Aristocrat Leisure Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aristocrat Leisure Bundle

Aristocrat Leisure operates in a dynamic gaming industry where buyer power from casinos and the threat of new entrants are significant considerations. Understanding the intensity of rivalry and the bargaining power of suppliers is crucial for navigating this competitive landscape.

The complete report reveals the real forces shaping Aristocrat Leisure’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Aristocrat Leisure's reliance on suppliers for specialized technology, like advanced graphics processors and proprietary software modules, gives these vendors considerable bargaining power. The limited availability of some unique gaming technologies means these suppliers can command higher prices or favorable terms.

However, Aristocrat's significant investment in research and development, exceeding AUD 1 billion in recent years, allows them to develop more in-house capabilities. This reduces their dependence on external vendors for critical intellectual property, thereby mitigating supplier power.

Content creators and intellectual property (IP) holders can wield significant influence over Aristocrat Leisure. While Aristocrat produces much of its own gaming content, collaborations with popular media franchises or independent studios are vital for attracting players, particularly in digital and themed slots. For instance, securing rights to a blockbuster movie or a beloved video game can create a powerful draw.

Suppliers of highly sought-after IP for branded games often possess greater bargaining power because their content offers a unique appeal that differentiates Aristocrat's offerings. This is especially true in a competitive market where unique themes and familiar brands can drive customer engagement and revenue. Aristocrat's strategic focus on 'gaming-themed content' underscores the ongoing reliance on strong creative input, whether developed internally or sourced externally.

The availability of highly skilled engineers, game designers, software developers, and data scientists is crucial for Aristocrat Leisure's innovation. A shortage of talent, especially in emerging fields like AI and VR, can significantly boost the bargaining power of these human capital 'suppliers'.

Aristocrat's stated commitment to investing in talent, technology, and products underscores the strategic importance of attracting and retaining specialized expertise. In 2024, the demand for these specialized skills remains high across the tech and gaming sectors, potentially increasing supplier leverage.

Manufacturing and Assembly Partners

Aristocrat Leisure's reliance on manufacturers and assemblers for its land-based gaming machines means these partners hold some bargaining power. While many can handle standard production, suppliers with specialized tooling or unique manufacturing capabilities can command greater leverage. For instance, the global supply chain challenges experienced in 2021 and 2022, which saw increased lead times and component costs, temporarily amplified the power of manufacturing suppliers across many industries, including electronics.

- Specialized Capabilities: Suppliers with unique tooling or production processes can increase their bargaining power.

- Supply Chain Vulnerabilities: Disruptions, like those seen in 2021-2022, can shift power towards manufacturing partners.

- Market Concentration: If only a few manufacturers possess the necessary expertise for Aristocrat's specific needs, their influence grows.

Data and Analytics Providers

In the digital gaming arena, data and analytics providers wield considerable influence. Companies like Aristocrat Leisure rely heavily on these providers for insights into user behavior, crucial for personalizing game experiences and optimizing monetization. For instance, Aristocrat's focus on AI-driven personalization in its digital gaming portfolio underscores the dependency on advanced data analytics. The competitive edge derived from unique data insights can significantly bolster a provider's bargaining power.

The digital gaming sector's increasing reliance on sophisticated data analytics for personalization and monetization means that providers offering unique or critical capabilities can command significant leverage. Aristocrat Leisure, a major player, actively uses AI for personalization across its digital offerings, demonstrating the essential nature of these data-driven services. The ability to access and interpret vast amounts of player data offers a distinct competitive advantage.

- Essentiality of Data: Robust data analytics and user behavior insights are fundamental for personalization and monetization in digital gaming.

- Competitive Advantage: Unique data offerings from providers can grant a critical competitive edge, increasing their bargaining power.

- AI Integration: Aristocrat's use of AI for personalization in its digital games highlights the demand for advanced data capabilities.

Aristocrat Leisure faces supplier bargaining power from providers of specialized technology, such as advanced graphics processors and proprietary software, given the limited availability of certain unique gaming technologies. However, the company's substantial R&D investments, exceeding AUD 1 billion in recent years, foster in-house capabilities, thereby reducing external dependency and mitigating supplier leverage.

