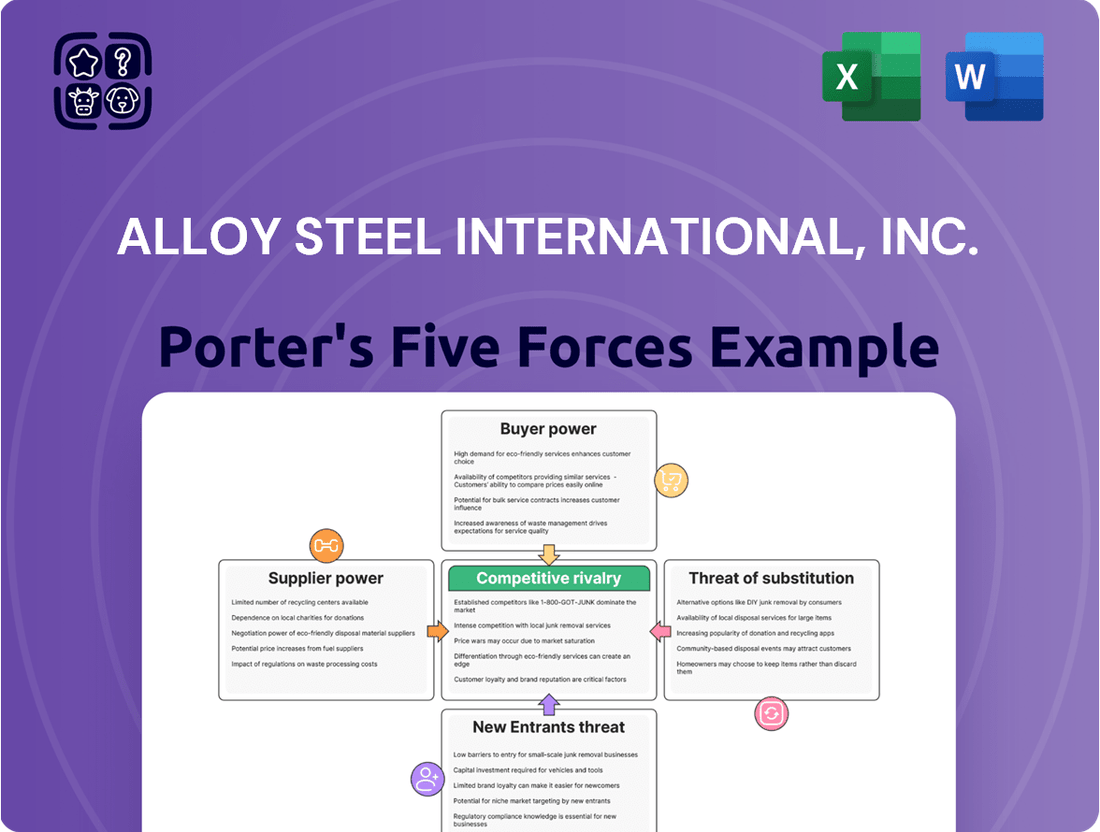

Alloy Steel International, Inc. Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alloy Steel International, Inc. Bundle

Alloy Steel International, Inc. faces a dynamic competitive landscape, with significant forces like buyer bargaining power and the threat of substitutes shaping its market. Understanding these pressures is crucial for strategic planning.

The complete report reveals the real forces shaping Alloy Steel International, Inc.’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Alloy Steel International, Inc. relies heavily on specialized alloy steel for its ground engaging tools (GET) and wear products. The production of this specific type of steel demands complex processes and unique alloying elements, meaning not just any steel producer can meet these requirements.

The market for high-grade alloy steel suppliers capable of consistently delivering products that meet the rigorous quality and performance standards of industries like mining and construction is quite restricted. This limited pool of capable suppliers means they often hold considerable sway in negotiations.

In 2023, the global alloy steel market was valued at approximately $180 billion, with a significant portion driven by demand from heavy industries. This substantial market size, coupled with the specialized nature of production, underscores the concentrated power of key suppliers within this sector.

