nima Educação Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

nima Educação Bundle

Understand the strategic positioning of [Company Name]'s product portfolio with this insightful BCG Matrix overview. See where your offerings fit as Stars, Cash Cows, Dogs, or Question Marks, and begin to grasp the implications for your business. Purchase the full BCG Matrix report for a comprehensive breakdown, including detailed quadrant analysis and actionable strategies to optimize your product investments and drive growth.

Stars

Inspirali, the medical education segment of nima, is a clear star in the company's portfolio. It boasts high growth and a substantial market share, particularly in continuing medical education.

This segment commands a high average ticket price of R$ 9,360. Its impressive operational margin stands at 53.2%, making it a significant profit driver and a key area for the company's expansion efforts.

nima Educação is strategically targeting the continuing and executive education market, a segment estimated at R$ 100 billion. This expansion signifies a deliberate move to tap into high-growth areas beyond traditional higher education, aiming to capture new revenue streams and market share.

Innovative postgraduate programs, like those developed with Finland University, are carving out a high-value niche in education. These collaborations bring global best practices directly to students, offering specialized knowledge crucial for today's dynamic professional landscape.

The demand for such advanced, internationally-aligned education is robust. In 2024, the global online education market alone was projected to reach over $370 billion, with postgraduate and professional development courses forming a significant segment of this growth. Professionals are actively seeking these programs to stay competitive and acquire in-demand skills.

Cursos com Foco em Empregabilidade

Cursos com Foco em Empregabilidade são cruciais para o sucesso de instituições de ensino, especialmente quando se alinham com as demandas do mercado. A nima Educação exemplifica essa estratégia, com uma impressionante taxa de empregabilidade de 80% para seus alunos, indicando que 8 em cada 10 estudantes encontram colocação profissional.

Programas educacionais que comprovadamente conectam os estudantes ao mercado de trabalho, focando em áreas de alta demanda, demonstram um potencial de crescimento contínuo e forte atração de novos alunos. Esse modelo de negócio, quando bem executado, posiciona a instituição como um parceiro valioso para o desenvolvimento de talentos.

- Alta Empregabilidade: A nima Educação registra 80% de empregabilidade entre seus alunos.

- Conexão com o Mercado: Programas focados em áreas de alta demanda criam um ciclo virtuoso de atração e crescimento.

- Retorno sobre Investimento: Alunos empregados geram valor para a instituição através de mensalidades e reputação.

- Estratégia de Crescimento: O investimento em cursos com alta empregabilidade impulsiona a participação de mercado.

Crescimento Qualificado de Receita

A nima Educação tem priorizado o crescimento qualificado de receita, o que se traduz em um aumento do tíquete médio e em uma melhoria na margem EBITDA. Isso demonstra que a estratégia de focar em alunos dispostos a pagar mais por programas de maior valor está gerando resultados financeiros sólidos e sustentáveis.

Essa abordagem de "receita de qualidade" tem sido particularmente eficaz em impulsionar o desempenho da companhia. Em 2024, por exemplo, a nima reportou um crescimento expressivo em sua receita líquida, impulsionado pela expansão em modalidades de ensino com maior valor agregado e pela otimização do portfólio de cursos.

- Aumento do Tíquete Médio: A nima tem conseguido elevar o valor médio pago por aluno, refletindo a percepção de valor dos seus programas.

- Melhora na Margem EBITDA: O foco em receita qualificada contribuiu para uma expansão da margem EBITDA, indicando maior eficiência operacional e rentabilidade.

- Crescimento Sustentável: Os segmentos que atraem alunos com maior disposição a pagar são identificados como os de maior valor e com potencial de crescimento a longo prazo.

- Desempenho em 2024: A empresa registrou um crescimento notável na receita líquida, impulsionado pela estratégia de valorização dos seus serviços educacionais.

Inspirali stands out as a star in nima Educação's portfolio due to its high growth and significant market share in continuing medical education. This segment commands a high average ticket price of R$ 9,360 and boasts an impressive operational margin of 53.2%, making it a key profit driver and expansion focus.

nima is strategically targeting the continuing and executive education market, an estimated R$ 100 billion segment, to capture new revenue streams. Innovative postgraduate programs, like those developed with Finland University, offer specialized knowledge and align with global best practices. The global online education market, projected to exceed $370 billion in 2024, highlights the robust demand for such advanced, internationally-aligned courses.

