Anonim Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Anonim Bundle

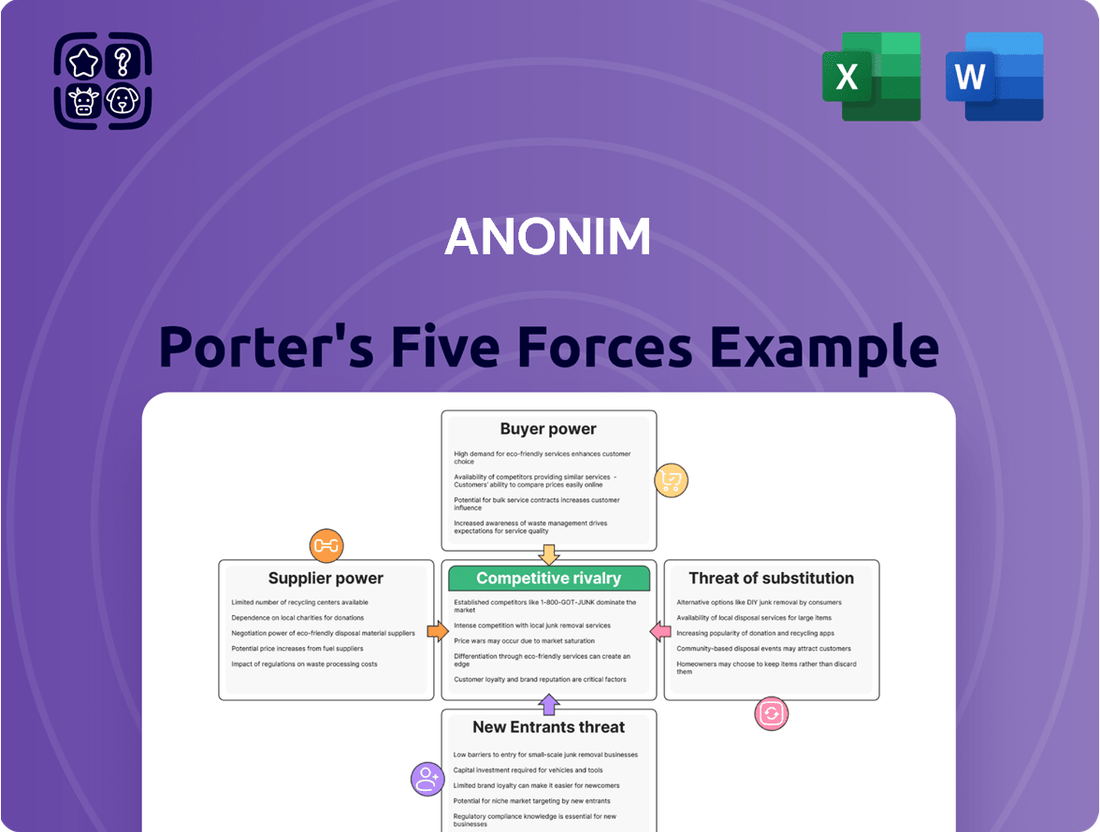

Anonim's competitive landscape is shaped by the interplay of five key forces: the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, the threat of substitute products or services, and the intensity of rivalry among existing competitors. Understanding these dynamics is crucial for any business operating within or considering entry into Anonim's market.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Anonim’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The household appliance industry's dependence on a global supply chain for essential raw materials and electronic components means that supplier concentration can be a major factor. When a small number of suppliers control critical components, or when those components are highly specialized, they gain substantial bargaining power over manufacturers such as Arçelik.

This leverage is further magnified if manufacturers face limited options for sourcing alternatives or if the costs associated with switching suppliers are prohibitively high. For instance, a significant portion of advanced semiconductor chips used in smart appliances might come from a handful of global manufacturers, giving them considerable influence over pricing and availability.

Fluctuations in the prices of key raw materials like steel, plastics, and electronic components significantly influence Arçelik's production expenses. For instance, global steel prices saw considerable volatility in 2023 and early 2024, impacting appliance manufacturing costs. Suppliers can exploit these rising input costs, demanding higher prices from Arçelik, particularly if the company has few alternatives or limited capacity to absorb such increases.

The home appliance sector has grappled with elevated energy and transportation expenses throughout 2023 and into 2024. These increased operational costs for suppliers can translate into greater supplier bargaining power, as they pass on these higher overheads to manufacturers like Arçelik.

