Appian Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Appian Bundle

Appian's competitive landscape is shaped by the intense rivalry among existing players, the significant bargaining power of buyers, and the constant threat of new entrants disrupting the market. Understanding these forces is crucial for anyone looking to navigate the low-code development platform industry.

The complete report reveals the real forces shaping Appian’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Appian, a leader in low-code automation, operates in a sector where the primary inputs are intellectual property and specialized human capital, not physical commodities. This significantly diminishes the bargaining power of traditional commodity suppliers over Appian's operational costs and supply chain stability.

Unlike manufacturing firms heavily reliant on raw materials, Appian's business model is built on software development and cloud infrastructure. For instance, in 2024, Appian's cost of revenue was $261.7 million, a figure largely driven by cloud hosting, personnel, and software-related expenses, rather than the procurement of bulk raw materials.

Appian's reliance on cloud infrastructure providers like AWS, Azure, and Google Cloud is a key factor in its supplier bargaining power. As Appian's low-code platform is cloud-delivered, these providers are essential. While competition exists, the significant investment and technical expertise required to build and maintain such robust, scalable infrastructure can grant these providers considerable leverage.

The costs and complexities associated with migrating to a different cloud provider mean that switching isn't always straightforward for Appian. This can solidify the position of existing providers. Appian's financial disclosures consistently highlight the growing importance of its cloud subscription revenue, underscoring the critical nature of these supplier relationships.

The development and ongoing enhancement of a sophisticated low-code platform like Appian necessitate a workforce possessing highly specialized skills, particularly in software engineering and artificial intelligence. This demand for niche expertise can significantly influence supplier bargaining power.

A scarcity of these highly skilled professionals, a trend observed in the tech industry, directly translates to increased bargaining power for those individuals. This could force Appian to offer higher compensation and benefits, thereby escalating labor costs and impacting profitability. For instance, the average salary for a senior AI engineer in the US, as of early 2024, often exceeds $150,000 annually, reflecting this specialized demand.

However, the very nature of low-code development is to democratize application building, which in turn aims to broaden the available talent pool over time. As more individuals become proficient in low-code environments, the reliance on a small group of highly specialized engineers may diminish, potentially mitigating this supplier bargaining power in the long run.

Bargaining power of technology partners

Appian's reliance on technology partners for integrations and specialized functionalities can influence their bargaining power. This power is directly tied to how unique and essential these partner offerings are to the core of Appian's platform. If a partner provides a critical component that is difficult to replicate or substitute, their leverage increases.

For 2024, Appian launched its enhanced 'One Appian' Global Partner Program. This initiative aims to foster deeper collaboration and mutual growth among its technology partners. The program's focus on shared success and integrated solutions suggests an effort to create a more balanced and mutually beneficial power dynamic, potentially mitigating excessive supplier power.

- Dependence on Unique Offerings: The bargaining power of Appian's technology partners is significant when their solutions are proprietary and essential for Appian's platform functionality, such as specialized AI modules or data integration tools.

- Impact of Partner Program 2024: Appian's 'One Appian' Global Partner Program for 2024 is designed to strengthen relationships, potentially reducing the individual bargaining power of partners by creating a more integrated ecosystem.

- Strategic Partnerships: Appian strategically selects partners whose technologies enhance its low-code automation platform, thereby managing the supplier power by diversifying its integration options where possible.

Open-source software dependencies

Appian's platform may incorporate open-source software components. This approach can lower direct costs associated with proprietary software. However, it introduces a reliance on the communities actively maintaining these open-source projects.

While open-source generally diffuses power, a dependency on a specific, niche open-source project could still create leverage for its maintainers. For instance, if Appian heavily relies on a particular library for a core function, and that library's development slows or changes direction, it could impact Appian's product roadmap. In 2024, the adoption of open-source in enterprise software continued to grow, with many companies leveraging it for cost efficiency and flexibility.

- Reduced Direct Costs: Open-source software often eliminates licensing fees, directly impacting Appian's cost structure.