The company's focus on employability is a critical differentiator, with an 80% employment rate for its students. This strong connection to the job market attracts new students and generates value through tuition fees and enhanced institutional reputation. Investing in courses with high employability directly fuels market share growth and contributes to sustainable revenue generation.

nima Educação's emphasis on qualified revenue growth has led to an increased average ticket price and improved EBITDA margins. This strategy of focusing on students willing to invest in higher-value programs is yielding solid financial results. In 2024, nima experienced notable net revenue growth, driven by its expansion in higher value-added educational modalities and portfolio optimization.

| Segment | Growth Potential | Market Share | Average Ticket Price | Operational Margin |

|---|---|---|---|---|

| Inspirali (Medical Education) | High | Substantial | R$ 9,360 | 53.2% |

| Continuing & Executive Education | High (R$ 100 billion market) | Growing | High | Strong |

| Postgraduate Programs (e.g., with Finland University) | High | Niche, High Value | High | Strong |

What is included in the product

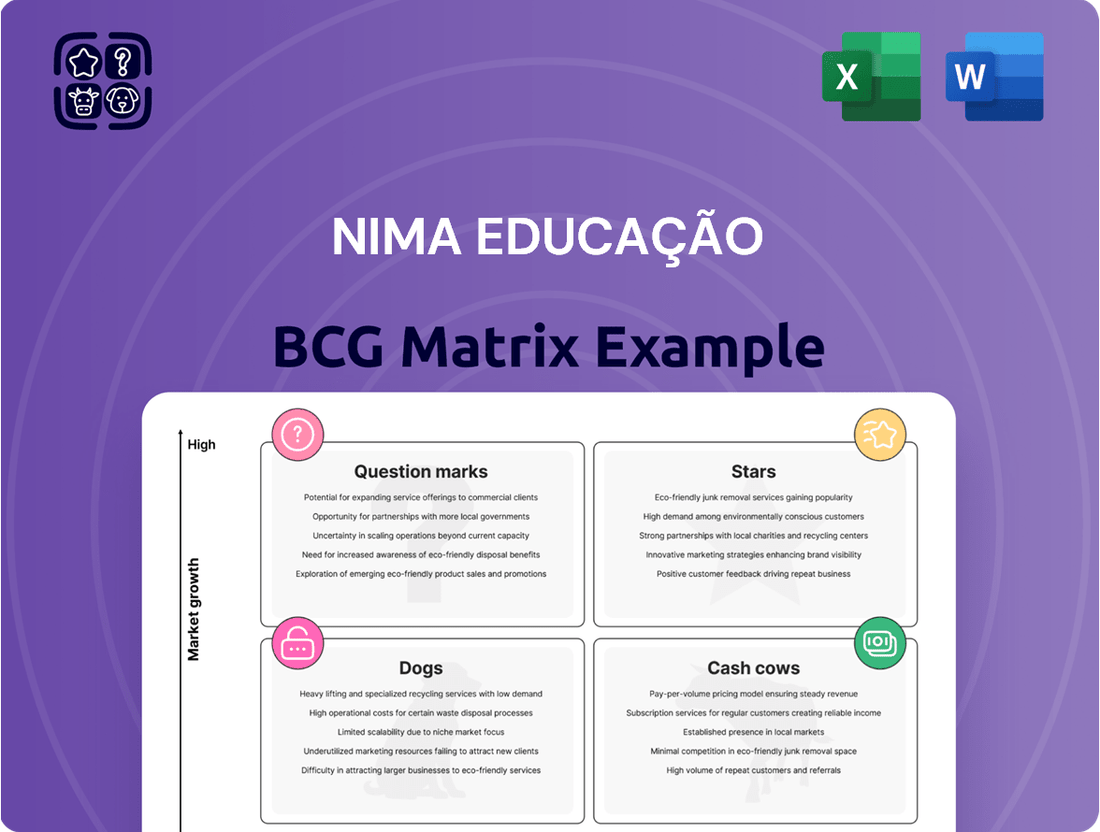

The Nima Educação BCG Matrix provides strategic guidance by categorizing business units into Stars, Cash Cows, Question Marks, and Dogs.

