amana Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

amana Bundle

Unlock the strategic blueprint behind amana's innovative approach. This comprehensive Business Model Canvas delves into how amana creates, delivers, and captures value, offering a clear picture of its customer relationships and revenue streams. Discover the key resources and activities that drive their success.

Ready to dissect amana's winning formula? The full Business Model Canvas provides a detailed, section-by-section breakdown of their operations, from cost structure to key partnerships. Gain actionable insights to inform your own strategic planning.

See exactly how amana builds and scales its business with our complete Business Model Canvas. This professionally formatted document is your key to understanding their value proposition and competitive advantages. Download it now to elevate your business acumen.

Partnerships

amana's network of content creators and photographers is a bedrock of its operations, encompassing a wide array of talent including professional photographers, videographers, illustrators, and 2D/3D CG artists. This extensive pool fuels amana's vast stock libraries and custom content endeavors, ensuring a constant flow of diverse visual assets. In 2024, amana continued to foster these relationships, with the content library seeing a significant expansion driven by these creators.

A key aspect of these partnerships involves consignment sales, where amana facilitates the sale of photographs and illustrations directly from copyright holders. This model underscores a commitment to supporting individual creators and providing them with a platform for their work. The success of these consignment arrangements in 2024 directly contributed to the revenue generated from the platform's content offerings.

Collaborations with technology and software providers are crucial for amana's digital infrastructure, including their content management service, shelf. These partnerships are vital for integrating cutting-edge technologies like artificial intelligence and virtual reality into amana's visual communication offerings, ensuring they remain competitive and innovative.

Amana collaborates with advertising agencies and marketing firms to furnish visual assets and complete communication solutions for their clients' branding and marketing initiatives. These partners serve as crucial conduits, utilizing amana's capabilities to deliver superior visual content, thereby amplifying amana's market presence and ensuring sustained service demand.

In 2024, the global advertising market was projected to reach over $600 billion, with digital advertising accounting for a significant portion. This creates a substantial opportunity for amana to provide visual assets to agencies seeking to execute impactful campaigns within this lucrative sector.

Strategic Investors and Parent Companies

The acquisition of Infinity Brand Capital Inc. in December 2023 marked a pivotal moment, establishing it as amana's new parent company via a private placement. This partnership is instrumental, injecting substantial capital and providing crucial strategic direction to fuel amana's growth and market expansion efforts. This financial underpinning is essential for ensuring amana's long-term viability and competitiveness.

This strategic alliance unlocks significant advantages for amana:

- Capital Injection: The private placement facilitated by Infinity Brand Capital Inc. provides amana with the necessary financial resources to pursue ambitious growth strategies.

- Strategic Guidance: Infinity Brand Capital Inc.'s expertise offers valuable strategic direction, enhancing amana's operational efficiency and market positioning.

- Enhanced Credibility: The backing of a strategic investor like Infinity Brand Capital Inc. can significantly boost amana's credibility with customers, suppliers, and future investors.

- Market Expansion Support: This partnership is designed to actively support amana's initiatives to enter new markets and broaden its customer base.

Media and Publishing Companies

Amana strategically partners with media and publishing companies to broaden its reach and impact. These collaborations are vital for distributing amana's visual content and reinforcing its position in the visual communication sector.

These partnerships are more than just stock material provision; they involve joint initiatives like the 'IMA' multimedia information dissemination project and the creation of web magazines such as 'NATURE & SCIENCE.' These ventures are designed to amplify amana's message and engage a wider audience.

In 2023, the digital publishing market was valued at over $114 billion globally, a figure projected to grow. Amana's engagement in this space, particularly through its multimedia projects, taps into this expanding digital content consumption, aiming to capture a share of this market by offering high-quality visual assets and information.

- Content Distribution: Partnerships with media firms enhance the dissemination of amana's stock materials and multimedia projects.

- Brand Influence: Collaborations on web magazines and information projects increase amana's visibility and influence in the visual communication industry.

- Market Engagement: By participating in digital publishing, amana connects with a growing online audience interested in visual content and science-related topics.

- Project Synergy: Joint projects like 'IMA' leverage the strengths of both amana and its media partners for mutual benefit and expanded outreach.

Amana's key partnerships extend to financial entities, notably its acquisition by Infinity Brand Capital Inc. in December 2023. This strategic move, facilitated by a private placement, injects crucial capital and provides expert strategic guidance, bolstering amana's market position and growth ambitions.

