Alta Equipment Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alta Equipment Group Bundle

Navigate the complex external forces shaping Alta Equipment Group's future with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are impacting the heavy equipment industry. Download the full version to gain actionable intelligence and refine your strategic planning.

Political factors

Government infrastructure spending, particularly through initiatives like the Infrastructure Investment and Jobs Act (IIJA), is a significant tailwind for equipment providers. The IIJA, enacted in late 2021, allocates substantial funds towards repairing and upgrading America's roads, bridges, public transit, and water systems, directly boosting the need for construction and material handling machinery.

This sustained investment is projected to create robust demand for heavy equipment throughout 2024 and into 2025. For companies like Alta Equipment Group, this translates into increased sales opportunities as contractors secure projects funded by these government programs, driving higher utilization rates for their rental fleets and new equipment sales.

Global trade uncertainties, including tariffs and trade route disputes, significantly impact equipment manufacturers and distributors like Alta Equipment Group. For instance, the ongoing trade tensions between major economies can disrupt the flow of essential components, leading to supply chain bottlenecks. In 2024, the International Monetary Fund (IMF) projected global trade growth to be around 3.3%, a modest increase but still susceptible to geopolitical shocks that could introduce new tariffs or trade barriers.

These policies directly influence the cost structure for companies. Increased tariffs on raw materials or manufactured parts can inflate the cost of goods sold, forcing equipment providers to adjust their pricing strategies. This, in turn, affects the affordability and availability of heavy machinery for customers, potentially dampening demand. For example, a 10% tariff on steel imports, a key material for construction equipment, could add millions in costs for manufacturers.

Governments worldwide are tightening regulations on carbon emissions, particularly for heavy machinery. This trend is accelerating the demand for low-emission and zero-emission equipment. For instance, the European Union's Stage V emission standards, implemented in 2019 and continuing to evolve, significantly impact engine technology for construction and agricultural machinery, pushing manufacturers towards cleaner alternatives.

These stricter standards directly influence Alta Equipment Group's product portfolio, affecting both sales and rental segments. The company must increasingly offer and support equipment that meets these evolving environmental benchmarks. By 2024, many regions are seeing increased enforcement and potential penalties for non-compliance, making this a critical operational consideration.

Political Stability and Economic Policy

Political stability significantly influences Alta Equipment Group's operating environment. Uncertainty surrounding interest rate levels, particularly in late 2024 and into 2025, coupled with potential policy shifts from new administrations, can lead to a more cautious approach in construction spending and new project initiations. This directly impacts demand for the equipment Alta provides.

A stable political landscape and predictable economic policies are foundational for building business confidence. When these elements are in place, companies in the construction and industrial sectors are more likely to invest in new projects and equipment upgrades, benefiting Alta Equipment Group. For instance, a clear fiscal policy outlook can encourage longer-term capital expenditure decisions.

- Interest Rate Influence: Federal Reserve projections and actual rate decisions in late 2024 and early 2025 will be key indicators for construction project financing.

- Policy Impact: Proposed infrastructure spending bills or changes in environmental regulations could either stimulate or dampen demand for heavy equipment.

- Economic Confidence: Consumer and business sentiment surveys, often correlated with political stability, provide a gauge for future capital investment in sectors served by Alta.

Government Incentives for Green Technology Adoption

Governments worldwide are actively promoting the adoption of green technologies through various incentives. These can include direct grants, tax credits, and subsidies designed to lower the upfront cost of environmentally friendly equipment. For instance, the United States' Inflation Reduction Act of 2022 offers significant tax credits for clean energy investments, which can extend to electrified construction equipment.

These financial incentives directly impact Alta Equipment Group's customer base by making the transition to low-emission machinery more affordable. When customers can reduce their capital expenditure through government support, it stimulates demand for electric and hybrid equipment that Alta offers. This creates a more favorable market environment for sustainable fleet upgrades.

- Tax Credits: Reductions in tax liability for purchasing or leasing qualifying green equipment.

- Grants: Direct financial awards to businesses or individuals to support the acquisition of eco-friendly machinery.

- Subsidies: Financial assistance that lowers the overall cost of green technology, making it more competitive with traditional options.

- Accelerated Depreciation: Allowing businesses to deduct the cost of green assets more quickly, improving cash flow.

