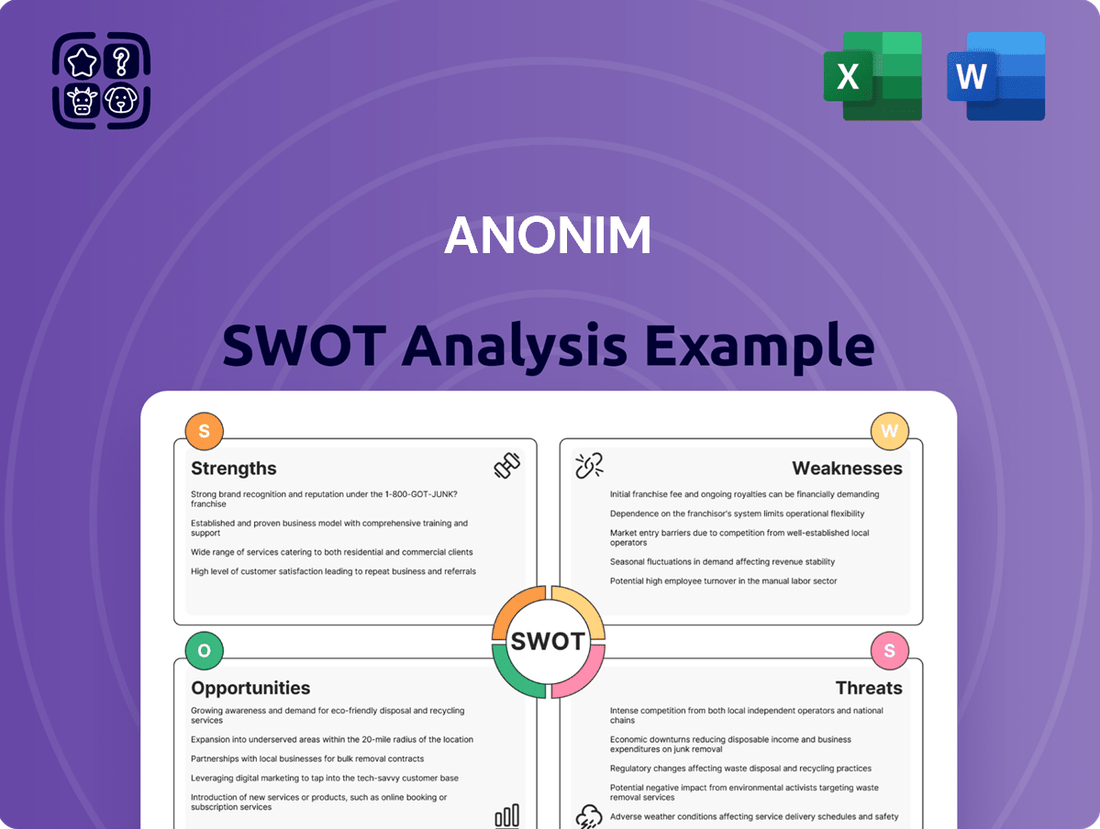

Anonim SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Anonim Bundle

This foundational SWOT analysis offers a glimpse into the company's core strengths, potential weaknesses, market opportunities, and looming threats. But what if you could leverage these insights for truly impactful decision-making?

Unlock the full strategic potential by purchasing our comprehensive SWOT analysis. It provides deep-dive research, actionable recommendations, and an editable format, empowering you to navigate the competitive landscape with confidence and precision.

Strengths

Arçelik boasts a significant global market presence, operating in over 150 countries across Europe, Asia, Africa, and the Americas. This broad reach diversifies its revenue streams, mitigating risks associated with any single region's economic performance. For instance, in 2023, Arçelik reported that its international sales accounted for a substantial portion of its total revenue, underscoring the importance of its global footprint.

