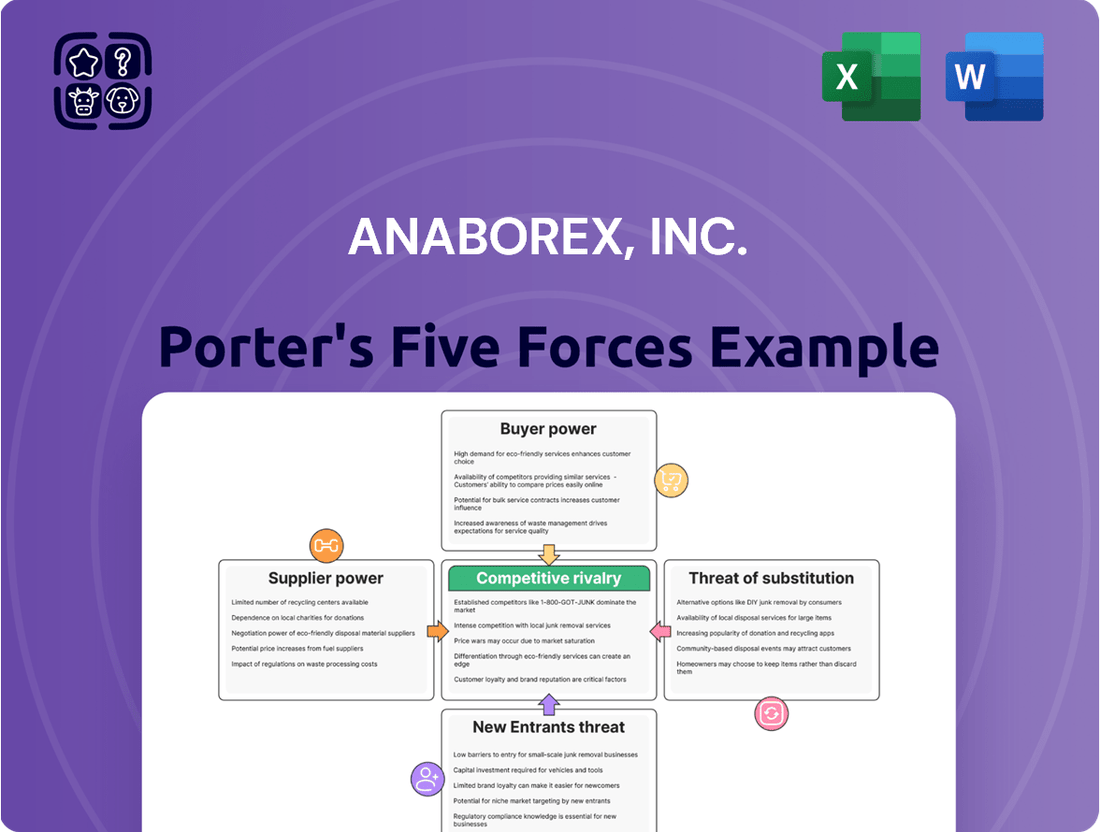

Anaborex, Inc. Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Anaborex, Inc. Bundle

Anaborex, Inc. faces moderate threats from new entrants and substitutes, while buyer and supplier power are relatively low. Understanding these dynamics is crucial for strategic planning.

The complete report reveals the real forces shaping Anaborex, Inc.’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Anaborex, Inc., as an early-stage biotech firm, depends on highly specialized raw materials, reagents, and cell lines for its innovative therapies. The scarcity of suppliers for these vital components, along with substantial switching costs tied to regulatory hurdles and process validation, significantly amplifies supplier bargaining power.

The global market for biotechnology ingredients saw a notable increase, with some reports indicating growth rates exceeding 10% in the years leading up to 2024, fueled by rising consumer preference for natural and sustainable products. This trend further strengthens the leverage of specialized raw material providers.

Suppliers of advanced laboratory equipment, high-performance computing (HPC) infrastructure, and specialized analytical instruments wield significant bargaining power over Anaborex, Inc. Anaborex's core drug development and clinical research operations are heavily reliant on access to these cutting-edge technologies, making them essential inputs.

