Amtech SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Amtech Bundle

Amtech's SWOT analysis reveals a compelling blend of technological innovation and a strong market presence, but also highlights areas ripe for strategic development. Understanding these dynamics is crucial for anyone looking to capitalize on Amtech's trajectory.

Want to truly grasp Amtech's competitive edge and potential challenges? Purchase the full SWOT analysis to unlock a comprehensive, professionally crafted report that provides actionable intelligence for investors, strategists, and business leaders.

Strengths

Amtech Systems boasts a significant global footprint, serving critical industries like semiconductors, advanced packaging, and solar. This international reach is bolstered by its portfolio of highly respected brands, including BTU International, Entrepix, PR Hoffman, and Intersurface Dynamics. These established names signify Amtech's deep market credibility and the trust it has cultivated with customers worldwide, enabling robust competition in niche global markets.

Amtech's strategic emphasis on high-growth semiconductor areas, especially power electronics like Silicon Carbide (SiC) and 300mm silicon horizontal thermal reactors, is a significant strength. The company is a market leader in these specific segments, positioning it to capitalize on surging demand.

This targeted approach directly supports the expanding needs of advanced mobility, including electric vehicles (EVs) and hybrid electric vehicles (HEVs), sectors projected for substantial growth through 2025 and beyond. For instance, the global SiC power semiconductor market was valued at approximately $1.5 billion in 2022 and is anticipated to reach over $10 billion by 2028, with Amtech well-positioned to capture a share of this expansion.

By concentrating its resources and expertise on these lucrative niches, Amtech effectively leverages its core competencies. This allows the company to build a strong foundation for sustained future expansion and market leadership in critical, forward-looking technologies.

Amtech is seeing significant demand for its advanced semiconductor packaging equipment, particularly for systems that enable AI infrastructure. This strong market reception is a key strength for the company.

The company's bookings for these specialized packaging solutions in the second quarter of fiscal year 2025 were impressive, surpassing the entire fiscal year 2024's bookings for the same product line. This surge underscores Amtech's ability to meet the growing needs of the AI sector.

This robust performance demonstrates Amtech's capacity to leverage the ongoing secular trend of AI-driven computing, positioning it favorably in a high-growth market.

Diverse Product and Service Offerings

Amtech's strength lies in its broad spectrum of capital equipment, encompassing automation, coating, and thermal processing systems. This diverse product line, coupled with crucial services and spare parts, caters to multiple facets of customer needs. For instance, in the semiconductor sector, Amtech's offerings support critical fabrication and advanced packaging processes, vital for the industry's continued expansion. This wide array of solutions across semiconductor fabrication, advanced packaging, and solar industries not only aids customer growth but also creates several avenues for revenue generation.

This diversification significantly mitigates Amtech's dependence on any single product or market segment. By serving industries like semiconductors and solar, which experienced robust growth in 2024, Amtech benefits from varied market dynamics. The company's ability to provide end-to-end solutions, from equipment to ongoing support, solidifies customer relationships and fosters recurring revenue streams.

- Diverse Portfolio: Offers automation, coating, and thermal processing systems, plus services and spare parts.

- Multi-Industry Reach: Serves semiconductor fabrication, advanced packaging, and solar sectors.

- Revenue Diversification: Multiple product and service lines reduce reliance on single markets.

- Customer Support: Comprehensive offerings aid customer strategic growth and operational continuity.

Improved Operational Efficiency and Cost Management

Amtech has demonstrated significant improvements in its operational efficiency and cost management. These efforts have yielded approximately $7 million in annualized operating cost reductions in recent quarters.

This disciplined approach to cost optimization has directly contributed to consistent positive adjusted EBITDA and operating cash flow, bolstering the company's financial stability.

- Annualized cost reductions: ~$7 million

- Financial impact: Consistent positive adjusted EBITDA and operating cash flow

- Strategic advantage: Enhanced profitability potential during market recovery

Amtech's strength is rooted in its broad global presence and the strong reputation of its acquired brands, serving vital sectors like semiconductors and solar. This international reach, combined with a focus on high-growth areas such as Silicon Carbide (SiC) power electronics, positions Amtech to benefit from significant market expansion, with the SiC market alone projected to exceed $10 billion by 2028.

