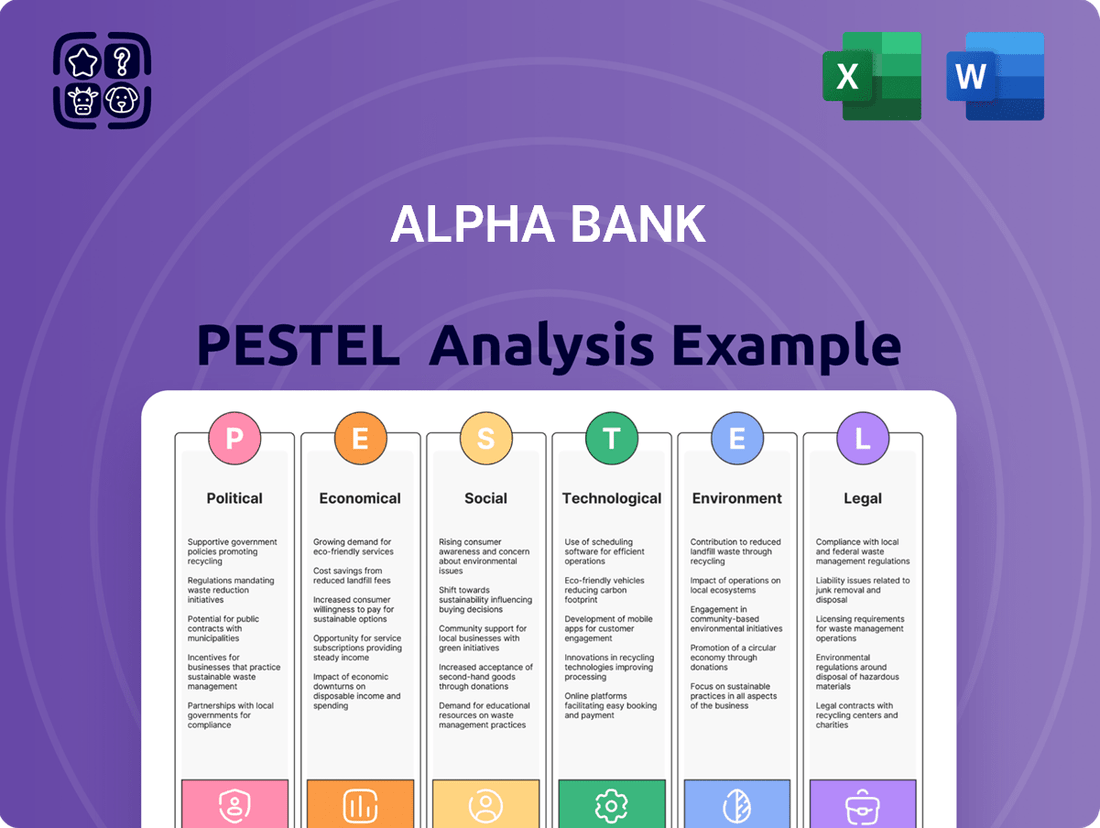

Alpha Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alpha Bank Bundle

Alpha Bank operates within a dynamic external environment, influenced by shifting political landscapes, evolving economic conditions, and rapid technological advancements. Understanding these forces is crucial for strategic planning and anticipating future challenges and opportunities. Our PESTLE analysis delves deep into these factors, providing you with the critical intelligence needed to stay ahead.

Gain a competitive edge by leveraging our comprehensive PESTLE analysis of Alpha Bank. Discover how political stability, economic fluctuations, social trends, technological innovation, environmental regulations, and legal frameworks are shaping its trajectory. Equip yourself with actionable insights to refine your market strategy and investment decisions.

Don't get blindsided by external shifts affecting Alpha Bank. Our meticulously researched PESTLE analysis offers a clear roadmap of the political, economic, social, technological, environmental, and legal forces at play. Download the full version now to unlock strategic foresight and make more informed choices.

Political factors

The stability of the Greek government and its policy direction are critical for Alpha Bank. A stable political landscape, as seen with the current New Democracy government's parliamentary majority, generally fosters investor confidence and supports predictable economic planning. This stability is crucial for Alpha Bank's long-term strategic decisions and investment outlook.