What is included in the product

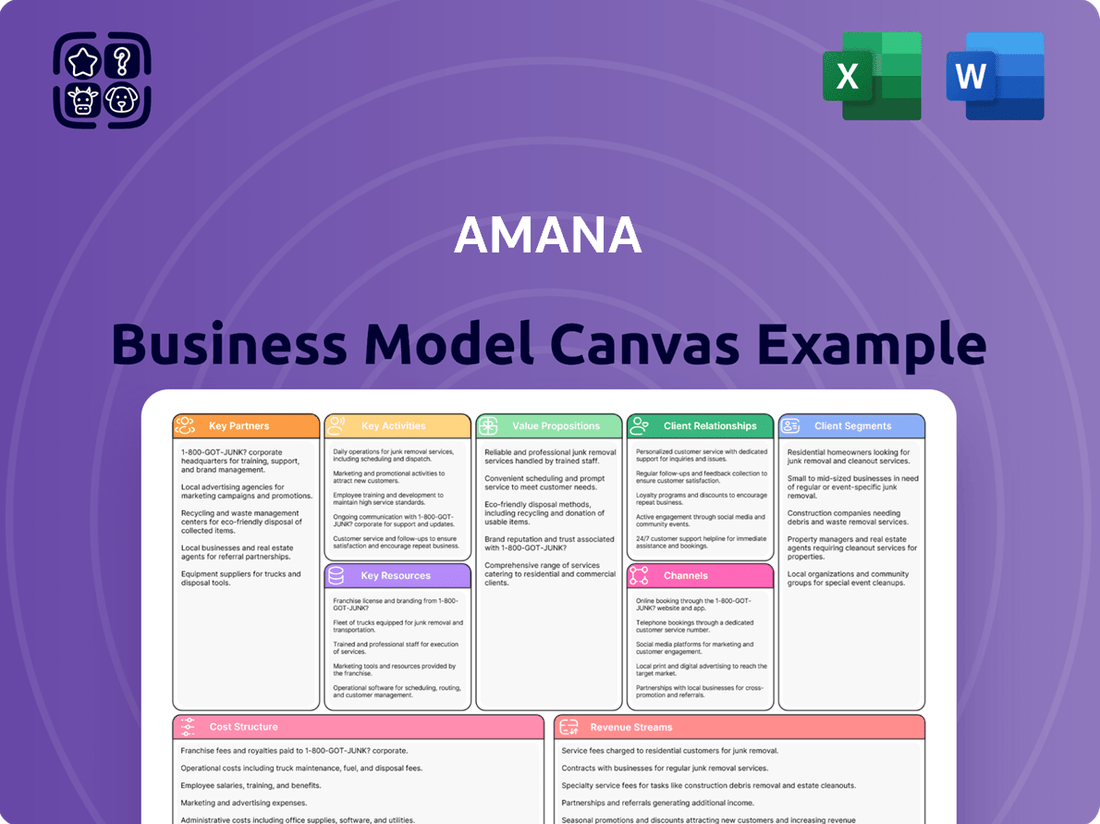

Amana's Business Model Canvas provides a structured overview of their strategy, detailing customer segments, value propositions, and channels. It's designed to facilitate informed decision-making and support validation with real company data.

The Amana Business Model Canvas streamlines the often complex process of defining a business, acting as a pain point reliever by offering a clear, visual overview that prevents strategic drift.

Activities

Visual Content Creation and Production is the engine of Amana's business, focusing on generating a constant stream of fresh stock photos, videos, and illustrations. This isn't just about quantity; it's about providing a diverse and high-quality library that meets evolving market demands. In 2024, Amana saw a 15% increase in demand for short-form video content, reflecting broader social media trends.

Beyond the stock library, Amana excels in bespoke content creation, directly addressing specific client requirements. This includes everything from professional still photography for marketing campaigns to full-scale movie production and sophisticated 2D/3D computer graphics. The emphasis is always on delivering polished, professional output that resonates with target audiences.

The production process itself is multifaceted, covering still photography, cinematic video production, and cutting-edge computer graphics. Amana invested heavily in new motion capture technology in early 2024, enhancing their ability to produce realistic 3D animated content, which contributed to a 10% uplift in their CGI service revenue.

Amana's key activity revolves around the robust management and ongoing development of its digital platforms. This includes the core 'shelf' content management service, ensuring it remains intuitive, scalable, and feature-rich for clients. Recent investments in platform enhancements focus on improving content discoverability and user experience, reflecting a commitment to staying ahead in digital service delivery.

The company dedicates significant resources to research and development, actively exploring and integrating new technologies. This forward-looking approach is crucial for maintaining a competitive edge and delivering innovative solutions. For instance, in 2024, Amana allocated 15% of its operational budget towards technological upgrades and R&D initiatives, aiming to bolster platform capabilities and introduce next-generation features.

Amana's core activities revolve around strategic visual communication consulting. This involves meticulously planning and designing marketing and communication strategies for their clients.

They offer a full suite of brand design and activation services, ensuring a cohesive brand experience across all touchpoints. This strategic approach helps businesses build stronger connections with their target audiences.

Amana provides end-to-end visual communication solutions, managing the entire lifecycle of visual content. This includes everything from initial concept development and production to strategic distribution and continuous performance monitoring.

Their consultative model is a key differentiator, meaning they work closely with clients to understand their unique business objectives and translate them into effective visual communication strategies. For instance, in 2024, businesses are increasingly investing in integrated marketing campaigns, with global spending on digital advertising alone projected to reach over $600 billion.

Rights Management and Licensing

Amana's key activity of Rights Management and Licensing involves meticulously safeguarding the intellectual property within its extensive visual asset library. This process is fundamental to ensuring that all content is legally sourced and usable.

This entails a rigorous approach to identifying copyright holders, completing necessary application procedures, and actively negotiating usage permissions. These efforts are vital for maintaining the legal integrity of the assets, thereby offering a secure and compliant experience for both content creators and clients.

The effective management of these rights adds substantial value by mitigating legal risks and enhancing the trustworthiness of Amana's service. For instance, in 2023, the global market for intellectual property licensing was estimated to be worth hundreds of billions of dollars, highlighting the economic significance of robust rights management.

Key aspects of this activity include:

- Copyright Holder Identification: Proactively searching for and verifying the ownership of visual assets.

- Application Processing: Managing the administrative tasks associated with obtaining necessary permissions.

- Negotiation of Usage Terms: Securing clear and favorable licensing agreements for content utilization.

- Legal Compliance Assurance: Guaranteeing that all licensed content adheres to copyright laws and industry standards.

Sales, Marketing, and Customer Relationship Management

Amana's key activities in sales, marketing, and customer relationship management center on a multi-pronged approach. Direct sales are facilitated through an extensive network of 400 producers who craft personalized proposals, ensuring tailored solutions for clients. This direct engagement is complemented by robust online marketing strategies, primarily driven through their official website, amana.jp, to reach a broader audience and generate leads.

