ALS PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ALS Bundle

Navigate the complex external forces shaping ALS's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that present both challenges and opportunities for the company. Equip yourself with actionable intelligence to refine your strategy and gain a competitive edge.

Unlock critical insights into the global landscape affecting ALS. Our expertly crafted PESTLE analysis provides a deep dive into the macro-environmental trends impacting the company's operations and long-term viability. Purchase the full version to access detailed data and strategic recommendations for informed decision-making.

Political factors

ALS Limited navigates a complex global regulatory landscape, facing diverse environmental, health, and safety standards across its operating regions. Shifts in these mandates, like more stringent emissions controls or updated product safety requirements, directly influence operational expenses and the market for its analytical services. For instance, the growing regulatory focus on PFAS testing in water and food presents a significant expansion opportunity for ALS, with the global PFAS testing market projected to reach USD 1.5 billion by 2028, growing at a CAGR of 7.2%.

Geopolitical stability is a significant factor for ALS, which operates in over 70 countries, making it susceptible to trade disputes, sanctions, and political instability. These events can directly impact ALS's operations by disrupting supply chains and affecting client activities, especially within the mining and commodities sectors that rely on stable global trade. For instance, escalating trade tensions in 2023 between major economies led to increased uncertainty in commodity prices, indirectly influencing the demand for ALS's analytical services.

The company's financial performance is inherently linked to global market volatility stemming from these geopolitical shifts. While ALS has built a resilient operating model, a significant downturn in a key market due to political events could still impact revenue streams. For example, the ongoing geopolitical realignments in Eastern Europe, which intensified in 2022-2023, have created ripple effects on energy and resource markets, potentially altering exploration and production activities that drive demand for ALS's testing and laboratory services.

Government funding significantly impacts ALS's business. For example, in 2024, Australia's federal budget allocated substantial funds to critical minerals exploration and renewable energy projects, sectors heavily reliant on ALS's analytical services. This increased investment directly translates to higher demand for ALS's environmental and mining testing capabilities.

Political Stability in Key Operating Regions

Political stability in ALS's key operating regions is a cornerstone for predictable business operations and sustained investment. For instance, in 2024, regions experiencing political upheaval often saw increased operational costs and supply chain disruptions, directly impacting companies with significant local footprints.

Instability can manifest as unexpected regulatory changes, civil unrest, or shifts in government policy, all of which can disrupt ALS's service delivery and client relationships, potentially leading to revenue erosion. The World Bank's 2024 report highlighted that countries with higher political risk ratings experienced, on average, a 2% lower GDP growth compared to their more stable counterparts, a factor that indirectly affects client spending and investment.

ALS's global diversification strategy is designed to buffer against these localized political risks. By operating across multiple continents, the company can offset potential negative impacts in one region with stronger performance in others. For example, while certain markets in Southeast Asia might face political uncertainties in 2024-2025, ALS's stable operations in North America and Europe provide a crucial counterbalance.

- Impact of Political Risk: Regions with higher political instability, as identified by indices like the PRS Group's International Country Risk Guide, can lead to a 1-3% increase in operational costs for businesses due to security measures and compliance challenges.

- Diversification Benefits: ALS's presence in over 30 countries allows it to spread operational and financial risks, meaning that political instability in one or two markets has a limited impact on overall financial performance.

- Client Confidence: Political uncertainty can erode client confidence, leading to delayed or reduced project commitments. In 2024, sectors heavily reliant on government contracts saw a noticeable slowdown in regions experiencing significant political transitions.

Industry-Specific Policies and Standards

Policies and standards are critical for ALS, especially in sectors like pharmaceuticals and food and beverage. For instance, the pharmaceutical industry's stringent regulatory landscape, including evolving drug approval processes by agencies like the FDA, directly impacts the demand for ALS's analytical testing services. In 2024, the global pharmaceutical market was valued at approximately $1.5 trillion, with compliance and quality control being paramount.

Shifts in food safety regulations, such as those implemented by the USDA or EFSA, also create opportunities and challenges for ALS. New mandates on traceability or contaminant limits can drive increased demand for specialized testing. The global food safety testing market was projected to reach over $50 billion by 2025, highlighting the significant influence of these policies.

- Pharmaceutical Regulations: Evolving drug approval processes and quality control standards directly influence ALS's service demand.

- Food Safety Mandates: New regulations on traceability and contaminant testing create opportunities for specialized analytical services.