The bargaining power of suppliers is influenced by the uniqueness of their offerings and Aristocrat's reliance on them. For instance, content creators holding rights to popular IP can command higher terms due to their ability to differentiate Aristocrat's products and drive player engagement. Similarly, a scarcity of specialized talent, particularly in AI and VR, in 2024 empowers these human capital 'suppliers' as Aristocrat invests in attracting and retaining expertise.

Manufacturing suppliers for land-based gaming machines can also exert influence, especially those with specialized tooling or unique production capabilities. Global supply chain disruptions, like those experienced in 2021-2022, temporarily amplified the power of such partners. In the digital realm, data and analytics providers offering unique insights into user behavior are critical for Aristocrat's AI-driven personalization strategies, granting them significant leverage.

| Supplier Type | Key Factors Influencing Bargaining Power | Aristocrat's Mitigation Strategies |

|---|---|---|

| Technology Providers | Limited availability of unique gaming tech | In-house R&D investment (over AUD 1B in recent years) |

| IP Holders/Content Creators | Uniqueness of branded content, player draw | Strategic focus on gaming-themed content, internal development |

| Skilled Labor (AI, VR, Devs) | Talent shortages, high demand in 2024 | Investment in talent attraction and retention |

| Manufacturing Partners | Specialized tooling, supply chain vulnerabilities | Diversification of manufacturing partners, long-term relationships |

| Data & Analytics Providers | Unique data insights, AI integration needs | Developing internal data science capabilities, strategic partnerships |

