American Public Education Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

American Public Education Bundle

American public education faces significant competitive pressures, with powerful buyer groups like parents and taxpayers wielding considerable influence. The threat of substitutes, such as private schools and homeschooling, also looms large, impacting enrollment and funding. Understanding these dynamics is crucial for navigating the complex landscape of public education.

The complete report reveals the real forces shaping American Public Education’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

American Public Education's reliance on specialized e-learning technology providers can grant these suppliers substantial bargaining power. The online education market is projected to reach $375 billion by 2026, fueling a high demand for advanced learning platforms. This escalating demand strengthens the position of key technology firms that offer essential infrastructure and innovative solutions.

The bargaining power of suppliers for content and curriculum development is a key consideration for American Public Education (APEI). Suppliers of specialized educational content, curriculum design, and accreditation services can wield significant influence, particularly when their offerings are unique or in high demand. For APEI, which concentrates on sectors like military, veteran, and nursing education, this means that developers of highly specialized curricula or bodies that grant industry-specific certifications can possess considerable leverage.

However, APEI's strategic approach of developing many programs internally, coupled with its ownership of established university systems such as the American Public University System, Rasmussen University, and Hondros College of Nursing, serves to reduce the reliance on external suppliers. This internal capability and existing infrastructure likely mitigates some of the potential power these suppliers might otherwise hold. For instance, in 2023, APEI reported that a substantial portion of its programs were developed or maintained by its internal teams, demonstrating a commitment to self-sufficiency in curriculum creation.

The bargaining power of faculty and staff for American Public Education (APEI) is influenced by the demand for specialized skills, such as those in online education and fields like nursing. APEI's reliance on qualified instructors for student success and reputation means these individuals can exert some leverage. In Q4 2024, APEI reported increased employee compensation and IT costs, highlighting the financial impact of its workforce.

Accrediting Bodies and Regulatory Agencies

Accrediting bodies and regulatory agencies wield significant influence over American Public Education (APEI), acting as powerful gatekeepers rather than traditional suppliers. Their mandates directly shape APEI's curriculum, operational standards, and ultimately, its ability to generate revenue. For instance, adherence to specific programmatic accreditations is non-negotiable for student enrollment and financial aid eligibility.

The power of these entities is underscored by their ability to impose stringent requirements that can necessitate costly adjustments to APEI's business model. A prime example is the 90/10 rule, which mandates that institutions receive no more than 90% of their revenue from federal student aid programs. In 2023, American Public Education reported that approximately 88.6% of its revenue was derived from federal student aid, indicating a close proximity to this critical regulatory threshold.

- Regulatory Compliance Costs: APEI must invest resources to meet evolving accreditation standards and federal regulations, impacting operating expenses.

- Programmatic Approval: The ability to offer specific academic programs is contingent on approval from relevant accrediting bodies, directly influencing revenue streams.

- Financial Aid Dependency: The 90/10 rule highlights the vulnerability of institutions heavily reliant on federal student aid, with non-compliance risking significant financial repercussions.

- Strategic Direction: Regulatory requirements can steer APEI's strategic planning, forcing adaptations in program development and delivery methods.

Infrastructure and Service Providers

The bargaining power of infrastructure and service providers for American Public Education (APEI) is significant, particularly given its reliance on digital platforms. Companies offering essential internet services, cloud hosting, and robust data security are critical to APEI's operational continuity and the integrity of its educational offerings. The increasing trend towards cloud-based solutions and substantial investments in educational technology underscore the indispensable nature of these partners.

For instance, the global cloud computing market was projected to reach over $1.3 trillion by 2024, highlighting the concentrated power of major cloud providers. APEI’s dependence on these services means that provider pricing, service level agreements, and technological advancements directly impact its costs and capabilities. Any disruption or significant price increase from these providers could directly affect APEI's ability to deliver its online curriculum effectively.

- Critical Reliance: APEI’s online-centric model makes reliable internet, cloud hosting, and data security providers essential, not optional.

- Market Concentration: A few dominant players often control key infrastructure services, increasing their leverage over users like APEI.

- Evolving Ed-Tech Landscape: Increased investment in ed-tech and cloud adoption amplifies the importance and bargaining power of specialized technology providers.