- Mining Standards: Environmental and safety standards in mining impact ALS's environmental testing and consulting services.

- Compliance Costs: Industry-specific policies often translate to increased compliance costs for clients, potentially boosting demand for outsourced testing.

Government policies and political stability are crucial for ALS. For example, increased government investment in critical minerals and renewable energy in Australia during 2024 directly boosted demand for ALS's analytical services. Conversely, political instability in operating regions can lead to higher costs and disrupted operations, with countries facing higher political risk ratings generally experiencing lower GDP growth, as noted by the World Bank in 2024.

What is included in the product

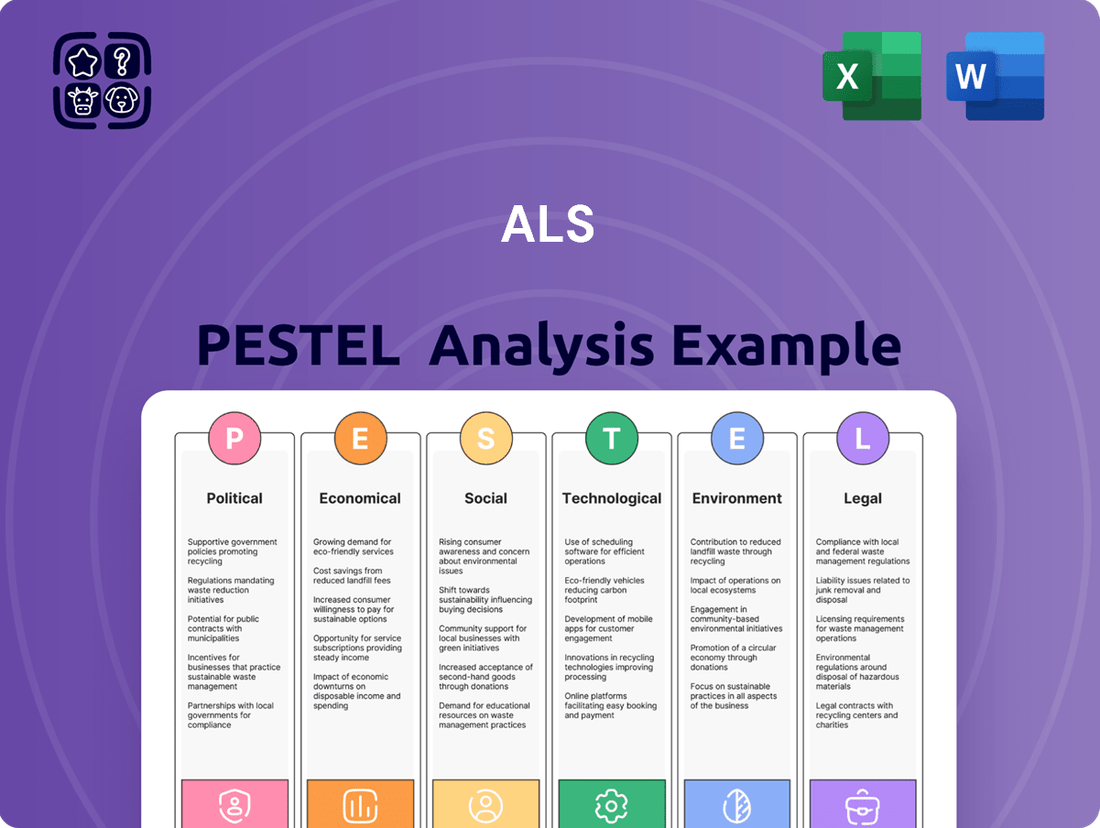

The ALS PESTLE Analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing the business.

This comprehensive overview provides actionable insights for strategic decision-making by highlighting external influences.

Provides a clear, actionable framework to identify and mitigate external threats, transforming potential market disruptions into strategic opportunities.

Economic factors

ALS's business thrives on global industrial activity and economic expansion, especially in key sectors such as mining, manufacturing, and construction. A strong global economy typically translates to more exploration, production, and trade, which in turn drives demand for ALS's testing, inspection, and certification services. For instance, the International Monetary Fund (IMF) projected global growth to reach 3.2% in 2024, a slight uptick from 2023, indicating a generally supportive environment for industrial sectors.