Conversely, political uncertainty or abrupt shifts in economic policy, which have historically been a concern in Greece, can create a more challenging operating environment. Such instability can impact Alpha Bank's ability to forecast and execute strategies, potentially affecting its profitability and risk management.

The Greek banking sector operates under a stringent regulatory environment, shaped by national bodies like the Bank of Greece and European institutions such as the European Central Bank (ECB) and the European Banking Authority (EBA). This oversight dictates much of Alpha Bank's operational framework and strategic planning.

Upcoming regulatory shifts will significantly impact Alpha Bank. For instance, the implementation of CRR 3 and CRD VI starting in 2025 will alter capital adequacy requirements, while the 6th Anti-Money Laundering (AML) Directive, effective from 2024, and the Digital Operational Resilience Act (DORA) in 2025, will necessitate adjustments in compliance, operational procedures, and risk management. These changes are projected to increase compliance costs but also bolster the bank's resilience and security.

The EU Recovery and Resilience Facility (RRF) is a significant driver for Greece's economic landscape. Greece's National Recovery and Resilience Plan, dubbed 'Greece 2.0', is set to receive substantial funding through this facility, channeling billions into domestic businesses and crucial development projects.

Alpha Bank, as a key financial institution in Greece, is strategically positioned to benefit from its role in disbursing these RRF funds. This involvement not only strengthens Alpha Bank's lending activities but also plays a vital part in fostering broader economic recovery and stimulating investment across the nation.

For instance, as of early 2024, Greece has already secured substantial tranches of RRF funding, with plans to deploy these resources across digital transformation, green transition, and infrastructure initiatives, areas where Alpha Bank is actively engaged.

Government Initiatives on Banking Costs and Lending

Government initiatives targeting reduced banking costs, such as the introduction of free payment orders and low-cost bank transfers, are set to impact Alpha Bank's revenue. These measures, coupled with an increase in daily IRIS transaction limits to €10,000 effective January 1, 2025, are designed to boost consumer activity but will likely compress traditional fee-based income for banks.

Furthermore, the opening of the loan market to non-banking institutions presents a significant shift in the competitive landscape. This regulatory push aims to foster greater competition and potentially lower borrowing costs for businesses and individuals, directly challenging Alpha Bank's market share in lending operations.

- Reduced Fee Income: Free payment orders and lower transfer fees, implemented from 2025, directly impact revenue from these services.

- Increased Competition: Allowing non-banking entities into the loan market intensifies competition for Alpha Bank.

- Consumer Benefit Focus: Initiatives prioritize consumer cost savings, potentially at the expense of bank profitability.

- Transaction Volume Growth: Higher IRIS transaction limits may drive volume but could also shift transaction types.

Privatization and State Influence

The Greek banking sector's journey towards full re-privatization marks a significant reduction in state influence. The Hellenic Financial Stability Fund (HFSF) has been actively divesting its stakes in major Greek banks, including Alpha Bank. For instance, by late 2023, the HFSF had reduced its stake in Alpha Bank to below 10%, a substantial decrease from its previous holdings.

This transition away from state ownership is expected to foster more market-driven decision-making within banks like Alpha Bank. Consequently, the bank's operational autonomy and its ability to forge strategic partnerships may be enhanced, potentially leading to greater agility in responding to market dynamics and competitive pressures.

- Reduced State Ownership: HFSF stake in Alpha Bank significantly decreased by late 2023.

- Market-Driven Decisions: Privatization encourages strategies aligned with market forces.

- Enhanced Autonomy: Banks gain more freedom in operational and strategic choices.

- Strategic Partnerships: Increased potential for collaborations driven by business objectives.

Government policies aimed at reducing banking costs, such as the introduction of free payment orders and lower bank transfer fees from 2025, will directly impact Alpha Bank's fee-based income streams. The increase in daily IRIS transaction limits to €10,000 from January 1, 2025, while intended to boost consumer activity, could also compress revenue from certain transaction types.

The liberalization of the loan market to non-banking institutions, a policy shift designed to increase competition, presents a direct challenge to Alpha Bank's traditional lending business. This move aims to foster a more dynamic financial environment, potentially leading to lower borrowing costs for consumers and businesses, but also intensifying competition for market share.