It highlights which units to invest in, hold, or divest based on market share and growth potential.

Nima Educação's BCG Matrix offers a clear, visual way to understand your portfolio, relieving the pain of strategic uncertainty.

Cash Cows

nima Core, representing traditional in-person undergraduate courses, is the financial powerhouse of nima Educação, contributing a significant 55.4% to net revenue. This segment boasts an impressive operational margin of 37.7%, underscoring its strong profitability.

While the overall growth in the in-person sector has seen some variability, nima has demonstrated resilience in student acquisition and retention. The company's ability to manage student attrition effectively points to a mature and stable operation, consistently generating substantial cash flow.

nima Educação's established educational brands are significant cash cows. The company operates over 30 well-recognized brands across 12 Brazilian states, many boasting a long history and strong market presence. This extensive portfolio includes names like Anhembi Morumbi and São Judas, which command substantial market share in their respective regions.

These mature brands consistently generate robust cash flow for nima Educação. Their established reputation and high participation rates in their markets allow them to operate efficiently and reliably, contributing significantly to the company's overall financial health. For instance, in 2023, nima Educação reported a net revenue of R$6.7 billion, with its high-performing segments, including these established brands, driving profitability.

Nima Educação's extensive network of over 70 physical campuses and their established infrastructure represent significant revenue-generating assets. These facilities, having already received their initial investment, continue to attract a steady stream of students through ongoing maintenance and optimization efforts, firmly positioning them as cash cows.

Operações de Ensino Pós-Aquisição Laureate

The post-acquisition operations of Laureate, fully integrated by 2021, have solidified nima Educação's standing as a dominant force in the Brazilian education sector.

These acquired units, once stabilized, are now mature revenue and EBITDA generators, functioning as nima's cash cows.

For instance, in 2024, these operations are expected to contribute substantially to the company's overall financial performance, demonstrating their reliable cash-generating capabilities.

- Strong Revenue Contribution: The Laureate assets are key drivers of nima's top-line growth.

- EBITDA Generation: These units provide consistent and significant earnings before interest, taxes, depreciation, and amortization.

- Market Consolidation: Their successful integration underpins nima's position as a leading educational group.

- Mature Operations: As mature entities, they require less investment for sustained cash flow, maximizing returns.

Parcerias e Convênios Corporativos

Parcerias e convênios corporativos representam uma estratégia chave para a nima Educação alavancar sua posição como vaca leiteira. Ao firmar acordos com empresas, a instituição pode oferecer programas de educação continuada e benefícios educacionais para funcionários, criando um fluxo de receita previsível e com custos de aquisição de alunos significativamente reduzidos.

Essa abordagem permite que a nima Educação capitalize sobre sua marca já estabelecida e sua infraestrutura educacional para gerar caixa adicional com eficiência. Em 2024, o mercado de educação corporativa no Brasil continuou a demonstrar forte crescimento, impulsionado pela necessidade de requalificação e desenvolvimento de habilidades em um cenário econômico dinâmico.

- Crescimento do Mercado: O setor de educação corporativa no Brasil projetou um crescimento de 8% em 2024, segundo dados da Associação Brasileira de Treinamento e Desenvolvimento (ABTD).

- Redução de Custos: Parcerias corporativas podem diminuir o custo por aluno em até 30% em comparação com estratégias de marketing tradicionais.

- Fidelização e Receita: A oferta de benefícios educacionais fortalece o relacionamento com as empresas, garantindo contratos de longo prazo e receita recorrente.

- Expansão de Portfólio: Empresas buscam cada vez mais soluções educacionais personalizadas, abrindo portas para a nima Educação diversificar sua oferta.

Cash Cows in the BCG Matrix are business units or products that have a high market share in a slow-growing industry. These entities generate more cash than they consume, providing a stable source of funds for the company. nima Educação's traditional in-person undergraduate courses, its established brands like Anhembi Morumbi and São Judas, and the post-acquisition Laureate units all fit this description, consistently contributing to the company's financial stability.

