Alta Equipment Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alta Equipment Group Bundle

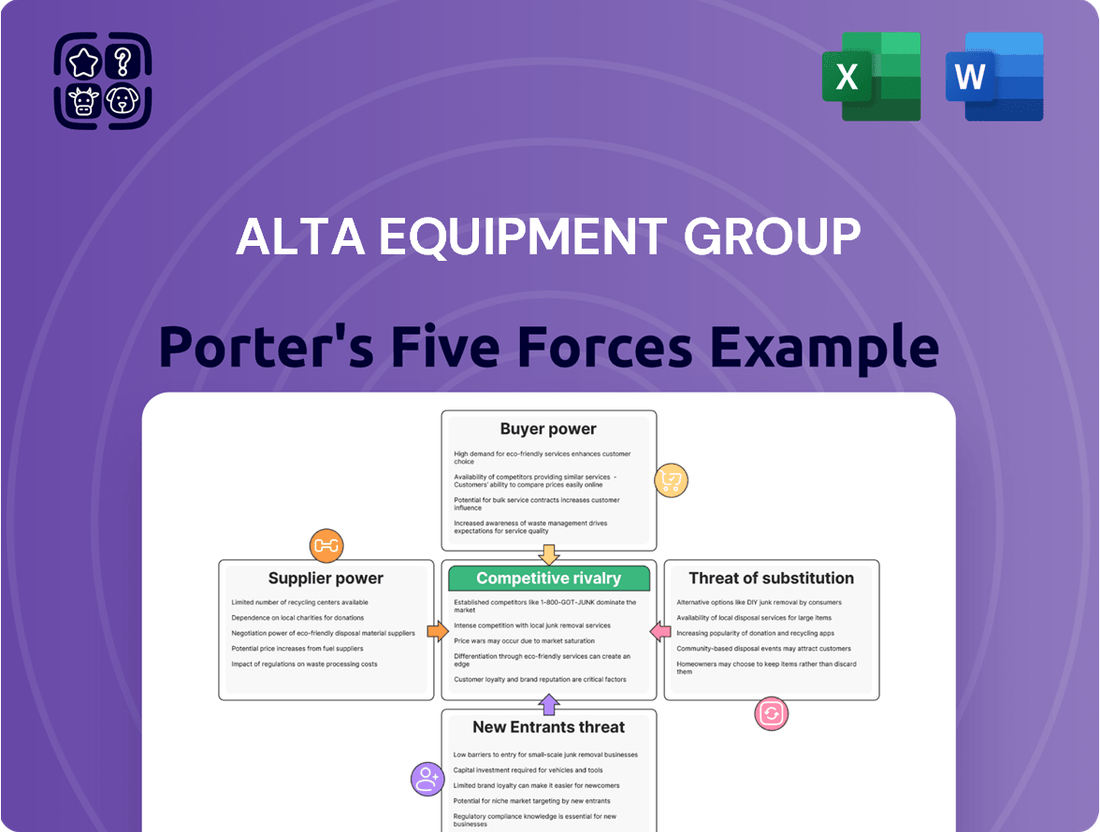

Alta Equipment Group operates within an industry where supplier power can be significant due to specialized equipment, and the threat of new entrants is moderated by high capital requirements. Understanding these dynamics is crucial for any stakeholder.

The complete report reveals the real forces shaping Alta Equipment Group’s industry—from buyer power to the intensity of rivalry. Gain actionable insights to drive smarter decision-making and uncover strategic opportunities.

Suppliers Bargaining Power

The industrial and construction equipment sector, which Alta Equipment Group operates within, is characterized by a relatively small number of dominant original equipment manufacturers (OEMs) supplying new machinery. This concentration means that these suppliers hold considerable sway, particularly when it comes to specialized equipment where replacement options are scarce.

