American Public Education Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

American Public Education Bundle

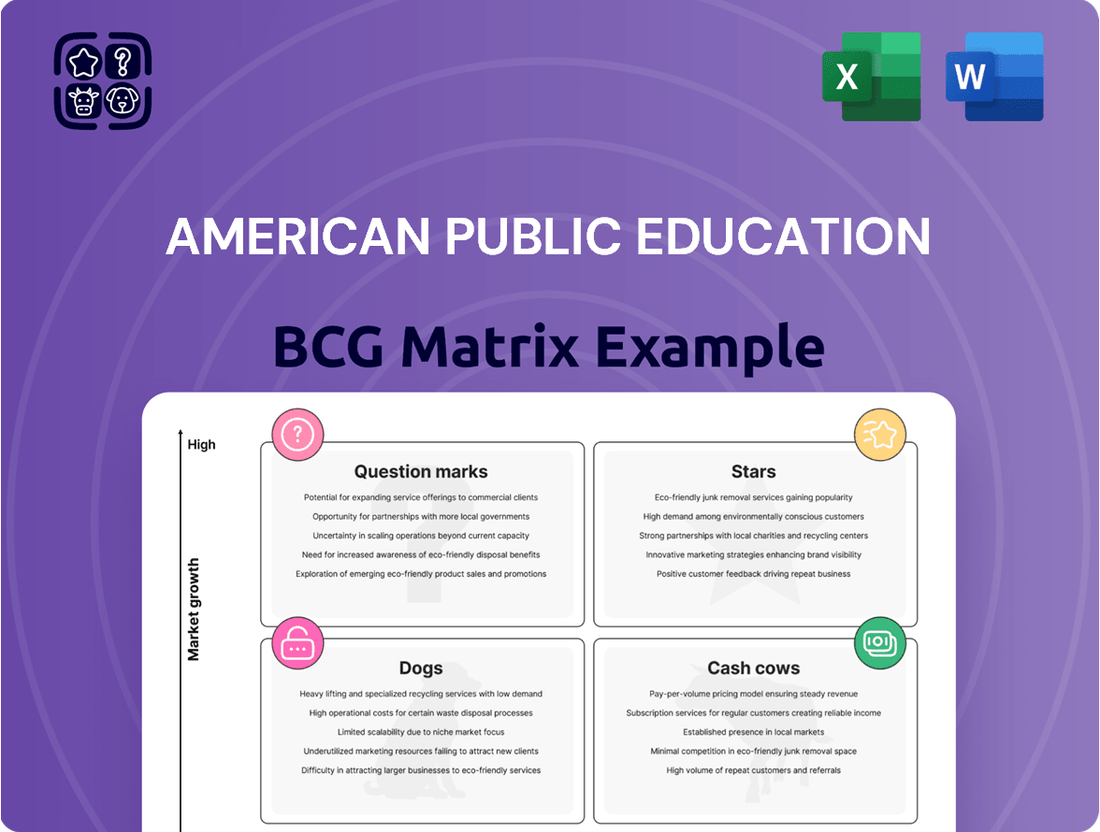

Curious about the strategic positioning of American public education? Our preview offers a glimpse into how key programs might fit into the BCG Matrix, highlighting potential Stars, Cash Cows, Dogs, or Question Marks.

Unlock the full potential of this analysis by purchasing the complete American Public Education BCG Matrix. Gain a comprehensive understanding of each segment's market share and growth rate, empowering you to make informed decisions about resource allocation and future investments.

Don't miss out on actionable insights that can shape the future of educational funding and policy. Invest in the full report for a detailed roadmap to optimizing performance and navigating the evolving landscape of public education.

Stars

Rasmussen University's strong performance in nursing and health sciences positions it as a Star within American Public Education's (APEI) portfolio. This segment experienced a notable 6.8% increase in enrollments for Q1 2025 when compared to the same period in 2024.

The robust growth is directly linked to the persistent and escalating demand for healthcare professionals, especially nurses, across the United States, a trend expected to continue well into the future.

