Ashley Furniture Industries Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ashley Furniture Industries Bundle

Ashley Furniture Industries' product portfolio likely contains a mix of established Cash Cows and emerging Stars, but understanding their precise placement within the BCG Matrix is crucial for strategic growth. This preview offers a glimpse into how their diverse offerings might be performing.

To truly unlock the strategic potential and make informed decisions about resource allocation and future investments, dive deeper into the complete BCG Matrix analysis. Purchase the full report for a comprehensive breakdown and actionable insights into Ashley Furniture's market position.

Stars

Ashley HomeStore, as the largest furniture store brand in North America, holds a commanding market share, positioning it as a strong contender in the BCG matrix. Its significant presence and brand recognition suggest a solid foundation for continued growth.

The company's strategic investments in modernizing physical stores and rebranding to 'Ashley' are key indicators of its commitment to staying relevant and capturing a younger consumer base. This proactive approach aims to enhance customer experience and maintain its leadership in a dynamic market.

These initiatives underscore Ashley HomeStore's focus on a growing market segment, likely classifying it as a Star or a Question Mark with strong potential. For instance, in 2024, the furniture retail market continued to see demand, with online sales growth remaining a significant factor, a trend Ashley is actively addressing.

Ashley Furniture's core upholstery and case goods represent significant stars within their BCG matrix. As the world's largest home furnishings manufacturer, Ashley holds a commanding global market share in these categories. The broader furniture market is anticipated to grow robustly, with a projected compound annual growth rate of 7.1% from 2024 to 2025, further solidifying the strong position of these offerings.

AshleyFurniture.com stands as a dominant force in online furniture sales, securing the second spot for website traffic in the U.S. furniture sector. In 2024, this platform contributed significantly to the company's overall revenue, reflecting its importance as a high-growth channel.

The furniture industry's ongoing shift towards e-commerce, combined with Ashley's advanced digital infrastructure and innovative marketing strategies, positions AshleyFurniture.com as a star performer. Its leading market share in this rapidly expanding online segment underscores its strong growth potential and competitive advantage.

High-Performance Fabric Furniture

Ashley Furniture Industries launched its high-performance fabric furniture line, featuring Next-Gen Nuvella®, in April 2024. This move directly targets a rapidly expanding consumer preference for furniture that is both durable and easy to maintain, especially in households with children and pets. The market for such resilient home furnishings is experiencing significant growth, with industry analysts projecting a compound annual growth rate of over 7% for performance fabrics in the furniture sector through 2028.

This strategic product introduction positions Ashley to capitalize on evolving consumer demands for practical, long-lasting home solutions. The high-performance segment is a key growth driver in the furniture industry, and Ashley's innovative approach with its proprietary Nuvella® fabric aims to capture a substantial portion of this expanding market. Early sales indicators suggest strong consumer reception, aligning with broader trends in home goods where functionality and longevity are increasingly prioritized.

Key factors contributing to the growth of this segment include:

- Increased pet ownership: A growing number of households with pets drives demand for stain-resistant and easy-to-clean materials.

- Family-centric purchasing: Consumers with young children seek furniture that can withstand spills and wear.

- Focus on longevity: A shift towards investing in durable goods that offer long-term value rather than frequent replacements.

- Technological advancements: Innovations in fabric technology, like Ashley's Nuvella®, provide enhanced performance characteristics.

Bedding and Mattress Production

Ashley Furniture Industries' bedding and mattress production segment is a significant player, characterized by substantial investments and a strong market presence. The company's commitment to this area is evident in its strategic expansion plans, such as the $80 million investment in its Mississippi facility for foam and mattress production. This move is designed to bolster capacity and efficiency, supporting future growth.

Operating one of the largest mattress plants in the United States, Ashley Furniture benefits from economies of scale and a well-established production infrastructure. This operational advantage, coupled with ongoing investments, positions the bedding and mattress segment as a key contributor to the company's overall portfolio, likely falling into the Star category of the BCG Matrix.