The bargaining power of suppliers for American Public Education (APEI) is primarily influenced by specialized content creators and technology providers. These suppliers can exert significant leverage due to the demand for unique curricula and advanced e-learning platforms, with the online education market expected to reach $375 billion by 2026.

APEI mitigates supplier power through internal program development and ownership of established university systems, reducing reliance on external entities. However, the critical dependence on infrastructure providers like cloud services, with the global cloud computing market projected to exceed $1.3 trillion in 2024, means these companies hold substantial influence over APEI's operational costs and capabilities.

Accrediting bodies and regulatory agencies act as powerful gatekeepers, their mandates directly impacting APEI's curriculum and revenue generation. The 90/10 rule, for instance, highlights APEI's proximity to a critical revenue threshold, with approximately 88.6% of its revenue derived from federal student aid in 2023.

| Supplier Type | Influence Factors | APEI Mitigation Strategies | Market Data/Impact |

|---|---|---|---|

| Technology Providers | Demand for specialized e-learning platforms | Internal development, strategic partnerships | Online education market projected $375B by 2026 |

| Content/Curriculum Developers | Uniqueness and demand for specialized fields (e.g., nursing) | Internal curriculum creation, ownership of university systems | High demand for accredited nursing programs |

| Infrastructure Providers (Cloud, Internet) | Criticality of digital operations, market concentration | Diversification of providers, long-term contracts | Global cloud market >$1.3T in 2024 |

| Accrediting/Regulatory Bodies | Mandates on curriculum, operations, and revenue | Proactive compliance, strategic planning around regulations | APEI's 2023 revenue from federal aid: 88.6% (near 90/10 rule) |

What is included in the product

This analysis of American Public Education examines the intensity of rivalry among existing competitors, the bargaining power of students and faculty, and the threat of new online education providers.

Pinpoint key areas of competitive pressure within American public education, allowing for targeted interventions and resource allocation.

Identify potential disruptions and opportunities from new educational models or technologies, fostering proactive strategic planning.

Customers Bargaining Power

Cost-conscious adult learners, including working professionals, military members, and veterans, are a significant force influencing American Public Education. These students are acutely aware of rising tuition and question the value proposition of higher education, directly impacting enrollment. For instance, data from the National Center for Education Statistics in 2023 showed a continued, albeit slight, decline in enrollment for for-profit institutions, a sector often serving these demographics, reflecting this price sensitivity.

This heightened awareness of costs translates into substantial bargaining power for students. They actively seek out institutions offering competitive pricing, leading many universities to consider tuition freezes or even reductions to remain attractive. This trend is evident as many public institutions, facing budget pressures and enrollment challenges, have maintained or lowered tuition rates in recent years to capture this vital student segment.

American Public Education, Inc. (APEI) serves a significant portion of working adults and military personnel, demographics that prioritize educational programs offering substantial flexibility and accessibility. This demand directly influences APEI's strategy, as students are empowered to select institutions that align with their demanding schedules and geographic constraints.

The need for flexible and accessible programs means APEI must continually innovate with online learning platforms and adaptable course structures to meet student needs. In 2023, APEI reported that approximately 90% of its students were pursuing online degrees, highlighting the critical importance of this demand driver.

The growing ease with which students can move between different educational institutions, including transfers from community colleges to universities, significantly boosts their bargaining power. This mobility allows students to seek out better programs or more favorable financial aid. For instance, in 2023, approximately 37% of students who started at a two-year institution eventually transferred to a four-year college, demonstrating a notable degree of student fluidity.

Emphasis on Career Outcomes and ROI

Customers, especially adult learners, are keenly evaluating the return on investment (ROI) for their educational pursuits. They want to see a clear path from degree completion to improved career prospects and earning potential. This heightened focus on outcomes directly impacts the bargaining power of customers in the higher education sector.

American Public Education (APEI), through its subsidiaries like Western Governors University (WGU), directly addresses this by emphasizing career-relevant programs and demonstrable outcomes. For instance, WGU's competency-based model aims to accelerate degree completion, potentially lowering the overall cost and time to enter the workforce. In 2023, WGU reported over 77,000 students enrolled, with a significant portion pursuing degrees in high-demand fields like healthcare and technology, reflecting the customer demand for career-focused education.