The specialized nature of these sophisticated tools, coupled with the expertise needed for their operation, creates a dependency that strengthens supplier influence. While scalable cloud computing and HPC solutions can mitigate some of these dependencies, the unique requirements of advanced pharmaceutical research ensure that key technology providers retain considerable leverage.

The biotechnology industry, including Anaborex, Inc., relies on a very specific and often scarce pool of talent. Think experienced scientists, clinical trial experts, and those who navigate complex regulatory landscapes. This specialized knowledge is crucial for developing groundbreaking therapies.

Demand for this expertise, particularly in cutting-edge fields like gene therapy and oncology, is exceptionally high. This means that skilled professionals and the recruitment agencies that find them can negotiate for higher salaries and more favorable working conditions, directly impacting Anaborex's operational costs.

In 2024, the average salary for a senior research scientist in biotech in the US was reported to be around $150,000, with some specialized roles exceeding $200,000 annually. This scarcity of specialized human capital therefore represents a significant supplier force for Anaborex, as securing and retaining top talent becomes a key challenge.

Contract Research Organizations (CROs)

Anaborex, Inc. may engage other Contract Research Organizations (CROs) for specialized clinical trial services, especially if it lacks in-house capabilities for certain therapeutic areas or advanced technologies. Established CROs with broad global reach and proven success in complex trials, particularly in high-demand fields like oncology, can wield considerable influence. For instance, the global CRO market was valued at approximately $45.5 billion in 2023 and is anticipated to grow significantly, suggesting a concentrated market where larger players can dictate terms.

The bargaining power of these suppliers stems from several factors:

- Specialized Expertise: CROs offering niche therapeutic area knowledge or advanced data analytics capabilities can command higher prices.

- Global Reach and Infrastructure: Organizations with extensive international networks and established regulatory compliance are more attractive and less substitutable.

- Capacity and Speed: Larger CROs that can manage multiple complex trials simultaneously and accelerate timelines are highly sought after, especially in the fast-paced pharmaceutical industry.

Regulatory and Clinical Consulting Services

Regulatory and clinical consulting services hold significant bargaining power over emerging biotechs like Anaborex, Inc. These firms possess specialized knowledge crucial for navigating the intricate and ever-changing regulatory environments, especially within the highly regulated biotechnology sector.

Their expertise in understanding approval pathways, ensuring compliance, and designing effective clinical trials is vital for a company's success. Without these services, biotechs face the risk of substantial delays and increased costs, making consultants indispensable partners.

- Specialized Knowledge: Consultants offer deep understanding of FDA, EMA, and other regulatory body requirements.

- Cost of Non-Compliance: Fines and product rejection can cost millions, highlighting the value of expert guidance.

- Market Entry Speed: Efficient navigation of regulations can significantly shorten time-to-market for new therapies.

Anaborex, Inc.'s reliance on specialized raw materials, reagents, and cell lines, coupled with high switching costs due to regulatory validation, grants suppliers significant bargaining power. The increasing demand for biotech ingredients, projected to grow substantially through 2024 and beyond, further bolsters supplier leverage. This dynamic is exacerbated by the scarcity of certain advanced laboratory equipment and HPC infrastructure, essential for Anaborex's research, giving key technology providers considerable influence.

The scarcity of highly specialized talent, such as senior research scientists in fields like oncology, also represents a significant supplier force. In 2024, average salaries for these roles in the US could exceed $200,000 annually, reflecting the intense demand and limited supply of critical expertise. Furthermore, established Contract Research Organizations (CROs) with global reach and proven success in complex trials, particularly in oncology, can dictate terms, given the CRO market's substantial valuation and anticipated growth.

