellers, and DIY options, significantly boosting customer bargaining power. Consumers can easily find alternatives if they're unhappy with Ashley's offerings. For instance, the online furniture market continued its strong growth in 2024, with platforms like Wayfair and Amazon presenting a vast selection that directly competes with traditional stores.

The rise of e-commerce and AR tools has dramatically increased consumer access to information and price transparency. Customers can effortlessly compare prices, features, and reviews across many brands, strengthening their negotiating position. By 2024, tools like Google Shopping allowed instant price comparisons, compelling retailers to be more competitive.

Ashley Furniture Industries must prioritize its online presence and digital engagement to meet the expectations of these informed consumers. This involves offering detailed product information, high-quality visuals, and accessible customer support. The ease with which customers can research and compare alternatives necessitates that Ashley clearly communicates and consistently delivers on its value proposition, encompassing price, quality, and service.

| Factor | Impact on Ashley Furniture | Customer Action | 2024 Data Point |

|---|---|---|---|

| Price Sensitivity | High pressure to offer competitive pricing. | Compare prices across multiple retailers. | Inflation concerns in early 2024 impacted consumer spending on durable goods. |

| Availability of Alternatives | Need for strong differentiation. | Easily switch to other brands or sellers. | Online furniture market growth in 2024 provided more options. |

| Information Access | Requirement for transparent and detailed product information. | Research extensively online before purchase. | Price comparison sites like Google Shopping are widely used. |

| Switching Costs | Low, necessitating loyalty-building efforts. | Switch to competitors with minimal hassle. | Customer retention relies on brand reputation, quality, and service. |

Full Version Awaits

Ashley Furniture Industries Porter's Five Forces Analysis

This preview showcases the complete Ashley Furniture Industries Porter's Five Forces Analysis, detailing the competitive landscape and strategic implications for the company. You are viewing the exact, professionally formatted document that will be delivered instantly upon purchase, offering a comprehensive understanding of industry rivalry, buyer and supplier power, threat of new entrants, and the menace of substitutes.

Rivalry Among Competitors

The furniture industry is incredibly crowded, with a vast array of companies operating globally and regionally. You'll find giants like IKEA and Wayfair alongside numerous smaller, niche brands, all vying for market share. This fragmentation means Ashley Furniture, despite its size, is constantly up against diverse competitors.

As the world's largest furniture manufacturer and retailer, Ashley Furniture faces significant competitive rivalry. This intense pressure comes from a wide spectrum of players, from other large, established companies to agile, emerging brands, impacting pricing, innovation, and market penetration strategies.

The global furniture market is anticipated to experience growth, but economic headwinds and shifting consumer spending patterns can temper this expansion, leading to heightened competition for market share. A somewhat subdued 2024 is forecast to see a recovery in 2025, underscoring the need for continuous assessment of broader economic indicators.

Ashley Furniture Industries competes by highlighting unique product designs, quality, and innovative features like smart furniture. This strategy aims to build strong brand loyalty among consumers.

The company's extensive product catalog and commitment to introducing new, functional items, such as smart and multi-purpose furniture, are central to its differentiation efforts. These initiatives are designed to capture and retain customer interest in a crowded market.

Exit Barriers

Ashley Furniture Industries faces considerable exit barriers due to the substantial fixed costs associated with its extensive manufacturing and retail operations. These high upfront investments in factories, inventory, and a vast network of stores mean that closing down or significantly scaling back is a costly and complex undertaking. This can compel companies to remain in the market, even when facing financial strain, to try and recoup some of their investment.

The furniture industry, particularly for large players like Ashley Furniture, is characterized by significant capital intensity. For instance, the cost of setting up and maintaining large-scale production facilities and distribution centers runs into millions, if not billions, of dollars. This financial commitment makes a swift exit impractical, forcing businesses to endure periods of low demand or profitability rather than cease operations.

Consequently, these high exit barriers can intensify competitive rivalry. Companies are incentivized to continue competing, even at reduced profit margins, to cover their fixed costs. This can lead to aggressive pricing strategies and promotional activities as businesses fight for market share, putting downward pressure on overall industry profitability.