Alta Equipment Group, functioning as a dealership, finds itself reliant on cultivating robust relationships with these pivotal manufacturers. For instance, in 2023, the top five global construction equipment manufacturers accounted for a significant portion of the market share, highlighting the limited number of primary sources for new equipment.

Switching between major equipment brands or suppliers presents significant hurdles for Alta Equipment Group. These challenges include the substantial costs associated with retraining technicians on new equipment, reconfiguring existing parts inventories to accommodate different models, and the potential disruption to established customer relationships that are often brand-specific. For instance, a fleet of machinery from a single manufacturer might require specialized diagnostic tools and a dedicated parts supply chain, making a transition to a new brand a complex and expensive undertaking.

While many heavy equipment parts can be standardized, Original Equipment Manufacturers (OEMs) often hold sway with unique, specialized machinery or proprietary service tools. This uniqueness means Alta Equipment Group and its customers have limited alternatives when sourcing these specific items. For instance, in 2024, the market for specialized construction equipment saw continued demand for advanced, proprietary technologies, making it harder for buyers to negotiate on price for these critical components.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers, such as equipment manufacturers, could impact Alta Equipment Group. If these Original Equipment Manufacturers (OEMs) were to significantly expand their direct sales and rental operations, it would reduce the reliance on independent dealerships like Alta, thereby bolstering supplier bargaining power. For instance, a major OEM deciding to open its own rental branches in key markets could directly compete with Alta’s existing rental fleet.

However, the capital intensity required to build and maintain extensive service and support networks, a core competency for established dealers like Alta, presents a significant barrier for OEMs. Developing a nationwide network of service centers, parts inventory, and trained technicians is a substantial undertaking. In 2024, the cost of establishing a new full-service dealership location can range from several million dollars upwards, depending on the size and location, making it a challenging proposition for many manufacturers to replicate the reach of established players.

- OEMs face substantial capital investment hurdles to replicate dealership service and support networks.

- The cost of establishing new, fully operational dealerships is a significant deterrent for manufacturers considering forward integration.

- Alta's established infrastructure provides a competitive advantage against potential supplier encroachment.

Importance of Alta to Suppliers

Alta Equipment Group's position as one of North America's largest integrated dealership platforms, boasting over 85 locations, grants it considerable leverage with its suppliers. This expansive network provides suppliers with access to a vast customer base and a broad market reach, potentially reducing the suppliers' individual bargaining power.

Alta's significant sales volume and comprehensive service offerings create a strong incentive for suppliers to maintain a favorable relationship. For instance, in 2023, Alta reported total revenues of $1.7 billion, highlighting the substantial business Alta can drive for its manufacturing partners.

- Alta's extensive dealer network: Over 85 locations across North America.

- Significant sales volume: $1.7 billion in revenue for 2023, demonstrating substantial purchasing power.

- Integrated services: Offering sales, rentals, parts, and service amplifies Alta's value proposition to suppliers.

The bargaining power of suppliers for Alta Equipment Group is moderate, primarily due to the concentrated nature of original equipment manufacturers (OEMs) in the heavy equipment sector. While these OEMs can exert influence through proprietary parts and specialized equipment, Alta's scale and integrated service model offer a counterbalance.

Suppliers, particularly major OEMs, hold significant power due to limited alternative sources for new, specialized equipment. For example, in 2024, the demand for advanced, proprietary technologies in construction equipment remained high, reducing negotiation flexibility for buyers like Alta on these critical components.