Government infrastructure spending, notably through initiatives like the Infrastructure Investment and Jobs Act (IIJA), continues to be a significant driver for equipment providers. The IIJA's substantial funding for roads, bridges, and public transit is projected to sustain robust demand for heavy equipment throughout 2024 and into 2025, directly benefiting companies like Alta Equipment Group through increased sales and rental utilization.

Stricter global regulations on carbon emissions are accelerating the demand for low-emission and zero-emission heavy machinery. This trend directly influences Alta Equipment Group's product offerings, necessitating a greater emphasis on supporting and selling equipment that meets evolving environmental standards, with increased enforcement anticipated in 2024 and 2025.

Political stability and predictable economic policies are crucial for fostering business confidence in sectors reliant on heavy equipment. Uncertainty regarding interest rates or potential policy shifts in late 2024 and 2025 could lead to more cautious capital expenditure decisions by customers, impacting Alta Equipment Group's market.

What is included in the product

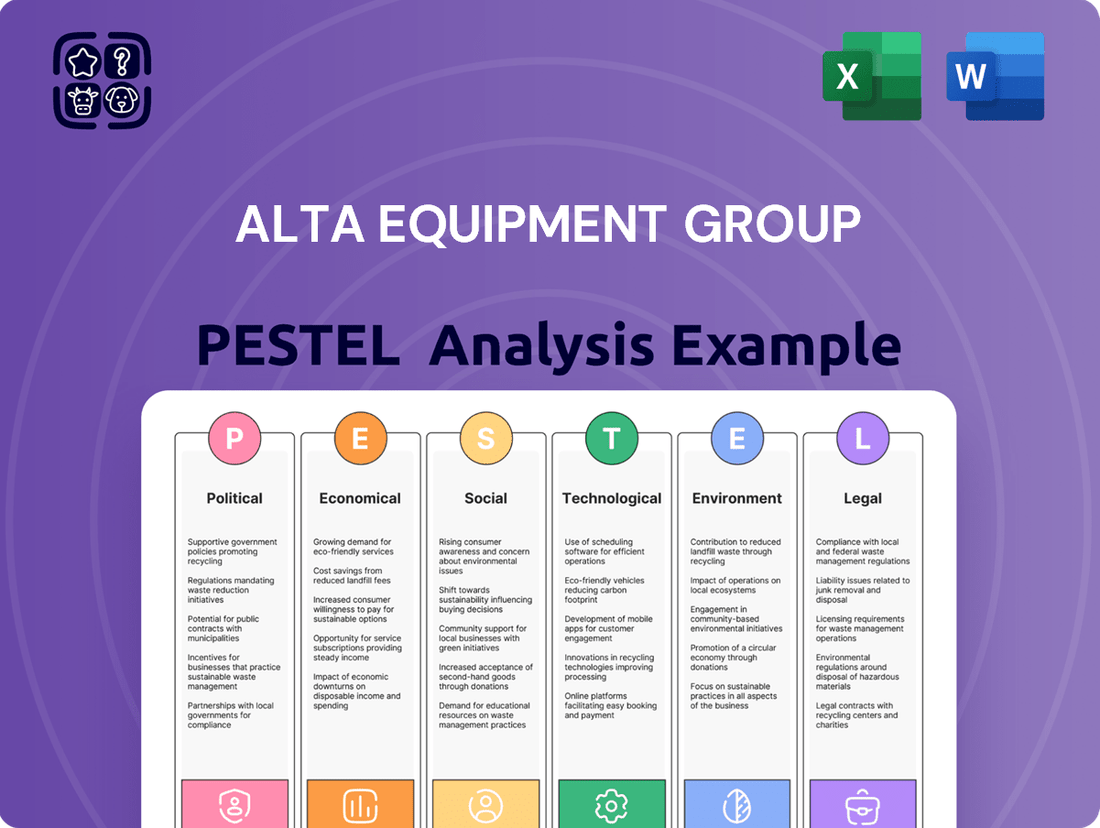

This PESTLE analysis for Alta Equipment Group examines how external macro-environmental factors, including Political, Economic, Social, Technological, Environmental, and Legal forces, influence its operations and strategic positioning.

A concise PESTLE analysis for Alta Equipment Group that highlights key external factors impacting the heavy equipment industry, serving as a pain point reliever by providing clarity for strategic decision-making.

