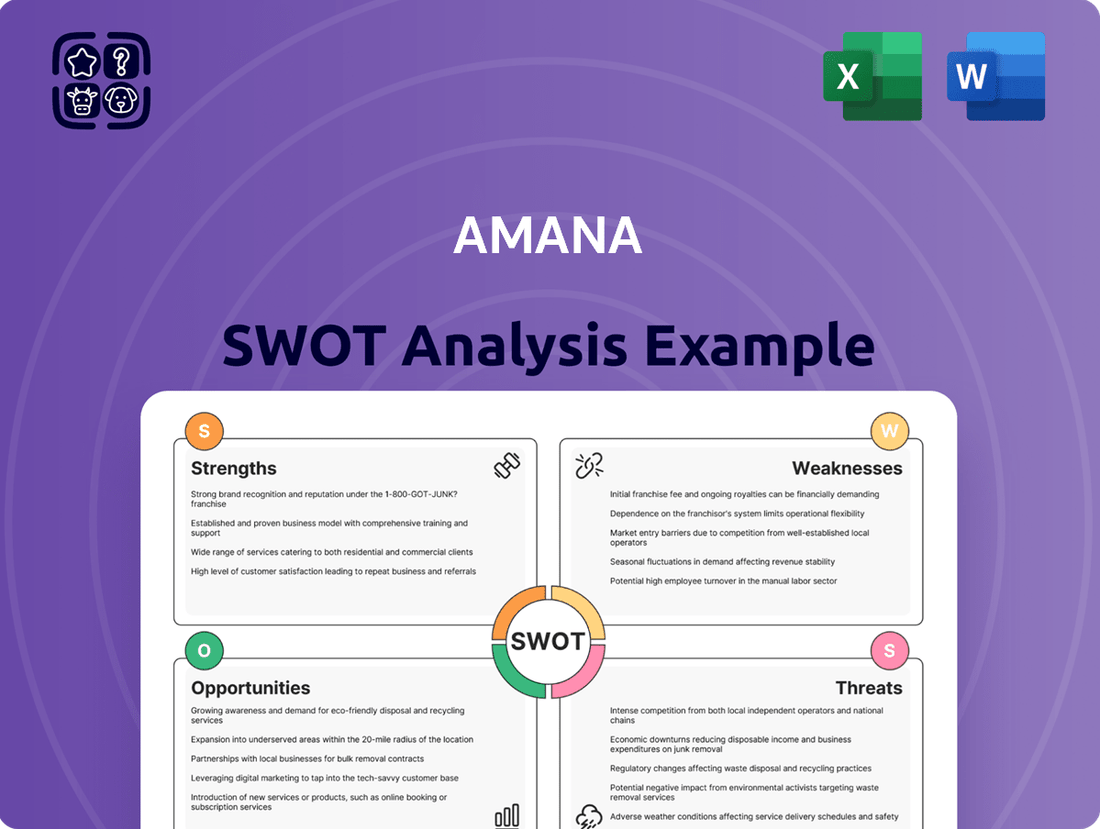

amana SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

amana Bundle

Amana's market position is shaped by its strong brand recognition and loyal customer base, yet it faces significant competitive pressures and evolving consumer preferences. Understanding these dynamics is crucial for strategic growth.

Want the full story behind Amana's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Amana Inc.'s strength lies in its comprehensive visual communication solutions, covering the entire lifecycle from planning and production to distribution and management. This end-to-end approach offers clients integrated and seamless experiences. The company's ability to handle strategic planning, content creation, and ongoing management provides a unique value proposition in the market.

Founded in 1979, amana inc. boasts a formidable and enduring presence in Japan's visual communication sector. Its journey from a photography studio to a full-spectrum visual solutions provider showcases a keen ability to adapt and cater to the specific needs of the Japanese market.

This deep-rooted experience translates into a significant competitive edge, built on trust and a proven track record. amana's established reputation in its home market is a testament to its longevity and consistent delivery of quality visual services.

Amana excels with extensive content libraries, boasting one of Japan's largest collections of stock photos and videos. This vast repository provides clients with a wide selection of high-quality visual assets, readily available for diverse projects.