The ongoing privatization of Greek banks, evidenced by the Hellenic Financial Stability Fund's (HFSF) reduction of its stake in Alpha Bank to below 10% by late 2023, signals a move towards more market-driven operations. This reduced state influence is expected to grant Alpha Bank greater autonomy in its strategic decisions and partnerships, allowing for more agile responses to market dynamics.

What is included in the product

This Alpha Bank PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the bank's operations and strategic planning.

It provides a comprehensive overview of external influences, enabling informed decision-making and proactive risk management.

Provides a clear, actionable overview of Alpha Bank's external environment, simplifying complex factors to facilitate strategic decision-making and mitigate potential risks.

Economic factors

Greece's economic growth is set to outpace the Euro area average, with projections indicating a GDP growth of around 2.5% in 2024 and a similar trajectory for 2025. This positive outlook is a significant tailwind for Alpha Bank.

This anticipated expansion, fueled by robust private consumption and a surge in investment, directly translates to higher demand for banking services. Alpha Bank can expect to see increased opportunities for lending and a general uptick in business activity across its portfolio.

The European Central Bank's (ECB) monetary policy significantly shapes the interest rate environment, directly impacting Alpha Bank's net interest income. As of early 2024, the ECB has maintained a cautious stance, with key interest rates holding steady after a period of increases aimed at curbing inflation. This environment presents both challenges and opportunities for banks like Alpha Bank.

While lending rates have seen some moderation from their peaks, the bank's profitability hinges on its capacity to effectively manage interest rate sensitivity. For instance, if deposit costs rise faster than loan yields, net interest margins could compress. Alpha Bank's strategic focus on diversifying its funding sources and optimizing its balance sheet structure is therefore paramount in navigating this evolving landscape.

Alpha Bank's asset quality has seen a notable improvement, largely due to the Greek banking system's success in reducing non-performing loans (NPLs). The Hellenic Asset Protection Scheme (HAPS), extended through the end of 2024, has been instrumental in this process, directly benefiting Alpha Bank by cleaning up its balance sheet.

As of Q1 2024, Alpha Bank reported a significant drop in its NPL ratio, reaching 5.5%, a substantial decrease from previous years. This ongoing effort to manage and reduce NPLs remains crucial for maintaining the bank's financial stability and bolstering investor confidence in its future performance.

Inflation and Consumer Spending

While inflation is generally projected to slow down, ongoing price increases in the services sector, coupled with potential rises in wages and rent, could put a squeeze on what consumers can afford to buy. This directly affects how much money households have available for savings and their capacity to borrow, which in turn impacts Alpha Bank's retail banking operations.

For instance, in the US, the Consumer Price Index (CPI) saw a notable deceleration throughout 2024, with core inflation easing. However, services inflation remained stickier, driven by sectors like housing and transportation. In the Eurozone, similar trends were observed, with energy price drops helping to lower headline inflation, but services prices continued to be a concern for central banks. This persistent services inflation, potentially exacerbated by wage growth which averaged around 4-5% in many developed economies during 2024, limits discretionary spending and can reduce the flow of new deposits into banks like Alpha Bank. Consequently, this can constrain the bank's ability to originate new loans, particularly in the competitive retail mortgage and consumer credit markets.

- Persistent services inflation: Expected to remain elevated, impacting disposable income.

- Wage growth: Moderate wage increases in 2024 could be outpaced by inflation in key service areas.

- Rental price increases: Continued upward pressure on rents further reduces consumer spending power.

- Impact on retail banking: Reduced household deposits and a lower capacity for new loans for Alpha Bank.

Investment and Foreign Direct Investment (FDI)

Increased investment, significantly bolstered by Foreign Direct Investment (FDI) and the EU's NextGenerationEU recovery fund, presents a robust opportunity for loan growth and project financing for Alpha Bank. This influx of capital directly translates into expanded business for the bank's corporate banking division.

For instance, in 2024, FDI inflows into the EU were projected to continue their upward trend, building on the recovery seen in prior years. This trend is expected to persist into 2025, driven by strategic investments in sectors like green technology and digital infrastructure, areas where Alpha Bank is actively seeking to participate.

Alpha Bank's strategic involvement in financing these burgeoning projects is a primary engine for its corporate banking segment's revenue generation. The bank's ability to underwrite and manage these large-scale initiatives directly impacts its overall financial performance and market position.

