Ameren Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ameren Bundle

Explore how Ameren's product portfolio stacks up using the BCG Matrix, identifying potential Stars, Cash Cows, Dogs, and Question Marks. Understanding these positions is crucial for strategic resource allocation and future growth. Purchase the full BCG Matrix for a comprehensive analysis and actionable insights to optimize Ameren's market performance.

Stars

Ameren is aggressively expanding its renewable energy portfolio, particularly in solar and wind power. In 2024 alone, Ameren Missouri brought 500 MW of solar online, signaling a strong commitment to clean energy expansion. This strategic focus is designed to meet growing customer demand for sustainable power sources.

The company has ambitious plans, aiming to increase its wind and solar capacity to 3,200 MW by 2030 and further to 4,700 MW by 2035. These investments are supported by favorable market conditions, including increasing demand for clean energy and various government incentives, positioning these renewable segments as significant growth drivers for Ameren.

Ameren's commitment to grid modernization and smart technology is a significant growth driver. Their Smart Energy Plan, a five-year initiative with $16.2 billion in investments, is actively integrating smart meters and switches to boost reliability and reduce outages.

This strategic focus is already yielding impressive results. In Missouri, the deployment of over 1,700 smart switches in 2024 successfully averted an estimated 8 million minutes of customer outages, highlighting the tangible benefits and strong growth potential of these smart grid investments.

Ameren's investment in transmission infrastructure upgrades, exemplified by the Central Illinois Grid Transformation Program, positions it strongly within the BCG matrix. This program, approved in July 2025 by the ICC, allocates significant capital to approximately 380 miles of new and upgraded transmission lines, alongside new substations.

These substantial infrastructure enhancements directly address the need for increased transmission capacity, bolstering grid reliability and facilitating the integration of diverse energy sources. Such forward-looking investments are critical for meeting escalating energy demands and accommodating the evolving generation landscape, underscoring Ameren's role as a key player in modernizing energy networks.

Economic Development Initiatives

Ameren's commitment to economic development is a key driver for future energy demand and business expansion within its service areas. This strategy directly supports its position in the BCG Matrix.

In 2024 alone, Ameren's initiatives were instrumental in generating significant economic impact.

- Job Creation: Over 2,700 new jobs were created across Missouri and Illinois.

- Capital Investment: More than $3.6 billion in capital investment was attracted to the regions.

- Business Growth: These efforts foster an environment conducive to new and expanding businesses.

Battery Energy Storage Systems (BESS)

Ameren Missouri's strategic push into Battery Energy Storage Systems (BESS) positions it as a significant player in grid modernization. The company has ambitious deployment goals, targeting 1,000 MW of battery storage by 2030 and a substantial 1,800 MW by 2045. This investment is driven by the critical need for enhanced grid flexibility and the seamless integration of renewable energy sources, which often have variable output. BESS also plays a vital role in ensuring grid reliability, particularly during periods of high demand.

The planned Big Hollow Energy Center is a prime example of Ameren's commitment to this evolving energy landscape. This facility will integrate both natural gas generation and large-scale battery storage, showcasing a forward-thinking approach to energy infrastructure. Such projects are essential for managing the intermittency of renewables like solar and wind, ensuring a stable power supply even when these sources are not actively generating. The significant capital allocated to these BESS projects underscores their importance in Ameren's long-term operational strategy.

- Deployment Targets: 1,000 MW by 2030, 1,800 MW by 2045.

- Key Functions: Grid flexibility, renewable energy integration, peak demand reliability.

- Illustrative Project: Big Hollow Energy Center (natural gas + BESS).

- Strategic Importance: Modernizing grid infrastructure for a cleaner energy future.

Ameren's significant investments in renewable energy, grid modernization, and battery storage position its clean energy initiatives as strong "Stars" in the BCG matrix. The company's aggressive expansion of solar and wind capacity, targeting 3,200 MW by 2030, coupled with the successful deployment of smart grid technology, exemplifies high growth and market leadership.

The substantial capital allocated to these areas, including the $16.2 billion Smart Energy Plan and ambitious battery storage targets of 1,000 MW by 2030, underscores their current high performance and future potential. These initiatives are driving significant customer benefits, such as reduced outages, and are crucial for integrating diverse energy sources.