What is included in the product

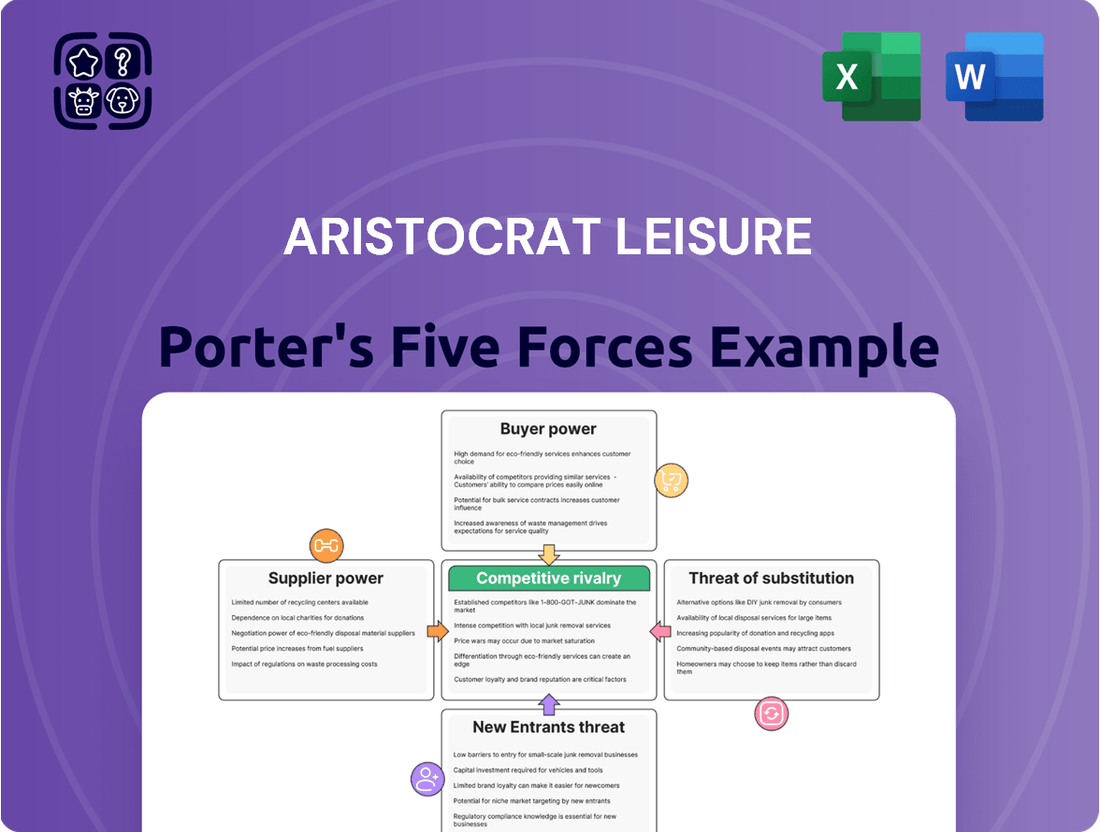

This Porter's Five Forces analysis for Aristocrat Leisure dissects the competitive intensity within the gaming industry, examining the power of buyers and suppliers, the threat of new entrants and substitutes, and the overall rivalry among existing players.

Effortlessly identify and neutralize competitive threats with a visual representation of Aristocrat Leisure's Porter's Five Forces, simplifying complex market dynamics.

Customers Bargaining Power

Large casino operators, Aristocrat Leisure's main clients for gaming and electronic table games, are sophisticated buyers with substantial order volumes. They can leverage their power through extended contracts, requests for tailored products, and by playing Aristocrat against rivals such as Light & Wonder.

Despite this, Aristocrat's commanding 42% market share in North America and its robust product offerings effectively counterbalance the bargaining power held by its customers.

Digital gaming players, as consumers, generally wield low bargaining power. Their switching costs between different games and platforms are minimal, and the sheer volume of available entertainment options means they can easily opt out if unsatisfied. This power is seen in how developers must constantly innovate and offer engaging content to retain players and encourage in-app spending.

In 2024, the global gaming market was valued at over $200 billion, highlighting the immense competition for player attention. Aristocrat Leisure, recognizing this, focuses on creating compelling experiences and utilizing AI to personalize recommendations, aiming to foster loyalty and reduce the likelihood of players switching to competitors.

Regulatory bodies and the jurisdictions where Aristocrat Leisure operates wield significant influence, akin to powerful customers. They set the rules for licensing, game design, and operational conduct within the gaming sector. For instance, in 2023, Aristocrat continued to navigate complex regulatory environments across key markets like North America and Australia, where licensing fees and compliance costs are substantial, directly impacting profitability and market entry strategies.

These authorities directly shape Aristocrat's market access and revenue potential by approving or denying licenses and imposing operational constraints. Their decisions on game content, payout percentages, and responsible gambling measures can necessitate costly adjustments to Aristocrat's product portfolio. The company's commitment to robust compliance and proactive engagement with these regulatory stakeholders is therefore crucial for sustained success and to mitigate risks associated with changing legal frameworks.

Consolidation Among Casino Groups

Further consolidation among casino operators could significantly amplify their collective bargaining power. As fewer, larger entities emerge, they gain greater leverage when negotiating with gaming equipment and solutions providers like Aristocrat Leisure. This trend might translate into demands for more aggressive pricing, customized integrated solutions, or exclusive content arrangements, potentially impacting Aristocrat's margins and market access.

However, Aristocrat Leisure's robust scale and its diversified portfolio of gaming machines, digital solutions, and payment technologies provide a strong counterpoint. The company is well-equipped to cater to the complex needs of these large, integrated resort groups, offering a comprehensive suite of products and services that can be difficult for competitors to match. For instance, in fiscal year 2023, Aristocrat reported a 16.8% increase in revenue to AUD 3.05 billion, demonstrating its ability to grow even within a consolidating market.

- Increased buyer concentration: Consolidation leads to fewer, larger casino operators, enhancing their negotiating stance.

- Potential for price pressure: Larger buyers can demand more favorable pricing from suppliers like Aristocrat.

- Demand for integrated solutions: Consolidated operators may seek bundled offerings and tailored services.

- Aristocrat's resilience: The company's scale and diverse product range help it serve major integrated resort groups effectively.