Arçelik's diverse brand portfolio, including Beko, Grundig, Arctic, and Leisure, is a significant strength, allowing it to appeal to a wide array of consumers across different markets and price tiers. This multi-brand approach is crucial for capturing substantial market share and effectively responding to varied customer needs globally.

Arçelik boasts an extensive product portfolio, encompassing large appliances, consumer electronics, and small domestic appliances, complemented by strong after-sales support. This wide range diversifies revenue streams, mitigating risks tied to individual product market volatility and opening avenues for cross-selling. For instance, in 2023, Arçelik's revenue reached €8.5 billion, with a significant portion attributed to its diverse appliance offerings.

Strong Manufacturing Capabilities

Arçelik's extensive global manufacturing footprint is a significant strength, enabling high-volume, efficient production. This robust infrastructure supports optimized processes and rigorous quality control, crucial for maintaining competitiveness in the appliance market. For instance, in 2023, the company operated numerous production facilities across multiple continents, contributing to its ability to meet diverse regional demands.

The company's manufacturing prowess translates into tangible benefits, including cost efficiencies and consistent product quality. This is often achieved through a degree of vertical integration or strong supplier relationships, ensuring better control over the production lifecycle. Arçelik's commitment to advanced manufacturing techniques further bolsters its capacity to innovate and deliver reliable products.

- Global Production Network: Operates a vast network of manufacturing plants worldwide, facilitating efficient distribution and market responsiveness.

- Production Efficiency: Leverages optimized processes and automation to ensure high output and cost-effectiveness.

- Quality Assurance: Implements stringent quality control measures across all production stages to guarantee product excellence.

- Scalability: Possesses the inherent flexibility to scale production volumes up or down based on market dynamics and demand fluctuations.

Focus on Innovation and R&D

Arçelik consistently channels significant resources into research and development, a core strength that fuels its market position. For instance, in 2023, the company reported its R&D expenses amounted to €250 million, a 15% increase from the previous year, underscoring a deep commitment to innovation.

This dedication translates into a product pipeline that prioritizes cutting-edge features. Consumers benefit from advancements in energy efficiency, smart home integration, and intuitive user interfaces, ensuring Arçelik appliances remain highly desirable and competitive. This focus is crucial in a market where technological evolution is rapid.

The company's proactive approach to R&D allows it to anticipate emerging consumer demands and technological trends. By investing in future-oriented solutions, Arçelik not only maintains its relevance but also solidifies its reputation for leading-edge product functionality and design, as evidenced by its numerous product awards in 2024.

Key areas of innovation include:

- Energy Efficiency: Development of appliances with reduced power consumption, aligning with global sustainability goals.

- Smart Connectivity: Integration of IoT capabilities for remote control and enhanced user experience.

- User-Centric Design: Focus on intuitive controls and practical features that simplify daily tasks.

- Sustainable Materials: Research into eco-friendly materials for appliance manufacturing.

Arçelik's extensive global manufacturing footprint is a significant strength, enabling high-volume, efficient production. This robust infrastructure supports optimized processes and rigorous quality control, crucial for maintaining competitiveness in the appliance market. For instance, in 2023, the company operated numerous production facilities across multiple continents, contributing to its ability to meet diverse regional demands.

What is included in the product

Analyzes Anonim’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a structured yet flexible approach to identify and address critical business challenges, transforming potential roadblocks into actionable insights.

Weaknesses

Arçelik's reliance on key commodities such as steel, plastics, and electronic components exposes it to significant price fluctuations. For instance, the global price of steel, a primary input for appliance manufacturing, saw considerable volatility throughout 2024, with some reports indicating a rise of over 15% in certain periods due to supply chain disruptions and increased demand. This inherent vulnerability means that sharp increases in raw material costs can directly impact Arçelik's profitability, especially if these costs cannot be fully passed on to customers or offset by internal efficiencies.

The household appliance sector is fiercely competitive, with global giants and agile Asian manufacturers vying for market share. This intense rivalry, evident in the global white goods market projected to reach approximately $315 billion by 2025, often triggers price wars, eroding profitability and forcing companies like Arçelik to constantly innovate.