However, Alta's substantial revenue, reaching $1.7 billion in 2023, and its extensive network of over 85 locations across North America provide considerable leverage. This broad market reach and significant purchasing volume make Alta a crucial partner for suppliers, tempering their individual bargaining power.

| Factor | Impact on Alta Equipment Group | Supporting Data/Observation |

| Supplier Concentration | Moderate to High | Few dominant OEMs for new machinery. In 2023, top 5 global construction equipment manufacturers held a substantial market share. |

| Switching Costs | High for Alta | Costs associated with retraining, parts inventory, and customer relationships make changing brands difficult. |

| Product Differentiation | Moderate to High | OEMs possess unique, specialized machinery and proprietary service tools, limiting alternatives. Demand for proprietary tech in 2024 reinforced this. |

| Forward Integration Threat | Moderate | OEMs could expand direct sales/rentals, but capital intensity for service networks (costing millions in 2024 for new dealerships) is a barrier. |

| Alta's Purchasing Power | Moderate to High | $1.7 billion in 2023 revenue and 85+ locations provide significant leverage with suppliers. |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Alta Equipment Group's position in the heavy equipment industry.

Instantly understand the competitive landscape for Alta Equipment Group with a clear, one-sheet summary of all five forces—perfect for quick decision-making.

Customers Bargaining Power

Alta Equipment Group serves a wide array of customers spanning industries like manufacturing, logistics, construction, and infrastructure. This broad customer base is a significant factor in moderating customer bargaining power.

Because Alta isn't heavily dependent on any single customer or a small cluster of large buyers, the ability of individual customers to negotiate lower prices or demand more favorable terms is diminished. For instance, in 2023, Alta reported revenue from a wide range of customer segments, with no single segment dominating its sales, which reinforces this point.

In the industrial and construction sectors where Alta Equipment Group operates, customers often face substantial capital expenditures for acquiring new machinery. This inherent costliness makes them highly sensitive to the pricing of both equipment sales and rental services. For instance, a significant purchase or a prolonged rental agreement can represent a major outlay, directly impacting a company's budget and profitability, thus amplifying their focus on price.

The prevailing economic climate, particularly interest rate levels, directly influences customer price sensitivity. As of mid-2024, many economies are experiencing elevated interest rates, making financing new equipment purchases more expensive. This financial pressure can push customers to favor rental options over outright ownership, as rentals often require less upfront capital. Consequently, this shift can increase the bargaining power of customers, as they have more alternatives and are more willing to negotiate on rental rates or seek out more competitive pricing.

Alta Equipment Group's customers benefit from a broad market with numerous alternative suppliers and dealers. Major players like United Rentals, Herc Rentals, and Sunbelt Rentals offer extensive equipment fleets, directly impacting customer choice.

This widespread availability of rental and sales options significantly amplifies customer bargaining power. Customers can readily compare pricing structures, service agreements, and equipment availability across multiple providers, putting pressure on Alta to remain competitive.

Switching Costs for Customers

Switching costs for customers in the heavy equipment sector, like those interacting with Alta Equipment Group, are typically quite low. This means customers can readily shift their business from one provider to another without incurring significant expenses or facing major operational disruptions.

This ease of switching directly translates into increased bargaining power for customers. They are not locked into a particular supplier and can leverage this flexibility to negotiate better terms, prices, or service levels. For instance, a customer needing a specific piece of machinery can easily compare offerings from multiple dealerships, including Alta Equipment Group, based on immediate factors like rental rates or purchase prices.

- Low Switching Costs: Customers can easily rent or buy equipment from various dealerships, making it simple to change suppliers.

- Enhanced Bargaining Power: This low switching cost empowers customers to demand better pricing and service from providers like Alta Equipment Group.

- Price and Availability Driven Decisions: Customer loyalty is often secondary to immediate needs such as cost-effectiveness and equipment availability.

Information Availability to Customers

Customers in the equipment sector, including those interacting with companies like Alta Equipment Group, benefit significantly from readily available information. Online platforms, industry publications, and rental rate aggregators now provide detailed equipment specifications, competitive pricing, and current rental market trends. This surge in transparency directly empowers buyers and renters, enabling them to compare options and negotiate terms with greater confidence.

This enhanced information access translates into increased bargaining power for customers. They can more easily identify the best value propositions and leverage this knowledge to secure more favorable pricing and rental agreements. For instance, a customer researching heavy machinery in 2024 can readily access data on fuel efficiency, maintenance costs, and competitor pricing across multiple vendors, shifting the negotiation leverage towards them.