- Community Dependence: Reliance on specific open-source projects means Appian is subject to the pace and direction of community development.

- Mitigated Supplier Power: The distributed nature of open-source development typically prevents any single entity from exerting significant bargaining power.

- Potential for Forks: If a critical open-source project's direction becomes unfavorable, Appian could theoretically fork the project, though this is resource-intensive.

Appian's bargaining power with its suppliers is influenced by its reliance on specialized talent and technology partners. The demand for skilled software engineers, particularly in AI, gives these professionals considerable leverage, as seen in average salaries exceeding $150,000 annually for senior AI engineers in early 2024. Appian's 'One Appian' Global Partner Program, launched in 2024, aims to foster a more balanced dynamic by encouraging integrated solutions and shared growth among its technology partners.

What is included in the product

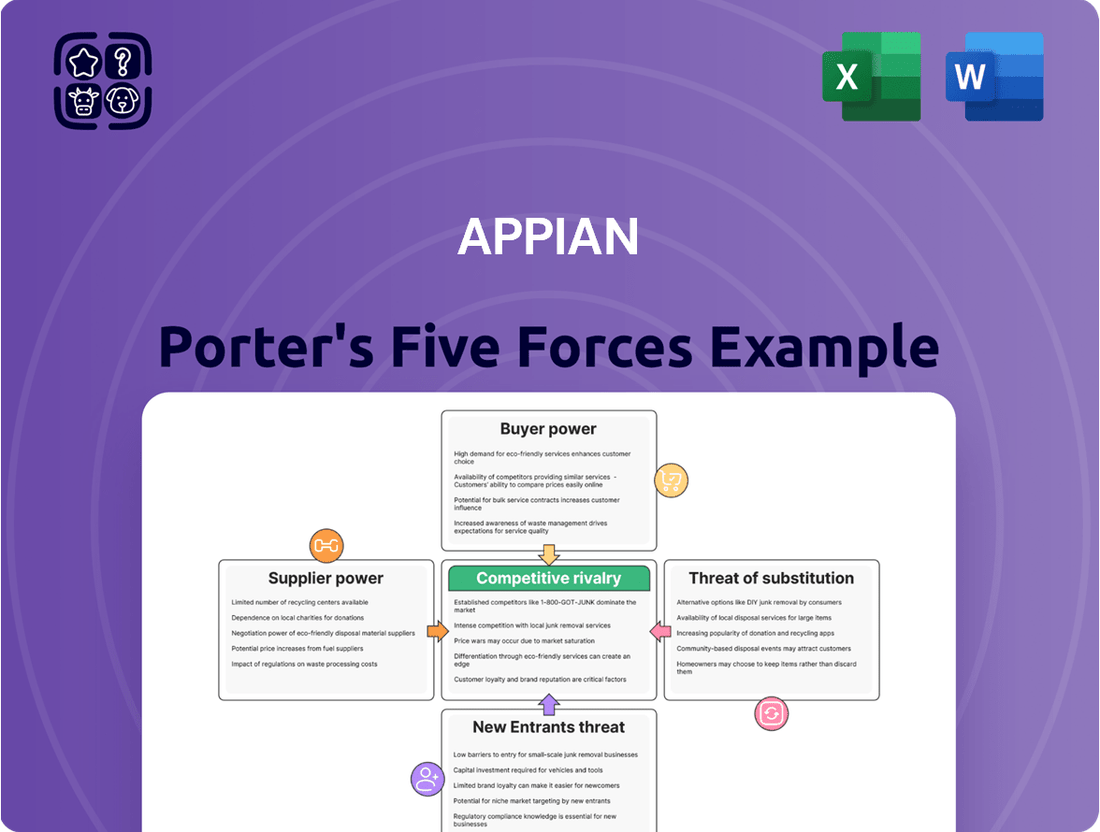

Appian's Porter's Five Forces analysis meticulously examines the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the low-code automation market.