Arçelik faces significant bargaining power from its suppliers when switching costs are high. The expense and intricacy of changing suppliers for critical components, driven by certification mandates, design integration, and existing long-term agreements, can amplify supplier leverage. For instance, if Arçelik has deeply integrated a specific supplier's proprietary technology into its manufacturing processes or relies on uniquely engineered parts, the financial and operational disruption of transitioning to a new supplier can be substantial, potentially running into millions of dollars in retooling and validation costs.

Threat of Forward Integration by Suppliers

If suppliers possess the capability and the motivation to move into manufacturing household appliances themselves, this presents a substantial threat to companies like Arçelik. This potential for direct competition can significantly boost their bargaining power during price negotiations. They could simply choose to bypass Arçelik and sell their components or finished goods directly to consumers or retailers, thereby cutting out the existing manufacturer.

Consider the automotive industry in 2024, where some advanced component suppliers, particularly in electric vehicle technology, have explored direct-to-consumer sales models for specialized parts. This strategic shift, driven by the growing EV market, gives these suppliers considerable leverage over traditional automakers who rely on their innovations. For instance, a supplier of advanced battery management systems might find it increasingly feasible to offer these systems directly to EV conversion specialists or even individual enthusiasts, reducing their dependence on large-scale OEM contracts.

- Supplier Capability: Suppliers demonstrating a strong R&D focus and manufacturing expertise in finished goods are more likely to integrate forward.

- Market Understanding: Suppliers with a deep understanding of end-customer needs and distribution channels are better positioned for forward integration.

- Industry Trends: Emerging technologies or market shifts that create new direct-to-consumer opportunities can incentivize supplier forward integration.

Importance of Arçelik to Suppliers

The significance of Arçelik as a customer directly impacts its suppliers' bargaining power. If a supplier relies heavily on Arçelik for a substantial portion of its revenue, Arçelik can leverage this dependence to negotiate more favorable terms, such as lower prices or extended payment periods. This is particularly true for specialized component manufacturers where Arçelik might be a dominant client.

Conversely, if Arçelik represents only a minor part of a supplier's overall business, the supplier holds greater leverage. In such scenarios, suppliers are less incentivized to concede to Arçelik's demands, potentially leading to higher costs or less flexibility. For example, in 2023, Arçelik's total revenue was approximately €10.5 billion, indicating its substantial market presence, which can be a negotiating advantage with many suppliers.

- Supplier Dependence: Arçelik's substantial revenue contribution to certain suppliers can reduce their bargaining power, enabling Arçelik to secure better terms.

- Market Share Impact: For suppliers whose Arçelik sales represent a significant percentage of their total turnover, Arçelik's importance increases their leverage in negotiations.

- Diversification of Suppliers: Arçelik's strategy of diversifying its supplier base can diminish the individual bargaining power of any single supplier.

- Industry Concentration: In sectors with fewer suppliers, the bargaining power of those suppliers can be amplified, potentially impacting Arçelik's procurement costs.

Suppliers wield significant power when they are few in number, offer unique or essential inputs, or when switching costs for manufacturers are high. This can lead to increased prices and reduced quality for the end product. For example, if a critical component for smart appliances is only produced by a handful of firms, they can dictate terms.

This leverage is amplified if suppliers can credibly threaten to integrate forward into the manufacturer's industry or if the manufacturer represents a small portion of the supplier's business. In 2024, the rising costs of specialized electronic components, driven by global demand and limited production capacity, exemplify this dynamic, forcing appliance makers to absorb higher input prices.

Arçelik's substantial market presence, with revenues around €10.5 billion in 2023, can be a negotiating advantage against suppliers who rely heavily on its business. However, for suppliers of highly specialized or proprietary components, their bargaining power can remain considerable regardless of Arçelik's overall size.

| Factor | Impact on Supplier Bargaining Power | Example for Arçelik |

|---|---|---|

| Supplier Concentration | High (Few suppliers) | Limited sources for advanced semiconductor chips |

| Switching Costs | High (Expensive/Complex to change) | Integration of proprietary technology in manufacturing |

| Supplier Forward Integration Threat | High (Can become competitor) | Suppliers exploring direct-to-consumer sales of components |

| Customer Dependence | Low (Arçelik is small part of supplier's business) | Suppliers less motivated to concede on price |

What is included in the product

This analysis dissects the competitive landscape for Anonim by examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the availability of substitutes.

