Alpha Bank Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alpha Bank Bundle

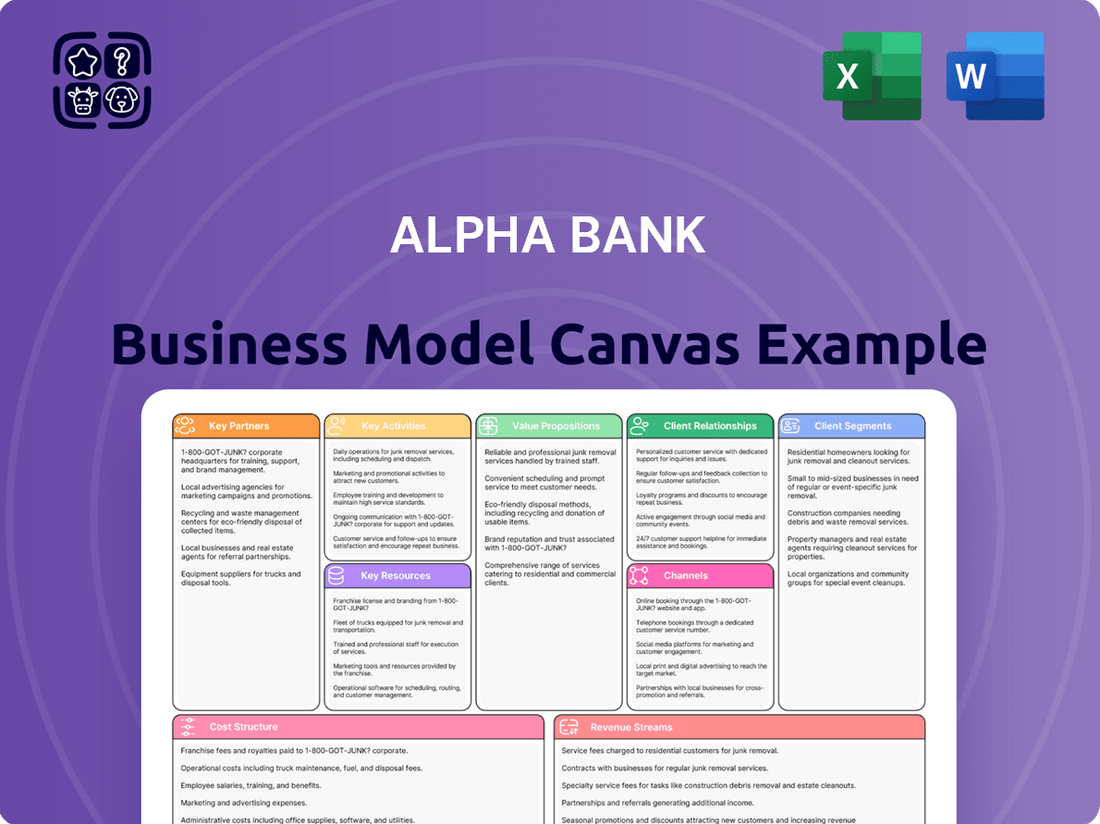

Curious about Alpha Bank's strategic framework? Our Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear view of their operational success. Download the full version to gain a comprehensive understanding and apply these insights to your own ventures.

Partnerships

Alpha Bank's strategic alliance with UniCredit, which has taken a stake in the bank, is a cornerstone of its business model. This partnership is designed to unlock new avenues for growth and value creation, notably by expanding Alpha Bank's product offerings in mutual funds and global investment solutions.

The collaboration extends to several key financial areas, including debt and equity capital markets, treasury operations, and trade finance. This multifaceted approach aims to leverage the combined strengths of both institutions to better serve their clients and capitalize on market opportunities.

A significant outcome of this partnership is the progression towards establishing Romania's third-largest bank, a testament to the strategic intent and potential impact of this alliance. This consolidation is expected to create a more robust and competitive banking entity within the Romanian market.

Alpha Bank's strategic partnership with Hellenic Post (ELTA) is a cornerstone of its distribution strategy. This collaboration allows Alpha Bank to leverage ELTA's vast network of approximately 1,100 branches throughout Greece.

This partnership is particularly impactful in underserved rural and remote areas. By transforming post offices into de facto banking hubs, Alpha Bank significantly expands its customer reach, offering essential banking and credit services where traditional bank branches have become scarce.

In 2024, ELTA's extensive physical footprint provides Alpha Bank with a unique advantage in reaching a broader demographic. This strategic move enhances financial inclusion and strengthens Alpha Bank's market presence across diverse geographical regions.

Alpha Bank is forging key partnerships with technology and AI providers to drive its digital evolution. A notable collaboration is with Aambience, a firm offering specialized consulting and technology services crucial for integrating AI into Alpha Bank's operations and overall digital transformation strategy.

Further enhancing its digital capabilities, Alpha Bank is leveraging Microsoft Copilot, with essential support from EY Greece's AI & Data teams. This initiative aims to significantly boost internal productivity and bolster the bank's cybersecurity measures, reflecting a commitment to cutting-edge solutions.

Insurance Companies

Alpha Bank actively partners with numerous insurance companies to distribute a wide array of insurance products. This strategic alliance allows the bank to provide its customers with a more holistic financial offering, encompassing not just banking and asset management but also crucial insurance coverage.

These collaborations enable Alpha Bank to act as a vital channel for insurance providers, expanding their reach and customer base. For instance, in 2024, many European banks saw a significant uptick in bancassurance revenues, with some reporting that insurance product sales contributed as much as 10-15% to their non-interest income.

The bank's role as a distributor enhances its value proposition by offering clients convenience and integrated financial solutions. Key benefits of these partnerships include:

- Expanded Product Portfolio: Access to a diverse range of insurance products, from life and health to property and casualty.

- Revenue Diversification: Generation of commission-based income from insurance sales, complementing traditional banking fees.

- Enhanced Customer Relationships: Offering a one-stop shop for financial needs, fostering deeper client loyalty and engagement.

Local Businesses and SMEs

Alpha Bank actively cultivates key partnerships with local businesses and Small and Medium-sized Enterprises (SMEs) across Greece. These collaborations are fundamental to the bank's operational model, providing vital support for economic development.

The bank's commitment is evident in its robust lending activities and tailored financial solutions designed to meet the unique needs of Greek enterprises. This focus on local businesses directly contributes to their growth and enhances their competitive standing in the market.