For Alloy Steel International, Inc., the significant expenses associated with changing raw material suppliers or integrating new material compositions create a formidable barrier. These costs encompass vital research and development for novel product formulations, the necessary retooling of existing manufacturing lines, and rigorous testing protocols to validate the performance and resilience of alternative materials in demanding industrial environments.

These substantial switching costs directly enhance the leverage of Alloy Steel International's current suppliers. For instance, the automotive industry, a major consumer of alloy steel, often faces millions of dollars in re-engineering and testing costs when switching from one steel grade to another, as seen in the extensive validation required for new chassis designs.

The bargaining power of suppliers for Alloy Steel International, Inc. is significantly influenced by the volatility of specialized metal and alloy prices. These essential raw materials are subject to global market forces, meaning suppliers can pass on cost increases. This directly impacts Alloy Steel International's profitability and its ability to maintain competitive pricing.

For instance, the price of nickel, a key alloying element, saw significant fluctuations in 2024, with prices ranging from approximately $15,000 to $20,000 per metric ton. Suppliers of these critical inputs can leverage such market conditions to their advantage, increasing the cost of goods sold for Alloy Steel International.

Looking ahead, the global crude steel production is projected for a gradual rebound in 2025. This anticipated increase in overall steel supply could potentially stabilize or even temper the upward pressure on alloy steel prices, offering some relief to companies like Alloy Steel International, though specific alloy demands will still play a crucial role.

Proprietary Material Technology of Suppliers

Suppliers holding proprietary material technology for alloy steels and wear-resistant components can significantly leverage their position. This technological edge limits Alloy Steel International, Inc.'s alternatives, compelling dependence on these specialized suppliers, particularly for advanced product lines. For instance, if a supplier develops a novel heat treatment process that drastically improves wear resistance, Alloy Steel International, Inc. may have no other choice but to procure from them, even at a premium.

The impact of this proprietary technology is amplified when it is critical to Alloy Steel International, Inc.'s own competitive offerings. Given that Alloy Steel International, Inc. utilizes its own proprietary technology in serving the mining sector, the company understands the strategic value of such intellectual property. This mutual reliance on advanced technology creates a dynamic where suppliers with unique material science innovations wield considerable bargaining power.

- Supplier Technological Advantage: Proprietary material formulations and manufacturing processes grant suppliers a distinct competitive edge.

- Limited Alternatives: Alloy Steel International, Inc. faces restricted sourcing options when specific advanced materials are required.

- Increased Dependence: Reliance on suppliers with unique technologies can lead to higher input costs and reduced negotiation flexibility.

- Strategic Importance: The value of proprietary technology is underscored by Alloy Steel International, Inc.'s own use of such IP in its mining sector products.

Potential for Forward Integration by Suppliers

The potential for suppliers to integrate forward into manufacturing finished goods, such as Ground Engaging Tools (GETs) or wear products, represents a significant, albeit less common, threat to Alloy Steel International, Inc. If a major alloy steel producer were to leverage its scale and resources to enter this market directly, it would fundamentally alter the competitive landscape, directly challenging Alloy Steel International and substantially increasing supplier bargaining power.

This scenario highlights the critical importance of cultivating robust, collaborative relationships and strategic alliances with key alloy steel suppliers. Such partnerships are essential to proactively manage and mitigate the risks associated with potential forward integration by these raw material providers.

- Supplier Integration Threat: Major alloy steel producers could potentially integrate forward into GETs and wear product manufacturing.

- Impact on Competition: Direct competition from a large alloy steel supplier would significantly increase their bargaining power.

- Mitigation Strategy: Building strong relationships and strategic alliances with critical suppliers is paramount.

Alloy Steel International, Inc. faces considerable supplier bargaining power due to the specialized nature of its raw materials. The limited number of high-grade alloy steel producers capable of meeting stringent quality standards means these suppliers hold significant leverage. For instance, the global alloy steel market, valued at around $180 billion in 2023, is characterized by a concentration of specialized producers.