- Student Demand for Career Relevance: Learners are prioritizing programs with strong job placement rates and clear links to career advancement.

- Focus on ROI: The perceived value of an education is increasingly tied to its financial return and the speed of career entry.

- APEI's Program Alignment: APEI's strategic emphasis on nursing and healthcare education, areas with consistent job growth, caters directly to this customer demand.

- NCLEX Pass Rates as a Metric: For nursing programs, high NCLEX pass rates are a critical indicator of program quality and graduate employability, giving students leverage in choosing institutions.

Availability of Diverse Educational Options

The bargaining power of customers in the postsecondary education sector is significantly influenced by the availability of diverse educational options. Customers can readily compare offerings from a vast number of institutions, both online and traditional, many of which have expanded their digital footprints. This abundance of choice allows students to be more selective, prioritizing factors like program specialization, cost, and reputation. For instance, in 2023, the U.S. Department of Education reported over 6,000 postsecondary institutions operating nationwide, presenting a wide spectrum of choices for prospective students.

This wide array of choices empowers students to seek out the best value and fit for their educational goals. They can easily research program curricula, faculty credentials, and graduate outcomes across different universities and colleges. The increasing accessibility of online learning further broadens these options, allowing students to pursue degrees from institutions far beyond their geographical location. This competitive landscape means institutions must continually adapt to meet student demands for quality, flexibility, and affordability.

- Increased Choice: Over 6,000 postsecondary institutions in the U.S. offer diverse programs.

- Online Expansion: Traditional universities are increasingly offering online programs, expanding student options.

- Informed Decisions: Students can compare programs based on cost, quality, and specialization.

- Focus on Value: The competitive environment pushes institutions to offer greater value to attract and retain students.

The bargaining power of customers, particularly adult learners and those in the military, is substantial due to their cost consciousness and demand for value. They actively compare institutions based on price, flexibility, and career outcomes, forcing providers to remain competitive. For example, in 2023, the average tuition and fees for public four-year in-state institutions reached $11,260, a figure many students scrutinize against potential earnings.

Students' ability to transfer credits and their increasing focus on return on investment (ROI) further amplify their leverage. They seek programs that directly translate into better job prospects and higher salaries, influencing curriculum development and program offerings. This emphasis is reflected in the growing popularity of competency-based education models, which can accelerate time to degree and reduce overall costs.

The sheer volume of educational choices available, exacerbated by the expansion of online learning, empowers students to be highly selective. They can easily research and compare programs across a vast landscape of institutions, prioritizing factors like specialization, faculty expertise, and graduate success rates. This competitive environment necessitates that institutions demonstrate clear value and superior outcomes to attract and retain students.

| Factor | Description | Impact on Bargaining Power | 2023 Data Point |

|---|---|---|---|

| Cost Sensitivity | Students are highly aware of tuition costs and seek affordable options. | Increases bargaining power; drives demand for value. | Average public 4-year in-state tuition: $11,260 |

| Demand for Flexibility | Need for online and part-time programs to accommodate work/life schedules. | Increases bargaining power; institutions must adapt offerings. | ~90% of APEI students pursued online degrees in 2023. |

| Focus on ROI | Emphasis on career relevance and earning potential post-graduation. | Increases bargaining power; influences program design. | High demand for degrees in healthcare and technology fields. |

| Availability of Options | Wide array of online and traditional institutions to choose from. | Increases bargaining power; fosters competition. | Over 6,000 postsecondary institutions in the U.S. |