The company is also experiencing robust demand for its advanced semiconductor packaging equipment, particularly those supporting AI infrastructure. Bookings for these solutions in Q2 fiscal year 2025 notably surpassed the entire fiscal year 2024's bookings for the same product line, highlighting Amtech's ability to capitalize on the AI trend.

Amtech's diverse capital equipment portfolio, including automation, coating, and thermal processing systems, along with essential services and spare parts, caters to a wide range of customer needs across semiconductor fabrication, advanced packaging, and solar industries. This diversification, evidenced by strong performance in 2024 across these sectors, reduces market dependency and fosters recurring revenue.

Furthermore, Amtech has achieved approximately $7 million in annualized operating cost reductions, enhancing profitability and financial stability through consistent positive adjusted EBITDA and operating cash flow, providing a strategic advantage during market upturns.

| Key Strength | Supporting Data/Fact | Impact |

| Global Footprint & Brand Recognition | Serves semiconductor, advanced packaging, and solar industries with respected brands (BTU, PR Hoffman, etc.). | Deep market credibility and robust competition in niche global markets. |

| Focus on High-Growth Semiconductor Segments | Market leader in SiC and 300mm horizontal thermal reactors; SiC market projected to exceed $10B by 2028. | Capitalizes on surging demand from sectors like electric vehicles. |

| Strong Demand for AI Infrastructure Equipment | Q2 FY2025 bookings for AI packaging solutions exceeded FY2024 full-year bookings for the same line. | Leverages secular AI trend for favorable market positioning. |

| Diverse Capital Equipment & Services | Offers automation, coating, thermal processing, services, and spare parts. | Mitigates reliance on single markets, fosters recurring revenue, and supports customer growth. |

| Operational Efficiency & Cost Management | Achieved ~$7 million in annualized operating cost reductions. | Contributes to consistent positive adjusted EBITDA and operating cash flow, enhancing financial stability. |

