Appian Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Appian Bundle

This glimpse into the Appian BCG Matrix highlights its strategic product portfolio. Understand which of Appian's offerings are driving growth and which require careful consideration. Purchase the full BCG Matrix for a comprehensive analysis, including detailed quadrant placements and actionable strategies to optimize Appian's market position.

Stars

The Appian AI Process Platform is a definite Star in Appian's portfolio, blending low-code agility with advanced AI for business process automation. This platform thrives in the rapidly expanding low-code and AI automation sectors, a space where Appian consistently earns accolades as a market leader.

Appian's strategic focus on driving swift digital transformation and enhancing operational efficiency for businesses is heavily reliant on this platform. In 2024, the demand for intelligent automation solutions continued to surge, with analysts projecting the global market for AI in business process automation to reach tens of billions of dollars, underscoring the significant growth potential for Appian's Star product.

Appian's consistent recognition as a Leader in Gartner's Magic Quadrant for Enterprise Low-Code Application Platforms underscores its robust market standing. This leadership is especially significant given the low-code market's projected expansion, expected to surpass $100 billion by 2030. Enterprises are increasingly turning to these platforms for scalable and efficient application development.

Appian's AI-Powered Process Orchestration is a standout feature within its platform, firmly placing it in the 'Star' category of the BCG Matrix. The company's commitment to embedding AI directly into business processes, exemplified by its AI Agents and AI Copilot, highlights a high-growth segment where Appian is driving significant innovation and customer adoption.

Customer adoption of AI capabilities has seen a substantial year-over-year increase, underscoring the market's strong appetite for practical AI solutions integrated into daily workflows. This strategic emphasis on AI for tangible business outcomes positions Appian as a key player in the evolving AI landscape.

Cloud Subscription Revenue Growth

Cloud subscription revenue is a significant driver for Appian, showcasing its position as a Star in the BCG Matrix. The company reported a robust 19% increase in cloud subscription revenue for the full year 2024. This upward trend continued into the first quarter of 2025, with a 15% growth.

This consistent expansion highlights strong customer adoption and the reliable nature of recurring revenue within Appian's scalable cloud model. Such high-growth revenue, originating from the core platform, is a definitive characteristic of a Star product.

- Consistent Growth: Cloud subscription revenue grew 19% in 2024 and 15% in Q1 2025.

- Customer Adoption: Strong growth indicates high customer uptake and trust in the platform.

- Recurring Revenue: The scalable cloud model generates predictable and growing recurring revenue.

- Retention Rate: Appian maintained a strong cloud revenue retention rate of 112% as of March 31, 2025.

Complex Internal Applications Specialization

Appian's specialization in complex internal applications positions it strongly within the enterprise software market. Gartner's recognition of Appian as number one for this use case underscores its capability to handle sophisticated automation and data integration challenges, crucial for large organizations.

This focus allows Appian to attract and successfully deliver on demanding projects where intricate workflows and seamless data connectivity are paramount. Such a specialization is key to capturing market share in high-value enterprise segments.

- Gartner Critical Capabilities: Appian ranked #1 for Complex Internal Applications Use Case.

- Market Position: Strong competitive advantage in a critical enterprise segment.

- Project Focus: Caters to demanding projects requiring sophisticated automation and data integration.

- Value Proposition: Excellent fit for high-value, complex enterprise needs.

The Appian AI Process Platform is a clear Star, demonstrating robust growth and market leadership in the expanding low-code and AI automation sectors. Its ability to drive digital transformation and operational efficiency positions it for continued success.

Appian's cloud subscription revenue, a key indicator of its Star status, saw a 19% increase in 2024 and continued its upward trajectory with 15% growth in Q1 2025. The platform's strong customer adoption and high retention rate of 112% as of March 31, 2025, further solidify its position.