High switching costs, including R&D for new formulations and retooling, further empower suppliers. The volatility of key alloy prices, such as nickel which fluctuated between $15,000 and $20,000 per metric ton in 2024, allows suppliers to pass on increased raw material expenses. Proprietary technologies held by suppliers also limit Alloy Steel International's alternatives, increasing dependence and potentially raising input costs.

| Factor | Description | Impact on Alloy Steel International, Inc. |

| Supplier Concentration | Limited number of specialized alloy steel producers. | High leverage for suppliers in price and terms negotiations. |

| Switching Costs | Significant R&D, retooling, and testing expenses. | Creates barriers to changing suppliers, increasing dependence. |

| Raw Material Price Volatility | Fluctuations in prices of key alloying elements (e.g., nickel). | Enables suppliers to pass on cost increases, impacting profitability. |

| Proprietary Technology | Unique material formulations and manufacturing processes. | Reduces sourcing alternatives and increases reliance on specific suppliers. |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Alloy Steel International, Inc.'s position in the steel industry.

Gain immediate clarity on competitive pressures with a visually intuitive breakdown of each of Porter's Five Forces for Alloy Steel International, Inc.

Effortlessly adapt the analysis to reflect shifts in buyer power or the threat of substitutes by simply updating key data points.

Customers Bargaining Power

Alloy Steel International, Inc. faces significant customer bargaining power due to its focus on large, concentrated industries like mining, construction, and earthmoving. Major players in these sectors, such as global mining conglomerates or large infrastructure developers, possess substantial purchasing volumes. For example, in 2024, global mining output was projected to remain robust, driven by demand for essential minerals, indicating the scale of potential buyers for Alloy Steel's ground engaging tools.

These industrial giants can effectively leverage their buying power to negotiate favorable pricing, flexible payment terms, and even demand highly customized product specifications. The sheer scale of their operations means that even small price concessions can translate into substantial cost savings for them, making them formidable negotiators.

The bargaining power of customers for Alloy Steel International, Inc.'s Ground Engaging Tools (GET) can be influenced by product standardization. While Alloy Steel International aims for premium, specialized wear solutions, some GET components might share industry-standard specifications. This means customers could potentially source comparable products from various suppliers, thereby increasing their leverage.

However, Alloy Steel International actively works to differentiate its offerings. By emphasizing enhanced performance and durability through proprietary materials like Arcoplate, the company can reduce the substitutability of its products. For instance, Arcoplate's superior wear resistance, often outperforming standard alloys, provides a compelling reason for customers to choose Alloy Steel International, even if some basic GET features are standardized across the market.

Customers in the mining and construction industries place a high premium on the performance, durability, and overall lifespan of Ground Engaging Tools (GET) and wear products. These attributes directly influence their operational efficiency, minimizing costly downtime and reducing ongoing maintenance expenses.

While price is certainly a consideration, the mission-critical nature of these components often leads customers to accept higher costs for superior quality. This willingness to invest in products that guarantee reduced downtime and enhanced productivity significantly lessens customer price sensitivity.

Customers' Ability to Switch Suppliers

The ease with which customers can switch from Alloy Steel International, Inc. to a competitor significantly impacts their bargaining power. If a customer has made substantial investments in equipment or processes tailored to Alloy Steel's specific alloy steel products, the cost and complexity of retooling or ensuring compatibility with a new supplier's materials can be prohibitive. This investment acts as a switching cost, thereby diminishing the customer's leverage.

Conversely, if Alloy Steel International, Inc.'s products are largely standardized and easily interchangeable with those offered by other steel manufacturers, customers face minimal barriers to switching. In such scenarios, customers can readily seek out alternative suppliers offering more favorable pricing, delivery terms, or product specifications. This high degree of substitutability empowers customers to negotiate more aggressively.

- High Switching Costs: Customers invested in specialized machinery for Alloy Steel's products face significant retooling expenses, limiting their ability to switch.

