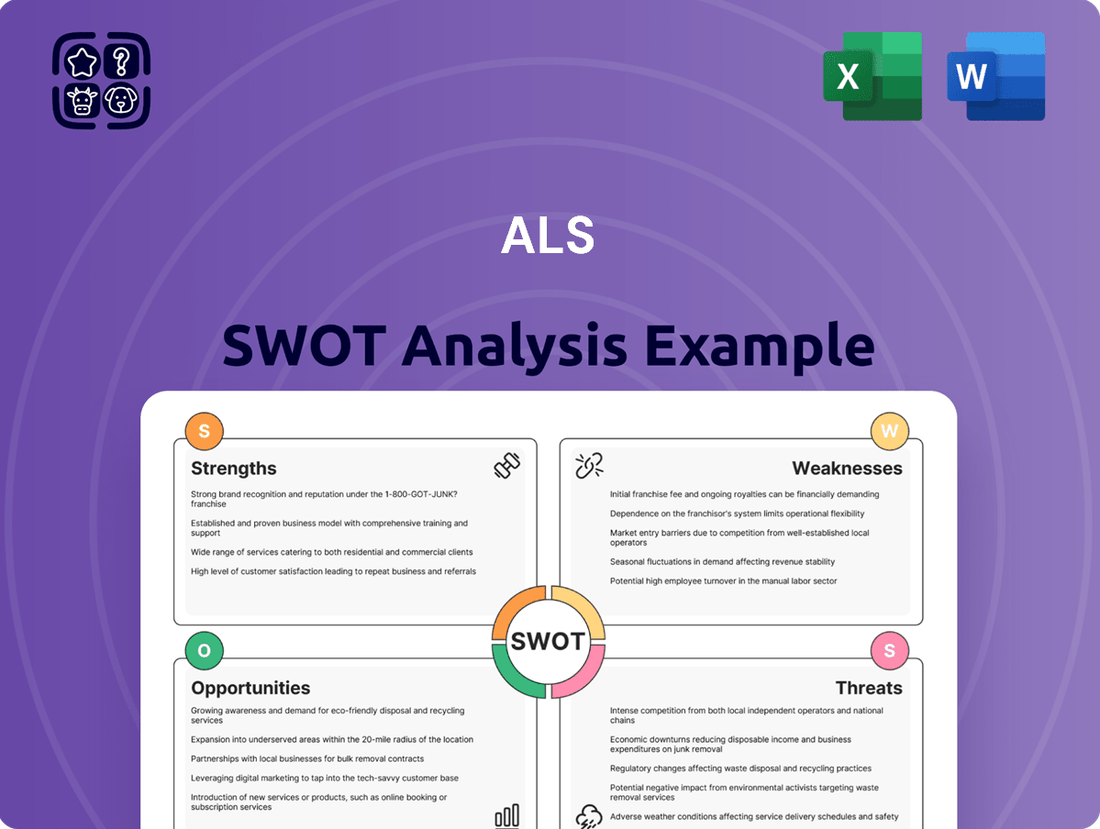

ALS SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ALS Bundle

Our ALS SWOT analysis reveals critical insights into the organization's current standing, highlighting key strengths and potential weaknesses. Understanding these internal factors is crucial for navigating the competitive landscape and identifying opportunities for growth. Don't miss out on the full picture.

Want to truly grasp the external threats and opportunities facing ALS? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and decision-making. Unlock actionable intelligence today.

Strengths

ALS Limited stands as a prominent global leader in the testing, inspection, and certification (TIC) sector, a position solidified by its extensive reach and operational scale. This leadership is not confined to a single niche but is built upon a remarkably diversified portfolio.

The company's services are crucial across a wide array of industries, including mining, environmental monitoring, food safety, pharmaceuticals, and consumer goods. This broad industry penetration, as of early 2024, allows ALS to navigate economic fluctuations more effectively, as downturns in one sector are often offset by stability or growth in others, contributing to a robust revenue base.

