Amgen Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Amgen Bundle

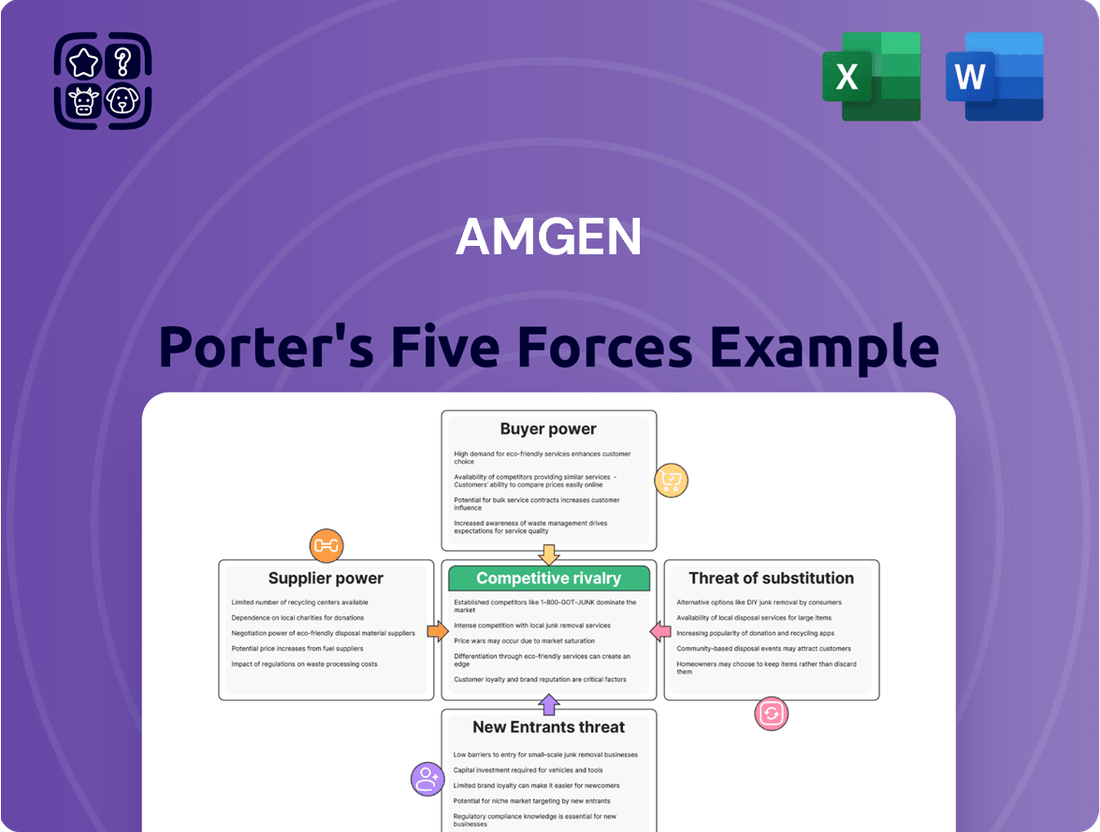

Amgen navigates a complex pharmaceutical landscape, where intense rivalry and the threat of substitutes significantly shape its competitive environment. Understanding these dynamics is crucial for any stakeholder looking to grasp Amgen's strategic positioning.

The complete report reveals the real forces shaping Amgen’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Amgen's reliance on highly specialized raw materials and active pharmaceutical ingredients (APIs) for its innovative biologic medicines significantly bolsters supplier bargaining power. The limited pool of specialized suppliers for these unique components means they can command higher prices, directly impacting Amgen's production costs.

In 2024, the cost of these critical APIs was a notable driver of Amgen's Cost of Goods Sold (COGS), highlighting the substantial influence these suppliers wield over Amgen's financial performance.

The biopharmaceutical sector frequently sees a limited number of suppliers for crucial components, which can significantly impact Amgen. When a few dominant suppliers control the market for essential raw materials, they gain considerable leverage to dictate prices. This concentration means Amgen has fewer alternatives, potentially leading to higher input costs.

