Alliance Pharma Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alliance Pharma Bundle

Alliance Pharma navigates a complex pharmaceutical landscape, where the bargaining power of buyers can significantly impact pricing strategies. Understanding the intensity of rivalry among existing competitors is crucial for identifying Alliance Pharma's competitive edge. The threat of substitute products, while potentially lower in specialized pharma, still warrants close examination.

The full report reveals the real forces shaping Alliance Pharma’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The pharmaceutical sector, encompassing consumer healthcare, often depends on a limited number of suppliers for essential Active Pharmaceutical Ingredients (APIs) and other crucial raw materials. This consolidation, with a substantial percentage of API manufacturers situated in a few Asian nations, grants these suppliers considerable leverage over firms such as Alliance Pharma. For instance, in 2023, India and China collectively accounted for a significant majority of global API production, creating a bottleneck.

Switching suppliers for specialized pharmaceutical ingredients or manufacturing services is a significant hurdle for companies like Alliance Pharma. The stringent regulatory landscape, encompassing rigorous quality control and the necessity for re-validation of processes and materials, makes such transitions inherently complex. This complexity translates directly into high switching costs, thereby empowering suppliers by reducing Alliance Pharma's flexibility and increasing their leverage in negotiations.

The process of establishing new supplier relationships is not a simple matter of finding a new vendor. It involves extensive audits, thorough quality assessments, and the lengthy approval processes mandated by health authorities. For example, the U.S. Food and Drug Administration (FDA) requires detailed documentation and validation for any changes in critical raw materials or manufacturing processes. This entire endeavor is not only time-consuming but also financially burdensome, often running into hundreds of thousands, if not millions, of dollars for a single change, further solidifying supplier power.

When suppliers possess proprietary technology or unique formulations for essential compounds, their bargaining power over Alliance Pharma significantly increases. This is particularly true if Alliance Pharma's acquired brands depend on these specialized inputs, leaving few viable alternatives and compelling the company to accept supplier-dictated terms.

For instance, if a key ingredient for a successful Alliance Pharma drug is protected by a patent, or if its manufacturing involves a highly specialized, proprietary technique, the supplier of that ingredient holds substantial leverage. This situation can lead to higher input costs or restricted supply, directly impacting Alliance Pharma's profitability and operational flexibility.

In 2024, the pharmaceutical industry continued to see significant reliance on patented active pharmaceutical ingredients (APIs). Companies like Alliance Pharma, especially those with portfolios including specialized or niche treatments, often face scenarios where a single supplier controls a critical, patented component, giving that supplier considerable pricing power.

Regulatory Requirements and Quality Standards

The pharmaceutical industry, including companies like Alliance Pharma, operates under a rigorous regulatory framework. Suppliers must consistently meet stringent quality and compliance standards, such as Good Manufacturing Practices (GMP). For instance, in 2024, regulatory bodies like the FDA continued to emphasize strict adherence to GMP, with a significant number of inspections conducted globally.

Suppliers who reliably meet these demanding requirements and possess a proven history of quality become highly valued. This reliability makes them indispensable partners, thereby enhancing their bargaining power. The cost and complexity of achieving and maintaining these standards mean fewer suppliers can consistently deliver, concentrating power among the compliant few.

- Regulatory Compliance as a Barrier: Suppliers meeting GMP and other pharmacopoeial standards possess a competitive advantage, limiting the pool of viable alternatives for pharmaceutical firms.

- Impact of Non-Compliance: A single product recall due to supplier quality issues can cost millions in lost sales and reputational damage, making reliable suppliers crucial for risk mitigation in 2024 and beyond.

- Supplier Indispensability: Pharmaceutical manufacturers rely on suppliers for critical raw materials and active pharmaceutical ingredients (APIs) that are essential for drug production, granting significant leverage to those who consistently provide high-quality, compliant products.

Asset-Light Model and Outsourced Manufacturing

Alliance Pharma's asset-light strategy, which involves outsourcing manufacturing and logistics, significantly impacts the bargaining power of its suppliers. By not owning production facilities or extensive distribution networks, Alliance Pharma becomes more dependent on its contract manufacturers and logistics partners. This reliance can empower these suppliers, particularly when their capacity is strained or when the market experiences unexpected demand surges.