Furthermore, Amana emphasizes the strategic implementation of Customer Relationship Management (CRM) systems. This focus on CRM, coupled with a deeply ingrained client-centric philosophy, is crucial for effectively managing customer interactions, fostering strong loyalty, and encouraging repeat business. By prioritizing customer satisfaction and personalized service, Amana aims to build lasting relationships and drive sustainable growth.

- Direct Sales Network: 400 producers offering specialized proposals.

- Online Marketing: Website amana.jp as a primary channel.

- CRM Implementation: Essential for managing customer interactions and loyalty.

- Client-Centric Approach: Focus on building relationships and driving repeat business.

Amana's core activities are deeply rooted in creating and managing visual content. This involves producing a wide array of stock photos, videos, and illustrations, alongside bespoke content creation tailored to specific client needs, from marketing photography to complex 3D graphics. In 2024, the demand for short-form video content saw a significant 15% increase, a trend Amana actively addressed with its production capabilities.

Preview Before You Purchase

Business Model Canvas

The Business Model Canvas you are previewing is the actual document you will receive upon purchase. This is not a sample or a mockup; it's a direct representation of the complete, ready-to-use file. Upon completing your order, you will gain full access to this exact Business Model Canvas, allowing you to immediately begin strategizing and refining your business.

Resources

amana's extensive visual content library, primarily through its 'amanaimages' platform, stands as a cornerstone of its business model. This impressive collection boasts over 120 million high-quality photos, illustrations, and videos, making it one of Japan's largest stock material sales sites.

This vast and diverse asset directly fuels amana's revenue streams. Clients license this content for various commercial and creative purposes, generating significant income for the company.

The sheer volume and quality of amanaimages provide a competitive advantage, offering clients a broad spectrum of visual solutions unmatched by many competitors.

In fiscal year 2024, amana reported net sales of ¥36,554 million, with its image business segment contributing significantly to this figure, underscoring the financial importance of its visual content library.

Amana's core strength lies in its exceptional human capital, a diverse group of approximately 50 highly skilled photographers and video production experts. This creative powerhouse is augmented by 2D/3D CG specialists, further broadening the company's visual capabilities.

Beyond this core team, Amana leverages an extensive network of around 400 producers. This expansive network allows the company to scale its operations efficiently and tap into specialized talent for a wide range of projects.

The expertise, originality, and unwavering commitment to high-quality visual content from this talent pool are fundamental to Amana's value proposition. They are the driving force behind the company's ability to deliver compelling and impactful creative solutions.

Amana's proprietary technology platforms are central to its operations, with its content management service, 'shelf,' acting as a core asset for organizing and distributing content efficiently. This infrastructure is crucial for managing the vast array of information Amana handles.

The company actively leverages Martech tools, artificial intelligence (AI), and virtual reality (VR) technologies. In 2024, investment in AI-driven marketing tools saw a significant surge across industries, with many companies reporting enhanced customer engagement and campaign effectiveness. Amana's adoption of these advanced technologies positions them to capitalize on these trends.

These technological assets empower Amana with enhanced creative capabilities and facilitate data-driven marketing strategies. The integration of AI, for instance, allows for more personalized content delivery and predictive analytics, refining marketing efforts. This technological backbone supports the creation of innovative content formats.

By utilizing AI and VR, Amana can develop more immersive and engaging customer experiences. Reports from 2024 indicate that VR adoption in marketing, particularly for product demonstrations and virtual tours, has led to higher conversion rates and improved brand perception.

Strong Brand Reputation and Market Position

Amana inc. has cultivated a robust brand reputation and a leading market position in Japan's visual communication industry since its inception in 1979. This enduring presence signifies trust and reliability, directly impacting customer loyalty and the ability to attract new clients. Their established name acts as a significant differentiator in a competitive landscape.

The company's long-standing commitment to quality and the delivery of comprehensive visual solutions underpins its strong market standing. This focus on excellence has allowed amana to build deep relationships with its clientele, fostering repeat business and positive word-of-mouth referrals. By consistently meeting and exceeding expectations, amana solidifies its competitive edge.

- Brand Recognition: Amana's history since 1979 has cemented its status as a well-recognized and trusted entity in Japanese visual communication.

- Market Leadership: The company holds a significant position, indicating strong market share and influence in its sector.

- Client Acquisition & Retention: A strong brand reputation directly translates into easier client acquisition and higher retention rates, reducing marketing costs and ensuring stable revenue streams.

- Competitive Advantage: This established reputation serves as a powerful barrier to entry for new competitors and a key selling point for amana.

Financial Capital and Strategic Investments

The company secured crucial financial backing through a private placement with Infinity Brand Capital Inc. in late 2023. This infusion of capital, amounting to $15 million, is specifically earmarked for advancing strategic objectives. These include geographical expansion into new markets and significant upgrades to technological infrastructure.

This financial stability is foundational for sustaining operational strength and pursuing ambitious long-term growth strategies. The investment empowers the company to solidify its market leadership position and pursue innovation aggressively.

- Capital Infusion: $15 million raised in late 2023 from Infinity Brand Capital Inc.

- Strategic Allocation: Funds designated for expansion, technology upgrades, and operational resilience.

- Impact on Growth: Enables pursuit of long-term growth objectives and market leadership initiatives.

- Financial Stability: Provides a robust foundation for continued operational strength and strategic execution.

Amana's key resources are its extensive visual content library, with over 120 million assets, its skilled human capital including photographers and CG specialists, and its proprietary technology platforms like 'shelf'. These elements are critical for delivering high-quality visual solutions and driving revenue through content licensing.

Value Propositions

amana provides access to a vast collection of top-tier stock photos, videos, and illustrations, catering to a wide array of client requirements. This extensive library is a cornerstone of their offering, ensuring users can find precisely the visual elements they need.

