Align Technology Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Align Technology Bundle

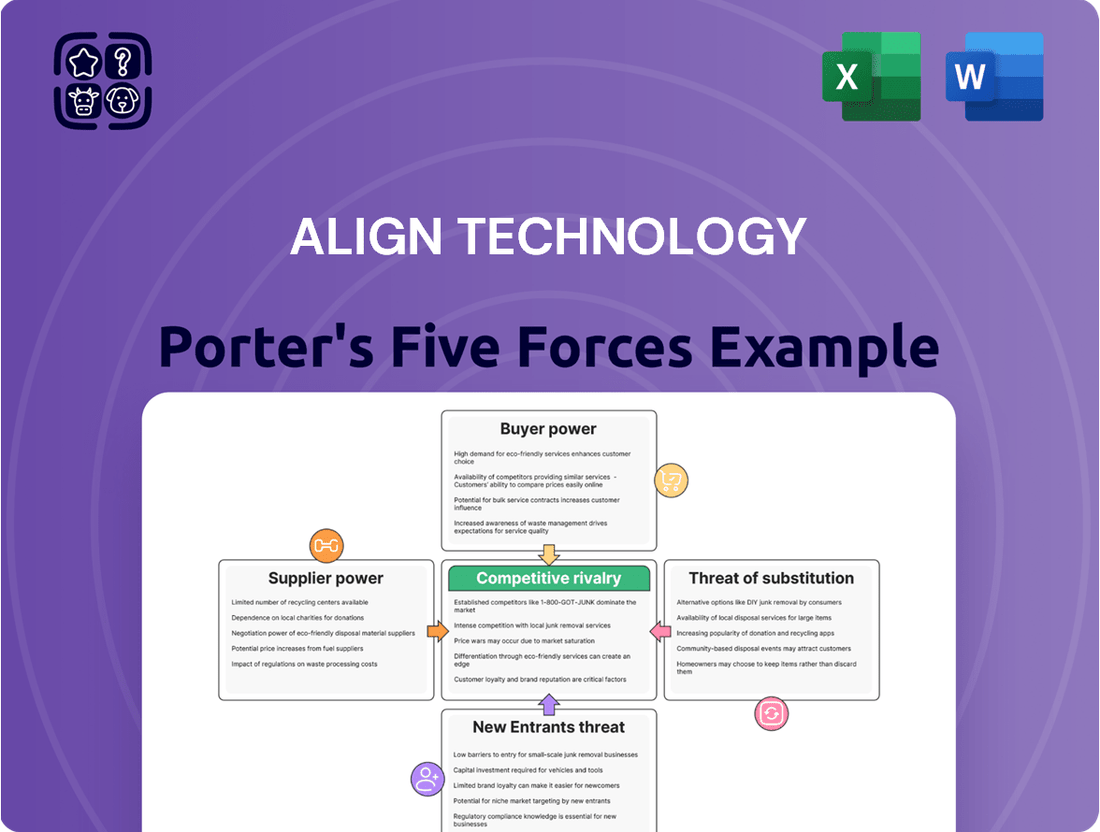

Align Technology, a leader in clear aligners, faces a dynamic competitive landscape. Understanding the intensity of rivalry, the bargaining power of buyers (dentists and patients), and the threat of new entrants is crucial for strategic planning. The availability of substitutes and the power of suppliers also significantly shape its market position.

The complete report reveals the real forces shaping Align Technology’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Align Technology's reliance on a small group of specialized suppliers for crucial materials, like the advanced polymers used in their clear aligners and the precision components for their iTero scanners, presents a significant factor in supplier bargaining power. In 2024, the market for these specialized polymers is dominated by approximately 4 to 6 key manufacturers, while the precision component sector sees around 5 to 7 major players.

This concentrated supplier landscape, where a limited number of entities control substantial market share for essential inputs, inherently strengthens their negotiating position. The specialized nature of these materials means that finding viable alternatives can be challenging and costly for Align Technology, giving these suppliers considerable leverage in pricing and contract terms.

Align Technology encounters significant hurdles when considering changes to its manufacturing equipment. The cost to switch a specialized manufacturing line for dental production can range from $3.5 million to $5.2 million. This substantial expense encompasses not only the initial purchase of new machinery but also the intricate processes of recalibration and comprehensive training for staff.

These elevated switching costs inherently limit Align's agility in sourcing decisions, thereby strengthening the bargaining power of its equipment suppliers. Consequently, suppliers can often dictate pricing and contractual terms more assertively, knowing that Align faces considerable financial and operational disincentives to seek alternative providers. This dynamic highlights a key factor influencing Align Technology's operational costs and strategic flexibility.

Align Technology's reliance on a concentrated supplier base for critical components significantly amplifies supplier bargaining power. The company sources 85% of its specialized 3D printing materials from just two manufacturers, highlighting a substantial dependence. This concentration means these suppliers can exert considerable influence over pricing and availability, potentially impacting Align's production costs and output.