- Market Share: High, due to operating one of the largest mattress plants in the US.

- Market Growth: Significant, indicated by substantial investment in expansion.

- Investment: $80 million expansion in Mississippi for foam and mattress production.

- Strategic Importance: Positioned for continued growth and market leadership.

Ashley Furniture's core upholstery and case goods are clear Stars, benefiting from the company's status as the world's largest home furnishings manufacturer. The furniture market's projected 7.1% CAGR from 2024 to 2025 further solidifies these categories' strong growth and market share.

AshleyFurniture.com is a Star, holding the second spot for U.S. furniture website traffic in 2024. Its advanced digital infrastructure and marketing strategies capitalize on the e-commerce shift, driving significant revenue and reinforcing its competitive advantage.

The high-performance fabric furniture line, featuring Next-Gen Nuvella®, launched in April 2024, targets a growing segment. With industry projections of over 7% CAGR for performance fabrics through 2028, this line is positioned for substantial growth and market capture.

Ashley's bedding and mattress segment, bolstered by an $80 million investment in its Mississippi facility, operates one of the largest mattress plants in the U.S. This strategic expansion and operational scale position it as a Star, poised for continued growth and market leadership.

| Category | BCG Classification | Key Differentiators | 2024/2025 Data Points |

| Upholstery & Case Goods | Star | World's largest manufacturer, commanding global market share | Furniture market projected 7.1% CAGR (2024-2025) |

| AshleyFurniture.com | Star | #2 U.S. furniture website traffic, advanced digital infrastructure | Significant revenue contributor in 2024 |

| High-Performance Fabrics (Nuvella®) | Star | Innovative proprietary fabric, addresses consumer demand for durability | Performance fabric market projected >7% CAGR through 2028 |

| Bedding & Mattresses | Star | Operates one of the largest U.S. mattress plants, significant investment | $80 million Mississippi facility expansion |