Appian's recognition as a leader in Gartner's Magic Quadrant for Enterprise Low-Code Application Platforms, particularly its #1 ranking for the Complex Internal Applications use case, highlights its competitive advantage in a market projected to exceed $100 billion by 2030.

| Key Performance Indicator | 2024 Data | Q1 2025 Data |

| Cloud Subscription Revenue Growth | 19% | 15% |

| Cloud Revenue Retention Rate | N/A | 112% |

| Gartner Recognition (Use Case) | Leader | #1 for Complex Internal Applications |

What is included in the product

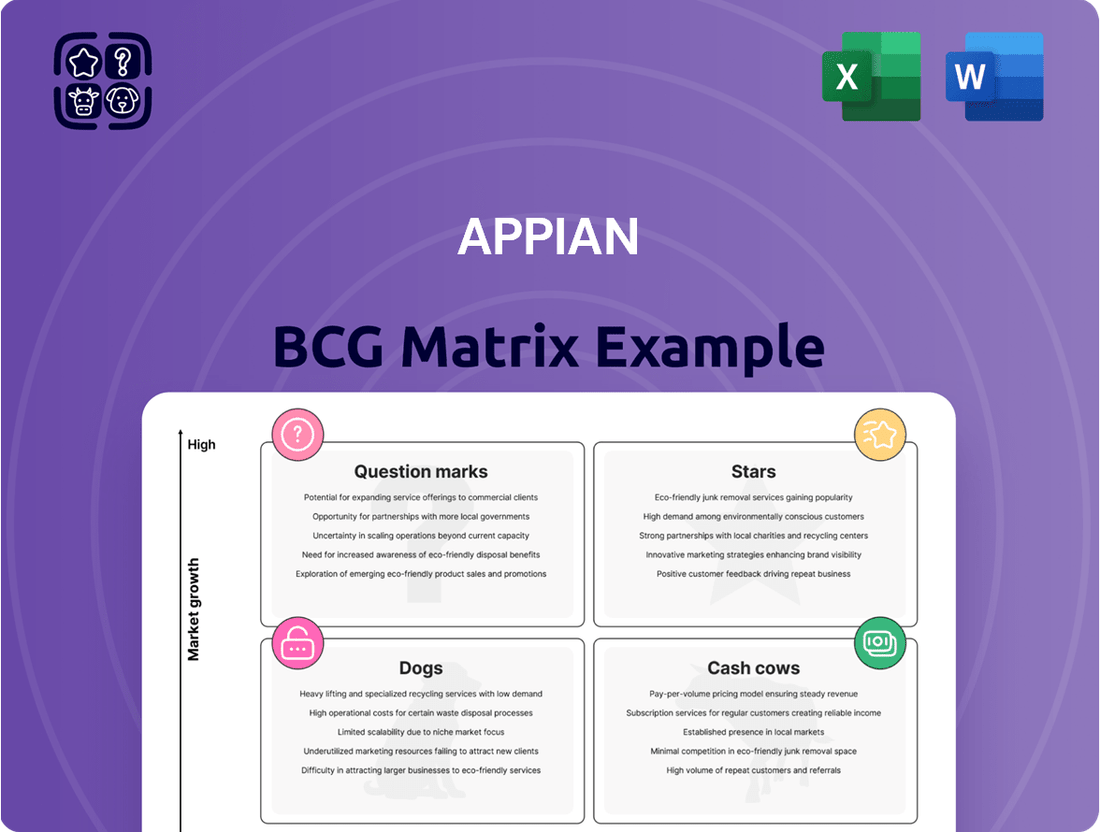

Highlights which Appian products to invest in, hold, or divest based on market growth and share.

Visualize your entire portfolio in a single, clear BCG matrix, instantly identifying stars, cash cows, question marks, and dogs to guide strategic resource allocation.

Cash Cows

Appian's core low-code application development, the bedrock of its platform, continues to be a significant cash generator. This mature offering, distinct from its newer AI advancements, is a stable revenue stream, widely utilized by established enterprise clients for critical business applications.

