Amgen Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Amgen Bundle

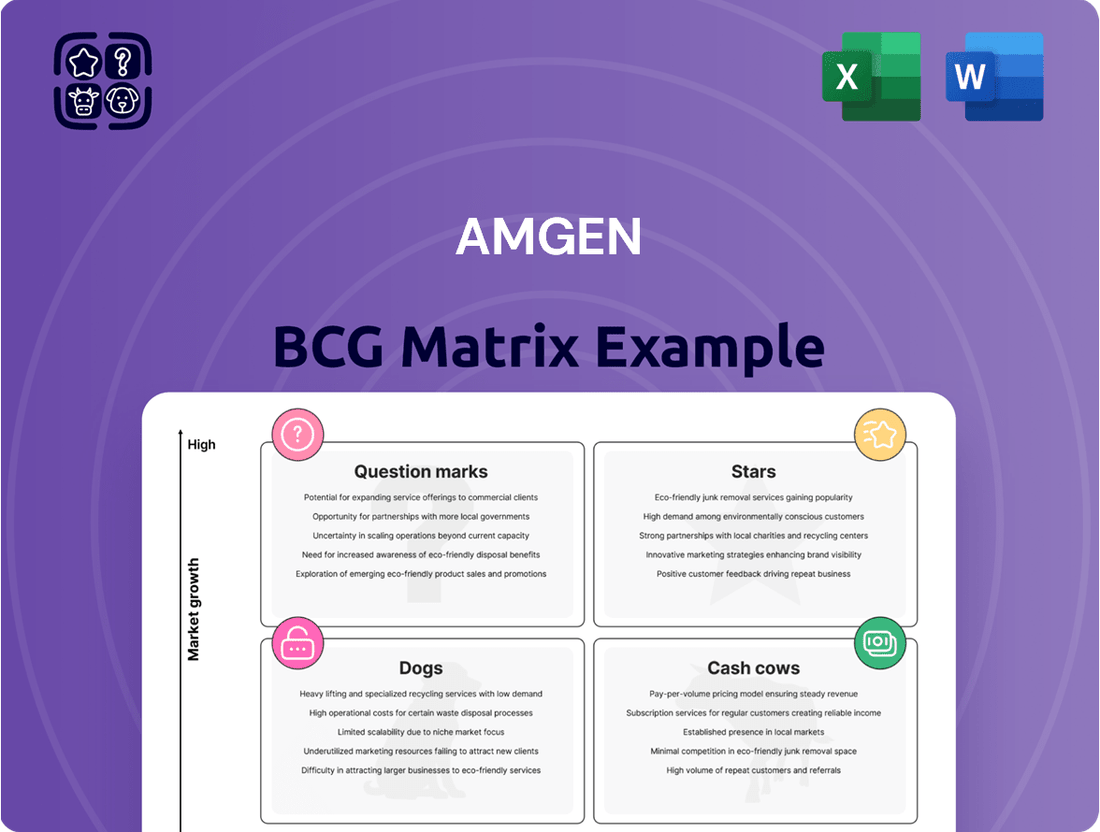

Unlock the strategic potential of Amgen's product portfolio with a clear understanding of its BCG Matrix. See which products are driving growth as Stars, generating stable revenue as Cash Cows, requiring careful consideration as Question Marks, or potentially needing divestment as Dogs.

This glimpse into Amgen's strategic positioning is just the beginning. Purchase the full BCG Matrix report for a comprehensive breakdown of each product's quadrant placement, along with actionable insights and data-driven recommendations to optimize your investment and product development strategies.

Don't miss out on the opportunity to gain a competitive edge. Invest in the complete Amgen BCG Matrix and equip yourself with the knowledge to make informed decisions for future success.

Stars

Tezspire (tezepelumab-ekko) is a significant growth engine for Amgen, demonstrating robust sales momentum and broadening its therapeutic reach beyond severe asthma. Its unique position as the first biologic for severe asthma without phenotype or biomarker restrictions unlocks substantial market potential.

Amgen and AstraZeneca are actively pursuing expanded indications for Tezspire, with promising Phase 3 data emerging for its use in Chronic Obstructive Pulmonary Disease (COPD) and chronic rhinosinusitis with nasal polyps. These developments are poised to further solidify Tezspire's position as a key player in respiratory medicine.