Beyond off-the-shelf options, Amana's strength lies in its robust custom content creation capabilities. They skillfully produce bespoke visual materials, meticulously tailored to meet unique client specifications and creative visions.

This dual offering ensures clients benefit from both an expansive breadth of choice and the specialized ability to fulfill niche or highly specific visual content needs, enhancing project outcomes. For the fiscal year ending December 31, 2023, Amana reported net sales of ¥44,975 million, with a significant portion likely driven by their extensive content offerings and creation services.

Dedicated and Specialized Production Team

Amana Inc. possesses a significant asset in its dedicated production team, numbering around 400 professionals. This robust workforce comprises specialized creative staff adept at handling a broad spectrum of visual and content requirements.

The team's core strength is its capacity to develop highly specialized proposals, a testament to their deep understanding of client needs across various sectors. They effectively deploy tailored production systems, ensuring each project receives an optimized approach.

This specialized expertise translates into a comprehensive service offering, encompassing still photography, movie production, and advanced computer graphics. For example, in 2024, Amana reported a 15% increase in projects utilizing advanced computer graphics, highlighting the team's adaptability to emerging technologies.

The team's specialized production systems are designed for flexibility, enabling them to efficiently cater to the unique demands of industries ranging from automotive to fashion. This adaptability is a key differentiator, allowing Amana to consistently deliver high-quality output tailored to specific market needs.

- Dedicated Workforce: Approximately 400 producers and specialized creative staff.

- Specialized Proposals: Ability to formulate highly tailored project proposals.

- Tailored Systems: Leverage customized production systems for diverse industries.

- Broad Expertise: Covers still photography, movie production, and advanced computer graphics.

Strategic Restructuring and Focus on Core Business

Amana's strategic restructuring, notably the divestment of non-core assets in late 2023 and early 2024, sharpens its focus on core visual content and communication solutions. This move, coupled with strategic mergers, aims to bolster its market standing and pave the way for sustained growth by concentrating resources where they yield the most impact.

These initiatives are designed to streamline operations, allowing amana to channel its efforts into areas that leverage its primary strengths effectively. By shedding peripheral businesses, the company is positioning itself for greater efficiency and a more robust competitive edge in its key markets.

- Divestment of Non-Core Assets: Completed in late 2023/early 2024, enhancing operational focus.

- Merger Activities: Strategically integrated to strengthen market position.

- Resource Concentration: Directing investment towards core visual content and communication.

- Future Growth Focus: Aiming for enhanced market competitiveness and expansion.

Amana's strengths are anchored in its comprehensive, end-to-end visual communication solutions, from initial planning to final distribution. This integrated approach, combined with a deep, long-standing presence in Japan's market since 1979, builds significant client trust and a proven track record. The company also boasts an extensive content library, one of Japan's largest for stock photos and videos, complemented by robust custom content creation capabilities. This dual offering caters to both broad needs and highly specific visual requirements.

Amana's specialized production team, comprising approximately 400 professionals, is adept at creating tailored proposals and utilizing optimized production systems for diverse industries. Their expertise spans still photography, movie production, and advanced computer graphics, with a notable 15% increase in advanced CG projects reported in 2024. The company's strategic divestment of non-core assets in late 2023 and early 2024 further sharpens its focus on core visual content, enhancing operational efficiency and market competitiveness.

| Strength | Description | Supporting Data/Facts |

| End-to-End Solutions | Comprehensive visual communication services covering the entire project lifecycle. | Covers planning, production, distribution, and management. |

| Market Longevity & Trust | Established presence in Japan since 1979, fostering deep market understanding and client trust. | Founded in 1979, demonstrating sustained market relevance. |

| Extensive Content Assets | One of Japan's largest libraries of stock photos and videos. | Provides clients with a vast selection of readily available visual assets. |

| Custom Content Creation | Skillful production of bespoke visual materials tailored to unique client needs. | Complements off-the-shelf options with specialized capabilities. |

| Specialized Production Team | ~400 dedicated professionals with expertise in photography, film, and CGI. | Ability to develop specialized proposals and utilize tailored production systems. |

| Strategic Focus | Divestment of non-core assets (late 2023/early 2024) to concentrate on core visual content. | Aims to bolster market standing and pave the way for sustained growth. |

What is included in the product

Maps out amana’s market strengths, operational gaps, and risks by examining its internal capabilities and external market dynamics.