The company's commitment to economic development, evidenced by over 2,700 new jobs created and $3.6 billion in attracted capital investment in 2024, further solidifies the growth trajectory of its clean energy portfolio.

| Initiative | Growth Potential | Market Share | BCG Category |

| Renewable Energy Expansion (Solar & Wind) | High | Growing | Star |

| Grid Modernization (Smart Grid) | High | Leading | Star |

| Battery Energy Storage Systems (BESS) | High | Emerging Leader | Star |

What is included in the product

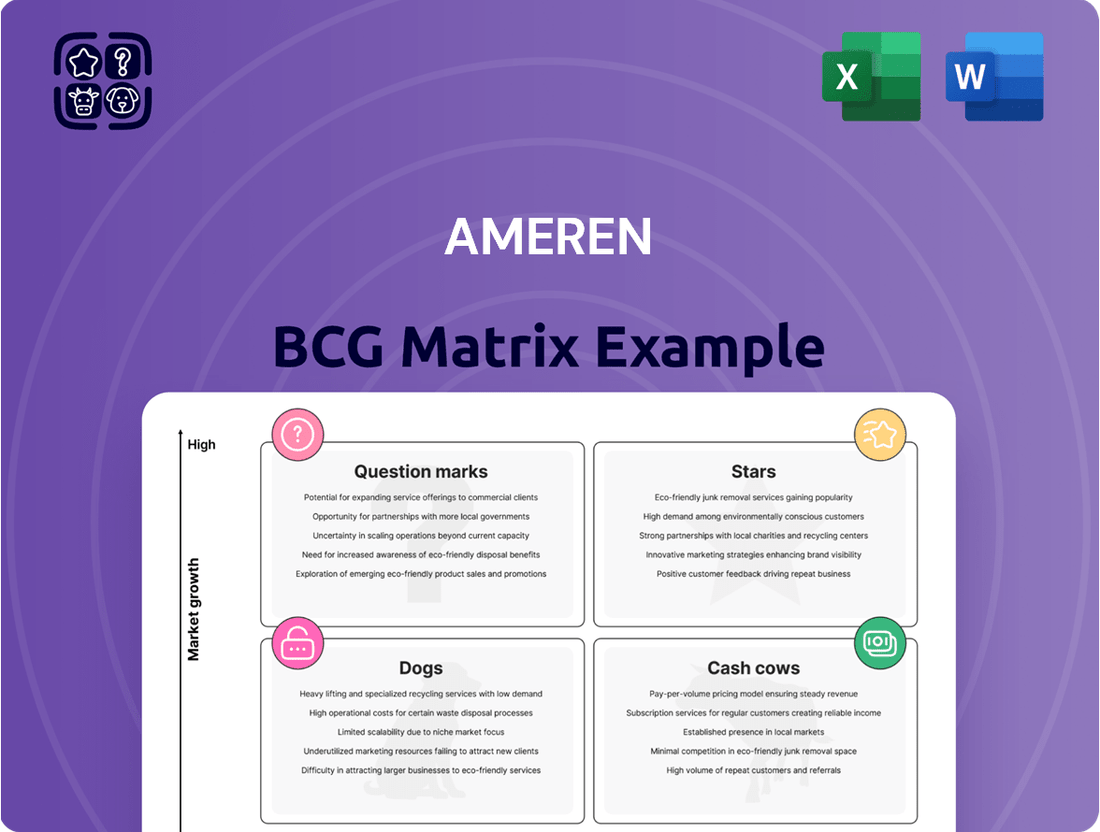

Ameren's BCG Matrix provides a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs to guide investment and resource allocation.

The Ameren BCG Matrix provides a clear, one-page overview, instantly relieving the pain of unclear strategic direction by categorizing business units.

Cash Cows

Ameren's regulated electric and natural gas distribution segments in Missouri and Illinois are classic Cash Cows. These operations boast high market share within their service territories, benefiting from the essential nature of utility services and a stable, established customer base. This translates into predictable and consistent revenue streams, a hallmark of mature, low-growth industries protected by regulatory oversight.

In 2024, Ameren's regulated utility operations continue to be the bedrock of its financial performance. For instance, the company's electric distribution segment consistently delivers reliable earnings, supported by investments in infrastructure modernization and a growing demand for electricity. Similarly, the natural gas distribution business provides a steady cash flow, even with fluctuating energy prices, due to its essential role in heating and industrial processes.

Ameren's existing natural gas-fueled energy centers are vital cash cows, providing essential dispatchable power. These facilities, like the 800-MW simple-cycle natural gas energy center approved for the Meramec Energy Center site, ensure grid stability and meet peak demand, generating consistent revenue streams.

