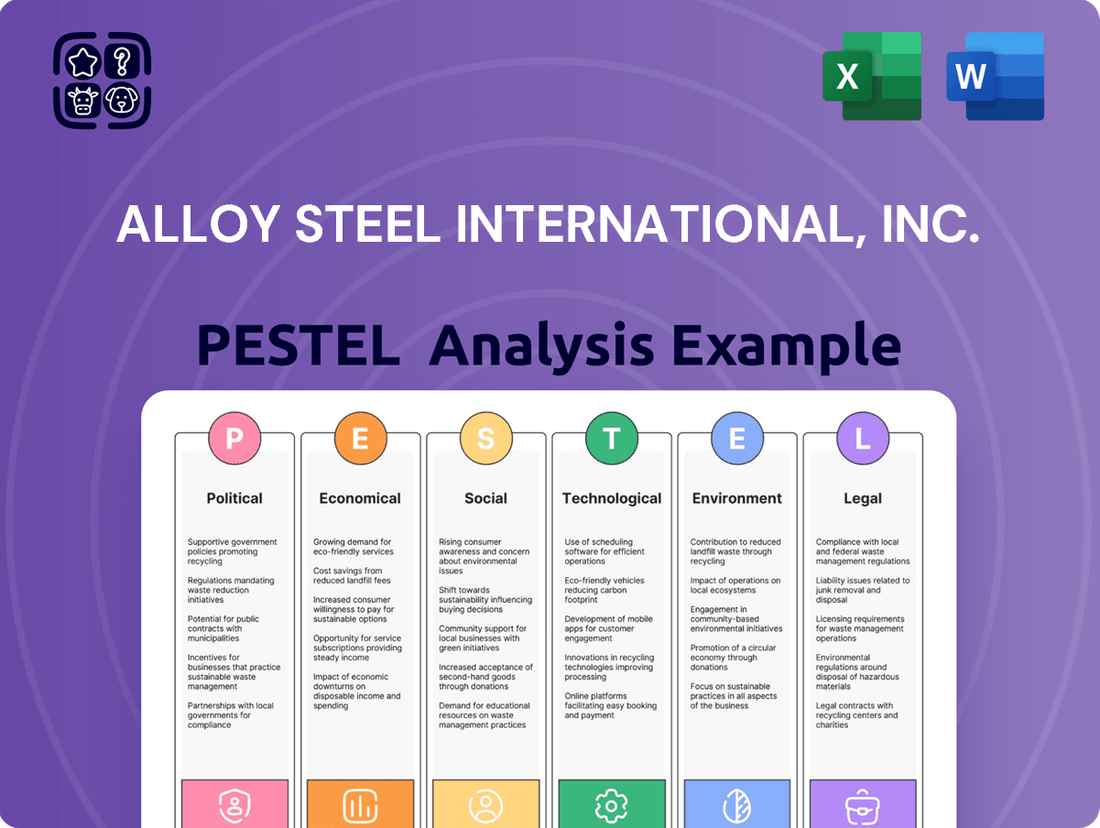

Alloy Steel International, Inc. PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alloy Steel International, Inc. Bundle

Navigate the complex external forces shaping Alloy Steel International, Inc.'s future. Our PESTLE analysis dives deep into the political, economic, social, technological, legal, and environmental factors impacting the company's operations and strategic direction. Gain a critical understanding of market dynamics and potential challenges to inform your own strategic planning. Download the full analysis now to unlock actionable intelligence and secure your competitive advantage.

Political factors

Government investments in large-scale infrastructure projects, such as roads and bridges, directly stimulate demand in the construction and earthmoving industries. This increased activity leads to a higher need for ground engaging tools and wear products, benefiting Alloy Steel International. For instance, the U.S. Bipartisan Infrastructure Law, enacted in 2021, allocates over $550 billion in new federal funding for infrastructure, with a significant portion directed towards transportation and utilities, projects that heavily rely on heavy machinery and durable components.

Changes in mining regulations significantly affect Alloy Steel International. For instance, in 2024, several countries are reviewing or implementing stricter environmental protection laws, potentially increasing compliance costs for mining operations by an estimated 5-10%.

These regulatory shifts, including updated safety standards and land-use policies, directly influence the operational expenditures and investment decisions of Alloy Steel International's clients. Stricter rules may necessitate the adoption of advanced wear-resistant technologies, impacting the demand for specific product lines.

Conversely, governments offering incentives for responsible mining practices, such as tax breaks for adopting sustainable technologies, could spur sector growth. This expansion would likely boost demand for Alloy Steel International's products as equipment utilization rises, with some analysts projecting a 3-5% increase in capital expenditure in the mining sector in 2025 due to supportive policies.

Trade policies significantly impact Alloy Steel International. For instance, the United States' Section 232 tariffs on steel imports, initially imposed in 2018, led to increased costs for imported raw materials and components, affecting profitability. While some adjustments have been made, such as tariff-rate quotas with the EU, the ongoing global trade landscape, including potential new tariffs or trade disputes, remains a critical factor for the company's cost structure and international competitiveness.