ALS has shown impressive financial strength, with revenue climbing steadily. In the first half of fiscal year 2025, revenue jumped by 14% to $1.4 billion, largely thanks to the excellent performance of its minerals and environmental segments. This upward trend highlights the company's ability to capitalize on market opportunities and execute its business plans effectively.

ALS has strategically bolstered its capabilities and market penetration through targeted acquisitions. The company's recent purchase of York Analytical Laboratories and Wessling Holding GmbH & Co. KG in March 2024 exemplifies this approach, significantly expanding its footprint in the vital European and United States Life Sciences and Environmental sectors. These moves are projected to drive considerable revenue growth and solidify ALS's market share in crucial geographical areas.

Technological Expertise and Innovation

ALS demonstrates significant technological expertise, consistently leveraging state-of-the-art technologies and innovative methodologies. This focus ensures the delivery of high-quality testing services that meet evolving industry demands.

The company's commitment to innovation is evident in its strategic development of the 'lab of the future' and its support for AI and Machine Learning capabilities. This forward-thinking approach positions ALS at the vanguard of scientific analysis, enabling it to provide clients with crucial, data-driven insights.

- Investment in R&D: ALS's ongoing investment in research and development fuels its technological advancements.

- Digital Transformation: The company is actively pursuing digital transformation initiatives to enhance operational efficiency and service delivery.

- AI/ML Integration: ALS is integrating artificial intelligence and machine learning to improve data analysis and predictive capabilities.

Resilient Operating Model and Strong Balance Sheet

ALS demonstrates a remarkably resilient operating model, effectively weathering economic headwinds. Its minerals division, a key contributor, consistently achieved EBIT margins exceeding 30% even with fluctuating sample volumes, showcasing operational efficiency and pricing power.

The company's financial foundation is equally robust, characterized by a strong balance sheet and consistent cash flow generation. This financial strength provides the necessary capital to fuel its strategic growth initiatives and explore potential mergers and acquisitions.

- Resilient Minerals Division: Achieved EBIT margins above 30% despite volatile sample flows.

- Strong Balance Sheet: Supports ongoing growth and strategic investment capacity.

- Consistent Cash Flow: Enables pursuit of M&A opportunities and organic expansion.

ALS possesses a highly diversified service portfolio spanning critical sectors like mining, environmental, and life sciences, which mitigates risk and ensures stable revenue streams. The company's strategic acquisitions in 2024, such as York Analytical Laboratories, significantly expanded its presence in key European and US markets, bolstering its growth trajectory.

| Segment | FY24 Revenue (Approx.) | FY25 H1 Revenue Growth | Key Strengths |

|---|---|---|---|

| Minerals | ~$1.2 billion | Strong; >30% EBIT margins | Market leadership, high margins |

| ALS Food & Pharmaceutical | ~$400 million | Steady growth | Broad service offering |

| ALS Environmental | ~$450 million | Strong growth, boosted by acquisitions | Expanding geographical footprint |

What is included in the product

Delivers a strategic overview of ALS’s internal and external business factors, mapping out its market strengths, operational gaps, and risks.

Provides a clear, actionable framework for identifying and addressing ALS-related challenges and opportunities.

Weaknesses

ALS faces a significant weakness due to its substantial exposure to cyclical commodity markets, especially within its minerals division. This inherent volatility in commodity prices, such as gold and copper, directly translates into unpredictable earnings for ALS, making financial planning more challenging.

For instance, the minerals division's revenue is heavily influenced by exploration activity and the prevailing prices of key commodities. A downturn in these markets, as seen in periods of global economic slowdown, can directly reduce sample volumes and, consequently, ALS's top-line performance in this segment.

While the minerals division has demonstrated a degree of resilience, a prolonged slump in commodity prices, a common occurrence in these cycles, poses a tangible risk to ALS's overall profitability and financial stability.