Instantly identify and neutralize competitive threats with a dynamic, data-driven analysis of all five forces.

Customers Bargaining Power

Enterprise clients often face significant hurdles when considering a move away from Appian's low-code platform. The deep integration of Appian into their core business processes means that migrating data, retraining personnel on a new system, and rebuilding custom applications represent substantial investments of both time and capital. This complexity inherently diminishes their leverage to demand lower prices or more favorable terms.

Appian's strategic focus on large enterprises, securing long-term contracts with significant revenue per client, inherently limits customer bargaining power. These deep integrations and extended commitments create a sticky customer base, making it less feasible for clients to switch providers in the short term.

For instance, Appian's reported cloud subscription revenue consistently shows robust year-over-year growth, a testament to their success in retaining these high-value enterprise clients. This strong retention underscores the reduced leverage customers have when locked into these substantial, long-term agreements.

Appian's platform provides substantial value by accelerating the design, development, and deployment of enterprise applications. This rapid development capability directly translates to enhanced operational efficiency and improved decision-making for its customers.

The tangible benefits derived from Appian's platform, such as faster time-to-market and streamlined workflows, can significantly reduce a customer's sensitivity to price. For instance, a company implementing an Appian-based solution might see a 30% reduction in process cycle times, making the platform's cost a secondary consideration compared to the operational gains.

Customer willingness to recommend

Appian's customer satisfaction is exceptionally high, with a remarkable 99% willingness to recommend score reported in the 2025 Gartner Peer Insights Voice of the Customer for Enterprise Low-Code Application Platforms (LCAP). This strong customer endorsement significantly diminishes their bargaining power.

This high satisfaction level indicates that customers find substantial value in Appian's offerings, making them less inclined to seek alternative solutions or demand concessions. Consequently, their ability to drive down prices or demand higher quality is considerably weakened.

- Customer Loyalty: A 99% willingness to recommend fosters strong customer loyalty, reducing the likelihood of churn and the need for price reductions to retain business.

- Value Perception: High satisfaction suggests customers perceive Appian's solutions as superior or uniquely beneficial, limiting their ability to leverage competitive alternatives.

- Reduced Price Sensitivity: Satisfied customers are typically less sensitive to price increases, further reducing their bargaining power.

Increasing adoption of low-code/no-code technologies

The increasing adoption of low-code/no-code (LCNC) technologies significantly impacts the bargaining power of customers. As more businesses embrace LCNC platforms for faster application development, they gain leverage due to the wider array of available solutions. This trend means customers can more easily switch between providers if they find better pricing or features elsewhere.

However, Appian's strategic positioning within the LCNC market helps mitigate this. While simpler no-code tools are abundant, Appian focuses on enterprise-grade automation designed for complex, mission-critical workflows. This specialization creates a degree of stickiness, as customers requiring robust process automation and integration capabilities may find fewer direct substitutes for Appian's comprehensive offerings.

For instance, in 2024, the global LCNC market was projected to reach substantial figures, with various segments catering to different needs. Appian's ability to handle sophisticated business process management (BPM) and robotic process automation (RPA) differentiates it from platforms primarily designed for simpler tasks. This distinction means that customers needing Appian's depth of functionality are less likely to find readily available, equally capable alternatives, thus tempering their bargaining power.

- Increased Choice: The proliferation of LCNC platforms empowers customers by offering a broader selection of tools for application development.

- Appian's Differentiation: Appian distinguishes itself by focusing on enterprise-level automation for complex processes, not just simple app creation.

- Customer Dependence: Businesses requiring advanced workflow automation and integration may remain dependent on Appian's specialized capabilities.

- Market Context: The robust growth of the LCNC market in 2024 highlights the competitive landscape, yet Appian's niche addresses a specific, high-value customer need.

Appian's customers generally have limited bargaining power. The substantial investment required to integrate Appian into core business processes, including data migration and retraining, creates high switching costs. This makes it difficult for clients to negotiate lower prices or more favorable terms, as the effort and expense of moving to an alternative platform are significant deterrents.