Hondros College of Nursing (HCN) is a significant player in the pre-licensure nursing education sector, positioning it as a potential star in the BCG Matrix. Its specialized focus and consistent growth underscore its strong market position.

HCN anticipates a 14% enrollment increase to 3,700 students by Q2 2025, highlighting its expanding reach. As the largest educator of Licensed Practical Nurses (LPNs) in Ohio, HCN demonstrates a dominant presence in a key geographic market.

The introduction of a new Medical Assisting program in 2024 further solidifies HCN's commitment to meeting evolving healthcare workforce demands. This strategic expansion diversifies its offerings and strengthens its overall market appeal.

The online education market is experiencing robust expansion, presenting a fertile ground for American Public Education, Inc. (APEI). This sector is projected to reach $203.81 billion by 2025, demonstrating a substantial growth trajectory. APEI's strategic focus on online learning, complemented by its campus-based offerings, positions it well to capture a significant share of this burgeoning market.

Strategic Consolidation Initiatives

American Public Education (APEI) is undertaking a significant strategic consolidation, merging American Public University System (APUS), Rasmussen University, and Hondros College of Nursing into a unified university system by the close of 2025. This move is designed to bolster its presence in the critical military and healthcare education sectors.

The anticipated benefits include operational efficiencies, a richer array of academic programs, and improved financial resilience. This consolidation could translate into a stronger market position and enhanced profitability for APEI.

- Consolidation Goal: To create a single, more robust university system by the end of 2025.

- Key Sectors Targeted: Strengthening military and healthcare educational platforms.

- Expected Outcomes: Streamlined operations, enhanced academic offerings, and improved financial stability.

- Potential Impact: Increased market share and profitability.

Strong Financial Performance and Guidance

American Public Education, Inc. (APEI) demonstrated a strong financial performance, with Q1 2025 net income reaching $25.5 million, a substantial jump from the previous year. This robust growth was further underscored by an adjusted EBITDA of $40.1 million for the same period, showcasing operational efficiency and profitability.

The company's confidence in its ongoing strategies is reflected in its upward revision of full-year 2025 financial guidance. APEI now anticipates full-year net income to be between $75 million and $85 million, and adjusted EBITDA to range from $140 million to $155 million. This positive outlook suggests effective execution of their business plan and a favorable market environment.

- Improved Q1 2025 Net Income: $25.5 million.

- Strong Q1 2025 Adjusted EBITDA: $40.1 million.

- Revised Full-Year 2025 Net Income Guidance: $75 million - $85 million.

- Revised Full-Year 2025 Adjusted EBITDA Guidance: $140 million - $155 million.

Rasmussen University's nursing programs, showing a 6.8% enrollment increase in Q1 2025 year-over-year, are Stars due to high demand for healthcare professionals. Hondros College of Nursing, a leader in LPN education in Ohio, is also a Star, expecting a 14% enrollment boost to 3,700 students by Q2 2025 with its new Medical Assisting program.

These segments represent high-growth, high-market-share areas for APEI, particularly within the booming online education sector, projected to hit $203.81 billion by 2025.

| Segment | BCG Category | Key Growth Driver | 2025 Enrollment Projection (HCN) | Q1 2025 Enrollment Growth (Rasmussen) |

|---|---|---|---|---|

| Rasmussen University (Nursing) | Star | Healthcare Workforce Demand | N/A | 6.8% |

| Hondros College of Nursing (LPN/Medical Assisting) | Star | Healthcare Workforce Demand, Program Expansion | 3,700 students (Q2 2025) | N/A |

What is included in the product

This BCG Matrix overview details American public education's status in each quadrant, guiding strategic decisions for investment and resource allocation.

A clear BCG Matrix visualizes public education's challenges, easing the pain of understanding complex resource allocation.

This matrix offers a simplified view, relieving the burden of navigating intricate educational funding issues.

Cash Cows

The American Public University System (APUS), which includes American Military University and American Public University, is a significant player in the education sector, particularly for military and veteran students. In 2024, APUS continued to be a dominant force, serving a substantial number of adult learners, many of whom are affiliated with the U.S. military. This consistent demand translates into a reliable revenue stream for the company.