- Low Switching Costs: If Alloy Steel's products are easily substitutable, customers can readily switch to competitors for better deals.

- Market Dynamics: In 2024, the automotive sector, a key customer for alloy steel, continued to experience supply chain volatility, potentially increasing customer sensitivity to price and availability, thus enhancing their bargaining power if alternatives exist.

- Information Availability: Increased transparency in pricing and product comparisons in the industrial materials market in 2024 allows customers to more easily identify and switch to more cost-effective suppliers.

Customers' Potential for Backward Integration

Large mining and construction firms, significant buyers of Alloy Steel International's products like wear parts, possess the capability to integrate backward. This means they could potentially produce some of their own ground engaging tools or specialized wear components, particularly if their volume needs are substantial or highly specific. While this requires significant capital investment, the mere possibility acts as a powerful lever during price negotiations, increasing customer bargaining power.

The market for heavy machinery parts is substantial, with companies like Caterpillar reporting billions in revenue from their parts and services divisions. For instance, in 2023, Caterpillar's Machinery, Industrial and Transportation segment generated over $50 billion in revenue, highlighting the significant expenditure these industries allocate to components and wear parts. This financial scale underscores why backward integration, though costly, remains a credible threat for large customers.

- Customer Threat of Backward Integration: Large mining and construction companies can potentially manufacture their own wear parts.

- Capital Intensity as a Deterrent: While possible, backward integration requires significant upfront capital investment.

- Market Significance: The heavy machinery parts market represents a considerable cost for these customer industries.

- Impact on Bargaining Power: The latent threat of self-production enhances customer leverage in negotiations with suppliers like Alloy Steel International.

The bargaining power of Alloy Steel International's customers is moderate to high, primarily due to the concentrated nature of their client base in sectors like mining and construction. These large industrial players often buy in significant volumes, giving them considerable leverage to negotiate favorable terms. For instance, in 2024, the global demand for critical minerals continued to drive substantial investment in mining operations, meaning major mining conglomerates are key customers with significant purchasing power.

While Alloy Steel International strives to differentiate its specialized wear products through superior performance and durability, the potential for customers to source standardized components from alternative suppliers exists. This is particularly relevant as information on pricing and product comparisons becomes more readily available in the industrial materials market, as seen in 2024 trends. The threat of customers switching to competitors, especially if switching costs are low, amplifies their bargaining position.

The potential for large customers to integrate backward and produce their own wear parts, while capital-intensive, remains a credible threat that influences negotiations. The substantial expenditure these industries allocate to components, with sectors like heavy machinery parts representing billions in annual spending, underscores why this threat is taken seriously by suppliers. For example, Caterpillar's parts and services revenue exceeding $50 billion in 2023 highlights the scale of these markets.

| Factor | Impact on Bargaining Power | 2024/2023 Relevance |

|---|---|---|

| Customer Concentration | High | Major mining and construction firms are significant buyers. |

| Purchase Volume | High | Large orders provide leverage for price negotiation. |

| Product Differentiation | Moderate (reduces power) | Proprietary materials like Arcoplate can mitigate substitutability. |

| Switching Costs | Variable (low to high) | Depends on product standardization and customer investment. |

| Threat of Backward Integration | Moderate | Large customers can consider in-house production, influencing pricing. |

Same Document Delivered

Alloy Steel International, Inc. Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces Analysis for Alloy Steel International, Inc., offering a comprehensive evaluation of competitive forces. The document you see here is precisely what you will receive instantly upon purchase, providing actionable insights into the industry's structure and strategic positioning.

Rivalry Among Competitors

The ground engaging tools and wear parts market is quite crowded, with many established global and regional companies vying for market share. This means Alloy Steel International, Inc. faces significant competition from well-known names in the industry.

Key players like Caterpillar, Komatsu, Hitachi Construction Machinery, and Sandvik are major competitors, offering extensive product lines that include ground engaging tools (GET). For instance, Caterpillar's GET segment is a substantial part of its overall business, contributing significantly to its revenue from the construction and mining sectors.