Appian's focus on enterprise clients and long-term contracts further solidifies this position. These deep integrations and extended commitments result in a sticky customer base, reducing the immediate feasibility of clients switching providers. For example, Appian's reported cloud subscription revenue growth in 2024 demonstrates their success in retaining these high-value clients, indicating their reduced leverage.

The tangible benefits customers derive from Appian, such as accelerated development cycles and improved operational efficiency, also lessen price sensitivity. A company experiencing, for instance, a 30% reduction in process cycle times due to an Appian solution may prioritize these gains over platform costs, thereby weakening their bargaining position.

Appian's high customer satisfaction, evidenced by a 99% willingness to recommend score in 2025 Gartner Peer Insights data, further limits customer bargaining power. This strong endorsement suggests clients perceive significant value, making them less inclined to seek alternatives or demand concessions, thus diminishing their ability to drive down prices.

Full Version Awaits

Appian Porter's Five Forces Analysis

This preview showcases the comprehensive Appian Porter's Five Forces Analysis you will receive immediately after purchase, ensuring complete transparency. You are viewing the exact, professionally formatted document, ready for immediate download and application to your strategic planning. Rest assured, there are no placeholders or samples; what you see is precisely the complete analysis you'll acquire.

Rivalry Among Competitors

The low-code and no-code landscape is a crowded space, brimming with established vendors. Companies like OutSystems, Mendix, Microsoft PowerApps, Salesforce Platform, and Pegasystems are significant players, offering robust solutions that directly compete with Appian. This crowded field intensifies the battle for market share.

These competitors often provide overlapping functionalities, creating a highly competitive environment where differentiation is key. For instance, many platforms offer visual development tools, pre-built connectors, and workflow automation capabilities, directly challenging Appian's core offerings. This similarity fuels aggressive competition for customer acquisition and retention.

The market's high growth, projected to reach $126 billion by 2030 according to some estimates, attracts new entrants and encourages existing players to innovate rapidly. This dynamic means Appian must constantly adapt and enhance its platform to maintain its competitive edge against a backdrop of intense rivalry.

Appian sharpens its competitive edge by concentrating on the seamless integration of data, human collaboration, and artificial intelligence within its low-code platform, a strategy that highlights end-to-end process orchestration. This deliberate specialization allows Appian to sidestep direct confrontation with more generalized low-code competitors.

By championing this unified approach, Appian aims to deliver superior value in complex process automation scenarios. For instance, in 2024, many enterprises are actively seeking solutions that can manage intricate workflows involving multiple stakeholders and data sources, a need Appian's focused strategy is well-positioned to address.

The global low-code application development platform market is booming, with projections indicating it will reach $187 billion by 2030, up from $21.6 billion in 2022. This impressive expansion acts like a magnet, drawing in a steady stream of new companies eager to capture a piece of the action.

This influx of new players, alongside the substantial investments made by established vendors to enhance their offerings, significantly heats up the competition. Companies are constantly innovating to differentiate themselves and gain market share in this dynamic environment.

Pricing and licensing models

Competitive rivalry in the low-code platform space is intensified by how companies structure their pricing and licensing. Appian's approach, which can involve significant upfront investment and complex per-user or per-application fees, might be a point of differentiation when compared to competitors offering simpler, more transparent, or usage-based models. This can particularly impact smaller businesses or those with fluctuating needs, making alternative platforms with lower entry barriers more attractive.

The complexity of licensing can also create barriers to entry or adoption. For instance, if Appian's licensing is perceived as rigid or difficult to scale, rivals with more flexible subscription tiers or even open-source options could gain an advantage. This dynamic is crucial for businesses evaluating total cost of ownership and the ease of scaling their low-code solutions. In 2024, the market saw continued emphasis on value-based pricing, with many platforms adjusting their models to better align with customer outcomes and reduce perceived risk.