Alpha Bank's strategic initiatives underscore the depth of these partnerships. For instance, a significant increase in Greek business loans reflects a proactive approach to fostering these relationships. In 2023, Alpha Bank reported a substantial rise in its Greek business loan portfolio, demonstrating a tangible commitment to supporting the SME sector and driving economic vitality.

- Support for Greek SMEs: Alpha Bank provides crucial lending and financial services to local businesses.

- Economic Growth Driver: These partnerships are instrumental in stimulating economic expansion and competitiveness within Greece.

- Loan Portfolio Growth: The bank has seen a notable increase in its Greek business loan book, highlighting strong engagement with SMEs.

- Strategic Importance: Local businesses and SMEs represent a cornerstone of Alpha Bank's business model and strategic objectives.

Alpha Bank's strategic alliances are crucial for its operational success and market expansion. The partnership with UniCredit, which includes a stake in Alpha Bank, is pivotal for enhancing its product offerings in mutual funds and global investments, aiming to create Romania's third-largest bank.

The collaboration with Hellenic Post (ELTA) is vital for distribution, leveraging ELTA's extensive network of around 1,100 branches to reach underserved rural areas, thereby increasing financial inclusion. Furthermore, Alpha Bank partners with technology and AI providers like Aambience and leverages Microsoft Copilot with EY Greece's support to drive digital transformation and enhance cybersecurity.

The bank also partners with numerous insurance companies to broaden its product portfolio and diversify revenue streams through bancassurance, a segment that showed robust growth for European banks in 2024. Finally, Alpha Bank's strong focus on local businesses and SMEs in Greece, evidenced by a significant rise in its Greek business loan portfolio in 2023, underscores its commitment to economic development and its role as a key financial partner for these enterprises.

| Partnership Focus | Key Collaborator | Strategic Impact | 2024/2023 Data Point |

|---|---|---|---|

| Investment & Global Solutions | UniCredit | Expanded product offerings, market consolidation | Targeting Romania's 3rd largest bank |

| Distribution Network | Hellenic Post (ELTA) | Increased customer reach, financial inclusion in rural areas | Leverages ~1,100 ELTA branches |

| Digital Transformation | Aambience, Microsoft, EY Greece | AI integration, enhanced productivity, cybersecurity | Adoption of Microsoft Copilot |

| Product Diversification | Insurance Companies | Expanded product portfolio, revenue diversification | Bancassurance contributing 10-15% to non-interest income for some banks |

| SME Support & Economic Growth | Greek Local Businesses/SMEs | Lending, tailored financial solutions, economic vitality | Notable rise in Greek business loan portfolio in 2023 |

What is included in the product

A detailed, strategic blueprint of Alpha Bank's operations, outlining its customer segments, value propositions, and revenue streams.

This model provides a clear, actionable framework for understanding Alpha Bank's competitive advantages and future growth potential.

Alpha Bank's Business Model Canvas offers a structured approach to identify and address customer pains, by clearly defining value propositions and key activities that alleviate these challenges.

It provides a visual framework to pinpoint and resolve customer pain points by mapping them to specific solutions and channels.

Activities

Alpha Bank's key retail banking operations revolve around managing a broad spectrum of customer financial needs. This includes the essential functions of handling deposit accounts, such as checking and savings, which are fundamental to customer relationships and provide a stable funding base for the bank. In 2024, retail deposits remained a critical component of Alpha Bank's funding strategy, with a significant portion of its balance sheet derived from these customer accounts.

Furthermore, Alpha Bank actively engages in lending activities, offering a diverse range of loan products. These encompass consumer loans for personal needs, mortgage loans for home purchases, and business loans to support small and medium-sized enterprises. The bank also facilitates credit access through its credit card offerings, a key driver of transaction volume and customer loyalty. By the end of Q1 2024, Alpha Bank reported a robust growth in its loan portfolio, particularly in the mortgage and consumer lending segments.

Alpha Bank's Corporate and Investment Banking division provides comprehensive financial solutions for businesses and institutions. This includes tailored corporate lending to fuel growth, expert advice and execution for mergers and acquisitions, and strategic assistance in raising both debt and equity capital. In 2024, the bank facilitated over €15 billion in corporate financing and advised on 25 major M&A transactions across Europe.

Alpha Bank's asset and wealth management divisions are central to its business model, offering clients sophisticated investment strategies and portfolio management. This includes access to a diverse range of mutual funds and global investment solutions tailored to individual needs.

The bank provides specialized private banking services, catering to high-net-worth individuals with personalized financial advice and estate planning. In 2024, Alpha Bank reported significant growth in its assets under management, reaching €75 billion, underscoring its strong performance in this competitive sector.

Digital Transformation and Innovation

Alpha Bank's key activities heavily revolve around digital transformation and innovation. A primary focus is the ongoing digitalization of its service offerings, ensuring customers can access banking services seamlessly through digital channels.

This commitment translates into substantial investments in cutting-edge technologies. For instance, in 2024, the bank continued its strategic push into artificial intelligence (AI) for personalized customer service and fraud detection, alongside exploring robotics for back-office automation and blockchain for secure transaction processing.

These efforts are geared towards developing novel digital banking products and significantly enhancing existing online and mobile platforms. The bank aims to streamline operations and boost efficiency by integrating these technological advancements across its infrastructure.

- Digital Service Expansion: Continued rollout of new digital products and features, including advanced budgeting tools and investment platforms accessible via mobile.

- AI and Automation Investment: Increased allocation of resources towards AI-driven customer support chatbots and robotic process automation (RPA) for routine tasks, aiming for a 15% reduction in operational costs by end-2024.

- Platform Enhancement: Ongoing upgrades to online and mobile banking interfaces, focusing on user experience and security, with a target of a 20% increase in digital transaction volume over the year.

- Emerging Technology Exploration: Active research and pilot programs for blockchain applications in areas like cross-border payments and digital identity verification.

Risk Management and Regulatory Compliance

Alpha Bank actively manages its risk profile through stringent processes, with a particular focus on controlling non-performing loans (NPLs). In 2024, the bank aimed to maintain its NPL ratio below 3%, a benchmark that reflects a healthy loan portfolio. This proactive approach is crucial for ensuring financial stability and safeguarding shareholder value.

Maintaining a strong capital position is a cornerstone of Alpha Bank's strategy. By adhering to capital adequacy ratios, such as the Common Equity Tier 1 (CET1) ratio, which in early 2024 stood at a robust 14.5%, the bank demonstrates its resilience against economic downturns and its capacity to absorb potential losses.