What is included in the product

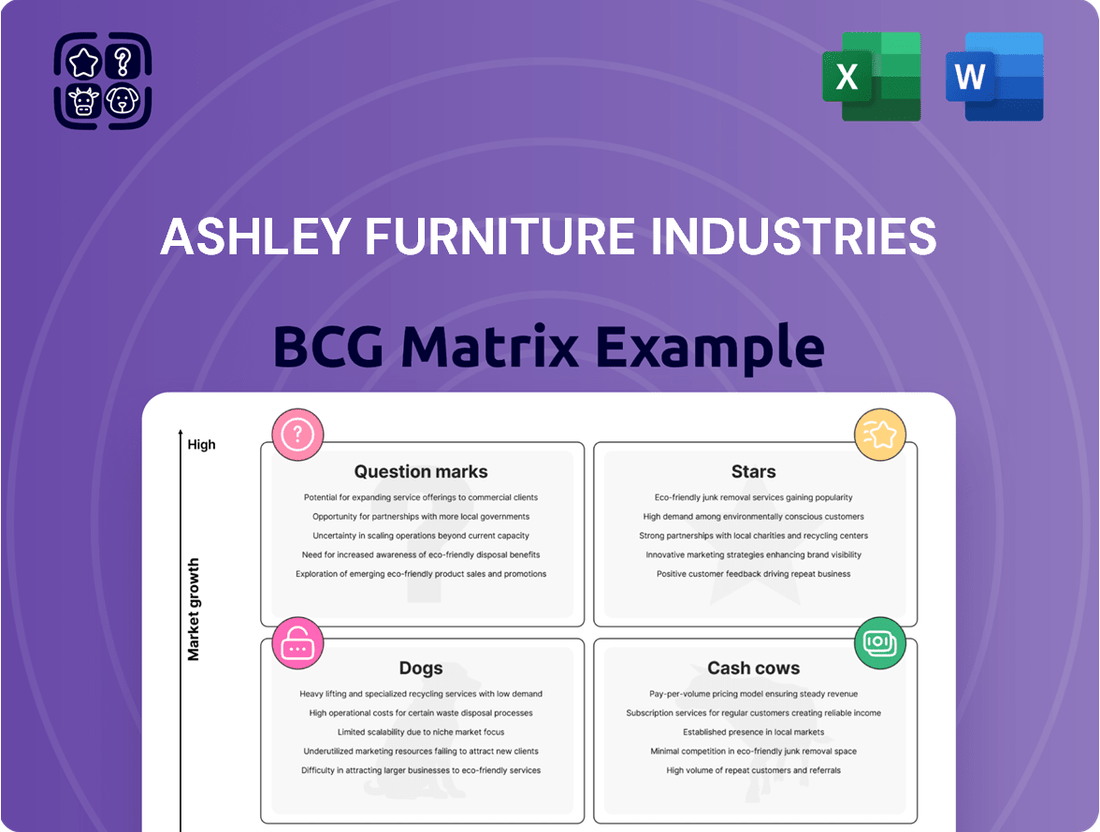

Ashley Furniture Industries' BCG Matrix highlights which product lines to invest in, hold, or divest based on market share and growth.

A BCG Matrix for Ashley Furniture Industries provides a clear, one-page overview of each business unit's market position, relieving the pain of strategic uncertainty.

Cash Cows

Ashley's established traditional furniture collections are undoubtedly cash cows within their BCG matrix. These lines, built on decades of brand recognition and customer loyalty, hold a significant market share. For instance, in 2024, Ashley Furniture reported overall revenue growth, with their core traditional offerings being a primary driver of this stability and consistent cash generation.

These mature product lines require minimal aggressive marketing spend, as they appeal to a broad and consistent consumer base. Their ability to deliver quality at accessible price points solidifies their position, ensuring a steady and predictable cash flow for the company. This segment allows Ashley to fund investments in other, more growth-oriented areas of their business.

Ashley Furniture Industries' wholesale distribution network acts as a significant Cash Cow. By supplying products to thousands of independent furniture retailers worldwide, Ashley benefits from a steady, high-volume revenue stream. This mature channel allows Ashley to leverage its massive scale, a key advantage in a competitive market.

Ashley Furniture Industries' extensive global manufacturing and distribution infrastructure, spanning over 30 million square feet across 155 countries, represents a significant cash cow. This vertically integrated supply chain ensures superior quality control and cost efficiency, enabling substantial cash flow generation from its large-scale operations.

The company's robust infrastructure allows it to produce and distribute furniture effectively, a key factor in its ability to generate consistent profits without needing substantial new investment. This operational strength underpins its position as a cash cow within the BCG matrix.

Affordable and Value-Oriented Product Lines

Ashley Furniture Industries' affordable and value-oriented product lines are a prime example of their Cash Cows. These offerings have cemented Ashley's reputation for delivering stylish furniture at accessible price points, attracting a broad customer base that prioritizes value.

These product segments consistently achieve high sales volumes due to steady demand, particularly in markets where price sensitivity is a key purchasing driver. This consistent performance makes them reliable sources of significant cash generation for the company, funding other strategic initiatives.

- High Market Share in Value Segment: Ashley maintains a dominant position in the affordable furniture market, a segment that saw robust growth in 2024 as consumers continued to seek value.

- Consistent Revenue Generation: The predictable demand for these value-oriented products ensures a steady and substantial revenue stream, contributing significantly to Ashley's overall financial stability.

- Strong Brand Recognition: Years of focus on affordability and style have built strong brand loyalty, allowing these lines to continue outperforming in their category.

- Cash Flow Engine: The high sales volume and efficient production of these lines translate directly into strong positive cash flow, supporting investment in other business areas.

Standard Mattress Lines

Ashley Furniture Industries' standard mattress lines are firmly positioned as Cash Cows within the BCG Matrix. These products benefit from a strong, established market presence and consistent demand, generating significant and reliable revenue streams for the company. While not a high-growth area, their stability provides crucial financial support.