- Aggressive Pricing: Competitors may undercut Appian on price, especially for basic functionality or smaller deployments.

- Licensing Complexity: Appian's licensing structure could be less appealing than more straightforward or usage-based models offered by rivals.

- Entry Costs: Higher initial investment for Appian might deter smaller businesses compared to platforms with lower starting prices.

- Flexibility: Competitors offering more adaptable licensing terms can attract customers seeking greater control over their spending.

Innovation and feature parity

The low-code platform market is intensely competitive, with rivals constantly pushing the boundaries of innovation. Competitors are actively integrating advanced AI capabilities, refining user interfaces for better experience, and broadening their functional offerings to attract and retain customers. For Appian, this means a relentless need to upgrade its platform to stay ahead, especially in crucial areas like AI-powered development and seamless integration with other systems.

This drive for innovation creates a dynamic environment where feature parity is a constant challenge. Companies like Microsoft with its Power Platform, OutSystems, and Mendix are all investing heavily in R&D. For instance, in 2024, many low-code platforms have announced significant enhancements in their AI co-pilot features, aiming to accelerate development cycles and improve application quality. Appian's ability to match or exceed these advancements directly impacts its market position and ability to capture new business.

- AI Integration: Competitors are embedding AI for tasks like code generation and intelligent automation.

- User Experience: Enhancements focus on intuitive design and ease of use for both developers and end-users.

- Functionality Expansion: Platforms are broadening capabilities, including advanced analytics and broader integration options.

- Feature Parity Pressure: Appian must keep pace with rivals to avoid falling behind in critical feature sets.

Competitive rivalry in the low-code space is fierce, with numerous established players like Microsoft PowerApps, OutSystems, and Mendix offering similar functionalities. This intense competition, fueled by a rapidly expanding market projected to reach $187 billion by 2030, necessitates continuous innovation and differentiation for Appian to maintain its market share.

Appian differentiates itself by focusing on end-to-end process orchestration, integrating data, human collaboration, and AI. This strategic specialization allows it to address complex automation needs, a crucial factor for enterprises in 2024 seeking comprehensive workflow solutions.

Pricing and licensing models also contribute to rivalry, with competitors potentially offering more flexible or lower-entry-barrier options than Appian's potentially complex structures. This can influence customer adoption, especially for smaller businesses or those with variable needs, as the total cost of ownership and scalability become key considerations.

The constant drive for innovation, particularly in AI integration and user experience, puts pressure on Appian to keep pace with rivals. For example, many platforms in 2024 have enhanced their AI co-pilot features to speed up development, a trend Appian must actively match to remain competitive.

| Competitor | Key Offerings | 2024 Focus Areas |

|---|---|---|

| Microsoft PowerApps | Integrated with Microsoft ecosystem, broad functionality | AI integration, citizen developer enablement |

| OutSystems | Enterprise-grade, complex application development | AI-driven development, cloud-native architecture |

| Mendix | Collaborative development, broad integration | AI-powered insights, IoT integration |

SSubstitutes Threaten

Traditional hand-coding and custom development represent a significant threat of substitutes for low-code platforms like Appian. Organizations can opt for bespoke application development, which provides unparalleled flexibility and precise control over every aspect of the software. This approach allows for highly specialized functionalities that might not be achievable with pre-built components.

However, the inherent drawbacks of hand-coding are substantial. The development lifecycle is considerably longer, often taking months or even years for complex projects, compared to weeks or months with low-code. Furthermore, the resource requirements are far greater, demanding larger teams of highly skilled developers and incurring higher labor costs. For instance, a custom-built enterprise resource planning (ERP) system could cost millions and take several years to deploy, whereas a similar solution on a low-code platform might be implemented in a fraction of the time and budget.

This makes custom development a less viable substitute for businesses prioritizing speed-to-market and agility. In 2024, the demand for rapid digital transformation continues to grow, with many companies seeking to deploy new applications and update existing ones quickly to stay competitive. The extended timelines and higher costs associated with traditional coding can hinder this agility, making low-code solutions increasingly attractive for a wider range of use cases.