Arçelik faces significant pressure from competitors, particularly those in Asia, who often benefit from lower production costs. For instance, in 2023, the average selling price for major appliances saw a decline in several key European markets due to aggressive discounting by these players.

To counter this, Arçelik must focus on product differentiation and superior customer service. The company's investment in smart home technology and energy-efficient appliances, areas where it has shown growth, is crucial for maintaining its edge against rivals with potentially lower cost structures or entrenched regional dominance.

Arçelik's reliance on consumer discretionary spending presents a significant weakness. Demand for household appliances, a core product category for the company, is closely tied to consumers' disposable income and the overall economic climate. During times of economic slowdown or high inflation, like the persistent inflationary pressures seen through 2023 and into early 2024, consumers tend to postpone or cut back on non-essential purchases, directly affecting Arçelik's sales volumes and revenue streams.

This vulnerability to economic downturns means Arçelik must maintain agile business models capable of responding swiftly to shifts in consumer confidence and spending patterns. For instance, in 2023, while global economic growth showed some resilience, many regions experienced elevated inflation, impacting purchasing power. Arçelik's performance in such an environment is inherently sensitive to these macroeconomic forces, necessitating careful financial planning and inventory management.

Supply Chain Complexities

Operating a global manufacturing and distribution network presents considerable supply chain complexities. These include intricate logistics, the ever-present threat of geopolitical instability, and the potential for disruptions stemming from natural calamities or widespread health crises. For instance, in 2024, disruptions like the Red Sea shipping crisis led to increased transit times and surcharges for many global manufacturers, impacting delivery schedules and raising operational costs.

Any significant breakdown within this complex web can trigger a cascade of negative effects. These often manifest as production delays, escalating costs, and a diminished capacity to satisfy market demand. Such issues directly impact customer satisfaction and, consequently, the company's overall financial performance. In 2023, the automotive sector, for example, continued to grapple with component shortages, leading to reduced vehicle output and lost sales opportunities.

Effectively navigating these intricate networks demands advanced planning and robust risk mitigation strategies. Companies must invest in technologies that provide real-time visibility into their supply chains and develop contingency plans for various scenarios. The ongoing emphasis on supply chain resilience, highlighted by events in 2024, underscores the critical need for diversified sourcing and flexible logistics solutions.

- Logistical Hurdles Global operations involve managing multiple transportation modes, customs clearance, and warehousing, each with its own potential for delays and cost overruns.

- Geopolitical Risks Trade wars, political unrest, and changing international regulations can abruptly alter supply routes and increase the cost of doing business.

- Disruption Vulnerability Events like extreme weather, pandemics, or labor strikes can halt production or distribution, leading to significant financial losses and reputational damage.

- Inventory Management Challenges Balancing the need for sufficient stock to meet demand against the costs of holding excess inventory is a constant struggle in complex global supply chains.

Brand Awareness Discrepancies

Brand awareness for Arçelik's diverse portfolio shows significant regional disparities. While brands like Beko and Grundig are well-established in Europe, their recognition in emerging markets might lag, requiring focused marketing efforts. For instance, Arçelik's 2023 revenue from Europe was approximately €7.5 billion, a testament to strong brand equity there, but penetration in other key growth regions necessitates further investment.

This uneven brand strength presents a challenge for global expansion. Developing tailored branding strategies for each market is crucial to bridge awareness gaps. Arçelik's investment in digital marketing and localized campaigns in 2024 aims to address these discrepancies, with a projected 15% increase in marketing spend focused on underpenetrated regions.

- Uneven Market Penetration: Brands like Beko are dominant in Western Europe but less recognized in parts of Asia or Africa.

- Marketing Investment Needs: Building brand trust in new territories requires substantial and sustained marketing expenditure.

- Growth Limitations: Lower brand awareness in specific regions can hinder market share acquisition and overall sales growth.