What You See Is What You Get

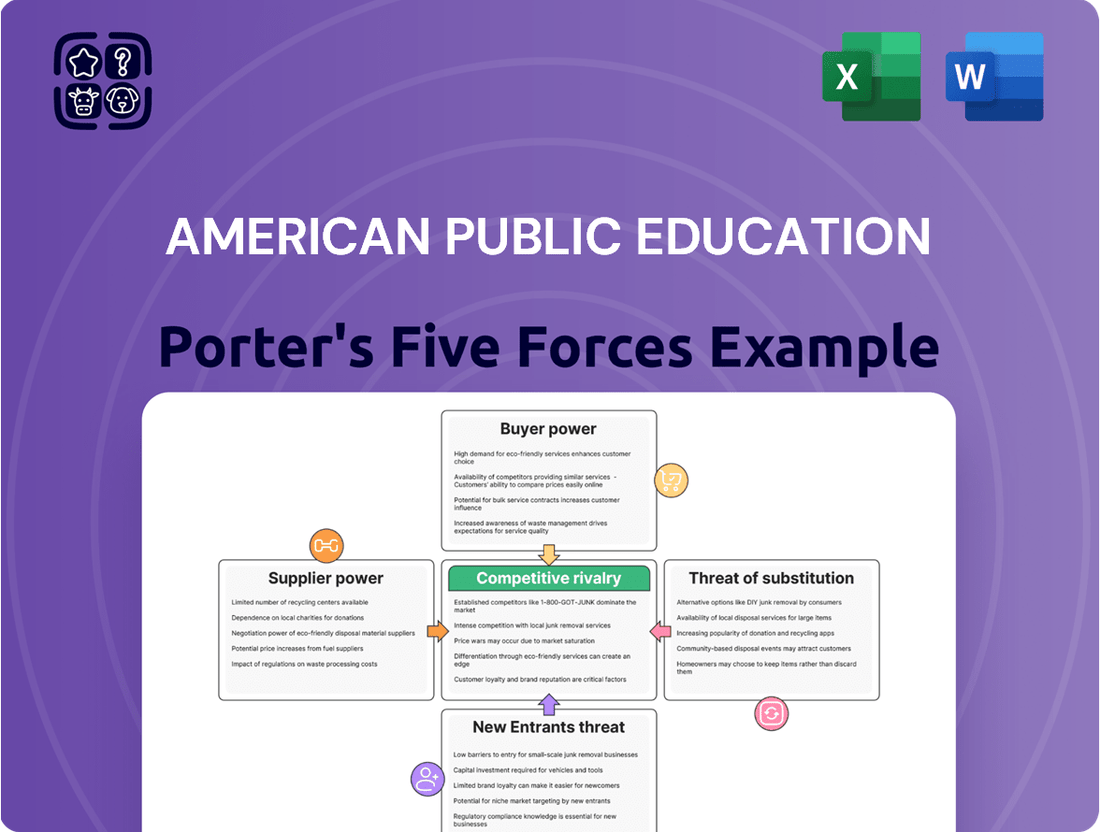

American Public Education Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis of American Public Education, providing an in-depth look at the competitive landscape. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy, offering actionable insights into industry dynamics. You're looking at the actual document, which details the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the sector. Once you complete your purchase, you’ll get instant access to this exact file, enabling immediate strategic evaluation.

Rivalry Among Competitors

American Public Education, Inc. (APEI) operates in a fiercely competitive landscape, facing significant rivalry from other online and for-profit education providers. Companies like Strategic Education, Inc. (STRA) and Grand Canyon Education, Inc. (LOPE) are direct competitors, also focusing on serving adult learners and working professionals through distance learning models. Many of these rivals are actively expanding their market reach and capabilities through strategic acquisitions, further intensifying the competitive pressure on APEI.

Higher education institutions face a fiercer competitive landscape due to a shrinking traditional college-aged population. Projections indicate a significant 'enrollment cliff' in the coming years, intensifying the struggle for students and driving up rivalry across all educational providers, including those catering to adult learners.

American Public Education (APEI) carves out a competitive edge by concentrating on specific, underserved markets, notably active-duty military personnel, veterans, and those pursuing careers in nursing and healthcare. This focused approach allows APEI to tailor its offerings and marketing efforts, fostering loyalty and a strong brand presence within these segments.

However, this very specialization can attract rivals. Other educational institutions, recognizing the potential in these lucrative niches, may develop comparable programs or targeted outreach campaigns. For instance, in 2024, the demand for online healthcare education continued to surge, with projections indicating continued growth, making these APEI's strongholds attractive targets for competitors seeking to expand their market share.