Repatha, a key PCSK9 inhibitor from Amgen, demonstrates robust sales expansion, fueled by rising patient uptake and physician confidence, even with some pricing adjustments. In 2023, Repatha achieved over $2 billion in global sales, solidifying its market leadership in cholesterol management.

The drug has successfully treated millions worldwide, offering a vital treatment option for lowering LDL cholesterol. Amgen's commitment to Repatha is further underscored by an ongoing Phase 4 trial investigating its potential to reduce cardiovascular events following a heart attack, a significant area of unmet medical need.

Evenity, a significant osteoporosis treatment from Amgen, is showing impressive sales momentum. In 2023, its net sales reached $776 million, marking a substantial increase from the previous year, driven by strong demand.

The drug's robust year-over-year sales growth, particularly in the United States, is a key indicator of its success. This growth is largely attributed to increasing prescriber adoption, especially among patients identified as high-risk for osteoporosis, highlighting its perceived clinical value.

Blincyto (blinatumomab)

Blincyto, a groundbreaking bispecific T-cell engager, has demonstrated robust, consistent double-digit sales growth. This impressive performance is largely attributed to its widespread adoption and prescribing for B-cell precursor acute lymphoblastic leukemia (ALL).

Amgen is actively pursuing further development for Blincyto, notably advancing its subcutaneous administration, which promises enhanced patient convenience. Furthermore, the company is exploring its therapeutic potential beyond oncology, investigating its efficacy in autoimmune conditions such as rheumatoid arthritis and systemic lupus erythematosus.

- Sales Growth: Blincyto has achieved consistent double-digit sales growth.

- Primary Indication: Broad prescribing in B-cell precursor acute lymphoblastic leukemia.

- Development Pipeline: Advancing subcutaneous administration for improved patient experience.

- New Therapeutic Areas: Exploring potential in rheumatoid arthritis and systemic lupus erythematosus.

Imdelltra (tarlatamab-dlle)

Imdelltra (tarlatamab-dlle), a recent addition to Amgen's portfolio, is positioned as a potential star in the BCG matrix. It gained accelerated FDA approval in May 2024 for extensive-stage small cell lung cancer (ES-SCLC), a challenging area with significant unmet need.

Initial sales performance for Imdelltra has been robust, indicating strong market acceptance. This early success is further bolstered by the positive results from its Phase 3 confirmatory study, which demonstrated a statistically significant improvement in overall survival for patients treated with tarlatamab.

- Product: Imdelltra (tarlatamab-dlle)

- Indication: Extensive-stage small cell lung cancer (ES-SCLC)

- Approval Status: Accelerated FDA Approval (May 2024)

- Key Data: Phase 3 study showed improved overall survival, supporting its potential as a blockbuster drug.

Imdelltra, approved in May 2024 for extensive-stage small cell lung cancer, shows early promise as a star product for Amgen. Its accelerated FDA approval was based on a Phase 3 study demonstrating improved overall survival, a critical metric in this challenging indication. The initial market uptake suggests strong physician confidence and a significant unmet need being addressed.

| Product | Indication | Approval Date | Key Data Point |

|---|---|---|---|

| Imdelltra (tarlatamab-dlle) | Extensive-stage small cell lung cancer (ES-SCLC) | May 2024 | Phase 3: Improved overall survival |

What is included in the product

This BCG Matrix overview provides strategic insights into Amgen's product portfolio, highlighting which units to invest in, hold, or divest.

Amgen's BCG Matrix provides a clear, visual snapshot of its portfolio, easing the pain of resource allocation decisions.

Cash Cows

Prolia stands as a significant cash cow for Amgen, consistently delivering robust revenue. In 2023, Prolia achieved $3.27 billion in sales, a testament to its strong market presence in osteoporosis treatment.

Despite being a mature product, Prolia's established efficacy and widespread adoption continue to fuel substantial cash flow for Amgen. The drug's consistent volume growth underscores its enduring demand.

However, the landscape is shifting, with biosimilar competition anticipated to begin impacting Prolia's sales in the latter half of 2025, posing a future challenge to its cash cow status.

Xgeva, a key product for Amgen, is a significant revenue generator, particularly for managing bone metastases in cancer patients. Its strong market presence, however, is expected to face pressure from biosimilar entrants, with notable impacts anticipated from late 2025 onwards.