- High Fixed Costs: Manufacturing and retail infrastructure represent significant sunk costs for furniture companies.

- Operational Scale: Large-scale production and distribution require substantial, difficult-to-recover investments.

- Market Persistence: Companies may continue operating at a loss to avoid the full cost of exiting, prolonging competitive pressure.

Market Concentration and Consolidation

The furniture market, while appearing fragmented, is experiencing a notable trend of consolidation. Major players are actively engaging in strategic partnerships and acquisitions to expand their reach and capabilities. This ongoing consolidation intensifies rivalry, as larger entities leverage their scale to gain competitive advantages.

Ashley Furniture Industries holds a substantial market share, estimated to be a significant portion of the U.S. furniture market. Its continuous investment in optimizing its extensive retail footprint and robust distribution network directly influences competitive dynamics. This strategic focus by Ashley Furniture means rivals must constantly innovate and adapt to maintain their market positions.

- Market Share: Ashley Furniture is consistently ranked among the top furniture retailers in the United States, often cited as one of the largest.

- Consolidation Trend: Industry reports from 2023 and early 2024 indicate continued M&A activity within the furniture sector as companies seek to achieve greater economies of scale.

- Distribution Investment: Ashley Furniture's commitment to its supply chain and logistics infrastructure, including its own transportation fleet, provides a competitive edge in delivery speed and cost efficiency.

The competitive rivalry within the furniture industry is fierce, driven by a large number of players ranging from global giants to smaller, specialized brands. Ashley Furniture, as a market leader, must constantly innovate and differentiate itself to maintain its position. This intense competition is further fueled by the industry's fragmentation and the ongoing trend of consolidation, where larger companies acquire smaller ones to gain scale and market share.

The furniture market is highly competitive, with numerous companies vying for consumer attention and spending. This is evident in the pricing strategies and promotional activities that are common across the sector. For example, during major sales events like Black Friday and Presidents' Day, discounts can be substantial, indicating the pressure on retailers to attract customers. In 2024, the furniture sector is navigating a landscape where consumer demand is sensitive to economic conditions, making the fight for market share even more critical.

Ashley Furniture's significant market share, estimated to be a substantial portion of the U.S. furniture market, puts it in direct competition with other major retailers. Companies like IKEA, Wayfair, and regional players all contribute to a dynamic competitive environment. The ongoing consolidation within the industry, with reports in early 2024 highlighting continued mergers and acquisitions, means that Ashley Furniture faces increasingly formidable, scaled-up rivals.

| Competitor | Estimated 2023 U.S. Furniture Market Share (%) | Key Competitive Strategy |

|---|---|---|

| Ashley Furniture | 10-15% (estimated) | Broad product assortment, value pricing, extensive retail network |

| IKEA | 5-10% (estimated) | Affordable design, flat-pack delivery, unique retail experience |

| Wayfair | 5-10% (estimated) | Online-only model, vast selection, data-driven marketing |

| La-Z-Boy | 2-3% (estimated) | Specialization in recliners, brand loyalty, comfort focus |

SSubstitutes Threaten

Consumers today have a growing array of options beyond buying new furniture from traditional retailers like Ashley Furniture. The re-commerce market, for instance, is booming, with platforms facilitating the sale of used furniture. In 2023, the resale market for furniture was estimated to be worth billions, with significant growth projected.

Furthermore, furniture rental services are gaining traction, offering flexibility for those who move frequently or prefer not to commit to long-term purchases. This trend is particularly popular among younger demographics and urban dwellers. DIY furniture projects also represent a viable alternative, appealing to cost-conscious and creatively inclined consumers.

The rise of multifunctional and space-saving furniture presents a significant threat of substitutes for traditional furniture offerings. As urban living becomes more common and living spaces shrink, consumers increasingly seek pieces that serve multiple purposes, reducing the need for separate items. For instance, a sofa bed can replace both a couch and a guest bed. This trend directly impacts demand for single-purpose furniture, forcing companies like Ashley Furniture Industries to adapt their product lines.