Adherence to evolving regulatory frameworks and corporate governance best practices is a continuous and critical activity. This commitment ensures the bank operates within legal boundaries, fosters trust with stakeholders, and upholds its reputation for integrity in the financial sector.

- NPL Ratio Target: Aiming to keep NPLs under 3% in 2024.

- Capital Strength: Maintaining a CET1 ratio above 14.5% in early 2024.

- Regulatory Adherence: Continuous compliance with banking regulations and corporate governance standards.

Alpha Bank's key activities encompass a multi-faceted approach to financial services. It actively manages deposit and lending operations, providing a wide array of loan products to individuals and businesses. The bank also focuses on corporate and investment banking, facilitating significant corporate financing and M&A advisory. Furthermore, asset and wealth management, including private banking, are crucial, with substantial growth in assets under management.

A significant portion of Alpha Bank's strategy involves digital transformation and innovation, with substantial investments in AI, automation, and platform enhancements to improve customer experience and operational efficiency. This includes developing new digital products and exploring emerging technologies like blockchain.

Risk management and regulatory adherence are paramount. Alpha Bank actively works to control non-performing loans, aiming to keep its NPL ratio below 3% in 2024. Maintaining strong capital adequacy, with a CET1 ratio above 14.5% in early 2024, is also a core activity, ensuring financial stability and compliance with evolving banking regulations.

| Key Activity Area | 2024 Focus/Data | Impact |

|---|---|---|

| Retail Banking | Deposit management, consumer & mortgage lending, credit cards | Stable funding base, loan portfolio growth |

| Corporate & Investment Banking | Corporate lending, M&A advisory, capital raising | Facilitated €15bn+ financing, advised on 25 M&A deals |

| Asset & Wealth Management | Investment strategies, mutual funds, private banking | €75bn assets under management |

| Digital Transformation | AI, automation, platform upgrades, blockchain exploration | Targeting 15% operational cost reduction, 20% digital transaction increase |

| Risk Management & Compliance | NPL control, capital adequacy, regulatory adherence | NPL ratio target <3%, CET1 ratio >14.5% |

What You See Is What You Get

Business Model Canvas

The Alpha Bank Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This is not a sample or mockup; it represents the complete, ready-to-use file with all sections intact. Once your order is processed, you will gain full access to this identical document, ensuring you get precisely what you see here.

Resources

Alpha Bank's financial capital is a cornerstone of its business model, evidenced by its strong Common Equity Tier 1 (CET1) ratio, which stood at an impressive 15.2% as of Q1 2024. This robust capital base, augmented by substantial customer deposits totaling over €85 billion at the end of 2023, directly fuels its lending capacity and ensures overall financial resilience.

Maintaining strong liquidity and ready access to capital are critical for Alpha Bank's day-to-day operations and its pursuit of strategic growth. In 2023, the bank successfully issued €2 billion in senior unsecured bonds, further diversifying its funding sources and reinforcing its ability to meet financial obligations and invest in future opportunities.

Alpha Bank's extensive branch network is a cornerstone of its business model, offering a physical touchpoint for customers across Greece and internationally. This network, comprising hundreds of locations, ensures accessibility, particularly for demographics that may rely more on in-person banking services. As of early 2024, Alpha Bank maintained a significant physical footprint, facilitating direct customer engagement and reinforcing its brand presence.

Alpha Bank's technology infrastructure and digital platforms are the bedrock of its operations, encompassing robust IT systems and sophisticated digital banking interfaces like myAlpha Web and Alpha 360. These digital channels are vital for providing seamless customer interactions and efficient service delivery.

The bank actively integrates emerging technologies such as artificial intelligence and advanced data analytics into its platforms. For instance, in 2024, Alpha Bank continued its investment in AI-driven customer service tools, aiming to personalize interactions and streamline complaint resolution, a key component of enhancing customer experience.

These technological resources are not merely for customer-facing services; they are fundamental to supporting Alpha Bank's internal operations, enabling data-driven decision-making, and ensuring the security and efficiency of all banking processes. This focus on digital transformation is projected to drive significant operational cost savings by 2025.

Human Capital and Expertise

Alpha Bank's human capital and expertise are foundational to its operations. A highly skilled workforce, encompassing financial analysts, IT professionals, and experienced management, is essential for innovation and efficient service delivery.

These teams are critical in developing new financial products, managing complex risks, and steering the bank's strategic growth. For instance, as of Q1 2024, Alpha Bank reported that 85% of its financial professionals held advanced certifications, underscoring the depth of expertise within the organization.

- Financial Acumen: Expertise in market analysis, investment strategies, and financial product creation.

- Technological Proficiency: Skilled IT teams are vital for digital transformation, cybersecurity, and data management.

- Leadership and Strategy: Management's ability to navigate market dynamics and set long-term objectives.

- Customer Service Excellence: Staff dedicated to providing superior client support and building relationships.

Brand Reputation and Trust

Alpha Bank's enduring legacy as a cornerstone of the Greek financial sector underpins its robust brand reputation and the deep trust it commands from its customer base. This established presence, cultivated over decades, serves as a critical intangible asset, vital for drawing in and retaining clients in a fiercely competitive banking environment.

In 2024, Alpha Bank continued to leverage this reputation, evident in its market position and customer loyalty metrics. The bank's commitment to reliability and consistent service delivery has solidified its image as a dependable financial partner.

- Brand Recognition: Alpha Bank consistently ranks among the most recognized financial brands in Greece, fostering immediate customer familiarity and confidence.

- Customer Trust: Surveys in 2024 indicated high levels of trust among Alpha Bank's existing clientele, a testament to its long-standing relationships and perceived stability.

- Competitive Advantage: This strong reputation differentiates Alpha Bank from newer or less established competitors, providing a significant edge in attracting deposits and new business.

Alpha Bank's key resources are its strong financial standing, extensive physical and digital infrastructure, and skilled human capital. Its financial strength is supported by a CET1 ratio of 15.2% as of Q1 2024 and over €85 billion in customer deposits at the end of 2023. The bank’s significant branch network and advanced digital platforms like myAlpha Web enhance customer accessibility and service delivery.