In the first quarter of 2024, Amgen reported Xgeva sales of $569 million, showcasing its continued importance to the company's portfolio. While this indicates robust performance, the looming biosimilar threat, especially as patent expirations approach, positions it as a potential future challenge within the BCG matrix.

Enbrel, a cornerstone in Amgen's portfolio for autoimmune diseases, continues to be a significant revenue generator, acting as a classic cash cow. Despite facing increasing competition and a noticeable decline in sales, its substantial patient base and established market presence still contribute robust cash flows to the company. For instance, in the first quarter of 2024, Enbrel's sales were reported at $496 million, a decrease from the previous year, highlighting the competitive landscape but also its enduring revenue-generating capacity.

Tepezza (teprotumumab-trbw)

Tepezza, now part of Amgen's portfolio following the Horizon Therapeutics acquisition, is a significant revenue contributor, particularly within the rare disease segment.

This drug, a first-in-class treatment for Graves' ophthalmopathy, addresses a critical unmet medical need, solidifying its position as a valuable cash-generating asset for Amgen.

- Tepezza's Revenue Impact: In the first quarter of 2024, Tepezza generated $529 million in net sales, underscoring its substantial contribution to Amgen's overall revenue.

- Market Position: As the only FDA-approved therapy for moderate to severe Graves' ophthalmopathy, Tepezza holds a dominant market position.

- Growth Potential: Despite some sales variability, Tepezza's unique therapeutic offering and the ongoing need for effective treatments suggest continued strong performance.

Krystexxa (pegloticase)

Krystexxa, acquired through the Horizon Therapeutics deal, is a significant revenue generator for Amgen. This treatment targets chronic refractory gout, a condition with limited therapeutic options, establishing it as a reliable income source.

The drug's effectiveness in addressing a specific unmet medical need solidifies its position. In 2023, Amgen reported Krystexxa sales of approximately $577 million, demonstrating its robust contribution to the company's financial performance.

- Krystexxa's Role: A key product from the Horizon acquisition, bolstering Amgen's revenue.

- Market Niche: Addresses chronic refractory gout, a specific unmet medical need.

- Financial Impact: Generated around $577 million in sales in 2023, highlighting its value.

- BCG Matrix Classification: Positioned as a Cash Cow due to its strong market share and low growth potential in a niche indication.

Amgen's portfolio includes several established products that function as cash cows, generating consistent revenue with mature market positions. These products, while not experiencing rapid growth, provide a stable financial foundation for the company.

Prolia and Xgeva, both significant revenue drivers, are key examples of Amgen's cash cows, though they face future challenges from biosimilar competition. Enbrel, despite market pressures, continues to contribute substantially.

Tepezza and Krystexxa, acquired through the Horizon Therapeutics deal, have quickly established themselves as valuable cash cows by addressing specific unmet medical needs in rare disease segments.

| Product | 2023 Sales (Approx.) | Q1 2024 Sales | BCG Status |

|---|---|---|---|

| Prolia | $3.27 billion | N/A | Cash Cow |

| Xgeva | N/A | $569 million | Cash Cow |

| Enbrel | N/A | $496 million | Cash Cow |

| Tepezza | N/A | $529 million | Cash Cow |

| Krystexxa | $577 million | N/A | Cash Cow |

Delivered as Shown

Amgen BCG Matrix

The Amgen BCG Matrix preview you're seeing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks or placeholder content, just a professionally crafted strategic tool ready for your analysis and decision-making. You can confidently use this preview to understand the depth and clarity of the insights provided, knowing the purchased version will be exactly the same, enabling you to seamlessly integrate it into your business planning and presentations.

Dogs

Otezla, a key product for Amgen, is exhibiting characteristics of a Question Mark or potentially a Dog in the BCG Matrix. While it saw some volume growth, its net selling prices have declined, leading to an overall sales dip. This trend, coupled with significant pricing pressures and escalating competition, suggests Otezla operates in a mature market with limited future expansion prospects.

Kyprolis, a proteasome inhibitor used to treat multiple myeloma, has seen its sales growth slow. In 2023, Amgen reported Kyprolis net sales of $1.2 billion, a modest increase from the previous year but indicating a deceleration from earlier growth rates. This slowdown is attributed to rising competition from newer therapies entering the multiple myeloma landscape.