In 2024, this supplier concentration was evident as certain critical raw material costs rose by an average of 5% to 7%. This increase directly affected the cost of goods sold for many biopharmaceutical companies, including Amgen, squeezing profit margins and necessitating careful cost management strategies.

Switching suppliers within the biopharmaceutical sector presents significant hurdles for companies like Amgen. The stringent regulatory landscape, coupled with the meticulous validation processes required for any change, means that shifting to a new supplier isn't a simple transaction. This complexity directly translates into high switching costs.

These elevated switching costs empower suppliers by reducing Amgen's ability to negotiate favorable terms or easily move to alternatives. For instance, the time and resources invested in qualifying a new raw material supplier, ensuring its consistency meets FDA standards, can easily run into millions of dollars and take many months, if not years. This inertia makes it challenging for Amgen to exit unfavorable supplier relationships, thereby increasing the bargaining power of those suppliers.

Proprietary Technologies

Suppliers holding proprietary technologies or crucial intellectual property for Amgen's production processes significantly bolster their bargaining power. This unique ownership means Amgen may face limited alternatives for these specialized technological inputs, granting suppliers leverage.

This reliance on exclusive technologies can translate into higher costs for essential components, directly impacting Amgen's operational expenses. For instance, if a key biologic manufacturing process relies on a patented enzyme or cell line, the supplier of that technology can command premium pricing.

- Proprietary Technology Advantage: Suppliers with exclusive patents or unique manufacturing know-how create dependency for Amgen.

- Limited Alternatives: The scarcity of comparable technologies restricts Amgen's ability to switch suppliers, enhancing supplier leverage.

- Cost Implications: This exclusivity can lead to premium pricing for critical inputs, impacting Amgen's cost of goods sold.

Global Supply Chain Diversification

Amgen's robust global supply chain, which operates in over 100 countries, significantly dilutes supplier bargaining power. With substantial sourcing operations in key regions like Europe and Asia, Amgen can leverage geographical diversity to its advantage.

This extensive network allows Amgen to source critical inputs from multiple vendors, preventing any single supplier from dictating terms. For example, in 2024, Amgen's strategic partnerships with contract manufacturing organizations (CMOs) across different continents provided flexibility and competitive pricing for active pharmaceutical ingredients (APIs).

- Global Reach: Operations in over 100 countries, with significant sourcing in Europe and Asia.

- Supplier Diversification: Maintaining multiple suppliers for essential raw materials and components.

- Negotiation Leverage: Ability to secure better pricing and terms due to a diversified supplier base.

- Cost Structure Enhancement: Improved cost efficiency through competitive sourcing strategies.

Suppliers of highly specialized raw materials and active pharmaceutical ingredients (APIs) hold significant bargaining power over Amgen due to the limited pool of qualified providers. This scarcity allows these suppliers to command premium prices, directly impacting Amgen's cost of goods sold. In 2024, the cost of certain critical APIs saw an increase of 5% to 7%, underscoring the leverage these suppliers possess.

The intricate regulatory environment and rigorous validation processes required for supplier changes in the biopharmaceutical sector create substantial switching costs for Amgen. These high barriers, often involving millions of dollars and extended timelines for qualification, effectively lock Amgen into existing supplier relationships, further empowering them.

Suppliers possessing proprietary technologies or unique intellectual property crucial for Amgen's manufacturing processes also wield considerable influence. This exclusivity limits Amgen's alternatives, enabling these suppliers to charge higher prices for essential components, as seen with patented enzymes or cell lines critical for biologic production.

| Factor | Impact on Amgen | 2024 Data/Example |

| Supplier Concentration | High bargaining power due to limited qualified suppliers for specialized APIs. | 5-7% increase in critical API costs impacting COGS. |

| Switching Costs | High due to regulatory hurdles and validation processes, limiting Amgen's flexibility. | Millions of dollars and months/years to qualify new suppliers. |

| Proprietary Technology | Suppliers with exclusive patents or manufacturing know-how gain leverage. | Premium pricing for patented enzymes or cell lines used in biologics. |

What is included in the product

This analysis delves into the competitive landscape for Amgen, examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitute products on Amgen's market position and profitability.