Identify and quantify competitive threats with actionable insights, allowing for proactive strategy adjustments.

Customers Bargaining Power

Customers in the household appliance market are showing a heightened sensitivity to price, a trend amplified by prevailing economic pressures. This means that even with advanced features, the perceived uniqueness of a product is crucial in determining how much pricing power a company like Arçelik truly holds.

For instance, while Arçelik's smart and energy-efficient appliances are attractive, if competitors offer similar innovations, the customer's ability to switch to a cheaper alternative increases, thereby strengthening their bargaining power. The growing demand for energy efficiency, a key selling point for many appliance manufacturers, also plays a role, as customers can more easily compare offerings based on this specific benefit.

The internet has fundamentally shifted the balance of power towards customers. With readily accessible online reviews, detailed product comparisons, and a vast array of e-commerce platforms, consumers are more informed than ever before. This transparency allows them to easily vet options and identify the best value, significantly amplifying their ability to negotiate or switch providers.

For instance, in 2024, a significant portion of consumer purchasing decisions, estimated to be over 70% for many retail sectors, are influenced by online research and reviews. This widespread access to information means customers can pinpoint the lowest prices and most desirable features across numerous brands, directly challenging companies to offer competitive terms or risk losing business.

The rise of online retailing and direct-to-consumer (DTC) models further fuels this trend. These channels bypass traditional intermediaries, giving customers more direct access to products and information, and in turn, enhancing their bargaining leverage by simplifying the comparison and purchasing process.

Brand loyalty in the home appliance sector has been on a noticeable decline, empowering consumers with greater flexibility to switch brands. This shift is driven by a heightened focus on price, innovative features, and attractive promotional offers, meaning companies like Arçelik can no longer rely solely on established brand recognition.

In 2024, for instance, a significant portion of consumers, estimated to be around 60% in market surveys, indicated they would consider switching appliance brands if a competitor offered a 10-15% price advantage or a demonstrably superior feature set. This trend necessitates continuous innovation and a strong emphasis on delivering consistent value to keep customers engaged and prevent churn.

Customer Concentration (Retailers/Distributors)

For a company like Arçelik, the concentration of sales through a few large retailers and distributors significantly amplifies customer bargaining power. These major buyers, by virtue of the sheer volume of products they purchase, can effectively negotiate for more favorable pricing, extended payment terms, and increased promotional assistance. This dynamic can put pressure on Arçelik's profit margins and operational flexibility.

In 2024, the home appliance market saw multi-brand retail stores continue to hold a substantial market share, underscoring the importance of these channels. This concentration means that a disruption in relationships with even a few key retailers could have a considerable impact on Arçelik's overall sales performance and market reach.

- Customer Concentration: A significant portion of Arçelik's sales are channeled through a limited number of large retail chains and distributors.

- Bargaining Leverage: These major customers wield considerable power due to their high purchase volumes, enabling them to demand better terms.

- Market Landscape (2024): Multi-brand retailers maintained a dominant presence in the home appliance sector during 2024, reinforcing the influence of these large buyers.

Demand for Smart and Sustainable Features

Consumers are increasingly demanding smart, AI-integrated, and eco-friendly appliances. This trend is driven by a desire for convenience, energy efficiency, and a commitment to sustainable living. For instance, a 2024 survey indicated that over 60% of consumers consider energy efficiency a key factor when purchasing home appliances.

Arçelik's responsiveness to these evolving customer preferences is crucial. The company's ability to incorporate AI-powered features, such as predictive maintenance or personalized usage settings, and to emphasize sustainable design and materials can solidify its market position. Conversely, a failure to meet these demands can empower customers, allowing them to shift their purchasing power to competitors who better align with these priorities.

- Consumer demand for smart appliances is growing, with projections suggesting the global smart home market will reach over $150 billion by 2025.

- Sustainability is a major purchasing driver; a 2024 report found that 70% of consumers are willing to pay a premium for eco-friendly products.

- AI integration in appliances offers enhanced user experience and efficiency, a feature increasingly sought after by modern households.