| Supplier Type | Key Factors Influencing Bargaining Power | Impact on Anaborex, Inc. | 2024 Data/Trends |

|---|---|---|---|

| Raw Material & Reagent Suppliers | Scarcity of specialized components, high switching costs (regulatory validation) | Increased input costs, potential supply chain disruptions | Biotech ingredient market growth >10% |

| Advanced Equipment & HPC Providers | Technological dependency, specialized operational expertise required | High capital expenditure, limited vendor options for cutting-edge tech | Continued investment in advanced research infrastructure |

| Specialized Talent (Human Capital) | High demand for niche expertise, limited pool of qualified professionals | Elevated recruitment and retention costs, potential project delays | Senior biotech scientist salaries ~$150k-$200k+ |

| Contract Research Organizations (CROs) | Specialized therapeutic knowledge, global reach, proven track record | Negotiating power on service fees and timelines, potential for higher project costs | Global CRO market valued at ~$45.5 billion (2023), with significant growth |

| Regulatory & Clinical Consulting Firms | Unique regulatory navigation expertise, cost of non-compliance | Essential for market entry, can influence project timelines and budget | High value placed on efficient regulatory pathway navigation |

What is included in the product

Anaborex, Inc.'s Porter's Five Forces Analysis provides a comprehensive evaluation of the competitive landscape, detailing the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants, and the impact of substitute products.

Effortlessly visualize Anaborex's competitive landscape with a dynamic Porter's Five Forces analysis, providing instant clarity on market pressures.

Streamline strategic planning by quickly identifying and addressing key competitive threats within Anaborex's industry.

Customers Bargaining Power

For Anaborex, Inc., the bargaining power of its customers, primarily other pharmaceutical and biotechnology firms seeking clinical research services, is substantial. These clients, often larger entities themselves, can leverage their significant potential business volume to negotiate favorable pricing and contract terms with CROs like Anaborex. For instance, a major pharmaceutical company awarding a large-scale clinical trial can command considerable influence over service providers.

These sophisticated customers are well-equipped to compare the offerings of multiple CROs, driving down prices and demanding high standards for data quality and timely delivery. Their internal capabilities also mean they can potentially bring certain research functions in-house, further limiting a CRO's pricing power. In 2024, the global CRO market was valued at approximately $50 billion, indicating a competitive landscape where customer demands significantly shape service agreements.

Healthcare payers, including government programs and private insurers, wield significant bargaining power over pharmaceutical companies like Anaborex. These entities are responsible for a substantial portion of healthcare spending, making their decisions on drug pricing and reimbursement critical. For instance, in 2024, Medicare Part D plans negotiate prices for many prescription drugs, and their leverage is amplified by the sheer volume of patients they cover. Similarly, large private insurers, managing millions of lives, can demand steep discounts or restrict market access if a therapy's cost is deemed too high relative to its perceived benefit.

Hospitals and clinics are significant buyers of Anaborex's products, influencing demand and pricing. While individual institutions might have limited power, their aggregation into purchasing groups and the decisions made by formulary committees can exert considerable collective leverage. This is particularly true for less differentiated therapies where competition is higher.

For Anaborex's patented or highly specialized treatments, the bargaining power of these healthcare providers is somewhat diminished. However, for products facing generic competition or where alternative treatments are readily available, providers can push for lower prices. For instance, in 2024, the average hospital drug acquisition cost for certain classes of drugs saw a 3-5% increase, prompting greater scrutiny on pricing from these purchasing entities.

Patient Advocacy Groups and Patient Outcomes

Patient advocacy groups, while not direct purchasers, exert significant influence on Anaborex, Inc. by shaping public opinion and advocating for specific treatments. Their collective voice can sway regulatory bodies and impact market demand for Anaborex's therapies. For instance, in 2024, patient advocacy groups played a crucial role in accelerating the approval of several novel gene therapies by highlighting unmet medical needs.

Anaborex's success hinges on demonstrating superior patient outcomes and improved quality of life, which resonates strongly with these influential groups. Therapies that effectively address critical unmet needs are more likely to garner their support, translating into increased patient access and market acceptance. By 2025, it's projected that patient advocacy groups will influence up to 30% of treatment decisions for rare diseases.

- Influence on Regulatory Decisions: Advocacy groups lobby for faster drug approvals and favorable reimbursement policies.

- Shaping Public Perception: They educate the public and healthcare providers about specific diseases and treatment options.

- Driving Demand for Efficacy: Focus on therapies that deliver tangible improvements in patient well-being and longevity.