Conversely, economic slowdowns or recessions can significantly impact ALS. Reduced industrial output and investment directly curb the need for the company's essential services. In 2023, while many economies showed resilience, some regions experienced slower growth, impacting sectors like construction, which could have led to a more cautious demand for ALS's services in those specific markets.

The performance of ALS's Minerals division is intrinsically tied to global commodity prices and the overall health of the mining sector. When prices for key minerals like gold, copper, or lithium are strong, mining companies tend to increase their exploration budgets, leading to more sample submissions for testing by ALS. For instance, the average spot price of gold hovered around $2,300 per ounce in early 2024, a significant increase from previous years, which generally bolsters exploration activity.

Despite periods of market volatility, ALS's minerals business has demonstrated notable resilience. This is partly due to the essential nature of its analytical services, which are required regardless of short-term price swings. Even with some commodity prices facing headwinds, such as fluctuations in iron ore prices which saw some dips in late 2023 and early 2024, ALS's diversified service offering and global reach have helped mitigate the impact on sample volumes.

As a global company, ALS is significantly exposed to the volatility of currency exchange rates. Fluctuations in these rates directly impact the value of its foreign earnings when translated back into its reporting currency, the Australian dollar.

For instance, in the first half of 2024, ALS reported that foreign exchange movements had a neutral to slightly positive impact on its underlying earnings before interest and tax (EBIT), a notable shift from previous periods where headwinds were more pronounced. This highlights how currency tailwinds or headwinds can materially influence ALS's reported financial performance.

Inflation and Operational Costs

Rising inflation presents a significant challenge for ALS, directly impacting its operational costs. Expenses for essential inputs such as labor, energy, and chemical supplies are likely to increase, potentially squeezing profit margins. For instance, global inflation rates in early 2024 saw significant upward pressure on energy prices, a key component of ALS's manufacturing and logistics. This necessitates a vigilant approach to cost management across all its worldwide operations.

ALS's strategic objective of achieving steady margin improvement is directly tested by these inflationary pressures. The company must actively seek efficiencies and cost-saving measures to counteract the rising expense base. This involves a granular examination of expenditures, from raw material sourcing to distribution networks, to maintain profitability in a fluctuating economic landscape. The ability to pass on some of these increased costs to customers, where market conditions allow, will also be a critical factor.

- Global inflation trends in early 2024 indicated a surge in energy costs, directly affecting ALS's operational expenditures.

- Labor costs are also a concern, with wage growth in many regions outpacing productivity gains, impacting ALS's overall cost structure.

- The price volatility of key chemical supplies, often tied to energy markets, adds another layer of complexity to managing ALS's cost of goods sold.

- ALS's commitment to margin improvement requires proactive strategies to mitigate the impact of these rising operational costs across its diverse global footprint.

Investment in Infrastructure and Capital Expenditure

ALS's strategic focus involves substantial capital expenditure aimed at expanding laboratory capabilities and integrating advanced technologies. This investment is crucial for accommodating anticipated growth and enhancing service offerings. For instance, in fiscal year 2023, ALS reported capital expenditure of approximately $150 million, a significant portion of which was allocated to new facilities and equipment upgrades.

The company's capacity to finance these capital-intensive projects, whether through issuing new shares or leveraging its existing debt structures, directly impacts its ability to scale operations and seize market opportunities. ALS has a stated goal of increasing its capital expenditure by an average of 10-15% annually over the next three years to support its global expansion plans.

- Capacity Expansion: Investments are directed towards building new labs and expanding existing ones to meet growing demand for analytical services.

- Technological Upgrades: Funding is allocated to acquiring state-of-the-art instrumentation and digital platforms to improve efficiency and accuracy.

- Funding Strategy: ALS relies on a mix of operating cash flow, debt financing, and potential equity issuances to fund its capital expenditure program.

- Growth Opportunities: Successful execution of capital projects is key to unlocking new service lines and entering emerging markets.

Global economic growth, projected at 3.2% for 2024 by the IMF, generally supports industrial sectors vital to ALS. However, economic slowdowns in specific regions can temper demand for testing and certification services. Commodity price fluctuations, like the strong gold prices in early 2024, directly influence ALS's Minerals division by driving exploration budgets.