This robust competitive environment demands that Alloy Steel International, Inc. consistently focuses on innovation and developing unique selling propositions to stand out. The need for differentiation is paramount to capture and retain customers in this dynamic market.

The global ground engaging tools market is expected to see robust growth, projected to expand from USD 3.06 billion in 2024 to USD 7.5 billion by 2033. This upward trend, coupled with a strong performance in the broader wear parts market, signals a highly attractive sector for companies like Alloy Steel International, Inc. However, this very attractiveness intensifies competitive rivalry as numerous players vie for increasing market share in a sector fueled by rapid urbanization and infrastructure development.

Manufacturing alloy steel GET and wear products demands substantial capital for specialized equipment and facilities, a reality reflected in Alloy Steel International, Inc.'s advanced steel mill. These high fixed costs create a powerful incentive for producers to maximize production volume. This drive for capacity utilization often translates into intense price competition, particularly when market demand softens, as companies strive to cover their overhead.

Product Differentiation and Innovation

Competitive rivalry in the alloy steel sector is significantly fueled by companies striving to differentiate their offerings. This differentiation is achieved through the development of advanced materials, superior product design, and the incorporation of enhanced performance features. For instance, many players are investing in wear-resistant materials, integrating IoT capabilities for real-time monitoring, and adopting sustainable manufacturing processes.

Alloy Steel International, Inc. leverages its focus on product durability, extended lifespan, and cost-effective wear solutions, exemplified by its Arcoplate product line. This strategic emphasis is vital for Alloy Steel International to secure and maintain its competitive standing within the industry.

- Focus on Advanced Materials: Companies are actively researching and developing new alloy compositions to achieve superior strength, hardness, and corrosion resistance.

- Integration of IoT: The incorporation of sensors and connectivity allows for real-time performance monitoring and predictive maintenance, adding significant value.

- Sustainability Initiatives: A growing trend involves adopting eco-friendly production methods and developing materials with a reduced environmental footprint.

- Arcoplate's Value Proposition: Alloy Steel International's Arcoplate, known for its exceptional wear resistance, directly addresses customer needs for longer-lasting, lower-maintenance components.

Global Reach and Distribution Networks

Many competitors boast vast global distribution networks, leveraging established relationships with key players in heavy machinery and mining sectors. This widespread presence allows them to serve a broad customer base efficiently. For Alloy Steel International, Inc., maintaining and enhancing its own distribution and service infrastructure is crucial to counter these deeply rooted rivals.

The competitive landscape for alloy steel products is characterized by significant global reach among key players. For instance, ArcelorMittal, a major global steel producer, reported revenues of approximately $70.4 billion in 2023, underscoring its extensive operational and distribution capabilities worldwide. Similarly, Nippon Steel Corporation, another industry giant, generated around $46.7 billion in revenue for the fiscal year ending March 2024, indicating a substantial global footprint.

- Global Distribution Prowess: Competitors often possess extensive networks, enabling them to reach diverse markets and customer segments efficiently.

- Established Customer Relationships: Long-standing ties with major heavy machinery manufacturers and mining companies provide competitors with a stable demand base.

- Alloy Steel International's Challenge: The company must continuously invest in and optimize its distribution and service channels to remain competitive against these established global players.

- Strategic Importance of Reach: A robust global network is not just about logistics but also about market penetration and customer support, critical factors in the alloy steel industry.

The competitive rivalry within the alloy steel sector is intense, driven by numerous established global and regional players. Companies like Caterpillar and Komatsu, with substantial GET segments, represent significant competition for Alloy Steel International, Inc. The market's projected growth from USD 3.06 billion in 2024 to USD 7.5 billion by 2033 further intensifies this rivalry as more entities vie for market share.

High capital requirements for specialized manufacturing, such as Alloy Steel International's advanced steel mill, lead to a strong incentive for maximizing production volumes. This often results in aggressive price competition, especially during periods of softer demand, as firms aim to cover their fixed costs. Differentiation through advanced materials, superior design, and enhanced performance features, like Alloy Steel International's Arcoplate, is crucial for survival.

