Aristocrat Leisure Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aristocrat Leisure Bundle

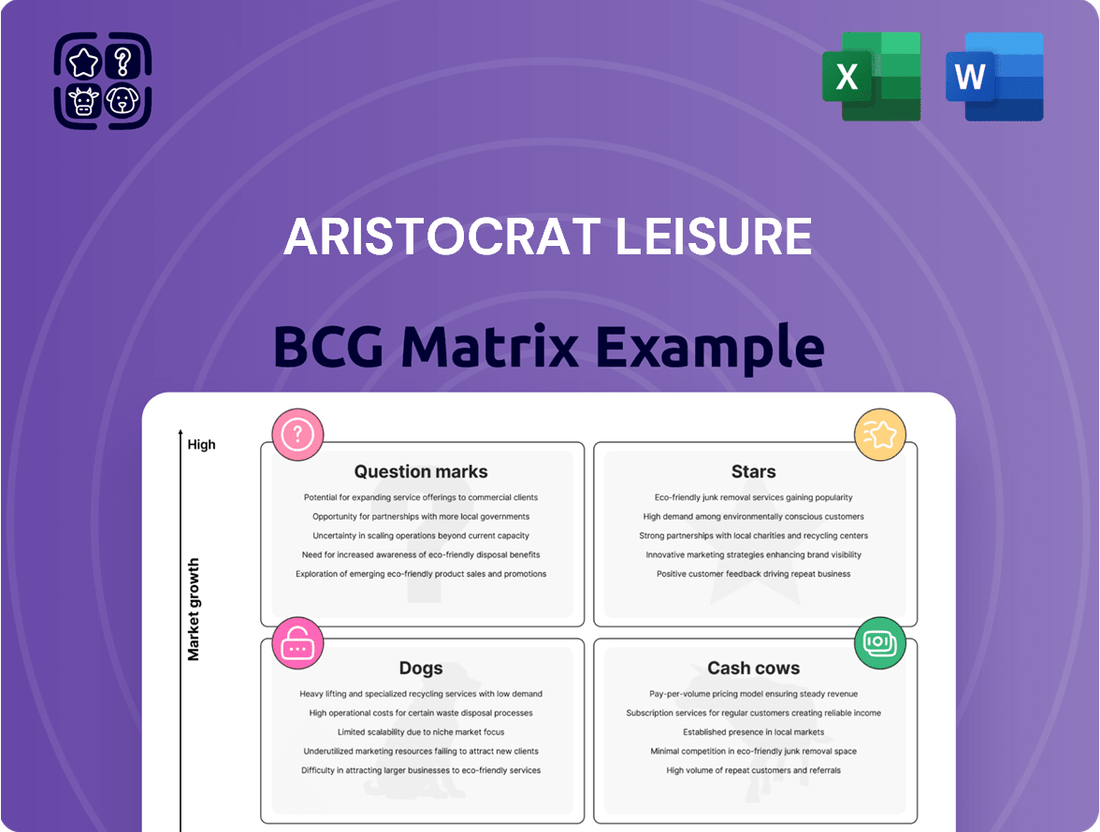

Aristocrat Leisure's position in the dynamic gaming market is illuminated by its BCG Matrix. Understanding which of their offerings are Stars, Cash Cows, Dogs, or Question Marks is crucial for strategic growth and resource allocation. Purchase the full BCG Matrix report to unlock detailed quadrant analysis and actionable insights that will guide your investment decisions.

Stars

Aristocrat's North American Gaming Operations are a clear Star in their BCG Matrix. This segment boasts a high market share and has shown consistent, robust growth.

For fiscal year 2024, this division experienced a healthy 6.1% increase in revenue, underscoring its importance to Aristocrat's financial health. The company's strategic expansion efforts are evident in the installed base, which grew by roughly 7,100 net units in FY24, pushing the total to over 71,000 units. This expansion highlights their strong market leadership and ongoing success in the North American gaming market.

Aristocrat Interactive, a new entity formed by combining Anaxi and NeoGames, is positioned as a Star in Aristocrat Leisure's BCG Matrix. Its high growth potential stems from the booming online real money gaming (RMG) sector.