For instance, in 2023, the pharmaceutical contract manufacturing sector faced capacity constraints due to increased demand for various drug products and ongoing supply chain challenges. Companies like Alliance Pharma, heavily reliant on these external partners, found themselves negotiating with suppliers who had greater leverage. This situation can lead to price increases or less favorable terms for Alliance Pharma, directly affecting its cost structure and operational flexibility.

- Increased Dependence: Outsourcing manufacturing and logistics to third parties inherently increases Alliance Pharma's reliance on these external entities.

- Capacity Constraints: Suppliers can wield power when their production capacity is limited, especially during peak demand periods.

- Supply Chain Vulnerabilities: Disruptions in the broader supply chain can amplify the bargaining power of contract manufacturers and logistics providers.

- Negotiating Leverage: These suppliers can leverage their critical role to negotiate higher prices or more advantageous contract terms with Alliance Pharma.

Alliance Pharma faces substantial supplier bargaining power due to the concentrated nature of Active Pharmaceutical Ingredient (API) production, with a significant portion originating from a few key countries like India and China, as seen in 2023. This reliance on a limited supplier base, coupled with high switching costs stemming from complex regulatory approvals and the need for process re-validation, grants suppliers considerable leverage. The exclusivity of proprietary technologies or patented ingredients further amplifies this power, enabling suppliers to dictate terms, as was evident with patented APIs in 2024.

Alliance Pharma's asset-light strategy, relying on outsourced manufacturing and logistics, heightens its dependence on contract partners. When these suppliers experience capacity constraints, as observed in the pharmaceutical contract manufacturing sector in 2023, their bargaining power increases, potentially leading to higher costs for Alliance Pharma. Moreover, suppliers who consistently meet stringent regulatory standards, such as Good Manufacturing Practices (GMP), become indispensable, further solidifying their negotiating strength.

| Factor | Description | Impact on Alliance Pharma |

|---|---|---|

| Supplier Concentration | Dominance of a few nations (e.g., India, China) in API production. | Limited sourcing options, increased reliance on key suppliers. |

| Switching Costs | Regulatory hurdles, re-validation, audits for new suppliers. | High costs and time delays make changing suppliers difficult. |

| Proprietary Technology/Patents | Exclusive control over critical ingredients or manufacturing processes. | Suppliers can command higher prices and dictate terms. |

| Regulatory Compliance | Adherence to GMP and other pharmacopoeial standards. | Reliable, compliant suppliers are essential, increasing their leverage. |

| Asset-Light Strategy | Outsourcing manufacturing and logistics. | Increased dependence on contract manufacturers and logistics providers. |