Demand for Specific Game Types and Features

The demand for specific game types and features significantly impacts Aristocrat Leisure's bargaining power with its customers, primarily casinos. Casinos, in turn, are driven by player preferences. For example, the increasing popularity of social casino games and the integration of mobile technology in gaming experiences directly influence what Aristocrat develops and sells. Casinos actively seek out games that resonate with their customer base to maximize foot traffic and revenue.

This creates a dynamic where casinos can exert pressure on Aristocrat by demanding games that align with current player trends, such as specific themes or innovative technological integrations like cashless payment systems. Aristocrat's ability to meet these demands, evidenced by its strong performance in key markets, allows it to maintain its market position. In 2023, Aristocrat reported a 23% increase in revenue, partly driven by its robust portfolio of popular game titles, demonstrating its responsiveness to customer-driven demand.

- Player Demand for Innovation: Casinos prioritize games with popular themes and features, influencing Aristocrat's product roadmap.

- Technological Integration: The demand for features like cashless payments or advanced player interfaces gives casinos leverage.

- Market Responsiveness: Aristocrat's success, with reported revenue growth of 23% in FY23, highlights its ability to adapt to evolving player preferences.

- Competitive Landscape: Casinos can switch to competitors offering games that better capture current player interests, increasing customer bargaining power.

The bargaining power of customers for Aristocrat Leisure is significant, primarily due to the concentration of large casino operators who represent substantial order volumes. These sophisticated buyers can leverage their purchasing power by negotiating extended contracts, demanding customized game features, and playing Aristocrat against its competitors. This dynamic is further amplified by industry consolidation, leading to fewer, larger operators who possess even greater negotiation leverage, potentially driving down prices and demanding integrated solutions.

Aristocrat's substantial market share, reaching 42% in North America by 2023, and its diverse product offerings serve as a crucial counterbalance to this customer power. The company's ability to innovate and respond to player demand, as seen in its 23% revenue growth in fiscal year 2023, allows it to maintain a strong market position. However, the increasing demand for specific, trending game types and integrated technologies like cashless systems means casinos can exert pressure by seeking out games that best capture current player interests, potentially influencing Aristocrat's product development pipeline.

| Customer Type | Bargaining Power Level | Key Influencing Factors |

|---|---|---|

| Large Casino Operators | High | Order volume, industry consolidation, potential for switching, demand for customization |

| Digital Gaming Players | Low | Minimal switching costs, abundance of choices, low individual impact |

| Regulatory Bodies | High (akin to customers) | Licensing, game design rules, operational conduct, compliance costs |

Same Document Delivered

Aristocrat Leisure Porter's Five Forces Analysis

This preview showcases the complete Aristocrat Leisure Porter's Five Forces Analysis, offering a thorough examination of the competitive landscape within the gaming industry. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, providing actionable insights into the forces shaping Aristocrat's market position. You can be confident that what you preview is precisely what you will download, ready for immediate use.

Rivalry Among Competitors

The land-based gaming machine arena is a battlefield, with giants like Light & Wonder, IGT, and Everi constantly pushing the boundaries. These companies fiercely compete for prime casino floor real estate, aiming to capture market share and keep players captivated through cutting-edge game development, advanced hardware, and sophisticated system integration.

Aristocrat Leisure, while a dominant force, particularly in North America where it commands an impressive 42% market share, is not immune to this intense rivalry. The pressure to consistently innovate and clearly distinguish its products remains a critical factor for maintaining its leadership position in this dynamic market.

The digital gaming market, including social casino and real money gaming, is incredibly fragmented with a multitude of developers and publishers vying for attention. This intense competition fuels a constant battle for user acquisition and retention, making it a dynamic environment. Aristocrat's Product Madness and Aristocrat Interactive segments operate within this highly competitive landscape, facing off against a broad spectrum of global and specialized players.

Competitive rivalry within the gaming industry, particularly for companies like Aristocrat Leisure, is significantly amplified by the immense investment needed for research and development. This focus on R&D is essential for creating cutting-edge gaming content, advanced hardware, and sophisticated software that captivates players and operators alike. For instance, Aristocrat consistently allocates substantial capital to innovation, a strategy that allows them to introduce fresh and engaging products to the market, thereby staying competitive.