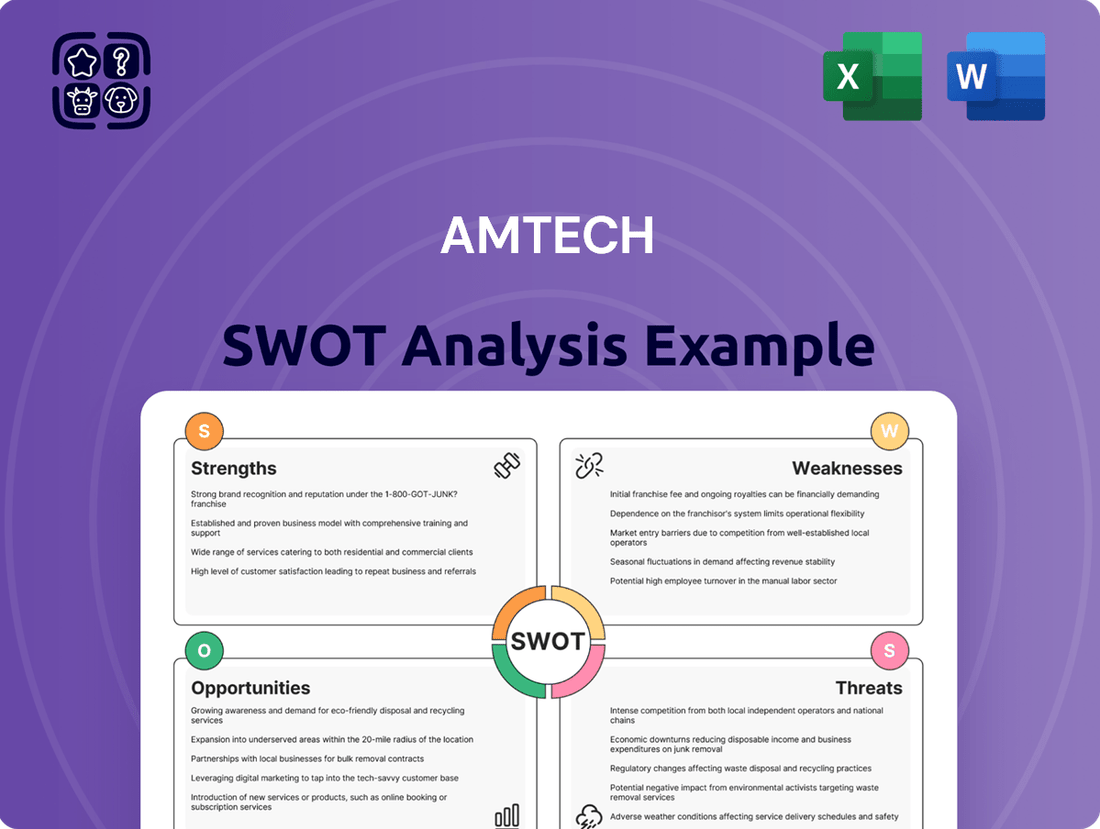

What is included in the product

Delivers a strategic overview of Amtech’s internal and external business factors, identifying key strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable SWOT framework to identify and address strategic weaknesses, transforming potential roadblocks into opportunities.

Weaknesses

Amtech Systems recently experienced a significant revenue miss, failing to meet Wall Street's expectations in its fiscal Q2 2025. Sales for the quarter dropped by a considerable 38.7% compared to the previous year, totaling $15.6 million. This performance indicates a notable slowdown in the company's top-line growth.

Adding to these concerns, Amtech's revenue projections for the upcoming quarter also fell below what analysts had anticipated. This continued shortfall in revenue generation suggests persistent headwinds that are impacting the company's ability to meet market expectations.

Amtech has grappled with a prolonged downturn in the mature node semiconductor market, impacting sales of key equipment such as wafer cleaning, diffusion, and high-temperature furnaces. This sustained market softness led to significant financial repercussions, including non-cash asset impairments and inventory write-downs recorded in the second quarter of fiscal year 2025.

The company's reliance on these cyclical mature markets presents a substantial hurdle for achieving consistent financial performance. For instance, the mature node segment, which historically contributed a significant portion of revenue, experienced a notable contraction in demand throughout 2024 and into early 2025, directly affecting Amtech's top-line results.

Amtech's reliance on the semiconductor equipment sector exposes it to significant industry cyclicality. This means that fluctuations in chip demand directly impact Amtech's sales, leading to less predictable revenue streams. For instance, the semiconductor industry experienced a notable slowdown in early 2023 following a boom in 2021-2022, a trend that would likely continue to influence equipment manufacturers like Amtech throughout 2024.

This inherent cyclicality can create challenges in managing operations and financial performance, as periods of high demand can be abruptly followed by sharp declines. The industry's sensitivity to economic conditions and technological shifts necessitates robust risk management and strategic flexibility to navigate these boom-and-bust cycles effectively.

Impact of Shipping Delays and Disputed Orders

Amtech experienced a significant operational challenge in Q2 FY2025, marked by substantial shipping delays on a disputed order. This disruption directly impacted net revenues, contributing to a sequential decline. Such issues not only affect immediate financial performance but also strain customer goodwill and can lock up valuable working capital.

The financial implications are clear: a disputed order of roughly $4.9 million created a tangible drag on Amtech's top line. Beyond the direct revenue loss, these delays can ripple through the business, affecting inventory management and potentially leading to increased carrying costs or write-downs if not resolved promptly.

- Revenue Impact: Approximately $4.9 million in revenue was deferred or lost due to shipping delays on a disputed order in Q2 FY2025.

- Operational Bottlenecks: Shipping delays highlight potential inefficiencies in Amtech's logistics and order fulfillment processes.

- Financial Forecasting: Such disruptions make accurate financial forecasting more challenging, impacting investor confidence and strategic planning.

- Customer Relations: Extended delays on disputed orders can damage customer satisfaction and loyalty, potentially leading to lost future business.

Relatively Smaller Scale in a Competitive Market

Amtech Systems operates in a fiercely competitive global semiconductor equipment market, where its relatively smaller scale presents a notable challenge. As of September 30, 2024, the company's annual revenue stood at approximately $101 million. This positions Amtech against much larger, well-established competitors who often possess greater financial resources and market leverage.

The company's size, with 405 employees as of September 30, 2023, means it may struggle to match the research and development investments of its larger rivals. This disparity could impact Amtech's ability to innovate and maintain a competitive edge in a rapidly evolving technological landscape.

- Limited R&D Budget: Smaller revenue can translate to a constrained budget for crucial research and development initiatives.

- Market Influence: Amtech's scale may limit its ability to influence market trends or secure large, strategic partnerships.