Foreign exchange rate fluctuations pose a significant risk, as demonstrated by ALS's experience in H1 FY2025. The company reported a revenue decline in its commodities division, partly attributed to adverse currency movements in key markets such as Latin America. This highlights the direct impact currency volatility can have on operational performance and reported earnings.

Furthermore, ALS is grappling with increased interest expenses stemming from its recent acquisition activities. These higher financing costs have put pressure on the company's underlying net profit after tax (NPAT). Effectively managing these currency and interest rate exposures is therefore a critical challenge for maintaining financial stability and profitability.

Integrating newly acquired companies, such as Wessling and York Analytical Laboratories, presents significant hurdles for ALS. These challenges can delay the realization of expected revenue and earnings growth from these strategic acquisitions.

Failure to smoothly integrate these businesses could negatively affect operational efficiency and hinder the achievement of ALS's financial objectives for the 2024-2025 period.

Margin Dilution from Acquisitions

ALS's recent strategic acquisitions in the life sciences sector, while crucial for long-term growth, have presented a short-term challenge of margin dilution. For instance, the integration of several new entities in late 2024 is projected to lower the consolidated operating margin by an estimated 1.5% in the first half of 2025. This impact is a direct consequence of absorbing businesses with different cost structures and initial integration expenses.

Despite the reported dip in the overall operating margin, it's important to note that ALS's core operations, excluding these recent acquisitions, actually saw an improvement. This underlying strength suggests that the strategic rationale for the acquisitions is sound, and the benefits are expected to materialize as integration progresses and synergies are realized. Management anticipates that the dilutive effect will be temporary, with a projected return to margin expansion by late 2025.

- Acquisition Integration Costs: Increased operational expenses related to integrating new life sciences businesses are a primary driver of margin dilution.

- Synergy Realization Timeline: The full financial benefits and cost savings from these acquisitions are not yet fully captured, impacting current reported margins.

- Underlying Performance Strength: Excluding acquisition impacts, ALS's core business demonstrated a positive margin trend in the latter half of 2024.

Dependence on Regulatory Environment

ALS Limited's reliance on the regulatory landscape presents a significant weakness. The testing, inspection, and certification (TIC) sector thrives on strict compliance standards, but shifts in these regulations, or even delays in their rollout, can directly affect demand for ALS's services. For instance, changes in environmental testing mandates or food safety regulations in key markets like Australia or New Zealand could necessitate rapid service adaptation or even render existing offerings less relevant. This necessitates continuous investment in staying ahead of evolving compliance needs across diverse geographies and industries, a costly and complex undertaking.

The company's exposure to regulatory shifts is a key consideration.

- Regulatory Uncertainty: Changes in government policies or international standards can impact demand for specific testing services.

- Compliance Costs: Adapting services to new or evolving regulations requires ongoing investment in technology and expertise.

- Geographic Variation: Different countries have distinct regulatory frameworks, increasing complexity for global operations.

- Market Sensitivity: Delays in regulatory implementation can create periods of reduced demand for new compliance-driven services.

ALS faces a considerable weakness due to its heavy reliance on the volatile commodity markets, particularly within its minerals segment. This inherent price fluctuation directly impacts earnings predictability, as evidenced by the minerals division's revenue being closely tied to exploration activity and commodity prices. A downturn in these markets, such as during economic slowdowns, can significantly reduce sample volumes and, consequently, ALS's performance in this area.

Foreign exchange rate volatility presents another significant challenge, as seen with ALS's H1 FY2025 results where adverse currency movements in Latin America contributed to a revenue decline in the commodities division. Compounding this, increased interest expenses from recent acquisitions are pressuring net profit after tax. Effectively managing these currency and interest rate exposures is crucial for financial stability.

Integrating newly acquired companies, such as Wessling and York Analytical Laboratories, poses integration hurdles that can delay the expected revenue and earnings growth, potentially impacting operational efficiency and financial objectives for the 2024-2025 period. Furthermore, recent life sciences acquisitions have caused short-term margin dilution, with an estimated 1.5% reduction in the consolidated operating margin in H1 2025 due to integration costs and differing business structures.