This high expenditure on R&D serves a dual purpose: it fuels innovation and acts as a formidable barrier to entry for smaller, less-resourced competitors. By continuously pushing the boundaries of what's possible in gaming technology and design, established players like Aristocrat solidify their market positions and maintain leadership. In 2023, Aristocrat Leisure reported R&D expenses of approximately AUD 500 million, underscoring the critical role of this investment in their competitive strategy.

Strategic Mergers and Acquisitions (M&A)

The gaming sector is characterized by consistent strategic mergers and acquisitions as companies aim to bolster their market presence, integrate novel technologies, or penetrate emerging markets. Aristocrat Leisure has actively participated in this trend, notably acquiring NeoGames for approximately $1.2 billion in 2023, a move designed to significantly expand its digital gaming capabilities. Concurrently, the company has explored divestitures, such as the potential sale of its digital gaming subsidiary Plarium, to refine its strategic priorities.

These M&A activities foster industry consolidation, leading to a dynamic reshaping of the competitive environment. Larger, more integrated rivals emerge with enhanced scale and broader operational capacities, intensifying rivalry for all players in the market. For instance, Aristocrat's acquisition of NeoGames bolstered its position in the iLottery and digital real-money gaming sectors, directly impacting competitors in those spaces.

- Market Consolidation: M&A activity leads to fewer, larger competitors, increasing the intensity of rivalry.

- Technological Advancement: Acquisitions often focus on integrating new technologies, giving acquiring companies a competitive edge.

- Aristocrat's Strategy: The acquisition of NeoGames for ~$1.2 billion in 2023 highlights Aristocrat's commitment to digital expansion.

- Portfolio Optimization: Divestitures, like the potential sale of Plarium, allow companies to concentrate resources on core, high-growth areas.

Global Market Reach and Regional Strongholds

Competitive rivalry in the gaming industry is intense and global. Companies like Aristocrat Leisure constantly battle for market share across numerous regulated jurisdictions. While Aristocrat boasts a significant presence in North America, its competitive landscape shifts dramatically by region. For instance, in certain European or Asian markets, local manufacturers or other international powerhouses might hold a more dominant position.

Adapting to diverse regional tastes and navigating varying regulatory frameworks is a paramount challenge. Aristocrat's ability to maintain a broad global reach while tailoring its offerings to specific local preferences directly impacts its competitive standing. For example, in 2023, Aristocrat reported strong performance in its Americas segment, contributing significantly to its overall revenue, yet it also actively pursued growth in other international markets, highlighting this global-regional dynamic.

- Global Competition: Aristocrat competes with major players like IGT, Scientific Games, and Novomatic across international markets.

- Regional Strengths: Aristocrat holds a leading position in North America, particularly in the US Class III market.

- Market Adaptation: Success hinges on tailoring game content and technology to regional player preferences and regulatory requirements.

- Regulatory Landscape: Navigating diverse gaming regulations in over 300 jurisdictions presents a continuous challenge.

The competitive rivalry within the gaming industry is fierce, driven by significant R&D investments and a constant need for innovation to capture player attention and casino floor space. Aristocrat Leisure, a major player, faces intense competition from established giants like Light & Wonder and IGT, particularly in the land-based sector where market share is hard-won.

In the digital realm, Aristocrat's Product Madness and Aristocrat Interactive segments contend with a fragmented landscape of numerous developers and publishers, necessitating continuous efforts in user acquisition and retention. The company's strategic acquisitions, such as the $1.2 billion purchase of NeoGames in 2023, underscore its commitment to bolstering its digital capabilities and navigating this dynamic competitive environment.