Economic factors

Elevated interest rates, such as the Federal Reserve's benchmark rate holding steady in the 5.25%-5.50% range through early 2024, can significantly dampen demand for heavy equipment. This is because higher borrowing costs make large capital expenditures, like purchasing new machinery or expanding construction projects, less attractive for businesses and individuals alike, prompting a deferral of investments until financing conditions improve.

Conversely, a projected or actual decrease in interest rates, potentially driven by central bank policy shifts in late 2024 or 2025, is expected to stimulate the heavy equipment rental market. Easier and cheaper access to loans for construction and infrastructure projects would encourage more activity, thereby increasing the need for rental equipment as companies opt for flexible, short-term solutions rather than outright purchases.

The global construction machinery market is expected to reach approximately $235 billion by 2028, demonstrating robust growth. This upward trend is fueled by significant infrastructure development projects worldwide and increasing urbanization, particularly in emerging economies.

Alta Equipment Group directly benefits from this expansion as higher demand for construction translates into greater sales and rental opportunities for their heavy and specialized machinery.

For instance, in 2023, the U.S. infrastructure sector saw substantial investment, with the Infrastructure Investment and Jobs Act continuing to drive project pipelines, creating a favorable environment for equipment providers like Alta.

The material handling industry is experiencing robust expansion, fueled by technological innovation and a growing emphasis on sustainability. This evolution is creating a dynamic market for advanced solutions.

Key drivers include the integration of automation, artificial intelligence, and the Internet of Things (IoT) into logistics and warehousing. These technologies are not only making operations more efficient but also optimizing delivery networks, directly boosting the demand for cutting-edge material handling equipment and systems.

For instance, the global automated material handling market was valued at approximately $20.5 billion in 2023 and is projected to reach $37.8 billion by 2030, with a compound annual growth rate (CAGR) of 9.1%. This significant growth underscores the industry's positive trajectory.

Supply Chain Costs and Inflation

Supply chain disruptions and persistent inflation remain significant headwinds for Alta Equipment Group in 2025. The cost of raw materials and components, crucial for heavy equipment manufacturing, has seen continued upward pressure. This directly impacts production expenses and, consequently, profitability margins.

Several factors contribute to these elevated supply chain costs:

- Transportation and Logistics: Freight rates, both domestic and international, continue to be a major cost driver, exacerbated by labor shortages and fuel price volatility.

- Inventory Carrying Costs: Businesses are holding higher levels of inventory to mitigate potential stockouts, leading to increased warehousing and capital costs.

- Supplier Pricing: Suppliers are passing on their own rising input costs, resulting in higher prices for parts and sub-assemblies for manufacturers like Alta Equipment Group.

These combined pressures can squeeze margins, forcing companies to either absorb costs or pass them on to customers, potentially impacting sales volume in the competitive equipment sector.

Equipment Rental Market Trends

The equipment rental market is poised for continued expansion, with a notable shift in its primary growth engines. While non-residential construction has historically been a dominant force, projections for 2024-2025 indicate a growing reliance on residential construction to fuel market gains in certain geographical areas. This transition suggests evolving demand patterns that rental companies need to monitor closely.

A significant trend shaping the industry is the increasing demand for specialized equipment rentals. Businesses are increasingly recognizing the strategic advantage of leasing rather than owning, particularly when fulfilling niche project requirements or addressing specific, short-term operational challenges. This approach allows for greater flexibility and cost efficiency.

- Market Growth Drivers: Shifting from non-residential to residential construction in key regions is a major trend.

- Specialized Equipment Demand: Businesses are opting for rentals to meet unique project needs and manage specific challenges.

- Leasing Advantages: Leasing offers flexibility and cost-effectiveness for businesses needing specialized or project-specific equipment.

- Industry Outlook: The overall equipment rental market is expected to see continued growth through 2025.

Economic factors significantly influence Alta Equipment Group's performance, with interest rates playing a crucial role. Elevated rates, like the Federal Reserve's 5.25%-5.50% range in early 2024, increase borrowing costs, potentially delaying large equipment purchases and capital projects.

Conversely, anticipated interest rate decreases in late 2024 or 2025 could stimulate the heavy equipment rental market by making financing more accessible for construction and infrastructure projects.