What You See Is What You Get

nima Educação BCG Matrix

The nima Educação BCG Matrix preview you see is the precise, fully formatted document you will receive upon purchase. This means no watermarks or demo content, ensuring you get a professional and ready-to-use strategic planning tool. You can confidently download this exact file, knowing it's designed for immediate application in your business analysis and decision-making processes. It's a complete, uncompromised resource for evaluating your product portfolio and guiding future investments.

Dogs

Some in-person courses, particularly those in oversaturated markets or with declining relevance, are seeing fewer students enroll. This low student attraction translates to a small market share, placing them in the 'dog' category of the BCG matrix. For example, a 2024 survey indicated a 15% year-over-year decline in enrollment for traditional, in-person language courses, a segment facing significant competition from online alternatives.

These 'dog' courses often require more investment to maintain their existence than the revenue they generate. This is a common challenge for educational institutions trying to adapt to evolving student preferences and technological advancements. In 2023, institutions reported that maintaining physical classroom infrastructure for low-enrollment courses represented an average of 8% of their operational budget, with little prospect of future growth.

Campi or educational units struggling with low profitability, often due to local market conditions, intense competition, or high operating costs, can be categorized as 'dogs' within the BCG matrix. These units may not contribute substantially to overall profit, impacting the financial health of the educational institution.

The 'quality revenue' strategy aims to address this by focusing on attracting students who are more likely to complete their programs and generate sustainable revenue, rather than simply increasing enrollment numbers. For instance, a university might analyze its student retention rates by campus; if a particular campus has a significantly lower retention rate and higher cost per student, it could be flagged as a potential 'dog'.

In 2024, some private higher education institutions in Brazil, for example, might be experiencing this challenge. Data from the Brazilian Ministry of Education could reveal specific campuses with enrollment declines and higher operational expenses per student compared to the national average, indicating a need for strategic review.

While Ânima is actively working to decrease student dropout rates, certain programs or courses that consistently show high attrition can be classified as 'dogs' within the BCG Matrix. This persistent high evasion directly translates to lost revenue streams and inefficient deployment of valuable resources for the company.

For instance, if a specific vocational course, perhaps in a niche technical field with evolving job market demands, experienced a 45% dropout rate in 2024, it would strongly indicate its 'dog' status. Such a situation highlights a significant drain on Ânima's financial health and operational effectiveness.

Ofertas Educacionais Desatualizadas

Ofertas educacionais desatualizadas, onde os programas de estudo não acompanham as demandas do mercado de trabalho ou carecem de inovação curricular, representam um desafio significativo. Essa desconexão pode resultar na evasão de alunos e em uma diminuição da participação de mercado, pois os cursos que não se modernizam correm o risco de se tornarem obsoletos rapidamente.

No Brasil, em 2024, a taxa de empregabilidade para recém-formados em cursos considerados tradicionais e com currículos menos adaptáveis tem mostrado sinais de estagnação. Por exemplo, dados preliminares de algumas instituições indicam que a taxa de inserção profissional em áreas específicas caiu cerca de 5% em comparação com o ano anterior.

As consequências dessa desatualização são claras:

- Perda de Alunos: Instituições com currículos desatualizados podem ver uma redução de 10-15% em suas matrículas em cursos específicos.

- Baixa Participação de Mercado: A relevância de programas que não incorporam novas tecnologias ou metodologias de ensino diminui, afetando a competitividade.

- Desalinhamento com o Mercado: Em 2024, a demanda por profissionais com habilidades em inteligência artificial e análise de dados cresceu exponencialmente, enquanto a oferta de cursos que preparam para essas áreas ainda é limitada em algumas universidades.

Investimentos Ineficientes em Tecnologia Antiga

Investimentos ineficientes em tecnologia antiga, muitas vezes chamados de 'dogs' na Matriz BCG da Nima Educação, representam sistemas ou plataformas tecnológicas legadas que demandam altos custos de manutenção. Esses sistemas não oferecem mais diferenciais competitivos significativos no mercado atual. Eles consomem recursos valiosos, como capital e pessoal, sem, contudo, impulsionar o crescimento do negócio ou otimizar a eficiência operacional de maneira relevante.