These foundational capabilities are the engine driving Appian's consistent cash flow, reflecting their deep integration into existing business processes. Appian's focus for this segment is on maintaining reliability and implementing incremental enhancements rather than major overhauls.

For instance, Appian reported total revenue of $591.6 million for the fiscal year 2023, with a substantial portion attributed to its established platform offerings. This demonstrates the ongoing strength and cash-generating power of its core low-code development services as businesses continue to rely on these solutions.

Appian's Business Process Management (BPM) solutions represent a mature segment, acting as a reliable cash cow. This established offering generates consistent revenue from enterprises prioritizing operational workflow optimization.

These BPM solutions are deeply integrated into the infrastructure of many large organizations, ensuring ongoing demand. Unlike nascent products, they require minimal aggressive new investment, allowing them to contribute stable cash flow to Appian's portfolio.

In 2023, Appian reported revenue growth of 16% year-over-year, reaching $591.7 million, with a significant portion attributed to its foundational cloud subscription and professional services, which include its robust BPM capabilities.

Appian's Professional Services, a key component of its BCG Matrix, generated a solid $126.5 million in revenue for the full year 2024. This revenue stream remained stable, showing no significant change from Q1 2024 to Q1 2025.

This consistent income is derived from the crucial work of implementing, customizing, and supporting Appian's platform for its major enterprise clients. It acts as a dependable cash generator, underpinning the company's broader operational activities.

Established Enterprise Client Base

Appian's established enterprise client base is a significant strength, positioning it firmly within the Cash Cows quadrant of the BCG Matrix. The company boasts relationships with numerous Fortune 500 companies across various sectors, including financial services, healthcare, and government. This broad adoption by large organizations translates into a predictable and substantial stream of recurring revenue from software subscriptions and professional services. For instance, Appian reported that 66% of its revenue in 2023 came from recurring sources, highlighting the stability provided by its existing client contracts.

- Strong Recurring Revenue: Appian's focus on enterprise clients ensures a high percentage of its income is subscription-based and therefore predictable.

- Long-Term Relationships: The company's success in retaining large enterprise clients, often through multi-year contracts, underpins its stable cash flow generation.

- Industry Diversification: Serving a wide array of industries reduces Appian's reliance on any single market, further enhancing revenue stability.

- Client Success Focus: Appian's commitment to client success fosters loyalty and reduces churn, reinforcing the 'cash cow' status of its established client relationships.

Maintenance and Support Services

Appian's maintenance and support services are a prime example of a Cash Cow within its business portfolio. These services generate a highly predictable and profitable revenue stream, crucial for the company's financial stability.

Clients depend on Appian for their critical operations, making these support services indispensable and often secured through long-term agreements. This translates into a consistent cash inflow with minimal need for further capital expenditure.

- Predictable Revenue: In 2023, Appian reported that its maintenance and subscription revenue, which includes these support services, represented a significant portion of its total revenue, demonstrating the stability of this segment.

- High Margins: The nature of software support and maintenance typically commands higher gross margins compared to initial software sales, contributing substantially to Appian's profitability.

- Low Investment: Once the platform is established, the incremental cost to provide ongoing maintenance and support is relatively low, allowing for strong cash generation.

- Client Retention: The essential nature of these services fosters high client retention rates, ensuring a continuous and reliable cash flow for Appian.

Appian's established enterprise client base, which includes numerous Fortune 500 companies, represents a significant cash cow. This broad adoption across sectors like financial services, healthcare, and government translates into a predictable and substantial stream of recurring revenue from software subscriptions and professional services. For instance, Appian reported that 66% of its revenue in 2023 came from recurring sources, highlighting the stability provided by its existing client contracts.