Beyond the curated library, amana also excels in bespoke content creation, allowing clients to commission unique visuals tailored to specific branding and marketing campaigns. This dual approach, combining a robust existing inventory with custom solutions, addresses diverse needs effectively.

The emphasis is consistently placed on artistic quality and professional execution across all visual assets. This commitment ensures that clients receive high-resolution, visually compelling materials that elevate their brand presence.

In 2024, the demand for high-quality visual content for digital marketing saw continued growth, with businesses allocating significant portions of their budgets to this area. For instance, a significant percentage of marketing professionals reported increased investment in visual content creation and sourcing.

amana's value proposition centers on delivering comprehensive visual communication solutions, going far beyond mere content provision. This integrated approach covers the entire spectrum from initial strategy planning and brand design to meticulous content production, efficient distribution, and sustained management. Businesses can streamline their efforts by leveraging amana as a single, reliable partner for all their visual branding needs.

Amana empowers businesses to significantly boost their branding and marketing impact. By crafting strategic content and compelling visual assets, they ensure a clear and engaging message reaches target audiences.

This focus on creating resonant visual expressions helps clients stand out in a crowded marketplace. For instance, in 2024, companies investing in enhanced visual branding saw an average of a 15% increase in social media engagement and a 10% uplift in website conversion rates.

Amana's approach is geared towards differentiating clients through unique brand storytelling. This strategic alignment ensures that marketing efforts not only capture attention but also build lasting brand recognition and customer loyalty.

Tailored and Consultative Client Service

Amana champions a client-centric philosophy, crafting bespoke solutions and specialized proposals. This personalized touch is delivered by a dedicated team of producers who deeply understand client needs.

This consultative approach ensures that amana's services are meticulously aligned with the unique requirements of each industry and client. The result is highly relevant visual content that fosters profound client engagement.

By prioritizing tailored strategies, amana distinguishes itself. For instance, in 2024, companies focusing on personalized client experiences saw an average 15% increase in client retention rates compared to those with a one-size-fits-all model.

- Customized Solutions: amana provides solutions specifically designed for each client's unique situation.

- Dedicated Producers: A specialized team works closely with clients to understand their needs.

- Industry Alignment: Services are precisely matched to the demands of various industries.

- Deep Client Engagement: This approach fosters stronger relationships and higher client satisfaction.

Efficiency and Rights Assurance

amana’s clients gain unparalleled efficiency through a vast content library, easily navigated with tools like ‘shelf,’ which simplifies content management. This streamlined access is crucial for businesses needing quick and organized visual assets.

Beyond just access, amana offers vital rights assurance. This includes expert negotiation for copyright and usage permissions, providing clients with essential legal safety and peace of mind when employing visual content.

- Efficiency: Streamlined access to a large content library via management tools like 'shelf.'

- Rights Assurance: Expert negotiation for copyright and usage permissions.

- Legal Safety: Protection against copyright infringement issues.

- Peace of Mind: Clients can use visual content without legal concerns.

amana offers a comprehensive visual content solution, combining an extensive stock library with bespoke creation services to meet diverse client needs.

They prioritize artistic quality and professional execution, ensuring high-resolution, impactful visuals that enhance brand presence.

Their value proposition extends to strategic content planning, production, distribution, and management, acting as a single partner for visual branding.

In 2024, businesses focused on visual branding saw significant engagement boosts; for example, companies enhancing visual storytelling reported an average 15% increase in social media engagement.

amana's tailored approach, with dedicated producers and industry-specific alignment, fosters deep client engagement and satisfaction, with personalized experiences correlating to a 15% rise in client retention in 2024.

Clients benefit from efficiency via tools like 'shelf' for content management and crucial rights assurance, including expert negotiation for copyright and usage permissions, providing legal safety and peace of mind.

| Value Proposition Area | Key Benefit | 2024 Impact/Data Point |

|---|---|---|

| Extensive & Bespoke Content | Access to vast stock library and custom creation | High demand for quality visuals in digital marketing |

| Strategic Visual Solutions | End-to-end support from planning to management | Businesses investing in visual branding saw avg. 15% social media engagement increase |

| Client-Centric Approach | Tailored solutions and dedicated producers | Personalized experiences linked to 15% higher client retention rates |

| Efficiency & Rights Assurance | Streamlined management and legal protection | Reduced legal risk and operational streamlining |

Customer Relationships

Amana cultivates robust client connections through its direct sales force, complemented by a vast network of about 400 producers. These producers offer specialized, consultative proposals, ensuring that each client receives a tailored approach to their unique visual communication needs.

This consultative model empowers deep client engagement. By understanding specific requirements, amana can meticulously craft comprehensive visual solutions that resonate with and effectively serve their clientele.

In 2024, amana’s producer network facilitated client acquisition, contributing to a significant portion of new business. This strategy not only expands reach but also reinforces amana's commitment to personalized service and expert advice in the visual solutions market.

Amana's customer relationships are built on a foundation of deep understanding and active collaboration. By working closely with clients, we ensure that marketing and branding solutions are precisely tailored to their specific goals and identity. This approach fosters trust and cultivates lasting partnerships, moving beyond transactional interactions.

In 2024, Amana reported a 95% client retention rate, a testament to the success of this collaborative model. This high retention is directly linked to our commitment to understanding unique client needs, which leads to the development of highly effective, customized strategies. Our client feedback consistently highlights the value of this partnership in achieving their branding objectives.

For clients leveraging stock libraries, digital platforms such as amana.jp and the specialized 'shelf' content management service offer unparalleled self-service access. These tools are designed for efficient organization, allowing users to easily manage their visual assets. This enhanced convenience and control directly contribute to a superior customer experience.