Proprietary Material Technology

Align Technology's proprietary SmartTrack material technology provides a degree of differentiation for its clear aligners. This technological edge can reduce reliance on suppliers for specific material formulations. However, Align still requires basic polymers and other raw materials from external sources, meaning supplier power isn't entirely eliminated.

The company's innovation in its final product does somewhat counteract supplier leverage, but the availability and cost of fundamental components remain critical. This creates a dynamic where Align's unique product offers strength, yet its dependence on raw material sourcing presents a potential vulnerability. In 2023, the global market for medical-grade polymers, a key input for aligners, was valued at approximately $28.5 billion, indicating a substantial external market for these essential materials.

- Proprietary Technology: SmartTrack material enhances product uniqueness.

- Raw Material Dependence: Reliance on external suppliers for base polymers persists.

- Mitigated but Present Power: Innovation lessens supplier control, but sourcing remains a factor.

Limited Threat of Forward Integration from Suppliers

Suppliers to Align Technology typically face significant barriers if they consider moving into the orthodontic or dental equipment space themselves. The intricate manufacturing processes for dental aligners and related technologies, coupled with strict regulatory approvals needed for medical devices, present substantial challenges. Established distribution networks within the dental industry further complicate direct entry for many suppliers, limiting their ability to become direct competitors.

This lack of forward integration potential from suppliers directly diminishes their bargaining power. When suppliers cannot easily become competitors, their leverage over Align Technology is reduced, as they are less likely to disrupt the market by entering Align's core business. For instance, while a supplier of specialized resins might have some leverage on pricing, they are unlikely to launch their own aligner brand, thus capping their power.

- Limited Forward Integration: Suppliers to Align Technology generally cannot easily integrate forward into manufacturing and selling aligners or related dental equipment.

- Manufacturing Complexity: The production of advanced dental devices requires specialized knowledge and technology, deterring many suppliers from direct market entry.

- Regulatory Hurdles: The dental and medical device industries are heavily regulated, adding significant cost and time to any new product introduction.

- Established Distribution: Align Technology benefits from its established relationships and distribution channels within the dental professional community, which are difficult for suppliers to replicate.

Align Technology's supplier bargaining power is moderated by its proprietary SmartTrack material, which differentiates its clear aligners. However, reliance on external suppliers for fundamental polymers and precision components, with 85% of 3D printing materials sourced from just two manufacturers, retains significant supplier leverage. The global medical-grade polymer market, valued at approximately $28.5 billion in 2023, underscores the scale of these external dependencies.

Suppliers of specialized materials for Align Technology, such as advanced polymers, face a concentrated market with only 4 to 6 key manufacturers in 2024. Similarly, precision components for iTero scanners are supplied by a limited pool of 5 to 7 major players. This scarcity of specialized providers grants them considerable negotiating strength regarding pricing and terms.

The high switching costs for Align Technology, estimated between $3.5 million and $5.2 million for new manufacturing equipment, further bolster supplier power. These expenses, encompassing machinery purchase, recalibration, and training, make it financially prohibitive for Align to easily change suppliers, allowing existing providers to dictate terms more assertively.

| Factor | Description | Impact on Align's Bargaining Power |

|---|---|---|

| Supplier Concentration | Limited number of suppliers for critical polymers and components. | Strengthens supplier power. |

| Switching Costs | High costs associated with changing manufacturing equipment. | Strengthens supplier power. |

| Proprietary Technology | SmartTrack material offers product differentiation. | Moderates supplier power. |

| Supplier Forward Integration | Suppliers face barriers to entering Align's market. | Weakens supplier power. |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Align Technology's unique position in the clear aligner and dental scanner market.

Understand the competitive landscape of clear aligner orthodontics with a comprehensive five forces analysis, highlighting Align Technology's strategic advantages and potential vulnerabilities.

Customers Bargaining Power

Align Technology's core customer base consists of dental professionals, such as orthodontists and general dentists. These professionals are the ones who recommend and oversee treatments using Align's Invisalign clear aligners, as well as employ their iTero intraoral scanners and exocad dental CAD/CAM software. This direct relationship with over 271,000 doctor customers worldwide positions them as key influencers in treatment decisions and the adoption of new dental technologies.

Dental professionals are increasingly embracing digital workflows, a trend that directly impacts the bargaining power of customers. The adoption of intraoral scanners and CAD/CAM solutions is on the rise, fueled by a desire for greater precision, efficiency, and improved aesthetic results in dental treatments. This shift means customers, i.e., dental practices, are becoming more sophisticated and have more options for digital solutions.

