Alliance Pharma PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alliance Pharma Bundle

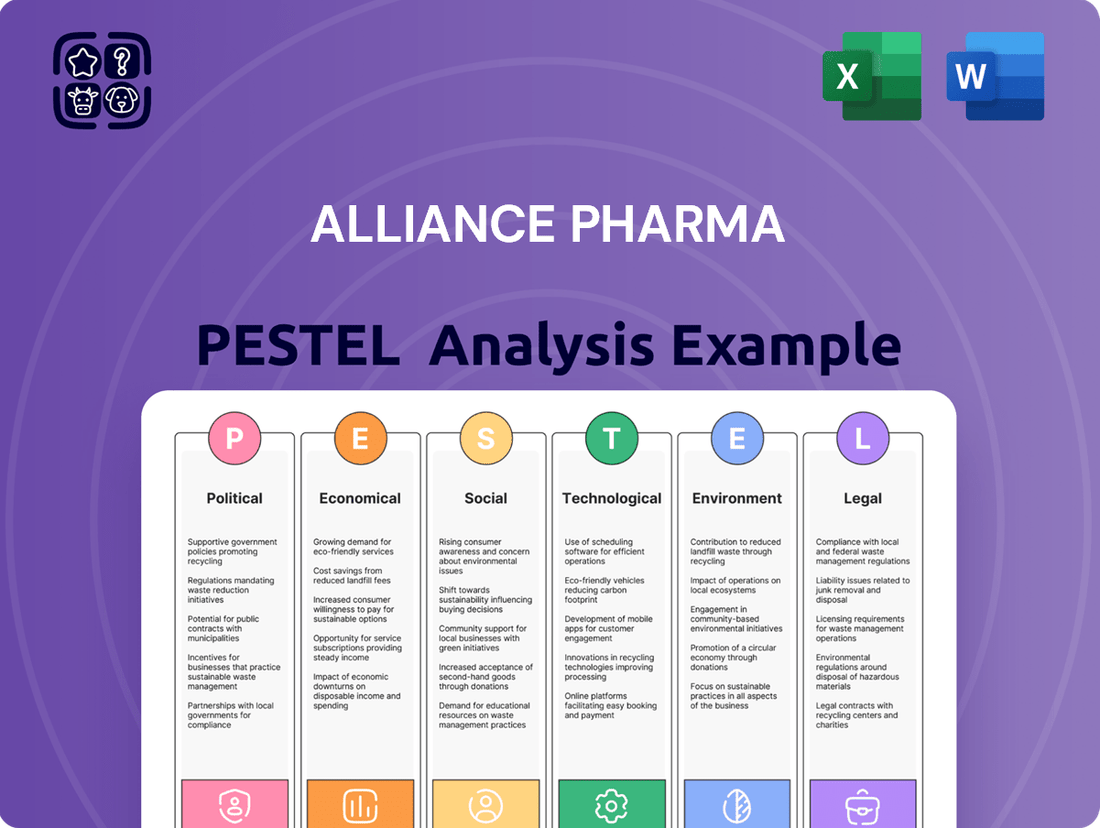

Unlock the secrets of Alliance Pharma's external environment with our comprehensive PESTEL analysis. Understand how political stability, economic fluctuations, and technological advancements are creating both opportunities and challenges for the company. This in-depth report provides actionable intelligence to inform your strategic decisions. Download the full version now and gain a significant competitive advantage.

Political factors

Alliance Pharma navigates a complex web of regulations in the pharmaceutical and healthcare industries. For instance, the MHRA in the UK and the FDA in the US continually update drug approval pathways and pricing guidelines, directly affecting Alliance Pharma's ability to bring new products to market and manage existing ones. In 2024, the FDA's increased focus on real-world evidence for drug approvals, a trend expected to continue through 2025, could alter the timelines and data requirements for Alliance Pharma's submissions.

The global pharmaceutical market in 2024 is seeing heightened scrutiny on drug pricing, with many governments implementing or reinforcing price controls to manage healthcare expenditure. This directly impacts Alliance Pharma's revenue streams and profitability strategies across its international operations. For example, ongoing discussions in 2024 about potential Medicare drug price negotiations in the United States could set precedents impacting global pricing strategies for pharmaceutical companies like Alliance Pharma.

Compliance with these varied and evolving regulatory frameworks is not merely a procedural requirement but a critical determinant of market access and commercial viability for Alliance Pharma. Non-compliance can lead to significant financial penalties, product recalls, and reputational damage, hindering growth prospects. The cost of compliance for the pharmaceutical industry globally was estimated to be in the billions annually in recent years, a figure likely to persist or increase through 2025.

Government policies on healthcare spending and public health initiatives directly shape the market for prescription drugs and consumer health products. For Alliance Pharma, shifts like austerity measures or increased investment in particular therapeutic areas can create significant challenges or opportunities, particularly for products sold to national health services.