- Increased Information Access: Customers can easily find equipment specs, pricing, and rental rates online.

- Informed Decision-Making: This transparency allows customers to make smarter choices and compare offerings effectively.

- Enhanced Negotiation: Greater knowledge empowers customers to negotiate better terms and prices.

- Market Transparency: The availability of data fosters a more competitive and customer-centric equipment market.

Alta Equipment Group's customers possess considerable bargaining power due to the fragmented nature of the heavy equipment market, which offers numerous alternatives. This, combined with low switching costs and increased price transparency, allows customers to readily compare offerings and negotiate favorable terms.

The sensitivity to price, especially in the current economic climate with elevated interest rates in mid-2024, further amplifies customer leverage. Customers can more easily opt for rentals over purchases or seek out more competitive pricing from other suppliers, putting pressure on Alta to maintain attractive pricing and service levels.

| Factor | Impact on Alta Equipment Group | Customer Bargaining Power |

|---|---|---|

| Availability of Alternatives | Broad market with many competitors like United Rentals, Herc Rentals | High |

| Switching Costs | Low for customers to change suppliers | High |

| Price Sensitivity | Elevated due to high interest rates (mid-2024) and large capital expenditures | High |

| Information Access | Online platforms provide easy comparison of pricing and specs | High |

Full Version Awaits

Alta Equipment Group Porter's Five Forces Analysis

This preview provides a comprehensive Porter's Five Forces Analysis for Alta Equipment Group, detailing competitive rivalry, the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, and the threat of substitute products. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy. This analysis offers critical insights into the industry dynamics affecting Alta Equipment Group's strategic positioning and profitability.

Rivalry Among Competitors

Alta Equipment Group operates in a dynamic environment with significant competitive rivalry. The equipment sales and rental sector is characterized by the presence of large national competitors, such as United Rentals and Herc Rentals, which possess substantial market share and resources.

In addition to these national giants, Alta also contends with a multitude of regional and local dealerships. This fragmented nature of the market necessitates continuous efforts by Alta to distinguish its services and product offerings to maintain and grow its market position.

The construction and heavy equipment sector is projected for moderate growth in 2025. Some analysts anticipate a slight deceleration in specific market segments following a period of robust expansion. This shift towards more tempered growth can heighten competitive pressures as businesses vie for market share in a less dynamic environment.

Alta Equipment Group distinguishes itself through a broad spectrum of new and used equipment, coupled with robust parts, maintenance, and repair services. This 'one-stop-shop' approach, emphasizing extensive aftermarket support, is a key differentiator.

However, the competitive landscape is fierce, with rivals also providing similar comprehensive service packages. For instance, in 2024, the heavy equipment rental market saw significant competition, with companies like United Rentals and Sunbelt Rentals investing heavily in fleet expansion and technological upgrades to enhance customer service and availability, forcing Alta to continuously innovate its service offerings and operational efficiencies to maintain its competitive edge.

Exit Barriers

Alta Equipment Group, like many in the heavy equipment sector, faces substantial exit barriers. The sheer amount of capital tied up in equipment inventory, specialized machinery, and physical infrastructure makes it incredibly costly and difficult for a company to simply walk away. This financial commitment means firms are often compelled to stay in the market, even when facing challenging economic conditions.

These high exit barriers directly contribute to intense competitive rivalry. When companies cannot easily leave the industry, they are forced to compete more aggressively for market share and profitability. This can lead to price wars or increased investment in sales and marketing to maintain their position, even if the overall market is shrinking.

- High Capital Investment: The heavy equipment industry requires significant upfront investment in machinery, parts inventory, and service facilities. For instance, a typical dealership might hold millions of dollars in new and used equipment.

- Specialized Assets: Much of the infrastructure and inventory is highly specialized, with limited resale value outside the industry, further increasing the cost of exiting.