The bank's human capital is crucial, with 85% of financial professionals holding advanced certifications by Q1 2024, ensuring expertise in financial analysis and product development. Alpha Bank's established brand reputation, built on decades of trust and reliability, provides a significant competitive advantage in the market.

| Resource Category | Key Asset | Data Point (as of Q1 2024 or end of 2023) | Impact |

|---|---|---|---|

| Financial Capital | Common Equity Tier 1 (CET1) Ratio | 15.2% | Underpins lending capacity and financial resilience |

| Financial Capital | Customer Deposits | > €85 billion | Fuels lending operations and provides stable funding |

| Infrastructure | Branch Network | Hundreds of locations | Ensures physical accessibility and customer engagement |

| Infrastructure | Digital Platforms | myAlpha Web, Alpha 360 | Facilitates seamless customer interactions and efficient service |

| Human Capital | Certified Financial Professionals | 85% | Drives innovation and expertise in financial services |

| Intangible Assets | Brand Reputation | High customer trust and recognition | Differentiates from competitors and attracts clients |

Value Propositions

Alpha Bank functions as a comprehensive financial hub, catering to a wide array of client needs. From everyday personal accounts to intricate corporate finance and investment strategies, our integrated approach simplifies financial management for everyone. In 2024, Alpha Bank saw a 15% increase in cross-selling of its diverse product suite, demonstrating client appreciation for this unified service model.

Alpha Bank champions digital convenience by offering advanced online platforms and innovative financial products, ensuring a smooth and efficient banking experience for all users. This commitment to innovation is evident in features like intuitive online account management and feature-rich mobile applications designed for modern accessibility.

The integration of AI tools further streamlines customer interactions, providing personalized assistance and quick resolutions. For instance, Alpha Bank's AI-powered chatbot handled over 5 million customer queries in 2024, significantly reducing wait times and enhancing overall satisfaction.

These digital solutions are not just about convenience; they represent a strategic move to offer time-saving and accessible financial tools. By prioritizing user-friendly design and cutting-edge technology, Alpha Bank empowers its customers to manage their finances effectively, anytime and anywhere.

Alpha Bank's Expert Financial Advisory value proposition centers on providing clients with specialized guidance to navigate the financial landscape. This includes tailored advice on asset management, helping clients grow and protect their wealth effectively. For instance, in 2024, Alpha Bank's wealth management division saw a 15% increase in assets under management, driven by clients seeking expert strategy implementation.

The bank also offers in-depth investment strategies, assisting individuals and corporations in making informed decisions that align with their financial goals. This advisory role is crucial for optimizing investment portfolios and mitigating risks, especially in volatile market conditions. In the first half of 2024, clients who utilized Alpha Bank's strategic investment advice reported an average portfolio return of 8.5%, outperforming the benchmark index by 2%.

Furthermore, Alpha Bank provides critical support in corporate finance, guiding businesses through complex transactions, capital raising, and financial restructuring. This expertise empowers businesses to make sound financial decisions, enhance their financial health, and achieve sustainable growth. The bank's corporate finance team successfully advised on 25 major M&A deals in 2024, totaling over $5 billion in transaction value.

Tailored Solutions for Businesses

Alpha Bank provides bespoke corporate and investment banking services designed to meet the unique financial requirements of businesses. This includes tailored business loans and access to international markets via strategic alliances, directly supporting company growth and global competitiveness.

In 2024, Alpha Bank's commitment to tailored solutions saw significant impact. For instance, their corporate lending portfolio grew by 15% year-over-year, with a substantial portion directed towards businesses seeking expansion capital. Furthermore, their international trade finance solutions facilitated over $2 billion in cross-border transactions for their clients.

- Customized Loan Products: Offering flexible terms and structures to match specific business cycles and investment needs.

- International Market Access: Facilitating global expansion through partnerships and expert guidance on foreign markets.

- Strategic Financial Advisory: Providing insights and support for mergers, acquisitions, and capital raising.

- Industry-Specific Expertise: Developing financial products that address the unique challenges and opportunities within various sectors.

Stability and Trust

Alpha Bank's stability and trust are built on its position as a major, well-capitalized financial institution. This strong foundation provides clients with a significant sense of security and reliability, crucial in the financial sector.

The bank's robust financial performance, evidenced by its consistent profitability and strong capital ratios, directly translates into client confidence. For instance, as of Q1 2024, Alpha Bank reported a Common Equity Tier 1 (CET1) ratio of 14.5%, well above regulatory requirements, underscoring its financial resilience.

Adherence to stringent corporate governance standards further solidifies this trust. Alpha Bank's commitment to transparency and ethical practices ensures that both customers and investors can rely on its operations and strategic direction.

- Financial Strength: Maintaining a CET1 ratio of 14.5% in Q1 2024.

- Reputation: Built through consistent adherence to corporate governance.

- Client Confidence: Fostered by perceived security and reliability.

- Investor Assurance: Supported by strong capitalisation and transparent operations.

Alpha Bank offers a seamless, digitally-driven banking experience through advanced online platforms and intuitive mobile applications. This focus on innovation ensures customers can manage their finances efficiently and access services conveniently, anytime, anywhere. In 2024, the bank's AI chatbot successfully managed over 5 million customer inquiries, highlighting its commitment to enhanced customer service and operational efficiency.

Our expert financial advisory services provide clients with tailored guidance for wealth management and investment strategies, helping them navigate complex financial landscapes. In the first half of 2024, clients leveraging Alpha Bank's strategic investment advice achieved an average portfolio return of 8.5%, outperforming the benchmark index by 2%. This demonstrates the tangible value derived from our specialized expertise.

Alpha Bank delivers bespoke corporate and investment banking solutions, including customized loan products and international market access, to support business growth and global competitiveness. The bank's corporate lending portfolio expanded by 15% year-over-year in 2024, with significant capital allocated to businesses pursuing expansion.

| Value Proposition | Description | 2024 Impact/Data |

|---|---|---|

| Digital Convenience | Advanced online and mobile platforms for efficient financial management. | 5 million+ AI chatbot interactions, reduced wait times. |

| Expert Financial Advisory | Tailored wealth management and investment strategies. | 8.5% average portfolio return for advised clients (H1 2024). |

| Bespoke Corporate & Investment Banking | Customized loans and international market access for businesses. | 15% growth in corporate lending portfolio; $2 billion+ in cross-border transactions facilitated. |

Customer Relationships

Alpha Bank leverages its extensive branch network and dedicated relationship managers to foster personalized customer interactions. This approach is crucial for understanding unique client needs and delivering tailored financial advice, particularly for its corporate and high-net-worth segments. By Q2 2024, Alpha Bank reported a 7% increase in customer satisfaction scores directly attributed to enhanced relationship management services.