No-code platforms present a growing threat by enabling citizen developers to create simpler applications without traditional coding. This democratizes application development for basic needs.

However, these platforms often struggle with the scalability and complex workflow management that enterprise-grade solutions like Appian's low-code platform are designed for. For instance, while a no-code tool might suffice for a simple internal request form, it would likely falter when managing intricate, multi-stage business processes.

The threat of substitutes for Appian's low-code platform is significant from readily available Software-as-a-Service (SaaS) and off-the-shelf software. Many businesses can fulfill specific needs like customer relationship management (CRM) or enterprise resource planning (ERP) using these pre-built solutions.

While SaaS and off-the-shelf software offer quicker deployment and often lower upfront costs, they generally lack the deep customization capabilities required for unique or complex business processes that Appian excels at. For instance, a company with highly specialized workflow requirements might find generic CRM solutions inadequate compared to a custom-built application on Appian.

The market for SaaS solutions continues to grow, with the global SaaS market projected to reach over $300 billion in 2024. This widespread availability means businesses have more options than ever to address functional needs without resorting to custom development, thereby increasing the pressure on platforms like Appian that cater to bespoke solutions.

Manual processes and legacy systems

Manual processes and legacy systems can act as substitutes for modern automation solutions like Appian. The significant cost and disruption associated with replacing deeply entrenched, albeit inefficient, systems can deter organizations from adopting new technologies. This inertia, driven by the perceived risk and expense of change, presents a viable alternative for businesses unwilling or unable to invest in modernization.

While these legacy approaches are undeniably less efficient, the sheer effort required to transition can make them a formidable substitute. Consider that in 2024, many enterprises still grapple with the technical debt accumulated over decades, with estimates suggesting that a significant percentage of IT budgets are allocated to simply maintaining existing, outdated systems. This persistent reliance on the old, even when inefficient, highlights the threat of substitutes.

- Inertia of Change: The difficulty and cost of replacing manual or legacy systems often outweigh the perceived benefits of new technology for many organizations.

- Technical Debt: In 2024, businesses continue to invest heavily in maintaining outdated systems, making the transition to modern platforms a substantial hurdle.

- Risk Aversion: The perceived risks associated with implementing new, complex software can lead companies to stick with familiar, albeit less efficient, processes.

- Appian's Solution: Appian's platform directly counters this threat by offering a path to automate and modernize these entrenched manual and legacy processes, thereby reducing the appeal of these substitutes.

Spreadsheet-based solutions and departmental tools

Spreadsheet-based solutions and departmental tools present a significant threat of substitution for comprehensive low-code platforms like Appian. For many smaller or less complex departmental needs, businesses can leverage existing tools like Microsoft Excel or Google Sheets for data management and basic process automation. These familiar, low-cost alternatives often require minimal training and can be implemented quickly, making them an attractive option for organizations not yet ready for a full-scale low-code investment.

The accessibility and cost-effectiveness of spreadsheets mean they can fulfill many basic operational requirements. For instance, a small sales team might use a shared spreadsheet to track leads and manage customer interactions, effectively substituting for a dedicated CRM module that could be built on a low-code platform. This represents a viable, albeit less scalable and feature-rich, substitute.

- Cost Savings: Businesses can save significantly by avoiding the licensing fees associated with dedicated low-code platforms, opting instead for widely available spreadsheet software.

- Familiarity and Ease of Use: Employees are generally well-versed in using spreadsheets, reducing the learning curve and implementation time for basic tasks.

- Limited Scalability: While effective for simple tasks, spreadsheets struggle with complex workflows, large datasets, and robust collaboration features, areas where low-code platforms excel.

- Data Integrity Concerns: Spreadsheets are prone to errors and can lack the built-in validation and security features of dedicated business process management (BPM) software.