What is included in the product

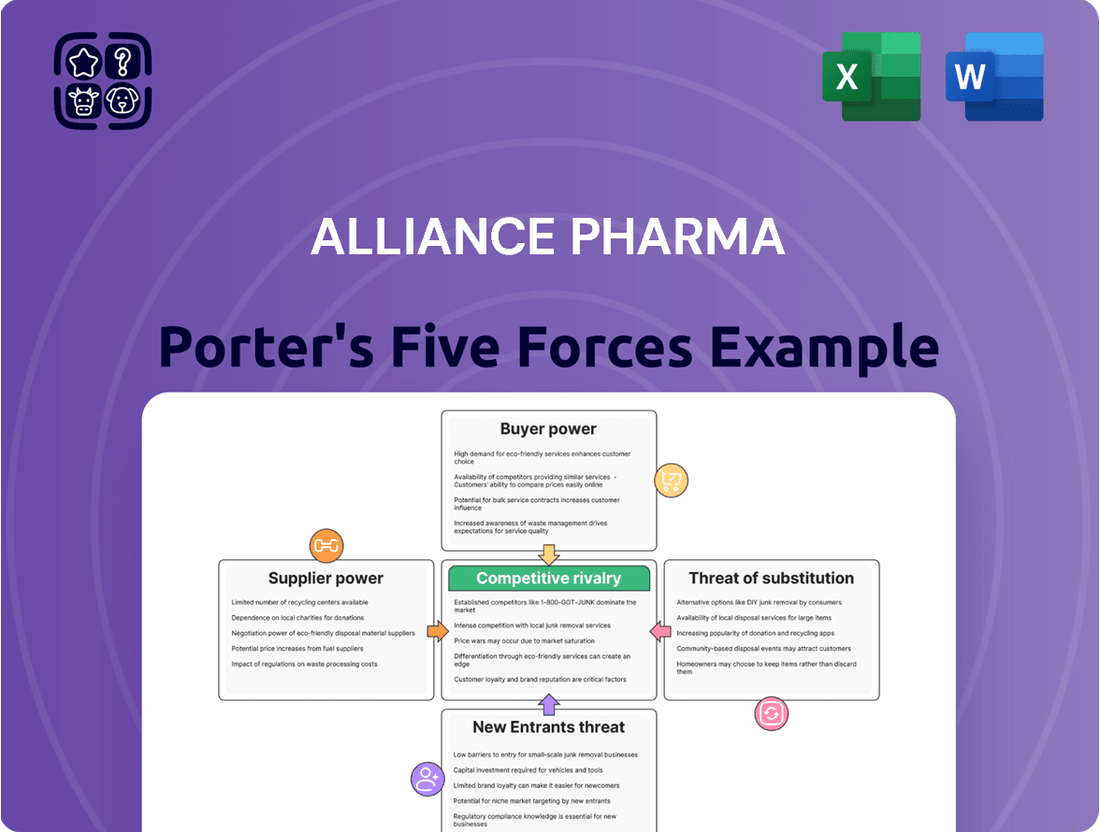

This analysis dissects Alliance Pharma's competitive environment by examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the danger posed by substitute products.

Instantly visualize competitive pressure with a dynamic, color-coded Porter's Five Forces chart, simplifying complex market dynamics for strategic clarity.

Customers Bargaining Power

Alliance Pharma caters to a broad spectrum of customers. For its over-the-counter (OTC) products, it reaches individual consumers directly. For its prescription medications, the customer base shifts to healthcare professionals and institutions like hospitals and clinics.

The sheer volume of individual consumers for its OTC lines generally weakens their collective bargaining power. No single consumer can significantly impact Alliance Pharma's sales volume or pricing. This fragmentation works in the company's favor.

However, larger entities within the healthcare system do possess more leverage. Major retail pharmacy chains, which distribute many of Alliance Pharma's products, can negotiate terms. Similarly, large hospital networks or government health programs buying prescription drugs in bulk can exert considerable influence on pricing and supply agreements.

For many of Alliance Pharma's offerings, especially in consumer health, customers can easily find generic or over-the-counter alternatives. This abundance of substitutes naturally makes consumers more aware of pricing and provides them with more choices, strengthening their ability to negotiate better deals. This is especially noticeable for products that don't have unique features or strong brand loyalty.

Consumers in the healthcare market, especially for over-the-counter products, often exhibit significant price sensitivity. This is particularly true when they can easily find similar or identical items from different brands. For instance, in 2024, the global market for OTC drugs, a segment where consumer price sensitivity is high, was valued at approximately $150 billion, reflecting the vast number of purchasing decisions influenced by price.

This price sensitivity is further heightened by the persistent upward trend in overall healthcare expenses. As individuals face higher costs for medical services and prescription drugs, they naturally look for savings in other areas, including their daily health and wellness purchases. Data from 2023 indicated that consumer spending on healthcare services continued to rise, creating a ripple effect on the demand for more budget-friendly alternatives in the pharmaceutical sector.

Influence of Healthcare Professionals and Formularies

For prescription drugs, the influence of healthcare professionals and institutional formularies significantly shapes the bargaining power of patients. These intermediaries often act on behalf of patients, negotiating prices based on volume and clinical value.

Large purchasers like major hospital networks, insurance companies, and national health services leverage their substantial buying power. Their formulary decisions, which dictate which drugs are covered and at what cost-sharing level, can strongly influence a pharmaceutical company's pricing strategies.

- Healthcare systems and insurers can negotiate volume discounts, impacting pharmaceutical revenue.

- Formulary inclusion is critical for market access, giving payers significant leverage.

- In 2024, the average list price increase for branded drugs in the U.S. was around 4.5%, but net prices after rebates were considerably lower, reflecting payer negotiations.

- Payer negotiations are increasingly focused on value-based agreements, tying reimbursement to patient outcomes.

Digital Engagement and Information Access

Digital engagement significantly shifts power towards customers in the pharmaceutical sector. Patients and healthcare providers can now readily access vast amounts of information online, comparing treatment options, efficacy data, and pricing with unprecedented ease. This heightened awareness directly translates to increased bargaining power as informed customers can more effectively negotiate or seek alternative solutions.

Online pharmacies and digital health platforms further amplify this trend by offering greater accessibility and transparency. For instance, by mid-2024, platforms like GoodRx reported millions of active users accessing prescription drug price comparisons, demonstrating the tangible impact of digital tools on consumer empowerment. This accessibility allows customers to bypass traditional gatekeepers and directly influence purchasing decisions.