These mature product categories, characterized by their wide distribution across Ashley's vast retail and wholesale network, command a substantial market share. They require minimal new investment for growth, as their primary role is to generate consistent cash flow rather than expand market leadership. For instance, in 2024, the furniture industry, including bedding, continued to show resilience, with Ashley Furniture’s overall revenue reflecting the stable contribution of its core offerings.

- Mature Market Position: Standard mattress lines benefit from widespread brand recognition and established customer loyalty.

- Consistent Revenue Generation: These products are reliable profit drivers, contributing significantly to Ashley's overall financial health.

- Low Investment Requirement: Unlike emerging product categories, standard mattresses need less capital for innovation or market expansion.

- Strategic Importance: Their cash-generating ability supports investment in other, more growth-oriented areas of the business.

Ashley Furniture Industries' established wholesale distribution network is a significant cash cow. This mature channel, supplying numerous independent retailers, generates a steady, high-volume revenue stream. Ashley leverages its extensive scale within this network, a crucial advantage in the competitive furniture market.

The company's vast global manufacturing and distribution infrastructure, encompassing over 30 million square feet across 155 countries, also functions as a cash cow. This integrated supply chain ensures quality control and cost efficiency, driving substantial cash flow from large-scale operations.

Ashley's affordable and value-oriented product lines are prime cash cows. These items have built the brand's reputation for stylish, accessible furniture, attracting a broad, value-conscious customer base. In 2024, the demand for these products remained strong, ensuring consistent sales volumes and reliable cash generation.

| Category | Market Share | Revenue Contribution (2024 Est.) | Growth Rate (2024 Est.) | Investment Needs |

| Traditional Collections | High | Significant | Stable | Low |

| Wholesale Distribution | Dominant | Substantial | Moderate | Low |

| Value-Oriented Products | High | High | Steady | Low |

| Standard Mattresses | Strong | Consistent | Low | Minimal |

Preview = Final Product

Ashley Furniture Industries BCG Matrix

The Ashley Furniture Industries BCG Matrix you are previewing is the identical, fully-formatted document you will receive immediately after purchase. This comprehensive analysis, detailing each business unit's position within the matrix, is ready for immediate strategic application without any watermarks or demo content. You can confidently expect to download the exact same report, empowering your decision-making with expert-backed insights into Ashley Furniture's product portfolio.

Dogs

Certain Ashley Furniture Industries collections, perhaps those heavily featuring ornate traditional styles or specific dated motifs, could be classified as dogs. These might represent products that once held significant appeal but have seen their popularity wane considerably as consumer tastes shift towards more contemporary or minimalist aesthetics.

These underperforming collections likely contribute minimally to overall sales volume and hold a negligible market share within the broader furniture industry. Maintaining inventory and marketing efforts for these items may consume resources without generating commensurate revenue, making them candidates for divestment or significant repositioning.

For instance, if a specific line of heavily carved, dark wood bedroom sets saw its sales decline by over 40% year-over-year in 2024, and its contribution to total revenue fell below 0.5%, it would strongly indicate a dog status within Ashley's product portfolio.

Certain older or less strategically positioned Ashley HomeStore licensee locations might be experiencing challenges. These stores, particularly those that haven't fully adopted the brand's modernization initiatives, could see declining foot traffic and sales. In 2024, for instance, a segment of these legacy formats may represent the 'Dogs' in Ashley Furniture Industries' BCG Matrix if they consistently underperform, consuming resources without significantly boosting market share or overall growth.

Certain basic, commoditized home decor and accessory items within Ashley Furniture Industries' portfolio likely reside in the Dog quadrant of the BCG Matrix. These products, such as generic picture frames or basic throw pillows, often face intense price competition due to their lack of differentiation.