Aristocrat's global presence means it must adapt to diverse regional tastes and regulatory frameworks, facing different dominant players in various markets. This necessitates a balance between global strategy and localized product offerings to maintain its competitive edge across all operating jurisdictions.

| Competitor | Key Market Focus | 2023 Revenue (Approx.) | Key Strengths |

|---|---|---|---|

| Light & Wonder | Land-based & Digital Gaming | $2.3 billion | Strong game portfolio, robust distribution |

| IGT | Land-based, Digital & Lottery | $4.1 billion | Diversified offerings, extensive global reach |

| Everi | Gaming Equipment & Payments | $770 million | Payment solutions, casino operations support |

SSubstitutes Threaten

The escalating popularity of online and mobile gaming presents a substantial threat of substitutes for Aristocrat Leisure's traditional gaming machines. Players increasingly opt for the convenience and accessibility of digital platforms, which offer a wide array of casino-style games and sports betting accessible from personal devices. For instance, the global online gambling market was valued at approximately USD 64.1 billion in 2023 and is projected to grow significantly, indicating a strong shift in player preference.

The threat of substitutes for Aristocrat Leisure's gaming offerings is significant, as a wide array of other entertainment options vie for consumer attention and discretionary spending. Activities like attending live concerts, watching movies, participating in sports, or engaging with social media platforms all represent alternative ways for individuals to spend their leisure time and money. For instance, global box office revenue reached approximately $26 billion in 2023, indicating a substantial portion of entertainment budgets allocated to cinema.

Aristocrat must continually innovate to ensure its gaming products remain more engaging and rewarding than these readily available substitutes. The sheer volume of digital content, with platforms like YouTube hosting billions of hours of video watched daily, underscores the intense competition for consumer engagement. Failure to offer compelling gameplay and unique experiences could lead players to opt for these other forms of entertainment, impacting Aristocrat's market share and revenue.

Emerging technologies like Virtual Reality (VR) and Augmented Reality (AR) present a growing threat of substitutes for Aristocrat Leisure's traditional gaming offerings. These immersive technologies are creating new entertainment avenues that could divert consumer spending and attention away from physical casinos and their digital counterparts. For instance, the global VR market was valued at approximately $28.2 billion in 2023 and is projected to grow significantly, indicating a substantial potential shift in entertainment preferences.

While VR/AR gaming is still developing, its increasing sophistication offers more compelling experiences that could rival the allure of traditional gaming environments. This could lead to a gradual erosion of market share if companies like Aristocrat do not adapt. Aristocrat's strategic investments in technology, including exploration of new gaming platforms, are crucial for mitigating this threat and ensuring continued relevance in a rapidly evolving entertainment landscape.

Skill-Based Games and Esports Betting

The burgeoning popularity of skill-based games and esports betting presents a significant threat of substitutes for traditional gaming companies like Aristocrat Leisure. These new forms of entertainment cater to younger demographics, offering interactive and competitive experiences that can draw attention and spending away from slot machines and other casino offerings. For instance, the global esports market was valued at approximately $1.5 billion in 2023 and is projected to grow substantially, indicating a strong shift in consumer preference towards digital and skill-intensive entertainment.

These alternative markets provide different engagement models, often leveraging digital platforms and social interaction. Esports betting, in particular, has seen rapid growth, with significant volumes of money wagered annually, diverting potential gaming revenue. This trend is amplified by the increasing accessibility of online betting platforms and the widespread appeal of competitive video gaming.

Aristocrat's strategic move into real money gaming (RMG) platforms is a direct response to these evolving consumer preferences. By diversifying its portfolio, Aristocrat aims to capture a share of this growing market and mitigate the threat posed by substitutes. This diversification allows them to tap into the digital-native audience that is increasingly drawn to skill-based and esports-related activities.

- Market Shift: Younger demographics increasingly favor interactive, skill-based gaming and esports over traditional casino games.

- Market Size: The global esports market reached roughly $1.5 billion in 2023, highlighting a substantial alternative entertainment sector.

- Engagement Models: Esports and skill-based games offer digital and social engagement, contrasting with the more solitary nature of many traditional casino games.

- Aristocrat's Response: Diversification into real money gaming platforms is a key strategy to address this substitute threat.

Free-to-Play Models and Casual Gaming

The rise of free-to-play (F2P) mobile games and the broader casual gaming market presents a significant threat of substitutes for Aristocrat Leisure. These games often require no upfront cost, offering a low-barrier entry that can attract players who might otherwise engage with Aristocrat's offerings.