- FDI Growth: Projections indicate continued FDI growth in the EU through 2025, supporting economic expansion.

- EU Recovery Fund Impact: NextGenerationEU funds are channeling significant capital into key European projects.

- Loan Growth Driver: Increased investment activity directly fuels demand for Alpha Bank's lending products.

- Corporate Banking Focus: Project financing is a cornerstone for Alpha Bank's corporate revenue streams.

Greece's economy is projected for robust growth, with GDP expected to expand by approximately 2.5% in both 2024 and 2025, outpacing the Eurozone average. This expansion, driven by strong consumer spending and increased investment, creates a favorable environment for Alpha Bank, boosting demand for its lending and financial services.

The European Central Bank's monetary policy, particularly interest rate decisions, directly influences Alpha Bank's net interest income. While rates have stabilized in early 2024 after earlier increases, managing interest rate sensitivity remains key for profitability, especially if deposit costs rise faster than loan yields.

Alpha Bank's asset quality has improved significantly, with its Non-Performing Loan (NPL) ratio falling to 5.5% by Q1 2024, aided by the Hellenic Asset Protection Scheme (HAPS) which extends through the end of 2024.

Persistent services inflation and moderate wage growth in 2024 could limit consumer spending and savings, impacting Alpha Bank's retail operations and capacity for new loans, despite overall inflation trends showing a slowdown.

Preview Before You Purchase

Alpha Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Alpha Bank PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the bank's operations and strategic positioning.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain a detailed understanding of the external forces shaping Alpha Bank's industry, enabling informed decision-making and risk assessment.

The content and structure shown in the preview is the same document you’ll download after payment. This PESTLE analysis provides a robust framework for evaluating Alpha Bank's competitive landscape and identifying potential growth opportunities and challenges.

Sociological factors

Demographic shifts, particularly the aging population in many developed economies, significantly impact banking. For instance, in the Eurozone, the proportion of individuals aged 65 and over is projected to reach 28.7% by 2050, up from around 20.8% in 2022. This trend means a growing customer base with potentially different financial needs, such as retirement planning, wealth management, and healthcare-related financing.

Alpha Bank must adapt its product suite to serve these evolving demographics. Younger customers, often digital natives, expect seamless online and mobile banking experiences, including intuitive apps and instant payment options. Conversely, older customers may still prefer in-person interactions, personalized advice for complex financial decisions, and accessible services that accommodate potential physical limitations.

The increasing life expectancy and the desire for financial security in retirement present opportunities for banks like Alpha. Offering specialized savings accounts, investment products tailored for retirement income, and advisory services focused on estate planning can attract and retain this segment. By 2025, it's estimated that assets under management for wealth management services targeting affluent seniors will see continued growth, reflecting this demand.

Consumer behavior in Greece is increasingly leaning towards digital channels for banking. In 2023, e-banking transactions through Alpha Bank saw a notable surge, reflecting a broader trend of digital adoption across the population.

This shift means that Alpha Bank's focus on enhancing its digital platforms and mobile payment solutions is not just a strategic advantage but a necessity to align with evolving customer expectations and stay competitive in the Greek market.

Financial literacy initiatives are crucial for broadening banking access. For example, programs targeting students and women can significantly increase financial inclusion. Alpha Bank's involvement in these efforts not only builds trust but also opens avenues for new customer acquisition, potentially tapping into previously underserved markets.

Trust in Traditional Banking Institutions

Trust in traditional banking institutions remains a significant sociological factor in Greece, even with the rapid growth of FinTech. A notable 2024 survey indicated that over 70% of Greek consumers, across all age demographics, express a higher degree of confidence in established banks compared to newer FinTech alternatives, particularly concerning the safety of their funds and personal data.

This deeply rooted trust offers Alpha Bank a distinct competitive edge. While FinTechs are often lauded for innovation and user experience, the perceived security and stability of traditional institutions like Alpha Bank continue to resonate strongly with the Greek public. For instance, Alpha Bank's consistent investment in robust cybersecurity measures, which were further enhanced in late 2024 with a new multi-factor authentication system across all digital platforms, directly addresses these consumer concerns.