- Commitment to Operations: Companies are often bound by long-term leases, service contracts, and supplier agreements that are not easily terminated, reinforcing their commitment to continued operations.

Market Concentration and Acquisitions

Alta Equipment Group's competitive rivalry is shaped by a market characterized by both large, established players and a trend towards consolidation driven by strategic acquisitions. Alta itself has actively pursued mergers and acquisitions, a strategy that has demonstrably expanded its geographic footprint and broadened its product offerings. This M&A activity signals a market undergoing consolidation, which could result in a landscape with fewer, but significantly larger and more powerful, competitors.

The acquisition strategy employed by companies like Alta is a key indicator of this consolidation. For instance, in 2023, Alta completed several acquisitions, including that of Honnen Equipment, a significant move that bolstered its presence in the Rocky Mountain region and added new product lines. This type of growth through acquisition not only increases market share but also intensifies the competitive pressure from other similarly aggressive consolidators.

- Market Consolidation: The heavy reliance on acquisitions by major players, including Alta Equipment Group, points to an ongoing trend of market consolidation.

- Increased Rivalry Intensity: As companies grow through M&A, they become larger and more formidable rivals, leading to heightened competitive pressures across the industry.

- Geographic and Product Expansion: Acquisitions allow companies to quickly gain market share, expand into new territories, and diversify their product and service portfolios, thereby intensifying competition in those expanded areas.

Alta Equipment Group faces intense competition from large national players like United Rentals and Herc Rentals, as well as numerous regional and local dealerships. The sector's projected moderate growth in 2025, following a period of rapid expansion, is expected to heighten these competitive pressures as firms fight for market share.

Companies are differentiating through comprehensive service packages and aftermarket support, but rivals offer similar value propositions. For example, in 2024, major competitors heavily invested in fleet expansion and technology, forcing Alta to continually innovate its offerings and operations to stay competitive.

The industry's high exit barriers, stemming from substantial capital investment in specialized assets and operational commitments, compel firms to remain active competitors, intensifying rivalry even in slower growth periods.

Market consolidation, driven by strategic acquisitions like Alta's purchase of Honnen Equipment in 2023, is creating larger, more formidable competitors, thereby increasing overall industry rivalry and pressure.

SSubstitutes Threaten

Customers for Alta Equipment Group might explore alternative equipment solutions that fulfill their material handling and construction needs. For instance, the increasing adoption of automation and robotics in warehousing, a trend expected to continue growing, could reduce the reliance on traditional forklift or heavy machinery rentals for certain tasks. In 2024, the global industrial automation market was valued at over $80 billion, indicating a significant shift towards technologically advanced alternatives.

The robust used equipment market presents a significant threat of substitutes for Alta Equipment Group. When new equipment prices surge or delivery times stretch out, customers frequently turn to reliable pre-owned machinery to achieve cost savings and bypass lengthy delays. This directly siphons demand away from Alta's new equipment sales, as evidenced by the continued strength in the secondary market, which saw transaction volumes remain high throughout 2024.

Customers weighing whether to rent or buy equipment face a significant decision. This choice acts as a substitute threat to outright sales. For instance, in 2024, with interest rates remaining a key consideration for capital expenditures, many businesses might find renting a more attractive option than taking on significant debt to purchase new machinery.

The decision to rent instead of buy is often influenced by economic conditions. If financing costs, reflected in interest rates, are high, the appeal of rental agreements increases, directly substituting for the purchase of new or used equipment. This is particularly relevant for companies needing equipment for short-term projects or those hesitant about long-term asset commitments in an uncertain economic climate.

Alta Equipment Group's strategy of offering both rental and sales helps to address this substitute threat. By providing flexibility, they can capture customers who prefer renting due to immediate cost savings or project-specific needs, while still serving those who opt for ownership. However, the underlying availability of rental as an alternative remains a constant factor influencing purchasing decisions.