Quickly identify and mitigate competitive threats by visualizing Amgen's Bargaining Power of Buyers and Suppliers with an intuitive force diagram.

Customers Bargaining Power

Healthcare payers, such as insurance providers and government programs, possess substantial leverage over pharmaceutical companies like Amgen. They actively negotiate drug prices and reimbursement terms, which directly influences Amgen's financial performance. For instance, in 2024, payers continued to exert pressure on drug costs, with pricing and market access remaining critical concerns for the life sciences sector heading into 2025.

The increasing availability of biosimilars and generic drugs significantly boosts customer bargaining power. As patents on Amgen's blockbuster drugs expire, more affordable alternatives flood the market, compelling Amgen to adopt more aggressive pricing strategies to maintain its market share and profitability.

For example, biosimilars for Amgen's key products like Prolia and Xgeva are anticipated to enter the market around May 2025. This imminent competition is projected to lead to substantial sales erosion for these established treatments, highlighting the direct impact of generic and biosimilar entry on Amgen's revenue streams.

Customers, especially healthcare providers and insurers, are acutely aware of costs, making them highly price-sensitive. This sensitivity is amplified by reimbursement policies and growing pressure to control drug spending, pushing buyers to negotiate lower prices or explore cheaper options, which directly impacts Amgen's profitability.

The increasing demand for cost-effective treatments is evident in the biosimilar market, which saw an estimated 20% growth in 2024. This trend highlights a significant customer shift towards more affordable alternatives, directly challenging Amgen's pricing power and market share.

High Switching Costs (for patients/providers)

High switching costs significantly bolster Amgen's bargaining power with its customers, particularly patients and healthcare providers. Once a patient is established on an Amgen therapy and experiencing positive outcomes, the inertia to switch becomes substantial. This is driven by the need to re-establish treatment efficacy and manage potential patient discomfort or adverse reactions associated with a new medication. For healthcare providers, changing a patient's established treatment regimen involves administrative effort and a risk assessment, further cementing loyalty to existing, effective therapies.

These high switching costs translate into reduced price sensitivity for certain Amgen products. For example, in 2024, the market for biologics, where Amgen is a major player, continued to see patients and providers prioritize efficacy and established treatment pathways over minor price differences. This is particularly true for chronic conditions where treatment stability is paramount. The investment in clinical trials and regulatory approvals for these specialized drugs also contributes to the difficulty and cost of developing direct competitors that can easily displace Amgen's offerings.

- High Switching Costs: Patients and providers face significant hurdles when switching from an established Amgen medication, often due to the need to re-validate treatment effectiveness and manage patient tolerance.

- Treatment Protocol Inertia: Established treatment protocols and the potential for patient discomfort with new therapies create a strong disincentive to switch, even if lower-cost alternatives emerge.

- Reduced Price Sensitivity: The focus on efficacy and treatment continuity in areas like chronic disease management means that some customer segments are less responsive to price competition for Amgen's successful therapies.

Information Access and Patient Advocacy

Patients and healthcare providers are increasingly well-informed about treatment alternatives and costs, which can amplify their ability to negotiate. For instance, by July 2025, a significant portion of patients are expected to utilize online resources for drug comparisons and reviews, directly impacting their purchasing decisions.

Patient advocacy organizations play a crucial role in shaping medication accessibility and pricing policies. These groups often lobby for lower drug costs and wider availability, exerting considerable pressure on pharmaceutical giants like Amgen to maintain competitive pricing and expand patient access to their innovative therapies.

- Informed Decision-Making: Patients accessing detailed information on treatment efficacy and cost comparisons can leverage this knowledge in discussions with providers and manufacturers.