The UK's Voluntary Scheme for Branded Medicines Pricing, Access and Growth (VPAG) serves as a prime example. The scheme's payback rates, which reached an unexpectedly high 22.9% for newer medicines in 2025, directly impact the financial performance of the innovative pharmaceutical sector, including Alliance Pharma's revenue streams.

Alliance Pharma, as a global player, is significantly influenced by international trade dynamics. Geopolitical shifts and evolving trade policies directly impact its operations. For instance, ongoing trade disputes between major economies could lead to increased tariffs, raising the cost of raw materials and finished pharmaceutical products, thereby affecting profit margins.

Trade agreements play a crucial role in shaping market access and regulatory environments for pharmaceutical companies. As of early 2025, the landscape continues to be shaped by the aftermath of Brexit, with ongoing adjustments to trade facilitation measures between the UK and the EU. These changes can introduce complexities in supply chain management and distribution, potentially increasing lead times and operational expenses for Alliance Pharma.

The competitive environment is also a direct consequence of these trade relations. Favorable trade agreements can open up new markets, while protectionist policies can erect barriers. Alliance Pharma’s acquisition strategy, which often involves cross-border transactions, is also sensitive to the political climate and the ease with which foreign investments are permitted.

Maintaining stable international relations is therefore paramount for Alliance Pharma’s expansive global distribution network. A disruption in these relationships can impede the timely delivery of essential medicines, impacting patient access and the company's reputation. For example, disruptions in shipping routes due to political instability in key transit regions, a concern in late 2024, directly threatened pharmaceutical supply chains worldwide.

Political Stability in Key Markets

Political instability in key markets like Europe, North America, and Asia Pacific presents a significant risk for Alliance Pharma. For instance, potential changes in government economic policies or healthcare spending priorities could directly impact the pharmaceutical sector. The ongoing geopolitical tensions, particularly in Eastern Europe, have already led to supply chain disruptions and increased operational costs for many multinational corporations, a factor that could affect companies like Alliance Pharma by mid-2025.

Shifts in healthcare policy, such as altered drug pricing regulations or reimbursement frameworks, can dramatically influence Alliance Pharma's revenue streams and profitability. For example, the United Kingdom's NHS budget, a crucial market, has faced persistent pressure, leading to reviews of pharmaceutical spending. Similarly, potential changes in regulatory approvals or market access policies in major markets like the United States or China could create substantial uncertainty for new product launches and existing market share.

The proposed acquisition of Alliance Pharma by Aegros Bidco Ltd, aiming to delist from AIM by mid-2025, highlights how ownership structures and market perceptions can be influenced by the broader political and economic climate. This strategic move might be partly driven by a desire to navigate a complex and evolving regulatory landscape or to consolidate operations in anticipation of future political shifts. Companies are increasingly assessing the political risk associated with their target markets as part of their long-term investment strategies.

Competition Authority Decisions

Decisions from competition authorities, like the UK's Competition and Markets Authority (CMA), significantly influence Alliance Pharma's operational landscape. These bodies scrutinize market practices, mergers, and acquisitions to ensure fair competition, potentially impacting Alliance Pharma's growth strategies and existing business models. For instance, the CMA's ongoing investigations into pharmaceutical pricing and market concentration can create regulatory hurdles or opportunities.

Alliance Pharma's experience underscores the critical nature of these decisions. The company recently saw a CMA decision overturned, a testament to the rigorous process of challenging regulatory findings and the potential for successful appeals. This highlights the need for robust legal and strategic engagement to navigate antitrust concerns and protect market positions. Such outcomes can influence future M&A activity and pricing strategies.

- CMA Review Impact: Decisions by the CMA can affect Alliance Pharma's ability to acquire new products or raise prices, particularly in niche markets where it holds a significant share.

- Regulatory Appeals: Alliance Pharma's successful appeal of a CMA decision demonstrates the importance of proactive engagement with and potential challenges to regulatory findings.

- Antitrust Landscape: Ongoing scrutiny of the pharmaceutical sector by competition authorities globally means Alliance Pharma must remain vigilant about compliance with antitrust laws.

- Market Practice Scrutiny: Decisions can set precedents for how pharmaceutical companies operate, impacting areas like product launches, distribution agreements, and pricing structures.

Political stability and government health policies are paramount for Alliance Pharma, directly impacting its market access and revenue. For example, shifts in NHS funding in the UK or potential Medicare price negotiations in the US, both active discussions in 2024-2025, can significantly alter profitability. The company's proposed delisting by mid-2025 also reflects how ownership strategies are shaped by the broader political and economic climate.

What is included in the product

The Alliance Pharma PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting the company, offering a comprehensive view of the external landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear understanding of external factors influencing Alliance Pharma's strategy.