- Competitive Disadvantage: Larger competitors can leverage their scale for cost efficiencies and broader market penetration.

Amtech's performance is significantly hampered by its exposure to the cyclical mature node semiconductor market, leading to a substantial 38.7% revenue drop in fiscal Q2 2025 to $15.6 million. This reliance on a segment experiencing prolonged softness, as seen in the contraction of demand throughout 2024, directly impacts the company's ability to achieve consistent financial results. Furthermore, operational issues, such as significant shipping delays on a disputed $4.9 million order in Q2 FY2025, highlight potential inefficiencies and create further revenue uncertainty.

| Weakness | Description | Impact |

|---|---|---|

| Market Cyclicality | Heavy reliance on the mature node semiconductor market, which is prone to significant demand fluctuations. | Contributed to a 38.7% revenue decline in Q2 FY2025; makes revenue streams less predictable. |

| Operational Disruptions | Recent shipping delays on a disputed order of approximately $4.9 million in Q2 FY2025. | Directly impacted net revenues and highlights potential logistics inefficiencies. |

| Competitive Scale | Smaller market presence compared to larger, well-resourced competitors in the semiconductor equipment sector. | May limit R&D investment capacity and market influence, creating a competitive disadvantage. |

Preview the Actual Deliverable

Amtech SWOT Analysis

This is the same Amtech SWOT analysis document you'll receive upon purchase, offering a clear and professional overview of the company's strategic position. You can trust that the preview accurately represents the full, detailed report you'll download. No surprises, just the complete, actionable insights you need.

Opportunities

The burgeoning field of Artificial Intelligence (AI) and High-Performance Computing (HPC) is creating a massive appetite for sophisticated semiconductor solutions. This surge translates into a significant opportunity for Amtech, especially with its cutting-edge packaging equipment, which is essential for building the infrastructure that powers AI. The increasing need for AI accelerators and High-Bandwidth Memory (HBM) is a direct pathway to substantial growth for the company.

The global advanced packaging technologies market is set for robust expansion, projected to grow from $7.24 billion in 2024 to $8.16 billion in 2025. This surge is driven by the increasing demand for enhanced performance, smaller device footprints, and better heat dissipation in electronics.

Amtech's strategic focus on advanced packaging solutions places it favorably to capitalize on this market's upward trajectory. The market is expected to reach $14.22 billion by 2029, highlighting substantial long-term opportunities for companies like Amtech that can meet evolving industry needs.

The semiconductor industry is experiencing a significant rebound, with 2024 showing strong growth, particularly in AI and memory segments, a trend anticipated to continue into 2025. This resurgence creates a fertile ground for Amtech’s capital equipment business, as manufacturers ramp up production to meet escalating demand.

Industry forecasts project global sales of semiconductor manufacturing equipment to hit an all-time high of $125.5 billion in 2025, marking a healthy 7.4% increase from the previous year. Such a robust market expansion directly benefits Amtech by increasing the overall demand for its specialized equipment and services.

Growth in Solar PV Manufacturing Equipment Market

The global solar PV manufacturing equipment market is set for substantial expansion, with projections indicating a compound annual growth rate exceeding 23.1% between 2025 and 2034. This robust growth is fueled by a global emphasis on energy security and the widespread implementation of government incentives supporting renewable energy adoption. Furthermore, ongoing advancements in solar technology are leading to more efficient and cost-effective solar solutions, driving demand for sophisticated manufacturing equipment.

Amtech's strategic position within the solar industry allows it to capitalize on these powerful long-term trends favoring renewable energy sources. The company's expertise in manufacturing equipment directly aligns with the escalating need for production capacity to meet the surging demand for solar panels.

- Market Expansion: Global solar PV manufacturing equipment market expected to grow at over 23.1% CAGR from 2025-2034.

- Key Drivers: Increased focus on energy security and supportive government incentives worldwide.

- Technological Advancement: Continuous innovation in high-efficiency solar technologies boosts equipment demand.

- Amtech's Advantage: Company is well-positioned to leverage these growth trends due to its solar industry involvement.

Increasing Adoption of 5G Technology and IoT Devices

The escalating deployment of 5G networks and the surge in Internet of Things (IoT) devices are significant tailwinds for the semiconductor capital equipment sector. This technological shift necessitates the production of more sophisticated and power-efficient semiconductors, directly boosting the demand for Amtech’s specialized manufacturing solutions.