The ability to share experiences and reviews online also plays a crucial role. Patient communities and review sites provide peer-to-peer validation or critique of pharmaceutical products. A significant percentage of consumers, often upwards of 70% by 2024 surveys, report consulting online reviews before making health-related purchases, directly influencing brand perception and product demand.

- Increased Information Access: Patients can research drug side effects, clinical trial results, and alternative treatments online, reducing reliance on single physician recommendations.

- Price Transparency: Online comparison tools allow customers to identify the most cost-effective pharmacies or generic alternatives, putting pressure on brand-name drug pricing.

- Peer Reviews and Social Proof: Online testimonials and community discussions influence purchasing decisions, empowering consumers with collective experience.

- Direct-to-Consumer Channels: Digital platforms facilitate direct engagement between pharmaceutical companies and consumers, potentially bypassing traditional intermediaries and increasing customer leverage.

Alliance Pharma faces varying customer bargaining power, with individual consumers for OTC products having low power due to fragmentation, while large institutional buyers like hospital networks and major pharmacy chains exert significant influence through bulk purchasing and formulary negotiations. The availability of numerous substitutes for many of Alliance Pharma's products, particularly in the competitive OTC market, further empowers customers by increasing price sensitivity and providing readily accessible alternatives.

| Customer Segment | Bargaining Power Factors | Impact on Alliance Pharma |

|---|---|---|

| Individual Consumers (OTC) | High fragmentation, low individual volume | Weak bargaining power, less price sensitivity |

| Retail Pharmacy Chains | Bulk purchasing, distribution control | Moderate to high bargaining power, can negotiate pricing and terms |

| Hospitals & Clinics (Prescription) | Large volume purchases, formulary decisions | High bargaining power, influences pricing and market access |

| Insurance Companies/Payers | Rebate negotiations, formulary management | Very high bargaining power, significantly impacts net pricing |

Same Document Delivered

Alliance Pharma Porter's Five Forces Analysis

This preview showcases the complete Alliance Pharma Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the pharmaceutical industry. The document you see here is precisely what you will receive upon purchase, ensuring full transparency and immediate access to a professionally formatted and ready-to-use strategic tool. This comprehensive analysis will equip you with invaluable insights into the industry's structure, enabling informed decision-making and strategic planning for Alliance Pharma.

Rivalry Among Competitors

The consumer healthcare sector is characterized by intense rivalry, with many global and regional companies vying for dominance. Alliance Pharma operates within this fragmented landscape, meaning it encounters a diverse array of competitors depending on the specific therapeutic areas and product categories of its acquired brands.

For instance, in the over-the-counter pain relief segment, Alliance Pharma might face off against giants like GSK or Bayer, while in niche dermatological products, its rivals could be smaller, specialized firms. This dynamic means Alliance Pharma must constantly monitor and adapt to a shifting competitive environment, as different brands attract different competitive pressures.

The market's dynamism is fueled by ongoing product innovation and evolving consumer preferences, further intensifying competition. Companies are continually investing in research and development and marketing to capture consumer attention and loyalty, creating a challenging environment for any single player to maintain a dominant position across multiple segments.

Alliance Pharma operates in a landscape dominated by giants. Companies like Pfizer, Johnson & Johnson, and Novartis boast R&D budgets in the tens of billions of dollars annually, far exceeding Alliance Pharma's resources. For instance, in 2023, Pfizer reported R&D expenses of approximately $10.5 billion, a figure that highlights the significant disparity.

These larger competitors leverage their immense scale to achieve cost advantages through bulk purchasing and efficient manufacturing. Their established brand recognition, built over decades, also allows them to command premium pricing and secure prime shelf space, creating a formidable barrier for smaller players.

Furthermore, their vast marketing and sales forces can execute broad-reaching campaigns, effectively capturing consumer attention and influencing prescribing habits. This extensive reach and financial muscle enable them to weather market fluctuations and invest heavily in new product development and strategic acquisitions.

Alliance Pharma's competitive rivalry is shaped by its efforts in product differentiation and brand loyalty. While some of its specialized products command lower rivalry due to their unique nature, many of its over-the-counter and prescription medicines face significant competition. In 2024, the pharmaceutical market continued to see intense price and marketing battles for these more commoditized offerings.