Persistent inflation and supply chain disruptions continue to be major challenges, driving up raw material and component costs for heavy equipment manufacturing, impacting production expenses and profit margins.

The global construction machinery market is projected for robust growth, expected to reach around $235 billion by 2028, driven by infrastructure development and urbanization, creating favorable sales and rental opportunities for Alta Equipment Group.

| Economic Factor | 2024/2025 Outlook | Impact on Alta Equipment Group |

|---|---|---|

| Interest Rates | Holding elevated, potential for decreases late 2024/2025 | Higher borrowing costs may deter purchases; lower rates could boost rentals |

| Inflation | Persistent upward pressure on costs | Increases raw material and component expenses, squeezing margins |

| Construction Market Growth | Projected to reach ~$235B by 2028 | Increased demand for sales and rentals due to infrastructure projects |

What You See Is What You Get

Alta Equipment Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. It details the Alta Equipment Group PESTLE analysis, covering Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. This comprehensive report provides valuable insights for strategic decision-making.

Sociological factors

The construction sector is grappling with a significant shortage of skilled workers, a situation worsened by an aging workforce retiring and fewer young people choosing to enter the trades. This deficit directly affects project schedules and budgets, driving up the need for advanced equipment that can compensate for fewer hands on deck.

For instance, in the US, the Associated General Contractors of America reported in early 2024 that over 70% of construction firms struggled to find enough qualified hourly craft workers, a persistent issue impacting project delivery and profitability.

The construction industry faces an aging workforce, a trend impacting equipment demand. As older, experienced workers retire, there's a growing gap in skilled labor. This demographic shift, particularly noticeable in regions like the US where the average age of construction workers has been rising, means companies like Alta Equipment Group must consider equipment that simplifies operation and reduces the reliance on highly specialized manual skills. For instance, the Bureau of Labor Statistics indicated a significant percentage of construction workers were over 45 in recent years, highlighting this demographic reality.

Worker safety is paramount in the material handling and construction sectors, driving significant innovation. Alta Equipment Group, like its peers, is seeing increased demand for machinery designed with advanced safety features and improved ergonomics to minimize operator fatigue and prevent injuries. For instance, the Occupational Safety and Health Administration (OSHA) reported a 15% decrease in workplace fatalities in the construction industry between 2019 and 2022, underscoring the impact of these safety-focused trends.

Shifting Perceptions of Vocational Trades

For a significant period, societal emphasis has heavily favored academic routes, often overshadowing the value and appeal of vocational trades. This has led to a noticeable decline in younger generations choosing skilled trades as career paths, a trend that impacts industries reliant on these specialized skills.

Efforts to reframe the perception of vocational careers are gaining momentum, aiming to highlight their viability and earning potential. This shift is critical for bridging the persistent labor gap seen in many skilled trades, ensuring a sustainable workforce for the future.

- Labor Shortage Impact: In 2024, the U.S. Bureau of Labor Statistics projected that 12 million new jobs would require a bachelor's degree, but also noted that vocational trades, such as electricians and plumbers, are in high demand with projected growth rates often exceeding the average for all occupations. For instance, the demand for HVAC technicians was expected to grow 6% from 2022 to 2032.

- Attractiveness of Trades: Many vocational careers offer competitive salaries and less student debt compared to traditional four-year degrees. For example, the median annual wage for electricians in May 2023 was $61,990, while for plumbers it was $60,070, according to the BLS.

- Government Initiatives: In 2024, various government and industry-led initiatives continue to promote apprenticeships and vocational training programs, aiming to attract more individuals to skilled trades and address the skills gap.

Impact of Automation on Employment

The increasing adoption of automation and advanced technologies within the construction and material handling sectors, key areas for Alta Equipment Group, presents a dual impact on employment. While these innovations can help alleviate persistent labor shortages, they concurrently necessitate a workforce possessing enhanced technological proficiency. This evolution means a shift in the skills profile demanded, underscoring the critical need for robust training programs focused on new technologies.

The demand for workers skilled in operating and maintaining automated equipment is growing. For instance, the U.S. Bureau of Labor Statistics projected that employment in construction and extraction occupations is expected to grow 5 percent from 2022 to 2032, which is about average. However, the nature of these jobs is changing. Companies are increasingly seeking individuals with experience in robotics, data analytics, and advanced machinery operation. This trend suggests that traditional roles may be augmented or replaced by those requiring digital literacy.