This division experienced a remarkable 85% revenue surge in fiscal year 2024. Further accelerating this growth, H1 2025 saw an even more substantial 200.8% increase in revenue.

This impressive performance is fueled by robust organic expansion in iGaming platforms and strategic market penetration in North America and Europe. Aristocrat Leisure has ambitious plans, targeting at least US$1 billion in revenue from Aristocrat Interactive by fiscal year 2029.

Product Madness, a cornerstone of Aristocrat's social casino operations, is classified as a Star. This segment achieved a significant milestone in FY24, surpassing $1 billion in annual bookings for the first time.

In the first half of FY25, Product Madness demonstrated continued strength with a 1.5% revenue increase and a notable 9.4% rise in profit, solidifying its position.

Holding a dominant 21% share of the global social casino slot market, Product Madness benefits from a strong competitive standing and consistent profitability, even as the broader Pixel United segment saw a minor revenue dip in FY24.

Key Gaming Titles (e.g., Buffalo, Dragon Link)

Aristocrat's flagship gaming titles, such as the Buffalo brand and Dragon Link, are considered Stars in the BCG Matrix. These games are renowned for their enduring popularity and consistent strong performance, driving significant revenue for the company. Their continued innovation ensures they maintain a leading position in the land-based gaming market.

These highly successful franchises consistently generate substantial income and bolster Aristocrat's market share. The company actively invests in developing new iterations and expansions of Buffalo and Dragon Link, guaranteeing their sustained appeal and strong demand from players.

- Buffalo and Dragon Link are key revenue drivers for Aristocrat.

- These titles contribute significantly to Aristocrat's market share in land-based gaming.

- Aristocrat's ongoing innovation in these franchises ensures continued player engagement and demand.

Strategic IP Acquisitions (e.g., Monopoly)

Aristocrat Leisure's strategic acquisition of licensing rights for iconic intellectual properties, such as the Monopoly board game, firmly places these ventures in the Star category of its BCG Matrix. This strategy significantly bolsters its product portfolio with universally recognized brands, a key driver for new machine installations and for capitalizing on upgrade cycles that favor high-performing, established titles.

The company's forward-looking strategy includes the anticipated installation of approximately 4,000 Monopoly-branded gaming machines in the medium term, underscoring the significant market demand and revenue potential these 'Stars' are expected to generate. This focus on popular IP not only enhances Aristocrat's market presence but also ensures a consistent revenue stream through player engagement and the inherent appeal of familiar brands.

- Monopoly IP Acquisition: Aristocrat's strategic move to secure licensing for Monopoly enhances brand recognition and player appeal.

- Market Impact: This strengthens Aristocrat's position by driving new machine installations and capitalizing on replacement cycles.

- Growth Projection: The company anticipates installing 4,000 Monopoly-branded machines, indicating strong expected performance.

- Revenue Potential: The inherent popularity of such IPs translates into sustained revenue generation and market share growth.

Aristocrat's North American Gaming Operations are a clear Star, demonstrating robust growth and high market share. For fiscal year 2024, this segment achieved a 6.1% revenue increase, supported by a net unit expansion of approximately 7,100, pushing the installed base past 71,000 units.

Aristocrat Interactive, encompassing Anaxi and NeoGames, is also a Star, benefiting from the booming online real money gaming sector. This division saw an 85% revenue surge in fiscal year 2024, with H1 2025 revenue climbing an impressive 200.8%.

Product Madness, a leading social casino operator, is a Star, surpassing $1 billion in annual bookings in FY24 and showing continued profit growth in H1 FY25. It holds a significant 21% share of the global social casino slot market.

Flagship gaming titles like Buffalo and Dragon Link are Stars, consistently driving revenue and market share through ongoing innovation and player engagement.