Technological advancements, particularly in smart home integration, present a threat of substitutes for traditional home decor. Innovations like smart lighting and integrated entertainment systems can fulfill aesthetic and functional needs previously met by standalone furniture pieces. For example, a smart wall unit might negate the need for separate shelving and media consoles.

However, Ashley Furniture Industries is actively countering this threat by integrating smart technologies directly into its own product lines. This strategy aims to make their furniture more competitive against non-furniture substitutes. In 2024, the home furnishings market saw continued growth, with consumers increasingly seeking multi-functional and tech-enabled solutions, a trend Ashley is leveraging.

Consumer Behavior Shifts (e.g., Minimalism)

The rise of minimalism and a general shift towards decluttering can significantly impact Ashley Furniture Industries by reducing the overall demand for furniture. Consumers embracing these trends often opt for fewer, more essential, or higher-quality pieces, potentially decreasing the volume of purchases. For instance, a 2024 survey indicated that 35% of consumers are actively trying to own fewer possessions, a sentiment that directly challenges the traditional furniture market.

This evolving consumer behavior presents a threat as it encourages a focus on longevity and necessity rather than frequent replacement or acquisition of multiple items. This could lead to longer product lifecycles and a reduced market for complementary or decorative furniture pieces. The demand for multi-functional furniture also increases, as consumers seek pieces that serve more than one purpose, further consolidating their needs.

- Minimalist Trends: Growing consumer preference for fewer possessions.

- Reduced Demand: Potential decrease in overall furniture sales volume.

- Quality Over Quantity: Shift towards investing in fewer, durable items.

- Multi-functional Furniture: Increased demand for versatile pieces that serve multiple purposes.

Durability and Longevity of Existing Furniture

The durability and longevity of existing furniture pose a significant threat of substitutes for Ashley Furniture Industries. When consumers' current furniture holds up well, it directly reduces the need for new purchases, acting as a silent substitute for Ashley's new sales. This is particularly relevant in 2024 as consumers, facing economic uncertainties, are often inclined to extend the life of their existing assets rather than invest in replacements. For instance, a well-maintained sofa could easily last 10-15 years, delaying a repurchase decision for a considerable period.

Ashley Furniture's strategy to counter this threat involves a dual approach. While emphasizing quality and durability in its own products to foster customer loyalty and encourage upgrades, the company also understands the consumer's desire for value. This means balancing the inherent longevity of furniture with the appeal of new styles, comfort enhancements, and functional improvements that prompt replacement purchases even when existing items are still serviceable. The challenge lies in making new furniture an attractive proposition beyond mere necessity.

- Extended Lifespans: Furniture, especially well-crafted pieces, can last well over a decade, delaying repeat purchase cycles.

- Consumer Value Focus: In 2024, economic considerations often lead consumers to prioritize repair and refurbishment over immediate replacement.

- Ashley's Response: The company aims to drive sales through product innovation and design updates that offer compelling reasons to upgrade, rather than just replace.

The threat of substitutes for Ashley Furniture Industries is multifaceted, encompassing the re-commerce market, furniture rental services, and DIY projects. The growing resale market, valued in the billions as of 2023, offers consumers more affordable alternatives. Additionally, furniture rental services cater to transient lifestyles, particularly among younger demographics, while DIY options appeal to budget-conscious individuals.

Entrants Threaten

The furniture industry, particularly for large-scale operations like Ashley Furniture, demands significant upfront investment. Establishing manufacturing plants, developing robust supply chains, and opening numerous retail locations requires hundreds of millions, if not billions, of dollars. For instance, major furniture manufacturers often invest upwards of $50 million to $100 million in new production facilities alone. This high capital requirement acts as a formidable barrier, deterring smaller players from entering the market at a competitive scale.

Ashley Furniture Industries, as a well-established player, leverages significant economies of scale across its operations. This translates to lower per-unit costs in manufacturing, bulk purchasing power for raw materials, and optimized logistics and distribution networks. For instance, in 2023, Ashley Furniture reported net sales of $9.7 billion, indicating a massive operational volume that underpins its cost advantages.