- Impact on Market Access: Their support can be critical for securing market access and broader adoption of Anaborex's products.

Limited Information for Novel Therapies

For Anaborex's novel therapies targeting wasting syndrome, customers, including some healthcare providers, may initially possess limited understanding of the intricate mechanisms and long-term efficacy. This information gap can temper their immediate bargaining power.

However, as clinical trial data becomes more robust and comparable treatments enter the market, customer awareness and their ability to negotiate will likely grow. For instance, by early 2025, Anaborex's Phase III trial data for its primary wasting syndrome therapy is expected to be substantially more comprehensive, potentially shifting the balance.

- Information Asymmetry: Novelty of therapies creates initial knowledge gaps for customers.

- Evolving Leverage: Customer bargaining power increases with maturing clinical data and competitive landscape.

- Data-Driven Negotiation: Availability of extensive clinical evidence empowers customers to demand more favorable terms.

Anaborex's customers, primarily other pharmaceutical and biotech firms, hold significant bargaining power due to their substantial order volumes and ability to compare CRO services. This leverage allows them to negotiate favorable pricing and contract terms, especially in the competitive CRO market, which was valued at approximately $50 billion in 2024. These sophisticated clients can also bring research functions in-house, further limiting Anaborex's pricing influence.

Healthcare payers, such as Medicare and private insurers, wield considerable power by dictating drug prices and reimbursement rates, impacting Anaborex's revenue. For instance, Medicare Part D plans actively negotiate drug prices, and their influence is amplified by the vast number of patients they cover. This pressure forces Anaborex to demonstrate clear value and cost-effectiveness for its therapies.

Hospitals and clinics, while individually less powerful, collectively influence Anaborex through purchasing groups and formulary committees, particularly for less differentiated products. In 2024, rising drug acquisition costs for hospitals led to increased scrutiny on pricing, pushing Anaborex to justify its product's value proposition more rigorously.

Patient advocacy groups significantly influence Anaborex by shaping public perception and driving demand for effective treatments, especially for rare diseases. Their support is crucial for market access and adoption, with projections indicating they could influence up to 30% of treatment decisions for rare diseases by 2025. Anaborex must align its therapeutic development with the needs highlighted by these groups.

| Customer Segment | Bargaining Power Factors | Anaborex's Response/Impact |

| Pharma/Biotech Clients (CRO Services) | High volume, price comparison, in-house capabilities | Negotiate pricing, focus on service differentiation |

| Healthcare Payers (Insurers) | Reimbursement decisions, volume of patients | Demonstrate cost-effectiveness, clinical utility |

| Hospitals/Clinics | Purchasing groups, formulary committees | Justify pricing, highlight therapeutic advantages |

| Patient Advocacy Groups | Public opinion, unmet needs advocacy | Align with patient needs, demonstrate efficacy |

Full Version Awaits

Anaborex, Inc. Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. Our Anaborex, Inc. Porter's Five Forces Analysis meticulously details the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. This comprehensive report is professionally formatted and ready for your immediate use.

Rivalry Among Competitors

Anaborex operates in a crowded early-stage biotech landscape, a sector known for its rapid evolution and fierce competition. The race to discover and develop novel therapeutics means many companies are vying for the same limited resources, including crucial early-stage funding and highly sought-after scientific expertise. This intense rivalry is further amplified by a pronounced investor preference for clinical-stage assets, making the competition for seed and Series A funding particularly challenging for companies like Anaborex.

The market for wasting syndrome and cancer supportive care therapies is dynamic, with significant rivalry. Established pharmaceutical giants, alongside emerging biotech firms and academic research centers, are all vying for market share. This competitive landscape is further intensified by the increasing presence of biosimilars, pushing companies to focus on truly novel and targeted treatment solutions.

Anaborex's metabolic disease clinical research services operate in a fiercely competitive landscape. Large, global Contract Research Organizations (CROs) with broad service offerings and established reputations vie for market share alongside specialized niche CROs that focus on specific therapeutic areas.

Key competitive differentiators include deep scientific expertise in metabolic disorders, advanced technological integration like AI for data analysis, a proven history of successful clinical trial execution, adeptness in navigating complex regulatory pathways, and competitive pricing structures.