Acquisitions of popular IP, such as Monopoly, position these ventures as Stars. Aristocrat plans to install around 4,000 Monopoly-branded machines, leveraging brand recognition for strong revenue potential.

| Segment | BCG Category | FY24 Revenue Growth | Key Metrics/Notes |

|---|---|---|---|

| North American Gaming Operations | Star | 6.1% | Installed base > 71,000 units, +7,100 net units |

| Aristocrat Interactive | Star | 85% (FY24), 200.8% (H1 FY25) | High growth in online RMG, targeting $1B revenue by FY29 |

| Product Madness | Star | 1.5% (Revenue H1 FY25) | First time > $1B annual bookings (FY24), 21% social casino market share |

| Buffalo & Dragon Link | Star | N/A (Product Level) | Key revenue drivers, strong player engagement, ongoing innovation |

| Monopoly IP | Star | N/A (Product Level) | Leveraging popular IP, ~4,000 machines planned |

What is included in the product

This BCG Matrix overview provides strategic insights into Aristocrat Leisure's portfolio, highlighting which units to invest in, hold, or divest.

The Aristocrat Leisure BCG Matrix provides a clear, one-page overview, relieving the pain of complex portfolio analysis by placing each business unit in a quadrant.

Cash Cows

Aristocrat's established land-based gaming machines, especially those operating outside the booming North American region, function as the company's cash cows. These machines, prevalent in mature markets such as Australia and New Zealand, command a significant market share, consistently delivering robust and predictable cash flows with minimal expenditure on marketing efforts.

In the 2023 fiscal year, Aristocrat Leisure reported that its Gaming segment, which includes land-based machines, generated a substantial portion of its overall revenue. While specific figures for mature markets are often bundled, the stability of these operations is a key driver of the company's financial strength, enabling investment in other growth areas.

Aristocrat Leisure's established system solutions and services, particularly its casino management systems, represent a significant Cash Cow. These offerings are critical for the day-to-day operations of casinos worldwide, ensuring their widespread adoption and therefore a stable revenue stream.

The recurring revenue generated by these essential technologies, coupled with high profit margins, solidifies their Cash Cow status. For instance, in the fiscal year 2023, Aristocrat Leisure reported strong performance in its Gaming segment, which heavily relies on these system solutions, indicating continued demand and profitability.

Aristocrat's operations in mature land-based gaming markets such as Australia and New Zealand (ANZ) serve as its Cash Cows. Despite a slight dip in unit sales in ANZ during FY24 due to heightened competition, Aristocrat maintains a commanding market share, anticipated to reach 55-60%. This robust, entrenched position ensures a steady stream of reliable profits for the company.

Evergreen Titles within Product Madness (e.g., Big Fish Games' existing portfolio)

Aristocrat Leisure's strategic repositioning of Big Fish Games highlights a deliberate shift towards maximizing returns from its established digital titles. This focus on 'evergreen' games, such as those within the Product Madness portfolio, signifies a move to operate these assets efficiently and profitably. The decision to cease new game development and reduce investment underscores the maturity of these offerings as reliable revenue generators.

These established digital games now function as cash cows for Aristocrat. They consistently generate predictable income streams with a significantly lower need for ongoing capital expenditure. This strategy allows Aristocrat to allocate resources more effectively to other growth areas within its broader portfolio.

- Cash Cow Status: Big Fish Games' evergreen titles are now positioned as cash cows, providing stable and predictable revenue.

- Reduced Investment: The strategy involves minimal new investment, focusing on efficient operation rather than expansion.

- Profitability Focus: The primary goal is to ensure continued, profitable operations from these mature game assets.

- Resource Allocation: This allows Aristocrat to redirect capital towards more dynamic growth opportunities.

North American Outright Sales (Gaming Machines)

North American outright sales of gaming machines represent a strong Cash Cow for Aristocrat Leisure. This segment consistently generates substantial revenue due to its leadership in unit sales, holding a significant 31% ship share in the market.

Despite a slight dip in unit sales in FY24, the high-margin nature of these outright sales ensures a steady and reliable income stream, reinforcing its Cash Cow status.

- North American Outright Sales (Gaming Machines): A Cash Cow for Aristocrat Leisure.

- Market Leadership: Maintains a 31% ship share in North America.

- Revenue Contribution: Significant, despite a slight FY24 unit sales decrease.

- Profitability: Represents a consistent source of high-margin revenue.

Aristocrat's established land-based gaming machines in mature markets like Australia and New Zealand are key cash cows. Despite a slight dip in ANZ unit sales in FY24, Aristocrat maintained a commanding market share, projected between 55-60%, ensuring consistent, reliable profits.