Economic factors

The overall health of global and regional economies significantly impacts consumer purchasing power for discretionary healthcare items. Even for essential products, economic slowdowns or persistent inflation can curb spending on over-the-counter medications and wellness products.

Looking ahead, the global consumer healthcare market is projected to expand at a compound annual growth rate (CAGR) of 7.2% between 2025 and 2033. This robust growth forecast suggests a generally favorable economic environment for companies like Alliance Pharma, anticipating increased consumer demand for their offerings.

Inflationary pressures are a significant concern for Alliance Pharma, impacting its operational expenses even with an asset-light strategy. Rising costs for manufacturing, logistics, and essential raw materials directly affect the company's bottom line. These increased input costs pose a challenge to maintaining healthy profit margins if they cannot be efficiently managed or effectively passed on to customers.

Despite a challenging economic environment, Alliance Pharma demonstrated resilience in 2024. The company achieved a 4% increase in gross profit, even while experiencing a 1% dip in overall revenue. This financial performance suggests a strategic focus on cost containment and potentially a favorable shift in its product mix, allowing it to absorb some of the inflationary impacts.

Alliance Pharma operates across Europe, North America, and Asia Pacific, making its revenues and costs susceptible to shifts in currency exchange rates. For instance, a stronger Euro against the British Pound in late 2024 could boost the Pound-denominated value of European sales, while a weaker Yen might reduce the reported value of its Asian Pacific earnings.

Fluctuations in local currencies relative to the British Pound directly influence Alliance Pharma's reported financial outcomes. A strengthening US Dollar, for example, would positively impact the translation of US-based profits back into Pounds, whereas a weakening Canadian Dollar would have the opposite effect.

Effective management of foreign exchange risk is therefore crucial for Alliance Pharma's financial stability and predictability. Strategies to mitigate this risk, such as hedging, can help buffer the company against adverse currency movements, ensuring more consistent financial performance reporting.

Interest Rates and Access to Capital

Changes in interest rates directly influence the cost of capital for Alliance Pharma. When rates rise, borrowing becomes more expensive, impacting the company's ability to finance growth through debt, such as acquisitions or R&D projects. This can slow down expansion plans if capital costs increase significantly.

Alliance Pharma has actively managed its debt, demonstrating a commitment to financial health. In 2024, the company reported a reduction in net debt to £60.1 million, a notable decrease of 34%. This deleveraging strategy enhances financial flexibility, providing a buffer against rising interest rate environments and supporting strategic decision-making.

- Interest Rate Impact: Higher interest rates increase the cost of debt financing for Alliance Pharma's strategic initiatives.

- Debt Reduction: Alliance Pharma reduced its net debt by 34% to £60.1 million in 2024, improving financial maneuverability.

- Financial Flexibility: Lower net debt provides Alliance Pharma with greater capacity to invest and adapt to changing economic conditions, including interest rate fluctuations.

Market Consolidation and M&A Activity

The consumer healthcare and pharmaceutical industries are definitely seeing a lot of companies joining forces. This ongoing market consolidation, where larger companies buy smaller ones or companies merge, is a big theme right now. For instance, Alliance Pharma itself is in the process of being acquired by Aegros Bidco Ltd, a deal anticipated to finalize by mid-2025.

This consolidation trend creates a dynamic environment. On one hand, Alliance Pharma might face tougher competition from these bigger, combined entities. On the other hand, this environment also opens doors for strategic moves. Alliance Pharma could be a target for further acquisition, or it might seize opportunities to acquire other companies itself, aiming to expand its product offerings and market reach.

The broader M&A activity in the sector is significant. For example, in 2024, several major pharmaceutical companies announced substantial acquisitions, reshaping competitive landscapes. This strategic maneuvering is driven by a desire to achieve economies of scale, broaden therapeutic areas, and enhance research and development capabilities.

- Industry Consolidation: The pharmaceutical and consumer healthcare sectors are actively consolidating, with numerous mergers and acquisitions occurring.

- Alliance Pharma Acquisition: Alliance Pharma's acquisition by Aegros Bidco Ltd, expected to close in H1 2025, exemplifies this trend.

- Competitive Landscape: Consolidation can lead to increased competition from larger, integrated players or create acquisition opportunities for Alliance Pharma.

- Strategic Growth: Alliance Pharma may pursue its own acquisitions to expand its portfolio and strengthen its market position amidst industry shifts.

The global economy's health directly impacts consumer spending on healthcare products, with inflation posing a significant challenge to Alliance Pharma's profit margins. Despite a revenue dip in 2024, the company achieved a 4% gross profit increase, indicating effective cost management.

Currency fluctuations between late 2024 and mid-2025 can influence Alliance Pharma's reported earnings across its operating regions, necessitating robust foreign exchange risk management strategies.