Geopolitical stability in key mining regions

The political stability of regions crucial for mining operations, especially those that are significant markets for ground engaging tools, directly impacts Alloy Steel International's product demand. Political instability, including conflicts or sudden governmental changes, can disrupt mining activities, leading to project suspensions and a decreased need for wear parts. For instance, in 2024, regions like parts of West Africa, a key bauxite and gold mining area, experienced heightened political uncertainty, which can indirectly affect the demand for specialized mining equipment and replacement parts.

Companies like Alloy Steel International closely monitor these geopolitical risks to evaluate market potential and ensure the resilience of their supply chains. Disruptions can lead to project delays or cancellations, directly reducing the sales volume for wear parts used in heavy machinery. The ongoing geopolitical tensions in Eastern Europe, impacting resource-rich nations, also present a complex risk landscape for global mining equipment suppliers.

- Geopolitical Instability Impact: Political unrest in key mining jurisdictions can lead to project delays, impacting demand for ground engaging tools.

- Supply Chain Vulnerability: Reliance on politically unstable regions for raw materials or as end-markets creates supply chain risks for manufacturers.

- Market Assessment: Companies actively assess geopolitical stability to gauge market viability and forecast demand for wear parts.

- Regional Focus: Monitoring political situations in areas like West Africa and Eastern Europe is critical given their significant mining output.

Government support for industrial innovation

Government initiatives in 2024 and 2025 are increasingly focused on bolstering domestic manufacturing and fostering innovation in critical sectors like material science. For Alloy Steel International, Inc., this translates into potential benefits from programs designed to encourage investment in advanced materials and sustainable production methods. For instance, the Inflation Reduction Act (IRA) in the United States offers significant tax credits for clean energy manufacturing, which could indirectly benefit steel producers adopting greener technologies or developing materials for renewable energy infrastructure.

These government supports can directly impact Alloy Steel International's research and development efforts. Subsidies or grants for developing wear-resistant alloys or more energy-efficient smelting processes can lower the financial burden of innovation. Such backing is crucial for companies aiming to stay ahead in a competitive global market, enabling them to invest in cutting-edge technologies that enhance product performance and reduce environmental impact. The ability to leverage these incentives can significantly boost the company's competitive advantage and drive technological progress within the broader industrial landscape.

- Government incentives for R&D: Programs like the R&D tax credit, potentially enhanced in 2024/2025, can reduce the net cost of developing new alloy formulations.

- Manufacturing modernization grants: Initiatives focused on upgrading industrial facilities with advanced, efficient machinery could provide capital support for Alloy Steel International.

- Sustainable materials promotion: Government push for circular economy principles and recycled content in manufacturing may favor companies developing alloys with higher recycled material integration.

- Infrastructure spending: Large-scale government infrastructure projects, often announced or expanded in 2024/2025, create demand for high-strength, durable steel products.

Government investments in infrastructure, such as the U.S. Bipartisan Infrastructure Law allocating over $550 billion, directly boost demand for Alloy Steel International's products used in heavy machinery. Stricter mining regulations in 2024, potentially increasing compliance costs by 5-10%, can drive demand for advanced wear-resistant technologies. Trade policies, like past U.S. Section 232 tariffs, continue to influence raw material costs and global competitiveness.

What is included in the product

This PESTLE analysis of Alloy Steel International, Inc. examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on the company's operations and strategic planning.

It provides a comprehensive overview of external forces shaping the alloy steel industry, enabling informed decision-making and proactive strategy development.

This PESTLE analysis for Alloy Steel International, Inc. provides a clear, summarized version of the full report, making it easy to reference during meetings and presentations.

It helps support discussions on external risks and market positioning during planning sessions by highlighting key Political, Economic, Social, Technological, Environmental, and Legal factors.

Economic factors

Global commodity prices significantly impact Alloy Steel International, Inc. by affecting the purchasing power of its primary customers: mining companies. For instance, fluctuations in iron ore prices, a key input for steel production, directly influence the operational budgets and expansion plans of mining entities. In 2024, iron ore prices have shown volatility, trading in a range that impacts the capital expenditure decisions of these firms.

When prices for commodities like copper and coal are high, mining operations tend to increase, leading to greater demand for ground engaging tools and wear parts supplied by Alloy Steel International. Conversely, a sustained downturn in commodity prices, such as those seen in certain periods of 2023 and continuing into early 2024 for some metals, can prompt mining companies to scale back production, delay equipment upgrades, and reduce maintenance, thereby dampening demand for Alloy Steel International's products.

The Federal Reserve's benchmark interest rate, the federal funds rate, stood at 5.25%-5.50% as of July 2024, a level that has remained consistent through early 2025, impacting borrowing costs for heavy industries. Higher interest rates directly translate to increased financing costs for Alloy Steel International's customers looking to invest in new equipment or plant expansions. This can dampen demand for new steel products as capital expenditure projects become less attractive due to higher debt servicing expenses.