Customers possess significant bargaining power when they are well-informed and have numerous alternatives, especially with the proliferation of online information and direct-to-consumer channels. This power is further amplified when brand loyalty wanes, and consumers prioritize price and innovative features. In 2024, over 70% of consumer purchasing decisions in many retail sectors were influenced by online research, highlighting customers' ability to easily compare prices and features, thereby increasing their leverage.

| Factor | Impact on Customer Bargaining Power | Supporting Data (2024) |

|---|---|---|

| Information Availability | High | Over 70% of purchasing decisions influenced by online research. |

| Availability of Substitutes | High | Growing demand for energy efficiency allows easy comparison. |

| Brand Loyalty | Decreasing | ~60% of consumers consider switching for a 10-15% price advantage. |

| Switching Costs | Low | Direct-to-consumer models simplify purchasing and comparison. |

Full Version Awaits

Anonim Porter's Five Forces Analysis

The document you see here is the complete, ready-to-use Anonim Porter's Five Forces Analysis you will receive immediately after purchase. This preview showcases the exact, professionally formatted analysis, detailing the competitive landscape and strategic implications for Anonim. You can confidently expect this precise document to be available for download the moment your transaction is complete.

Rivalry Among Competitors

The household appliance sector is a crowded arena, featuring a multitude of formidable global competitors. Giants like Samsung, LG, Whirlpool, Haier, Midea, BSH Home Appliances, and Electrolux consistently vie for market share, setting a high bar for all participants.

Arçelik, a significant player particularly in Europe and surrounding regions, navigates this intensely competitive landscape across its broad range of white goods. The sheer volume of established and emerging global brands means constant pressure to innovate and maintain competitive pricing.

For instance, in 2024, the global major appliances market was valued at approximately USD 260 billion, with significant growth projected. This massive market size attracts numerous companies, intensifying rivalry and making it challenging for any single entity to dominate without continuous strategic effort.

Competitive rivalry in the home appliance sector is intensely driven by a relentless pursuit of product innovation. Companies are pouring significant resources into research and development to launch next-generation smart appliances, integrate artificial intelligence, enhance Internet of Things (IoT) connectivity, and boost energy efficiency. For instance, by the end of 2023, the global smart home market, encompassing appliances, was valued at over $100 billion, with projections indicating substantial growth driven by these technological advancements.

Arçelik, a key player, strategically leverages its commitment to environmentally friendly, high-tech, and innovative products as a cornerstone for maintaining its competitive edge. This focus allows them to differentiate themselves in a crowded market. Their investment in sustainable technologies and smart features is not just about keeping pace but about setting new industry standards and capturing consumer interest.

The global household appliance market is poised for robust expansion, with projections indicating significant growth through 2025. However, this growth isn't uniform across all regions, leading to varying levels of competitive rivalry.

In 2024, the Asia-Pacific region stood out as the largest market for household appliances. Despite this, companies like Arçelik maintain a strong competitive footing in other key territories, including Europe, Türkiye, South Africa, Pakistan, and Bangladesh, where they often command market leadership or substantial market share.

Strategic Mergers and Acquisitions

Strategic mergers and acquisitions are a significant driver of competitive rivalry in this sector. For instance, Arçelik's combination with Whirlpool Corporation's European operations to create Beko Europe in early 2024 is a prime example. This move consolidates market share and operational efficiencies, forcing competitors to re-evaluate their strategies to maintain parity.

These consolidations are not just about size; they are about creating more formidable entities capable of greater investment in innovation and market penetration. This intensifies the pressure on remaining independent players or those not involved in such large-scale integrations, leading to a more aggressive competitive landscape.

- Arçelik's Beko Europe formation with Whirlpool's European operations

- Focus on strengthening market presence and competitive advantages

- Increased pressure on rivals to adapt or consolidate

Marketing and Distribution Network Strength

Companies increasingly differentiate themselves not just by product innovation but by the robustness of their marketing and distribution capabilities. A strong brand presence and efficient logistics can significantly sway consumer choice and market share.

Arçelik leverages its diverse product portfolio and a strong suite of brands to capture a broad customer base. This multi-brand strategy, coupled with an expansive distribution and after-sales service network across numerous international markets, provides a significant competitive advantage. For instance, in 2023, Arçelik reported a revenue of €8.5 billion, underscoring the scale of its operations and market reach.

- Brand Strength: Arçelik's portfolio includes well-recognized brands, enhancing customer loyalty and market penetration.

- Distribution Network: An extensive network of retailers and service centers ensures product accessibility and customer support globally.

- Marketing Investment: Significant investments in marketing campaigns amplify brand visibility and consumer engagement.

- Market Reach: Operations in over 150 countries highlight the breadth of Arçelik's distribution and marketing effectiveness.