APUS's position as a cash cow stems from its deep-rooted relationships within the military community and its tailored educational programs. These established connections and specialized offerings create a loyal student base, ensuring predictable enrollment numbers and, consequently, stable financial performance. The approximately 88,000 adult learners APUS serves in 2024 underscore its enduring market presence in this niche.

American Public Education's (APEI) mature online learning infrastructure, largely developed through American Public University System (APUS) and bolstered by strategic acquisitions, acts as a significant cash cow. This robust platform enables the efficient delivery of a wide array of educational programs, minimizing the need for substantial new capital investments.

The operational efficiency of this established infrastructure translates into strong cash flow generation. APEI's online model inherently carries lower operational costs compared to traditional physical campuses, allowing it to capture a larger portion of revenue as profit. For instance, in 2023, APEI reported total revenue of $325.7 million, with its online segment being the primary driver of profitability.

American Public Education's diverse program offerings for adult learners, particularly its undergraduate and graduate degrees and certificates in fields like business, technology, and health sciences, form a significant Cash Cow. This broad portfolio caters to working adults, ensuring a consistent and stable enrollment base. For instance, in 2023, the company reported a total enrollment of approximately 77,000 students, with a substantial portion being adult learners seeking career advancement through these varied programs.

Accredited Institutions and Program Recognition

Accredited Institutions and Program Recognition are key drivers for American Public Education (APEI), positioning its subsidiaries as cash cows. The institutional accreditation of APUS and Rasmussen University by the Higher Learning Commission (HLC), a recognized accreditor by the U.S. Department of Education, along with Hondros College of Nursing's accreditation by the Accrediting Bureau of Health Education Schools (ABHES), is fundamental. This accreditation ensures credibility and, crucially, eligibility for federal financial aid programs, which form a significant portion of student revenue. This long-standing recognition fosters consistent student enrollment and predictable revenue streams, solidifying their status as cash cows within the APEI portfolio.

The financial implications of this accreditation are substantial. For instance, in 2023, APEI reported total revenue of $736.6 million. A significant portion of this revenue is directly tied to the consistent student enrollment facilitated by these accreditations. The stability and predictability of these cash flows are hallmarks of a cash cow business unit.

- Institutional Accreditation: APUS and Rasmussen University are accredited by the Higher Learning Commission (HLC).

- Specialized Accreditation: Hondros College of Nursing holds accreditation from the Accrediting Bureau of Health Education Schools (ABHES).

- Federal Financial Aid Eligibility: Accreditation ensures access to federal student aid, a critical revenue source.

- Revenue Stability: This recognition contributes to consistent student enrollment and predictable revenue, supporting cash cow status.

Cost Management and Operational Efficiencies

American Public Education, Inc. (APEI) actively pursues operational improvement and cost management strategies. These initiatives, such as streamlining its operating structure and optimizing its physical footprint, directly contribute to robust profit margins. For instance, in 2024, APEI continued to focus on digital transformation to reduce administrative overhead, a key component of its efficiency drive.

These focused efforts on cost control and operational efficiencies are crucial for APEI's Cash Cows. By enhancing its internal processes, the company effectively boosts cash flow generation from its established and stable educational programs. This allows for greater financial flexibility and reinvestment opportunities.

- Streamlined Operations: APEI's commitment to simplifying its operating structure directly impacts profitability.

- Optimized Footprint: Strategic management of its physical presence further bolsters cost efficiencies.

- Healthy Profit Margins: These operational improvements are a key driver of APEI's strong profit margins.

- Enhanced Cash Flow: The resulting efficiencies directly translate into improved cash flow from its core offerings.

American Public Education's (APEI) established online learning infrastructure, primarily driven by the American Public University System (APUS), acts as a significant cash cow. This robust platform efficiently delivers diverse educational programs, minimizing the need for substantial new capital investments and leading to strong cash flow generation due to lower operational costs compared to traditional institutions.

APEI's broad program portfolio, including undergraduate and graduate degrees in business, technology, and health sciences, caters to a consistent base of adult learners seeking career advancement. In 2023, APEI served approximately 77,000 students, with a notable portion being adult learners, underscoring the stability of these offerings.