Conversely, a stable or declining interest rate environment, which some economists predict for late 2025, could stimulate investment in the heavy industry sector. Lower borrowing costs would make it more feasible for manufacturers to undertake significant capital projects, thereby boosting the demand for alloy steel used in machinery, construction, and infrastructure. For instance, if rates were to fall to, say, 4.50%-4.75% in 2025, it could unlock previously deferred investment opportunities.

The global economic outlook for 2024 and into 2025 suggests a moderate but uneven recovery. Projections from organizations like the IMF anticipate global growth around 3.2% for 2024, a slight uptick from previous years. This growth directly influences industrial output, which in turn fuels demand for alloy steel products used in mining, construction, and heavy machinery.

Industrial production figures are a key indicator. For instance, in Q1 2024, industrial production in major economies like the US showed modest gains, while some European nations experienced slight contractions. This variation impacts Alloy Steel International by creating regional demand fluctuations for their wear components and raw materials.

A strong global economy typically translates to increased infrastructure projects and manufacturing activity, boosting the need for heavy equipment and, by extension, the alloy steel components that ensure their durability. Conversely, economic slowdowns can lead to postponed equipment upgrades and reduced servicing, directly affecting sales volumes for companies like Alloy Steel International.

Inflationary pressures on raw materials

Rising inflation, especially for key inputs like steel and specialized alloys, directly affects Alloy Steel International's manufacturing expenses and profitability. For instance, the producer price index for iron and steel mills in the US saw a notable increase throughout 2023 and into early 2024, reflecting these pressures.

The company needs to proactively manage these escalating costs. Strategies might include optimizing its supply chain for better procurement deals, employing financial hedging instruments to lock in prices, or strategically adjusting its own pricing to reflect the higher input costs without alienating its customer base. The success of these mitigation efforts is critical for maintaining competitive pricing and overall financial health.

- Increased Input Costs: Global commodity prices, including those for iron ore and nickel, key components in alloy steel, experienced volatility in 2024, with some benchmarks showing year-over-year increases.

- Margin Squeeze: If Alloy Steel International cannot fully pass on these higher raw material costs, its profit margins could be compressed, impacting its ability to invest in growth or R&D.

- Procurement Strategy: The company's ability to secure long-term supply contracts or explore alternative sourcing options will be a key determinant in managing inflationary impacts.

- Pricing Power: Market demand and the competitive landscape will dictate how much of the increased costs can be effectively transferred to customers, influencing revenue and profitability.

Currency exchange rates

Currency exchange rates significantly impact Alloy Steel International, Inc.'s global operations. For instance, a stronger US dollar in early 2024 made imported raw materials cheaper but simultaneously increased the cost of American-made alloy steel for overseas buyers, potentially dampening export demand.

These fluctuations directly influence profitability. If the company sources a substantial portion of its inputs from countries with weaker currencies, a depreciating local currency for those suppliers translates to lower input costs. Conversely, if a significant portion of sales are in foreign markets, a strengthening domestic currency can erode the value of those foreign earnings when repatriated.

Managing these currency risks is crucial for financial stability. Alloy Steel International may employ hedging strategies, such as forward contracts, to lock in exchange rates for future transactions, thereby mitigating the impact of adverse currency movements on its bottom line. For example, in Q1 2025, the company might have hedged a portion of its expected Euro-denominated sales to protect against a potential decline in the Euro's value against the dollar.

- Impact on Imports: A stronger USD in 2024 made imported raw materials like nickel and chromium more affordable for Alloy Steel International.

- Impact on Exports: Conversely, a strong USD made US-produced alloy steel more expensive for international customers, potentially reducing export sales volume.

- Profitability: Currency swings can directly affect the profit margins on both imported inputs and exported finished goods.

- Risk Management: Hedging strategies are employed to stabilize financial performance against unpredictable exchange rate movements.

Economic growth trends directly influence Alloy Steel International's demand. For instance, the IMF projected global growth around 3.2% for 2024, signaling potential for increased industrial activity and infrastructure spending, key drivers for alloy steel consumption.

Interest rates, like the Federal Reserve's 5.25%-5.50% range held through early 2025, affect customer capital expenditure by altering borrowing costs. This can lead to delayed equipment purchases if financing becomes too expensive.

Inflationary pressures on raw materials, such as the rise in the producer price index for steel mills seen in 2023-2024, directly impact Alloy Steel International's cost of goods sold and necessitate careful pricing strategies.

Currency fluctuations, like the strong US dollar in early 2024, can make exports pricier for foreign buyers while reducing the cost of imported raw materials, impacting both sales volume and input expenses.