While Aristocrat's own social casino games utilize an F2P model with in-app purchases, the existence of purely free games can siphon off casual players who aren't motivated by the prospect of monetary stakes. This segment of the market is particularly susceptible to substitutes that offer entertainment without any financial commitment.

The challenge for Aristocrat lies in its ability to not only attract these casual players but also to convert them into engaged users who are willing to monetize. This requires exceptionally compelling gameplay, robust retention mechanics, and effective monetization strategies that provide perceived value.

- Market Share Erosion: Purely free games can capture a portion of the casual gaming audience, potentially reducing the addressable market for paid or in-app purchase-driven games.

- Player Acquisition Costs: To compete for attention, Aristocrat may face increased marketing and acquisition costs to draw players away from readily available free alternatives.

- Monetization Pressure: The prevalence of F2P models necessitates a continuous focus on optimizing in-app purchase strategies to ensure revenue generation from a player base accustomed to free access.

The proliferation of online and mobile gaming platforms, including social casino games and real money gaming (RMG) operations, represents a significant threat of substitutes for Aristocrat Leisure's land-based gaming machines. These digital alternatives offer convenience and accessibility, catering to evolving player preferences. For example, the global online gambling market was valued at approximately $64.1 billion in 2023, demonstrating a substantial shift towards digital entertainment.

Furthermore, a wide array of other leisure activities compete for consumer discretionary spending, acting as substitutes for traditional gaming. These include streaming services, social media, live events, and other forms of entertainment. The global box office revenue, reaching about $26 billion in 2023, illustrates the significant allocation of entertainment budgets to alternative activities, highlighting the need for Aristocrat to maintain compelling product offerings.

Emerging technologies like Virtual Reality (VR) and Augmented Reality (AR) are also poised to become potent substitutes, offering immersive experiences that could draw players away from conventional gaming. The global VR market was valued at approximately $28.2 billion in 2023, signaling a growing interest in these advanced entertainment formats. Aristocrat's strategic investments in technology are crucial to counter these evolving substitute threats.

| Substitute Category | Market Example | 2023 Market Value (Approx.) | Key Characteristic |

|---|---|---|---|

| Online & Mobile Gaming | Global Online Gambling | $64.1 billion | Convenience, Accessibility |

| Other Entertainment | Global Box Office Revenue | $26 billion | Broad Leisure Options |

| Immersive Technologies | Global VR Market | $28.2 billion | Immersive Experience |

Entrants Threaten

The land-based gaming machine sector demands significant upfront capital. Newcomers must invest heavily in research and development, establish robust manufacturing capabilities, and build extensive sales and support infrastructure. This financial hurdle alone deters many potential competitors.

For instance, developing a new gaming machine involves complex software, hardware, and regulatory compliance, easily costing millions. Aristocrat Leisure's substantial ongoing investments in innovation and its vast existing installed base of machines worldwide further solidify this barrier, making it exceptionally difficult for new players to gain traction.

The gaming industry, particularly land-based and real money online operations, faces a dense web of regulations and licensing mandates globally. For instance, in 2024, obtaining a gaming license in a major jurisdiction like Nevada can involve extensive background checks, substantial application fees often in the tens of thousands of dollars, and a lengthy approval process that can take over a year.

These intricate legal and regulatory landscapes present a significant hurdle for aspiring entrants. New companies must dedicate substantial capital and acquire specialized legal talent to understand and adhere to these diverse compliance demands, effectively deterring many potential new competitors.

Established brand recognition and deep customer relationships present a significant barrier for new entrants in the gaming industry, particularly for companies like Aristocrat Leisure. Aristocrat benefits from decades of building trust with casino operators worldwide, evidenced by its portfolio of popular and reliable gaming machines. For instance, in fiscal year 2023, Aristocrat reported a significant revenue increase, underscoring the continued demand for its established offerings, which new players would struggle to match immediately.