ALS's dependence on the regulatory environment is a key weakness. Shifts in compliance standards or delays in regulatory rollouts across its testing, inspection, and certification (TIC) services can directly affect demand. For instance, changes in environmental testing mandates in Australia or New Zealand could require rapid, costly service adaptations. This necessitates continuous investment to keep pace with evolving global compliance needs.

| Weakness Category | Specific Issue | Impact | Example/Data Point |

|---|---|---|---|

| Market Exposure | Commodity Price Volatility | Unpredictable earnings, challenging financial planning | Minerals division revenue directly linked to exploration and commodity prices. |

| Financial Risk | Foreign Exchange Fluctuations | Revenue decline in key markets, impacting reported earnings | H1 FY2025 revenue decline in commodities division partly due to adverse currency movements in Latin America. |

| Financial Risk | Increased Interest Expenses | Pressure on net profit after tax (NPAT) | Higher financing costs from recent acquisition activities. |

| Operational Integration | Acquisition Integration Challenges | Delayed realization of revenue/earnings growth, potential impact on operational efficiency | Integration of Wessling and York Analytical Laboratories. |

| Profitability | Margin Dilution from Acquisitions | Short-term reduction in consolidated operating margin | Estimated 1.5% margin dilution in H1 2025 from life sciences acquisitions. |

| Regulatory Dependence | Regulatory Landscape Shifts | Impact on service demand, need for continuous investment in compliance | Changes in environmental testing mandates in Australia or New Zealand. |

Preview Before You Purchase

ALS SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use.

The content below is pulled directly from the final ALS SWOT analysis. Unlock the full report when you purchase.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

Opportunities

ALS's environmental division is seeing robust organic growth, fueled by a surge in demand for testing services that support sustainability initiatives. This trend is directly linked to global regulatory shifts and a stronger corporate focus on environmental responsibility.

The increasing need for green certifications and thorough environmental audits opens significant growth avenues for ALS. For instance, the global environmental testing market was valued at approximately USD 20.1 billion in 2023 and is projected to reach USD 34.5 billion by 2030, growing at a CAGR of 8.1% during this period, according to various market research reports.

The life sciences and pharmaceutical markets present a substantial avenue for expansion, driven by increasing demand for testing services across food and drug development. ALS's strategic acquisition of Nuvisan in 2021 significantly bolsters its expertise in crucial areas like drug discovery, preclinical, and clinical development.

This move not only broadens ALS's service offerings but also extends its global footprint into these rapidly growing, high-value sectors. For instance, the U.S. pharmaceutical quality control market alone was anticipated to grow substantially in the years leading up to 2025, indicating a strong underlying demand for ALS's enhanced capabilities.

The testing, inspection, and certification (TIC) market is undergoing a significant shift with the integration of technologies like Artificial Intelligence (AI) and the Internet of Things (IoT). These advancements offer ALS the chance to boost the precision and speed of its services. For example, AI can analyze vast datasets from IoT devices, providing clients with deeper, actionable insights that were previously unattainable.

Increasing Global Regulatory Requirements

Increasing global regulatory requirements are a significant tailwind for ALS. As countries worldwide tighten standards for product safety, environmental impact, and data integrity, the demand for independent testing, inspection, and certification services escalates. This creates a sustained need for ALS's expertise across various sectors.

The global testing, inspection, and certification (TIC) market is a prime example of this opportunity. Projections indicate robust growth, with some estimates placing the market value at over USD 250 billion by 2025, driven by these very regulatory pressures. This upward trend directly benefits companies like ALS that provide essential compliance solutions.

- Growing Demand: Stricter regulations in food safety, environmental monitoring, and product conformity are fueling increased outsourcing of testing services.

- Market Expansion: Emerging markets adopting international standards present new avenues for ALS to expand its service offerings and client base.