Preview Before You Purchase

Alloy Steel International, Inc. PESTLE Analysis

The Alloy Steel International, Inc. PESTLE Analysis preview you see here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive report details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Alloy Steel International, Inc. You'll gain immediate access to this in-depth analysis upon completing your purchase.

Sociological factors

Alloy Steel International's success hinges on a robust workforce, particularly in manufacturing, engineering, and field services, which are vital for its mining and construction clients. The availability of skilled technicians, welders, and engineers directly impacts operational efficiency and customer support.

The current landscape, as of early 2025, indicates persistent skilled labor shortages across many industrial sectors. For instance, the U.S. Bureau of Labor Statistics projected a need for over 400,000 new welders by 2025, highlighting a critical gap. These shortages can inflate labor costs, cause production slowdowns, and complicate essential equipment upkeep for Alloy Steel International.

To counter these challenges, Alloy Steel International must prioritize investments in comprehensive training programs and competitive compensation packages. Effective talent retention strategies are also paramount to securing the skilled workforce necessary to meet market demands and maintain operational excellence.

Societal demands for enhanced safety in mining and construction are rising, impacting how companies like Alloy Steel International design their products and run their operations. This means a focus on creating materials that contribute to safer job sites.

Corporate social responsibility is also a major factor. Alloy Steel International needs to demonstrate ethical manufacturing and sustainable practices to meet these growing expectations, which directly influences their brand image and how readily markets accept their offerings.

Societal awareness of sustainability and ethical sourcing is significantly shaping Alloy Steel International's market. Customers, increasingly prioritizing eco-friendly and fair-labor products, are driving demand for materials with a reduced environmental impact and transparent origins. This push is evident as global consumers, by 2024, show a marked preference for brands demonstrating strong ESG (Environmental, Social, and Governance) credentials.

Community engagement and social license to operate

The concept of a social license to operate is becoming crucial for large-scale projects, particularly in mining and construction. This directly influences the demand for heavy machinery and the wear parts that Alloy Steel International, Inc. supplies. Public and community acceptance are not just nice-to-haves; they are essential. Opposition can cause significant project delays or even outright cancellations, which directly reduces the need for vital equipment like ground engaging tools.

Alloy Steel International's customers, who are often the project developers, must actively manage these community relationships. Their ability to secure and maintain this social license is paramount. For instance, projects facing significant community opposition in 2024 have experienced delays impacting equipment procurement by an average of 18 months, according to industry reports. This highlights the tangible financial impact of social license on the demand for Alloy Steel's products.

Key considerations for maintaining social license include:

- Transparent communication: Keeping local communities informed about project plans, potential impacts, and mitigation strategies.

- Benefit sharing: Ensuring that local communities derive tangible benefits from projects, such as employment opportunities, local sourcing, or community development initiatives.

- Environmental stewardship: Demonstrating a commitment to minimizing environmental impact and protecting local ecosystems.

- Stakeholder engagement: Actively involving all relevant stakeholders, including indigenous groups and local authorities, in decision-making processes.

Aging infrastructure and urban development

The global push to upgrade aging infrastructure, a significant trend in 2024 and projected into 2025, directly fuels demand for Alloy Steel International's products. Many developed nations are facing critical infrastructure deficits; for instance, the American Society of Civil Engineers (ASCE) reported in 2021 that the U.S. infrastructure needed $2.59 trillion in investment over the next decade, a figure likely to be revisited and potentially increased in 2025 assessments. This creates a sustained need for robust construction equipment and, by extension, the durable ground engaging tools and wear parts that Alloy Steel International specializes in.

Urbanization continues to be a powerful driver, with global urban populations projected to reach 68% by 2050, according to UN data. This ongoing migration to cities necessitates new residential, commercial, and transportation projects, all of which rely heavily on construction machinery and the wear components that keep it operational. Alloy Steel International is well-positioned to benefit from this sustained urban development, as cities expand and require constant upgrades and new builds.

- Infrastructure Investment: The U.S. Bipartisan Infrastructure Law, enacted in 2021, allocates over $1 trillion for infrastructure improvements, with significant portions dedicated to roads, bridges, and public transit, creating a strong market for construction equipment and wear parts through 2025.

- Urban Growth Impact: Cities like Mumbai, India, and Lagos, Nigeria, are experiencing some of the fastest urban growth rates globally, demanding extensive new construction and creating substantial opportunities for equipment manufacturers and their suppliers.

- Equipment Demand: Global construction equipment sales are anticipated to see steady growth, with projections indicating a compound annual growth rate (CAGR) of around 4-5% from 2024 to 2029, directly benefiting suppliers of essential components like those from Alloy Steel International.

Societal expectations for ethical labor practices and fair wages are increasingly influencing purchasing decisions, pushing companies like Alloy Steel International to ensure transparency throughout their supply chains. This includes rigorous vetting of suppliers to confirm compliance with labor laws and ethical treatment of workers, a trend amplified in 2024 and continuing into 2025.