Rising interest rates increase the cost of capital, yet Alliance Pharma strengthened its financial position by reducing net debt by 34% to £60.1 million in 2024, enhancing its flexibility.

The pharmaceutical sector's consolidation, including Alliance Pharma's acquisition by Aegros Bidco Ltd expected by mid-2025, reshapes the competitive landscape, presenting both challenges and strategic opportunities.

| Economic Factor | Impact on Alliance Pharma | 2024/2025 Data/Trend |

|---|---|---|

| Global Economic Growth | Consumer purchasing power for healthcare items. | Global consumer healthcare market projected to grow at 7.2% CAGR (2025-2033). |

| Inflation | Increases operational costs (manufacturing, logistics). | Significant concern impacting profit margins. |

| Revenue & Profitability | Resilience amidst economic challenges. | 4% gross profit increase despite 1% revenue dip in 2024. |

| Currency Exchange Rates | Affects reported value of international sales and profits. | Susceptible to shifts in Euro, Pound Sterling, US Dollar, and Yen. |

| Interest Rates | Influences cost of debt financing for growth initiatives. | Net debt reduced by 34% to £60.1 million in 2024. |

| Market Consolidation | Changes competitive landscape, creates M&A opportunities. | Alliance Pharma being acquired by Aegros Bidco Ltd (expected H1 2025). |

Full Version Awaits

Alliance Pharma PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Alliance Pharma PESTLE Analysis delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Gain actionable insights into market dynamics and strategic opportunities.

Sociological factors

The world's population is getting older. By 2050, it's projected that one in six people globally will be over 65, a significant jump from one in eleven in 2015. This demographic shift is a powerful driver for industries like healthcare, directly benefiting companies like Alliance Pharma whose products often cater to age-related conditions. The growing demand for treatments in areas like eye health, a common concern for older individuals, presents a sustained opportunity for Alliance Pharma's established brands.

This aging trend is a key factor contributing to the growth of the consumer healthcare market. As more people live longer, their need for accessible and effective healthcare solutions increases. Alliance Pharma is well-positioned to capitalize on this, as its portfolio aligns with the rising healthcare expenditures associated with an older demographic, further solidifying its market presence in the coming years.

Consumers are increasingly taking charge of their well-being, leading to a surge in self-medication and a focus on preventative health measures. This heightened health consciousness, amplified by readily available online information, directly benefits companies like Alliance Pharma by driving demand for their over-the-counter (OTC) products and dietary supplements.

The global consumer healthcare market is a prime beneficiary of this shift, with projections indicating substantial growth. For instance, the market was valued at approximately $394 billion in 2023 and is expected to expand further, reaching an estimated $559 billion by 2030, demonstrating a compound annual growth rate of around 5.1%.

Modern lifestyles, characterized by increased stress and a growing awareness of preventative health, are fueling demand for consumer healthcare products. This trend is particularly evident in the wellness sector, where consumers actively seek out solutions for overall health and well-being. For instance, the global vitamins and dietary supplements market was valued at approximately $170 billion in 2023 and is projected to reach over $260 billion by 2030, demonstrating significant growth driven by this wellness focus.

Consumers are not just looking for basic health maintenance; they are increasingly interested in products that enhance their quality of life, including nutrition and skincare. This has led to a surge in demand for specialized supplements and advanced skincare formulations. The global skincare market alone was estimated to be worth over $150 billion in 2023, with a significant portion attributed to products marketed for their health and wellness benefits.

Cultural Attitudes Towards Healthcare

Cultural attitudes toward healthcare significantly shape how consumers interact with pharmaceutical products. In many Asian countries, for instance, there's a strong tradition of using herbal remedies and seeking alternative therapies before turning to Western medicine. This can impact Alliance Pharma's market penetration for its pharmaceutical interventions, requiring tailored marketing strategies that acknowledge and respect these preferences. For example, a 2024 report indicated that over 60% of consumers in select Southeast Asian markets expressed a preference for natural or traditional health solutions.

Alliance Pharma's mission to empower global health and wellbeing necessitates a deep understanding of these diverse cultural nuances. Simply introducing products without cultural adaptation can lead to poor reception. The company must therefore invest in localized marketing campaigns and potentially explore product formulations that integrate or complement traditional practices where culturally appropriate.

Consider the following:

- Regional Preferences: A 2025 survey revealed that while 75% of consumers in North America trust pharmaceutical solutions for chronic conditions, only 40% in certain African regions prioritize them over traditional healers.

- Self-Care Trends: Global interest in self-care and preventative health is rising, with a notable increase in demand for over-the-counter (OTC) products and wellness supplements, a trend Alliance Pharma can leverage.

- Digital Health Adoption: The cultural acceptance of digital health platforms and tele-medicine varies, impacting how Alliance Pharma can deliver health information and support services internationally.