This technological shift has significant implications for workforce development strategies:

- Upskilling Requirements: A growing number of construction and material handling roles will require proficiency in operating and maintaining automated systems, robotics, and advanced software.

- Training Investment: Companies like Alta Equipment Group must invest in training initiatives to equip their existing workforce with the necessary tech-savvy skills to adapt to these changes.

- Talent Gap: A potential talent gap exists for individuals possessing both the foundational understanding of construction/material handling and the advanced technical skills required by automated environments.

- Future Workforce Needs: The long-term employment landscape will favor individuals who can integrate with and leverage technological advancements, rather than perform purely manual tasks.

Societal preferences have historically leaned towards academic pursuits, often overshadowing the appeal and recognition of skilled trades. This has contributed to a decline in younger individuals entering trades, directly impacting industries like construction and material handling that rely on these specialized skills. For example, in 2024, while 12 million new jobs were projected to require a bachelor's degree, vocational trades such as electricians and plumbers remained in high demand, with projected growth rates often exceeding the average for all occupations.

However, there's a growing movement to rebrand vocational careers, emphasizing their earning potential and stability, often with less student debt than traditional degrees. The median annual wage for electricians in May 2023 was $61,990, and for plumbers, it was $60,070, according to the U.S. Bureau of Labor Statistics, showcasing the financial viability of these paths.

Government and industry initiatives are actively promoting apprenticeships and vocational training in 2024, aiming to attract more talent to skilled trades and address the persistent labor gap. This focus on vocational education is crucial for ensuring a future workforce capable of meeting industry demands.

Technological factors

Technological advancements are reshaping the material handling sector, with automation and robotics at the forefront. Companies like Alta Equipment Group are increasingly incorporating automated storage and retrieval systems (AS/RS), robots, and autonomous mobile robots (AMRs) into their operations.

These technologies are crucial for boosting warehouse efficiency, as demonstrated by the global automated material handling market projected to reach $37.7 billion by 2025, growing at a CAGR of 12.1%. The focus is on improving cost control and achieving higher order accuracy.

Alta Equipment Group can leverage the integration of AI and machine learning to enhance operational efficiency. Smart warehouses, powered by AI, are becoming a reality, automating tasks like sorting and improving demand forecasting accuracy, which is crucial for managing inventory effectively.

Furthermore, AI-driven predictive maintenance algorithms can significantly reduce equipment downtime. For instance, in 2024, industries saw a notable reduction in unplanned outages due to AI-powered diagnostics, a trend Alta Equipment can capitalize on to improve service offerings and customer satisfaction.

The integration of the Internet of Things (IoT) is transforming the material handling sector, with connected systems offering real-time visibility into goods and equipment. This allows for proactive maintenance, streamlining inventory management, and better integration across supply chains, directly impacting operational efficiency for companies like Alta Equipment Group.

By 2025, the global IoT market is projected to reach over $1.5 trillion, with significant growth in industrial applications like material handling. This surge in connectivity enables predictive maintenance, reducing downtime and costs, and optimizes inventory levels, ensuring resources are available when and where needed.

Electrification of Heavy Equipment

The heavy equipment sector is seeing a significant shift towards electric and hybrid models, spurred by tighter environmental rules and escalating fuel expenses. This movement is projected to see diesel engines become less prevalent, particularly in smaller equipment, as the industry embraces cleaner alternatives.

By 2025, the global market for electric construction equipment is anticipated to reach approximately $10 billion, with a compound annual growth rate (CAGR) of over 15%. This growth indicates a strong market acceptance and a clear direction for manufacturers like Alta Equipment Group to invest in and offer these technologies.

- Growing Demand: Increased environmental awareness and government incentives are pushing for electrification.

- Technological Advancement: Battery technology and charging infrastructure are improving, making electric options more viable.

- Operational Benefits: Electric equipment often boasts lower running costs due to reduced fuel and maintenance needs.

Digital Transformation and Data Analytics

Digital transformation is reshaping the construction industry, with companies like Alta Equipment Group increasingly leveraging data. Telematics, for instance, is crucial for effective fleet management. This technology allows for real-time tracking of equipment, monitoring usage, and optimizing maintenance schedules. This proactive approach helps minimize downtime and reduce operational costs.