Technological Advancements

Technological advancements, particularly in areas like advanced robotics and automation, pose a potential threat by offering substitutes that could lessen the demand for traditional heavy equipment. For instance, the increasing adoption of automated construction processes, which were projected to grow significantly in the coming years, might reduce the need for certain types of machinery that Alta Equipment Group provides.

While these are often considered longer-term threats, the continuous evolution of more efficient construction methods presents a subtle but persistent substitute for current equipment solutions. The market for construction technology solutions, including automation, was expected to see robust growth, indicating a shift in how projects are executed.

The emergence of new equipment designs that are more fuel-efficient or require less maintenance can also act as substitutes, indirectly impacting the demand for older or less advanced models. Companies are increasingly looking at total cost of ownership, making newer, potentially more expensive but ultimately cheaper-to-operate equipment an attractive alternative.

- Emerging technologies like advanced robotics and automation could reduce reliance on traditional heavy equipment.

- Efficient construction methods represent potential long-term substitutes for current equipment solutions.

- The construction technology market is experiencing growth, signaling a potential shift in equipment needs.

Do-It-Yourself (DIY) Solutions

For smaller projects or businesses, a do-it-yourself (DIY) approach can act as a substitute for specialized equipment or services offered by companies like Alta Equipment Group. Customers might opt to handle minor tasks themselves using readily available tools, bypassing the need for rental or purchase of heavy machinery. While this is less prevalent for large-scale industrial or construction needs, it can still impact demand for certain types of equipment or services.

The threat of DIY solutions is generally low for Alta Equipment Group’s core business, which involves heavy construction and industrial equipment. However, for smaller repair jobs or less demanding tasks, customers might indeed opt for DIY methods. For instance, a small farm might use basic tools for minor equipment maintenance instead of renting specialized diagnostic equipment.

- DIY Impact: While not a direct competitor for major projects, DIY can substitute for minor equipment needs or basic maintenance, potentially reducing demand for smaller rental items.

- Market Segment: The threat is more pronounced in segments serving smaller businesses or individual users with less complex equipment requirements.

- Cost Consideration: Customers may choose DIY to save on labor costs and the expense of renting specialized equipment for simple tasks.

The threat of substitutes for Alta Equipment Group is multifaceted, encompassing technological advancements, the used equipment market, and alternative business models like renting versus buying. Emerging technologies, such as advanced robotics in construction, offer a potential substitute for traditional heavy machinery, a trend supported by the global industrial automation market exceeding $80 billion in 2024.

The robust used equipment market remains a significant substitute, with customers turning to pre-owned machinery for cost savings and quicker availability, especially when new equipment prices or delivery times increase. Furthermore, the option to rent equipment instead of purchasing it acts as a direct substitute, particularly when financing costs, like interest rates in 2024, make outright ownership less appealing for short-term needs or in uncertain economic climates.

| Substitute Type | Description | Impact on Alta Equipment Group | 2024 Data/Trend |

|---|---|---|---|

| Technological Advancements | Automation, robotics, and new construction methods | Reduces demand for certain traditional equipment | Industrial automation market > $80 billion |

| Used Equipment Market | Availability of pre-owned machinery | Siphons demand from new equipment sales | Continued high transaction volumes in secondary market |

| Rental vs. Purchase | Choosing to rent instead of buy | Directly substitutes for outright sales | Rental appeal increases with high interest rates |

Entrants Threaten

The equipment sales and rental sector demands significant upfront capital. Newcomers must invest heavily in acquiring a diverse fleet of machinery, establishing physical locations, and building a robust service and maintenance network. For instance, acquiring a comprehensive inventory of heavy construction equipment alone can easily run into millions of dollars, a substantial hurdle for aspiring competitors.

Established players like Alta Equipment Group leverage significant economies of scale, particularly in purchasing power and sophisticated inventory management systems across their extensive network of over 85 locations. This operational efficiency translates into lower per-unit costs for equipment and services.