The success of Alliance Pharma's differentiation strategy directly impacts the intensity of rivalry. When products are perceived as truly distinct, whether through patented technology or unique formulations, customer switching costs rise, and price-based competition lessens. For instance, in therapeutic areas with fewer approved treatments, Alliance Pharma might experience reduced competitive pressure.

However, for widely available medications, such as certain pain relievers or allergy treatments, rivalry is much higher. Competitors frequently engage in aggressive marketing campaigns and promotional pricing to capture market share. This was evident in 2024, where several established OTC brands saw price reductions to maintain their standing against new entrants and generics.

Brand loyalty plays a crucial role in mitigating rivalry for Alliance Pharma. Trust built over years of consistent product performance and effective marketing can insulate a brand from direct price wars. Building and maintaining this loyalty is a key strategy for Alliance Pharma to navigate the competitive landscape effectively, especially in crowded therapeutic categories.

Acquisition-Driven Growth Strategy

Alliance Pharma's acquisition-driven growth model inherently fuels competitive rivalry. By integrating new brands, the company often enters markets with existing players, intensifying competition for market share and customer loyalty. This constant influx of new products and therapeutic areas requires robust post-acquisition integration to ensure acquired assets remain competitive. For instance, in 2024, Alliance Pharma continued its acquisition strategy, notably acquiring brands that directly competed with established generic and branded pharmaceutical companies.

This strategy necessitates substantial investment not only in the acquisition itself but also in the ongoing marketing, R&D, and operational management of the acquired entities. Failure to effectively integrate or invest can lead to acquired brands losing their competitive edge against rivals who are either more established or have more focused strategies. The pressure is on to demonstrate value creation from these acquisitions quickly in a dynamic market. In 2023, Alliance Pharma reported £649.7 million in revenue, with a significant portion attributed to its expanding portfolio through acquisitions.

- Intensified Market Competition: Each acquisition introduces Alliance Pharma into markets with established competitors, raising the stakes for market share.

- Integration Challenges: Successfully merging new brands requires significant operational and strategic effort to maintain their competitiveness.

- Ongoing Investment Needs: Continued investment in marketing and development is crucial for acquired brands to thrive against rivals.

- Portfolio Expansion Impact: The strategy directly influences the competitive landscape by altering the concentration of brands within therapeutic areas.

Regulatory Landscape and Market Access

The competitive rivalry within the pharmaceutical sector, including for companies like Alliance Pharma, is significantly influenced by a complex regulatory environment. This includes stringent market access rules, which dictate how new drugs can be introduced and reimbursed, and evolving pricing regulations that impact profitability. For instance, in 2024, many European countries continued to implement health technology assessments (HTAs) that scrutinize the cost-effectiveness of new medicines, potentially delaying or restricting market entry. Intellectual property protection, particularly patent lifecycles, also plays a crucial role, determining the period of market exclusivity before generic competition emerges. The ability to successfully navigate these regulatory hurdles can either intensify or dampen competitive pressures.

Navigating this regulatory maze is a constant challenge. Companies must invest heavily in understanding and complying with diverse national and international regulations. This can create barriers to entry for smaller players or those lacking robust regulatory affairs departments. For Alliance Pharma, this means ensuring their product portfolio meets the specific requirements for approval and reimbursement in each target market. For example, the European Medicines Agency (EMA) and the U.S. Food and Drug Administration (FDA) have distinct approval processes, each demanding significant data and time investment. Failure to comply can lead to significant penalties or even product withdrawal, directly impacting competitive positioning.

- Market Access Hurdles: In 2024, the implementation and refinement of Health Technology Assessments (HTAs) across major European markets like Germany and the UK continued to pose challenges for new drug approvals, impacting time-to-market and reimbursement levels.

- Pricing Regulations: Governments globally, including in 2024, are increasingly scrutinizing pharmaceutical pricing, with mechanisms like reference pricing and value-based pricing impacting revenue potential and competitive dynamics.

- Intellectual Property: The expiration of key patents in 2024 for several blockbuster drugs opened the door for increased generic competition, intensifying rivalry for originator companies and creating opportunities for generic manufacturers.

- Regulatory Compliance Costs: The ongoing investment required for regulatory compliance, estimated to be in the tens of millions of dollars for a single drug approval in major markets, acts as a significant barrier to entry and influences competitive intensity.