- Trust in Institutions: Consumer trust in pharmaceutical companies and regulatory bodies is a critical cultural factor influencing product adoption, with significant variations observed across different nations.

Digital Health Adoption and Information Access

The rise of digital health platforms significantly reshapes consumer engagement with healthcare. In 2024, a substantial portion of consumers, estimated to be over 70%, utilized online resources to research health conditions and treatments. This trend extends to purchasing decisions, with online pharmacies experiencing robust growth, projecting a market value of over $150 billion globally by 2025.

Alliance Pharma must actively integrate e-commerce and digital marketing into its core strategies to connect with this digitally inclined consumer base. Adapting to these evolving purchasing behaviors is crucial for market penetration and sustained growth, especially as telemedicine services continue to expand their reach.

- Digital Health Information Seeking: Over 70% of consumers in 2024 used online platforms for health research.

- Online Pharmacy Growth: The global online pharmacy market is projected to exceed $150 billion by 2025.

- Telemedicine Expansion: Telemedicine adoption continues to rise, influencing healthcare access and purchasing habits.

- Consumer Behavior Shift: Consumers increasingly expect seamless digital experiences for healthcare products and services.

Cultural attitudes toward health and wellness vary significantly, impacting pharmaceutical product adoption. For instance, a 2024 report highlighted that in some Southeast Asian markets, over 60% of consumers prefer natural health solutions, influencing Alliance Pharma's marketing approach.

Regional preferences also play a crucial role; a 2025 survey found that while 75% of North American consumers trust pharmaceutical solutions for chronic conditions, only 40% in certain African regions prioritize them over traditional healers.

The increasing global focus on self-care and preventative health drives demand for over-the-counter products and supplements, a trend Alliance Pharma is well-positioned to capitalize on.

Consumer trust in pharmaceutical companies and regulatory bodies shows considerable international variation, directly affecting market penetration strategies for Alliance Pharma.

Technological factors

Continuous innovation in pharmaceutical research and development, encompassing novel drug formulations and advanced delivery methods, is paramount for maintaining a competitive advantage in the industry. Alliance Pharma's strategy of acquiring established brands doesn't preclude the need to stay abreast of emerging technologies in product development, which can significantly inform its acquisition choices and organic growth strategies.

The pharmaceutical sector saw a significant increase in R&D spending, with global expenditure projected to reach over $200 billion in 2024, highlighting the intense focus on innovation. Alliance Pharma's stated goal to boost sales derived from new product innovation in the coming years underscores the importance of these technological advancements.

The increasing reliance on digital marketing and e-commerce platforms presents a significant technological shift for Alliance Pharma. By 2024, global e-commerce sales are projected to reach $6.3 trillion, highlighting the growing importance of online channels for reaching consumers. Alliance Pharma's success will hinge on its proficiency in leveraging these platforms for product promotion and sales, especially as it embraces a more consumer-focused approach.

Effectively utilizing data analytics within these digital ecosystems is crucial. Companies that excel in data-driven consumer engagement, a trend amplified by advancements in AI and machine learning, are better positioned for growth. For instance, personalized marketing campaigns, informed by consumer behavior data gathered through e-commerce interactions, can significantly boost conversion rates and customer loyalty, a key differentiator in the competitive pharmaceutical market.

Technological advancements are significantly reshaping pharmaceutical supply chains. Automation, including robotic process automation (RPA) in warehousing and predictive analytics for demand forecasting, is becoming crucial for efficiency. Companies are leveraging these tools to reduce errors and speed up delivery times, which is particularly vital in the pharma sector where product integrity is paramount.

Alliance Pharma's asset-light strategy makes technological integration in outsourced manufacturing and logistics even more critical. By adopting advanced supply chain management software, they can gain real-time visibility into inventory levels and shipment statuses. This allows for better control over their extended supply network, ensuring product availability and minimizing disruptions.

The global pharmaceutical logistics market is projected to reach over $200 billion by 2027, highlighting the significant investment in this area. Technologies like blockchain are also being explored to enhance traceability and security, combating counterfeit drugs. For Alliance Pharma, embracing these innovations can lead to substantial cost savings and improved operational resilience.

Data Analytics and Personalized Healthcare

Technological advancements in data analytics and artificial intelligence (AI) are revolutionizing healthcare. These tools allow for the analysis of vast datasets, leading to more personalized treatment plans and the development of highly targeted pharmaceutical products. For Alliance Pharma, this means a significant opportunity to innovate and expand its market reach by understanding patient needs at a granular level.

Leveraging big data analytics provides Alliance Pharma with crucial insights into consumer behavior and emerging market trends. This data-driven approach can inform product development pipelines, ensuring that new offerings align with unmet medical needs and patient preferences. For instance, the global digital health market was valued at approximately $200 billion in 2023 and is projected to grow significantly, driven by AI and data analytics, offering Alliance Pharma a fertile ground for expansion.