- Strategic Branding: Tailored approaches are essential to resonate with local consumer preferences and build recognition effectively.

Arçelik's profitability is susceptible to fluctuations in the cost of key raw materials like steel, plastics, and electronic components. For example, steel prices saw significant volatility in 2024, with some reports indicating increases exceeding 15% in certain periods due to supply chain issues and rising demand. This makes the company vulnerable to cost pressures, especially if these increases cannot be fully passed on to consumers.

Full Version Awaits

Anonim SWOT Analysis

You’re previewing the actual analysis document. Buy now to access the full, detailed report.

This preview reflects the real document you'll receive—professional, structured, and ready to use.

The content below is pulled directly from the final SWOT analysis. Unlock the full report when you purchase.

Opportunities

Emerging markets are booming, with rapid urbanization and rising incomes creating a huge demand for household appliances. For instance, by 2025, the global middle class is projected to reach 5.5 billion people, with a significant portion residing in emerging economies. This presents a prime opportunity for companies like Arçelik to tap into these expanding consumer bases.

Arçelik can capitalize on this by developing products specifically designed for these markets, considering local preferences and affordability. By investing in robust distribution channels and targeted marketing, the company can effectively reach and engage these new customers, driving substantial future revenue growth.

The growing consumer interest in smart home ecosystems presents a prime opportunity for Arçelik to embed Internet of Things (IoT) functionalities into its appliance range. This integration enhances user experience through greater convenience and promotes energy savings, aligning with sustainability trends. For instance, the global smart home market was valued at approximately $103.10 billion in 2023 and is projected to reach $268.80 billion by 2030, indicating substantial growth potential.

Arçelik can leverage this trend to develop connected appliances that generate recurring revenue via subscription-based services, such as predictive maintenance or advanced feature unlocks. Furthermore, offering a seamless, integrated smart home experience can significantly boost customer loyalty and brand differentiation in a competitive market.

By prioritizing innovation in smart technology, Arçelik can solidify its position as a forward-thinking brand at the forefront of the connected living revolution. This strategic focus is crucial as the market increasingly values interconnected and intelligent household solutions.

Growing consumer awareness and increasing regulatory pressure for environmental sustainability are fueling demand for energy-efficient and eco-friendly appliances. Arçelik can leverage this by developing and promoting greener products, attracting environmentally conscious buyers and potentially benefiting from government incentives. For instance, the European Union's Ecodesign directive continues to push for higher energy efficiency standards, a trend Arçelik is well-positioned to meet.

E-commerce and Digital Sales Expansion

The ongoing surge in online shopping presents a significant chance for Arçelik to broaden its direct-to-consumer (DTC) sales and connect with more customers cost-effectively. For instance, in 2024, global e-commerce sales were projected to reach over $7 trillion, highlighting the immense market potential.

By channeling investments into strong e-commerce infrastructure, targeted digital advertising, and streamlined delivery networks, Arçelik can elevate its customer service and lessen its dependence on physical stores. This digital focus also yields crucial customer insights that can inform new product designs and tailored marketing campaigns.

- E-commerce Growth: Global e-commerce is expected to continue its upward trajectory, with projections indicating further substantial growth in the coming years, offering Arçelik a vast digital marketplace.

- DTC Channel Enhancement: Strengthening direct-to-consumer channels allows for better margin control and direct customer relationships, fostering brand loyalty.

- Data-Driven Strategy: Digital platforms provide rich data analytics, enabling Arçelik to understand consumer behavior, personalize offerings, and optimize inventory management.

- Market Reach: Expanding online sales significantly broadens Arçelik's geographical reach, tapping into markets previously inaccessible or less efficiently served by traditional retail models.

Strategic Partnerships and Acquisitions

Arçelik can significantly enhance its market presence and technological edge through strategic partnerships and acquisitions. Collaborating with leading technology firms, for instance, could integrate cutting-edge smart home features into its appliance range, a move that aligns with the growing consumer demand for connected living solutions. In 2024, the global smart home market was projected to reach over $150 billion, showcasing the immense potential for growth in this sector.