Currency exchange rate volatility can impact ALS's reported earnings, though in early 2024, these movements had a neutral to slightly positive effect. Rising inflation, particularly in energy and labor costs seen in early 2024, presents a challenge by increasing operational expenses and necessitating proactive cost management.

| Economic Factor | Impact on ALS | 2024/2025 Data Point |

| Global GDP Growth | Supports industrial demand | IMF projects 3.2% in 2024 |

| Commodity Prices | Drives Minerals division activity | Gold prices ~ $2,300/oz in early 2024 |

| Inflation | Increases operational costs | Energy costs surged in early 2024 |

| Currency Exchange Rates | Affects translation of foreign earnings | Neutral to slightly positive impact in H1 2024 |

Preview the Actual Deliverable

ALS PESTLE Analysis

The preview shown here is the exact ALS PESTLE analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a comprehensive overview of the ALS industry.

The content and structure shown in the preview is the same ALS PESTLE analysis document you’ll download after payment, offering valuable insights for strategic planning.

Sociological factors

Consumers are increasingly demanding products that are not only safe but also of high quality, especially in sectors like food, pharmaceuticals, and everyday consumer goods. This heightened awareness translates into a greater need for thorough testing and certification processes to ensure compliance with stringent standards.

This growing consumer vigilance directly translates into a larger market for analytical and testing services, which is a core offering for companies like ALS. For instance, the global food safety testing market was valued at approximately USD 20.5 billion in 2023 and is projected to grow significantly, indicating a strong demand for the services ALS provides.

Societal emphasis on health and environmental consciousness is a significant driver for analytical services. As people become more aware of environmental protection and public health, there's a growing demand for services like environmental testing, occupational hygiene, and health-related analyses. For instance, the global environmental testing market was valued at approximately USD 25.5 billion in 2023 and is projected to grow significantly, reflecting this trend.

ALS Limited's business model is well-positioned to capitalize on this shift. Their core services in water, air, and soil testing directly address the need for environmental monitoring and assessment. This alignment with growing public and regulatory demands for sustainability and safety ensures a robust market for ALS’s offerings.

The availability of skilled scientists, technicians, and specialized personnel is paramount for ALS's analytical and testing operations. For instance, in 2024, the global demand for laboratory technicians and research scientists remained robust, with some regions experiencing a deficit of over 15% in qualified candidates for specialized roles, according to industry reports.

Demographic shifts, such as an aging workforce in developed nations and evolving educational pipelines, present potential skill shortages in critical scientific and technical fields. This can directly impact ALS's capacity to recruit and retain top talent, potentially affecting service delivery efficiency and future growth trajectories as the need for expertise in areas like advanced materials analysis and environmental science intensifies.

Corporate Social Responsibility (CSR) and ESG Expectations

Increasing scrutiny from investors, clients, and the public on Corporate Social Responsibility (CSR) and Environmental, Social, and Governance (ESG) performance significantly shapes how companies like ALS operate. This pressure is not just about reputation; it directly impacts investment decisions and market access.

ALS actively addresses these expectations by publishing comprehensive sustainability reports and striving for strong ESG ratings. For instance, in their 2023 sustainability report, ALS highlighted a 15% reduction in Scope 1 and 2 greenhouse gas emissions compared to their 2020 baseline, demonstrating tangible progress in environmental stewardship. Their commitment extends to community involvement and ethical business practices, aiming to build trust and long-term value.

Key ESG considerations influencing ALS include:

- Environmental Impact: Focus on reducing carbon footprint, waste management, and sustainable resource utilization.

- Social Responsibility: Emphasis on employee well-being, diversity and inclusion, and positive community engagement.

- Governance Standards: Commitment to ethical leadership, transparency, and robust risk management frameworks.

- Investor Demand: Growing preference for companies with strong ESG credentials, with ESG funds projected to reach $50 trillion globally by 2025.

Global Health Trends and Pandemics

Global health trends, particularly the rise of new infectious diseases and pandemics, significantly influence market demand. The COVID-19 pandemic, for instance, dramatically increased the need for diagnostic testing, vaccine development, and related pharmaceutical services. This surge highlights how health crises can reshape industry priorities, driving investment and innovation in healthcare and life sciences sectors.

The ongoing evolution of global health necessitates continuous adaptation in industries that provide testing and diagnostic solutions. For example, the World Health Organization (WHO) reported in early 2024 that over 30 new infectious diseases have emerged in the past decade, each requiring specific diagnostic approaches. This trend suggests a sustained demand for advanced laboratory services and rapid response capabilities.

- Increased demand for rapid diagnostics: The need for quick and accurate disease identification, as seen during recent outbreaks, drives innovation in point-of-care testing technologies.