- Advocacy Influence: Patient advocacy groups have successfully influenced legislation and corporate policies, leading to more favorable pricing and access terms for critical medications.

- Market Transparency: Greater transparency in drug pricing, driven by public demand and regulatory scrutiny, empowers customers by revealing cost variations and potential savings.

- Competitive Pressure: As patients become more aware of alternatives, Amgen faces increased pressure to demonstrate the value and affordability of its products compared to competitors.

Healthcare payers, such as insurance providers and government programs, possess substantial leverage over pharmaceutical companies like Amgen. They actively negotiate drug prices and reimbursement terms, which directly influences Amgen's financial performance. For instance, in 2024, payers continued to exert pressure on drug costs, with pricing and market access remaining critical concerns for the life sciences sector heading into 2025.

The increasing availability of biosimilars and generic drugs significantly boosts customer bargaining power. As patents on Amgen's blockbuster drugs expire, more affordable alternatives flood the market, compelling Amgen to adopt more aggressive pricing strategies to maintain its market share and profitability.

For example, biosimilars for Amgen's key products like Prolia and Xgeva are anticipated to enter the market around May 2025. This imminent competition is projected to lead to substantial sales erosion for these established treatments, highlighting the direct impact of generic and biosimilar entry on Amgen's revenue streams.

Customers, especially healthcare providers and insurers, are acutely aware of costs, making them highly price-sensitive. This sensitivity is amplified by reimbursement policies and growing pressure to control drug spending, pushing buyers to negotiate lower prices or explore cheaper options, which directly impacts Amgen's profitability.

The increasing demand for cost-effective treatments is evident in the biosimilar market, which saw an estimated 20% growth in 2024. This trend highlights a significant customer shift towards more affordable alternatives, directly challenging Amgen's pricing power and market share.

Patients and healthcare providers are increasingly well-informed about treatment alternatives and costs, which can amplify their ability to negotiate. For instance, by July 2025, a significant portion of patients are expected to utilize online resources for drug comparisons and reviews, directly impacting their purchasing decisions.

Patient advocacy organizations play a crucial role in shaping medication accessibility and pricing policies. These groups often lobby for lower drug costs and wider availability, exerting considerable pressure on pharmaceutical giants like Amgen to maintain competitive pricing and expand patient access to their innovative therapies.

| Factor | Impact on Amgen | 2024/2025 Trend |

| Payer Negotiation Power | Significant leverage on drug pricing and reimbursement. | Continued pressure on drug costs, critical for life sciences. |

| Biosimilar/Generic Entry | Erosion of market share and revenue for established drugs. | Anticipated biosimilar entry for Prolia/Xgeva around May 2025. |

| Price Sensitivity | Customers seek cost-effective treatments, driving price negotiations. | Biosimilar market growth estimated at 20% in 2024. |

| Information Availability | Empowers customers to compare prices and demand better terms. | Increased patient use of online drug comparison resources by July 2025. |

| Patient Advocacy | Influences pricing policies and market access for medications. | Ongoing lobbying for lower drug costs and wider availability. |

Preview Before You Purchase

Amgen Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. You're looking at the actual Amgen Porter's Five Forces Analysis, which meticulously details the competitive landscape of the biotechnology giant. Once you complete your purchase, you’ll get instant access to this exact file, providing comprehensive insights into Amgen's industry dynamics.

Rivalry Among Competitors

Amgen faces formidable competition from established biopharma giants like Roche, Novartis, Pfizer, Merck, Gilead Sciences, Sanofi, and AstraZeneca. These companies boast extensive product portfolios, deep research and development pipelines, and substantial financial resources dedicated to innovation. For instance, in 2024, major pharmaceutical companies continued to invest heavily in R&D, with many reporting R&D expenditures in the billions of dollars, underscoring the high stakes and intense rivalry.