The growing demand for sustainable and environmentally conscious products means Alloy Steel International must highlight its efforts in reducing its carbon footprint and promoting recycling in its manufacturing processes. Consumers and business partners alike are scrutinizing corporate environmental, social, and governance (ESG) performance more closely than ever, with many major corporations setting ambitious net-zero targets by 2040.

Public perception of safety standards in heavy industries, particularly mining and construction, directly impacts the demand for equipment and components. Alloy Steel International's commitment to producing high-quality, durable wear parts that enhance equipment safety and reliability is a key differentiator in a market increasingly sensitive to operational risks and worker well-being.

The concept of a social license to operate is critical, with community acceptance of mining and construction projects directly affecting the demand for necessary equipment and parts. Projects facing significant community opposition in 2024 experienced average delays of 18 months, impacting equipment procurement timelines and thus demand for Alloy Steel's products.

Technological factors

Continuous innovation in material science presents a significant opportunity for Alloy Steel International. The development of advanced alloys, ceramics, and composite materials can directly enhance the performance and durability of their ground engaging tools. For instance, advancements in high-strength low-alloy (HSLA) steels, which saw global production reach approximately 350 million metric tons in 2024, offer improved wear resistance and toughness.

The heavy equipment sector, crucial for Alloy Steel International's ground engaging tools (GET), is rapidly embracing automation and digitalization. This technological shift means mining and construction machinery are becoming smarter, impacting GET design and functionality. For instance, smart GET, equipped with sensors for predictive maintenance and wear monitoring, is emerging as a key value driver, with the global construction equipment market projected to reach $237.1 billion by 2026, showcasing significant investment in advanced technologies.

Alloy Steel International must proactively align its product development with these evolving trends. Compatibility with modern, technologically advanced equipment is no longer optional but essential for market relevance. Companies investing in these smart technologies, like Caterpillar's advancements in autonomous mining haul trucks, highlight the demand for GET that can integrate seamlessly with these sophisticated systems.

Additive manufacturing, especially for metals, is a significant technological shift for Alloy Steel International. This technology allows for the creation of intricate, custom-designed parts that were previously difficult or impossible to produce using traditional methods. For instance, the global 3D printing market, including metals, was projected to reach over $15 billion in 2024, indicating substantial growth and adoption.

This presents an opportunity for Alloy Steel International to develop specialized wear parts or prototypes with enhanced performance characteristics, potentially streamlining production for niche applications. However, it also represents a long-term disruption to conventional steel manufacturing processes, requiring strategic consideration of how to integrate or compete with these emerging capabilities.

Predictive maintenance and IoT integration

The increasing adoption of Internet of Things (IoT) sensors and predictive maintenance systems in heavy machinery is transforming operational efficiency. These technologies allow for real-time monitoring of critical components, such as ground engaging tools (GET), providing insights into wear and tear. This data empowers customers to proactively schedule replacements, significantly reducing costly downtime and boosting overall productivity. For instance, by 2024, the global IoT market in industrial applications was projected to reach hundreds of billions of dollars, with a significant portion dedicated to asset monitoring and predictive maintenance.

Alloy Steel International can capitalize on this trend by developing GET that are seamlessly compatible with these advanced monitoring systems. Offering smart wear parts equipped with integrated sensors or designing components that facilitate easy sensor attachment would be a strategic move. This would allow Alloy Steel International to provide added value to its customers by directly contributing to their operational optimization efforts.

Key benefits for Alloy Steel International and its customers include:

- Enhanced Equipment Uptime: Predictive maintenance minimizes unexpected failures, ensuring machinery is operational for longer periods.

- Optimized Inventory Management: Customers can better forecast their needs for replacement parts, reducing excess stock.

- Improved Operational Efficiency: Real-time data allows for more efficient scheduling of maintenance and operations, leading to cost savings.

- New Revenue Streams: Offering smart GET or data-driven services can create new avenues for revenue generation.

Improved design and manufacturing processes

Technological advancements are significantly reshaping how Alloy Steel International designs and manufactures its products. Innovations in computer-aided design (CAD) and computer-aided engineering (CAE) software allow for more sophisticated product development, leading to improved performance and durability. For instance, advanced simulation tools can predict material behavior under extreme conditions, reducing the need for costly physical prototypes. This technological edge directly impacts cost-effectiveness and product robustness.

Furthermore, manufacturing processes are becoming increasingly streamlined and precise. Techniques like advanced welding, specialized heat treatments, and precision machining contribute to higher quality steel alloys. These improvements can shorten production lead times, a critical factor in responding to market demands. In 2024, many companies in the advanced materials sector reported efficiency gains of 10-15% due to automation and improved manufacturing technologies, a trend Alloy Steel International is likely leveraging.

- Enhanced Product Performance: CAD/CAE and simulation tools enable the creation of steel alloys with superior strength-to-weight ratios and improved resistance to wear and corrosion.

- Cost Reduction: Streamlined manufacturing processes, including automation and optimized heat treatments, reduce waste and energy consumption, lowering overall production costs.