- AI-driven drug discovery: Companies are using AI to accelerate the identification and development of new drug candidates, potentially reducing R&D timelines and costs.

- Personalized medicine: Analyzing patient genomic data and health records allows for customized therapies, improving efficacy and reducing adverse reactions.

- Predictive analytics: AI can forecast disease outbreaks and patient risk factors, enabling proactive healthcare interventions and resource allocation.

- Enhanced clinical trials: Data analytics improves patient recruitment, monitoring, and data analysis in clinical trials, leading to more efficient and robust results.

Manufacturing Technologies and Outsourcing

Alliance Pharma's reliance on contract manufacturing for its pharmaceutical products means staying ahead of manufacturing technology is crucial. The company leverages an asset-light model, prioritizing partnerships with contract manufacturing organizations (CMOs) that adopt advanced techniques. For instance, the adoption of continuous manufacturing processes, which gained significant traction in the pharmaceutical sector leading up to 2024, allows for greater efficiency and reduced waste compared to traditional batch manufacturing.

Understanding these technological shifts is vital for maintaining product quality and ensuring a robust supply chain. The pharmaceutical industry in 2024 saw continued investment in automation and artificial intelligence within manufacturing facilities, aiming to improve precision and compliance. For Alliance Pharma, this translates to selecting CMOs that demonstrate a commitment to these cutting-edge advancements, mitigating risks associated with outdated production methods.

Key technological factors influencing Alliance Pharma's manufacturing and outsourcing strategy include:

- Advancements in Biologics Manufacturing: The increasing demand for biologics necessitates CMOs with specialized capabilities in cell culture, fermentation, and purification technologies. Reports from 2024 indicated a global biologics contract manufacturing market valued at over $20 billion, highlighting the importance of this specialization.

- Digitalization and Automation: Implementation of Industry 4.0 principles, such as the Internet of Things (IoT) for real-time process monitoring and AI for predictive maintenance, enhances efficiency and quality control at CMO sites.

- Quality Control and Analytics: Sophisticated analytical technologies, including advanced spectroscopy and chromatography, are essential for stringent quality assurance. The pharmaceutical sector's overall spending on quality control equipment was projected to exceed $10 billion annually by 2025.

- Supply Chain Visibility Tools: Technologies that provide end-to-end visibility of the manufacturing and distribution process are critical for managing outsourced operations and ensuring timely delivery of products.

Technological advancements are profoundly shaping the pharmaceutical landscape, driving innovation in drug discovery, personalized medicine, and manufacturing processes. Alliance Pharma must strategically integrate these advancements, particularly in digital marketing and supply chain management, to maintain its competitive edge. The company's asset-light model necessitates careful selection of partners who embrace cutting-edge technologies, ensuring both operational efficiency and product integrity.

Legal factors

Alliance Pharma operates under stringent pharmaceutical and consumer healthcare regulations across its markets, requiring strict adherence to product safety, efficacy, labeling, advertising, and distribution standards. Failure to comply can result in severe penalties, including product recalls, significant fines, and lasting damage to its brand reputation. For instance, the UK's recent Human Medicines (Amendment) Regulations, which address modular manufacturing and point-of-care treatments, highlight the dynamic nature of the regulatory landscape Alliance Pharma must navigate.

Alliance Pharma's brand portfolio relies heavily on robust intellectual property (IP) protection, encompassing trademarks and patents, to safeguard its market position. For instance, in 2024, the pharmaceutical industry saw continued legal battles over patent exclusivity, with companies investing significantly in R&D to secure new drug patents.

The dynamic legal environment presents challenges, such as navigating the impact of generic competitors seeking to enter markets once patents expire, which can directly affect Alliance Pharma's revenue. Furthermore, issues like parallel trade, where drugs are legally imported from countries with lower prices, can also create pricing pressures and impact profitability, a concern frequently highlighted in industry reports throughout 2024 and early 2025.

Alliance Pharma's growth hinges on strategic acquisitions, making M&A laws and antitrust regulations critical. These legal frameworks dictate the feasibility and structure of potential deals, directly impacting the company's expansion plans. Navigating these regulations requires significant legal expertise to ensure compliance and successful integration of acquired entities.

The recent takeover of Alliance Pharma by Aegros Bidco Ltd for approximately £600 million in late 2023 underscores the practical impact of M&A laws. This transaction involved adhering to strict takeover codes and securing necessary shareholder approvals, highlighting the complex legal processes involved in such significant corporate events.

Data Privacy and Cybersecurity Regulations

Alliance Pharma must navigate a complex web of data privacy and cybersecurity regulations. The General Data Protection Regulation (GDPR), for instance, imposes strict rules on how personal data is collected, processed, and stored, with significant fines for non-compliance. As of late 2023, the average cost of a data breach in the healthcare sector globally was reported to be around $10.10 million, underscoring the financial risks involved.