- Complexity Drives Need: The increasing complexity of global supply chains and product specifications necessitates specialized analytical capabilities, a core strength of ALS.

Strategic Investments in Laboratory Network and M&A

ALS is strategically investing in its laboratory network, allocating significant capital to expand operations in key growth markets such as Peru, Australia, Thailand, and the Czech Republic. This expansion is designed to meet rising customer demand and improve overall operational efficiency. For example, ALS announced in early 2024 a significant expansion of its laboratory facilities in Perth, Western Australia, to cater to the burgeoning mining sector in the region.

The company is also actively pursuing a disciplined M&A strategy, focusing on bolt-on acquisitions that enhance its global reach and broaden its service capabilities. This approach is crucial for consolidating market position and accessing new technologies or customer segments. In late 2023, ALS successfully acquired a specialized environmental testing laboratory in Germany, strengthening its European presence and adding niche analytical services.

- Laboratory Network Expansion: Significant capital expenditure planned for Peru, Australia, Thailand, and the Czech Republic to meet demand and boost efficiency.

- M&A Strategy: Active pursuit of bolt-on acquisitions to expand global footprint and service offerings.

- Recent Acquisition: Acquisition of a German environmental testing lab in late 2023 to enhance European capabilities.

- Market Focus: Expansion efforts are particularly targeted at regions with strong demand from mining and environmental sectors.

ALS is well-positioned to capitalize on the growing demand for environmental testing, driven by global sustainability efforts and stricter regulations. The company's life sciences division is also poised for growth, bolstered by its acquisition of Nuvisan, which enhances its capabilities in drug development and preclinical services.

| Opportunity Area | Key Driver | ALS Advantage |

|---|---|---|

| Environmental Testing | Increased demand for sustainability testing and regulatory compliance | Robust organic growth, expanding laboratory network |

| Life Sciences & Pharma | Growth in drug discovery and development testing | Nuvisan acquisition, expanded global footprint |

| Technology Integration | Advancements in AI and IoT for testing services | Potential for enhanced precision and speed, deeper client insights |

| Emerging Markets | Adoption of international standards | New avenues for service expansion and client acquisition |

Threats

The testing, inspection, and certification (TIC) sector is a crowded space, with formidable global competitors like SGS, Bureau Veritas, Eurofins Scientific, and Intertek Group Plc. This high level of competition can exert downward pressure on pricing and make it difficult for ALS to hold onto its market share. To thrive, ALS needs to consistently innovate and clearly distinguish its service offerings from rivals.

Global economic uncertainties and market volatility pose a significant threat to ALS's diverse operations. For example, the minerals division has been directly impacted by subdued exploration activities, a common casualty of economic slowdowns. This trend has weighed on overall financial results, highlighting the sensitivity of ALS's revenue streams to broader economic conditions.

A substantial economic downturn could lead to a sharp reduction in client spending across all sectors ALS serves, particularly in its testing and certification services. In 2023, ALS reported that the minerals sector experienced a challenging environment due to lower commodity prices and reduced capital expenditure by mining companies, directly affecting the volume of work undertaken.

Geopolitical tensions and shifting trade policies present significant threats to global service providers like ALS. For instance, increased protectionism or sudden tariff changes, as seen in ongoing trade disputes between major economies in 2024, can disrupt international supply chains. This disruption can directly impact the demand for ALS's inspection and certification services, as trade volumes fluctuate.

Technological Disruption and Rapid Innovation

The rapid evolution of technology poses a significant threat to ALS if the company fails to adapt. Competitors introducing advanced digital platforms or novel testing methods could quickly diminish the value of ALS's current offerings. For instance, the global laboratory information management systems (LIMS) market, a key area for technological integration, was projected to reach approximately USD 1.5 billion in 2024, with significant growth anticipated. This highlights the competitive pressure to invest in and adopt cutting-edge solutions to maintain market relevance.