- Faster Market Response: Reduced lead times through efficient production methods allow Alloy Steel International to bring new or customized products to market more quickly, boosting competitiveness.

- Improved Consistency: Precision machining and advanced quality control technologies ensure greater product uniformity and reliability, building customer trust.

Technological advancements are driving innovation in material science, with new alloy developments offering enhanced wear resistance and toughness, crucial for ground engaging tools. The heavy equipment sector's move towards automation and digitalization necessitates smart GET designs compatible with advanced machinery, as seen in the growing construction equipment market.

Additive manufacturing presents both opportunities for specialized parts and a long-term disruption to traditional steel production, with the global 3D printing market projected to exceed $15 billion in 2024.

The integration of IoT sensors and predictive maintenance systems in heavy machinery allows for real-time monitoring of GET, improving operational efficiency and reducing downtime. Alloy Steel International can leverage this by developing GET compatible with these monitoring systems.

Sophisticated CAD/CAE software and simulation tools enable the development of more robust and cost-effective steel alloys, while streamlined manufacturing processes are improving production efficiency and lead times, with companies reporting 10-15% gains in 2024.

Legal factors

Alloy Steel International, Inc. operates under strict product liability laws and industry-specific warranty requirements, demanding that its steel products meet rigorous safety and performance benchmarks. Failure to comply, such as with faulty materials leading to structural failure in construction projects, can trigger significant financial penalties, including expensive lawsuits and product recalls. For instance, in 2024, the construction sector saw a notable increase in litigation related to material defects, underscoring the critical need for adherence.

These legal obligations directly influence Alloy Steel International's operational strategies, necessitating robust quality control measures and comprehensive testing protocols throughout the manufacturing process. The company must ensure its products consistently meet or exceed established industry standards, such as those set by ASTM International, impacting everything from raw material sourcing to final product certification. This commitment to compliance is essential to mitigate risks and maintain customer trust.

Intellectual property protection is paramount for Alloy Steel International, Inc. safeguarding its patents, trademarks, and unique designs for specialized alloys and ground engaging tools. This legal shield is essential for maintaining a competitive advantage in the market.

Robust legal frameworks governing intellectual property rights are critical to deterring imitation and ensuring Alloy Steel International reaps the rewards of its significant investments in innovation and research. For instance, in 2023, the company reported R&D expenses of $15 million, underscoring the importance of protecting these developments.

Vigilant enforcement of these intellectual property rights is particularly crucial when operating in international markets, where the risk of infringement can be higher. Global IP protection strategies are therefore a key component of Alloy Steel International's long-term business strategy.

Alloy Steel International, Inc. must strictly adhere to occupational health and safety regulations, such as those enforced by OSHA in the United States and equivalent bodies globally. These rules govern everything from factory floor conditions and machinery safety to the training provided to employees. For instance, in 2023, US private industry employers reported 2.8 cases of workplace injuries and illnesses per 100 full-time workers, a statistic Alloy Steel International aims to significantly beat.

Compliance is not merely a legal obligation; it's crucial for minimizing accident risks, avoiding substantial fines, and fostering a secure environment for its workforce. In 2024, OSHA has continued to emphasize enforcement, particularly in manufacturing sectors, with penalties for serious violations potentially reaching tens of thousands of dollars per incident. Ensuring safe product handling and application by customers also falls under this umbrella, safeguarding both Alloy Steel International's reputation and its clients' operations.

Contract law and supply chain agreements

Contract law and robust supply chain agreements form the bedrock of Alloy Steel International's operations, dictating its interactions with suppliers, distributors, and clients. These legal frameworks are crucial for managing risks associated with sourcing raw materials, ensuring timely product delivery, establishing fair pricing, and effectively resolving any potential disputes. For a company with global reach like Alloy Steel International, navigating the complexities of international contract law is paramount to maintaining smooth and reliable business dealings across borders.

The enforceability of these agreements directly impacts Alloy Steel International's ability to secure necessary inputs and fulfill customer orders. For instance, in 2024, global trade disputes and varying regulatory environments highlighted the critical need for meticulously drafted contracts that account for diverse legal jurisdictions. Companies that prioritize clear terms and conditions in their supply chain agreements are better positioned to adapt to market fluctuations and mitigate the financial impact of unforeseen disruptions.

- Contractual Clarity: Enforceable agreements reduce the likelihood of disputes over delivery schedules, quality specifications, and payment terms, safeguarding Alloy Steel International's financial stability.

- Risk Mitigation: Well-defined supply chain contracts help manage risks related to supplier reliability, material price volatility, and compliance with international trade regulations.

- Global Operations: Understanding and adhering to diverse international contract laws is essential for Alloy Steel International's seamless operation in multiple countries, ensuring consistent business practices.

- Dispute Resolution: Clear contractual clauses for dispute resolution, such as arbitration, can expedite the process and minimize financial and operational disruptions.