However, this advantage is not without its demands. To maintain and leverage this trust, Alpha Bank must remain vigilant, continuously investing in and transparently communicating its security protocols and operational reliability. This includes ensuring their digital banking interfaces are not only secure but also intuitive and user-friendly, bridging the gap between traditional trust and modern digital expectations.

Key aspects of this trust include:

- Perceived Security: Greek consumers associate traditional banks with a higher level of security for deposits and personal information.

- Brand Recognition: Established banks benefit from decades of brand building and customer relationships, fostering familiarity and comfort.

- Regulatory Oversight: The public often views traditional banks as more heavily regulated, adding another layer of perceived safety.

- Customer Service Expectations: While FinTech offers digital convenience, many still value the option of in-person support, a cornerstone of traditional banking.

Workforce Skills and Education

The educational attainment of Alpha Bank's employees directly influences their adaptability to new technologies and changing customer expectations. A highly educated workforce is better equipped to understand and implement digital solutions, ensuring the bank remains competitive.

Alpha Bank's commitment to continuous learning and development is crucial for its digital transformation journey. Investing in upskilling programs helps employees master new digital tools and customer service techniques, thereby maintaining high service standards.

In 2024, the banking sector, including Alpha Bank, faced a growing demand for employees proficient in data analytics, cybersecurity, and digital customer engagement. For instance, a significant portion of new hires in European banks in 2024 possessed advanced degrees in STEM fields or specialized financial technology certifications.

- Digital Literacy: Ensuring a baseline of digital proficiency across all staff levels is paramount for efficient operations and customer interaction.

- Specialized Skills: Developing expertise in areas like AI, blockchain, and advanced data analytics is key to innovation and competitive advantage.

- Customer Centricity: Training focused on understanding and meeting evolving customer needs, particularly in digital channels, is essential for retention and growth.

- Regulatory Compliance: Continuous education on new financial regulations and compliance protocols is vital to avoid penalties and maintain trust.

Greek consumers exhibit a strong preference for established banking institutions, with a 2024 survey revealing over 70% trust traditional banks more than FinTech alternatives, especially regarding fund safety and data privacy. This deep-seated trust is a significant asset for Alpha Bank, which continuously invests in robust cybersecurity, such as its late 2024 multi-factor authentication system, to reinforce this perception.

The increasing adoption of digital banking channels in Greece, evidenced by a notable surge in e-banking transactions through Alpha Bank in 2023, necessitates ongoing enhancement of digital platforms and mobile payment solutions. This digital shift aligns with evolving customer expectations and is critical for maintaining market competitiveness.

Financial literacy initiatives are vital for expanding banking access and fostering financial inclusion, particularly among students and women. Alpha Bank’s engagement in these programs builds trust and opens opportunities for acquiring new customers in previously underserved markets.

The educational background of Alpha Bank's workforce is crucial for adapting to technological advancements and evolving customer demands, with a growing need for employees skilled in data analytics and digital engagement, as seen in the 2024 hiring trends across European banks.

Technological factors

Alpha Bank is heavily invested in digital transformation, aiming to leverage technology for better operations and customer interactions. A prime example is their integration of AI tools, such as Microsoft Copilot, which is designed to boost efficiency and refine the customer journey. This commitment to innovation is crucial for streamlining internal processes and enhancing decision-making capabilities, ensuring Alpha Bank stays competitive in the rapidly changing financial sector.

With the accelerating pace of digitalization, cybersecurity and data protection are no longer optional but essential for Alpha Bank. Protecting sensitive customer information and maintaining operational integrity against evolving cyber threats is a top priority.

Alpha Bank must implement robust cybersecurity protocols and conduct frequent risk assessments to safeguard its digital infrastructure. The upcoming enforcement of the Digital Operational Resilience Act (DORA) from January 2025 mandates enhanced resilience and security measures across the financial sector, requiring significant investment in protective technologies and practices.

The FinTech sector in Greece is experiencing significant expansion, with innovative solutions frequently outperforming traditional financial services in efficiency. This growth presents Alpha Bank with a dual dynamic: a competitive challenge and a strategic opportunity.

Alpha Bank can actively engage with this FinTech evolution by integrating cutting-edge technologies and fostering collaborative partnerships. Embracing open banking, a key component of this ecosystem, allows the bank to enhance its existing service portfolio and tap into previously inaccessible market segments.