The company's North American outright sales of gaming machines also function as a significant cash cow. Holding a 31% ship share, this segment consistently delivers substantial, high-margin revenue, even with a minor decrease in unit sales during FY24.

Furthermore, Aristocrat's mature digital titles, particularly within Product Madness, have been strategically repositioned as cash cows. By ceasing new development and reducing investment, the focus is on efficiently generating predictable income from these established, profitable assets.

Aristocrat's established system solutions, including casino management systems, are also considered cash cows. These critical technologies ensure widespread adoption and a stable revenue stream, bolstered by recurring revenue and high profit margins, as evidenced by strong performance in the Gaming segment in FY23.

| Segment | BCG Category | Key Characteristic | FY24/FY23 Data Point |

| Land-based Gaming (ANZ) | Cash Cow | High Market Share, Stable Profits | 55-60% projected market share |

| Gaming Machines (North America Outright Sales) | Cash Cow | High Margin Revenue, Market Leadership | 31% ship share |

| Mature Digital Titles (e.g., Product Madness) | Cash Cow | Predictable Income, Low Investment | Focus on efficient, profitable operations |

| System Solutions (Casino Management) | Cash Cow | Recurring Revenue, High Profitability | Strong FY23 Gaming segment performance |

Preview = Final Product

Aristocrat Leisure BCG Matrix

The Aristocrat Leisure BCG Matrix you are previewing is the identical, fully formatted report you will receive immediately after purchase. This comprehensive analysis, meticulously crafted by industry experts, offers a clear strategic overview of Aristocrat Leisure's product portfolio, categorizing each into Stars, Cash Cows, Question Marks, and Dogs. You can confidently use this preview as a direct representation of the high-quality, actionable intelligence that will be yours to download and implement without any watermarks or demo content.

Dogs

Plarium Global Limited, a mobile gaming company, was categorized as a Dog within Aristocrat Leisure's Business Growth Matrix. This classification stemmed from a strategic review that identified it as an underperforming asset, prompting its sale.

The sale of Plarium to Modern Times Group in February 2025 for a potential $820 million underscores its position as a Dog. This divestiture indicates Plarium had low market share and growth prospects within Aristocrat's broader gaming portfolio, no longer fitting the company's strategic direction.

Certain regional land-based gaming markets, especially in the Rest of the World, are showing signs of weakness. These areas are grappling with reduced unit sales and heightened competition, pushing them towards a potential 'Dog' classification within Aristocrat Leisure's BCG Matrix.

For instance, revenue from gaming operations in these regions saw a 1.8% decrease in FY24, largely attributed to softer sales in Australia and New Zealand. This trend continued into H1 2025 with a further 9% decline, indicating a challenging environment characterized by low growth and shrinking market share.

Older, legacy gaming machine models, those being phased out by newer, more advanced technology, can be categorized as Dogs within Aristocrat Leisure's BCG Matrix. These machines typically exhibit low growth potential and are often overshadowed by the industry's rapid replacement cycle, which favors the latest high-performing games.

While Aristocrat may not formally divest these older units, their strategic emphasis on launching innovative, next-generation gaming machines clearly signals a move away from supporting or investing in these legacy products. This shift suggests a declining market share for these older models as they are superseded by more attractive offerings.

Non-Core, Underperforming Digital Gaming Assets

Aristocrat Leisure's strategic review has likely identified certain digital gaming assets, beyond the known divestment of Plarium, that are considered non-core and underperforming. These would be categorized as Dogs in the BCG Matrix. The company's stated aim to concentrate on regulated gaming and gaming-themed content signals a deliberate move away from digital ventures that did not meet profitability or growth targets.

For instance, any digital gaming operations that consistently failed to generate substantial revenue or showed declining user engagement would be prime candidates for this classification. Aristocrat's focus on core strengths means that assets not contributing to this strategy, or requiring disproportionate investment without commensurate returns, are likely candidates for divestment or significant de-prioritization.

- Underperforming Digital Portfolio: Aristocrat's strategic realignment, emphasizing regulated gaming markets, suggests that certain digital gaming assets have been deemed non-core due to their failure to meet performance benchmarks.

- Divestment or Reduced Investment: The company's approach involves either divesting these underperforming digital assets or significantly scaling back investment to reallocate capital towards more promising, strategically aligned ventures.