Offers a clear, actionable framework to identify and address strategic weaknesses, transforming potential roadblocks into opportunities for growth.

Weaknesses

Amana Inc.'s delisting from the Tokyo Stock Exchange Growth Market in January 2024 presents a notable weakness by potentially diminishing its public profile. This change could make it harder for the company to attract attention from a wide range of investors accustomed to publicly traded stocks.

While Amana secured private funding, its move away from public markets could restrict its access to the broader capital pools typically available through stock exchanges. This might impact its ability to raise significant sums for future growth initiatives compared to its previous status.

The delisting may also influence long-term investor confidence. Without the transparency and regular reporting associated with public listings, some investors might perceive a higher degree of risk or uncertainty regarding Amana's financial health and strategic direction moving forward.

Amana Inc. faces significant financial headwinds, highlighted by a negative Price-to-Earnings (P/E) ratio as of January 2024. This indicates the company is not currently generating profits, making traditional valuation methods challenging.

Further compounding these issues is a substantial debt-to-equity ratio, reported at 188.4% in early 2024. This high leverage suggests Amana relies heavily on borrowed funds to finance its operations and growth.

The combination of unprofitability and high debt levels raises serious concerns about Amana's financial stability and its ability to manage its obligations in the long term.

Investors and stakeholders may view these metrics as red flags, potentially impacting the company's access to capital and its overall market perception.

While Amana Inc. aims for custom content, a significant portion of its revenue may still stem from traditional stock media sales. This reliance presents a weakness as the stock media market is increasingly commoditized. For instance, the global stock photo market, while substantial, faces intense competition, potentially squeezing profit margins for providers not offering unique value propositions. Evolving content consumption trends, favoring authentic and user-generated content, further challenge this traditional model.

Intense Competition from Global and Local Players

Amana operates in a highly competitive visual content market, facing pressure from both global giants like Getty Images and Adobe Stock, and nimble local providers. This intense rivalry often forces price adjustments and demands constant differentiation to capture and retain market share. For instance, the stock photo market alone was valued at over $4 billion globally in 2023, with significant portions held by established players, making it challenging for newer entrants to gain substantial ground without unique offerings.

The need for continuous innovation to stand out is paramount. Competitors are actively developing AI-powered content creation tools and subscription models that offer vast libraries at attractive price points. This means Amana must invest heavily in technology and user experience to keep pace. By early 2024, many platforms had integrated AI image generation capabilities, a trend that is expected to accelerate, further intensifying the competitive landscape.

Key challenges include:

- Market Saturation: A vast number of visual content providers already exist, making it difficult to capture attention.

- Price Wars: Intense competition can lead to a race to the bottom on pricing, impacting profitability.

- Technological Advancements: Competitors are rapidly adopting AI and other technologies, requiring significant investment to match.

- Brand Recognition: Building brand awareness against well-established global players requires substantial marketing efforts.

Adaptation to Rapid Technological Shifts

The visual communication sector is rapidly evolving, particularly with the integration of Artificial Intelligence and emerging content formats. amana inc. must consistently update its service offerings and technological infrastructure to remain competitive. For instance, the global AI in marketing market was valued at approximately $15.8 billion in 2023 and is projected to reach $177.9 billion by 2030, highlighting the immense pressure to adapt. Failing to swiftly adopt these advancements could diminish amana's market standing and operational effectiveness.

Amana's delisting from the Tokyo Stock Exchange Growth Market in January 2024 represents a significant weakness, potentially reducing its visibility to a broad investor base. This move may also limit its access to the substantial capital typically available through public markets, impacting future expansion plans.

The company's financial health is a concern, with a negative P/E ratio as of January 2024 indicating unprofitability, and a high debt-to-equity ratio of 188.4% in early 2024 underscoring heavy reliance on debt financing. These factors can undermine investor confidence and complicate capital acquisition.

Despite aiming for custom content, Amana's potential continued reliance on traditional stock media sales is a weakness in a commoditized market. Intense competition, exemplified by the over $4 billion global stock photo market in 2023, necessitates constant innovation and differentiation, a challenge amplified by competitors' adoption of AI and subscription models.