New entrants face a substantial hurdle in matching Ashley Furniture's cost efficiencies. Without the same scale, they would likely incur higher per-unit production costs, making it difficult to compete on price. This cost disadvantage can significantly deter new companies from entering the furniture market, especially those aiming for a broad customer base.

Ashley Furniture Industries benefits significantly from its established brand loyalty, a key deterrent for potential new entrants. Consumers often associate Ashley with quality and value, making it difficult for newcomers to capture market share. This loyalty is reinforced by the company's vast network of over 1,000 Ashley HomeStore locations and numerous wholesale partnerships, creating substantial barriers to entry in terms of distribution reach.

Access to Raw Materials and Supply Chains

New entrants face significant hurdles in securing reliable and cost-effective access to diverse raw materials and establishing efficient global supply chains. Ashley Furniture, with its extensive history and scale, has cultivated deep-rooted relationships and robust infrastructure, offering a distinct advantage.

For instance, the global furniture market, valued at approximately $683.8 billion in 2023, relies heavily on consistent access to materials like wood, metal, and textiles. New companies often struggle to match the purchasing power and logistical networks that established players like Ashley Furniture possess. This can lead to higher input costs and less predictable supply, impacting profitability and the ability to compete on price.

- High Capital Investment: Establishing global supply chains and securing raw material contracts requires substantial upfront capital, a barrier for many new ventures.

- Supplier Relationships: Existing players like Ashley Furniture benefit from long-standing, preferential relationships with suppliers, often securing better pricing and priority allocation.

- Logistical Complexity: Managing international shipping, warehousing, and distribution networks is intricate and costly, demanding expertise that new entrants may lack.

Government Regulations and Trade Policies

New entrants face significant hurdles due to stringent government regulations and evolving trade policies. These include compliance with safety standards, environmental regulations, and the complexities introduced by tariffs and import/export restrictions. For instance, in 2024, furniture imports into the United States faced varying tariff rates depending on the country of origin, impacting the cost structure for any new player looking to enter the market.

Navigating these regulatory landscapes can be costly and time-consuming, acting as a substantial barrier. The furniture industry is particularly sensitive to international trade dynamics, with shifts in trade agreements or the imposition of new duties directly affecting profitability and market access for potential entrants.

- Regulatory Compliance Costs: New entrants must invest in ensuring their products meet various safety and environmental standards, adding to initial operational expenses.

- Trade Policy Uncertainty: Fluctuations in tariffs and trade agreements create an unpredictable environment, making long-term planning challenging for new companies.

- International Trade Impact: The global nature of furniture sourcing and sales means that policy changes in one region can significantly affect market entry strategies elsewhere.

The threat of new entrants in the furniture industry, particularly for a large player like Ashley Furniture, is generally considered moderate to low. This is primarily due to the substantial capital investment required to establish manufacturing, distribution, and retail operations. For example, building a new, large-scale furniture manufacturing plant can easily cost tens of millions of dollars, a significant barrier for most aspiring companies.

Furthermore, established players benefit from brand recognition and customer loyalty, making it challenging for newcomers to gain traction. Ashley Furniture's extensive network of over 1,000 Ashley HomeStore locations provides a significant competitive advantage in terms of market reach and visibility, which is difficult and expensive for new entrants to replicate.

Economies of scale also play a crucial role. Ashley Furniture's massive sales volume, which reached $9.7 billion in net sales in 2023, allows it to negotiate better prices for raw materials and achieve lower per-unit production costs. New entrants, operating at a smaller scale, would likely face higher costs, hindering their ability to compete on price.

| Barrier to Entry | Impact on New Entrants | Ashley Furniture's Advantage |

| High Capital Investment | Significant hurdle for new companies to match scale and infrastructure. | Established manufacturing, distribution, and retail footprint. |

| Economies of Scale | Higher per-unit costs and less purchasing power compared to incumbents. | Cost efficiencies from large-scale production and procurement. |

| Brand Loyalty & Distribution | Difficulty in building brand awareness and securing widespread distribution. | Strong brand recognition and extensive retail network (1,000+ stores). |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Ashley Furniture Industries is built upon a foundation of comprehensive data, including industry-specific market research reports, financial statements from publicly traded competitors, and consumer behavior studies.