Competitive rivalry in the household appliance sector is fierce, characterized by a constant drive for innovation and market share. The global major appliances market, valued at approximately USD 260 billion in 2024, attracts numerous players, intensifying competition.

Companies like Arçelik differentiate themselves through a focus on high-tech, energy-efficient, and smart appliances, investing heavily in R&D to stay ahead. The formation of Beko Europe in early 2024 by Arçelik and Whirlpool's European operations exemplifies the consolidation trend, creating larger entities that further pressure competitors.

Beyond product development, strong brand portfolios and extensive distribution networks are crucial differentiators. Arçelik's €8.5 billion revenue in 2023 highlights its significant market presence, achieved through multi-brand strategies and widespread after-sales service.

The intense rivalry necessitates continuous strategic adaptation, including mergers, acquisitions, and substantial marketing investments, to maintain or expand market share in this dynamic global industry.

| Key Competitor | 2024 Market Value (USD Billion) | 2023 Revenue (EUR Billion) | Key Strategic Move (2024) |

|---|---|---|---|

| Global Major Appliances Market | ~260 | N/A | Continued growth and innovation |

| Arçelik | N/A | 8.5 | Formation of Beko Europe with Whirlpool |

| Samsung | N/A | N/A | Focus on smart home integration |

| LG | N/A | N/A | Emphasis on AI-powered appliances |

SSubstitutes Threaten

The increasing trend towards multi-functional and compact appliances presents a significant threat of substitutes. For instance, a single high-end blender might now incorporate features for juicing, making dough, and even cooking, directly substituting for separate juicers, stand mixers, and slow cookers. This internal substitution within the appliance market itself can erode demand for companies specializing in single-function products.

The threat of substitutes for home appliances is growing as consumers increasingly turn to external services to fulfill core needs. For instance, the rise of laundry services offers a viable alternative to owning washing machines and dryers, potentially impacting sales for appliance manufacturers. Similarly, meal delivery services can diminish the necessity for elaborate kitchen appliances, shifting consumer spending away from appliance purchases.

Emerging technologies in unrelated sectors can present indirect substitute threats to appliance manufacturers. For example, significant breakthroughs in home food preservation, perhaps through advanced packaging or localized atmospheric control, could diminish the demand for traditional refrigerators and freezers. Similarly, the rise of sophisticated wearable health trackers and smart clothing, which monitor vital signs and nutritional intake, might lessen the reliance on specialized kitchen appliances designed for health-conscious consumers.

Increased Durability and Repairability

The increasing durability and repairability of appliances represent a significant threat of substitutes. As products are designed to last longer and be more easily fixed, consumers are less likely to need frequent replacements. This directly impacts sales of new units, as continued use of existing, well-maintained appliances effectively substitutes for purchasing a brand-new model. For example, a report from 2023 indicated that the average lifespan of major home appliances had increased by approximately 15% over the past decade due to better materials and design.

Companies like Arçelik, while pursuing sustainability through enhanced durability and repairability, also face this challenge. Their commitment to these principles, though commendable for environmental reasons, can inadvertently reduce the immediate demand for new appliance sales. This means that a strategy focused on longevity, a key sustainability metric, can simultaneously function as a substitute for new product purchases, potentially impacting revenue streams in the short to medium term.

This trend is further supported by evolving consumer behavior and regulatory pressures. Growing awareness of environmental impact and the rising cost of living in 2024 are encouraging consumers to opt for repair over replacement. Furthermore, legislative initiatives in several key markets are mandating longer product lifespans and easier repair access, reinforcing the threat of substitutes by making existing products more viable alternatives to new purchases.

- Decreased Replacement Cycles: Enhanced product durability directly extends the functional life of appliances, reducing the frequency with which consumers need to buy new ones.

- Repair as a Substitute: The increasing ease and affordability of appliance repair offer a viable alternative to purchasing new units, acting as a direct substitute.

- Impact on Sales Volume: A longer product lifespan and greater repairability can lead to lower overall sales volumes for manufacturers of new appliances.

- Consumer and Regulatory Drivers: Growing environmental consciousness and supportive legislation are accelerating the adoption of durable and repairable products, amplifying this threat.

DIY Solutions and Manual Alternatives

While major appliance manufacturers face limited direct substitution, smaller tasks might see consumers opting for manual methods or less sophisticated, non-electric tools. For instance, a growing interest in DIY home repair and maintenance could lead some individuals to tackle minor tasks themselves rather than purchasing specialized small appliances.