For instance, by Q1 2025, the Greek FinTech market is projected to see a compound annual growth rate of 12.5%, reaching an estimated €1.2 billion by 2028, according to industry reports. This underscores the potential for Alpha Bank to gain a competitive edge through strategic alliances and the adoption of new digital financial tools.

Automation and Artificial Intelligence (AI)

Alpha Bank is actively integrating automation and artificial intelligence (AI) into its operations, exemplified by the adoption of tools like Microsoft Copilot. This technology is being utilized for routine tasks such as drafting emails, creating documents, summarizing meetings, and enhancing cybersecurity measures. This strategic move is designed to significantly boost employee productivity and reclaim valuable time across various departments.

The impact of AI adoption is substantial. For instance, studies in 2024 indicate that AI-powered tools can reduce time spent on administrative tasks by up to 30%. Alpha Bank's investment in these technologies aligns with a broader industry trend where financial institutions are leveraging AI to streamline workflows and improve efficiency. This focus on automation is crucial for maintaining a competitive edge in the rapidly evolving financial landscape.

- AI Adoption for Efficiency: Microsoft Copilot is being deployed for tasks like email drafting and document creation, aiming to save employee time.

- Productivity Gains: Automation is expected to lead to significant improvements in overall employee productivity.

- Cybersecurity Enhancement: AI is also being used to bolster cybersecurity protocols within the bank.

- Industry Trend Alignment: Alpha Bank's move reflects a wider industry push towards AI-driven operational improvements.

Mobile Banking and Digital Platforms

Alpha Bank is heavily investing in its mobile banking and digital platforms, recognizing their critical role in customer engagement and operational efficiency. The bank's strategic push to develop advanced phone banking solutions and streamline e-banking registration through alternative channels like ATMs underscores this commitment. This focus is designed to make banking more accessible and user-friendly, directly impacting customer satisfaction and digital adoption rates.

By enhancing these digital touchpoints, Alpha Bank aims to capture a larger share of the digitally active customer base. In 2024, the global mobile banking market was valued at over $20 billion and is projected to grow significantly, with a substantial portion of this growth driven by user-friendly interfaces and expanded service offerings, areas where Alpha Bank is concentrating its efforts.

- Enhanced Accessibility: Alpha Bank's initiatives make banking services available 24/7, removing geographical and time-based barriers for customers.

- Improved Customer Experience: Simpler registration processes and advanced phone banking features aim to boost user satisfaction and loyalty.

- Digital Transformation: The bank's investment in mobile and digital platforms aligns with the broader trend of digital transformation in the financial sector, where convenience and speed are paramount.

- Market Competitiveness: By staying ahead in digital offerings, Alpha Bank strengthens its competitive position against fintech disruptors and traditional banking rivals.

Alpha Bank's technological strategy centers on AI integration for operational efficiency and enhanced customer experience, exemplified by Microsoft Copilot adoption. This focus on automation, projected to save up to 30% on administrative tasks in 2024, aligns with a broader industry trend. Furthermore, the bank is bolstering its digital and mobile banking platforms to improve accessibility and customer satisfaction, tapping into a global mobile banking market valued over $20 billion in 2024.

Legal factors

Alpha Bank navigates a complex web of EU banking regulations, including directives like CRD IV, CRR, MiFID II, PSD2, and AML Directives, alongside specific Greek national laws. Staying compliant with these evolving rules, such as the upcoming CRR 3 implementation in 2025 and the 6th AML Directive effective from 2024, is fundamental for maintaining operational integrity and financial resilience.

Alpha Bank must navigate the dynamic landscape of Anti-Money Laundering (AML) and Countering Financing of Terrorism (CFT) regulations. The introduction of a new EU legislative toolkit in June 2024 and the forthcoming 6th AML Directive necessitate continuous adaptation of compliance measures and internal controls to effectively combat financial crime.

These evolving legal frameworks, aimed at strengthening financial sector integrity, place a significant burden on institutions like Alpha Bank to invest in robust monitoring systems and employee training. Failure to comply can result in substantial fines; for instance, in 2023, fines for AML breaches across the EU exceeded €2 billion, highlighting the financial repercussions of inadequate adherence.