The expiration of patents on key Amgen drugs significantly intensifies competitive rivalry. For instance, biosimilars for blockbuster treatments like Prolia, Enbrel, Xgeva, and Repatha are projected to enter the market around 2025, directly threatening Amgen's revenue streams.

This impending patent cliff means Amgen faces substantial financial risk as lower-cost biosimilar and generic alternatives become available. The entry of these competitors will inevitably lead to intensified price wars and a subsequent erosion of Amgen's market share for these vital medications.

The biopharmaceutical sector thrives on a relentless pursuit of innovation, compelling companies to pour significant resources into research and development. This intense R&D investment is crucial for discovering and bringing to market groundbreaking new treatments, which directly impacts a company's ability to compete and maintain market share.

In 2024, Amgen demonstrated this commitment by investing a substantial $6.0 billion in R&D. This record-breaking expenditure underscores the fierce competition to develop first-in-class or best-in-class medicines, a critical strategy for securing a lasting competitive advantage in the dynamic biopharma landscape.

Strategic Acquisitions and Partnerships

Companies actively pursue mergers, acquisitions, and strategic partnerships to broaden their product offerings, gain access to cutting-edge technologies, and extend their market presence.

Amgen's significant acquisition of Horizon Therapeutics in late 2023, a deal valued at approximately $27.8 billion, exemplifies this trend, aiming to bolster its standing in the rare disease sector and reshape the competitive landscape.

The pharmaceutical industry anticipates a surge in M&A activity throughout 2025 as companies proactively seek to mitigate the impact of upcoming patent expirations.

Key strategic moves in 2024 include:

- Amgen's acquisition of Horizon Therapeutics for $27.8 billion, enhancing its rare disease portfolio.

- Increased collaboration in gene therapy and biologics research to leverage specialized expertise.

- Partnerships focused on developing AI-driven drug discovery platforms to accelerate R&D.

- Consolidation within the biotech sector to achieve economies of scale and market share.

Therapeutic Area Overlap and Pricing Pressures

Amgen faces heightened competitive rivalry due to significant therapeutic area overlap, particularly in lucrative fields like oncology and immunology. This convergence means multiple biopharma firms are developing drugs targeting similar biological pathways, intensifying direct competition.

This intense competition, even before the advent of generics or biosimilars, can exert considerable downward pressure on pricing. For instance, in 2024, the oncology market, a key focus for Amgen, saw increased competition with several new entrants and pipeline advancements, potentially impacting pricing power for established therapies.

- Therapeutic Area Focus: Biopharma companies, including Amgen, concentrate on high-demand areas like oncology and immunology, leading to a crowded competitive landscape.

- Asset Overlap: The development of drugs targeting similar biological pathways by multiple companies intensifies rivalry.

- Pricing Pressure: This overlap can force price reductions, impacting market share and profit margins for all players.

- 2024 Market Dynamics: The oncology sector, a significant area for Amgen, experienced notable competitive pressures in 2024 due to new drug approvals and pipeline progress.

Amgen's competitive rivalry is intense, fueled by deep-pocketed, established biopharma giants like Roche and Pfizer, who are also heavily invested in R&D, with many reporting billions in 2024 expenditures. The impending patent expirations on Amgen's key drugs, such as Prolia and Enbrel, are a major concern, as biosimilar competitors are expected to enter the market around 2025, directly threatening revenue. This situation intensifies price wars and market share erosion for Amgen's vital medications.

The industry's relentless pursuit of innovation necessitates significant R&D investment, with Amgen itself investing $6.0 billion in 2024 to stay ahead. Strategic M&A, like Amgen's $27.8 billion acquisition of Horizon Therapeutics in late 2023, is a key tactic to bolster portfolios and market presence, a trend expected to continue through 2025. Overlap in therapeutic areas, particularly oncology and immunology, further heightens competition, as multiple companies target similar pathways, leading to pricing pressures even before generic entry.