This ongoing evolution presents a robust, long-term growth opportunity for Amtech, as the underlying demand for advanced chip manufacturing capabilities is expected to remain strong through 2025 and beyond. For instance, the global IoT market size was valued at approximately USD 1.1 trillion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of around 18% from 2024 to 2030, according to various market research reports. This expansion fuels the need for new and upgraded semiconductor fabrication equipment.

- 5G Expansion: The continued rollout of 5G infrastructure requires advanced chipsets, driving demand for wafer fabrication equipment.

- IoT Growth: Proliferation of connected devices across industries, from smart homes to industrial automation, necessitates increased semiconductor production.

- Advanced Chip Demand: 5G and IoT applications demand higher performance and lower power consumption chips, pushing innovation in semiconductor manufacturing technology.

- Market Projections: The semiconductor capital equipment market is anticipated to see sustained growth, with analysts projecting significant increases in capital expenditure by leading foundries and integrated device manufacturers (IDMs) in the 2024-2025 period to meet this demand.

Amtech is well-positioned to benefit from the increasing demand for advanced semiconductor packaging, driven by AI and HPC applications. The global advanced packaging market is projected for significant growth, expected to reach $14.22 billion by 2029, with a substantial portion of this expansion anticipated in the 2024-2025 period.

The company also stands to gain from the robust expansion of the semiconductor manufacturing equipment market, which is forecasted to hit a record $125.5 billion in 2025, a 7.4% increase year-over-year. This surge is largely attributed to increased production needs for AI and memory chips.

Furthermore, Amtech's involvement in the solar manufacturing equipment sector presents a considerable opportunity, with that market expected to grow at over 23.1% CAGR between 2025 and 2034, fueled by energy security concerns and government incentives.

The ongoing global rollout of 5G networks and the expansion of the Internet of Things (IoT) ecosystem also create sustained demand for Amtech's specialized semiconductor manufacturing solutions, as the IoT market is projected to grow at a CAGR of around 18% from 2024 to 2030.

| Opportunity Area | 2024 Projection | 2025 Projection | Key Drivers |

| Advanced Packaging Market | $7.24 Billion | $8.16 Billion | AI/HPC demand, performance needs |

| Semiconductor Mfg. Equip. | $116.8 Billion (est.) | $125.5 Billion | AI, memory production ramp-up |

| Solar PV Mfg. Equipment | N/A (CAGR 23.1% from 2025) | N/A | Energy security, govt. incentives |

| 5G/IoT Semiconductor Demand | Strong growth | Continued strong growth | 5G rollout, IoT device proliferation |

Threats

Ongoing geopolitical tensions, especially the prolonged US-China trade conflict, directly threaten the semiconductor supply chain, a critical area for Amtech. These trade disputes can lead to export restrictions on essential materials and advanced chipmaking equipment, potentially creating significant bottlenecks and driving up Amtech's operational expenses. For instance, in 2023, the US government's expanded export controls on advanced semiconductor technology to China impacted global supply dynamics, highlighting the real-world risk of such conflicts.

Despite some improvements, the global semiconductor supply chain remains fragile. Factors such as high infrastructure investment needs, the lingering threat of natural disasters, and a persistent lack of skilled labor continue to create vulnerabilities.

Industry analysts are projecting potential shortages in the supply of chips manufactured using mature node technologies by late 2025 or into 2026. This scenario poses a direct risk to Amtech, potentially hindering its access to essential components and its capacity to fulfill orders for its equipment.

The consequences of these persistent vulnerabilities could manifest as significant production delays for Amtech. Furthermore, these disruptions are likely to drive up the cost of sourcing necessary components, impacting overall profitability and operational efficiency.

Amtech faces a fiercely competitive environment, with a multitude of domestic and international rivals, including larger, more established companies. This intense rivalry often translates into significant pricing pressures and can erode market share, demanding constant innovation to stay ahead. For instance, in the semiconductor industry where Amtech operates, major players like Intel and TSMC consistently invest billions in R&D, creating a challenging benchmark for smaller firms.

Economic Volatility and Cyclical Downturns

The semiconductor industry, including companies like Amtech, is deeply intertwined with broader economic trends. A significant economic slowdown or recessionary pressures can directly impact consumer spending and business investment, leading to reduced demand for the end products that rely on semiconductors. For instance, a downturn in the automotive sector, a key market for many chip manufacturers, could translate into fewer orders for specialized semiconductor equipment.