Em 2024, muitas empresas ainda enfrentam o desafio de gerenciar infraestruturas de TI obsoletas. Um estudo recente indicou que empresas globais gastaram, em média, 70% de seus orçamentos de TI em manutenção de sistemas legados, em vez de inovação. Isso deixa pouco espaço para investimentos em novas tecnologias que poderiam gerar vantagem competitiva.

A Nima Educação destaca que a persistência com essas tecnologias pode levar a:

- Custos de manutenção elevados: Manter sistemas antigos pode ser proibitivamente caro, consumindo uma parcela significativa do orçamento de TI.

- Falta de inovação: Recursos desviados para a manutenção de tecnologia legada impedem investimentos em soluções mais modernas e eficientes.

- Risco de obsolescência: Sistemas desatualizados aumentam a vulnerabilidade a falhas de segurança e a incapacidade de integrar novas funcionalidades.

Courses or educational units categorized as 'Dogs' in the Nima Educação BCG Matrix are those with low market share and low growth potential. These offerings often struggle with declining enrollment and profitability, requiring significant investment for maintenance without generating substantial returns. For example, in 2024, traditional in-person language courses saw a 15% year-over-year enrollment decline, placing them firmly in this category due to competition from online alternatives.

Maintaining these 'dog' offerings can be a drain on resources. In 2023, educational institutions reported that maintaining physical classroom infrastructure for low-enrollment courses consumed an average of 8% of their operational budget, with minimal prospects for future growth. This situation highlights the need for strategic evaluation and potential divestment or restructuring of such programs.

An example of a 'dog' within the Nima Educação framework could be a vocational course with a high dropout rate, such as a niche technical field experiencing evolving job market demands. If such a course had a 45% dropout rate in 2024, it would represent a significant drain on financial health and operational effectiveness, underscoring its 'dog' status.

The strategic response to 'dogs' often involves either revitalization through innovation or divestment. For instance, if a university campus shows lower retention and higher costs per student, it might be a candidate for restructuring or closure, especially if it represents a substantial portion of the 8% operational budget allocated to low-enrollment courses.

| Category | Market Share | Market Growth | Example (Nima Educação) | 2024 Data Point |

|---|---|---|---|---|

| Dogs | Low | Low | Traditional in-person language courses | 15% year-over-year enrollment decline |

| Dogs | Low | Low | Vocational courses with high attrition | 45% dropout rate in specific technical fields |

| Dogs | Low | Low | Outdated educational offerings | 5% drop in graduate employability in less adaptable curricula |

Question Marks

The Distance Learning (EAD) modality in Brazil is a rapidly expanding market, projected to surpass traditional in-person education in terms of student enrollment. Ânima's EAD segment, while showing revenue growth, has grappled with significant student attrition and a slight dip in new enrollments as of Q3 2024. This suggests that while promising, it still needs to solidify its market position to ascend to 'star' status within the BCG matrix.

Ânima Educação is strategically targeting the B2B and corporate education market, a sector estimated at R$ 100 billion. This move signifies a significant expansion beyond its traditional student base, aiming to capture a substantial share of this high-growth opportunity.

While this market presents immense potential, Ânima is currently in the process of establishing its footprint and building market share within this competitive landscape. The company's investment in this area reflects a forward-looking strategy to diversify revenue streams and leverage its educational expertise.

The educational sector is experiencing a significant surge in the adoption of emerging technologies, particularly Artificial Intelligence (AI) and hybrid learning models. These innovations are reshaping how knowledge is delivered and acquired, marking a high-growth trajectory for edtech. For instance, the global AI in education market was valued at approximately $3.7 billion in 2023 and is projected to reach over $25 billion by 2030, showcasing its rapid expansion.

Ânima Educação is actively participating in this innovation wave, investing in new technological solutions to enhance its educational offerings. While Ânima's commitment to innovation is clear, its specific market share and leadership position within these rapidly evolving niches of AI and hybrid learning are still in the formative stages of development. This presents both an opportunity for growth and a challenge to establish a dominant presence.