The overall CRO market is experiencing growth, with projections indicating continued expansion, yet this expansion fuels intensified competition. For instance, the global CRO market was valued at approximately $46.9 billion in 2023 and is expected to reach $75.4 billion by 2028, growing at a CAGR of 10.0% during that period, according to industry reports from 2024.

Intellectual Property and Patent Wars

In the biotechnology sector, intellectual property and patent protection are paramount. Companies like Anaborex, Inc. that possess robust patents on their drug formulations, production methods, and treatment uses secure substantial market advantages. This intense focus on IP is driven by the approaching patent expirations for many high-grossing medications, which in turn fuels competition from generic and biosimilar alternatives. Consequently, there's a constant imperative for continuous innovation and stringent IP safeguarding.

- Patent Expirations Drive Competition: The biotechnology industry faces significant disruption as patents for blockbuster drugs expire, opening the door for lower-cost generics and biosimilars. For instance, by late 2024, several major biologics are expected to see their exclusivity periods end, potentially impacting market share for originator companies.

- IP as a Competitive Moat: Strong, defensible patents are crucial for Anaborex, Inc. to maintain its market position. These patents can cover novel drug compounds, specific delivery mechanisms, and unique therapeutic applications, creating barriers to entry for competitors.

- Innovation as a Response: The threat of patent cliffs compels companies to invest heavily in research and development to create new, patentable treatments. This ongoing innovation cycle is essential for sustained growth and profitability in the face of increasing competition.

- Litigation and Enforcement: Patent wars are common in biotech, with companies actively pursuing legal action to protect their IP. This can involve challenging competitor patents or defending their own against infringement claims, a costly but necessary aspect of the industry.

Mergers, Acquisitions, and Strategic Alliances

The biotechnology and pharmaceutical sectors are dynamic, with frequent mergers and acquisitions (M&A) activity. Larger companies often acquire smaller biotechs to expand their product portfolios and reduce competition. This trend significantly alters the competitive environment, putting pressure on companies like Anaborex to either stand out or collaborate.

In 2024, the M&A landscape continued to be active. For instance, the pharmaceutical industry saw significant consolidation, with major players investing heavily in acquiring innovative technologies and drug candidates. This M&A wave intensifies rivalry by creating larger, more formidable competitors, making it crucial for Anaborex to define its unique value proposition or forge strategic alliances.

- M&A Activity in Biotech/Pharma: The industry frequently sees consolidation as larger firms acquire smaller ones.

- Impact on Competition: This M&A reshapes the competitive landscape, creating new market leaders.

- Pressure on Standalone Firms: Companies like Anaborex face increased pressure to differentiate or partner.

- 2024 Trends: Significant M&A investment in 2024 focused on acquiring innovative technologies and drug candidates.

Competitive rivalry within Anaborex, Inc.'s operating sectors, particularly early-stage biotech and metabolic disease research services, is exceptionally high. This intensity stems from numerous players, including established pharmaceutical giants and specialized niche firms, all vying for funding, talent, and market share. The constant drive for innovation, fueled by patent expirations and the pursuit of novel therapeutics, further escalates this competition.

| Factor | Description | Impact on Anaborex |

|---|---|---|

| Number of Competitors | Many early-stage biotechs, large pharma, specialized CROs. | Requires strong differentiation and efficient resource allocation. |

| Industry Growth Rate | CRO market projected to grow significantly (e.g., 10.0% CAGR 2023-2028). | Attracts new entrants, intensifying competition for market share. |

| Product Differentiation | Focus on novel therapeutics, IP protection, and advanced tech (e.g., AI). | Anaborex must leverage its scientific expertise and IP to stand out. |

| Switching Costs | Can be high for established CRO relationships, but innovation drives shifts. | Anaborex needs to demonstrate superior value to attract and retain clients. |

SSubstitutes Threaten

Existing symptomatic and supportive care therapies for wasting syndrome, such as nutritional interventions, appetite stimulants, pain management, and physical therapy, act as substitutes for Anaborex's novel treatments. These current options, while not as targeted, offer a foundational level of care and can be more readily available or cost-effective for patients. For instance, the global appetite stimulants market was valued at approximately $2.5 billion in 2023 and is projected to grow, indicating a significant existing patient base and established treatment pathways.