The company's maintenance and support services are a prime example of a cash cow, generating a highly predictable and profitable revenue stream crucial for financial stability. Clients depend on these indispensable services, often secured through long-term agreements, leading to consistent cash inflow with minimal capital expenditure. In 2023, Appian's maintenance and subscription revenue, including these support services, represented a significant portion of its total revenue, demonstrating the segment's stability and high gross margins.

| Category | 2023 Revenue (Millions USD) | Key Characteristics |

|---|---|---|

| Core Low-Code Platform | (Estimated portion of total revenue) | Mature, stable revenue stream, widely utilized by established enterprise clients. |

| Business Process Management (BPM) | (Included in subscription/professional services) | Established offering generating consistent revenue from workflow optimization. |

| Professional Services | 126.5 | Consistent income from implementation, customization, and support for enterprise clients. |

| Maintenance & Support | (Included in recurring revenue) | Highly predictable and profitable, essential for client operations, high gross margins. |

What You’re Viewing Is Included

Appian BCG Matrix

The Appian BCG Matrix preview you are viewing is the complete, unwatermarked document that will be delivered to you immediately after purchase. This means you'll receive the exact same professionally formatted analysis, ready for immediate integration into your strategic planning and decision-making processes without any additional steps or modifications required.

Dogs

Legacy on-premises deployments for Appian, while still offered via term licenses, represent a segment that is increasingly out of step with the broader industry's shift towards cloud-native solutions. This trend is clearly reflected in Appian's own financial reports, where cloud subscription revenue consistently emerges as the company's primary growth engine.

Consequently, these older on-premises installations are best categorized as a low-growth or even declining market share for Appian. The resources required to maintain and support these legacy systems may not yield a return commensurate with the investment, especially when contrasted with the rapid expansion seen in their cloud offerings.

In the bustling low-code landscape, features that simply replicate common functionalities without tapping into Appian's core strengths, like advanced process automation or AI, fall into the undifferentiated category. These generic offerings risk becoming commodities, easily matched by competitors, often at lower price points.

For instance, basic form building or drag-and-drop interfaces, while useful, don't inherently showcase Appian's unique value proposition. The low-code market is projected to reach $187 billion by 2030, according to some estimates, highlighting the intense competition where generic features struggle to stand out.

These undifferentiated features may demand significant investment to maintain market relevance, as they don't offer a distinct competitive edge against a multitude of similar solutions, including those from emerging players with aggressive pricing strategies.

Non-strategic, older integrations within Appian's ecosystem might represent functionalities that are no longer central to the company's forward-looking strategy, particularly concerning data unification, human collaboration, and AI integration. These might include legacy connectors or modules that, while functional, don't actively drive new business or enhance the core platform's value proposition.

These types of integrations often demand continued maintenance resources, potentially diverting investment from more innovative and growth-oriented projects. For instance, if an older integration supporting a niche industry segment sees declining customer adoption, the cost of its upkeep might outweigh its contribution. In 2023, many tech companies reviewed their product portfolios, and those with underutilized or legacy components often saw resource reallocation. Appian's focus on its low-code platform and AI-driven automation suggests a strategic pruning of less impactful integrations to streamline development and enhance core offerings.

Niche Solutions with Limited Scalability

Niche solutions with limited scalability represent offerings that cater to a very specific, often small, client segment. For instance, a custom-built workflow automation for a unique manufacturing process within a single company might fall into this category. The challenge here is that the investment in development and ongoing support might exceed the revenue generated if the solution cannot be adapted for a broader market. In 2024, companies focusing on such highly specialized, bespoke software often found themselves with high maintenance costs relative to their market penetration.

These offerings typically exhibit low market share and minimal growth prospects because their inherent design restricts wider adoption. The effort required to maintain and update these solutions can easily outweigh the financial returns if they remain confined to their original, limited scope. Without a clear path to productization or expansion, these become isolated investments with little potential for significant scaling.

Consider these key characteristics:

- Highly Specialized Functionality: Developed for very specific, often unique, client needs.

- Limited Client Base: Serves a small and narrowly defined group of customers.