While custom coding offers ultimate flexibility, its lengthy development cycles and high resource demands make it a less attractive substitute for businesses prioritizing speed. In 2024, the drive for rapid digital transformation amplifies the appeal of low-code solutions over traditional development.

No-code platforms democratize development for simpler needs but lack the scalability and complex workflow management of enterprise-grade low-code. Off-the-shelf SaaS solutions offer quick deployment and lower upfront costs, but often fall short on the deep customization required for unique business processes.

The global SaaS market's projected growth to over $300 billion in 2024 underscores the availability of alternatives that bypass the need for bespoke development. Legacy systems and manual processes, though inefficient, remain substitutes due to the high cost and disruption of modernization, with many enterprises still allocating significant IT budgets to maintaining outdated systems in 2024.

Spreadsheet-based solutions offer a low-cost, familiar alternative for basic departmental needs, but lack the scalability and data integrity of robust low-code platforms.

| Substitute Category | Key Characteristics | Appian's Advantage | Market Trend (2024) |

|---|---|---|---|

| Traditional Hand-Coding | High flexibility, long development times, high cost | Faster development, lower cost, agility | Increased demand for rapid deployment |

| No-Code Platforms | Ease of use for simple apps, limited scalability | Handles complex workflows, enterprise-grade scalability | Growing adoption for citizen developers |

| SaaS/Off-the-Shelf Software | Quick deployment, lower upfront cost, limited customization | Deep customization for unique processes | Global market projected over $300 billion |

| Legacy Systems/Manual Processes | Entrenched, inefficient, high switching cost | Automates and modernizes existing processes | Significant IT budgets allocated to maintenance |

| Spreadsheets | Low cost, familiar, limited scalability/integrity | Robust data management, complex workflow automation | Widely used for basic departmental tasks |

Entrants Threaten

Developing a sophisticated low-code automation platform, akin to Appian's offerings, demands significant upfront capital. This includes extensive investment in research and development, robust infrastructure, and attracting top-tier engineering and design talent. For instance, companies in the competitive software development sector often report R&D expenditures in the tens of millions, if not hundreds of millions, annually.

These substantial financial requirements act as a considerable barrier. Potential new entrants must secure vast amounts of funding to even begin competing. This high capital threshold effectively deters many smaller players or startups from entering the market, thereby reducing the immediate threat of new competition for established firms like Appian.

Appian operates in markets demanding profound industry knowledge and established customer relationships. New competitors must surmount significant hurdles in acquiring specialized expertise and building the trust that Appian has cultivated over years of serving complex enterprise needs.

For instance, the financial services sector, a key Appian market, involves intricate regulatory compliance and data security protocols. A new entrant would need to invest heavily in understanding these nuances and demonstrating a proven track record, a process that can take years and substantial capital, potentially exceeding $100 million for robust compliance and security infrastructure alone.

Appian benefits from strong brand recognition and a loyal customer base, including major government entities and Fortune 500 companies. This established trust makes it difficult for new competitors to gain traction.

New entrants would struggle to replicate Appian's credibility and customer loyalty, requiring substantial investment in marketing and sales to even approach its current market position. For instance, Appian reported over 6,500 customers globally as of its 2024 filings, a significant hurdle for any newcomer.

Network effects and ecosystem development

The threat of new entrants is significantly mitigated by Appian's established network effects and its deeply integrated ecosystem. As more users adopt the platform, its value proposition grows through increased data, enhanced collaboration, and a wider range of available applications, a phenomenon that is difficult for newcomers to replicate.

Appian's robust partner ecosystem, comprising technology providers and implementation specialists, further solidifies its market position. This network of collaborators provides customers with a broad spectrum of solutions and support, creating a significant barrier for any new entrant attempting to build a comparable level of integration and value.

For instance, Appian's commitment to fostering its partner network has led to a substantial number of certified professionals and integrations. As of early 2024, the company boasts thousands of certified developers and a vast marketplace of pre-built applications and connectors, demonstrating the depth and breadth of its ecosystem.