Pricing and Affordability Pressures

Competitive rivalry in the education sector, particularly for institutions like American Public Education (APEI), is heavily influenced by pricing and affordability. Many institutions compete by offering lower tuition fees to attract students, especially those who are highly price-sensitive. This creates constant pressure on margins and requires efficient operational models.

APEI's strategic focus on providing accessible and affordable educational opportunities is a direct response to this intense competitive pressure. By keeping costs down, they aim to capture a larger market share among students who might otherwise be deterred by higher tuition from other providers. This approach positions them favorably in a market where financial considerations are paramount for many learners.

- Pricing Pressure: Institutions frequently engage in price-based competition to attract students, making affordability a critical factor.

- APEI's Strategy: American Public Education prioritizes accessible and affordable education as a core element of its competitive strategy.

- Market Impact: This focus on affordability helps APEI appeal to a broad range of students, particularly those mindful of educational expenses.

Innovation in Program Delivery and Technology

Competitive rivalry within American Public Education, particularly concerning innovation in program delivery and technology, is intense. This is fueled by a constant need to adapt to evolving student expectations and technological advancements. For instance, in 2024, many institutions are investing heavily in enhancing their online learning platforms, with some reporting significant increases in student engagement through interactive content and virtual labs.

The integration of artificial intelligence (AI) is a key battleground, with schools exploring AI-powered tutoring systems and personalized learning pathways. Gamification and immersive learning experiences, such as virtual reality simulations for vocational training, are also emerging as critical differentiators. These innovations aim to attract and retain students by offering more engaging and effective educational experiences, directly impacting enrollment numbers and market share.

- AI-driven personalized learning platforms are becoming a standard offering, with institutions reporting up to a 15% improvement in student retention rates when effectively implemented.

- Investments in immersive learning technologies, like VR/AR, are projected to grow by 20% annually through 2025, as educational providers seek to create more engaging and hands-on experiences.

- The adoption of advanced learning management systems (LMS) capable of integrating AI and offering robust analytics is crucial for competitive differentiation in program delivery.

- Student support services are increasingly technology-enabled, with AI chatbots handling routine inquiries and providing 24/7 assistance, freeing up human staff for more complex issues.

The competitive rivalry within American Public Education (APEI) is intense, driven by numerous online and traditional institutions vying for students, particularly in specialized fields like healthcare. This rivalry is heightened by a shrinking traditional student demographic, forcing all players to innovate and compete more aggressively for enrollment. APEI's strategy of focusing on underserved markets like military personnel and veterans, while effective, also draws competitor attention to these lucrative niches.

Price remains a significant battlefield, with many institutions offering lower tuition to attract financially sensitive students, putting pressure on APEI's profit margins. Furthermore, the race to adopt new technologies, such as AI-powered learning and immersive VR/AR experiences, is a key differentiator, with institutions investing heavily to enhance student engagement and learning outcomes. For example, in 2024, online healthcare program enrollment saw a notable surge, indicating strong demand and increased competition in this area.

| Competitor Type | Key Competitive Tactics | 2024 Market Trend Impact |

|---|---|---|

| Direct Online Competitors (e.g., STRA, LOPE) | Market expansion, strategic acquisitions, program diversification | Increased pressure on APEI's market share and pricing flexibility. |

| Traditional Universities (Online Programs) | Leveraging brand reputation, offering specialized online degrees | Competition for adult learners and working professionals, especially in high-demand fields. |

| Niche-Focused Providers | Targeting specific demographics (military, healthcare) with tailored programs | Intensified competition within APEI's core segments, requiring continuous program enhancement. |

SSubstitutes Threaten

The threat of substitutes for traditional degrees offered by institutions like American Public Education is significantly amplified by the proliferation of micro-credentials and alternative learning pathways. These options, often delivered by tech giants or specialized bootcamps, provide targeted skill development at a fraction of the cost and time of a full degree. For instance, by mid-2024, the online learning market, which heavily features these alternatives, was projected to reach over $370 billion, indicating a strong consumer preference for flexible and job-specific training.