- Low Scalability Potential: Difficult or impossible to adapt for a wider market without significant rework.

- High Maintenance Costs: Ongoing support and updates can be disproportionately expensive relative to revenue.

Components Facing Strong Commoditization

Components facing strong commoditization within Appian's platform are those easily replicated by competitors, lacking unique Appian advantages. These are typically basic automation features becoming commonplace in business software. For instance, many platforms now offer straightforward workflow automation at competitive price points, eroding Appian's differentiation in this segment.

These commoditized areas often result in lower profit margins and diminished growth prospects for Appian. As competitors catch up and offer similar functionalities at lower costs, Appian must focus on its unique value propositions to maintain market share and profitability.

- Basic Workflow Automation: Core process automation features that are now table stakes in the low-code market.

- Standard Form Builders: Drag-and-drop interfaces for creating simple data collection forms, widely available.

- Generic Reporting Tools: Basic dashboards and reporting capabilities that lack deep analytical customization.

Within the Appian BCG Matrix, "Dogs" represent offerings that have low market share and low growth prospects. These are typically legacy products or features that have been surpassed by market evolution or intense competition. For Appian, this could include older, on-premises deployment models or basic, undifferentiated functionalities that are now commoditized.

These segments require significant resources for maintenance but generate minimal returns, hindering Appian's ability to invest in high-growth areas. The company's strategic focus on cloud-native solutions and AI-driven automation naturally sidelines these less dynamic components. In 2023, the technology sector saw a trend of divesting or de-emphasizing underperforming product lines to streamline operations.

Appian's own reporting highlights the dominance of cloud subscription revenue, indicating that legacy offerings are not driving growth. For instance, while term licenses for on-premises solutions are still available, they are not the primary revenue driver compared to their cloud counterparts. This strategic shift means that components fitting the Dog category are those that do not align with Appian's future vision.

These offerings often face high maintenance costs relative to their market penetration and lack scalability. Without a clear path for expansion or productization, they represent isolated investments with limited potential for significant scaling, a common challenge for many software companies in 2024.

Question Marks

Appian is making significant strides with its generative AI investments, notably AI Copilot for its data fabric and Agent Studio for creating AI agents. This strategic focus highlights a high growth potential within the dynamic AI market, with the company actively positioning these as key differentiators. For instance, Appian's commitment to AI development is reflected in its ongoing research and development expenditures, which are crucial for bringing these advanced capabilities to market.

Appian is actively fostering a partner ecosystem to deliver specialized, industry-focused SaaS solutions. For instance, collaborations with firms like PwC allow for the creation of tailored offerings, such as PwC's Interactions Hub, built on the Appian platform. This approach significantly broadens Appian's market penetration into niche vertical sectors, presenting substantial growth potential.

This strategy is designed to tap into the high-growth potential of specialized vertical markets. By empowering partners, Appian can extend its reach and offer solutions that precisely address the unique needs of different industries. This decentralized development model allows for greater agility and customization.

While this strategy holds promise, the market share for each individual partner-developed solution remains nascent. Success hinges on substantial investment from partners and the execution of robust go-to-market strategies to gain traction in competitive segments.

Appian's advanced Intelligent Document Processing (IDP) leverages sophisticated AI skills to tackle the growing demand for automating document-heavy processes. This capability is a significant growth driver within their broader automation suite, addressing a substantial market need.

The capacity for processing vast volumes of documents efficiently positions Appian to capture a larger share of this competitive market. For instance, by mid-2024, many enterprises reported handling over a million documents monthly, highlighting the scale of the opportunity IDP addresses.

Continued innovation and strategic investment are crucial for Appian to solidify its position and differentiate itself in this rapidly evolving, highly competitive IDP segment. Achieving market leadership necessitates ongoing development of AI capabilities and demonstrating clear value propositions to clients facing increasingly complex document workflows.