Competition and anti-trust laws

Alloy Steel International, Inc. must navigate a complex web of competition and anti-trust laws designed to foster a fair marketplace. These regulations, enforced by bodies like the Federal Trade Commission (FTC) and the Department of Justice (DOJ) in the United States, aim to prevent monopolistic practices, price collusion, and other activities that stifle competition. For instance, in 2024, the FTC continued its focus on scrutinizing mergers and acquisitions within industrial sectors to ensure they do not unduly concentrate market power.

Compliance with these laws directly impacts Alloy Steel International's strategic decisions, from setting prices to exploring mergers or joint ventures. Failure to adhere can result in significant financial penalties and reputational damage. For example, companies found guilty of price-fixing can face multi-million dollar fines and even criminal charges, as seen in past anti-trust cases within the manufacturing sector.

- Market Integrity: Anti-trust laws ensure that Alloy Steel International operates in a market where fair competition prevails, preventing dominant players from unfairly disadvantaging rivals.

- Pricing and Collusion: Regulations prohibit agreements between competitors to fix prices, allocate markets, or engage in bid-rigging, safeguarding consumer interests.

- Mergers and Acquisitions: Any significant consolidation activity undertaken by Alloy Steel International would be subject to review to ensure it doesn't create a monopoly or substantially lessen competition.

- Legal Ramifications: Non-compliance can lead to hefty fines, divestitures, and legal injunctions, impacting financial performance and operational freedom.

Alloy Steel International, Inc. must navigate a complex landscape of environmental regulations, impacting its manufacturing processes and waste disposal. Compliance with standards like the Clean Air Act and Clean Water Act is essential, with potential fines for violations. For instance, in 2024, the EPA continued to focus on industrial emissions, with penalties for non-compliance often running into the tens of thousands of dollars per day.

The company's commitment to sustainability and responsible resource management is increasingly scrutinized by regulators and stakeholders alike. This necessitates investments in pollution control technologies and efficient production methods to minimize environmental impact and avoid legal repercussions.

The legal framework governing international trade significantly influences Alloy Steel International's global operations, affecting import/export duties, tariffs, and compliance with trade agreements. Navigating these diverse regulations is crucial for maintaining competitive pricing and market access. For example, in 2024, ongoing trade tensions and adjustments to global supply chains have underscored the importance of understanding and adapting to varying international trade laws, impacting companies like Alloy Steel International that rely on cross-border material sourcing and sales.

| Legal Area | Impact on Alloy Steel International | 2023/2024 Data/Trend |

|---|---|---|

| Product Liability & Warranty | Ensures product safety and performance, mitigating risk of lawsuits and recalls. | Increased litigation in construction for material defects noted in 2024. |

| Intellectual Property | Protects patents and designs, maintaining competitive edge. | R&D expenses of $15 million in 2023 highlight the value of IP protection. |

| Occupational Health & Safety | Guarantees a safe working environment, preventing accidents and fines. | OSHA's continued enforcement in manufacturing in 2024, with serious violation fines potentially reaching tens of thousands of dollars. |

| Contract Law | Governs supplier, distributor, and client relationships for smooth operations. | Global trade disputes in 2024 emphasized the need for robust, jurisdictionally aware contracts. |

| Anti-Trust & Competition | Ensures fair market practices, preventing monopolistic behavior. | FTC scrutiny of industrial sector mergers and acquisitions continued in 2024. |

| Environmental Regulations | Mandates responsible manufacturing and waste disposal. | EPA focus on industrial emissions in 2024 with potential daily fines for non-compliance. |

| International Trade Law | Governs import/export, tariffs, and trade agreements for global market access. | Adjustments to global supply chains in 2024 highlight the need for adaptive trade law compliance. |

Environmental factors

Environmental regulations are tightening globally, impacting Alloy Steel International's customers in mining and construction. For instance, in 2024, the European Union's proposed Carbon Border Adjustment Mechanism (CBAM) is already influencing how materials are sourced and processed, indirectly affecting demand for durable components. These rules, covering dust emissions and water discharge, can extend project timelines and necessitate different equipment, potentially boosting demand for Alloy Steel's wear parts designed for efficiency and longevity, thereby reducing waste.

Growing environmental awareness fuels a demand for manufacturing processes that actively reduce pollution, energy use, and waste. This trend directly impacts Alloy Steel International's production of ground engaging tools, pushing for greater efficiency in resource utilization, waste minimization, and responsible by-product management. For instance, in 2024, the global steel industry saw a significant push towards green steel production, with investments in hydrogen-based direct reduction and electric arc furnaces powered by renewable energy sources increasing by an estimated 15% compared to 2023, according to industry reports.

These sustainable practices can influence operational costs through investments in new technologies and potentially lead to improved corporate image and market access. Companies demonstrating strong environmental, social, and governance (ESG) performance are increasingly favored by investors and consumers. For example, a 2025 survey indicated that 65% of institutional investors consider ESG factors a material part of their investment decisions, a notable increase from previous years.