Intellectual Property and Proprietary Technology

Aristocrat Leisure's substantial intellectual property (IP) portfolio, encompassing patents for innovative gaming mechanics, software, and hardware, acts as a significant barrier to new entrants. The immense R&D investment and specialized expertise required to develop comparable proprietary technology and unique gaming content make it exceptionally difficult for newcomers to compete effectively. Without access to or the ability to replicate Aristocrat's established IP, new entrants face a steep uphill battle in creating compelling and legally sound gaming products.

The threat of new entrants is significantly mitigated by the high cost and complexity of developing and securing intellectual property in the gaming industry. For instance, in 2024, companies like Aristocrat continue to invest heavily in R&D, with a substantial portion of their capital expenditure dedicated to innovation and IP protection. This ongoing investment creates a moving target for potential competitors, who must not only match existing technological capabilities but also invest in future-proofing their own IP portfolios.

- High R&D Expenditure: Aristocrat's commitment to innovation necessitates significant ongoing investment in research and development, creating a substantial financial hurdle for new entrants.

- Patent Portfolio: A deep and broad patent portfolio protects Aristocrat's core gaming technologies and designs, making it challenging and costly for new companies to operate without infringing on existing IP.

- Proprietary Technology Development: The creation of unique gaming software and hardware requires specialized expertise and considerable time, further deterring new market entrants.

- Legal and Licensing Costs: New entrants would face substantial legal fees and potential licensing costs to navigate the existing IP landscape, adding to the overall barrier to entry.

Challenges in Digital User Acquisition and Scaling

While the digital gaming market might seem easier to enter than traditional casinos, actually getting a large number of players and making money from them is tough. New companies have to fight hard for people's attention and spend a lot on advertising to get noticed in a very busy space. For example, in 2024, the cost per install for mobile games continued to be a significant hurdle for many new developers.

Aristocrat's digital arms, like Product Madness and Aristocrat Interactive, have a big advantage. They already have a large group of players and established ways to reach them, which makes it much easier and cheaper to grow compared to a brand-new competitor trying to break in.

The struggle for user acquisition in digital gaming is substantial. In 2023, the average cost to acquire a new paying user in the social casino genre, a key area for Aristocrat, saw an increase of approximately 15% year-over-year, highlighting the escalating marketing expenses.

- High Marketing Costs: Acquiring new users in the competitive digital gaming landscape often requires significant investment in advertising and promotions, impacting profitability for new entrants.

- Player Attention Scarcity: The sheer volume of available games means new entrants must offer truly compelling experiences to capture and retain player attention against established titles.

- Leveraging Existing Assets: Aristocrat's established digital divisions benefit from cross-promotional opportunities and existing player data, creating a barrier for newcomers.

The threat of new entrants into Aristocrat Leisure's core markets remains relatively low. Significant capital investment is required for R&D, manufacturing, and regulatory compliance, creating substantial financial barriers. For example, in 2024, obtaining gaming licenses in key jurisdictions involves lengthy processes and substantial fees, often exceeding tens of thousands of dollars.

Aristocrat's extensive intellectual property portfolio, built through decades of innovation, further deters new players. Developing comparable proprietary technology and unique gaming content is both time-consuming and expensive, with companies like Aristocrat continuing to invest heavily in R&D and IP protection in 2024.

Furthermore, established brand recognition and deep customer relationships with casino operators, honed over many years, provide a competitive moat. Aristocrat's strong performance, such as its revenue growth in fiscal year 2023, demonstrates the loyalty and demand for its established offerings, which new entrants would find difficult to replicate quickly.

In the digital gaming space, high user acquisition costs and the challenge of capturing player attention are significant hurdles. In 2023, the cost to acquire a new paying user in social casino games increased by roughly 15% year-over-year, making it difficult for new companies to compete with established players like Aristocrat's digital divisions, which leverage existing player bases and cross-promotional advantages.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Aristocrat Leisure leverages data from company annual reports, investor presentations, and industry-specific market research reports. We also incorporate information from financial news outlets and regulatory filings to provide a comprehensive view of the competitive landscape.