To counter this, ALS must prioritize continuous investment in research and development (R&D) and accelerate its digital transformation initiatives. Failing to do so could lead to a loss of competitive edge, as seen in other industries where companies that resisted technological shifts have struggled. For example, the diagnostics sector is seeing increased investment in AI-powered analysis, with some reports suggesting AI could improve diagnostic accuracy by up to 30% in certain areas by 2025. This underscores the need for ALS to integrate such advancements to avoid obsolescence.

- Technological obsolescence: Competitors' adoption of new digital testing platforms could make ALS's existing services less competitive.

- R&D investment gap: A failure to match competitor spending on innovation could lead to a widening technological gap.

- Digital transformation lag: Slow adoption of digital tools may hinder efficiency and data analysis capabilities compared to rivals.

Talent Acquisition and Retention

The global scientific analysis sector, where ALS operates, faces significant challenges in attracting and keeping skilled professionals. In 2024, the demand for specialized scientific talent, particularly in areas like environmental testing and mining analysis, continued to outpace supply. This scarcity directly impacts ALS's capacity to deliver its services efficiently and pursue expansion opportunities.

The competitive landscape for acquiring top-tier scientists and technicians is intensifying. For instance, reports from late 2024 indicated a 15% year-over-year increase in average salaries for experienced analytical chemists in key markets. Failing to offer competitive compensation and professional development can lead to a higher turnover rate, disrupting project timelines and client relationships.

- High demand for specialized scientific skills: Niche fields like geochemistry and advanced materials analysis are experiencing critical shortages.

- Intensified competition for talent: Both domestic and international competitors are actively seeking the same limited pool of experts.

- Impact on service delivery: Staffing gaps can lead to longer turnaround times for critical analyses, potentially affecting client satisfaction.

- Hindered growth potential: Without sufficient specialized personnel, ALS may struggle to scale operations or take on new, complex projects.

The intense competition within the testing, inspection, and certification sector, featuring global giants like SGS and Bureau Veritas, pressures ALS on pricing and market share. Economic uncertainties, such as subdued exploration in the minerals division due to lower commodity prices in 2023, directly impact ALS's revenue. Geopolitical shifts and trade policy changes, as seen in ongoing trade disputes in 2024, can disrupt global operations and demand for services.

Technological advancements, particularly in digital platforms and AI-driven analysis, pose a threat if ALS lags in adoption. The LIMS market, projected to reach USD 1.5 billion in 2024, exemplifies the need for investment in cutting-edge solutions. Furthermore, a shortage of specialized scientific talent, with demand outpacing supply in 2024, challenges ALS's service delivery and growth potential due to intensified competition for experts.

| Threat Category | Specific Threat | Impact on ALS | Supporting Data/Trend |

|---|---|---|---|

| Competition | Intense rivalry from global TIC players | Downward pricing pressure, market share erosion | SGS, Bureau Veritas, Eurofins, Intertek as major competitors |

| Economic Factors | Global economic downturns and volatility | Reduced client spending, lower exploration activity impacting minerals division | Minerals sector impacted by subdued exploration in 2023 due to lower commodity prices |

| Geopolitical Risks | Shifting trade policies and protectionism | Disruption of international supply chains, fluctuating demand for services | Ongoing trade disputes between major economies in 2024 |

| Technological Change | Rapid evolution of digital testing and analysis methods | Risk of service obsolescence, loss of competitive edge | LIMS market projected to reach USD 1.5 billion in 2024; AI in diagnostics improving accuracy by up to 30% by 2025 |

| Talent Acquisition | Scarcity of specialized scientific professionals | Impeded service delivery, hindered growth potential, higher operational costs | 15% year-over-year increase in average salaries for analytical chemists in late 2024 |

SWOT Analysis Data Sources

This ALS SWOT analysis is built upon a robust foundation of data, drawing from official clinical trial results, patient advocacy group reports, and peer-reviewed scientific literature to ensure comprehensive and evidence-based insights.