Ameren Missouri's Callaway Energy Center, a nuclear facility, has been a cornerstone of reliable, carbon-free electricity generation. Celebrating its 40th anniversary in December 2024, the plant is a vital asset for Ameren, providing a consistent, high-capacity power supply.

Ameren intends to pursue an extension of the Callaway plant's operating license beyond its current term ending in 2044. This strategic move underscores the facility's ongoing importance to Ameren's energy portfolio and its contribution to stable, predictable earnings for the company.

Customer Energy Efficiency Programs

Ameren's customer energy efficiency programs, like those in Missouri and Illinois, act as cash cows within its business portfolio. These initiatives provide customers with rebates and incentives designed to lower energy usage. For instance, in 2023, Ameren Illinois reported that its energy efficiency programs helped customers save over 200,000 megawatt-hours of electricity, equivalent to powering roughly 30,000 homes for a year.

These programs contribute to stable operations by managing peak demand and optimizing the grid. This, in turn, reduces the capital expenditure needed for new power generation facilities. Such operational efficiencies indirectly bolster cash flow by minimizing the need for expensive infrastructure upgrades and expansions.

- Demand Management: Efficiency programs flatten energy demand curves, reducing strain on infrastructure during peak times.

- Cost Avoidance: By reducing overall energy consumption, Ameren avoids the significant costs associated with building and maintaining new generation capacity.

- Customer Engagement: Offering tangible benefits like rebates fosters customer loyalty and satisfaction, supporting a stable customer base.

- Regulatory Support: These programs often align with regulatory goals for sustainability, potentially leading to favorable operational environments.

Long-Term Transmission Agreements

Ameren Transmission Company of Illinois (ATXI) benefits significantly from its rate-regulated electric transmission operations, which are underpinned by long-term agreements. These agreements are crucial as they establish stable and predictable revenue streams, a hallmark of a cash cow business. The Federal Energy Regulatory Commission (FERC) oversees these operations, ensuring a consistent regulatory environment.

The structure of these long-term transmission agreements is designed to guarantee consistent returns on the substantial investments made in transmission infrastructure. This predictability makes ATXI's transmission business a reliable generator of cash for Ameren. For instance, in 2023, Ameren reported that its regulated utilities, including transmission, represented a significant portion of its overall earnings, highlighting the stability these operations provide.

Key aspects of Ameren's long-term transmission agreements as cash cows include:

- Stable Revenue Streams: Long-term agreements provide predictable income, shielding Ameren from market volatility.

- Regulated Returns: FERC oversight ensures consistent, albeit regulated, returns on invested capital in transmission assets.

- Infrastructure Investment: These agreements incentivize and support ongoing investment in critical transmission infrastructure, ensuring future revenue generation.

- Predictable Cash Flow: The nature of these contracts makes the transmission segment a reliable source of cash flow, supporting the company's overall financial health.

Ameren's regulated utility operations, including its electric and natural gas distribution in Missouri and Illinois, are prime examples of cash cows. These segments benefit from high market share, essential service demand, and regulatory stability, ensuring consistent revenue. The company's investments in infrastructure modernization in 2024 further solidify the predictable earnings from these mature, low-growth sectors.

Ameren's existing natural gas power plants and the nuclear Callaway Energy Center, which is seeking a license extension beyond 2044, are also key cash cows. These facilities provide essential, reliable power, generating stable cash flow. For instance, the 800-MW natural gas energy center at Meramec exemplifies the consistent revenue from dispatchable power sources.

Customer energy efficiency programs, like those in Missouri and Illinois, contribute to Ameren's cash cow status by managing demand and reducing the need for costly infrastructure upgrades. In 2023, Ameren Illinois' efficiency programs saved over 200,000 megawatt-hours, demonstrating their role in operational efficiency and cost avoidance.

Ameren Transmission Company of Illinois (ATXI) leverages its rate-regulated electric transmission operations, secured by long-term agreements overseen by FERC. These agreements guarantee consistent returns on infrastructure investments, making transmission a reliable cash generator for Ameren, as evidenced by its significant contribution to overall earnings in 2023.

What You’re Viewing Is Included

Ameren BCG Matrix

The Ameren BCG Matrix preview you see is the complete, unwatermarked document you will receive upon purchase. This professionally formatted report provides a clear strategic overview of Ameren's business units, ready for immediate use in your decision-making processes. You can confidently expect the exact same analysis and layout in the downloadable file, ensuring no surprises and full utility for your business planning.

Dogs

Ameren is phasing out its aging coal-fired power plants, with plans to retire 1,665 MW by 2030 and all coal generation by 2042. Assets like the Rush Island Energy Center, which ceased operations in 2024, exemplify these units in mature, declining markets.