Expansion into New Geographic Markets

Appian's strategy to expand into new geographic markets positions it as a 'Question Mark' within the BCG Matrix. This means these regions offer high growth potential for low-code adoption but currently represent a relatively small market share for Appian. Successfully entering these markets demands significant upfront investment in building out sales teams, tailoring marketing efforts, and localizing the platform.

For instance, while the global low-code market is projected to reach $100 billion by 2028, Appian’s penetration in emerging economies in Southeast Asia or parts of Africa, where digital transformation is accelerating, is still nascent. These areas present substantial opportunities for growth, but the cost of establishing a strong presence, including channel partnerships and local support, is considerable.

- High Growth Potential: Emerging markets are increasingly adopting digital solutions, creating a fertile ground for Appian's low-code platform.

- Low Market Share: Appian's current footprint in these new territories is minimal, reflecting the early stage of its expansion efforts.

- Significant Investment Required: Success hinges on substantial capital allocation for sales, marketing, localization, and talent acquisition in these new regions.

- Strategic Importance: These markets are crucial for Appian's long-term global growth and diversification strategy.

Strategic Partnerships for Broader Ecosystem Integration

Appian is actively pursuing strategic partnerships to weave its low-code platform into a wider technology ecosystem. These alliances are designed to open up new market segments and application possibilities, extending Appian's capabilities beyond its core offerings.

The success of these integrations, particularly with leading technologies that broaden Appian's reach, is crucial for future growth. While the intent is clear, the tangible impact on Appian's market share and revenue remains a key area to monitor, contingent on successful joint execution and adoption.

- Ecosystem Expansion: Appian's strategy involves integrating with complementary technologies, aiming to create a more comprehensive solution set for customers.

- Market Reach: These partnerships are intended to unlock new customer segments and industry-specific use cases that might not be accessible through the core platform alone.

- Revenue Potential: While the groundwork is being laid, the direct correlation between these partnerships and increased market share or revenue is still developing and requires effective co-selling and joint go-to-market strategies.

- Execution Risk: The ultimate success hinges on the ability of Appian and its partners to seamlessly integrate, market, and support these combined solutions, a process that carries inherent execution challenges.

Appian's expansion into new geographic markets places it in the Question Mark category of the BCG Matrix. These regions offer substantial growth potential for low-code adoption, but Appian's current market share there is minimal. Success in these nascent markets requires significant upfront investment in sales, marketing, and platform localization.

The global low-code market is expected to reach $100 billion by 2028, indicating a vast opportunity. However, Appian's presence in emerging economies in Southeast Asia and Africa, while growing, is still developing. Establishing a strong foothold, including local partnerships and support, demands considerable financial commitment.

These new territories are vital for Appian's long-term global growth and diversification. The investment is strategic, aiming to capture future market share in regions undergoing rapid digital transformation, even though the immediate return on investment may be low.

Appian's strategic partnerships are designed to integrate its low-code platform into a broader technology ecosystem, opening new market segments. While the intent is to expand reach and application possibilities, the actual impact on Appian's market share and revenue is still developing and depends on successful joint execution and customer adoption.

| BCG Category | Appian's Strategy | Market Characteristic | Investment Need | Potential Outcome |

|---|---|---|---|---|

| Question Mark | Geographic Expansion & Ecosystem Integration | High Growth Potential, Low Market Share | Significant Capital Outlay | Increased Market Share, Revenue Growth |

| Targeting emerging economies (e.g., Southeast Asia, Africa) | Low-code adoption accelerating | Sales, Marketing, Localization, Partnerships | Diversification, Long-term Growth | |

| Partnering with complementary technologies | Expanding platform capabilities | Co-selling, Joint Go-to-Market | New Customer Segments, Broader Use Cases |

BCG Matrix Data Sources

Our Appian BCG Matrix leverages a robust blend of internal performance metrics, customer usage data, and market trend analysis to provide actionable insights.