| Key Competitors | 2024 R&D Focus Areas | Impact on Amgen |

|---|---|---|

| Roche | Oncology, Immunology, Neuroscience | Direct competition in key therapeutic areas, pipeline overlap |

| Pfizer | Oncology, Vaccines, Inflammation & Immunology | Patent expirations, biosimilar threats, market share competition |

| Merck | Oncology, Vaccines, Hospital Acute Care | Intensified rivalry in oncology, strategic partnerships |

| Gilead Sciences | Oncology, Virology, Inflammation | Competition in oncology and immunology, potential M&A targets |

SSubstitutes Threaten

The most significant threat of substitution for Amgen stems from biosimilars and generic versions of its biologic and small-molecule drugs. As patents expire, these more affordable alternatives, engineered to be highly similar to Amgen's offerings, directly challenge for market share and apply substantial downward pressure on pricing. For instance, biosimilars for Amgen's key drugs Prolia and Xgeva are anticipated to enter the market in May 2025, directly impacting Amgen's revenue streams for these products.

New drugs with different mechanisms of action, even for the same disease, can be potent substitutes for Amgen's products. For example, if Amgen has a successful drug for a specific cancer, a new therapy that targets a completely different pathway in cancer cell growth could draw patients away.

Emerging therapies are a significant threat. Treatments like CAR-T cell therapy, advanced targeted drugs, gene therapies, and precision medicine offer entirely new ways to treat conditions, potentially making Amgen's existing biologics or small molecules less competitive. The global gene therapy market is projected for substantial expansion, with estimates suggesting it could reach over $15 billion by 2026, indicating a strong shift towards these novel approaches.

Non-pharmaceutical interventions, including surgical procedures and medical devices, present a significant threat of substitutes for Amgen's drug therapies. For instance, the global surgical devices market was valued at around $130 billion in 2024, indicating a substantial alternative for treating various conditions.

Lifestyle modifications such as diet and exercise can also reduce the need for certain medications, directly impacting demand for Amgen's products. The effectiveness and patient preference for these non-drug alternatives are key factors that can sway market share away from pharmaceutical solutions.

'Me-Too' Drugs with Improved Profiles

Competitors frequently launch 'me-too' drugs that offer incremental advantages over Amgen's existing therapies. These can include enhanced efficacy, better safety profiles, or more convenient administration, such as less frequent dosing. Such developments can siphon market share by appealing to both patients and prescribing physicians seeking marginal improvements.

For instance, in the competitive landscape of cholesterol management, while Amgen has established products, new entrants have introduced PCSK9 inhibitors with slightly different efficacy curves or injection frequencies. This creates a challenge for Amgen to maintain its market position without continuous innovation or strong value propositions.

- Incremental Innovation: Competitors can develop drugs with minor but meaningful improvements in patient outcomes or convenience.

- Market Share Erosion: These 'me-too' products can gradually capture market share from established Amgen drugs.

- Pricing Pressure: The presence of slightly better alternatives can put pressure on Amgen's pricing strategies.

- R&D Focus: Amgen must continually invest in research and development to stay ahead of such competitive threats.

Advancements in Disease Prevention and Diagnostics

Breakthroughs in disease prevention, such as novel vaccine technologies and enhanced public health campaigns, pose a significant threat. For instance, advancements in mRNA vaccine platforms, which saw rapid development in the early 2020s, could lead to more effective preventative measures against a wider range of diseases. This reduces the overall patient pool requiring Amgen's therapeutic treatments.

Similarly, improvements in early diagnostic tools, including sophisticated genetic screening and advanced imaging techniques, can identify predispositions or early stages of diseases, potentially leading to non-pharmacological interventions or lifestyle changes. By 2024, the global diagnostics market was projected to reach over $100 billion, highlighting the increasing reliance on and innovation in this sector. Such early detection can diminish the need for long-term pharmaceutical treatments, impacting the demand for Amgen's existing drug portfolio.

- Reduced Incidence: Effective preventative measures can lower the number of patients who develop chronic conditions.

- Shift to Non-Pharmacological Solutions: Early diagnostics may favor lifestyle or procedural interventions over drug-based therapies.