These pre-retirement coal facilities are often cash drains, requiring significant investment for upkeep and environmental compliance while offering limited potential for future growth. The Meramec Energy Center's site repurposing highlights the shift away from these older assets.

Ameren's legacy infrastructure, particularly portions of the grid not yet upgraded by the Smart Energy Plan, can be categorized as Dogs in the BCG Matrix. These aging assets, such as older distribution lines and substations, are less efficient and demand significant maintenance without driving future growth. For instance, Ameren's 2024 capital expenditures focus heavily on modernization and reliability, with a substantial portion allocated to replacing or upgrading these older components rather than expanding their capacity.

Ameren's portfolio includes older, smaller renewable energy projects, some of which began operation over ten years ago. These assets, often lacking current incentive structures like expired solar rebates, may represent stable but low-growth, low-return investments within the BCG matrix.

Certain Legacy Natural Gas Distribution Pipelines Requiring Extensive Compliance Upgrades

Ameren Illinois is undertaking a substantial $140 million project to modernize its natural gas transmission system, aiming to meet federal compliance standards. This initiative involves replacing over 20 miles of pipelines originally installed in the 1960s.

While these upgrades are crucial for ensuring safety and adhering to regulatory requirements, they represent significant capital expenditure on mature, low-growth infrastructure. The primary driver is compliance, not expansion, which suggests these investments may generate lower returns compared to opportunities in emerging or higher-growth sectors.

- Investment in Compliance: $140 million allocated for natural gas transmission system upgrades.

- Scope of Work: Replacement of over 20 miles of pipelines dating back to the 1960s.

- Strategic Implication: Focus on regulatory adherence rather than market expansion for existing infrastructure.

- Financial Outlook: Potential for lower return on investment due to the nature of the upgrade versus growth projects.

Non-Strategic Real Estate Holdings

Non-strategic real estate holdings represent assets that Ameren no longer needs for its core utility operations or future development plans. These might include unused land or buildings acquired historically. In 2024, utilities are increasingly divesting such non-core assets to improve capital allocation and reduce carrying costs.

These holdings can become a drain on resources, incurring expenses like property taxes and maintenance without contributing to Ameren's primary mission or growth. The company's focus is on optimizing its operational footprint and investing in areas that directly support its regulated business and renewable energy transition.

- Potential Divestiture: Non-strategic real estate is a prime candidate for sale to unlock capital.

- Cost Reduction: Selling these assets eliminates ongoing maintenance and tax liabilities.

- Focus on Core Business: Divestment allows Ameren to concentrate resources on essential infrastructure and growth areas.

Ameren's legacy coal plants, like the Rush Island Energy Center retired in 2024, are prime examples of Dog assets. These are mature, cash-draining operations with limited growth potential, requiring significant upkeep for compliance rather than expansion.

Aging grid infrastructure, such as older distribution lines and substations not yet modernized under the Smart Energy Plan, also falls into the Dog category. These assets demand substantial maintenance investment without contributing to future growth, as evidenced by Ameren's 2024 capital focus on upgrades.

Furthermore, older, smaller renewable energy projects lacking current incentives can be considered Dogs. These may offer stable but low-return investments, reflecting their mature stage and reduced growth prospects.

Non-strategic real estate holdings, requiring ongoing costs without contributing to core operations, are also candidates for divestiture, aligning with Ameren's 2024 strategy of optimizing capital allocation.

| Asset Type | Description | BCG Category | 2024 Relevance | Strategic Action |

|---|---|---|---|---|

| Coal Power Plants | Aging, high-maintenance facilities | Dogs | Retirements ongoing (e.g., Rush Island in 2024) | Phased retirement |

| Legacy Grid Infrastructure | Older distribution lines, substations | Dogs | Significant capital for modernization | Upgrade/replacement |

| Older Renewables | Projects without current incentives | Dogs | Low growth, stable returns | Monitor, potential divestment |

| Non-Strategic Real Estate | Unused land/buildings | Dogs | Carrying costs, no operational contribution | Divestiture |

Question Marks

Ameren Missouri is aiming to transition its natural gas power plants to hydrogen or a hydrogen blend, coupled with carbon capture, by 2040. This strategic move positions these emerging clean energy technologies as potential stars in Ameren's future generation portfolio. While currently in their nascent stages for widespread utility use, they offer substantial growth prospects alongside significant investment risks and market penetration challenges.