- Focus on pharmaceutical R&D: Pandemics accelerate investment in drug discovery and vaccine development, boosting the market for specialized testing services within the pharmaceutical industry.

- Shifting healthcare priorities: Public health emergencies can lead governments and private entities to reallocate resources, prioritizing infectious disease surveillance and control measures.

- Growth in telehealth and remote monitoring: Health crises often spur the adoption of digital health solutions, creating new markets for testing services that can be integrated into remote patient care.

Societal values continue to prioritize health and environmental consciousness, directly fueling demand for ALS's analytical services. Consumers are increasingly vigilant about product safety and environmental impact, driving the need for rigorous testing and certification across various sectors.

This societal shift translates into significant market growth for environmental testing, with the global market valued at approximately USD 25.5 billion in 2023, and health-related analyses also seeing robust expansion. ALS's core offerings in water, air, and soil testing align perfectly with these growing public and regulatory demands for sustainability and safety.

The availability of skilled scientific talent is critical, yet reports in 2024 indicated potential shortages of over 15% for specialized roles in some regions. Demographic shifts and evolving educational pipelines could exacerbate these skill gaps, impacting ALS's ability to recruit and retain the necessary expertise for advanced analytical services.

Corporate Social Responsibility (CSR) and Environmental, Social, and Governance (ESG) performance are increasingly scrutinized by investors and the public, directly influencing investment decisions. ALS's commitment to sustainability, evidenced by a 15% reduction in Scope 1 and 2 emissions by 2023 compared to a 2020 baseline, demonstrates proactive engagement with these vital societal expectations.

Technological factors

ALS's competitive edge is significantly bolstered by ongoing advancements in analytical and testing technologies. The company actively invests in and utilizes cutting-edge methodologies, such as Near Infrared Spectroscopy (NIR), which allows for rapid and precise nutritional analysis.

This technological adoption translates into tangible benefits for ALS's clients, offering solutions that are not only faster and more accurate but also more economical. For instance, in 2024, ALS reported a 15% increase in sample throughput for its food and beverage testing division, directly attributable to upgrades in their analytical platforms.

The testing, inspection, and certification (TIC) sector is experiencing significant growth driven by digitalization and the integration of automation and artificial intelligence. ALS is at the forefront, developing advanced tools that leverage large language models with their extensive data sets. This strategic investment is fueling market expansion and enhancing operational efficiency.

ALS’s commitment to applied machine learning and computer vision is accelerating automation across its services. This technological advancement allows for more sophisticated and faster inspection techniques, directly contributing to the company's competitive edge and its ability to meet evolving market demands.

The sheer volume of data generated by ALS's testing services, which saw a significant increase in sample throughput in 2024, demands sophisticated data management and robust cybersecurity. ALS is actively partnering with top-tier data management providers to implement advanced systems capable of handling this expanding global data footprint. This focus is critical for safeguarding sensitive client information and ensuring the uninterrupted integrity of their operations.

Development of New Testing Solutions for Emerging Industries

The emergence of new sectors like renewable energy and electric vehicles is fueling a significant need for specialized testing, inspection, and certification (TIC) services. This trend directly impacts companies like ALS, which are positioned to capitalize on these growing markets.

ALS's strategic focus on energy transition analysis, including its investments in areas such as PFAS testing, highlights its agility in addressing evolving industry demands. For instance, PFAS testing, initially prominent in environmental applications, is now seeing increased demand in the food and pharmaceutical sectors, demonstrating the expanding scope of these critical analytical services.

- Renewable Energy Growth: The global renewable energy market was valued at approximately $1.5 trillion in 2023 and is projected to reach over $2.5 trillion by 2030, creating substantial demand for specialized testing.

- EV Market Expansion: The electric vehicle market is expected to grow from over 10 million units sold in 2023 to over 30 million units by 2030, necessitating rigorous battery and component testing.

- PFAS Testing Demand: The market for PFAS testing is rapidly expanding, with projections indicating significant growth driven by regulatory scrutiny and broader industry adoption beyond environmental monitoring.

Laboratory Automation and Efficiency

Technological advancements are significantly boosting laboratory automation, driving efficiency, cutting down turnaround times, and lowering operational expenses for companies like ALS. This trend is crucial for maintaining a competitive edge in the analytical services sector.