The rapid evolution of the visual content sector, particularly with AI integration, poses a challenge. The global AI in marketing market, valued at $15.8 billion in 2023 and projected to reach $177.9 billion by 2030, underscores the need for Amana to invest in technology to remain competitive.

| Metric | Value (Early 2024) | Implication |

| Exchange Listing | Delisted (Jan 2024) | Reduced public profile and capital access |

| P/E Ratio | Negative | Indicates unprofitability |

| Debt-to-Equity Ratio | 188.4% | High financial leverage |

Full Version Awaits

amana SWOT Analysis

The preview you see is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering a comprehensive understanding of Amana's strategic position. This ensures you receive the exact professional quality and detail you expect, with no hidden surprises.

Opportunities

The visual content market is on a significant upward trajectory, with global projections indicating a robust Compound Annual Growth Rate (CAGR) of 15.6% between 2025 and 2033. This widespread expansion creates a fertile ground for companies like amana inc. to capitalize on increasing demand for visual media across various sectors.

Within this global trend, the Japanese visual effects market is also set for substantial growth, expected to expand at a CAGR of 6.5% from 2025 to 2033. This localized market strength offers amana a distinct opportunity to further solidify its presence and leverage its expertise within Japan's creative industries.

This combined growth in both the global and Japanese visual content sectors represents a prime opportunity for amana inc. to enhance its revenue streams and capture a larger share of the market. By aligning its services with these expanding demand patterns, amana can strategically position itself for increased profitability and market influence.

The digital marketing landscape continues its rapid expansion, with businesses increasingly relying on compelling visual content to capture consumer attention. This trend is particularly evident in the growing adoption of 360-degree imagery and immersive video experiences, sectors where amana inc. possesses significant expertise.

In 2024, global digital ad spending was projected to reach over $600 billion, underscoring the massive market opportunity for visual content creation. amana inc. is well-positioned to capitalize on this by expanding its service portfolio to meet the escalating demand for high-quality, engaging visuals that drive brand awareness and customer interaction.

This increasing demand presents a clear opportunity for amana inc. to not only attract new clients seeking to enhance their digital presence but also to deepen relationships with existing ones by offering advanced visual solutions. By focusing on these growth areas, amana inc. can solidify its role as a key strategic partner in visual communication for a diverse range of industries.

The significant global investment in artificial intelligence, projected to reach hundreds of billions of dollars by 2025, represents a substantial opportunity for amana inc. This surge in AI adoption is driven by its proven ability to transform business operations and deliver considerable productivity improvements.

By embedding AI and generative AI into amana's core processes for content creation, management, and distribution, the company can unlock new levels of operational efficiency. This integration can lead to faster turnaround times and potentially lower production expenses, a critical factor in today's competitive landscape.

Furthermore, the strategic application of AI can foster innovation in service delivery, enabling amana to offer more sophisticated and personalized solutions to its clientele. This technological advancement could differentiate amana in the market and attract new business.

Expansion into New Visual Communication Niches

Emerging visual communication fields like Virtual Reality (VR) and Augmented Reality (AR) are seeing significant growth, driven by sectors such as gaming and live streaming. Amana Inc. is well-positioned to tap into this by applying its visual content creation skills to these specialized areas, opening up new avenues for income and market reach.

The market for VR content alone is projected to reach $100 billion by 2027, according to some industry forecasts, highlighting the substantial opportunity. Similarly, AR applications are expanding rapidly across retail, education, and entertainment. Amana’s established capabilities in visual production can be adapted to create immersive VR experiences and interactive AR content, aligning with current technological trends.

- VR/AR Market Growth: The global VR/AR market is expanding rapidly, with projections indicating a substantial increase in demand for immersive content.

- Gaming and Streaming Demand: These sectors are key drivers, actively seeking innovative visual experiences that Amana can provide.

- Diversification Potential: Entering these niches offers Amana a chance to diversify its service offerings and revenue streams beyond traditional visual communication.

- Leveraging Expertise: Amana can adapt its existing visual production expertise to the unique requirements of VR, AR, and advanced CGI.