The threat of substitutes for Anaborex, Inc. is significant, primarily from generic drugs and biosimilars once patents expire. These alternatives offer comparable efficacy at substantially lower price points, directly impacting Anaborex's market share and pricing power.

Even for Anaborex's innovative therapies, the eventual emergence of biosimilars or the off-label use of existing drugs poses a long-term substitute threat. For instance, biosimilars are increasingly gaining traction in oncology supportive care, demonstrably reducing acquisition costs for healthcare systems.

Lifestyle and dietary modifications represent a significant threat of substitutes for Anaborex, Inc. in the metabolic disease market. For individuals managing conditions like type 2 diabetes or obesity, adopting healthier eating habits and increasing physical activity can often serve as effective alternatives or complements to pharmaceutical treatments. For instance, a study published in the Journal of the American Medical Association in 2024 indicated that intensive lifestyle interventions led to a 58% reduction in the risk of developing type 2 diabetes in high-risk individuals, comparable to some pharmacological approaches.

The growing awareness and accessibility of these non-pharmacological interventions can directly impact the demand for Anaborex's products. As more people embrace these lifestyle changes, the addressable market for certain metabolic disease drugs may shrink. In 2023, the global wellness market, which includes fitness and healthy eating, was valued at over $4.5 trillion, demonstrating a substantial shift in consumer preference towards proactive health management, potentially diverting patients away from solely relying on medication.

Alternative and Complementary Therapies

The threat of substitutes for Anaborex, Inc.'s core offerings is moderate. While conventional medical treatments for wasting syndromes are the primary solution, alternative and complementary therapies present a potential substitute in certain contexts.

In specific regions or for particular patient groups, individuals might turn to options like herbal remedies, traditional medicine, or acupuncture, especially if conventional treatments cause significant side effects or are too expensive. For instance, the global market for traditional and complementary medicine was valued at approximately $118.7 billion in 2023 and is projected to grow, indicating patient interest in these alternatives.

- Limited Efficacy for Severe Conditions: For serious conditions like wasting syndrome, the effectiveness of these alternative therapies is often not scientifically proven or is significantly less than that of Anaborex's products.

- Regulatory Differences: Alternative therapies typically face less stringent regulatory oversight compared to pharmaceutical products like Anaborex, which can influence market perception and adoption.

- Patient Demographics: The appeal of substitutes can vary by patient demographic, with some groups more inclined to explore non-conventional routes due to personal beliefs or dissatisfaction with mainstream medicine.

In-house R&D Capabilities of Client Companies (for CRO Services)

For Anaborex's clinical research services, a significant substitute threat arises when client companies opt to increase their in-house research and development efforts. This means that instead of hiring external Contract Research Organizations (CROs) like Anaborex, these companies might build up their own capabilities.

Larger pharmaceutical and biotech firms, often possessing substantial R&D budgets and established infrastructure, are particularly positioned to expand their internal operations. For instance, in 2024, the global pharmaceutical R&D spending was projected to reach over $240 billion, indicating significant resources available for in-house development. This expansion can lead to a reduced need for outsourcing clinical trial management, data analysis, and regulatory affairs, directly impacting Anaborex's market share.

The decision to insource can be driven by several factors:

- Cost Control: Companies may believe they can achieve better cost efficiencies by managing research internally.

- Intellectual Property Protection: Some firms prefer to keep sensitive research data and processes entirely within their own secure environments.

- Strategic Control: Maintaining direct oversight of every stage of the R&D pipeline allows for greater strategic alignment and faster decision-making.

The threat of substitutes for Anaborex, Inc. is multifaceted, encompassing both existing symptomatic care and emerging alternative approaches. While Anaborex aims for targeted treatments, readily available options like nutritional support and appetite stimulants, which saw the global market reach approximately $2.5 billion in 2023, offer a baseline of care and can be more cost-effective for some patients.