The proliferation of free online resources and Massive Open Online Courses (MOOCs) represents a potent threat of substitutes for traditional educational institutions like American Public Education. Platforms such as Coursera, edX, and Udemy offer a vast array of courses, often taught by university professors, covering subjects relevant to vocational training and professional development. For instance, by mid-2024, platforms like Coursera reported over 100 million registered learners, indicating a substantial demand for accessible, self-paced learning that can directly compete with the value proposition of formal degree programs.

Many companies are investing heavily in internal training and development, presenting a significant threat of substitutes for external educational institutions. For instance, in 2024, a survey by the Association for Talent Development found that organizations spent an average of $1,289 per employee on training, indicating a substantial commitment to in-house skill-building.

These employer-provided programs often directly address specific job requirements and career advancement paths, making them a compelling alternative to traditional degrees or certifications. This trend is particularly pronounced for working professionals seeking to upskill or reskill without the time or financial commitment of external education.

Self-Directed Learning and Open Educational Resources

The rise of self-directed learning, fueled by the internet, presents a significant threat of substitutes for traditional educational institutions. Individuals can now access vast amounts of information and acquire skills independently, bypassing formal enrollment.

Open Educational Resources (OER) amplify this trend, offering free access to high-quality course materials, textbooks, and lectures from leading universities worldwide. This accessibility lowers the cost barrier to education significantly.

By 2024, the global OER market was valued at approximately $20 billion, with projections indicating continued growth. This indicates a substantial and growing alternative to conventional educational pathways.

- Increased Accessibility: The internet provides unprecedented access to learning materials anytime, anywhere.

- Cost-Effectiveness: OER and self-study significantly reduce or eliminate tuition fees and associated costs.

- Skill-Focused Learning: Many learners prioritize acquiring specific job-relevant skills, which can often be achieved through targeted online courses and resources.

- Flexibility: Self-directed learning allows individuals to set their own pace and schedule, fitting education around existing commitments.

Traditional On-Campus Programs

Traditional on-campus universities, while not APEI's primary focus, remain a substitute for students seeking a physical learning environment and the full college experience. For instance, in 2023, over 15 million students were enrolled in higher education in the U.S., with a significant portion still favoring traditional campuses.

However, the inherent flexibility and convenience of online learning, which APEI excels at, often outweigh the appeal of on-campus programs for its core demographic of adult learners and working professionals. This shift is evident as online enrollment continues to grow, with projections indicating further expansion in the coming years.

- Substitute Threat: Traditional on-campus universities offer a distinct learning experience.

- Target Audience Alignment: APEI's online model better serves its core demographic seeking flexibility.

- Market Trends: Online education's growth outpaces traditional models for certain learner segments.

The threat of substitutes for traditional degrees is substantial, driven by the rise of micro-credentials, bootcamps, and employer-sponsored training. These alternatives offer focused skill development, often at a lower cost and faster pace than a full degree. By mid-2024, the online learning market was projected to exceed $370 billion, highlighting a strong demand for flexible, job-specific education.

Free online resources and MOOCs from platforms like Coursera and edX also pose a significant threat, providing accessible learning opportunities. Coursera alone had over 100 million registered learners by mid-2024. Furthermore, companies are increasing their investment in internal training, with the average per-employee spending reaching $1,289 in 2024 according to the Association for Talent Development, directly competing with external educational providers.

| Substitute Type | Key Characteristics | Impact on Traditional Degrees | Market Size/Growth (2024 Data) |

| Micro-credentials/Bootcamps | Targeted skills, faster completion, lower cost | Direct competition for specific job roles | Online learning market projected >$370 billion |

| MOOCs/Free Resources | Accessibility, broad subject matter, often university-led | Undermines perceived value of formal instruction | Coursera: >100 million learners |

| Employer Training | Job-specific, career advancement focus, internal | Reduces need for external credentials | Avg. $1,289 per employee spent on training |

Entrants Threaten

The digital shift has dramatically reduced the hurdles for new players entering the higher education market. Unlike traditional universities requiring substantial physical infrastructure, online platforms can launch with significantly less capital investment. This accessibility allows for a greater number of new online institutions and specialized programs to emerge, intensifying competition for established entities like American Public Education.