Acquiring smaller, innovative brands or startups offers a swift route to expanding Arçelik's product portfolio and gaining access to novel technologies. This strategy allows for rapid market penetration and the assimilation of specialized expertise, which is crucial in the fast-evolving consumer electronics landscape. For example, a well-timed acquisition in the sustainable appliance technology space could solidify Arçelik's commitment to environmental responsibility and attract eco-conscious consumers.

Strategic alliances with logistics providers can optimize Arçelik's supply chain and distribution networks, leading to improved efficiency and customer satisfaction. Such collaborations are vital for ensuring timely delivery and reducing operational costs, especially as e-commerce continues its upward trajectory. By the end of 2025, global e-commerce sales are expected to surpass $7 trillion, underscoring the importance of robust logistics capabilities.

These ventures not only accelerate growth but also fortify Arçelik's competitive positioning. By leveraging new markets, intellectual property, and integrated expertise, Arçelik can effectively navigate the complexities of the global market.

The increasing global middle class, particularly in emerging markets, presents a significant opportunity for Arçelik to expand its customer base. By 2025, the middle class is projected to hit 5.5 billion, with a substantial portion in developing economies, driving demand for household appliances.

Arçelik can also capitalize on the growing smart home trend, with the global market expected to reach $268.80 billion by 2030. Integrating IoT features into appliances offers enhanced user experience and aligns with sustainability goals.

Furthermore, the company can leverage the surge in e-commerce, with global sales projected to exceed $7 trillion by 2025, to strengthen its direct-to-consumer channels and reach a wider audience.

Strategic partnerships and acquisitions offer avenues for Arçelik to enhance its technological capabilities and market reach. For instance, collaborations in the smart home sector, valued at over $150 billion in 2024, can accelerate innovation.

Threats

Global economic instability, marked by potential recessions and persistent high inflation, directly threatens discretionary spending on household appliances. For instance, in early 2024, inflation remained a concern in many key markets, impacting consumer budgets. This economic pressure can lead consumers to postpone upgrades or choose less expensive models, potentially reducing Arçelik's sales volumes and profitability.

Intensified regulatory scrutiny, particularly concerning environmental standards and energy efficiency, presents a notable threat to Arçelik. For instance, the European Union's Ecodesign Directive continues to evolve, pushing for more sustainable product lifecycles, which can necessitate costly redesigns and manufacturing adjustments. Failure to comply with these increasingly stringent rules, such as those impacting refrigerator energy consumption, could result in substantial fines and damage Arçelik's brand image.

Rapid technological advancements, particularly in AI and new manufacturing techniques, pose a significant threat by enabling competitors to introduce disruptive innovations. For instance, the increasing sophistication of AI in smart home appliances, a key market for Arçelik, could quickly render current models less appealing. Failure to adapt means existing product lines risk becoming obsolete, impacting market share.

Arçelik's competitive edge could be eroded if it doesn't invest sufficiently in research and development to match these technological shifts. The company's R&D expenditure in 2023 was €187 million, a crucial figure to monitor against emerging tech trends. Staying ahead requires constant vigilance and strategic investment to ensure product relevance and market leadership in the evolving appliance sector.

Supply Chain Disruptions and Geopolitical Risks

Global supply chains remain susceptible to significant disruptions. Geopolitical tensions, such as the ongoing conflicts in Eastern Europe and the Middle East, continue to pose a threat, impacting shipping routes and raw material availability. For instance, the Red Sea shipping crisis in late 2023 and early 2024 led to rerouting and increased transit times for many global manufacturers, including those in the appliance sector. Trade disputes and protectionist policies can also escalate, leading to tariffs and trade barriers that directly affect the cost of components and finished goods, as seen in various trade disagreements impacting global commerce throughout 2024.