- Focus on Core Competencies: This classification reflects a business strategy to streamline operations and concentrate resources on areas where Aristocrat possesses a competitive advantage, such as land-based gaming and licensed intellectual property.

Big Fish Games (Pre-Restructuring)

Prior to its restructuring, Big Fish Games, especially its new game development, likely fit the profile of a Dog in Aristocrat Leisure's BCG Matrix. The company's strategic shift to cease new game development and drastically cut investment, concentrating solely on established titles, indicates that its new ventures weren't yielding adequate returns or capturing significant market share in a rapidly expanding market. This move suggests a lack of competitive advantage or growth potential in its newer offerings.

The decision to pivot away from new development and focus on maintaining existing, profitable games highlights a recognition of limited future growth prospects for Big Fish Games' newer products. This strategy is typical for Dogs, where resources are minimized to preserve cash flow rather than invested for expansion. For instance, in the fiscal year ending June 30, 2024, Aristocrat Leisure reported a substantial portion of its revenue still coming from its established gaming machine segments, while the digital segment, which includes Big Fish Games, faced ongoing portfolio optimization efforts.

- Limited Market Share: Big Fish Games' new game development struggled to gain significant traction against competitors in the fast-paced digital gaming market.

- Low Growth Potential: The decision to halt new development signaled a lack of confidence in the future growth prospects of its unproven titles.

- Resource Reallocation: Aristocrat Leisure likely shifted resources from Big Fish Games' underperforming new projects to more promising areas within its portfolio.

- Focus on Core Assets: The strategy emphasized sustaining revenue from existing, popular Big Fish Games titles rather than investing in potentially loss-making new ones.

Certain older, less popular slot machine titles within Aristocrat Leisure's portfolio can be classified as Dogs. These games, lacking the appeal of newer releases or licensed content, exhibit low player engagement and minimal revenue generation. Their continued presence in the market is often due to sunk costs or the difficulty of outright removal from existing gaming floors.

For example, Aristocrat's FY24 report indicated a slight decline in revenue from some legacy gaming machine segments, a trend expected to continue as newer hardware and software dominate. The company's strategic focus on innovation means these older titles receive minimal marketing support or updates, further limiting their growth potential and market share.

These underperforming assets require ongoing maintenance but contribute little to overall profitability. Aristocrat's strategy likely involves a gradual phasing out of such titles, prioritizing capital and resources for their more successful Stars and Cash Cows.

Aristocrat Leisure's strategic review has identified specific regional markets, particularly in emerging or less regulated territories, that are underperforming. These markets often have lower disposable incomes, less developed gaming infrastructure, and intense competition, pushing them towards a Dog classification. In FY24, revenue from certain Rest of World markets saw a 1.8% decrease, with H1 2025 showing a further 9% decline, underscoring these challenges.

| Business Unit/Asset | BCG Matrix Classification | Rationale | Supporting Data (FY24/H1 FY25) |

|---|---|---|---|

| Plarium Global Limited | Dog | Underperforming mobile gaming asset, sold in Feb 2025. | Sale price potential $820 million; low market share and growth prospects. |

| Certain Regional Land-Based Markets (Rest of World) | Dog | Weak performance, reduced unit sales, high competition. | Revenue from gaming operations down 1.8% in FY24, down 9% in H1 FY25. |

| Legacy Gaming Machine Models | Dog | Phased out by newer technology, low growth potential. | Minimal marketing support; declining player engagement compared to new releases. |

| Underperforming Digital Assets (Excluding Plarium) | Dog | Non-core, not meeting profitability or growth targets. | Focus on regulated gaming suggests de-prioritization of ventures without substantial returns. |

| Big Fish Games (New Development) | Dog | Ceased new game development due to low returns. | Shift to sustaining existing titles; FY24 digital segment faced portfolio optimization. |

Question Marks

Aristocrat's new mobile game launches, like the NFL-themed social casino app that soft-launched in February 2025, are positioned as Question Marks in the BCG Matrix. This category represents new products in a growing market, but their market share is still uncertain.

Significant investment is needed to boost adoption and capture market share in the competitive mobile gaming sector. Success here could see these ventures transition into Stars, becoming significant revenue drivers for Aristocrat.