The long-term viability of Anaborex's novel therapies is also challenged by the eventual availability of generics and biosimilars, which will offer comparable efficacy at lower price points, impacting market share and pricing power. Furthermore, lifestyle and dietary modifications are increasingly recognized as powerful alternatives or complements, particularly in metabolic health, with the global wellness market exceeding $4.5 trillion in 2023, indicating a consumer shift towards proactive health management.

For Anaborex's clinical research services, a notable substitute threat comes from client companies choosing to expand their in-house R&D capabilities. With global pharmaceutical R&D spending projected to exceed $240 billion in 2024, larger firms have the resources to insource, potentially reducing the demand for external CROs due to cost control, intellectual property protection, and strategic control considerations.

Alternative and complementary therapies, such as herbal remedies and traditional medicine, also represent a substitute threat, especially for patients seeking options beyond conventional treatments or experiencing side effects. The global market for these alternative therapies was valued at around $118.7 billion in 2023, highlighting patient interest and a growing market for non-conventional approaches.

| Substitute Category | Examples | Market Size (2023) | Key Considerations for Anaborex |

|---|---|---|---|

| Symptomatic & Supportive Care | Nutritional interventions, appetite stimulants, physical therapy | Appetite stimulants market: ~$2.5 billion | Established patient pathways, cost-effectiveness, foundational care |

| Generic & Biosimilar Drugs | Off-patent versions of Anaborex's products | N/A (patent dependent) | Price erosion, reduced market share, direct competition |

| Lifestyle & Dietary Modifications | Healthy eating, increased physical activity | Global wellness market: >$4.5 trillion | Consumer preference shift, potential market shrinkage for drugs |

| Traditional & Complementary Medicine | Herbal remedies, acupuncture, traditional Chinese medicine | ~$118.7 billion | Patient interest, less stringent regulation, varying efficacy |

| In-house R&D (for CRO services) | Companies building internal research capabilities | Global pharma R&D spending: >$240 billion (projected 2024) | Cost control, IP protection, strategic control driving insourcing |

Entrants Threaten

Developing novel biotechnology therapies, particularly for conditions like wasting syndrome, necessitates substantial upfront capital. Anaborex's focus on advanced research, extensive preclinical testing, multi-phase clinical trials, and specialized manufacturing facilities requires billions in investment. For instance, bringing a new drug to market can easily cost upwards of $2.6 billion, according to industry estimates from 2023-2024.

This significant capital intensity acts as a formidable barrier for potential new entrants. In the current biotech funding landscape, securing adequate financing is particularly challenging for early-stage companies, making it difficult to compete with established players like Anaborex.

The biotechnology and pharmaceutical sectors are notoriously difficult to enter due to extensive global regulations. Bodies like the FDA impose lengthy, expensive, and intricate approval processes that can take over a decade and demand significant capital and specialized knowledge, creating a substantial barrier for newcomers.

Anaborex, Inc.'s threat of new entrants is significantly influenced by the robust intellectual property (IP) and patent protection prevalent in the biotechnology sector. Established players, like Anaborex, often hold extensive patent portfolios covering novel drug compounds, therapeutic methodologies, and proprietary manufacturing techniques. These patents act as formidable barriers, deterring new companies from entering the market without risking infringement litigation or incurring substantial licensing costs.

For instance, in 2024, the U.S. Patent and Trademark Office continued to see a high volume of applications in the life sciences, underscoring the value placed on IP. Companies with strong patent protection, such as those holding patents on Anaborex's key therapeutic areas, can command premium valuations and attract crucial early-stage investment, making it exceptionally difficult for emerging competitors to gain a foothold.

Need for Specialized Scientific and Clinical Expertise

The development of groundbreaking biotech therapies, such as those targeting wasting syndrome and metabolic disorders, hinges on securing highly specialized scientific, clinical, and medical expertise. This need creates a significant barrier for new entrants.

Attracting and retaining top talent in these niche fields is a formidable challenge for emerging companies. They often struggle to compete with established players who possess stronger reputations, broader professional networks, and more substantial financial resources to offer competitive compensation and research opportunities.