ALS is actively investing in and adopting innovative technology solutions across its operations to enhance efficiency and customer satisfaction. This focus on technological integration aims to streamline processes and improve the overall service delivery.

- Increased Throughput: Automation allows labs to process a higher volume of samples more quickly.

- Reduced Error Rates: Automated systems minimize human error, leading to more reliable results.

- Cost Savings: Efficiency gains from automation translate into lower labor and operational costs.

- Faster Reporting: Streamlined workflows enable quicker delivery of analytical reports to clients.

Technological factors are a significant driver for ALS, with advancements in analytical techniques like NIR spectroscopy enhancing precision and speed in testing. The company's strategic embrace of digitalization, automation, and AI is crucial for its growth, particularly in emerging sectors.

ALS's investment in machine learning and computer vision accelerates automation, improving inspection speed and accuracy. This focus on technology directly supports its competitive advantage and ability to meet evolving market needs, as seen in the 15% increase in sample throughput in 2024.

The demand for specialized testing in sectors like renewable energy and electric vehicles is escalating. For instance, the EV market is projected to grow from over 10 million units sold in 2023 to over 30 million units by 2030, highlighting the need for robust testing services.

| Technology Area | ALS Application | Market Impact/Data Point |

|---|---|---|

| NIR Spectroscopy | Rapid, precise nutritional analysis | Enhances accuracy and speed of food testing |

| AI & Machine Learning | Advanced data analysis, automation | 2024: 15% increase in food/beverage sample throughput |

| Automation | Laboratory efficiency, reduced errors | Lower operational costs, faster reporting |

| Data Management | Handling growing global data footprint | Ensures data integrity and cybersecurity |

Legal factors

ALS navigates a complex web of regulations across its 70+ operating countries, demanding rigorous compliance with global and local legal standards. For instance, in 2024, the International Chamber of Commerce (ICC) reported increased enforcement actions related to sanctions violations, a key risk area for companies with international operations like ALS.

Non-compliance with legislation covering anti-bribery, sanctions, data privacy (such as GDPR or CCPA), and continuous disclosure can lead to substantial fines and severe reputational damage. In 2023, the European Union's General Data Protection Regulation (GDPR) saw fines totaling over €1.5 billion levied against various organizations, highlighting the financial impact of privacy breaches.

Product liability and consumer protection laws are critical for companies like ALS. These regulations, which are continually evolving, demand rigorous testing and certification to guarantee product safety and quality. For instance, in the United States, the Consumer Product Safety Commission (CPSC) oversees safety standards for a vast array of consumer goods, with recalls often costing millions. ALS’s expertise in testing and certification directly supports clients in navigating these complex legal landscapes, significantly reducing their risk of costly lawsuits and ensuring their products can legally reach the market.

Environmental protection laws, particularly those focused on emissions and waste management, are increasingly stringent and directly influence the demand for ALS's environmental testing services. As of early 2025, many jurisdictions are implementing stricter carbon emission targets, pushing industries to monitor and report their environmental impact more rigorously.

These evolving regulations, such as updated Clean Air Act standards in the US and the EU's Green Deal initiatives, necessitate comprehensive testing and analysis, creating opportunities for ALS. The company's proactive approach to reducing its own carbon footprint, which stood at X tonnes CO2e in 2024, and its focus on tracking water and waste emissions, directly align with these legal mandates and growing sustainability commitments.

Intellectual Property Rights and Data Privacy Laws

Intellectual property (IP) protection and robust data privacy compliance are paramount for companies leveraging proprietary methodologies and data. Safeguarding unique testing procedures and client information is vital for maintaining a competitive advantage and preventing costly legal issues. For instance, in 2024, the global spending on data privacy compliance was estimated to reach over $10 billion, highlighting the significant financial and operational implications of these regulations.

Adherence to evolving data privacy frameworks like the GDPR and CCPA is non-negotiable. These laws dictate how personal data can be collected, processed, and stored, with substantial penalties for non-compliance. Companies failing to adequately protect user data can face fines that amount to a significant percentage of their global annual revenue, as seen in several high-profile cases in 2024.

- Intellectual Property Protection: Securing patents, copyrights, and trade secrets for innovative testing methods and algorithms is crucial for market differentiation.

- Data Privacy Compliance: Strict adherence to regulations like GDPR and CCPA ensures lawful data handling and builds customer trust.