Competitors frequently leverage vast global distribution networks and deep-rooted customer relationships, as evidenced by the significant revenues of giants like ArcelorMittal ($70.4 billion in 2023) and Nippon Steel Corporation ($46.7 billion in FY2024). Alloy Steel International must continually invest in its distribution and service capabilities to effectively counter these established global players and maintain its market position.

| Competitor | Approximate 2023/2024 Revenue | Key Product Focus |

|---|---|---|

| Caterpillar | Not specified for GET segment, but overall revenue was $67.1 billion in 2023 | Ground Engaging Tools (GET) for construction and mining |

| Komatsu | Not specified for GET segment, but overall revenue was ¥3.05 trillion (approx. $20.5 billion based on 2023 exchange rates) | GET for construction and mining equipment |

| ArcelorMittal | $70.4 billion (2023) | Global steel producer, supplies alloy steels |

| Nippon Steel Corporation | Approx. $46.7 billion (FY ending March 2024) | Global steel producer, supplies alloy steels |

SSubstitutes Threaten

The threat of substitutes for alloy steel in wear protection is significant, primarily stemming from advancements in alternative materials and sophisticated coatings. Innovations in areas like advanced ceramics, high-performance composites, and even other specialized alloys are increasingly capable of matching or exceeding the wear resistance of traditional alloy steels. For instance, the global advanced ceramics market, a key substitute, was projected to reach over $25 billion by 2024, indicating strong adoption.

These substitutes often present compelling cost-performance trade-offs or offer unique advantages, such as lighter weight or enhanced corrosion resistance, which can sway purchasing decisions. The wear protection product market itself is dynamic, with a notable surge in growth fueled by the development and integration of these novel materials. This ongoing innovation means that alloy steel manufacturers must continuously adapt to remain competitive against these evolving alternatives.

Customers might choose to extensively repair and refurbish worn-out ground engaging tools instead of buying new ones. This can significantly reduce demand for new products.

Specialized welding services and wear plate applications are key here, as they can greatly extend the lifespan of existing components, acting as a direct substitute for purchasing replacements.

Alloy Steel International, Inc. itself contributes to this threat by offering off-site repair and engineering services, directly providing customers with alternatives to new product purchases.

Technological advancements in heavy machinery design present a potential threat to Alloy Steel International by reducing the need for external wear parts. For example, innovations in additive manufacturing (3D printing) could allow for the creation of complex, integrated components with inherent wear resistance, thereby bypassing the market for traditional alloy steel wear plates and castings. This shift could impact Alloy Steel International's sales volume for these specific product lines.

3D Printing and Additive Manufacturing for Parts

The rise of 3D printing and additive manufacturing for metal parts presents a significant threat of substitutes for Alloy Steel International, Inc. These technologies enable the on-demand production of highly specialized or customized components, potentially bypassing traditional supply chains. For instance, in 2024, the global metal 3D printing market was valued at approximately $5.6 billion, with projections indicating substantial growth as the technology matures and becomes more accessible for producing complex parts.

Customers, particularly those with urgent or niche requirements, might opt to use third-party service providers or in-house 3D printing capabilities to create replacement or specialized ground engagement tools (GET) components. This direct manufacturing approach reduces reliance on established suppliers like Alloy Steel International, especially for low-volume, high-value parts where customization is key. The ability to print directly from digital designs means lead times can be drastically shortened compared to traditional manufacturing and distribution channels.

- Reduced Demand for Standardized Parts: 3D printing allows for the creation of unique or obsolete parts, diminishing the market for off-the-shelf offerings from companies like Alloy Steel International.

- Cost-Effectiveness for Niche Applications: For highly specialized or low-volume production runs, 3D printing can become more cost-effective than traditional methods, shifting customer preference.

- Increased Customization and Agility: The inherent flexibility of additive manufacturing empowers customers to design and produce parts tailored to specific needs, offering a level of customization difficult to match with mass production.