Recent Greek parliamentary approvals, slated to take effect in August 2025, will eliminate or cap ATM withdrawal fees and other bank transaction costs. This directly impacts Alpha Bank's fee-based revenue streams, necessitating strategic adjustments to its pricing models and overall business operations to ensure compliance with these enhanced consumer protection measures.

Corporate Governance Codes and Compliance

Alpha Bank actively embraces robust corporate governance, aligning its operations with the Hellenic Corporate Governance Code. This commitment is reflected in the recent revisions to its charters and policies, ensuring compliance with evolving regulatory landscapes and industry best practices. For instance, the bank's proactive stance on governance is exemplified by the appointment of an Independent Non-Executive Member as Chair of the Board of Directors, effective January 2025.

This strategic move signals a strengthened dedication to independent oversight and accountability. Such adherence to governance codes is crucial for maintaining investor confidence and fostering long-term sustainability. Alpha Bank's governance framework is designed to promote transparency and ethical conduct across all levels of the organization, a key factor in its 2024 and 2025 strategic planning.

Key aspects of Alpha Bank's corporate governance include:

- Adherence to Hellenic Corporate Governance Code

- Revised Charters and Policies for Regulatory Alignment

- Appointment of Independent Non-Executive Chair from January 2025

- Commitment to Transparency and Ethical Conduct

Digital Operational Resilience Act (DORA)

The Digital Operational Resilience Act (DORA), which becomes effective in January 2025, imposes rigorous cybersecurity requirements on financial entities, including Alpha Bank. This regulation necessitates regular risk assessments and comprehensive incident reporting to bolster the bank's defense against cyber threats and IT failures.

Compliance with DORA is paramount for Alpha Bank to ensure its operational continuity and safeguard sensitive data in an increasingly digital financial landscape. Failure to adhere to these new standards could result in significant penalties and reputational damage.

- DORA's Scope: Affects all EU financial institutions, including banks, investment firms, and insurance companies, requiring them to establish robust digital operational resilience frameworks.

- Key Requirements: Mandates comprehensive ICT risk management, third-party risk management, incident reporting, digital operational resilience testing, and information sharing.

- Impact on Alpha Bank: Alpha Bank will need to invest in enhanced cybersecurity infrastructure, develop detailed incident response plans, and conduct regular penetration testing to meet DORA's stringent criteria.

- Enforcement: Non-compliance can lead to fines of up to 1% of average daily worldwide turnover for continuous infringement, as stipulated by the European Supervisory Authorities (ESAs).

Alpha Bank must meticulously adhere to a growing body of EU financial regulations, including the impending CRR 3 implementation in 2025 and the 6th AML Directive effective from 2024. These legal mandates, alongside Greek national laws, shape operational requirements and risk management strategies. The Digital Operational Resilience Act (DORA), commencing January 2025, imposes stringent cybersecurity and ICT risk management protocols, with non-compliance potentially leading to fines up to 1% of average daily worldwide turnover.

Environmental factors

Alpha Bank is actively embedding sustainability into its core strategy, operations, and even its company culture, with a clear objective to achieve Net Zero emissions by 2050. This commitment is backed by concrete actions like setting specific targets, diligently tracking its environmental, social, and governance (ESG) performance, and providing active support to clients as they work towards their own decarbonization goals. This proactive stance highlights the increasing importance of environmental stewardship within the global financial landscape.

Alpha Bank's commitment to sustainability is evident in its Sustainable Finance Framework, which guides the classification of eligible financing and tracks progress towards sustainable finance goals. This framework supports initiatives like financing urban regeneration projects, demonstrating a clear alignment with the growing global demand for environmentally conscious financial solutions.

In 2023, Alpha Bank reported a significant increase in its green financing portfolio, with new issuances reaching €1.5 billion, a 30% rise from the previous year. This growth reflects the bank's proactive approach to offering green solutions, such as green bonds and sustainability-linked loans, catering to a market increasingly prioritizing environmental, social, and governance (ESG) factors.

Alpha Bank has implemented a robust Environmental Policy and an advanced Environmental Management System, underscoring its commitment to environmental protection and climate change mitigation. This proactive stance allows the bank to effectively manage its ecological impact and align with overarching environmental objectives.

ESG Reporting and Transparency

Alpha Bank is actively enhancing its ESG reporting and transparency. The bank has set specific targets and diligently tracks its performance, as evidenced by publications like its 2024 ESG Databook and Responsible Banking Progress Statement. This commitment allows stakeholders to scrutinize Alpha Bank's environmental footprint and its progress in sustainability initiatives.