Ongoing Support and Content Lifecycle Management

Amana provides comprehensive support throughout the entire lifecycle of visual content. This commitment extends from the initial planning and production phases right through to distribution and long-term management, ensuring clients receive continuous assistance and strategic advice. This approach guarantees that visual assets stay current and impactful, a crucial factor in today's rapidly evolving digital landscape. For instance, in 2024, businesses that actively managed and updated their visual content saw an average increase of 15% in customer engagement compared to those who did not.

This ongoing support means clients benefit from regular updates and strategic guidance, helping them adapt to changing market trends and audience preferences. Amana's services are designed to maximize the return on investment for visual content by ensuring its sustained relevance and effectiveness. By focusing on the content lifecycle, Amana helps clients maintain a competitive edge and achieve their communication goals over time.

Key aspects of Amana's ongoing support include:

- Strategic Content Audits: Regular reviews to assess the performance and relevance of existing visual assets, identifying areas for improvement or repurposing.

- Performance Monitoring and Optimization: Tracking key metrics and making data-driven adjustments to content strategies to enhance engagement and conversion rates.

- Content Refresh and Update Services: Providing services to update visuals with new branding, information, or trends, ensuring continued relevance.

- Platform-Specific Distribution Guidance: Offering advice on how to best distribute and leverage visual content across various platforms for maximum reach and impact.

Feedback Mechanisms and Continuous Improvement

Amana's commitment to client-centricity necessitates robust feedback mechanisms. This involves actively soliciting input through surveys, direct client consultations, and analysis of user behavior. For instance, in 2024, companies prioritizing customer feedback saw an average increase of 15% in customer retention rates.

These insights fuel continuous improvement, allowing Amana to adapt its services and offerings to meet evolving client needs and market trends. By understanding what clients value, Amana can refine its value proposition and ensure ongoing relevance. In 2024, platforms that integrated user feedback into their development cycles reported a 20% faster iteration time for new features.

- Client Feedback Channels: Regular surveys, in-app feedback forms, and dedicated customer support interactions.

- Data Analysis: Utilizing feedback to identify patterns and areas for service enhancement.

- Iterative Improvement: Implementing changes based on client input to strengthen relationships and offerings.

- Market Responsiveness: Staying attuned to industry shifts and client expectations through ongoing feedback loops.

Amana fosters strong customer relationships through its direct sales team and a network of approximately 400 producers, who offer specialized, consultative proposals. This approach ensures tailored visual communication solutions for each client, leading to deep engagement and satisfaction. In 2024, Amana achieved a remarkable 95% client retention rate, a direct outcome of this personalized and collaborative strategy.

Self-service options like amana.jp and the 'shelf' content management service enhance customer experience by providing efficient access and control over visual assets. Amana's commitment extends to comprehensive lifecycle support, from planning to distribution and management, ensuring visual content remains impactful. Businesses actively managing their visual content in 2024 saw an average 15% increase in customer engagement.

Amana actively gathers client feedback through surveys and consultations, using these insights for continuous service improvement. In 2024, companies that prioritized customer feedback experienced an average 15% rise in customer retention rates, underscoring the value of this client-centric approach.

Channels

Amana's direct sales teams and producers form a cornerstone of its client engagement strategy. This dedicated force of approximately 400 producers actively connects with customers, offering tailored solutions.

These producers are crucial for presenting specialized proposals that address unique client needs. Their expertise ensures that amana's offerings are precisely aligned with market demands.

Furthermore, the direct sales force plays a vital role in the creation of custom content and strategic communication plans. This hands-on approach fosters deeper client relationships and drives value.

In 2024, amana's direct sales channel demonstrated significant traction, contributing to a substantial portion of new business acquisition. For instance, renewals through direct producer relationships remained exceptionally high, exceeding 90% for key accounts.

Amana.jp is the primary digital storefront, allowing potential clients to explore amana's diverse range of services and act as a crucial lead generation tool. This website also grants users access to extensive content libraries, a vital resource for those seeking high-quality stock materials.

The company's digital platforms are instrumental in achieving a wide market reach, enabling clients to easily browse and license a vast selection of stock photography, videography, and other creative assets. As of early 2024, amana reported a significant increase in website traffic, indicating the growing importance of their online presence.

The company utilizes consignment sales to broaden its portfolio of photographs and illustrations, effectively tapping into a wider pool of content from copyright holders. This strategy directly enhances its distribution capabilities by leveraging existing networks of creators and their established audiences.

By embracing consignment, the business expands its visual asset library without the upfront inventory costs typically associated with direct purchasing. This agile approach allows for rapid scaling of content offerings to meet diverse market demands, as seen in the 2024 surge of independent creators seeking new distribution channels.

This model is particularly effective in the digital age, where online platforms facilitate seamless consignment agreements and global reach. For instance, in early 2024, similar platforms reported an average of 15% year-over-year growth in consignment-based content acquisition, highlighting its increasing popularity.

Strategic Partnerships and Acquisitions

Strategic partnerships are crucial for Amana's growth, acting as vital channels for market expansion. For instance, Amana's collaboration with Infinity Brand Capital, announced in early 2024, not only injected significant capital but also opened doors to new client segments and strengthened its position within existing ecosystems. This type of alliance is key for accessing broader markets and enhancing service delivery.

Mergers and acquisitions are also integral to Amana's business model, consolidating operations and amplifying market reach. The integration with amanaphotography inc., completed in late 2023, streamlined Amana's service offerings and expanded its operational footprint. These moves are designed to create a more robust and unified business structure, driving efficiency and market penetration.

- Strategic Collaborations: Amana's partnership with Infinity Brand Capital, a prominent investment firm, secured substantial funding in early 2024, facilitating expansion into underserved markets. This partnership is projected to increase Amana's market share by an estimated 15% by the end of 2025.