The development of hydrogen and carbon capture technologies represents a high-risk, high-reward proposition for Ameren. These innovations are crucial for decarbonizing existing infrastructure, but their commercial viability at scale for utilities is still being proven. For instance, the U.S. Department of Energy's Hydrogen Earthshot initiative targets a cost of $1 per kilogram of clean hydrogen within a decade, a benchmark that, if achieved, could significantly de-risk investments in this area.

Successfully integrating these technologies could fundamentally reshape Ameren's energy generation landscape, moving them from the question mark category towards becoming significant contributors. The uncertainty surrounding their large-scale deployment and cost-effectiveness places them firmly in the question mark quadrant of a BCG matrix, demanding substantial research and development investment.

Ameren Missouri is targeting 1,500 MW of new nuclear generation by 2045, with a keen eye on Small Modular Reactors (SMRs). This positions SMRs as a potential star in Ameren's future energy portfolio, representing a high-growth opportunity for reliable, clean power.

While SMRs offer significant promise for baseload electricity, the technology is still maturing, leading to a current low market share. Substantial upfront capital investment and navigating complex regulatory pathways are key challenges that need to be addressed for widespread adoption.

Ameren Illinois' electric vehicle (EV) charging tariff, approved in July 2021, is designed to accelerate EV adoption and the installation of charging stations. This initiative positions Ameren within a high-growth market for EV infrastructure.

Despite the market's potential, Ameren's current footprint in public EV charging infrastructure is relatively small, necessitating substantial investment to establish a widespread network. The tariff's effectiveness hinges on increasing EV adoption rates and the efficient rollout of charging solutions.

Advanced Grid Resilience Solutions (Beyond Current Smart Grid Deployment)

Beyond current smart meter and smart switch deployments, advanced grid resilience solutions like sophisticated real-time monitoring, predictive analytics, and self-healing grid technologies are poised for significant growth. These innovations are still in their nascent stages for broad utility adoption, demanding substantial research and development investment with an uncertain immediate market share.

Emerging technologies such as AI-powered predictive maintenance, which can anticipate equipment failures before they occur, are crucial. For instance, in 2024, utilities are increasingly investing in these advanced analytics, with the global grid analytics market projected to reach billions. This proactive approach minimizes downtime and enhances grid stability.

- Advanced Monitoring: Real-time data streams from sensors across the grid enable immediate identification of anomalies.

- Predictive Analytics: Machine learning algorithms forecast potential failures, allowing for preemptive repairs.

- Self-Healing Grids: Automated systems reroute power around faults, restoring service rapidly.

- Cybersecurity Integration: Robust security measures are paramount to protect these interconnected systems.

Large-Scale Energy Storage Beyond Batteries (e.g., Pumped Hydro, Compressed Air)

While battery storage is a key focus for Ameren, exploring other large-scale energy storage technologies like pumped hydro or compressed air energy storage (CAES) presents an opportunity. These methods, though currently holding a minimal share in Ameren's operations, offer significant advantages for grid stability and integrating renewable energy sources.

These technologies, such as pumped hydro, which accounted for approximately 2.5% of global energy storage capacity in 2023 according to the International Energy Agency, require substantial upfront capital and lengthy development periods. For instance, a typical large-scale pumped hydro project can cost billions and take over a decade from planning to operation.

- Pumped Hydro: Offers long-duration storage with high reliability, but is geographically constrained and has a significant environmental footprint.

- Compressed Air Energy Storage (CAES): Can provide grid-scale storage, but efficiency varies greatly depending on the system design and geological suitability.

- Capital Intensity: Both technologies demand significant upfront investment, making them less agile than battery solutions for rapid deployment.

Emerging grid resilience technologies, including advanced real-time monitoring and self-healing grid capabilities, represent significant growth potential for Ameren. These solutions are still in early adoption phases for widespread utility use, requiring substantial R&D investment and facing uncertain market penetration in the immediate future.

The integration of AI-powered predictive maintenance is a key area, with utilities increasingly investing in advanced analytics. For example, the global grid analytics market was projected to reach tens of billions of dollars by 2024, highlighting the significant growth trajectory for these technologies.

These advanced grid solutions, while promising for enhancing reliability and efficiency, are currently characterized by their nascent stage of utility adoption and the substantial investment needed to realize their full potential.

Other large-scale energy storage technologies like pumped hydro and compressed air energy storage (CAES) also fall into the question mark category for Ameren. While offering grid stability advantages, they demand significant upfront capital and long development timelines, with minimal current market share in Ameren's operations.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.