Institutional accreditation by the Higher Learning Commission for APUS and Rasmussen University, alongside specialized accreditation for Hondros College of Nursing, ensures credibility and access to federal financial aid. This accreditation is crucial for consistent student enrollment and predictable revenue streams, a hallmark of cash cow status. In 2023, APEI's total revenue reached $736.6 million, with these accredited programs forming a stable revenue base.

APEI's focus on operational improvements and cost management, such as digital transformation initiatives in 2024 to reduce administrative overhead, directly enhances profit margins and cash flow generation from its stable educational programs.

| Segment | Role in BCG Matrix | Key Strengths | 2023 Revenue (Millions USD) | 2024 Outlook |

|---|---|---|---|---|

| APUS (American Public University System) | Cash Cow | Established military/veteran relationships, mature online infrastructure, consistent enrollment | N/A (part of APEI total) | Continued stable demand, focus on operational efficiency |

| Rasmussen University | Cash Cow | Accreditation, diverse program offerings, adult learner focus | N/A (part of APEI total) | Leveraging accreditation for consistent enrollment |

| Hondros College of Nursing | Cash Cow | Specialized nursing programs, accreditation, federal aid eligibility | N/A (part of APEI total) | Maintaining strong position in healthcare education |

Preview = Final Product

American Public Education BCG Matrix

The American Public Education BCG Matrix preview you are viewing is the identical, fully formatted document you will receive upon purchase. This comprehensive analysis, meticulously crafted to provide strategic insights, will be delivered to you without any watermarks or demo content. You can be confident that the professional-grade report you see is precisely what you will download, ready for immediate application in your strategic planning or presentations.

Dogs

American Public Education, Inc. (APEI) has been actively addressing its underperforming campuses, a strategy that aligns with optimizing its physical footprint. This move suggests that certain segments within their portfolio exhibit characteristics of low growth potential and possibly a diminished market share.

These physical locations, often burdened by significant overheads and facing declining student enrollment, can become financial drains. APEI's plans to sell these buildings are a clear indication of a move to divest these cash traps, aiming to bolster overall financial performance by shedding assets that are no longer contributing positively to the company's bottom line. For instance, in 2023, APEI reported a net loss of $30.5 million, highlighting the need for such strategic divestitures to improve profitability.

Programs with stagnant or declining enrollment, even within a growing overall enrollment landscape, represent a concern for American Public Education (APEI). These might be niche programs or older offerings that are no longer attracting sufficient student interest. For instance, if a specific certification program saw a 5% year-over-year decline in new student sign-ups in 2024, and its market share remains small, it would fit this profile.

American Public Education (APEI) may have legacy programs that are not keeping pace with current market needs. These older offerings, potentially struggling to attract new students, could be draining resources without contributing significantly to the company's strategic expansion. For instance, if a program focused on a now-obsolete technology saw enrollment drop by 15% in 2024, it would exemplify this challenge.

Inefficient or Outdated Technology Systems (Pre-Consolidation)

Prior to consolidation, disparate technology systems within acquired educational institutions would likely fall into the question mark category of the American Public Education BCG Matrix. These legacy systems often lead to higher operational expenses due to maintenance and lack of interoperability. For instance, a 2024 report indicated that K-12 school districts nationwide spent an average of 1.4% of their budgets on IT infrastructure, a figure that can balloon with unintegrated systems.

These inefficient or outdated systems can significantly hinder scalability and require substantial capital for integration or outright replacement. Imagine trying to merge student information systems from multiple schools, each using a different platform. This often necessitates costly data migration and retraining of staff. The cost of upgrading or replacing these systems can be a major hurdle, impacting the institution's ability to invest in core educational programs.

- High Maintenance Costs: Older systems often require specialized, costly support.

- Integration Challenges: Merging different platforms is complex and expensive.

- Limited Scalability: Outdated tech struggles to support growing student populations or new educational tools.

- Security Vulnerabilities: Legacy systems are more susceptible to cyber threats.