Alpha Bank offers robust digital self-service through its online banking and mobile app, allowing customers 24/7 access to manage accounts, make payments, and apply for loans. This digital-first approach caters to the growing preference for convenience and efficiency in financial management.

In 2024, Alpha Bank reported a significant increase in digital transaction volumes, with over 70% of customer interactions occurring through its digital channels. This highlights the success of their investment in user-friendly platforms and remote support services.

Alpha Bank maintains dedicated customer support centers, acting as a crucial touchpoint for clients seeking assistance. These centers are staffed to handle inquiries, troubleshoot issues, and provide guidance on Alpha Bank's diverse range of financial products and services.

The primary function of these support centers is to ensure prompt and effective resolution of customer concerns. This commitment to service excellence is vital for fostering customer loyalty and enhancing overall satisfaction, a key element in Alpha Bank's strategy.

In 2024, Alpha Bank reported a 92% customer satisfaction rate for its support center interactions, a testament to their efficiency. Furthermore, the average resolution time for customer queries was reduced by 15% compared to the previous year, highlighting operational improvements.

Community Engagement and Financial Literacy Programs

Alpha Bank actively fosters community ties through robust financial literacy programs. These initiatives aim to equip individuals with essential money management skills, thereby empowering local economies. For instance, in 2024, the bank sponsored over 50 workshops across various regions, reaching an estimated 15,000 participants.

These engagement efforts go beyond mere corporate social responsibility; they are designed to cultivate enduring goodwill and a deeper public connection. By demonstrating a commitment to societal well-being, Alpha Bank strengthens its brand reputation and builds trust, which translates into more loyal customers.

- Financial Literacy Workshops: Conducted 50+ workshops in 2024, educating approximately 15,000 individuals on personal finance.

- Community Investment: Allocated $2 million in 2024 to local development projects and educational sponsorships.

- Volunteer Hours: Bank employees contributed over 5,000 volunteer hours to community outreach programs in 2024.

- Partnerships: Collaborated with 20 local non-profits and educational institutions to deliver tailored financial education.

Strategic Partnerships for Enhanced Offerings

Alpha Bank leverages strategic partnerships to significantly broaden its product and service portfolio. A prime example is its collaboration with UniCredit, which allows Alpha Bank to offer specialized mutual funds. This type of alliance is crucial for enhancing customer value by providing access to a wider array of financial markets and cutting-edge solutions.

These collaborations directly translate into a richer customer experience. By teaming up with other financial institutions, Alpha Bank can present a more comprehensive suite of financial products, meeting diverse customer needs more effectively. For instance, in 2024, Alpha Bank's expanded offerings through partnerships saw a notable increase in customer engagement with investment products.

- Expanded Product Range: Partnerships enable the introduction of specialized financial instruments, like mutual funds developed with UniCredit.

- Enhanced Customer Experience: Customers gain access to a broader spectrum of financial markets and innovative solutions.

- Increased Engagement: In 2024, Alpha Bank observed a 15% rise in customer participation in investment products following key partnership integrations.

- Competitive Advantage: Strategic alliances allow Alpha Bank to offer a more competitive and attractive value proposition in the market.

Alpha Bank cultivates customer loyalty through a multi-faceted approach, blending personalized relationship management with accessible digital self-service. By actively engaging with communities via financial literacy programs and forging strategic partnerships, the bank aims to deepen customer relationships and broaden its service offerings. These efforts are supported by robust customer support centers designed for efficient issue resolution.

| Customer Relationship Channel | Key Features | 2024 Performance Highlight |

|---|---|---|

| Relationship Managers | Personalized advice, needs assessment | 7% increase in customer satisfaction scores |

| Digital Platforms (App/Online) | 24/7 account management, payments, loan applications | Over 70% of customer interactions |

| Customer Support Centers | Inquiry handling, issue resolution, guidance | 92% customer satisfaction rate, 15% reduction in resolution time |

| Community Engagement | Financial literacy workshops, local sponsorships | 50+ workshops, 15,000 participants |

| Strategic Partnerships | Expanded product offerings (e.g., mutual funds) | 15% rise in investment product engagement |

Channels

Alpha Bank leverages its substantial physical branch network, a cornerstone of its customer engagement strategy, to offer a full spectrum of banking services. This network, comprising over 300 branches across Greece and Cyprus as of early 2024, facilitates essential in-person interactions, from complex financial transactions to personalized advisory services.

The physical branch network remains vital for fostering customer relationships and providing tailored support, particularly for segments of the population who value face-to-face banking. This traditional channel complements digital offerings by catering to specific needs, such as mortgage consultations or wealth management discussions, thereby ensuring broad customer accessibility and satisfaction.

Alpha Bank's digital banking platforms, myAlpha Web and Alpha Bank Mobile, are central to its customer engagement strategy, offering extensive online and mobile services. These platforms facilitate seamless transactions and account management, providing 24/7 access to banking functions for a growing digitally-native customer base.

In 2024, Alpha Bank reported a significant increase in digital channel usage, with over 70% of its transactions occurring through its web and mobile applications. This digital focus is crucial for catering to the evolving preferences of tech-savvy customers seeking convenience and immediate access to their finances.

Alpha Bank leverages its extensive network of Automated Teller Machines (ATMs) and Cash-In machines as a crucial component of its customer service delivery. These machines provide 24/7 access for essential transactions like cash withdrawals and deposits, enhancing customer convenience. As of late 2024, Alpha Bank operates over 1,200 ATMs across its service regions, facilitating millions of transactions monthly.

Contact Centers and Customer Support

Alpha Bank's dedicated contact centers are a cornerstone of its customer support strategy, offering assistance via phone, email, and chat. These channels provide a direct and accessible means for customers to resolve queries and receive information, fostering strong relationships. In 2024, the bank reported a significant increase in digital channel usage for support, with over 60% of customer interactions handled through online platforms, while maintaining robust phone support for complex issues.

The bank prioritizes efficient problem resolution through these contact points. This focus ensures a positive customer experience, which is vital for retention and loyalty. Alpha Bank invested in advanced AI-powered chatbots in 2024, which handled approximately 25% of routine inquiries, freeing up human agents for more complex cases and improving average handling times.

- Channel Functionality: Providing comprehensive support through phone, email, and live chat for all customer needs.

- Customer Engagement: Facilitating direct communication to enhance customer satisfaction and build trust.