Alliance Pharma operates in a highly competitive consumer healthcare market, facing rivals ranging from global giants to niche players. The intensity of this rivalry is amplified by continuous innovation and shifting consumer demands, forcing companies to invest heavily in R&D and marketing to maintain market share. For example, in 2024, the over-the-counter segment saw aggressive promotional pricing from established brands trying to fend off new entrants.

The company’s acquisition-driven strategy inherently increases competitive rivalry by introducing its brands into markets with existing competitors. This necessitates substantial investment in marketing and development to ensure acquired products remain competitive against rivals who may have greater scale or more focused strategies. In 2023, Alliance Pharma's revenue of £649.7 million reflects the ongoing efforts to integrate and compete with acquired assets.

Regulatory factors, such as Health Technology Assessments and pricing regulations implemented in 2024 across Europe, further shape competitive dynamics. Intellectual property protection, particularly patent lifecycles, is also critical, with patent expirations in 2024 leading to increased generic competition for some therapeutic areas.

| Competitive Factor | Impact on Alliance Pharma | 2024 Market Context |

|---|---|---|

| Rivalry Intensity | High, especially in OTC and generic segments | Continued aggressive marketing and pricing battles |

| Competitor Scale | Disadvantage against R&D/marketing giants like Pfizer | Pfizer’s 2023 R&D spend was ~$10.5 billion |

| Product Differentiation | Key to reducing rivalry for specialized products | Success hinges on unique formulations and IP |

| Brand Loyalty | Mitigates price-based competition | Crucial for retaining market share in crowded categories |

| Acquisition Strategy | Increases exposure to competitive markets | Requires ongoing investment to maintain acquired brands' edge |

SSubstitutes Threaten

The most significant threat of substitution for Alliance Pharma's prescription medicines arises from the availability of generic drug alternatives once their patents expire. These generics, containing the same active pharmaceutical ingredients, present a compelling lower-cost option for consumers and healthcare providers.

This direct cost advantage for generics can lead to substantial price erosion for Alliance Pharma's branded products, often exceeding 80% in some therapeutic areas within months of generic entry. Consequently, market share for the originator drug can plummet rapidly, impacting revenue streams considerably.

For instance, in 2024, the market for several blockbuster drugs saw significant shifts as generic versions gained traction, with some branded products experiencing revenue declines of over 50% year-over-year due to this competitive pressure.

For many consumer healthcare products, lifestyle changes, dietary adjustments, or non-pharmaceutical remedies can serve as effective substitutes. For instance, the growing popularity of mindfulness apps and wearable fitness trackers, with the global wellness market projected to reach $7 trillion by 2025 according to McKinsey, directly impacts demand for certain over-the-counter medications. Consumers are increasingly adopting holistic approaches to well-being, prioritizing mental health, stress reduction, and better sleep through non-medicinal means. This trend presents a significant threat to pharmaceutical companies whose revenue streams may be eroded by these alternative solutions.

The rise of alternative and complementary therapies presents a notable threat of substitution for conventional pharmaceutical companies like Alliance Pharma. Consumer interest in options like herbal remedies, acupuncture, and chiropractic care is steadily increasing. For instance, the global complementary and alternative medicine market was valued at approximately $105.7 billion in 2023 and is projected to grow significantly, indicating a growing consumer willingness to explore non-traditional treatments.

Prevention Over Treatment Trend

The growing emphasis on prevention over treatment presents a significant threat of substitutes for Alliance Pharma. Consumers are increasingly prioritizing wellness, investing in vitamins, supplements, and lifestyle changes to proactively maintain health. This shift can divert spending away from traditional pharmaceutical products aimed at treating illness.

For instance, the global dietary supplements market was valued at approximately $151.8 billion in 2023 and is projected to grow substantially. This indicates a strong consumer appetite for preventive health solutions that can act as substitutes for prescription medications or over-the-counter remedies.

- Shift in Consumer Behavior Consumers are actively seeking ways to avoid illness, leading them to invest in proactive health measures.

- Growth in Wellness Market The expanding market for vitamins, supplements, and health-focused services directly competes for consumer healthcare budgets.

- Reduced Demand for Curative Products As prevention becomes paramount, demand for products designed to treat existing conditions may decline.

- Investment in Lifestyle Interventions Consumers are channeling resources into fitness, nutrition, and stress management, further reducing reliance on pharmaceutical solutions.