Segments with Marginal Revenue Contribution

Segments with marginal revenue contribution, often referred to as 'Dogs' in the BCG Matrix framework, represent business units or subsidiaries within American Public Education that generate minimal revenue relative to their operational costs. These segments may be characterized by low market share and low market growth.

For American Public Education, such segments could include niche online course offerings with declining enrollment or smaller, legacy educational technology platforms that require ongoing maintenance but do not attract significant new users. In 2023, for instance, while the company's overall revenue grew, certain specialized certificate programs might have shown stagnant or declining enrollment, placing them in this category.

- Marginal Revenue Generators: These units contribute minimally to the company's consolidated revenue streams.

- High Operational Costs: Despite low revenue, these segments still incur significant operational expenses, impacting overall profitability.

- Strategic Re-evaluation: Their continued operation is often questioned for long-term strategic viability and resource allocation.

- Potential Divestment or Restructuring: Companies often consider divesting or restructuring these 'Dog' segments to focus resources on more promising ventures.

In the context of American Public Education's (APEI) portfolio, 'Dogs' represent programs or campuses that exhibit both low market share and low market growth. These units typically consume resources without generating substantial returns, potentially dragging down overall financial performance.

For APEI, these could be specific online courses with dwindling student interest or older, smaller campuses facing declining local demographics and competition. For example, a program that saw a 7% decrease in enrollment in 2024 and holds less than a 1% market share in its niche would fit this 'Dog' profile, requiring careful strategic consideration.

These segments often have high fixed costs relative to their revenue, making them inefficient. APEI's strategy likely involves either divesting these underperforming assets or undertaking significant restructuring to improve their viability. In 2023, APEI's net loss of $30.5 million underscores the financial pressure from such low-performing segments.

| Category | Description | APEI Example (Hypothetical) | Financial Implication |

|---|---|---|---|

| Dogs | Low Market Share, Low Market Growth | Niche online certificate program with declining enrollment | Resource drain, low profitability |

| Small, underutilized physical campus | High overhead, negative cash flow | ||

| Legacy educational technology platform with few users | Maintenance costs exceed revenue |

Question Marks

The new Medical Assisting program at Hondros College of Nursing, launched in 2024, can be viewed as a Question Mark within the American Public Education BCG Matrix. Its market share is naturally low due to its recent introduction, but it operates in a sector experiencing robust growth, with the U.S. Bureau of Labor Statistics projecting a 16% increase in medical assistant employment from 2022 to 2032, much faster than the average for all occupations.

This rapid market expansion presents a significant opportunity, but also necessitates substantial investment. Hondros College of Nursing will need to strategically allocate resources towards aggressive marketing campaigns and continuous program enhancement to capture a meaningful share of this expanding demand. Without such focused efforts, the program risks remaining a Question Mark or potentially declining.

American Public Education, Inc. (APEI) might consider expansion into new geographic markets or entirely new academic program areas as a potential 'Question Mark' in the BCG matrix. Such a move would represent a high-growth opportunity but would likely start with a low market share.

For instance, if APEI were to launch a new online degree program in artificial intelligence or expand its physical campus presence into a new international region, these would be considered Question Marks. These initiatives demand significant capital investment and a well-defined strategy to gain traction.

APEI's recent performance, as of early 2024, shows continued focus on its core competencies. For example, in the fourth quarter of 2023, APEI reported net income of $16.8 million, with revenue from its Rasmussen University segment remaining a significant contributor, indicating a strong existing market position in its core areas.

Rasmussen University, acquired by American Public Education (APEI) in 2021, is currently positioned as a Question Mark in the BCG matrix. While enrollment trends have been positive, with a reported 17% increase in student enrollment for the fall 2023 term compared to the previous year, the full realization of integration synergies and optimization of its contribution to APEI's overall portfolio remains a work in progress.

APEI is actively working to fully integrate Rasmussen University, aiming to leverage its strengths and address any remaining challenges. The success of these integration efforts is crucial for Rasmussen to transition from a Question Mark to a potential Star or Cash Cow within APEI's portfolio. Continued positive enrollment growth and improved operational efficiencies will be key indicators of this successful transition.