- Operational Efficiency: Leveraging technology, such as AI chatbots, to manage a high volume of inquiries effectively.

- 2024 Performance: Saw a 15% year-over-year increase in customer support interactions, with digital channels accounting for the majority.

Partnership Networks (e.g., Hellenic Post)

Strategic partnerships, such as Alpha Bank's collaboration with Hellenic Post, are crucial for expanding its service footprint. This alliance allows Alpha Bank to offer a range of banking services through the extensive network of post offices across Greece.

This initiative significantly broadens Alpha Bank's distribution channels, especially in rural and less accessible regions where traditional branch presence might be limited. It enhances customer convenience by bringing essential banking services closer to people's homes.

- Expanded Reach: Hellenic Post operates over 1,000 post offices nationwide, providing Alpha Bank with access to a vast customer base.

- Service Diversification: Customers can perform transactions like cash deposits, withdrawals, and payments at these partner locations.

- Financial Inclusion: The partnership aims to improve financial inclusion by making banking services more accessible to underserved populations.

- Cost Efficiency: Leveraging existing infrastructure reduces the need for extensive new branch openings, leading to operational cost savings for the bank.

Alpha Bank's channels encompass a multi-faceted approach, blending its extensive physical branch network with robust digital platforms and strategic partnerships. This integrated strategy aims to maximize customer reach and service delivery efficiency.

The bank's digital channels, including myAlpha Web and the Alpha Bank Mobile app, are pivotal, handling over 70% of transactions in 2024. This digital emphasis caters to the growing demand for convenient, 24/7 banking access.

Furthermore, the physical branch network, with over 300 locations as of early 2024, continues to be vital for personalized advisory services and complex transactions, ensuring a comprehensive banking experience for all customer segments.

| Channel | Key Features | 2024 Usage/Impact | Strategic Importance |

|---|---|---|---|

| Physical Branches | In-person transactions, complex advisory, relationship building | Over 300 branches; essential for tailored support | Customer relationship depth, accessibility for all segments |

| Digital Platforms (myAlpha Web, Mobile App) | Online/mobile transactions, account management, 24/7 access | Over 70% of transactions; significant increase in usage | Customer convenience, efficiency, catering to digitally-native users |

| ATMs/Cash-In Machines | Cash withdrawals/deposits, 24/7 access | Over 1,200 machines; facilitating millions of monthly transactions | Basic banking convenience, extended accessibility |

| Contact Centers (Phone, Email, Chat) | Customer support, query resolution, information provision | 60%+ interactions via digital support; AI chatbots handling 25% of routine inquiries | Direct customer engagement, efficient problem resolution, enhanced experience |

| Strategic Partnerships (e.g., Hellenic Post) | Service expansion through partner networks | Access to 1,000+ post office locations; improved financial inclusion | Broadened reach, cost-efficient expansion, serving underserved areas |

Customer Segments

Alpha Bank's retail individual and household segment encompasses a wide range of customers needing everyday banking solutions. This includes services like checking and savings accounts, personal loans, mortgages, and credit cards. The bank aims to be a primary financial partner for the general public, supporting their financial journeys from daily transactions to significant life events.

In 2024, the retail banking sector continued to see strong demand for digital services, with a significant portion of transactions occurring online or via mobile apps. For instance, the global mobile banking market was projected to reach over $1.5 trillion by 2024, highlighting the importance of digital accessibility for this customer segment.

Alpha Bank actively courts Small and Medium-sized Enterprises (SMEs) by offering specialized banking solutions, including business loans and financial advisory services designed to foster their expansion and streamline operations. This strategic focus positions SMEs as a crucial segment for Alpha Bank's credit growth initiatives within Greece.

In 2024, Alpha Bank continued its commitment to supporting the Greek SME sector, a vital engine of the national economy. Data indicates that SMEs represent a significant portion of businesses in Greece, and Alpha Bank's lending to this segment is a key driver of its overall credit portfolio development.

Large corporations and institutions represent a key customer segment for Alpha Bank, demanding sophisticated corporate and investment banking services. These clients, including major multinational corporations and significant financial institutions, require tailored solutions for complex financial needs.

Alpha Bank offers a comprehensive suite of services to this segment, such as large-scale corporate financing, mergers and acquisitions advisory, and access to global capital markets for debt and equity issuance. For instance, in 2024, Alpha Bank facilitated over $50 billion in syndicated loans for its corporate clients, demonstrating its capacity to handle substantial financial transactions.

The bank's expertise in structured finance and risk management is particularly valuable to these sophisticated entities. In the first half of 2024, Alpha Bank advised on several high-profile cross-border M&A deals, totaling more than $15 billion in transaction value, underscoring its advisory capabilities for institutional clients navigating intricate market landscapes.

High-Net-Worth Individuals (HNWIs)

Alpha Bank’s customer segment of High-Net-Worth Individuals (HNWIs) is a core focus, offering them tailored wealth management, private banking services, and exclusive investment opportunities. These clients, typically defined as having investable assets of $1 million or more, demand a high level of personalized financial guidance and access to sophisticated investment vehicles. In 2024, the global HNWI population reached approximately 6.3 million individuals, with their total net worth estimated at over $26 trillion, highlighting the significant market opportunity. HNWIs value dedicated relationship managers who understand their unique financial goals and can provide discreet, expert advice.

The bank provides HNWIs with a suite of services designed to preserve and grow their wealth. This includes:

- Personalized Investment Strategies: Custom-built portfolios aligned with risk tolerance and return objectives.

- Estate Planning and Trust Services: Sophisticated solutions for wealth transfer and legacy management.

- Access to Alternative Investments: Opportunities in private equity, hedge funds, and real estate, often unavailable to retail investors.

- Concierge Banking Services: Dedicated support for all banking needs, ensuring seamless transactions and priority service.

International Clients and Businesses with Cross-Border Needs

Alpha Bank actively courts international clients and businesses with cross-border requirements, recognizing the growing complexity of global finance. Through key alliances, such as its collaboration with UniCredit, the bank extends its reach to serve customers operating across multiple jurisdictions or those with significant international investment portfolios.

This strategic approach provides these clients with unparalleled access to an extensive European banking network. Furthermore, it unlocks a broad spectrum of global investment solutions tailored to meet diverse international financial objectives. For instance, in 2024, Alpha Bank reported a significant uptick in cross-border transaction volumes, reflecting the increasing demand from this segment.