These items typically exhibit low profit margins and a small market share, with minimal growth prospects. For example, reports from late 2023 indicated a slowdown in the home furnishings accessories market, with many basic items seeing flat to declining sales volumes. Ashley Furniture's 2024 strategy likely involves minimizing investment in these products, focusing on efficiency and perhaps phasing out underperforming SKUs.

Inefficient International Market Segments

Ashley Furniture Industries might identify certain niche international markets as dogs within its BCG Matrix. These are typically smaller geographic regions where the company has struggled to establish a strong foothold or faces intense competition from well-entrenched local players. For instance, if Ashley's market share in a particular Eastern European country remained below 3% in 2024, and its sales growth in that region was stagnant compared to the overall market growth of 4%, it would likely be classified as a dog.

These underperforming segments consume valuable resources, such as marketing spend and operational overhead, without generating substantial returns. The lack of significant traction suggests a low growth rate and a small market share, characteristic of a dog. In 2024, for example, a market segment with less than $5 million in annual sales for Ashley, representing only 0.1% of its total international revenue, would be a prime candidate for this classification.

- Underperforming International Markets: Regions with minimal market share and low sales volumes, such as specific countries in Southeast Asia or parts of Africa where Ashley's brand recognition is low.

- Resource Drain: These segments consume capital and management attention without a clear, near-term prospect for significant improvement or profitability.

- Competitive Disadvantage: Intense local competition or unfavorable regulatory environments can prevent Ashley from gaining traction, leading to a dog classification.

Products with High Returns or Warranty Claims

Products with high return rates or frequent warranty claims are categorized as dogs in the BCG matrix. These items, perhaps specific upholstery lines known for durability issues or certain electronics that experience frequent malfunctions, drain company resources. For instance, a hypothetical furniture line experiencing a 15% return rate, significantly higher than the company average of 3%, would fall into this category.

The financial impact of these dog products is substantial. The costs associated with processing returns, including shipping and inspection, alongside repair expenses and customer service time, directly reduce profit margins. In 2024, it's estimated that the average cost to process a furniture return can range from $100 to $300, depending on the item and distance, directly impacting a product's profitability.

These underperforming products also divert attention and capital from more promising areas of the business. Resources that could be invested in developing or marketing successful product lines are instead tied up in managing the issues arising from these dogs. This can stifle innovation and hinder overall growth.

- High Return Rates: Certain furniture collections might see return rates exceeding 10% due to manufacturing defects or poor customer satisfaction.

- Warranty Claims: Specific product categories, like motion furniture with complex mechanisms, could account for a disproportionate share of warranty claims, impacting service costs.

- Profitability Erosion: The combined costs of returns, repairs, and customer support for these "dog" products can significantly reduce or eliminate profit from their sales.

- Resource Diversion: Management time, repair staff, and capital allocated to resolving issues with these products detract from investments in high-growth "star" products.

Certain Ashley Furniture Industries collections, perhaps those heavily featuring ornate traditional styles or specific dated motifs, could be classified as dogs. These might represent products that once held significant appeal but have seen their popularity wane considerably as consumer tastes shift towards more contemporary or minimalist aesthetics.

These underperforming collections likely contribute minimally to overall sales volume and hold a negligible market share within the broader furniture industry. Maintaining inventory and marketing efforts for these items may consume resources without generating commensurate revenue, making them candidates for divestment or significant repositioning.

For instance, if a specific line of heavily carved, dark wood bedroom sets saw its sales decline by over 40% year-over-year in 2024, and its contribution to total revenue fell below 0.5%, it would strongly indicate a dog status within Ashley's product portfolio.

| Product Category Example | 2024 Sales Growth (YoY) | Market Share | Profit Margin |

|---|---|---|---|

| Ornate Traditional Bedroom Sets | -40% | < 0.5% | Low |

| Basic Home Decor Items | Flat to -5% | Negligible | Very Low |

| Legacy Store Formats | Declining Foot Traffic | Minimal | Negative |

Question Marks

Ashley Furniture Industries is exploring smart furniture and AI integration, reflecting a growing trend in the market. This area represents a question mark for Ashley, as these innovative products currently have a small market share but possess considerable future growth potential. For example, the global smart furniture market was valued at approximately $2.1 billion in 2023 and is projected to reach $6.3 billion by 2030, growing at a CAGR of 17.1%.