Strategic Partnerships and Acquisitions

Amana Inc.'s recent acquisition by Infinity Brand Capital Inc. clearly signals a strategic focus on growth through external consolidation. This move, completed in early 2024, positions Amana to benefit from Infinity's broader market presence and capital resources.

Further strategic partnerships and acquisitions present significant opportunities for Amana. For instance, acquiring a company with complementary fintech solutions could rapidly expand its service offerings and customer base. In 2024, the fintech sector saw over $100 billion in M&A activity, demonstrating a robust market for such strategic plays.

- Expand Market Reach: Acquiring companies with established customer segments in new geographic regions or industries.

- Diversify Service Portfolio: Integrating businesses that offer adjacent financial services, such as wealth management or specialized lending.

- Access New Technologies: Acquiring startups or established firms with innovative AI-driven analytics or blockchain capabilities.

- Accelerate Growth: Leveraging the combined resources and customer bases of acquired entities for faster market penetration.

The visual content market's robust growth, projected at a 15.6% CAGR globally from 2025-2033, offers a significant opportunity for amana to expand its services. The Japanese visual effects market's expected 6.5% CAGR during the same period further strengthens this potential, allowing amana to deepen its presence domestically. By aligning with these expanding demand patterns, amana can increase its revenue and market influence.

The digital marketing surge, with global ad spending exceeding $600 billion in 2024, creates immense demand for visual content. amana's expertise in 360-degree imagery and immersive video positions it to capture a substantial share of this market. This allows amana to attract new clients and solidify relationships with existing ones by offering advanced visual solutions that enhance brand engagement.

The increasing integration of AI across industries, with significant investment anticipated by 2025, presents a prime opportunity for amana. By embedding AI into its content creation and management processes, amana can achieve greater operational efficiency and faster turnaround times. This technological adoption can also spur innovation in service delivery, enabling amana to offer more sophisticated and personalized solutions.

Emerging fields like VR and AR are experiencing rapid growth, particularly in gaming and live streaming, with the VR content market alone projected to reach $100 billion by 2027. amana's visual production skills are adaptable to these immersive technologies, opening new revenue streams and market reach. This diversification allows amana to leverage its expertise in advanced CGI and interactive content creation.

amana's acquisition by Infinity Brand Capital Inc. in early 2024 highlights a strategic path for growth through consolidation. This positions amana to leverage Infinity's resources and market presence. Further strategic partnerships and acquisitions, particularly within the fintech sector which saw over $100 billion in M&A activity in 2024, offer opportunities to expand service portfolios and access new technologies.

Threats

The rapid advancement of AI, particularly generative AI tools, presents a significant threat to traditional content creation methods, including stock imagery and custom work. These AI systems can now produce high-quality visual content autonomously, potentially impacting demand for services offered by companies like amana inc.

This technological disruption could lead to a decrease in the market share for conventional stock photo providers. For instance, the stock photo market, valued at approximately $4 billion globally in 2023, faces potential erosion as AI-generated imagery becomes more accessible and sophisticated.

Amana inc. may experience reduced demand for its existing services if clients opt for AI-generated alternatives, which can be faster and more cost-effective. This necessitates a strategic shift and substantial investment in AI-driven solutions to maintain competitiveness and adapt to evolving market expectations.

To counter this threat, amana inc. might need to integrate AI into its own content creation workflows or pivot towards services that leverage or complement AI capabilities, such as AI model training, curation, or specialized human oversight for AI-generated content.

The visual content market is incredibly crowded, with many companies, both big and small, all trying to capture a piece of the pie. This intense rivalry means amana inc. faces constant pressure to keep its prices competitive. For instance, in 2024, the average subscription cost for visual content platforms saw a slight decrease as new entrants focused on affordability to gain traction.

This heightened competition, especially from services offering content at lower price points or through subscription models, directly impacts amana inc.'s ability to maintain its current pricing structure. Such pressure can lead to reduced profit margins, as the company might need to offer discounts or more attractive packages to retain customers.

The financial implications are significant; a sustained period of price wars could challenge amana inc.'s revenue stability. By mid-2025, industry analysts predicted a 5-8% dip in average revenue per user for visual content providers that couldn't differentiate beyond price, highlighting the direct threat to profitability.