Key aspects of Alpha Bank's ESG transparency include:

- Setting quantifiable ESG targets: Alpha Bank establishes measurable goals across environmental, social, and governance factors.

- Regular performance reporting: The bank publishes detailed reports, such as the 2024 ESG Databook, to showcase its progress.

- Focus on responsible banking: Initiatives are highlighted in documents like the Responsible Banking Progress Statement, detailing the bank's commitment to sustainable practices.

- Stakeholder engagement: Transparent reporting facilitates informed assessment by investors, customers, and regulators regarding the bank's sustainability efforts.

Impact of Environmental Risks on Loan Portfolios

The banking sector, including institutions like Alpha Bank, faces significant environmental risks stemming from climate change. These risks can manifest as physical impacts, such as extreme weather events damaging properties that serve as loan collateral, or transition risks, arising from shifts away from carbon-intensive industries. For instance, a severe drought in an agricultural region could impact the value of loans secured by farmland, while a rapid shift to renewable energy might devalue assets in traditional fossil fuel sectors.

Alpha Bank's approach to environmental, social, and governance (ESG) risk management is crucial in navigating these challenges. The bank's processes are designed to identify and assess these sectorial exposures, aiming to mitigate potential losses within its loan portfolio. This proactive stance is becoming increasingly important as regulatory bodies and investors place greater emphasis on climate-related financial disclosures and resilience.

Real-world data highlights the growing financial implications of climate change for banks. For example, the European Central Bank's 2024 report indicated that climate-related and environmental risks could lead to significant credit losses for Eurozone banks, particularly in sectors like real estate and agriculture. Studies by financial institutions in 2024 also projected that the physical impact of climate change could increase non-performing loan ratios by several percentage points over the next decade if not adequately managed.

- Physical Risks: Extreme weather events like floods, wildfires, and hurricanes can directly impair the value of collateral backing loans, increasing default probabilities.

- Transition Risks: Policy changes, technological advancements, and shifts in market sentiment towards decarbonization can negatively affect the creditworthiness of businesses in carbon-intensive sectors.

- Sectoral Exposure: Banks with significant exposure to sectors like agriculture, real estate, and energy production are particularly vulnerable to these environmental shifts.

- ESG Integration: Alpha Bank's ESG risk management framework is essential for identifying, measuring, and mitigating these climate-related financial risks within its loan portfolio.

Alpha Bank is actively integrating sustainability into its operations, aiming for Net Zero emissions by 2050, and has seen its green financing portfolio grow significantly. In 2023, new green financing issuances reached €1.5 billion, a 30% increase year-over-year, demonstrating a strong market demand for eco-conscious financial products.

The bank manages environmental risks through a robust Environmental Policy and Management System, crucial for mitigating impacts from climate change. These risks include physical damage to collateral from extreme weather and transition risks associated with shifts away from carbon-intensive industries.

Alpha Bank enhances transparency through detailed ESG reporting, including its 2024 ESG Databook, allowing stakeholders to assess its environmental performance and sustainability initiatives. This commitment aligns with increasing regulatory and investor focus on climate-related financial disclosures.

| Environmental Factor | Alpha Bank's Response/Data | Impact/Significance |

|---|---|---|

| Climate Change Risks | Managing physical and transition risks; significant exposure to sectors like real estate and agriculture. | Potential for increased non-performing loans if not managed; ECB reports potential credit losses for Eurozone banks. |

| Green Financing Growth | €1.5 billion in new green financing in 2023, a 30% rise from 2022. | Reflects increasing market demand for sustainable financial solutions and Alpha Bank's proactive offering. |

| Sustainability Targets | Net Zero emissions by 2050; quantifiable ESG targets and regular performance reporting (e.g., 2024 ESG Databook). | Demonstrates commitment to environmental stewardship and allows for stakeholder scrutiny of progress. |

PESTLE Analysis Data Sources

Our Alpha Bank PESTLE analysis is meticulously crafted using data from official government publications, reputable financial institutions like the IMF and World Bank, and leading market research firms. We incorporate insights from regulatory updates, economic forecasts, and technological advancements to provide a comprehensive view.