The trend of 'do-it-yourself' (DIY) activities, while not a direct substitute for large appliances like refrigerators or washing machines, can influence the market for smaller household gadgets. For example, instead of buying a dedicated food processor for occasional chopping, consumers might revert to manual choppers or knives. In 2024, the global DIY home improvement market was valued at approximately $150 billion, indicating a significant consumer interest in performing tasks manually or with simpler tools.

- DIY Influence: A growing DIY culture can reduce demand for certain small appliances used for occasional tasks.

- Manual Alternatives: Consumers may opt for manual tools or simpler, non-electric alternatives for minor household chores.

- Market Value: The global DIY home improvement market's substantial valuation in 2024 underscores the potential for manual or simpler solutions.

The threat of substitutes for home appliances is multifaceted, encompassing both direct and indirect alternatives. Consumers are increasingly opting for services that fulfill appliance functions, such as laundry or meal delivery, thereby bypassing the need for appliance ownership. Furthermore, advancements in unrelated technological fields could diminish reliance on traditional appliances, like refrigerators, if new food preservation methods emerge. This dynamic suggests that appliance manufacturers must continuously innovate and consider the broader landscape of consumer needs and technological possibilities.

The increasing durability and repairability of appliances, driven by consumer demand for sustainability and cost savings, directly act as substitutes for new purchases. A 2023 report highlighted a 15% increase in the average lifespan of major home appliances, meaning consumers are less likely to replace units frequently. This trend is amplified by growing environmental awareness and regulatory pushes for longer product lifespans, making existing, repaired appliances a compelling alternative to buying new ones. Companies focused on longevity, while environmentally sound, must navigate the resulting impact on sales volume.

The rise of the DIY movement and the preference for manual alternatives for smaller tasks also pose a threat. For instance, instead of specialized small appliances like food processors, consumers may opt for manual choppers or knives. The global DIY home improvement market’s valuation of approximately $150 billion in 2024 underscores the significant consumer interest in performing tasks themselves or with simpler tools, potentially reducing demand for certain appliance categories.

| Substitute Type | Example | Impact on Appliance Market | Supporting Data/Trend |

|---|---|---|---|

| Service-Based Alternatives | Laundry Services, Meal Delivery | Reduced demand for washing machines, dryers, and kitchen appliances | Growing consumer adoption of convenience services |

| Technological Advancements | Advanced Food Preservation | Potential decrease in demand for refrigerators/freezers | Emerging technologies in related sectors |

| Product Longevity & Repairability | Durable Appliances, Easy Repairs | Decreased replacement cycles, lower sales volume for new units | 15% increase in appliance lifespan (2023 data); Consumer preference for repair over replacement (2024) |

| Manual/DIY Solutions | Manual Choppers, Knives | Reduced demand for small kitchen appliances | $150 billion global DIY market value (2024) |

Entrants Threaten

Entering the household appliance manufacturing sector demands significant upfront capital. This includes substantial investments in research and development to innovate products, establishing state-of-the-art manufacturing facilities, and building robust, widespread distribution networks to reach consumers effectively. For instance, Arçelik, a major player, operates 45 production facilities across 13 countries, a scale that presents a formidable barrier for any aspiring newcomer.

Established brand loyalty and recognition present a significant barrier to new entrants. Companies like Arçelik, a major player in the home appliance sector, boast a portfolio of 22 brands, each with a history of building trust and preference among consumers. This deep-rooted customer loyalty means newcomers must invest heavily in marketing and product quality to even begin to chip away at existing market share.

For new appliance manufacturers, securing access to established distribution channels and robust supply chains presents a significant hurdle. Building a comprehensive retail presence and reliable after-sales service infrastructure requires substantial investment and time, often proving difficult to match the existing reach of global incumbents.

In 2024, companies like Arçelik continue to leverage their extensive distribution networks, encompassing thousands of retail outlets and service centers worldwide. This deep penetration makes it exceptionally challenging for new entrants to secure comparable shelf space and customer support capabilities, effectively blocking a key avenue for market entry.

Technological and R&D Hurdles

The threat of new entrants is significantly shaped by technological and R&D hurdles. The sector is rapidly advancing, with innovations like smart home integration, artificial intelligence, and enhanced energy efficiency becoming key differentiators.