Aristocrat's strategic push into new Video Lottery Terminal (VLT) markets, exemplified by its entry into Quebec and the Georgia Coin Operated Amusement Machine (COAM) sector, positions these ventures as potential Stars in its BCG matrix. These are considered high-growth adjacencies where the company aims to significantly expand its market footprint.

The Quebec VLT market, for instance, offers substantial revenue potential, and Aristocrat's investment there reflects a calculated move to capture a larger share of this expanding segment. Similarly, the Georgia COAM market represents a nascent but rapidly growing area where early strategic investment is crucial for establishing dominance.

While these new markets hold considerable promise for future growth and profitability, they also demand significant upfront investment and meticulous execution to solidify Aristocrat's competitive standing. Success in these territories will be key to driving overall portfolio performance.

Aristocrat Leisure is investing significantly in AI-enhanced gaming platforms, aiming to personalize user experiences and boost player retention. This strategic push places these initiatives within the "Question Marks" category of the BCG Matrix, as they represent a high-growth area with developing market share and profitability impact. Continued funding is crucial for Aristocrat to fully leverage these technologies and establish a competitive edge.

New Product Lines or Game Families

Aristocrat Leisure’s new product lines and game families, like those showcased at AGE 2024 with six brand-new games and over 40 support titles, represent potential Stars in the BCG Matrix. These innovations, while promising, are in their early stages of market adoption. Their success hinges on effective marketing and strategic placement to gain traction against established offerings.

- Innovation Showcase: Aristocrat unveiled a significant number of new games at AGE 2024, signaling a commitment to expanding its portfolio.

- Unproven Market Adoption: Despite the volume of new products, their actual market performance and player acceptance are yet to be fully determined.

- Strategic Investment: Significant marketing and distribution efforts will be crucial for these new lines to achieve substantial market share and move towards becoming Stars.

- Future Potential: These new offerings are positioned as potential growth drivers, but they require careful management and performance monitoring to confirm their status.

Untapped Real Money Gaming (RMG) Jurisdictions

Aristocrat Leisure's strategic focus on expanding its Real Money Gaming (RMG) footprint into emerging markets, such as Europe and Latin America, highlights potential 'Stars' in its BCG Matrix. These regions offer significant growth prospects, exemplified by the planned introduction of NFL-themed slots, catering to a massive and engaged audience.

Entering these new, regulated environments demands considerable capital outlay. This investment is crucial for securing necessary licenses, ensuring strict compliance with local gaming laws, and developing content tailored to regional player preferences. For instance, the European online gambling market alone was valued at approximately €23.5 billion in 2023, with significant growth anticipated in RMG segments.

- Europe: Strong potential for RMG growth, with countries like Spain and Italy already showing robust online gaming markets.

- Latin America: Emerging regulatory frameworks in countries such as Brazil and Mexico present substantial, albeit complex, opportunities for RMG expansion.

- Investment Needs: Significant upfront costs for licensing, regulatory adherence, and localized content development are critical for market penetration.

- Market Share: Building brand recognition and player loyalty in these new territories requires sustained marketing efforts and high-quality, relevant gaming experiences.

Question Marks for Aristocrat Leisure represent new ventures with uncertain market share in high-growth areas. These often include nascent digital products or entries into newly regulated markets where significant investment is required to establish a foothold. The success of these products is not guaranteed, and they could either become Stars or Dogs depending on market reception and strategic execution.

Aristocrat's new mobile game launches, like the NFL-themed social casino app that soft-launched in February 2025, are positioned as Question Marks in the BCG Matrix. This category represents new products in a growing market, but their market share is still uncertain.

Significant investment is needed to boost adoption and capture market share in the competitive mobile gaming sector. Success here could see these ventures transition into Stars, becoming significant revenue drivers for Aristocrat.

Aristocrat Leisure is investing significantly in AI-enhanced gaming platforms, aiming to personalize user experiences and boost player retention. This strategic push places these initiatives within the Question Marks category of the BCG Matrix, as they represent a high-growth area with developing market share and profitability impact. Continued funding is crucial for Aristocrat to fully leverage these technologies and establish a competitive edge.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.