While Kyprolis continues to contribute revenue, its position is challenged. The drug's declining sales growth trajectory suggests it may be transitioning into a question mark or even a dog in the BCG matrix if current trends persist. Amgen's strategy will likely focus on maintaining market share and exploring new indications or combination therapies to revitalize its performance.

Nplate (romiplostim) is currently positioned as a Dog in Amgen's BCG Matrix. Its sales have experienced a downturn, notably impacted by decreased government orders in recent times. This trend suggests a challenging market environment for the drug.

While Nplate is undergoing further research for potential new uses, its current market performance points to a low-growth sector. The drug is facing difficulties in replicating its past revenue figures, reinforcing its classification as a Dog. For instance, Amgen reported Nplate's revenue in the first quarter of 2024 was $170 million, a decrease from $183 million in the same period of 2023.

Lumakras (sotorasib)

Lumakras (sotorasib), a treatment for KRAS G12C-mutated non-small cell lung cancer, has experienced a mixed performance. While unit sales have seen an increase, this growth has been tempered by declining net selling prices. This situation suggests Lumakras is operating in a highly competitive landscape where pricing pressures are significant.

In the first quarter of 2024, Amgen reported Lumakras net sales of $166 million, a slight decrease from $173 million in the same period of 2023. This 4% year-over-year decline highlights the impact of pricing dynamics on the drug's overall revenue, despite potential volume increases. The market for KRAS G12C inhibitors is evolving rapidly, with new entrants and treatment options impacting market share and pricing power.

- Lumakras Q1 2024 Net Sales: $166 million.

- Year-over-Year Change: -4% compared to Q1 2023.

- Market Dynamics: Facing significant price erosion in a competitive oncology market.

- Strategic Implication: The drug's position may warrant a re-evaluation of its growth trajectory and market strategy within Amgen's portfolio.

Mvasi (bevacizumab biosimilar)

Mvasi, Amgen's biosimilar to Avastin, is experiencing declining sales, a clear indicator of its shift towards the 'Dog' category in the BCG Matrix. This decline is attributed to increased competition within the biosimilar market, with newer or more competitively priced products capturing market share.

By the end of 2023, Amgen reported a notable decrease in Mvasi sales, reflecting the intensified competitive pressures. This trend is expected to continue as more biosimilar options enter the market, further fragmenting the customer base and impacting Mvasi's market position.

- Declining Sales: Mvasi's revenue stream has shown a downward trend, signaling a weakening market presence.

- Increased Competition: The biosimilar landscape for Avastin has become crowded, with multiple competitors vying for market share.

- Market Share Erosion: Mvasi is losing ground to newer biosimilar entrants that may offer more aggressive pricing or enhanced market access.

- Strategic Re-evaluation: Amgen may need to reassess Mvasi's market strategy, potentially focusing on niche segments or considering divestment if profitability cannot be restored.

Products classified as Dogs in Amgen's BCG matrix are those with low market share and operating in a low-growth industry. These products typically generate just enough cash to maintain their market position but do not offer significant growth potential.

Amgen's Nplate and Mvasi are examples of products that have transitioned into the Dog category. Nplate's sales declined in Q1 2024 to $170 million from $183 million in Q1 2023, indicating a challenging market environment. Mvasi, a biosimilar, is also experiencing declining sales due to intense competition within its market segment.

The strategic approach for Dog products often involves minimizing investment, harvesting remaining profits, or considering divestment if they become a drain on resources. For Amgen, this might mean focusing on maintaining Nplate's market share or re-evaluating Mvasi's market strategy.

The performance of these products highlights the dynamic nature of the pharmaceutical market, where even established products can face significant headwinds from competition and evolving market demands.

| Product | BCG Category | Q1 2024 Net Sales (Millions USD) | Q1 2023 Net Sales (Millions USD) | Year-over-Year Change (%) | Key Challenges |

|---|---|---|---|---|---|

| Nplate | Dog | 170 | 183 | -7.10% | Decreased government orders, challenging market environment |

| Mvasi | Dog | Declining | Declining | Declining | Increased competition in biosimilar market, market share erosion |

Question Marks

MariTide (maridebart cafraglutide) is a significant player in Amgen's pipeline, currently positioned as a potential star in the BCG matrix. Its Phase 3 trials for obesity, a market experiencing substantial growth, indicate a strong future.