This sensitivity to economic cycles means that Amtech's revenue and profitability can fluctuate considerably. During periods of economic expansion, demand for advanced electronics surges, benefiting equipment suppliers. Conversely, during economic downturns, capital expenditures by semiconductor manufacturers often contract, directly affecting Amtech's order volumes. For example, the global semiconductor market experienced a notable slowdown in 2023 following a boom in 2021-2022, impacting many players in the supply chain.

- Cyclical Sensitivity: The semiconductor equipment sector is inherently cyclical, mirroring global economic health and demand for electronics.

- Demand Slowdown Impact: A contraction in consumer electronics or automotive markets can significantly reduce capital spending by chipmakers, directly affecting Amtech's sales.

- Revenue Volatility: Economic downturns can lead to lower equipment orders, impacting Amtech's revenue streams and profitability.

- 2023 Market Trends: The semiconductor industry saw a market contraction in 2023, highlighting the vulnerability to economic headwinds.

Rapid Technological Obsolescence and R&D Pressure

The semiconductor industry is a relentless race, and Amtech faces the threat of rapid technological obsolescence. Keeping up means constant, significant investment in research and development to stay ahead of advancements in areas like next-generation transistor designs and novel materials. For instance, the push towards sub-3nm process nodes by leading foundries in 2024/2025 necessitates entirely new metrology and lithography solutions, demanding substantial R&D expenditure from equipment providers like Amtech. Failure to innovate swiftly risks making current Amtech offerings outdated, directly impacting market share and revenue streams.

This pressure translates into a critical need for Amtech to allocate a substantial portion of its capital to R&D. Industry reports indicate that leading semiconductor equipment manufacturers reinvested between 15-20% of their revenue back into R&D in 2023, a trend expected to continue or even increase through 2025 to address these evolving demands. Amtech's ability to adapt its equipment and processes to these emerging technologies is paramount. The threat is clear: if Amtech cannot match the pace of innovation, its competitive edge will diminish rapidly.

- Technological Pace: The semiconductor industry sees new process nodes and architectures emerge every 18-24 months.

- R&D Investment: Leading equipment firms are expected to maintain R&D spending at 15-20% of revenue in 2024-2025.

- Obsolescence Risk: Failure to develop equipment for advanced nodes (e.g., sub-3nm) can lead to significant market share loss.

- Materials Innovation: New materials like advanced dielectrics and high-mobility channels require specialized metrology and processing tools.

Amtech faces significant threats from escalating geopolitical instability, particularly the ongoing US-China trade friction which directly impacts the semiconductor supply chain. These tensions can lead to export restrictions on crucial materials and equipment, creating supply bottlenecks and increasing operational costs. Furthermore, the semiconductor industry's inherent cyclicality means Amtech is vulnerable to economic downturns, which can sharply reduce demand for its equipment as chipmakers cut capital expenditures. For instance, the semiconductor market experienced a contraction in 2023, highlighting this sensitivity.

The rapid pace of technological advancement in semiconductors presents a constant threat of obsolescence for Amtech's products. Keeping pace requires substantial and continuous investment in research and development to support emerging technologies like sub-3nm process nodes. Leading companies in this sector are expected to maintain R&D spending at 15-20% of revenue through 2024-2025 to address these demands, a significant financial commitment that Amtech must match to remain competitive.

| Threat Category | Specific Threat | Impact on Amtech | Example/Data Point (2023-2025) |

|---|---|---|---|

| Geopolitical Instability | US-China Trade Tensions | Supply chain disruptions, increased costs | US export controls impacting global supply dynamics (2023) |

| Economic Cycles | Global Economic Slowdown | Reduced demand for chipmaking equipment | Semiconductor market contraction in 2023 |

| Technological Obsolescence | Rapid Advancements (e.g., sub-3nm nodes) | Risk of product becoming outdated, loss of market share | Leading firms investing 15-20% of revenue in R&D (2024-2025) |

SWOT Analysis Data Sources

This Amtech SWOT analysis is built upon a robust foundation of data, drawing from Amtech's official financial statements, comprehensive market research reports, and expert industry analyses to ensure a thorough and accurate strategic assessment.