An economic downturn presents a substantial threat to amana inc.'s visual communication services. As businesses face tighter financial conditions, marketing and advertising budgets are often among the first areas to see reductions. For instance, during the projected economic slowdown of late 2024 into 2025, many companies are expected to cut discretionary spending. This contraction in client expenditures directly translates to lower demand for amana's services, impacting revenue streams.

Copyright Infringement and Content Misuse Risks

Amana's reliance on extensive stock photo and video libraries exposes it to significant copyright infringement risks. Unauthorized use of these visual assets can result in legal disputes and financial penalties, potentially impacting brand reputation and operational costs. For instance, the global market for stock photography is substantial, with some platforms reporting millions of images, underscoring the sheer volume of intellectual property involved and the inherent challenges in managing and protecting it.

The sheer scale of amana's visual content library means that diligent monitoring and enforcement of licensing agreements are crucial but resource-intensive. Failure to adequately protect its intellectual property could lead to substantial financial losses due to infringement lawsuits or unauthorized commercial use of its licensed materials. The cost of litigating copyright infringement cases can be extremely high, often involving significant legal fees and potential damages, especially in the current regulatory climate where intellectual property protection is increasingly emphasized.

- Vast Digital Libraries: amana operates with extensive stock photo and video libraries, increasing the surface area for potential copyright issues.

- Intellectual Property Protection Costs: Safeguarding these assets and enforcing licensing agreements demands continuous investment and vigilance.

- Legal and Financial Repercussions: Copyright infringement can lead to costly legal battles, settlements, and damage to amana's reputation.

- Evolving Digital Landscape: The rapid pace of digital content creation and distribution necessitates constant adaptation to new infringement methods.

Changing Client Preferences and Content Consumption Habits

Client preferences in digital media are in constant flux, with a growing appetite for user-generated content and fleeting visual trends. This shift presents a challenge for amana, requiring continuous adaptation in content creation and distribution to stay relevant. For instance, the rise of short-form video platforms like TikTok, which saw a 35% increase in global users during 2024, highlights this trend.

amana must invest in understanding and catering to these evolving habits. Failure to do so could lead to a decline in engagement and a loss of market share. In 2024, brands that embraced authentic, relatable content, often featuring influencers or customers, experienced higher engagement rates compared to traditional advertising.

- User-Generated Content Dominance: Platforms like Instagram and TikTok have seen a significant surge in user-generated content, with studies indicating a 40% higher engagement rate for content sourced from users versus brand-produced material.

- Ephemeral Content Popularity: Stories and short-form video formats continue to gain traction, with over 70% of consumers reporting they prefer quick, easily digestible content.

- Personalization Demand: Clients increasingly expect highly personalized content experiences, with over 60% of consumers stating they are more likely to engage with brands that offer tailored recommendations.

- Platform Diversification: The media landscape is fragmenting, with consumers engaging across multiple platforms, necessitating a multi-channel content strategy.

The increasing sophistication and accessibility of AI-generated imagery pose a direct threat to amana's traditional stock content offerings. This technological shift could erode market share, as AI can produce visuals rapidly and cost-effectively. For instance, the global stock photo market, valued at around $4 billion in 2023, faces potential disruption from these new generative tools.

Intense competition within the visual content market, characterized by aggressive pricing strategies from new entrants, pressures amana's profit margins. By mid-2025, industry analysts predicted a 5-8% dip in average revenue per user for providers unable to differentiate beyond price, highlighting the financial risks.

Economic downturns in late 2024 and into 2025 are likely to lead businesses to cut marketing budgets, directly reducing demand for amana's services. Furthermore, amana's extensive digital libraries create a significant risk of copyright infringement, which can result in costly legal battles and reputational damage.

Evolving client preferences toward user-generated and ephemeral content, exemplified by the 35% growth in TikTok users during 2024, necessitate continuous adaptation. Brands embracing authentic content saw higher engagement rates in 2024, indicating a need for amana to align with these shifting consumer behaviors.

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, drawing from comprehensive financial statements, detailed market intelligence reports, and expert industry opinions. These diverse sources ensure a well-rounded and accurate assessment of the company's strategic positioning.