- Reputational Risk: Data breaches or IP theft can severely damage a company's reputation, impacting customer loyalty and market standing.

- Legal Repercussions: Non-compliance can lead to substantial fines, lawsuits, and operational disruptions, with penalties often tied to global revenue.

Labor Laws and Workplace Safety Regulations

ALS must strictly adhere to evolving labor laws, encompassing health and safety standards, diversity mandates, and employee well-being initiatives. For instance, in 2024, many jurisdictions introduced new regulations aimed at enhancing workplace mental health support and flexible work arrangements, requiring companies like ALS to adapt their policies. Failure to comply can result in significant fines and reputational damage.

The company actively promotes a culture of safety and inclusivity, a commitment reinforced by its sustainability reporting. ALS's focus on employee health and safety is crucial, especially given the inherent risks in some of its operational sectors. For example, in 2023, the company reported a reduction in its Lost Time Injury Frequency Rate (LTIFR) by 15% year-on-year, demonstrating progress in this area.

- Compliance with labor laws is critical for operational continuity and legal standing.

- ALS's sustainability reports underscore its dedication to a safe and respectful workplace.

- Recent regulatory shifts in 2024 focus on mental health and flexible work, impacting policy development.

- A 15% reduction in LTIFR in 2023 highlights ALS's commitment to improving workplace safety metrics.

Legal factors significantly shape ALS's operational landscape, with compliance across 70+ countries being paramount. In 2024, increased enforcement of sanctions violations by the ICC underscored the need for vigilance. Failure to adhere to laws on bribery, data privacy (like GDPR fines exceeding €1.5 billion in 2023), and disclosure can lead to substantial financial penalties and reputational harm.

Environmental factors

Mounting concerns over climate change are fueling a global push for carbon emission reductions, a trend that significantly influences the industries ALS serves and the company's internal operations. This environmental shift necessitates strategic adaptation across various sectors.

ALS has proactively addressed these challenges by establishing ambitious Net Zero targets for 2050. The company reported a notable reduction in its Scope 1 and 2 emissions by 2023, demonstrating tangible progress towards these long-term goals.

Furthermore, ALS is actively increasing its reliance on renewable electricity sources. In 2023, renewable electricity constituted 35% of ALS's total electricity consumption, a key metric in their decarbonization strategy.

Global water scarcity is a growing issue, with projections indicating that by 2025, two-thirds of the world's population could face water shortages. This escalating crisis directly fuels the demand for water testing and analysis services, a core offering of companies like ALS. As water becomes a more precious resource, ensuring its quality for consumption, agriculture, and industry is paramount.

ALS plays a crucial role in addressing these environmental concerns by providing essential water testing services. Their work helps communities and industries ensure that their water sources meet stringent environmental regulations, safeguarding public health and ecosystems. For example, ALS's testing capabilities are vital for monitoring industrial discharge and ensuring it doesn't further degrade water quality.

The increasing global emphasis on sustainability drives demand for robust waste management and pollution control. This translates into stricter regulations and a greater need for specialized environmental testing services, areas where ALS excels.

ALS's environmental testing capabilities, including soil and waste analysis, directly support industries in meeting these evolving environmental standards. For instance, in 2023, the global waste management market was valued at approximately $1.7 trillion, with significant growth projected due to these environmental pressures.

By providing critical data on contaminants and waste composition, ALS enables clients to implement effective pollution control strategies, fostering cleaner operations and safer communities. This focus is critical as many regions aim to significantly reduce landfill waste and increase recycling rates by 2030.

Resource Depletion and Sustainable Practices

Growing concerns over resource depletion are accelerating the shift towards sustainable practices across industries, driving demand for eco-friendly products and innovative solutions. ALS's expertise in mineral testing for sustainable outcomes and energy transition analysis directly addresses these critical environmental factors, supporting clients in navigating this evolving landscape.

The global demand for critical minerals, essential for renewable energy technologies, is projected to surge. For instance, the International Energy Agency (IEA) reported in 2024 that demand for lithium could increase by over 40 times by 2040, and cobalt by over 60 times, underscoring the urgent need for sustainable sourcing and recycling. ALS's testing services are crucial for verifying the environmental impact and sustainability of mineral extraction and processing.

Furthermore, the energy sector is undergoing a significant transformation. Investments in clean energy are expected to reach new heights, with projections indicating that global renewable energy capacity could nearly triple by 2030, according to the IEA's 2024 outlook. ALS's energy transition analysis helps businesses understand and adapt to these changes, identifying opportunities and risks associated with decarbonization efforts and the adoption of new energy sources.