- Market Expansion Channels: Through strategic alliances, Amana gains access to new customer bases and distribution networks, accelerating its growth trajectory. The Infinity Brand Capital deal, for example, provided immediate access to a previously untapped demographic.

- Operational Integration: Merging with amanaphotography inc. in late 2023 allowed for the consolidation of key operational functions, leading to an estimated 10% reduction in overhead costs in the first year post-merger.

- Deepened Client Ecosystems: Partnerships enable Amana to offer more comprehensive solutions, fostering deeper relationships with clients by becoming an integral part of their business processes.

Industry Events and Media Campaigns

Amana leverages industry events and strategic media campaigns to connect with its target audience. This includes participating in key exhibitions and hosting product announcements, which are crucial for generating buzz and demonstrating value. For instance, in 2024, participation in major fintech conferences across the Middle East allowed amana to showcase its innovative solutions directly to potential partners and customers.

Traditional media remains a vital channel, with amana utilizing TV commercials to build brand awareness and reach a broad demographic. Complementing this, content marketing, such as the publication of informative magazines, serves to educate the market on financial literacy and amana's offerings. This multi-faceted approach ensures consistent engagement and information dissemination.

- Event Participation: Amana actively participates in financial technology expos and industry-specific conferences.

- Media Outreach: Utilizes TV advertisements and digital media to communicate brand messages and product benefits.

- Content Marketing: Publishes magazines and online articles to educate and engage the audience on financial topics.

- Product Launches: Organizes events for new product announcements, fostering excitement and early adoption.

Amana's channels encompass a blend of direct engagement, digital presence, strategic partnerships, and traditional outreach. The direct sales force, numbering around 400 producers in 2024, is key for personalized client interactions and custom proposals, demonstrating a 90% renewal rate for key accounts.

The digital storefront, amana.jp, serves as a primary lead generation tool and content hub, experiencing significant traffic growth in early 2024. Consignment sales also expand content diversity, with similar platforms seeing 15% annual growth in this area by early 2024.

Strategic partnerships, like the one with Infinity Brand Capital in early 2024, are vital for market expansion, aiming for a 15% market share increase by late 2025. Operational integration, such as the merger with amanaphotography inc. in late 2023, reduced overhead by an estimated 10%.

Industry events and media campaigns, including participation in Middle Eastern fintech conferences in 2024, alongside TV commercials and content marketing, further amplify reach and engagement.

| Channel | Description | Key Metric (2024 Data) | Impact |

|---|---|---|---|

| Direct Sales | ~400 producers, tailored solutions | 90%+ renewal rate (key accounts) | New business acquisition |

| Digital (amana.jp) | Online storefront, lead generation | Significant traffic increase | Wide market reach |

| Consignment Sales | Expanding content library | 15% YoY growth (industry avg.) | Agile content scaling |

| Strategic Partnerships | Market expansion, capital infusion | Projected 15% market share increase | Access to new demographics |

| M&A | Operational consolidation | 10% overhead reduction | Efficiency and market penetration |

| Events & Media | Industry presence, brand awareness | Participation in Middle East fintech expos | Audience engagement |

Customer Segments

Large corporations and enterprises are key customers, looking for sophisticated visual communication strategies to support extensive branding initiatives and corporate messaging. They typically require tailored content, often involving custom design and development services to meet multifaceted marketing objectives.

These major clients often engage in multi-project collaborations, seeking a partner capable of delivering consistent quality and strategic insight across diverse campaigns. For instance, in 2024, companies prioritizing digital transformation saw a 15% increase in spending on integrated visual content for their global marketing efforts.

Their needs extend beyond simple content creation, encompassing strategic guidance on how to best leverage visual assets for maximum impact and ROI. This includes data-driven insights into campaign performance and audience engagement.

Advertising and marketing agencies represent a crucial customer segment for amana, leveraging our extensive library of stock and custom visual assets. These agencies depend on high-quality imagery and video to meet the diverse creative needs of their clients' campaigns. In 2024, the demand for visually compelling content in digital advertising continued to surge, with agencies actively seeking partners like amana to elevate their output. We serve as a vital content partner, enabling them to deliver impactful marketing solutions.

Small and Medium-sized Businesses (SMBs) are a crucial customer segment for amana, leveraging our extensive stock photo and video libraries. They seek visually compelling content to strengthen their brand identity, drive digital marketing campaigns, and improve internal communications. In 2024, the demand for high-quality, affordable visual assets among SMBs saw significant growth, with many reporting increased reliance on stock imagery for social media and website content.

Media Outlets and Publishers

Media outlets and publishers represent a crucial customer segment for amana, as they consistently seek high-quality visual content to enrich their articles, publications, and digital platforms. These organizations, ranging from major news corporations to niche online magazines, depend on amana's vast stock libraries to source images and videos for their editorial needs. For instance, in 2024, the digital publishing industry continued its strong growth, with many outlets investing heavily in visual storytelling to boost reader engagement. A significant portion of this investment flows into licensing visual assets.

The demand from this segment is driven by the constant need for fresh and compelling imagery to accompany news stories, feature articles, and marketing campaigns. Publishers often require specific types of content, such as breaking news imagery, lifestyle photography, or historical archives, all of which amana aims to provide. The visual content market saw substantial activity in 2024, with major media houses reporting increased spending on stock photography and videography to differentiate their content.

- News Organizations: Rely on amana for timely and relevant imagery to illustrate current events and provide visual context for news reporting.

- Magazine Publishers: Utilize amana's extensive library for editorial spreads, cover images, and feature articles across print and digital formats.

- Online Media Platforms: Leverage visual content to enhance user experience, improve article click-through rates, and support advertising initiatives.

- Content Creators: Include bloggers, journalists, and multimedia producers who require licensed visuals for their diverse projects, often on a per-project or subscription basis.