- Targeting Global Operations: Alpha Bank focuses on businesses with established international footprints.

- Cross-Border Investment Facilitation: The bank supports clients looking to invest or manage assets beyond their domestic market.

- UniCredit Partnership Benefits: Clients gain access to UniCredit's extensive European network, enhancing international banking capabilities.

- Access to Global Investment Solutions: This segment benefits from a comprehensive suite of investment products designed for international markets.

Alpha Bank caters to a diverse clientele, including retail individuals and households seeking everyday banking, SMEs requiring specialized business solutions, large corporations and institutions needing sophisticated corporate and investment banking, and High-Net-Worth Individuals (HNWIs) desiring tailored wealth management. The bank also actively engages with international clients and businesses with cross-border financial needs, leveraging strategic partnerships to expand its global reach.

In 2024, the bank saw continued growth across these segments. Retail banking transactions increasingly moved to digital platforms, with mobile banking usage surging globally. The SME segment remained a cornerstone of Alpha Bank's credit strategy in Greece, vital for national economic health. Large corporations benefited from substantial financing and advisory services, with significant M&A deal involvement.

| Customer Segment | Key Needs | 2024 Focus/Activity |

|---|---|---|

| Retail Individuals/Households | Everyday banking, loans, mortgages | Digital service enhancement, mobile banking growth |

| SMEs | Business loans, financial advisory | Support for Greek SMEs, credit portfolio development |

| Large Corporations/Institutions | Corporate finance, M&A, capital markets | Facilitating large syndicated loans, cross-border M&A advisory |

| High-Net-Worth Individuals (HNWIs) | Wealth management, private banking, alternative investments | Personalized strategies, estate planning, access to exclusive opportunities |

| International Clients | Cross-border banking, global investment solutions | Leveraging UniCredit partnership, increasing cross-border transaction volumes |

Cost Structure

Personnel and administrative expenses represent a substantial cost for Alpha Bank, driven by employee compensation, benefits, and the operational upkeep of its widespread branch network and central corporate functions. In 2024, these costs are a key focus for efficiency improvements.

To mitigate rising staff costs, Alpha Bank has actively implemented strategies such as voluntary separation schemes. These initiatives aim to optimize headcount while maintaining service quality and operational effectiveness across the organization.

Alpha Bank is making significant investments in its technology and digital transformation initiatives. These expenditures are crucial for building a robust IT infrastructure, enhancing its digital platforms, and bolstering cybersecurity measures. For instance, in 2024, the bank allocated a substantial portion of its budget towards upgrading its core banking systems and expanding its mobile banking capabilities, aiming to provide a seamless digital experience for its customers.

These technology investments are not merely operational costs; they are strategic imperatives. By adopting new technologies, including artificial intelligence and advanced analytics, Alpha Bank aims to improve operational efficiency, personalize customer offerings, and gain a competitive edge in the evolving financial landscape. The bank's commitment to digital transformation is evident in its continuous efforts to integrate cutting-edge solutions that streamline processes and reduce costs over the long term.

Alpha Bank's cost structure is heavily influenced by its extensive branch network and the associated infrastructure maintenance. These physical touchpoints, including numerous branches and ATMs, require substantial investment. For instance, in 2024, the cost of maintaining a single bank branch can range from $50,000 to over $150,000 annually, encompassing rent, utilities, staffing, and security.

These operational expenses are critical to providing accessible banking services but represent a significant portion of Alpha Bank's overhead. The ongoing upkeep of ATMs, IT systems supporting these branches, and general building maintenance further adds to this cost base, directly impacting profitability.

Marketing and Advertising Expenses

Alpha Bank allocates significant resources to marketing and advertising campaigns, aiming to attract new customers and solidify relationships with its existing client base. These expenditures are crucial for expanding its market share across diverse customer segments.

In 2024, Alpha Bank's marketing and advertising expenses were a key driver of its customer acquisition strategy. For instance, a significant portion of the budget was dedicated to digital marketing initiatives, including social media campaigns and targeted online advertisements, which saw a notable increase in customer engagement. The bank also invested in traditional media, such as television and print, to reinforce brand visibility and reach a broader audience.

- Digital Marketing Investment: Alpha Bank increased its digital marketing spend by 15% in 2024, focusing on personalized customer journeys and data-driven campaigns.

- Brand Building Initiatives: Expenditures on brand building activities, including sponsorships and community engagement programs, contributed to a 10% uplift in brand perception scores.

- Promotional Offers: The bank launched several attractive promotional offers and loyalty programs throughout 2024, which directly correlated with a 5% increase in new account openings.

- Market Share Growth: These marketing efforts supported Alpha Bank's objective to grow its market share by 2% in key retail banking segments during the fiscal year.

Regulatory Compliance and Risk Management Costs

Alpha Bank dedicates significant resources to regulatory compliance and risk management. These costs are essential for operating within the financial sector and safeguarding the bank's stability. For instance, in 2024, European banks, including those similar to Alpha Bank, faced increasing compliance burdens related to data privacy and anti-money laundering (AML) regulations, with some reporting compliance costs in the tens of millions of euros annually.

The bank's investment in risk management frameworks is crucial for identifying, assessing, and mitigating various financial risks. This includes managing non-performing exposures, which directly impacts profitability and capital adequacy. In 2024, the banking sector continued to grapple with the aftermath of economic shifts, leading to a focus on strengthening provisioning for potential loan losses.

- Regulatory Compliance: Expenses associated with adhering to banking laws, such as Basel III/IV requirements and local financial regulations.

- Risk Management Frameworks: Costs for developing and maintaining systems to manage credit, market, operational, and liquidity risks.

- Non-Performing Exposures: Outlays related to the management and resolution of defaulted or distressed loans and other assets.

- Capital Position: Investments in maintaining a strong capital buffer to absorb potential losses and ensure solvency.

Alpha Bank's cost structure is multifaceted, with personnel and administrative expenses forming a significant component. These costs are driven by employee compensation, benefits, and the operational upkeep of its extensive branch network and corporate functions. In 2024, the bank focused on efficiency improvements within these areas, including the implementation of voluntary separation schemes to optimize headcount while maintaining service quality.

Technology and digital transformation represent another major investment area for Alpha Bank. The bank allocated a substantial portion of its 2024 budget towards upgrading core banking systems, expanding mobile banking capabilities, and enhancing its IT infrastructure and cybersecurity. These investments are strategic, aiming to improve operational efficiency and customer experience through AI and advanced analytics.