- Market Erosion: A smaller patient population requiring treatment directly translates to a smaller addressable market for Amgen's drugs.

The threat of substitutes for Amgen is substantial, driven by biosimilars, generics, and novel therapeutic approaches. As patents expire, more affordable alternatives directly challenge Amgen's market share and pricing power. For example, biosimilars for Amgen's key drugs Prolia and Xgeva are expected to enter the market in May 2025, impacting revenue. Furthermore, emerging therapies like CAR-T cell therapy and gene therapies offer entirely new treatment paradigms, with the global gene therapy market projected to exceed $15 billion by 2026.

| Substitute Type | Impact on Amgen | Example/Data Point |

|---|---|---|

| Biosimilars/Generics | Pricing pressure, market share erosion | Biosimilars for Prolia/Xgeva expected May 2025 |

| Novel Therapies (e.g., Gene Therapy) | Displacement of existing treatments | Global gene therapy market projected >$15B by 2026 |

| Non-Pharmaceutical Interventions | Reduced demand for drug therapies | Global surgical devices market ~$130B in 2024 |

| Disease Prevention (Vaccines) | Reduced patient pool | Advancements in mRNA vaccine platforms |

Entrants Threaten

Developing new biopharmaceutical drugs requires massive financial investment in research and development, with drug development costs exceeding $2.6 billion in 2024. These substantial upfront costs act as a significant barrier, deterring many potential new entrants from entering the market.

The biopharmaceutical sector presents a significant threat of new entrants due to stringent regulatory hurdles. Agencies like the U.S. Food and Drug Administration (FDA) enforce exceptionally complex and rigorous approval processes. For instance, the average cost to develop a new drug, including the expense of failed trials, was estimated to be around $2.6 billion in 2023, a substantial barrier to entry.

Navigating extensive clinical trials, which can span many years and involve multiple phases, is a costly and time-consuming endeavor. Demonstrating both the safety and efficacy of a new therapy requires substantial investment in research and development, often exceeding hundreds of millions of dollars. This lengthy process, coupled with the high failure rate in clinical trials, deters many potential new players.

Obtaining market authorization is the final, critical step, and it is equally demanding. New companies must meticulously document every aspect of their drug development, from preclinical studies to post-market surveillance. The sheer volume of data and the need for expert scientific and regulatory knowledge make this a formidable challenge, effectively limiting the number of new entrants capable of successfully bringing a product to market.

Manufacturing complex biologic drugs, like those Amgen specializes in, demands highly specialized facilities, cutting-edge technology, and deep scientific expertise. This isn't something easily replicated; it requires significant investment in advanced equipment and highly trained personnel.

Building out robust, globally compliant manufacturing and distribution networks is a massive undertaking. It necessitates substantial capital expenditure and intricate operational knowledge, creating a formidable barrier for any potential new entrant aiming to compete effectively and scale their operations.

Amgen is actively strengthening its position by investing in expanding its manufacturing network. For example, in 2024, Amgen continued its strategic investments in its global manufacturing capabilities, aiming to ensure reliable supply chains for its innovative therapies.

Strong Intellectual Property and Patent Portfolios

Amgen, like many established biopharmaceutical companies, benefits from substantial intellectual property, primarily through its robust patent portfolio. These patents safeguard its innovative drug discoveries and manufacturing processes, granting a period of market exclusivity. For instance, Amgen's blockbuster drug Enbrel, used to treat autoimmune diseases, has faced patent expirations, opening the door for biosimilar competition. However, the company continues to invest heavily in R&D to build new patent-protected pipelines.

The strength of Amgen's intellectual property acts as a significant barrier to entry for potential new competitors. Developing a new drug is an incredibly costly and time-consuming endeavor, often exceeding billions of dollars and taking over a decade from discovery to market approval. Without the protection of patents, any new entrant would struggle to recoup these massive investments, especially when facing an incumbent with established market share and brand recognition.