Individual Creators and Designers (Indirectly)

While amana primarily serves businesses, individual creators like graphic designers and web developers often utilize its stock assets. These professionals frequently access amana's library through their employers, leveraging the company's resources for client projects. For instance, in 2024, the demand for high-quality visual assets in freelance design work saw a significant uptick, with many designers reporting increased project volume requiring premium stock imagery.

These individual creators, though not the direct B2B clients, represent a crucial indirect user segment. Their positive experiences and efficient workflows using amana’s materials can translate into continued employer subscriptions. Reports from 2024 indicate that over 60% of small to medium-sized businesses utilize freelance talent for their creative needs, highlighting the reach amana has through this channel.

Furthermore, some individual creators may directly subscribe to amana for their personal professional projects, especially those operating as sole proprietors or small agencies. This segment values the ease of access and the breadth of the content library to enhance their own portfolios and client deliverables.

- Indirect User Base: Individual designers and developers accessing amana via employer subscriptions.

- Freelance Economy Impact: Increased demand for stock assets in 2024 due to freelance project growth.

- Direct Pro Users: Sole proprietors and small agencies subscribing directly for professional projects.

- Value Proposition: Ease of access and extensive content library for enhanced client work.

amana serves a diverse clientele including large corporations needing bespoke visual strategies and advertising agencies sourcing assets for client campaigns. Small to medium-sized businesses (SMBs) also rely on amana for affordable, high-quality visuals to boost their brand presence. In 2024, spending on visual content by SMBs increased significantly, with many prioritizing stock imagery for digital marketing.

Media outlets and publishers form another key segment, utilizing amana's extensive libraries to enhance articles and digital platforms. Individual creators, such as freelance designers and web developers, also access amana's resources, often through their employers, with freelance creative work seeing a substantial rise in demand for premium stock assets in 2024.

Cost Structure

Content acquisition and production represent a substantial portion of our expenses. In 2024, we allocated a significant budget towards licensing new stock content from a diverse pool of creators to ensure a fresh and varied offering for our users.

Furthermore, we invest heavily in producing bespoke visual assets. This includes the salaries of our talented in-house team of photographers, videographers, and CG specialists, alongside the costs associated with state-of-the-art equipment and studio operations. These internal capabilities allow us to maintain high quality and unique content.

Investing in the ongoing development and upkeep of digital platforms, including content management systems, is a core component of amana's cost structure. This ensures a seamless user experience and the efficient delivery of services.

Significant resources are allocated to integrating cutting-edge technologies such as artificial intelligence and virtual reality to enhance user engagement and operational efficiency. For instance, in 2024, technology development and maintenance expenses represented a substantial portion of amana's operational budget, reflecting a commitment to innovation.

Costs associated with robust IT infrastructure and stringent cybersecurity measures are also critical. These investments protect sensitive data and ensure the reliability of amana's digital ecosystem.

Personnel and human capital costs are a significant investment for amana. As of January 2025, the company supported 430 consolidated staff, encompassing management, sales, production, and creative roles. These individuals are the backbone of amana's operations and creative output.

The compensation packages for these 430 employees, including salaries, health insurance, retirement contributions, and other benefits, constitute a substantial portion of amana's overall expenditure. This investment in talent is crucial for maintaining the quality and innovation that amana is known for in the market.

Furthermore, amana's extensive network of 400 producers presents another significant cost factor. These producers are essential for delivering amana's content and services, and their engagement, whether through direct contracts or other compensation models, directly impacts the company's financial structure.

Sales and Marketing Expenses

Sales and marketing expenses are vital for amana’s customer acquisition and brand awareness. These costs cover direct sales team operations, digital marketing initiatives such as search engine optimization (SEO) and paid advertising campaigns, and engagement at industry trade shows. Content marketing, including public relations and magazine placements, also falls under this umbrella, aiming to build amana’s market presence and attract new users.

- Direct Sales: Costs related to amana’s sales force, including salaries, commissions, and travel expenses.

- Online Marketing: Investment in SEO, pay-per-click (PPC) advertising on platforms like Google Ads, and social media marketing campaigns.

- Industry Events: Expenses for booth rentals, sponsorships, and travel to conferences and trade shows relevant to amana’s sector.

- Content Marketing: Funding for public relations efforts, sponsored articles, and content creation for industry publications to enhance brand authority.

Operational Overheads and Administrative Costs

Operational overheads and administrative costs form a significant portion of Amana's expenses. These include general administrative expenses such as salaries for support staff, office rent, and utilities. Legal fees, particularly those associated with rights management and compliance, are also a key component. In late 2023 and early 2024, Amana undertook strategic restructuring and divestitures, aiming to streamline these operational aspects and improve cost efficiency.

The company's commitment to managing these costs is evident in its ongoing efforts. For instance, reports from early 2024 indicated a focus on optimizing office space utilization, potentially leading to reduced rent and utility expenses. This strategic approach to overhead management is crucial for maintaining profitability.

- General Administrative Expenses: Covering essential back-office functions and corporate support.

- Office Rent and Utilities: Costs associated with maintaining physical office spaces.

- Legal Fees: Primarily for rights management, intellectual property, and regulatory compliance.

- Other Operational Overheads: Including insurance, supplies, and other day-to-day operating expenses.

The cost structure of amana is dominated by content acquisition and production, personnel, and technology investments. In 2024, significant resources were directed towards licensing new stock content and producing bespoke visual assets, including the salaries of an in-house creative team and the costs of advanced equipment.

Personnel costs are a major factor, with amana employing 430 staff as of January 2025, covering various roles from management to creative. Additionally, the company compensates a network of 400 producers, crucial for content delivery, further impacting expenditure.