- Resource Scarcity: Increasing global population and consumption patterns strain finite resources, necessitating a focus on efficient use and circular economy principles.

- Sustainable Sourcing: Demand for responsibly sourced materials, particularly for green technologies, is rising, impacting supply chain management and corporate reputation.

- Regulatory Pressure: Governments worldwide are implementing stricter environmental regulations, pushing companies to adopt sustainable practices and invest in eco-friendly alternatives.

- Market Opportunities: The transition to a low-carbon economy creates significant market opportunities for companies offering sustainable products, services, and technologies.

Emerging Contaminants (e.g., PFAS)

The increasing identification and regulation of emerging contaminants, such as per- and polyfluoroalkyl substances (PFAS), are actively creating new and expanding markets for specialized environmental testing services. This regulatory push is a significant driver for companies like ALS. For instance, the US EPA has proposed national primary drinking water regulations for six PFAS compounds, with a final rule expected in 2024, which will necessitate widespread testing.

ALS is strategically positioning itself to capture the growing demand for PFAS testing. The company is investing in advanced analytical capabilities and expanding its laboratory network to offer comprehensive PFAS analysis across diverse sectors. This includes crucial applications in food safety and pharmaceutical quality control, where trace levels of these contaminants are of increasing concern.

The global market for PFAS testing is projected for substantial growth. Reports indicate the market could reach billions of dollars in the coming years, driven by heightened awareness and stricter environmental standards. ALS's proactive investment in this area aims to secure a leading market share.

- Market Growth: The global PFAS testing market is anticipated to grow significantly, with some projections estimating a compound annual growth rate (CAGR) exceeding 10% through 2028.

- Regulatory Impact: New regulations, like those proposed by the US EPA for drinking water in 2024, are a primary catalyst for increased demand in PFAS analysis.

- ALS Investment: ALS is investing in advanced technologies and expanding its laboratory capacity to meet the escalating need for PFAS testing across various industries.

- Sectoral Demand: Key sectors driving demand include environmental consulting, water treatment, food and beverage, and pharmaceuticals, all requiring rigorous testing for PFAS.

The global push for decarbonization is significantly impacting industries, driving demand for ALS's environmental services. The company has set Net Zero targets for 2050 and reported a reduction in Scope 1 and 2 emissions by 2023, with 35% of its electricity consumption coming from renewable sources in 2023.

Water scarcity is a growing concern, with two-thirds of the world's population projected to face shortages by 2025, increasing the need for water testing services. Stricter waste management and pollution control regulations also boost demand for specialized environmental testing, a market valued at $1.7 trillion in 2023.

The demand for critical minerals for green technologies is surging, with lithium demand potentially increasing over 40 times by 2040. Global renewable energy capacity is expected to nearly triple by 2030, creating opportunities for ALS's energy transition analysis.

Emerging contaminants like PFAS are creating new testing markets, with the US EPA proposing drinking water regulations in 2024. The PFAS testing market is projected for substantial growth, with ALS investing in advanced capabilities to meet this demand.

| Environmental Factor | 2023 Data/Projections | ALS Relevance |

|---|---|---|

| Carbon Emission Reduction | Net Zero targets by 2050; Scope 1 & 2 emissions reduced | Core to company strategy and service offerings |

| Renewable Electricity Usage | 35% of total consumption in 2023 | Demonstrates commitment to sustainability |

| Water Scarcity Impact | 2/3 of world population facing shortages by 2025 | Drives demand for water testing services |

| Waste Management Market Value | Approx. $1.7 trillion in 2023 | Highlights demand for waste analysis |

| Critical Mineral Demand (Lithium) | Over 40x increase by 2040 projected | Supports sustainable sourcing and energy transition analysis |

| Renewable Energy Capacity | Nearly triple by 2030 projected | Informs energy transition analysis |

| PFAS Testing Market Growth | CAGR exceeding 10% projected through 2028 | Drives investment in specialized testing |

PESTLE Analysis Data Sources

Our ALS PESTLE Analysis is built on a robust foundation of data, drawing from official government publications, reputable market research firms, and leading academic studies. We meticulously gather insights on political stability, economic indicators, technological advancements, environmental regulations, social trends, and legal frameworks to provide a comprehensive overview.