The substantial research and development investment in MariTide is justified by its potential to capture a large share of the expanding obesity market. The once-monthly dosing regimen further enhances its competitive edge, with crucial data readouts anticipated in the latter half of 2025.

Olpasiran (AMG 890) represents a potential star in Amgen's portfolio, currently in Phase 3 trials for cardiovascular disease. Its mechanism, targeting lipoprotein(a) reduction, addresses a significant unmet medical need, with an estimated 20% of the global population having elevated levels of Lp(a).

If successful in its ongoing outcomes trials, Olpasiran could become a substantial growth driver for Amgen. The market for cardiovascular disease treatments is vast, and a novel therapy like Olpasiran, if proven effective and safe, could capture significant market share, potentially reaching billions in annual sales based on market projections for similar therapeutic areas.

Amgen's new biosimilars like Wezlana (adalimumab-vdbs), Pavblu (bevacizumab-pvvr), and Bekemv (eculizumab-aeel) represent significant potential growth drivers. These products target large, established markets with increasing biosimilar penetration, positioning them as potential stars in Amgen's portfolio. For instance, the adalimumab biosimilar market, where Wezlana competes, was projected to reach billions in sales by 2024.

Uplizna (inebilizumab-cdon) in new indications

Uplizna, acquired by Amgen from Horizon, is a significant asset. Its recent FDA approval for IgG4-related disease, a rare autoimmune condition, marks a key expansion. This move positions Uplizna to capture market share in a niche but potentially lucrative area.

Further investigation into generalized myasthenia gravis (gMG) represents another growth avenue. While Uplizna already contributes to Amgen's revenue, these new indications in rare diseases are designed to drive substantial future growth by tapping into underserved patient populations.

- Uplizna's FDA approval for IgG4-related disease expands its therapeutic reach.

- The drug is also under investigation for generalized myasthenia gravis (gMG).

- Acquisition from Horizon strengthens Amgen's rare disease portfolio.

- Expansion into these indications targets potentially high-growth, underserved markets.

Tavneos (avacopan)

Tavneos (avacopan) is positioned as a potential star within Amgen's portfolio, exhibiting impressive year-over-year sales growth. This surge is primarily fueled by substantial volume increases, especially within its rare disease segment.

The rapid market adoption of Tavneos, even in its early stages, strongly suggests significant growth potential.

- Strong Sales Growth: Tavneos has demonstrated robust year-over-year sales increases.

- Volume-Driven: Growth is largely attributed to higher prescription volumes.

- Rare Disease Focus: Significant traction is observed within the rare disease market.

- High Growth Potential: Early adoption indicates a promising future trajectory.

Amgen's portfolio includes several products that are either in late-stage development or have recently launched, positioning them as potential stars. These include MariTide for obesity and Olpasiran for cardiovascular disease, both in Phase 3 trials. Additionally, new biosimilars like Wezlana, Pavblu, and Bekemv are targeting large, established markets. Uplizna, acquired from Horizon, is expanding into new rare disease indications, and Tavneos is showing strong year-over-year sales growth driven by volume increases in the rare disease segment.

| Product | Indication | Stage/Status | Market Potential | Notes |

|---|---|---|---|---|

| MariTide | Obesity | Phase 3 | High (expanding market) | Once-monthly dosing; data readouts in 2025 |

| Olpasiran | Cardiovascular Disease (Lp(a) reduction) | Phase 3 | Very High (significant unmet need) | Targets ~20% of global population with elevated Lp(a) |

| Wezlana | Adalimumab biosimilar | Launched | High (billions in projected sales) | Competes in established biosimilar market |

| Uplizna | IgG4-related disease, gMG | Approved/Investigational | Significant (niche, lucrative rare diseases) | Acquired from Horizon; expands rare disease portfolio |

| Tavneos | IgA Vasculitis, ANCA-associated Vasculitis | Growth Phase | High (strong volume-driven growth) | Demonstrates robust year-over-year sales increases |

BCG Matrix Data Sources

Our Amgen BCG Matrix is built on a foundation of robust data, integrating internal financial statements, comprehensive market research, and publicly available regulatory filings to provide a clear strategic overview.