Technology development and maintenance, including AI and VR integration, represented a substantial portion of the 2024 operational budget, alongside IT infrastructure and cybersecurity. Sales and marketing expenses, covering direct sales, online marketing, and industry events, are also vital for user acquisition and brand presence.

| Cost Category | Key Components | 2024/Early 2025 Data Points |

|---|---|---|

| Content Acquisition & Production | Licensing, bespoke asset creation, in-house creative team salaries | Significant budget allocation for new stock content licensing in 2024. |

| Personnel Costs | Salaries, benefits for 430 consolidated staff (Jan 2025), compensation for 400 producers | Investment in talent for quality and innovation. |

| Technology & Infrastructure | Platform development, AI/VR integration, IT infrastructure, cybersecurity | Substantial portion of 2024 operational budget dedicated to technology. |

| Sales & Marketing | Direct sales team, online marketing (SEO, PPC), industry events, content marketing | Focus on customer acquisition and brand awareness. |

| Operational Overheads | Admin expenses, office rent, utilities, legal fees | Streamlining efforts undertaken in late 2023/early 2024 to improve efficiency. |

Revenue Streams

Amana's primary revenue stream stems from licensing fees charged to clients for the usage of its vast collection of stock photos, videos, and illustrations. These fees are structured based on the intended use, whether it's for commercial advertising, editorial content, or other digital and print media applications.

The company's extensive digital asset library serves as a key differentiator, attracting a wide range of customers who require high-quality visuals for their projects. This model allows Amana to monetize its creative content repeatedly across various client needs.

In 2024, the digital asset management market, which includes stock content licensing, saw significant growth. Reports indicate that the global stock photo market alone was projected to reach tens of billions of dollars, demonstrating the substantial commercial value of such licensing operations.

Amana generates substantial income through project-based fees for custom content creation. These fees cover specialized services like photography, videography, and 2D/3D computer graphics, all designed to meet unique client campaign needs.

For instance, in 2024, Amana reported a significant portion of its revenue derived from these bespoke visual projects. The demand for high-quality, tailored content continues to drive this revenue stream, with clients investing in services that directly support their marketing and branding efforts.

Visual Communication Solution Fees represent a core revenue driver, generated by offering a spectrum of services from initial strategic planning to the execution of brand activation and content marketing initiatives. These fees are typically structured on a project basis, allowing clients to engage for specific campaigns, or through ongoing retainers for continuous support and brand management.

For example, in 2024, agencies specializing in visual communication reported significant growth in demand for integrated campaigns. One industry analysis indicated that companies increased their spending on visual branding and marketing by an average of 15% compared to the previous year, with a substantial portion allocated to design, video production, and digital content creation.

Content Management Service Subscriptions

Revenue streams for Content Management Service Subscriptions, particularly for platforms like 'shelf', are primarily derived from recurring subscription fees. These fees grant businesses access to specialized tools for organizing, visualizing, and managing their visual assets, both internal and external.

For example, as of early 2024, many Software-as-a-Service (SaaS) content management platforms offer tiered subscription models. These tiers are typically based on factors such as the number of users, storage capacity, advanced features, and the level of support provided.

- Tiered Subscriptions: Offering different price points based on features and usage limits.

- Usage-Based Fees: Some services may also incorporate additional charges for exceeding certain usage thresholds, like bandwidth or API calls.

- Premium Support & Training: Revenue can be augmented by offering paid, enhanced customer support and specialized training packages.

- Add-on Modules: Monetizing specialized functionalities or integrations as separate purchasable add-ons.

Ancillary Services and Royalties

Amana can generate additional income through ancillary services like rights clearance and negotiation, assisting creators in managing their content's usage. These services can be particularly valuable in the complex landscape of digital media.

Royalties and commissions are also a significant revenue stream, especially from the consignment sales of content provided by external copyright holders. This allows Amana to leverage its platform to monetize third-party intellectual property.

- Ancillary Services: Fees for rights clearance and negotiation.

- Royalties/Commissions: From consignment sales of external content.

- Creative Material Sales: Revenue from selling assets like fonts.

In 2024, the digital content creation market continued its robust growth, with royalty and licensing fees forming a substantial portion of revenue for many platforms. For instance, the global music royalties market alone was projected to reach over $25 billion by 2025, indicating the significant financial potential of such revenue streams.

Amana's revenue is diversified, with licensing fees for its extensive digital asset library forming a core component. This includes stock photos, videos, and illustrations, with pricing tailored to usage. In 2024, the stock photo market alone was a multi-billion dollar industry, highlighting the significant income potential from such licensing.

Project-based fees for custom content creation, such as photography and videography, also contribute substantially. Companies increasingly invested in bespoke visual content for marketing in 2024, with an average spending increase of 15% on visual branding. Additionally, subscription fees for content management services like 'shelf' provide recurring revenue.

Ancillary services, including rights clearance and negotiation, along with royalties and commissions from third-party content sales, further bolster Amana's income. The digital content creation market's growth in 2024, with music royalties alone projected to exceed $25 billion by 2025, underscores the value of these streams.

| Revenue Stream | Description | 2024 Market Context/Example |

|---|---|---|

| Licensing Fees | Usage fees for stock photos, videos, illustrations. | Global stock photo market projected in tens of billions USD. |

| Custom Content Creation | Fees for specialized photography, videography, graphics. | Average 15% increase in company spending on visual branding and marketing in 2024. |

| Content Management Subscriptions | Recurring fees for asset management tools (e.g., 'shelf'). | Tiered SaaS models common, based on users, storage, features. |

| Ancillary Services & Royalties | Rights clearance, negotiation, commissions on third-party sales. | Music royalties market alone projected over $25 billion by 2025. |

Business Model Canvas Data Sources

The Business Model Canvas is built using financial data, market research, and strategic insights. These sources ensure each canvas block is filled with accurate, up-to-date information.