Expansão Geográfica em Novas Regiões

Expanding into new geographical regions where Ânima currently has a limited presence or brand recognition would be classified as a question mark in the BCG Matrix. These ventures require substantial investment to capture market share in potentially high-growth areas.

For instance, entering a new state or country necessitates significant outlays for marketing, establishing new campuses or partnerships, and adapting educational offerings to local needs. The return on these investments is uncertain, as success depends on market reception and competitive dynamics.

- Market Entry Costs: Significant capital is needed for brand building, regulatory compliance, and infrastructure development in uncharted territories.

- Competitive Landscape: New regions often present established local competitors, requiring strategic differentiation and aggressive market penetration tactics.

- Growth Potential: While risky, these expansions target markets with untapped demand for educational services, offering substantial long-term growth opportunities if successful.

- Investment Uncertainty: The success of these question mark initiatives is not guaranteed, demanding careful analysis and phased investment to mitigate risk.

Programas Recém-Lançados de Alto Potencial

Novos programas educacionais focados em áreas emergentes, como inteligência artificial e energias renováveis, são classificados como question marks na Matriz BCG da nima Educação. Esses cursos recém-lançados em 2024, por exemplo, representam um alto potencial de crescimento, mas ainda precisam demonstrar sua capacidade de atrair e reter alunos em um mercado competitivo.

O investimento em marketing e desenvolvimento para esses programas é crucial para que eles se tornem estrelas no futuro. Por exemplo, um novo curso de cibersegurança lançado em 2024 pode ter um custo de aquisição de aluno mais elevado inicialmente, mas se a demanda por profissionais qualificados continuar a crescer, como projetado em 15% anualmente até 2028, ele tem potencial para se destacar.

A nima Educação está monitorando de perto a taxa de matrícula e a satisfação dos alunos nesses programas para avaliar seu desempenho. A meta é que esses question marks evoluam para estrelas, gerando receita significativa e consolidando a posição da instituição em nichos de mercado de alta demanda.

- Potencial de Crescimento Elevado: Novos programas em tecnologia e sustentabilidade visam capitalizar tendências de mercado futuras.

- Aceitação de Mercado a Comprovar: A capacidade desses cursos de atrair um número expressivo de alunos ainda está em fase de validação.

- Investimento Estratégico: Recursos são direcionados para marketing e aprimoramento para impulsionar a adoção desses programas.

- Monitoramento de Desempenho: Métricas como taxa de matrícula e feedback dos alunos são essenciais para a evolução desses question marks.

New educational programs in emerging fields, such as artificial intelligence and renewable energy, are categorized as question marks within Ânima Educação's BCG Matrix. These recently launched courses in 2024, for instance, hold high growth potential but still need to prove their ability to attract and retain students in a competitive market.

Investment in marketing and development for these programs is crucial for them to become stars in the future. For example, a new cybersecurity course launched in 2024 might have a higher initial student acquisition cost, but if the demand for qualified professionals continues to grow, as projected at 15% annually until 2028, it has the potential to stand out.

Ânima Educação is closely monitoring enrollment rates and student satisfaction in these programs to assess their performance. The goal is for these question marks to evolve into stars, generating significant revenue and solidifying the institution's position in high-demand market niches.

| Question Mark Initiative | Market Potential | Current Status | Investment Focus | Key Metrics |

| AI & Machine Learning Courses (Launched 2024) | High growth, driven by industry demand | Low market share, building brand awareness | Marketing, curriculum development | Enrollment rate, student retention, graduate placement |

| Renewable Energy Programs (Launched 2024) | Growing demand for sustainability expertise | Nascent market presence, initial student intake | Partnerships, specialized faculty recruitment | Student enrollment, industry partnerships, course completion |

| Expansion into New Geographic Regions | Untapped demand in specific states/countries | Limited brand recognition, requires infrastructure investment | Market research, localized marketing, regulatory compliance | Market penetration, student acquisition cost, regional revenue |

BCG Matrix Data Sources

Our Nima Educação BCG Matrix leverages comprehensive data from educational performance metrics, enrollment statistics, and market research reports to offer strategic insights.