For a new entrant, replicating Alta's scale would require substantial upfront investment in infrastructure, inventory, and distribution, making it challenging to achieve comparable cost efficiencies. This cost disadvantage hinders their ability to compete effectively on price against incumbents.

Alta Equipment Group's four decades of operation have cultivated deep customer loyalty and strong brand recognition, making it difficult for new entrants to gain traction. Newcomers would need to invest significantly in building trust and demonstrating reliability to compete with established relationships that drive repeat business and service agreements.

Distribution Channels and Supplier Relationships

New entrants face significant hurdles in establishing distribution channels and forging relationships with Original Equipment Manufacturers (OEMs). Alta Equipment Group, like its established peers, benefits from decades of cultivated partnerships, granting it preferential access to a broad range of equipment and often exclusive sales territories. This makes it tough for newcomers to secure a competitive product lineup.

For instance, in the heavy equipment sector, OEMs typically have limited dealer networks and prioritize long-term, high-volume partners. New entrants may struggle to meet these stringent requirements, limiting their ability to offer a comprehensive product suite to customers. This reliance on established relationships creates a substantial barrier.

- OEM exclusivity agreements: Many major equipment manufacturers have exclusive distribution agreements with existing dealers, preventing new entrants from carrying their brands.

- Established dealer networks: Companies like Alta have built extensive physical and logistical networks over years, making it difficult and costly for new players to replicate.

- Brand loyalty and reputation: Customers often trust established brands and dealers, creating a hurdle for new entrants to gain market share.

Regulatory and Licensing Requirements

The industrial and construction equipment sector is subject to a complex web of regulations. For instance, in 2024, the Environmental Protection Agency (EPA) continued to enforce stringent emissions standards for heavy-duty vehicles and equipment, impacting manufacturers and operators alike. Obtaining the necessary licenses and certifications for operating specialized machinery, especially those involving hazardous materials or advanced technology, can be a significant hurdle for newcomers. These compliance costs, coupled with the need for specialized training and adherence to evolving safety protocols, effectively raise the barrier to entry for potential competitors looking to establish themselves in the market.

Navigating these regulatory landscapes presents a substantial challenge. New entrants must invest heavily in understanding and implementing compliance measures, which can include:

- Meeting EPA emissions standards for new equipment.

- Securing operational licenses for specialized machinery.

- Adhering to evolving OSHA safety regulations.

- Complying with state-specific environmental permits.

The threat of new entrants for Alta Equipment Group is moderate, primarily due to the substantial capital investment required to establish a competitive presence. Acquiring a diverse equipment fleet and building a service infrastructure demands millions, a significant barrier. Furthermore, established players benefit from economies of scale in purchasing and inventory management, making it difficult for newcomers to match cost efficiencies.

New entrants also face challenges in securing OEM relationships and building brand loyalty. Alta's decades of experience and established networks provide preferential access to equipment and customer trust, creating a considerable hurdle for new competitors aiming to gain market share. Regulatory compliance, including EPA emissions standards and safety protocols, further adds to the cost and complexity for potential entrants in 2024.

| Factor | Impact on New Entrants | Example/Data (2024) |

|---|---|---|

| Capital Requirements | High Barrier | Acquiring a basic heavy construction fleet can easily exceed $5 million. |

| Economies of Scale | Disadvantage for Newcomers | Alta's purchasing power allows for lower per-unit equipment costs. |

| Brand Loyalty & Relationships | Significant Hurdle | Established customer trust drives repeat business for incumbents. |

| OEM Access & Exclusivity | Restricted Access | Many OEMs have exclusive dealer agreements. |

| Regulatory Compliance | Costly Barrier | Meeting EPA emissions standards and safety regulations requires investment. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Alta Equipment Group is built upon a foundation of data from annual reports, SEC filings, and industry-specific market research reports. We also incorporate insights from financial analyst reports and macroeconomic data to provide a comprehensive view of the competitive landscape.