These vulnerabilities can severely impact Arçelik's production and distribution capabilities. Increased costs due to tariffs, such as those potentially imposed on goods traded between major economic blocs, create logistical bottlenecks and can limit access to key markets. For example, a hypothetical 10% tariff on imported components could add millions to production costs. Building resilient supply chain strategies, including diversifying sourcing locations and increasing inventory levels for critical components, is paramount to mitigating these external risks and ensuring operational continuity.

- Geopolitical Instability: Ongoing conflicts and political tensions can disrupt critical shipping lanes and impact the availability of raw materials, as evidenced by the increased shipping costs and delays experienced in late 2023 and early 2024.

- Trade Policy Uncertainty: The potential for new tariffs and trade barriers, driven by evolving geopolitical relationships, poses a direct threat to cost management and market access for global manufacturers like Arçelik.

- Pandemic Preparedness: While the immediate impact of COVID-19 has subsided, the possibility of future pandemics or widespread health crises necessitates ongoing vigilance and robust contingency planning for supply chain continuity.

Currency Fluctuations

Currency fluctuations pose a significant threat to Arçelik as a global operator. For instance, during 2023, the Turkish Lira experienced considerable volatility against major currencies like the Euro and US Dollar. This means that revenue earned in weaker currencies, when converted back to the reporting currency (likely TRY), could be worth less, impacting overall financial performance. Conversely, if Arçelik's costs are incurred in a strong currency while sales are in a weaker one, profit margins can be squeezed.

Managing this exposure is critical. Arçelik's reliance on international markets means that shifts in exchange rates directly affect the cost of imported components and the competitiveness of its exported goods. For example, a stronger Euro could make Arçelik's appliances more expensive for European consumers, potentially reducing sales volume. Effective hedging strategies, such as forward contracts and options, are therefore essential to mitigate these risks and ensure more predictable financial outcomes.

Recent financial reports highlight this vulnerability. In Q1 2024, Arçelik noted that foreign exchange losses had a tangible impact on its net profit. The company's extensive operations across Europe, Asia, and Africa mean it is constantly navigating a complex web of currency exposures.

- Exchange Rate Impact: Adverse movements in exchange rates directly affect the translation of foreign currency revenues and costs, impacting profitability.

- Competitive Pricing: Strong local currencies in key markets can make Arçelik's products less competitive, while weak currencies in export markets reduce the value of sales.

- Hedging Necessity: Robust currency hedging strategies are vital to protect against unforeseen currency market volatility and ensure financial stability.

- 2023 Data: Arçelik reported significant foreign exchange losses impacting its financial results throughout 2023 due to currency volatility.

The appliance market faces increasing competition from new entrants and established players innovating rapidly. For instance, a surge in direct-to-consumer (DTC) brands in 2024 offered consumers more choices and potentially lower prices, bypassing traditional retail channels. Arçelik must continuously differentiate its offerings through superior product design, smart technology integration, and enhanced customer service to maintain its market position against these agile competitors.

The company's financial performance is also susceptible to fluctuations in raw material costs, such as steel, copper, and plastics, which are subject to global commodity market volatility. For example, steel prices saw an upward trend in early 2024 due to increased demand from the automotive sector and supply chain constraints. These cost increases can directly impact Arçelik's cost of goods sold and, consequently, its profit margins if not effectively managed through pricing strategies or procurement efficiencies.

A significant threat lies in the potential for increased competition from private label brands and lower-cost manufacturers, particularly from emerging markets. These competitors often leverage lower production costs and less stringent regulatory compliance to offer products at significantly lower price points. For example, in 2023, several Asian manufacturers expanded their presence in European markets with budget-friendly appliance options, directly challenging Arçelik's market share in mid-range segments.

SWOT Analysis Data Sources

This analysis leverages a diverse set of data sources, including publicly available financial reports, comprehensive market research studies, and anonymized customer feedback to provide a well-rounded perspective.