- Patented Products: Amgen's portfolio includes numerous patented drugs, such as Repatha for cholesterol management and Otezla for inflammatory conditions, which currently enjoy market exclusivity.

- R&D Investment: In 2023, Amgen reported research and development expenses of approximately $4.0 billion, underscoring its commitment to innovation and the creation of new intellectual property.

- Patent Expirations: While key patents for older drugs like Enbrel have expired or are nearing expiration, Amgen actively works to extend its intellectual property advantage through new drug development and formulation patents.

- Biosimilar Landscape: The increasing prevalence of biosimilars for biologics highlights the competitive pressure that arises once patent exclusivity wanes, making the continuous development of novel, patent-protected therapies crucial for sustained market leadership.

Brand Reputation, Established Relationships, and Market Access

Amgen's formidable brand reputation, cultivated over decades, presents a significant barrier to new entrants. This strong brand recognition, coupled with deeply entrenched relationships with healthcare providers, payers, and patients, fosters loyalty and trust that newcomers would struggle to replicate. For instance, Amgen's long-standing presence in therapeutic areas like cardiovascular disease and oncology has solidified its market position.

Gaining effective market access is another substantial hurdle for potential competitors. Amgen has invested heavily in building robust distribution networks and navigating the complex regulatory and reimbursement landscapes. New entrants would face considerable challenges and require substantial capital investment to establish similar reach and influence, making it difficult to compete on distribution and access alone.

- Brand Reputation: Amgen's established name in biotechnology fosters immediate trust and credibility with stakeholders.

- Established Relationships: Long-standing partnerships with doctors, hospitals, and insurance companies create significant switching costs for customers.

- Market Access: Amgen's expertise in navigating regulatory approvals and securing favorable reimbursement terms is a complex barrier to entry.

- Investment Hurdle: New entrants must commit vast resources to build comparable brand equity, relationships, and distribution channels.

The threat of new entrants in the biopharmaceutical industry, particularly for companies like Amgen, is generally low due to exceptionally high barriers. These barriers include the immense capital required for research and development, lengthy and complex regulatory approval processes, and the need for specialized manufacturing capabilities. For example, in 2024, the estimated cost to bring a new drug to market remained in the billions, a significant deterrent for potential new players.

Intellectual property protection, primarily through patents, further solidifies the position of established firms like Amgen, making it difficult for newcomers to replicate their innovations. While patent expirations do open avenues for biosimilar competition, the continuous investment in novel drug pipelines by incumbents like Amgen mitigates this threat. Amgen's R&D spending in 2023 alone reached approximately $4.0 billion, highlighting this commitment to IP creation.

Furthermore, strong brand reputation and established relationships within the healthcare ecosystem create significant hurdles for new entrants. Navigating market access, including securing favorable reimbursement, demands considerable expertise and resources, which Amgen has cultivated over years of operation. Building comparable brand equity and distribution networks requires vast investment, effectively limiting the number of credible new competitors.

| Barrier Type | Description | Impact on New Entrants | Amgen's Position |

|---|---|---|---|

| Capital Requirements | High R&D costs (>$2.6B in 2024), clinical trials, manufacturing facilities | Significant financial hurdle | Established financial strength and investment capacity |

| Regulatory Hurdles | Stringent FDA approval processes, complex data requirements | Lengthy and costly approval timelines | Extensive experience and established regulatory affairs teams |

| Intellectual Property | Patents on drugs and manufacturing processes | Limits ability to replicate existing products | Robust patent portfolio and continuous R&D for new IP |

| Brand Reputation & Relationships | Trust with healthcare providers, payers, and patients | Difficulty in gaining market access and customer loyalty | Decades of building trust and strong stakeholder partnerships |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Amgen is built upon a foundation of comprehensive data, including Amgen's annual reports, SEC filings, and investor presentations. We also incorporate insights from leading industry publications, market research reports from firms like EvaluatePharma and GlobalData, and data from financial databases such as S&P Capital IQ.