Therapeutic Class Substitutes

Within both consumer healthcare and prescription medicine, different therapeutic classes can serve as substitutes, potentially impacting Alliance Pharma's market share. For instance, advancements in gene therapy or novel surgical techniques could diminish the need for traditional pharmaceutical interventions in certain chronic conditions. This threat is amplified as research and development pipelines across the industry yield new treatment modalities.

Consider the area of pain management. While Alliance Pharma might offer opioid-based or non-steroidal anti-inflammatory drugs (NSAIDs), the emergence of non-pharmacological approaches like advanced physical therapy, implantable nerve stimulators, or even entirely new drug classes with different mechanisms of action presents a significant substitute threat. The increasing focus on patient-centered care and reduced reliance on medication further fuels this substitution trend.

A relevant example from 2024 could be the growing adoption of GLP-1 receptor agonists for weight management, which, while primarily targeting obesity, also address comorbidities like type 2 diabetes and cardiovascular risk. This broad therapeutic impact means these drugs can substitute for older treatment regimens for multiple conditions, affecting various pharmaceutical portfolios.

- Therapeutic class substitution impacts demand for existing products.

- New treatment approaches, like gene therapy, pose a substitute threat.

- Non-pharmacological options are gaining traction as alternatives.

- The rise of multi-condition drugs, such as GLP-1 agonists, exemplifies this trend.

The threat of substitutes for Alliance Pharma's products is multifaceted, ranging from direct generic competition to evolving consumer preferences for non-pharmaceutical wellness solutions. The availability of lower-cost generic drugs post-patent expiry is a primary concern, often leading to significant price erosion and market share loss for branded medications. For instance, by 2024, many blockbuster drugs saw their branded versions face revenue declines exceeding 50% due to the influx of generics.

Beyond generics, lifestyle changes and alternative therapies are increasingly substituting for traditional medicines. The global wellness market, projected to reach $7 trillion by 2025, highlights a consumer shift towards holistic health, impacting demand for over-the-counter products. Similarly, the complementary and alternative medicine market, valued at $105.7 billion in 2023, demonstrates growing consumer interest in non-traditional treatments.

Furthermore, advancements in different therapeutic classes, such as gene therapy or new drug mechanisms like GLP-1 agonists for weight management, can displace existing pharmaceutical treatments. These innovative approaches, often addressing multiple conditions or offering non-pharmacological benefits, present a significant substitute threat by providing alternative solutions to prevalent health issues.

| Threat Category | Examples of Substitutes | Market Impact (Illustrative 2024 Data) | Consumer Trend |

|---|---|---|---|

| Generic Drugs | Off-patent versions of branded medications | Revenue decline of 50%+ for some branded drugs | Cost-consciousness |

| Wellness & Lifestyle | Dietary supplements, mindfulness apps, fitness trackers | Global wellness market to reach $7 trillion by 2025 | Preventive health focus |

| Alternative Therapies | Herbal remedies, acupuncture, chiropractic care | Global CAM market valued at $105.7 billion (2023) | Holistic health seeking |

| New Therapeutic Modalities | Gene therapy, advanced physical therapy, GLP-1 agonists | GLP-1s impacting multiple treatment regimens | Innovation adoption |

Entrants Threaten

The pharmaceutical industry is notoriously capital-intensive. Developing a new drug from discovery through clinical trials to market approval can cost billions of dollars, with estimates often exceeding $2.6 billion per successful drug. This immense financial hurdle, encompassing extensive research and development (R&D) and rigorous clinical testing, significantly deters potential new entrants.

Alliance Pharma, despite its asset-light manufacturing approach, still faces substantial capital demands. The company must allocate significant funds towards strategic acquisitions to build its pipeline, invest heavily in marketing and sales to establish market presence, and navigate complex global regulatory approval processes.

These ongoing capital requirements, particularly for R&D and regulatory compliance, create a formidable barrier. New companies entering the market would need to secure vast sums of funding to even begin competing, making it a challenging landscape for smaller or less capitalized players.

The pharmaceutical industry, including companies like Alliance Pharma, faces a significant threat from new entrants due to the formidable hurdles presented by stringent regulatory requirements and lengthy approval processes. These sectors demand rigorous clinical trials and unwavering adherence to quality and safety standards, creating substantial barriers.

New companies entering the market must navigate complex and time-consuming pathways, often involving years of research and development, followed by extensive data submission and review by bodies like the FDA or EMA. For instance, the average time from drug discovery to market approval can exceed 10 years, and the cost can run into billions of dollars, making it incredibly challenging for smaller or less-resourced entities to compete.