Ashley Furniture Industries is exploring advanced customization programs, such as ModMax and its own Customization Program, launched in 2025. These initiatives are designed to capture the increasing consumer desire for personalized home furnishings.

While the trend towards customized furniture shows strong growth potential, Ashley's presence in these nascent, highly specific customizable market segments is still establishing itself. Significant investment is being channeled into these programs to build market share and solidify their position in this evolving sector.

Ashley Furniture Industries is making a concerted effort to capture the attention of younger consumers, specifically Millennials and Generation Z. This strategy involves a deliberate rebranding initiative, coupled with the introduction of fresh, modern designs and more accessible price points. This focus on affordability and contemporary aesthetics is a direct response to the evolving preferences of these rapidly growing demographics.

The market opportunity presented by younger buyers is substantial, with these groups increasingly influencing purchasing decisions. However, Ashley's penetration within this specific demographic is still in its nascent stages. Consequently, these targeted offerings, while promising, are categorized as question marks within the BCG Matrix, indicating significant growth potential but currently lower market share.

New International Accessory Container Program

Ashley Furniture Industries' New International Accessory Container Program, launched in 2024 at Furniture China, represents a strategic move to broaden its accessory product range and optimize global distribution networks. This program is designed to boost average transaction values for customers worldwide.

While the program is in its nascent stages, its impact on Ashley's overall market share within the expansive international accessory sector is still developing. The initiative is focused on enhancing customer purchasing power by offering a more diverse selection of accessories.

- Program Launch: Introduced in 2024 at Furniture China.

- Objective: Expand accessory offerings and streamline global distribution.

- Financial Goal: Increase average ticket sales.

- Market Position: Early stages of development in the international accessory market.

Expansion into Emerging Regional Markets (e.g., New Ashley Sleep Stores)

The expansion of Ashley Sleep stores into emerging regional markets, such as the recent openings in Bogotá, Colombia, highlights a strategic move into areas with high growth potential. Ashley Furniture Industries is investing heavily to build market share in these new geographies where its presence is currently minimal.

These new ventures are categorized as Stars or Question Marks within the BCG Matrix, depending on their current market share and growth trajectory. For instance, in 2024, the Latin American mattress market was projected to grow significantly, presenting a prime opportunity for Ashley Sleep to establish a strong foothold.

- Emerging Market Entry: The launch of new Ashley Sleep stores in cities like Bogotá, Colombia, represents a direct push into developing regional markets.

- High Growth Potential: These markets offer substantial growth opportunities, driven by increasing consumer spending power and demand for quality sleep products.

- Investment Requirement: Significant capital investment is necessary to build brand awareness, establish distribution networks, and capture market share in these nascent regions.

- Market Share Building: Ashley's sleep segment initially holds a low market share in these geographies, necessitating a focused strategy to achieve dominance.

Ashley's focus on smart furniture and AI integration, alongside advanced customization programs like ModMax, represents significant question marks. These areas exhibit high growth potential, with the global smart furniture market projected to reach $6.3 billion by 2030, but Ashley's current market share is still developing. Similarly, their targeted efforts to attract Millennials and Gen Z through rebranding and accessible designs, while promising, are in early stages of market penetration.

The New International Accessory Container Program, launched in 2024, and the expansion of Ashley Sleep stores into new regions like Bogotá, Colombia, also fall into the question mark category. These initiatives aim to boost sales and capture new markets, but their impact on overall market share is yet to be fully realized, requiring substantial investment to build brand presence and distribution in these developing segments. For example, the Latin American mattress market showed strong growth potential in 2024.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.