- Supply Chain Disruption: The potential for localized, on-demand manufacturing through 3D printing could disrupt traditional, geographically dispersed supply chains, impacting Alloy Steel International's market reach.

Improved Maintenance Practices and Predictive Technologies

The rise of advanced maintenance strategies, particularly predictive maintenance powered by IoT, poses a significant threat by extending the lifespan of existing Ground Engaging Tools (GETs). This means customers may need to replace their equipment less often.

For instance, in 2024, the global predictive maintenance market was valued at approximately $11.2 billion, with a projected compound annual growth rate (CAGR) of over 25% through 2030. This growth indicates a strong market shift towards technologies that optimize asset performance and reduce the need for new purchases. Alloy Steel International, Inc. must consider how these technological advancements directly impact demand for its new GET products.

- Predictive Maintenance Adoption: Increased use of sensors and data analytics allows for early detection of wear and tear in heavy machinery.

- IoT Integration: Real-time monitoring capabilities enable proactive maintenance, minimizing unexpected failures and downtime.

- Extended Equipment Lifespan: Optimized maintenance schedules directly lead to longer operational periods for existing GETs, reducing the urgency for replacements.

- Reduced New Sales Potential: As existing equipment lasts longer and performs better, the demand for new GETs from customers focused on maintenance rather than outright replacement may decrease.

The threat of substitutes for alloy steel in wear protection is considerable, driven by material science advancements and innovative coatings. New ceramics, composites, and specialized alloys are increasingly competitive, with the global advanced ceramics market alone projected to exceed $25 billion by 2024. These alternatives offer compelling cost-performance benefits and unique properties like lighter weight, directly challenging alloy steel's market position.

Furthermore, sophisticated repair and refurbishment services act as substitutes for new alloy steel products. By extending the life of existing components, these services reduce the demand for replacements. Alloy Steel International, Inc. itself participates in this by offering repair services, which can divert customers from purchasing new wear parts.

Additive manufacturing, or 3D printing, presents another significant substitute threat. The global metal 3D printing market was valued at approximately $5.6 billion in 2024, with strong growth anticipated. This technology allows for on-demand, customized part production, potentially bypassing traditional suppliers like Alloy Steel International, especially for niche or low-volume applications.

The increasing adoption of predictive maintenance, fueled by IoT, also substitutes for new alloy steel products by extending the lifespan of existing equipment. The predictive maintenance market was valued at $11.2 billion in 2024 and is expected to grow rapidly. This trend means customers may need to replace GETs less frequently, impacting overall demand.

| Substitute Category | Key Technologies/Materials | Market Data (2024 Estimates) | Impact on Alloy Steel |

|---|---|---|---|

| Advanced Materials | Advanced Ceramics, High-Performance Composites | Advanced Ceramics Market: >$25 Billion | Direct competition on wear resistance and performance characteristics. |

| Repair & Refurbishment | Specialized Welding, Wear Plate Applications | N/A (Service-based) | Reduces demand for new alloy steel components by extending existing part life. |

| Additive Manufacturing | 3D Printing (Metal) | Metal 3D Printing Market: ~$5.6 Billion | Enables custom, on-demand parts, bypassing traditional supply chains for niche applications. |

| Maintenance Strategies | Predictive Maintenance, IoT Sensors | Predictive Maintenance Market: ~$11.2 Billion | Extends equipment lifespan, decreasing the frequency of GET replacements. |

Entrants Threaten

The ground engaging tools and wear products manufacturing sector demands significant upfront capital. Establishing modern steel mills, acquiring specialized machinery, and building advanced production facilities represent substantial financial commitments, acting as a strong deterrent for prospective entrants.

For instance, Alloy Steel International, Inc. operates a 5000 square meter facility, underscoring the considerable investment typically required to compete in this industry.

Developing and manufacturing high-performance GET (Grousers, End Bits, Teeth) and wear products, especially those utilizing advanced alloy steels and proprietary technologies, requires substantial metallurgical knowledge and ongoing research and development. Newcomers would face a considerable hurdle, needing to invest heavily in R&D to replicate the durability and performance characteristics that established companies like Alloy Steel International, Inc. have cultivated over time.