These high capital and time commitments effectively deter many potential new players. The need for specialized expertise in regulatory affairs, coupled with the sheer expense of compliance, means only well-funded and experienced organizations can realistically consider entering. This significantly limits the number of viable new competitors that Alliance Pharma might face.

Alliance Pharma's existing intellectual property, including patents on key active ingredients and drug formulations, presents a significant hurdle for potential new entrants. These patents, often lasting for many years, grant exclusive rights, effectively blocking competitors from entering the market with similar products. For instance, in the pharmaceutical industry, the cost and complexity of developing a new drug and securing patent protection can run into hundreds of millions of dollars, a substantial barrier for any newcomer.

New companies looking to challenge Alliance Pharma’s market position often face a stark choice: either wait for existing patents to expire, which can take over a decade, or invest heavily in licensing existing technology or, even more dauntingly, developing entirely novel compounds. The latter requires substantial research and development investment, often exceeding billions, and carries a high risk of failure, making it a formidable challenge for any aspiring competitor.

Established Distribution Channels and Brand Recognition

Alliance Pharma possesses a significant advantage through its well-entrenched distribution channels and a strong portfolio of recognized brands. This established presence makes it difficult for newcomers to penetrate the market effectively.

New entrants must overcome substantial hurdles in building brand awareness and earning consumer confidence. Furthermore, securing access to critical distribution points, such as pharmacies, hospitals, and various retail outlets, represents a major obstacle.

- Established Relationships: Alliance Pharma has cultivated long-standing relationships with key distributors and healthcare providers, ensuring consistent product placement and visibility.

- Brand Loyalty: Decades of providing reliable pharmaceutical products have fostered significant brand loyalty among consumers and healthcare professionals, creating a high barrier to entry for unproven brands.

- Distribution Network Costs: Building a comparable distribution network from scratch would require immense capital investment and time, estimated to cost new entrants hundreds of millions of dollars.

- Marketing and Promotion: Competing with Alliance Pharma's established marketing efforts and brand recognition necessitates substantial expenditure on advertising and promotional activities to gain any meaningful traction.

Talent Acquisition and Specialized Expertise

The pharmaceutical and consumer healthcare sectors demand a deep bench of specialized talent, encompassing scientific research, clinical development, regulatory affairs, and sophisticated commercial operations. New companies entering these fields often face considerable hurdles in attracting and retaining individuals with this critical expertise. Established players, with their strong brand recognition and proven track records, typically have an advantage in the competition for top-tier professionals.

This talent gap can significantly impede the progress of new entrants, as building a competent team is fundamental to innovation and market penetration. For instance, in 2024, the demand for biopharmaceutical researchers with expertise in areas like gene therapy and AI-driven drug discovery remained exceptionally high, often leading to bidding wars for qualified candidates.

- High Demand for Specialized Skills: The need for scientists, regulatory experts, and experienced commercial teams is a significant barrier.

- Competition for Talent: New entrants struggle to match the compensation and career development opportunities offered by established pharmaceutical giants.

- Impact on Innovation: A lack of specialized talent can slow down research and development, hindering a new company's ability to bring novel products to market.

- Retention Challenges: Even if acquired, retaining highly sought-after professionals can be difficult for companies without a strong existing infrastructure and reputation.

The threat of new entrants for Alliance Pharma is considerably low, primarily due to the immense capital requirements and extensive regulatory hurdles inherent in the pharmaceutical industry. Developing a new drug can cost upwards of $2.6 billion, a figure that deters many potential competitors.

Alliance Pharma benefits from significant patent protections and established distribution networks, further solidifying its market position. Navigating the complex global regulatory landscape, which can take over 10 years for drug approval, demands specialized expertise and vast financial resources, making entry challenging for newcomers.

The company's strong brand loyalty and established relationships with healthcare providers also create substantial barriers. Acquiring the necessary specialized talent in research, development, and regulatory affairs is another significant challenge for new players attempting to enter the market.

In 2024, the global pharmaceutical market size was valued at approximately $1.6 trillion, underscoring the scale of investment required to compete effectively. New entrants would need to secure substantial funding to match the R&D, marketing, and distribution capabilities of established firms like Alliance Pharma.

Porter's Five Forces Analysis Data Sources

Our Alliance Pharma Porter's Five Forces analysis is built upon a robust foundation of data, integrating information from company annual reports, SEC filings, and industry-specific market research reports to provide a comprehensive view of the competitive landscape.