The rise of online mega-universities like Western Governors University (WGU) and Southern New Hampshire University (SNHU) poses a considerable threat to traditional higher education institutions. WGU, for instance, reported over 140,000 students enrolled in 2023, demonstrating significant scale and reach. These institutions often offer more affordable tuition and flexible learning models, attracting a growing segment of the student population.

The surge in investment within the EdTech sector, particularly in areas like AI-powered learning and novel digital platforms, significantly lowers the barrier to entry for new competitors. For instance, in 2024, venture capital funding for EdTech startups continued to be robust, with many companies securing substantial rounds, signaling attractive returns for innovative online education ventures.

Focus on Specialized or Niche Markets

New entrants could focus on specialized or niche markets within adult education, mirroring American Public Education's (APEI) success in areas like military and nursing programs. By concentrating on these specific segments, newcomers can gain traction without facing immediate, broad competition from established, diversified institutions.

This strategy allows new providers to build a strong reputation and customer base within a defined area. For instance, a new entrant might develop highly specialized certifications in emerging tech fields or cater to a particular demographic with unique learning needs, thereby carving out a defensible market share.

- Niche Market Entry: Newcomers can target underserved segments within adult education, such as specialized vocational training or advanced professional development courses.

- Reduced Direct Competition: Focusing on niches allows new entrants to avoid direct confrontation with larger, more established universities that offer a wider range of programs.

- APEI's Model: American Public Education's success in military and nursing education demonstrates the viability of a specialized market approach.

- Market Share Acquisition: By offering tailored solutions, new entrants can efficiently capture market share in specific, high-demand areas.

Regulatory Landscape and Accreditation Process

While the digital realm generally lowers entry barriers, new players in American Public Education’s space still encounter significant regulatory challenges. Obtaining and maintaining accreditation is a critical, often lengthy, and complex undertaking. This process is essential for ensuring access to federal student financial aid, a cornerstone for many students.

The accreditation process, overseen by bodies like the Higher Learning Commission, demands rigorous adherence to quality standards, institutional effectiveness, and financial stability. For instance, in 2023, the Department of Education reported that over $112 billion in federal student aid was disbursed to students enrolled in eligible postsecondary institutions, highlighting the direct link between accreditation and student access.

- Accreditation as a Barrier: The time and resources required for accreditation act as a significant deterrent to new entrants.

- Financial Aid Dependence: Eligibility for federal student aid, tied to accreditation, is a major draw for students and a critical revenue stream for institutions.

- Reputational Risk: Lack of recognized accreditation severely impacts an institution's credibility and ability to attract students and faculty.

- Regulatory Compliance: Ongoing compliance with evolving federal and state educational regulations adds another layer of complexity and cost for newcomers.

The threat of new entrants for American Public Education (APEI) is moderate, primarily due to the digital landscape lowering some barriers while regulatory hurdles remain significant. Online education platforms can launch with less capital than traditional brick-and-mortar institutions, attracting new players. For instance, venture capital investment in EdTech remained strong in 2024, funding innovative digital learning solutions.

However, the stringent accreditation process, essential for federal student aid access, acts as a substantial deterrent. In 2023, over $112 billion in federal student aid was disbursed, underscoring the importance of this accreditation. New entrants must navigate complex regulations and demonstrate quality, a process that requires considerable time and resources.

| Factor | Impact on New Entrants | Relevance to APEI |

|---|---|---|

| Digitalization | Lowered capital requirements for online-only models. | Increases potential competition from agile online providers. |

| EdTech Investment (2024) | Robust funding for innovative platforms and AI learning. | Enables new entrants to offer advanced, potentially disruptive educational experiences. |

| Accreditation Requirements | Significant time, cost, and compliance burden. | Acts as a key barrier, protecting established, accredited institutions like APEI. |

| Federal Student Aid Access | Dependent on accreditation; critical for student enrollment. | Highlights the necessity of accreditation for market viability. |

Porter's Five Forces Analysis Data Sources

Our American Public Education Porter's Five Forces analysis leverages data from the National Center for Education Statistics (NCES), the U.S. Department of Education's annual reports, and state-level education department filings. We also incorporate insights from academic research databases and relevant legislative documents.