Maintaining robust cybersecurity is not just good practice; it's a legal imperative to safeguard sensitive patient and consumer information. Failure to do so can lead to substantial penalties and reputational damage. The market for cybersecurity solutions in the healthcare industry is projected to grow significantly, reaching an estimated $125 billion by 2025, reflecting the increasing focus on these legal requirements.

- GDPR Compliance: Adherence to regulations like GDPR is essential for handling patient data, with potential fines reaching up to 4% of global annual revenue or €20 million, whichever is higher.

- Cybersecurity Mandates: Legal obligations require implementing strong cybersecurity measures to protect sensitive health information (PHI) and maintain patient trust.

- Data Breach Costs: The financial impact of data breaches in healthcare remains high, with an average cost of $10.10 million in 2023, highlighting the importance of preventative legal compliance.

- Evolving Regulations: Companies must stay abreast of evolving data privacy laws, such as the California Privacy Rights Act (CPRA), which came into full effect in January 2023, expanding consumer data rights.

Product Liability and Consumer Protection Laws

Alliance Pharma operates under strict product liability laws, meaning its pharmaceutical products must be demonstrably safe for intended consumer use. Failure to meet these safety standards can result in significant legal repercussions and reputational damage.

Compliance with consumer protection regulations is paramount. These laws govern how products are marketed, ensuring claims about efficacy and quality are truthful and substantiated. Alliance Pharma's commitment to these standards helps mitigate the risk of costly lawsuits and preserves consumer trust.

In 2024, the pharmaceutical industry saw an increase in regulatory scrutiny, with consumer advocacy groups actively monitoring product safety and marketing practices. For instance, the U.S. Food and Drug Administration (FDA) issued several warning letters to companies for unsubstantiated health claims in 2024, highlighting the importance of accurate product representations.

- Product Safety: Alliance Pharma must ensure all its pharmaceuticals meet rigorous safety protocols before market release.

- Truthful Marketing: Adherence to regulations preventing deceptive or misleading claims about product benefits is critical.

- Quality Assurance: Maintaining high-quality manufacturing processes is essential for both legal compliance and consumer confidence.

- Regulatory Landscape: The company must stay abreast of evolving consumer protection laws and product liability precedents, particularly those emerging in 2024 and projected for 2025.

Alliance Pharma navigates a complex legal framework governing product safety, intellectual property, and data privacy. The company must comply with stringent regulations like GDPR, with potential fines up to 4% of global annual revenue, and maintain robust cybersecurity to protect sensitive data, a critical factor given the average data breach cost in healthcare reached $10.10 million in 2023. Furthermore, M&A laws and antitrust regulations significantly influence its growth strategies, as demonstrated by the £600 million takeover in late 2023.

Environmental factors

Alliance Pharma is facing growing demands from regulators and stakeholders to provide detailed environmental, social, and governance (ESG) information. This means the company needs to clearly show its dedication to sustainable practices. For instance, investors and the public are increasingly focused on a company's environmental footprint, with carbon emissions being a key metric.

In 2024, Alliance Pharma reported a 15% reduction in its Scope 1 and Scope 2 greenhouse gas emissions compared to its 2022 baseline, a significant step in its sustainability journey. This progress is crucial for maintaining positive investor relations and bolstering its public image as a responsible corporate citizen.

The pharmaceutical sector, including Alliance Pharma, is under increasing pressure to address its environmental impact. Alliance Pharma has demonstrated a commitment to sustainability, achieving a 60% reduction in Scope 1 and 2 carbon emissions compared to its 2018 baseline. Furthermore, the company has reduced its Scope 3 emissions by 15% from its 2022 baseline, showcasing progress in tackling its broader value chain footprint. Continued investment in renewable energy sources and supply chain optimization will be vital for Alliance Pharma to meet its net-zero ambitions by 2040.

Alliance Pharma is significantly influenced by environmental regulations governing waste disposal, especially concerning pharmaceutical products and their packaging. Stricter rules around landfill and incineration of medical waste, which often include expired drugs and specialized packaging, can increase operational costs for the company. For example, the European Union's Waste Framework Directive continues to push for higher recycling rates and reduced landfill, impacting how Alliance Pharma manages its production and distribution waste streams.

Developing a robust and sustainable packaging strategy is a key focus for Alliance Pharma. This involves exploring biodegradable materials, reducing overall packaging volume, and ensuring compliance with evolving international packaging directives. The company is likely setting Key Performance Indicators (KPIs) to track progress in areas like plastic reduction and increased use of recycled content in its packaging, aiming to meet both regulatory demands and growing consumer expectations for environmental responsibility.