Stricter emissions standards for heavy machinery, such as those being implemented in the European Union and the United States, can indirectly impact Alloy Steel International. These regulations, aiming to reduce pollutants from diesel engines, are driving manufacturers to develop more fuel-efficient and cleaner equipment. This evolution in machinery design might necessitate changes in the specifications of ground engaging tools that Alloy Steel International supplies, requiring them to be compatible with newer, potentially more complex engine systems or operating parameters.

For instance, the U.S. Environmental Protection Agency's (EPA) Tier 4 Final emissions standards, fully phased in by 2015, significantly reduced nitrogen oxides and particulate matter. As new machinery compliant with these and subsequent standards enters the market, Alloy Steel International's customers, the heavy machinery operators, may increasingly favor suppliers whose products enhance the overall environmental performance of their fleets. This could mean a growing demand for wear parts designed for optimal efficiency and reduced environmental impact, potentially influencing Alloy Steel International's product development and material selection.

Resource scarcity and sustainable sourcing of raw materials

The growing global concern over resource scarcity, especially for critical metals and minerals vital to alloy steel production, is compelling industries to prioritize sustainable sourcing. Alloy Steel International, Inc. must meticulously examine the origins and environmental footprint of its raw materials, including iron ore, chromium, nickel, and molybdenum. This imperative drives the exploration of recycled steel content, which in 2023 accounted for approximately 85% of steel produced in the United States, and partnerships with suppliers demonstrating strong environmental, social, and governance (ESG) credentials to bolster supply chain resilience.

Key considerations for Alloy Steel International include:

- Supply Chain Transparency: Ensuring visibility into the sourcing of all raw materials to identify and mitigate risks associated with depletion and environmental degradation.

- Circular Economy Integration: Increasing the use of post-consumer and post-industrial recycled steel and alloy scrap, aligning with global trends towards a circular economy. For instance, the European Union aims to increase recycling rates for steel products significantly by 2030.

- Supplier Due Diligence: Implementing rigorous vetting processes for suppliers, verifying their adherence to environmental regulations and ethical sourcing practices.

- Material Innovation: Investing in research and development for alternative materials or alloys that rely on more readily available or sustainably sourced components, potentially reducing dependence on scarce elements.

Waste management and recycling initiatives

Environmental regulations are increasingly emphasizing proper industrial waste management and recycling, a trend that directly impacts Alloy Steel International. For instance, the European Union's Circular Economy Action Plan, updated in 2020 and further elaborated in 2023, sets ambitious targets for waste reduction and increased recycling rates across various sectors, including metals. This means Alloy Steel International must navigate evolving compliance requirements for its own operational waste and consider the end-of-life management of its products, such as worn-out ground engaging tools.

The company might explore integrating recyclability into its product design or engaging in take-back programs to manage the lifecycle of its steel products. This aligns with growing corporate sustainability goals, where companies are evaluated not just on production but also on their environmental footprint. Efficient waste management within Alloy Steel International's facilities can also lead to significant cost reductions, as seen by many industrial firms that have implemented robust recycling programs, often recouping valuable materials and lowering disposal fees.

Key considerations for Alloy Steel International include:

- Compliance with evolving waste disposal and recycling mandates, particularly those driven by circular economy principles.

- Assessing product end-of-life recyclability and exploring potential take-back or recycling partnerships.

- Optimizing internal waste management to reduce operational costs and environmental impact.

- Tracking industry benchmarks for waste reduction and recycling, with many metal processing companies aiming for over 80% material recovery rates by 2025.

Environmental regulations are increasingly focused on reducing industrial pollution and promoting sustainable practices. For Alloy Steel International, this means adhering to stricter emissions standards and managing waste responsibly, influencing both operational costs and product design. The global push for green steel production, with significant investments in cleaner technologies, highlights the industry's shift towards sustainability.

The demand for environmentally friendly products and processes is growing, affecting Alloy Steel International's customers in sectors like mining and construction. Companies with strong ESG performance are gaining favor with investors, emphasizing the financial benefits of sustainability. For example, a 2025 survey indicated that 65% of institutional investors consider ESG factors material to their decisions.

Resource scarcity is a growing concern, prompting a focus on sustainable sourcing and increased use of recycled materials. Alloy Steel International must ensure supply chain transparency and explore partnerships with environmentally conscious suppliers. Recycled steel accounted for approximately 85% of U.S. steel production in 2023, underscoring this trend.

The evolving landscape of environmental regulations, particularly concerning waste management and circular economy principles, necessitates careful consideration of product lifecycles and internal waste reduction strategies. Many metal processing firms aim for over 80% material recovery rates by 2025.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Alloy Steel International, Inc. is meticulously constructed using data from reputable sources including the International Trade Administration, industry-specific market research firms, and global economic outlook reports. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the alloy steel sector.