The use of big data and advanced analytics is becoming a significant trend, enabling construction firms to gain deeper insights into their operations. By analyzing data from various sources, businesses can predict cost fluctuations more accurately, identify areas for efficiency improvements, and make more informed strategic decisions. This data-driven approach is key to staying competitive in the evolving market.

For example, in 2024, the construction technology market was valued significantly, with a substantial portion driven by data analytics and IoT solutions. Companies are investing heavily in platforms that can process telematics data to provide actionable intelligence. This focus on data analytics is projected to continue growing, with an estimated compound annual growth rate (CAGR) of over 15% through 2028, according to industry reports.

- Telematics Adoption: Increased use of GPS tracking and sensor data for equipment monitoring and utilization.

- Predictive Maintenance: Utilizing data analytics to forecast equipment failures and schedule proactive maintenance, reducing unexpected repair costs.

- Operational Optimization: Leveraging data insights to improve fuel efficiency, route planning, and resource allocation across job sites.

- Cost Management: Employing data to better understand and predict material costs, labor expenses, and project profitability.

Technological advancements are fundamentally altering how Alta Equipment Group operates and the products it offers. The increasing integration of automation, robotics, and AI in material handling is boosting efficiency, with the global automated material handling market expected to hit $37.7 billion by 2025. Alta can leverage AI-driven predictive maintenance to cut equipment downtime, a trend that saw notable success in 2024.

The shift towards electric and hybrid heavy equipment is accelerating, driven by environmental concerns and fuel costs. The electric construction equipment market is projected to reach around $10 billion by 2025, growing at over 15% CAGR. This presents a clear opportunity for Alta to expand its electric offerings.

Digital transformation, particularly through telematics and data analytics, is key for fleet management and operational optimization. The construction technology market, heavily influenced by data analytics and IoT, is seeing substantial investment, with projected CAGRs exceeding 15% through 2028. This allows for better cost management and predictive maintenance.

| Technology Area | Key Impact | 2025 Market Projection/Growth |

|---|---|---|

| Automation & Robotics | Increased operational efficiency, cost control | Global Automated Material Handling Market: $37.7 billion (CAGR 12.1%) |

| AI & Machine Learning | Predictive maintenance, demand forecasting | N/A (Significant growth in industrial applications) |

| Electric & Hybrid Equipment | Lower running costs, environmental compliance | Global Electric Construction Equipment Market: ~$10 billion (CAGR >15%) |

| Telematics & Data Analytics | Fleet management, predictive maintenance, cost optimization | Construction Tech Market (Data Analytics/IoT): CAGR >15% (through 2028) |

Legal factors

Environmental regulations, especially concerning carbon emissions from heavy machinery, are becoming increasingly stringent. For instance, the U.S. Environmental Protection Agency (EPA) is actively developing new rules aimed at reducing greenhouse gas emissions from non-road diesel engines, which directly impacts manufacturers like Alta Equipment Group.

These evolving standards necessitate significant investment in cleaner technologies and potentially impact the operational costs for equipment users. By 2024, the EPA's Tier 4 standards were already in effect, pushing for substantial reductions in particulate matter and nitrogen oxides, with further tightening expected in the coming years.

As construction and material handling equipment become more technologically advanced, regulatory bodies worldwide are continuously updating product safety and certification standards. Alta Equipment Group must remain vigilant, ensuring all new, used, and rental equipment adheres to these evolving requirements. For instance, in 2024, the Occupational Safety and Health Administration (OSHA) continued to emphasize stringent safety protocols for heavy machinery, impacting equipment design and operational guidelines across the United States.

Changes in labor laws, such as potential increases in minimum wage or new regulations on working conditions, directly affect Alta Equipment Group's operational expenses and how it manages its workforce. For instance, a shift towards higher mandated wages could increase labor costs for its technicians and support staff.

The persistent shortage of skilled labor, particularly in the heavy equipment sector, underscores the critical need for Alta Equipment Group to remain compliant with all employment regulations. This includes adhering to fair hiring practices and ensuring proper training and certification for its mechanics, which are vital for maintaining service quality and operational efficiency.