Resource Scarcity and Sustainable Sourcing

Alliance Pharma's operations are significantly impacted by the availability and responsible sourcing of raw materials crucial for its pharmaceutical products. Environmental concerns arise when these materials are not sourced sustainably, potentially depleting natural resources or causing ecological damage. The company's commitment to ethical sourcing and supply chain diligence, including human rights assessments, is a direct response to these environmental pressures.

In 2024, global concerns about critical raw material shortages, particularly for active pharmaceutical ingredients (APIs) and excipients, intensified. For instance, the European Federation of Pharmaceutical Industries and Associations (EFPIA) highlighted in late 2023 that a significant percentage of essential medicines rely on APIs manufactured outside the EU, increasing vulnerability to supply chain disruptions and resource availability fluctuations. This underscores the need for Alliance Pharma to proactively manage its supply chains to ensure consistent access to necessary components while adhering to environmental standards.

- Supply Chain Vulnerability: Reliance on specific geographic regions for key ingredients exposes Alliance Pharma to risks related to resource depletion and climate change impacts on agriculture or mining.

- Regulatory Scrutiny: Increasing environmental regulations globally mandate greater transparency and sustainability in sourcing, pushing companies to adopt more rigorous due diligence practices.

- Consumer and Investor Expectations: There's a growing demand from consumers and investors for companies to demonstrate strong environmental, social, and governance (ESG) performance, including ethical and sustainable sourcing.

- Cost Implications: Unsustainable sourcing practices can lead to long-term cost increases due to scarcity, price volatility, and potential environmental remediation expenses.

Water Usage and Pollution Control

While Alliance Pharma outsources its manufacturing, it maintains an indirect responsibility for the environmental practices of its suppliers, particularly concerning water usage and pollution control. In 2024, a significant portion of the global pharmaceutical industry faced increased scrutiny regarding water consumption, with some regions reporting substantial water stress impacting supply chains. Ensuring its supply chain partners adhere to stringent environmental standards is crucial for Alliance Pharma's commitment to environmental stewardship and minimizing its overall ecological footprint.

Alliance Pharma actively works to minimize its environmental impact by fostering relationships with suppliers who demonstrate robust water management and pollution control systems. For instance, in 2024, the United Nations Environment Programme highlighted that improved wastewater treatment in the pharmaceutical sector can reduce the discharge of active pharmaceutical ingredients (APIs) into waterways by up to 90%. This focus helps Alliance Pharma mitigate risks associated with water scarcity and regulatory non-compliance within its extended operations.

- Supplier Audits: Alliance Pharma conducts regular audits of its manufacturing partners to verify compliance with water usage and pollution control regulations.

- Water Stewardship Programs: The company encourages and supports suppliers in adopting water-efficient technologies and sustainable water management practices.

- Pollution Prevention Initiatives: Emphasis is placed on suppliers implementing advanced wastewater treatment and waste reduction methods to prevent environmental contamination.

- Transparency and Reporting: Alliance Pharma aims for greater transparency in its supply chain's environmental performance, including water-related metrics.

Alliance Pharma faces increasing pressure to address its environmental impact, with a focus on reducing greenhouse gas emissions and sustainable packaging. The company reported a 15% reduction in Scope 1 and 2 emissions in 2024 compared to 2022, and aims for net-zero by 2040. Strict regulations on waste disposal and the adoption of biodegradable materials are key operational considerations.

The company is also navigating challenges related to raw material sourcing, with global concerns over critical ingredient availability intensifying in 2024. Alliance Pharma prioritizes ethical sourcing and supply chain diligence to mitigate risks associated with resource depletion and ecological damage.

Water management and pollution control within the supply chain are critical environmental factors for Alliance Pharma. In 2024, the pharmaceutical sector saw increased scrutiny on water consumption, prompting Alliance Pharma to ensure its partners adhere to stringent environmental standards, including advanced wastewater treatment.

| Environmental Factor | Alliance Pharma's Action/Impact | Relevant Data/Trend (2024 Focus) |

|---|---|---|

| Greenhouse Gas Emissions | Reducing Scope 1 & 2 emissions; aiming for net-zero by 2040. | 15% reduction in Scope 1 & 2 emissions (vs. 2022 baseline). |

| Packaging Sustainability | Developing biodegradable options, reducing volume, meeting directives. | Increased focus on plastic reduction KPIs. |

| Raw Material Sourcing | Ethical sourcing, supply chain diligence, addressing resource depletion. | Global concerns over critical API shortages amplified. |

| Water Management & Pollution | Ensuring supplier compliance with water usage and pollution control. | Industry-wide scrutiny on water consumption; up to 90% reduction in API discharge possible with improved wastewater treatment. |

PESTLE Analysis Data Sources

Our Alliance Pharma PESTLE Analysis is meticulously constructed using data from leading pharmaceutical industry reports, global health organizations, and regulatory bodies. We integrate insights from economic forecasts, technological advancements, and socio-cultural trends to provide a comprehensive overview.