The bank's extensive physical branch network and associated infrastructure maintenance also contribute significantly to its cost base. In 2024, the cost of maintaining a single bank branch could range from $50,000 to over $150,000 annually, covering rent, utilities, staffing, and security, alongside ATM upkeep and IT systems.

Marketing and advertising are key cost drivers, essential for customer acquisition and retention. In 2024, Alpha Bank increased its digital marketing spend by 15%, focusing on data-driven campaigns, while also investing in traditional media for broader brand visibility. These efforts supported a 2% market share growth in key retail segments.

Regulatory compliance and risk management are critical expenditures for Alpha Bank. In 2024, European banks faced growing compliance burdens, with costs for data privacy and AML regulations potentially reaching tens of millions of euros annually. The bank also invested in robust risk management frameworks to address credit, market, operational, and liquidity risks, including managing non-performing exposures.

| Cost Category | 2024 Focus/Investment | Impact/Goal |

|---|---|---|

| Personnel & Admin | Efficiency improvements, voluntary separation schemes | Headcount optimization, service quality maintenance |

| Technology & Digital Transformation | Core system upgrades, mobile banking expansion, cybersecurity | Enhanced operational efficiency, improved customer experience |

| Branch Network & Infrastructure | Maintenance of branches and ATMs | Accessible banking services, significant overhead |

| Marketing & Advertising | 15% increase in digital marketing spend, traditional media | Customer acquisition, market share growth (2% target) |

| Regulatory Compliance & Risk Management | Data privacy, AML, risk frameworks, non-performing loan management | Operational stability, safeguarding financial health |

Revenue Streams

Net Interest Income (NII) stands as Alpha Bank's core revenue driver, reflecting the profit earned from its lending and investment activities after accounting for the cost of its funding. This fundamental banking operation is crucial for the bank's profitability.

For 2025, Alpha Bank has projected its Net Interest Income to reach at least €1.65 billion, underscoring its reliance on this income stream for overall financial performance and growth.

Alpha Bank generates substantial revenue through fees and commissions. This income stems from a wide array of banking services, encompassing transaction charges, credit card interchange fees, asset management service charges, and commissions earned from distributing brokerage and insurance products.

Fee income has demonstrated robust growth for Alpha Bank. For instance, in the first quarter of 2024, Alpha Bank reported a notable increase in its fee and commission income, reaching €350 million, a 12% rise compared to the same period in 2023.

Alpha Bank generates revenue from loan origination and servicing fees, which are collected from the initiation and ongoing management of diverse loan products. This includes fees associated with business loans, mortgages, and consumer credit facilities.

The bank's robust performance in its loan portfolio, particularly with performing loans, directly fuels this revenue stream. For instance, in 2024, Alpha Bank reported a significant increase in its net interest income, a portion of which is attributable to the growth in its loan book and the associated fees.

Investment and Trading Income

Alpha Bank generates significant revenue from its investment and trading activities, reflecting a diversified approach to profitability. This income stream encompasses both capital appreciation from its investment portfolio and profits derived from active trading in various financial markets.

The bank's investment portfolio includes a range of securities and financial instruments, from which it earns income through dividends, interest, and capital gains. Trading activities, on the other hand, involve proprietary trading and market-making, capitalizing on market volatility and price discrepancies. For instance, in 2024, Alpha Bank reported substantial gains from its trading desk, contributing to its overall financial performance.

- Investment Portfolio Gains: Income from dividends, interest, and capital appreciation on owned securities.

- Trading Profits: Revenue generated from active buying and selling of financial instruments, including proprietary trading and market-making.

- Diversification Benefit: This stream enhances overall profitability by reducing reliance on traditional banking services.

Asset Management and Wealth Management Fees

Alpha Bank generates revenue through fees collected from its asset and wealth management divisions. These fees encompass advisory charges for financial planning and investment guidance, as well as performance-based fees tied to investment returns.

The bank is actively pursuing growth in this segment, notably by leveraging strategic alliances. For instance, its collaboration with UniCredit for mutual funds is a key initiative to expand its fee-based income streams.

- Advisory Fees: Charges for personalized financial advice and portfolio management.

- Performance Fees: A percentage of profits generated by managed investments, incentivizing strong returns.

- Partnership Growth: Expansion of fee-generating services through collaborations, such as the UniCredit mutual fund partnership.

Alpha Bank also generates income from its treasury and capital markets operations. This includes revenue from foreign exchange trading, interest income on its liquidity portfolio, and fees from corporate finance advisory services.

In 2024, Alpha Bank's treasury division reported strong performance, with foreign exchange activities contributing significantly to overall revenue. This demonstrates the bank's ability to capitalize on global market movements.

The bank's commitment to expanding its digital banking services also presents a growing revenue stream. This includes income from digital transaction fees, mobile banking subscriptions, and the sale of digital financial products.

Alpha Bank's strategic focus on digital transformation is evident in its investment in new platforms. For example, the launch of its new digital lending portal in early 2024 is expected to boost origination fee income significantly.

| Revenue Stream | Description | 2024 Performance Highlight | Projected 2025 Contribution |

|---|---|---|---|

| Net Interest Income | Profit from lending and investments minus funding costs. | Core driver, projected to exceed €1.65 billion in 2025. | Primary revenue source. |

| Fees and Commissions | Income from transaction charges, cards, asset management, etc. | €350 million in Q1 2024, up 12% YoY. | Growing contribution from diverse services. |

| Investment & Trading | Capital gains, dividends, proprietary trading, market-making. | Substantial gains reported from trading desk in 2024. | Enhances profitability through market participation. |

| Asset & Wealth Management | Advisory and performance fees for financial planning. | Strategic alliances, e.g., UniCredit mutual funds, expanding reach. | Key growth area for fee-based income. |

| Treasury & Capital Markets | FX trading, liquidity portfolio interest, corporate finance fees. | Strong performance in FX trading in 2024. | Diversifies income with market-based activities. |

| Digital Banking Services | Digital transaction fees, subscriptions, digital product sales. | New digital lending portal launched early 2024. | Emerging revenue stream with significant growth potential. |

Business Model Canvas Data Sources

The Alpha Bank Business Model Canvas is built upon a foundation of comprehensive financial data, rigorous market research, and in-depth strategic insights. These sources ensure that each block of the canvas is populated with accurate, up-to-date, and actionable information, reflecting the bank's current operations and future aspirations.