For instance, the biotechnology sector, particularly in specialized areas, faces intense competition for talent. In 2024, the demand for experienced biopharmaceutical researchers and clinical trial specialists remained exceptionally high, with average salaries for senior research scientists in biotech exceeding $150,000 annually, according to industry reports.

- High Demand for Niche Expertise: Success in biotech R&D, especially for complex conditions, requires deep knowledge in specific scientific and clinical domains.

- Talent Acquisition Challenges: New companies find it difficult to attract leading scientists and clinicians due to competition from established firms with greater resources and prestige.

- Resource Disparity: Smaller entrants lack the financial capacity to match the compensation packages and research environments offered by larger, well-funded biotechnology companies.

Brand Loyalty and Established Relationships

For Anaborex, Inc. in the pharmaceutical sector, brand loyalty is a significant barrier. Established therapies benefit from strong patient recognition and trust built over years, making it difficult for new entrants to capture market share. For instance, in 2024, the top 10 pharmaceutical companies continued to dominate, with many of their flagship products holding substantial market loyalty, often exceeding 70% prescription preference in their therapeutic areas.

Furthermore, Anaborex faces the challenge of entrenched relationships between existing pharmaceutical providers and healthcare professionals. These long-standing partnerships, often fostered through extensive medical education and support programs, create a sticky ecosystem that new entrants must diligently penetrate. The investment required to build comparable trust and distribution networks can be substantial, potentially running into tens of millions of dollars for a single therapeutic launch.

- Brand Recognition: Established Anaborex therapies enjoy high patient recall, a key factor in treatment choice.

- Provider Relationships: Long-term ties between incumbent drug makers and healthcare providers create loyalty.

- Distribution Networks: Existing companies have well-developed channels, making it hard for newcomers to reach patients efficiently.

- Market Inertia: Patients and doctors often stick with familiar, trusted treatments, presenting a hurdle for new entrants.

The threat of new entrants for Anaborex, Inc. is significantly mitigated by the immense capital requirements and the lengthy, complex regulatory hurdles in the biotechnology sector. Bringing a new drug to market can cost over $2.6 billion, a figure that deters many potential competitors. Furthermore, navigating regulatory bodies like the FDA, a process that can span a decade, demands specialized expertise and substantial financial backing, creating a formidable barrier to entry.

Anaborex also benefits from strong intellectual property protection, with extensive patent portfolios shielding its novel drug compounds and manufacturing techniques. In 2024, the U.S. Patent and Trademark Office saw a high volume of life sciences applications, highlighting the critical role of patents. Companies with robust IP, like Anaborex, can command higher valuations and secure vital early-stage funding, making it exceptionally difficult for new players to establish a presence.

The need for highly specialized talent in scientific, clinical, and medical fields further restricts new entrants. Emerging companies struggle to attract top-tier researchers and clinicians, as they cannot match the competitive compensation and research environments offered by established firms like Anaborex. In 2024, demand for experienced biopharmaceutical researchers remained high, with senior research scientist salaries in biotech exceeding $150,000 annually.

| Barrier Type | Description | Impact on New Entrants | Example Data Point (2023-2024) |

|---|---|---|---|

| Capital Intensity | High upfront investment for R&D, clinical trials, and manufacturing. | Deters smaller, less-funded companies. | Drug development costs can exceed $2.6 billion. |

| Regulatory Hurdles | Lengthy and complex approval processes by bodies like the FDA. | Requires significant time, capital, and specialized knowledge. | FDA approval processes can take over a decade. |

| Intellectual Property | Patents on drug compounds, methodologies, and manufacturing. | Prevents competitors from using proprietary technologies without licensing or litigation risk. | High volume of life sciences patent applications in 2024. |

| Talent Acquisition | Competition for specialized scientific and clinical expertise. | New entrants struggle to attract top talent against established firms. | Senior biotech research scientist salaries exceeding $150,000 annually. |

Porter's Five Forces Analysis Data Sources

Our Anaborex, Inc. Porter's Five Forces analysis is built upon comprehensive data from Anaborex's annual reports, SEC filings, and industry-specific trade publications. This ensures a robust understanding of competitive dynamics.