Established players like Alloy Steel International, Inc. have developed robust distribution channels and deep-seated customer relationships over many years. These networks are crucial for reaching target markets efficiently. For instance, in 2024, the mining and construction sectors, key markets for alloy steel, continued to rely heavily on established suppliers with proven track records.

New entrants would find it exceptionally challenging to replicate these existing distribution infrastructures and build the necessary trust with major clients. Gaining access to these established channels and convincing customers to switch suppliers presents a significant barrier to entry, requiring substantial investment and time.

Economies of Scale in Production

Established alloy steel manufacturers, like those with significant operations, leverage substantial economies of scale. This means they can produce alloy steel at a much lower cost per unit due to bulk purchasing of raw materials, optimized production processes, and efficient distribution networks. For instance, in 2024, major global steel producers often operate integrated mills that significantly reduce input costs compared to smaller, standalone operations.

New entrants into the alloy steel market face a significant hurdle because they typically begin at a much smaller scale. This initial lack of scale translates directly into higher per-unit production costs for raw materials, energy, and labor. Consequently, new companies struggle to match the competitive pricing strategies of established players who benefit from years of optimizing their large-scale operations.

- Lower Per-Unit Costs: Established firms achieve lower costs through bulk purchasing of raw materials like nickel and molybdenum, essential for alloy steels.

- Production Efficiency: Large-scale, continuous production lines in established facilities are more efficient than smaller, batch-oriented processes for new entrants.

- Distribution Advantages: Incumbents have established logistics and distribution channels, reducing shipping costs and lead times, a benefit not readily available to newcomers.

Regulatory Hurdles and Quality Standards

The mining, construction, and earthmoving sectors impose rigorous safety and quality regulations on heavy machinery components, including Ground Engaging Tools (GETs). New market participants must successfully navigate intricate certification procedures and conform to elevated industry benchmarks, a process that can be both time-consuming and financially demanding. These substantial compliance requirements act as a significant deterrent for potential new entrants.

For instance, in 2024, the global construction equipment market was valued at approximately $220 billion, with a significant portion driven by demand for durable and reliable components like GETs. Meeting the specific ISO certifications and OEM (Original Equipment Manufacturer) approvals required in this market can cost new entrants hundreds of thousands of dollars in testing and validation alone, before even considering production scale-up.

- Stringent Safety and Quality Standards: Industries like mining and construction demand components that meet exceptionally high safety and quality benchmarks.

- Complex Certification Processes: Navigating and obtaining necessary certifications for heavy machinery parts is a lengthy and resource-intensive undertaking.

- High Industry Standards: Adherence to established, often proprietary, quality standards set by major equipment manufacturers presents a significant entry barrier.

- Cost and Time Investment: The financial outlay and time required for compliance can deter new companies from entering the market.

The threat of new entrants in the alloy steel sector, particularly for ground engaging tools, remains moderate. Significant capital investment for specialized manufacturing facilities, coupled with the need for advanced metallurgical expertise and extensive research and development, creates substantial barriers.

Established players benefit from economies of scale, leading to lower per-unit costs, and possess well-developed distribution networks and customer loyalty, which are difficult for newcomers to replicate. Furthermore, stringent safety and quality regulations, along with complex certification processes in key markets like mining and construction, add considerable time and financial hurdles for potential entrants.

For instance, in 2024, the global construction equipment market, a primary consumer of alloy steel GETs, continued to demand proven reliability, making it challenging for new suppliers to gain traction without extensive validation. The cost of obtaining OEM approvals alone can run into hundreds of thousands of dollars, deterring many from entering.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Alloy Steel International, Inc. is built upon a foundation of industry-specific market research reports, financial statements from the company and its key competitors, and publicly available trade data. We also incorporate insights from industry associations and economic forecasts to capture a comprehensive view of the competitive landscape.