Data Privacy and Cybersecurity Regulations

As Alta Equipment Group increasingly relies on connected equipment and digital platforms, navigating data privacy and cybersecurity regulations is paramount. The company must adhere to evolving laws designed to safeguard customer and operational data, such as the California Consumer Privacy Act (CCPA) and its successor, the California Privacy Rights Act (CPRA), which significantly impact how businesses handle personal information.

Failure to comply can result in substantial penalties. For instance, under the GDPR, fines can reach up to 4% of annual global turnover or €20 million, whichever is higher, highlighting the financial risk associated with data breaches and non-compliance. This necessitates robust data protection strategies and cybersecurity measures to maintain customer trust and operational integrity.

Key considerations for Alta Equipment Group include:

- Data Minimization: Collecting and retaining only necessary customer and operational data.

- Security Measures: Implementing strong encryption, access controls, and regular security audits.

- Transparency: Clearly communicating data collection and usage policies to customers.

- Incident Response: Developing and testing plans to address potential data breaches effectively.

Trade Compliance and Import/Export Regulations

International trade policies and regulations significantly impact Alta Equipment Group's operations. For instance, changes in import/export duties or quotas on heavy machinery and related parts can directly influence sourcing costs and the competitiveness of their distributed equipment. Navigating these complexities is crucial for maintaining efficient supply chains and market access.

Alta Equipment Group, dealing with a wide array of equipment, must stay abreast of evolving trade compliance. This includes understanding tariffs, sanctions, and country-specific import restrictions that could affect their ability to procure or sell equipment across different regions. In 2024, global trade tensions and protectionist measures continue to pose challenges.

- Tariff Impacts: Fluctuations in tariffs on construction and agricultural equipment, for example, can alter pricing strategies and demand.

- Regulatory Compliance: Adherence to varying import/export documentation requirements and product standards across jurisdictions is essential for seamless transactions.

- Supply Chain Disruption: Trade disputes or new regulations can lead to delays or increased costs in the movement of goods, impacting delivery timelines.

- Market Access: Understanding and complying with trade agreements and restrictions directly influences Alta's ability to serve international markets.

Legal factors significantly shape Alta Equipment Group's operational landscape, from environmental compliance to labor laws and data privacy. The company must navigate a complex web of regulations designed to ensure safety, fair labor practices, and the protection of sensitive information. Staying compliant with these evolving legal requirements is not just a matter of avoiding penalties but also crucial for maintaining operational efficiency and customer trust.

The increasing focus on data privacy, exemplified by regulations like the California Privacy Rights Act (CPRA), means Alta Equipment Group must meticulously manage customer and operational data. Non-compliance can lead to substantial financial penalties, with fines potentially reaching millions of dollars, as seen with stricter data protection laws globally. Furthermore, evolving international trade policies and tariffs directly impact supply chain costs and market access, requiring constant vigilance and strategic adaptation.

Environmental regulations continue to tighten, particularly concerning emissions from heavy machinery, necessitating investments in cleaner technologies. For instance, the U.S. EPA's ongoing efforts to reduce greenhouse gas emissions from non-road diesel engines directly influence equipment design and operational standards. Similarly, workplace safety regulations, like those emphasized by OSHA in 2024, dictate stringent protocols for heavy machinery operation, impacting equipment design and maintenance practices.

Environmental factors

The construction and industrial sectors are major contributors to global carbon emissions, prompting a stronger emphasis on minimizing the environmental footprint of heavy machinery. This regulatory and societal pressure is directly fueling the demand for equipment that produces fewer emissions, including electric and hybrid alternatives.

For instance, in 2023, the construction industry was estimated to be responsible for approximately 37% of global energy-related CO2 emissions, highlighting the urgency for greener solutions. Alta Equipment Group, like its competitors, faces increasing pressure to adapt its product lines to meet these evolving environmental standards and customer preferences.

Alta Equipment Group is navigating a landscape where eco-friendly practices are increasingly vital in material handling. The push for sustainability and energy efficiency is driving demand for solutions like electric forklifts, which represented a significant portion of new equipment sales growth in 2024. Companies are also exploring solar-powered equipment and the use of recyclable materials in their operations, reflecting a broader industry shift towards greener solutions.