New players must commit substantial capital to research and development to create products that are not only competitive but also align with shifting consumer expectations. This high barrier to entry makes it challenging for newcomers to gain traction.

- High R&D Investment: Companies in this space often allocate a considerable portion of their revenue to R&D. For instance, leading appliance manufacturers reported R&D spending in the range of 3-5% of their annual revenue in 2023, a figure expected to grow.

- Pace of Innovation: The rapid evolution of smart technology means that products can become obsolete quickly. New entrants need to demonstrate a clear path to continuous innovation to compete effectively.

- Intellectual Property: Existing players often hold significant patents related to core technologies, creating a legal and technical barrier for those looking to enter the market without licensing agreements.

Regulatory Compliance and Sustainability Standards

The household appliance market faces significant barriers to entry due to stringent regulatory compliance and evolving sustainability standards. New companies must invest heavily in ensuring their products meet energy efficiency mandates, such as those set by the EU's Ecodesign Directive, and adhere to safety regulations. For instance, in 2024, the US Department of Energy continued to update its energy conservation standards for various appliances, requiring manufacturers to demonstrate compliance through rigorous testing and certification processes.

Furthermore, the increasing consumer and governmental push for environmentally friendly products necessitates adherence to circular economy principles. This means new entrants must consider the entire lifecycle of their appliances, from sourcing sustainable materials to designing for repairability and recyclability. Companies failing to meet these growing demands for sustainability, which includes reducing waste and carbon footprints, risk alienating environmentally conscious consumers and facing potential penalties, as seen with stricter waste management regulations being implemented globally in 2024.

These combined regulatory and sustainability hurdles represent a substantial financial and operational challenge for potential new entrants. The cost of research and development to meet these standards, coupled with the time required for approvals and certifications, can deter smaller or less-capitalized businesses. For example, achieving certifications like ENERGY STAR or the EU's Ecolabel can be a lengthy and expensive process, adding to the initial investment required to compete in this market.

- Energy Efficiency Regulations: Compliance with standards like the EU's Ecodesign Directive and US Department of Energy standards is mandatory.

- Product Safety Standards: Adherence to international and national safety certifications is crucial for market access.

- Environmental Impact: Meeting requirements related to material sourcing, manufacturing processes, and end-of-life disposal is increasingly important.

- Circular Economy Initiatives: Designing for durability, repairability, and recyclability is becoming a competitive necessity.

The threat of new entrants in the household appliance sector is significantly mitigated by high capital requirements for manufacturing, R&D, and distribution. For instance, Arçelik's extensive global operations highlight the scale needed to compete. Established brand loyalty, cultivated over years by companies like Arçelik with its 22 diverse brands, necessitates massive marketing investment for newcomers to gain any traction.

Access to robust distribution networks and reliable after-sales service infrastructure presents a formidable barrier. In 2024, Arçelik's thousands of retail and service touchpoints underscore the difficulty for new players to secure comparable market penetration and customer support.

Technological advancements, particularly in smart home integration and AI, demand continuous and substantial R&D investment. New entrants must also navigate intellectual property rights held by incumbents, often requiring licensing agreements.

Stringent regulatory compliance, including energy efficiency standards like the EU's Ecodesign Directive and US DOE standards, along with product safety certifications, adds significant cost and time to market entry. Furthermore, the growing emphasis on sustainability and circular economy principles requires new entrants to design for longevity, repairability, and recyclability, a complex undertaking for those without established processes.

| Barrier | Description | Example/Data Point |

|---|---|---|

| Capital Requirements | High investment needed for R&D, manufacturing, and distribution. | Arçelik operates 45 production facilities across 13 countries. |

| Brand Loyalty | Established brands have deep consumer trust and preference. | Arçelik's portfolio includes 22 well-recognized brands. |

| Distribution Access | Securing widespread retail presence and service networks is challenging. | Incumbents like Arçelik have thousands of retail and service centers globally. |

| R&D and Technology | Rapid innovation in smart technology requires continuous investment. | Leading manufacturers spend 3-5% of revenue on R&D (2023 data). |

| Regulatory Compliance | Meeting energy efficiency, safety, and environmental standards is mandatory. | US DOE continues to update energy conservation standards in 2024. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a comprehensive dataset, including proprietary market research reports, company financial statements, and industry-specific trade publications. This multi-faceted approach ensures a robust understanding of competitive dynamics and strategic positioning.