Unspecified Future Acquisitions or Partnerships

American Public Education, Inc. (APEI) has indicated a strategic interest in acting as a platform for future growth through acquisitions and partnerships. These potential future ventures, before their market standing and growth potential are fully understood, would likely be classified as question marks within the BCG framework. This classification signifies that their future success is uncertain, necessitating significant investment and diligent analysis to ascertain their viability and potential market share.

As of the latest available data, APEI has been actively exploring strategic opportunities. For instance, in 2023, the company completed the acquisition of Rasmussen University, a move that expanded its educational offerings and market reach. This acquisition, while a significant step, also represents a potential question mark as its integration and long-term performance are still being evaluated. Such nascent ventures require substantial capital and careful management to navigate the competitive higher education landscape.

The company’s stated intent to be a platform for additional transactions underscores the dynamic nature of its growth strategy. These future endeavors, much like Rasmussen University's ongoing integration, will require substantial investment to foster development and determine their long-term market position. The success of these question mark initiatives is crucial for APEI’s overall portfolio diversification and future revenue generation.

- Strategic Intent: APEI aims to be a platform for future acquisitions and partnerships, indicating a proactive growth strategy.

- Question Mark Classification: New ventures, before their market position and growth trajectory are clear, fall into the question mark category, demanding careful evaluation.

- Investment Needs: These nascent initiatives require substantial investment to determine their viability and potential for market success.

- Example: The acquisition of Rasmussen University in 2023 serves as a recent example of APEI expanding its portfolio, a move that will be monitored as a potential question mark until its full impact is realized.

Initiatives to Attract a Broader Adult Learner Base Beyond Core Segments

American Public Education (APEI) is exploring strategies to broaden its appeal beyond its established military, veteran, and healthcare student base. This move into new adult learner segments is characteristic of a question mark in the BCG matrix, indicating high growth potential but currently low market share.

These expansion efforts require significant upfront investment in marketing and tailoring educational offerings to resonate with diverse groups. For instance, APEI's 2024 strategic planning likely includes targeted digital marketing campaigns and partnerships with organizations serving new demographics.

- Targeted Digital Marketing: Campaigns focusing on emerging fields like cybersecurity and data analytics to attract tech-savvy professionals.

- Curriculum Diversification: Developing new programs and certifications in high-demand areas outside of traditional healthcare.

- Partnerships: Collaborating with industry associations and employers to create customized learning pathways for their workforce.

- Flexible Learning Options: Enhancing online and hybrid course structures to accommodate a wider range of adult learner schedules and preferences.

Question Marks represent new ventures or offerings with high growth potential but currently low market share. For American Public Education (APEI), these are strategic initiatives that require significant investment to gain traction. Success hinges on effectively capturing market demand and transitioning these ventures into more established categories within the BCG matrix.

APEI's exploration of new academic program areas, such as artificial intelligence, or expansion into new geographic markets, exemplifies these Question Marks. These initiatives demand substantial capital and a well-defined strategy to gain market share. Without focused efforts, they risk remaining in this uncertain category.

The acquisition and integration of Rasmussen University, while showing positive enrollment growth with a 17% increase in fall 2023, still operates as a Question Mark. Its ultimate contribution to APEI's portfolio is still being optimized, requiring continued investment and strategic management.

APEI's broader strategy to act as a platform for future acquisitions and partnerships also places these potential ventures into the Question Mark category. Their future success is uncertain, necessitating significant capital and diligent analysis to ascertain viability and potential market share.

| Initiative | Market Growth Potential | Current Market Share | Investment Required | BCG Classification |

| New Online Degree Programs (e.g., AI) | High | Low | High | Question Mark |

| International Campus Expansion | High | Low | High | Question Mark |

| Rasmussen University Integration | Moderate to High (sector dependent) | Low to Moderate (within APEI portfolio) | Moderate | Question Mark (evolving) |

| Expansion into New Adult Learner Segments | High | Low | High | Question Mark |

BCG Matrix Data Sources

Our American Public Education BCG Matrix is informed by comprehensive data, including federal and state education statistics, enrollment figures, and funding reports.