The environmental footprint of heavy equipment, including its disposal, is under increasing scrutiny. Regulations and public demand are pushing for better waste management and recycling of machinery parts. Alta Equipment Group's commitment to extending equipment life through maintenance and repair directly addresses these concerns, fostering a more sustainable approach to machinery usage.

Noise Pollution Regulations

Noise pollution regulations are a growing concern for heavy equipment operators like Alta Equipment Group. The operation of machinery, particularly in populated areas, can lead to significant noise disturbances. For instance, in 2024, cities are increasingly implementing stricter noise ordinances, impacting construction timelines and equipment choices.

These regulations directly influence Alta Equipment Group's operational strategies and equipment procurement. The company must consider the noise output of its fleet, potentially favoring quieter, more technologically advanced models. This could mean a shift towards electric-powered machinery, which generally operates at lower decibel levels compared to traditional diesel engines.

- Increased demand for quieter equipment: Alta Equipment Group may see a rise in customer requests for low-noise machinery, especially for projects in urban environments.

- Investment in noise reduction technology: The company might need to invest in retrofitting existing equipment or prioritize new purchases with enhanced noise suppression features.

- Potential operational cost increases: Quieter, more advanced equipment can sometimes come with a higher upfront cost or require specialized maintenance.

- Competitive advantage: Early adoption of noise-compliant equipment could position Alta Equipment Group as a more responsible and preferred supplier in certain markets.

Resource Depletion and Material Sourcing

Concerns about resource depletion are increasingly shaping how companies like Alta Equipment Group manage their supply chains. The environmental toll of extracting raw materials, such as metals and minerals essential for manufacturing heavy equipment, is a significant consideration. This drives a push towards more sustainable sourcing practices and a deeper examination of the lifecycle impact of their products.

To counter the risks of material scarcity and price volatility, Alta Equipment Group is likely exploring strategies to diversify its supplier base. This involves identifying and vetting new sources for critical components and raw materials, potentially looking at regions with more stable supply or those with better environmental track records. Such diversification is key to maintaining operational continuity and managing costs effectively in a dynamic global market.

The company's focus on resource efficiency extends to the materials used in its equipment. This could involve research and development into alternative, more sustainable materials that offer comparable or superior performance while reducing reliance on finite resources. For instance, advancements in recycled content or bio-based materials could offer viable options for certain components.

The global demand for key industrial metals, like iron ore and copper, continues to be a factor. For example, the International Energy Agency (IEA) reported in its 2024 update that demand for critical minerals, essential for clean energy technologies and manufacturing, is projected to surge in the coming years, highlighting the ongoing pressure on resource availability.

The increasing focus on environmental sustainability directly impacts Alta Equipment Group's product development and operational strategies. The construction sector's significant contribution to global emissions, estimated at 37% of energy-related CO2 in 2023, necessitates a shift towards greener machinery.

Alta Equipment Group is responding to this by seeing growth in demand for electric forklifts, a trend that continued strongly into 2024. Furthermore, stricter noise pollution regulations in urban areas are compelling the company to consider quieter, potentially electric-powered equipment to comply with new ordinances implemented in 2024.

Resource depletion concerns are also driving Alta Equipment Group to diversify its supply chain and explore sustainable materials for its equipment. The rising global demand for industrial metals, as highlighted by the IEA's 2024 projections for critical minerals, underscores the importance of these strategies for long-term operational stability and cost management.

| Environmental Factor | Impact on Alta Equipment Group | 2023/2024 Data/Trend |

|---|---|---|

| Carbon Emissions Reduction | Increased demand for electric/hybrid equipment; pressure to reduce operational footprint. | Construction sector responsible for ~37% of global energy-related CO2 emissions (2023). |

| Noise Pollution | Need to adopt quieter machinery; potential investment in noise reduction technology. | Growing implementation of stricter noise ordinances in urban areas (2024). |

| Resource Depletion & Material Sourcing | Supply chain diversification; exploration of sustainable materials; managing price volatility. | Projected surge in demand for critical minerals (IEA, 2024). |

| Waste Management & Recycling | Emphasis on extending equipment life through maintenance; scrutiny of disposal practices. | Growing public and regulatory demand for better waste management in heavy machinery. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Alta Equipment Group is informed by a comprehensive review of official government publications, leading economic indicators from institutions like the IMF and World Bank, and specialized industry reports. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors influencing the heavy equipment sector.