- Network Effects: Appian's platform value escalates with user growth, fostering a virtuous cycle where more users attract more developers and integrations, thereby increasing its utility for all participants.

- Ecosystem Strength: A comprehensive network of technology partners and implementation specialists provides Appian users with extensive customization and support, making it challenging for new entrants to match this breadth of resources.

- Barrier to Entry: Replicating Appian's established network effects and ecosystem requires substantial time, investment, and strategic partnerships, presenting a formidable challenge for potential new competitors.

- Customer Lock-in: The deep integration of Appian's platform within customer workflows, coupled with the extensive ecosystem, creates significant switching costs, further deterring new entrants.

Intellectual property and technological complexity

The threat of new entrants into Appian's market is significantly mitigated by the intellectual property and technological complexity embedded within its platform. Appian's core offerings leverage advanced low-code development, artificial intelligence, and sophisticated process orchestration capabilities. These technologies are not easily replicated and are safeguarded by substantial intellectual property rights, creating a formidable barrier for potential challengers.

Developing or acquiring comparable technological prowess represents a major hurdle for new companies aiming to compete with Appian. This includes the significant investment in research and development, talent acquisition, and the intricate integration of these advanced functionalities. For instance, Appian's commitment to innovation is reflected in its ongoing R&D spending, which, in 2023, supported the continuous enhancement of its AI and automation features, making it harder for newcomers to match its existing capabilities.

- Intellectual Property Protection: Appian's proprietary algorithms and software architecture are protected by patents and trade secrets, making direct imitation extremely difficult.

- Technological Sophistication: The integration of AI, machine learning, and complex process automation requires specialized expertise and significant capital investment to replicate.

- R&D Investment Barrier: New entrants must commit substantial resources to research and development to achieve parity with Appian's established technological ecosystem. In 2023, Appian reported significant investments in AI and cloud infrastructure, underscoring the high cost of entry.

- Time-to-Market Disadvantage: Even with sufficient capital, new entrants face a considerable time lag in developing and refining technologies to compete effectively with Appian's mature platform.

The threat of new entrants for Appian is considerably low due to the immense capital required to develop a comparable low-code automation platform. Significant investments in R&D, infrastructure, and talent are essential, with software development sector R&D expenditures often reaching tens to hundreds of millions annually. This high financial threshold effectively deters smaller players.

New competitors face substantial hurdles in acquiring specialized industry knowledge and building the trust Appian has cultivated, particularly in regulated markets like financial services. Replicating Appian's established customer base of over 6,500 clients globally as of 2024, and its strong brand recognition, demands considerable marketing and sales investment.

Appian's robust network effects and integrated ecosystem present a formidable barrier. As more users adopt the platform, its value increases, making it difficult for newcomers to replicate. Furthermore, Appian's thousands of certified developers and vast marketplace of applications as of early 2024 solidify its position.

The technological sophistication and intellectual property protection surrounding Appian's platform, including AI and process orchestration, require significant investment and expertise to match. Appian's 2023 R&D spending further highlights the cost of entry for new competitors aiming for technological parity.

| Barrier Type | Description | Impact on New Entrants | Appian's Advantage |

|---|---|---|---|

| Capital Requirements | High upfront investment for R&D, infrastructure, and talent. | Deters smaller players and startups. | Established financial backing and scale. |

| Industry Expertise & Relationships | Need for specialized knowledge and customer trust. | Difficult to gain traction in complex markets. | Years of experience and cultivated customer loyalty. |

| Network Effects & Ecosystem | Increasing platform value with user growth and partner integrations. | Challenging to replicate the breadth of resources and utility. | Large user base and extensive partner network. |

| Intellectual Property & Technology | Proprietary algorithms, AI, and process orchestration. | Requires significant investment and time to develop comparable capabilities. | Patented technology and continuous R&D investment. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a foundation of diverse and credible data sources, including company annual reports, industry-specific market research, and government economic indicators. This comprehensive approach ensures a robust understanding of competitive intensity and strategic positioning within the industry.