The global dental CAD/CAM market is projected for substantial growth, with some estimates pointing to a compound annual growth rate (CAGR) of over 10% in the coming years. This expansion means more competitors offering digital solutions, giving dental professionals more leverage to negotiate terms and pricing with providers like Align Technology. As these digital tools become standard, customers can more easily switch between suppliers if they are not satisfied with the value or service provided.

This increasing adoption of digital solutions empowers dental professionals who are actively seeking streamlined and advanced workflows. They can now compare the integrated offerings of various companies, including Align's, and demand solutions that best fit their practice's needs and budget. This heightened awareness and availability of alternatives strengthen the customer's position in the market.

For dental practices, the cost of transitioning away from an established system like Align Technology's Invisalign and iTero can be substantial. These costs include retraining staff on new software and equipment, the expense of integrating new digital platforms, and the time needed to adapt established clinical workflows. This investment makes it less appealing for doctors to switch to competing systems once they have committed to Align's ecosystem.

Align's established digital treatment planning platform and its extensive global network of certified professionals further solidify customer loyalty. This creates a sticky customer base, as dentists have already invested in the training and infrastructure to utilize these tools effectively. The perceived value and integration of Align's offerings make the prospect of switching to alternatives less attractive for many practices.

Price Sensitivity and Alternative Options

Customers, primarily dental professionals and their patients, exhibit notable price sensitivity regarding clear aligner treatments. Invisalign, while a market leader, often carries a higher price tag compared to conventional orthodontic solutions like traditional braces or emerging competitive clear aligner brands. This cost differential directly influences purchasing decisions.

The competitive landscape offers alternatives that can exert downward pressure on Align Technology's pricing. For instance, the availability of more budget-friendly clear aligner systems, along with the enduring presence of traditional braces, provides customers with viable choices. This can limit Align's ability to unilaterally dictate prices, forcing them to remain competitive.

- Price Sensitivity: Patients are often influenced by the total cost of orthodontic treatment, making higher-priced options like Invisalign a point of consideration against cheaper alternatives.

- Alternative Orthodontic Solutions: The market for orthodontic care includes traditional braces, which remain a significant and often more affordable option for many consumers.

- Emerging Clear Aligner Competitors: A growing number of companies are entering the clear aligner market, offering similar products at lower price points, thereby increasing customer options.

- Market Share vs. Pricing Power: While Align Technology commands a substantial market share, the existence of these alternatives tempers their pricing power, as they must consider customer value perception.

Growing Influence of Dental Service Organizations (DSOs)

The growing influence of Dental Service Organizations (DSOs) significantly bolsters customer bargaining power against Align Technology. These consolidated entities, representing numerous dental practices, leverage their aggregated purchasing volume to negotiate more favorable pricing and bulk discounts.

This increased purchasing power means DSOs can exert greater pressure on Align for cost reductions and potentially demand more customized product offerings or service agreements. For instance, by the end of 2023, the DSO market continued its expansion, with many private equity-backed groups acquiring practices, further consolidating their negotiating leverage.

This trend can lead to heightened price sensitivity among dental providers and encourage a stronger demand for value-added services or alternative solutions if Align’s pricing is perceived as too high.

- DSO Consolidation: DSOs consolidate purchasing power, enabling them to negotiate better terms.

- Bulk Discounts: Aggregated demand allows DSOs to secure significant discounts from suppliers like Align.

- Price Sensitivity: Increased DSO market share can drive greater price competition in the dental sector.

- Tailored Solutions: DSOs may demand customized product bundles or service level agreements.

The bargaining power of Align Technology's customers, primarily dental professionals, is moderate but growing. While the high cost of switching away from Align's integrated ecosystem provides some stickiness, customers are increasingly empowered by the proliferation of digital dental solutions and the rise of large Dental Service Organizations (DSOs).

The increasing availability of alternative clear aligner brands and traditional orthodontic treatments means customers have more choices, leading to greater price sensitivity. For example, while Align's Invisalign is a market leader, its premium pricing is a key consideration for patients and dentists alike, especially when compared to more budget-friendly options. This competitive pressure limits Align's ability to dictate terms.

Dental Service Organizations (DSOs) further amplify customer bargaining power by consolidating purchasing volume. These large entities can negotiate bulk discounts and more favorable pricing terms, as seen in the continued expansion and private equity investment within the DSO market throughout 2023, which consolidates their leverage.

| Factor | Influence on Bargaining Power | Supporting Data/Observation |

|---|---|---|

| Digital Workflow Adoption | Increases sophistication and options for customers. | Global dental CAD/CAM market projected for over 10% CAGR. |

| Price Sensitivity | Customers seek cost-effective solutions. | Invisalign's higher price point compared to alternatives. |

| Availability of Alternatives | Provides customers with more choices. | Presence of traditional braces and numerous emerging clear aligner brands. |

| DSO Consolidation | Aggregates purchasing power for better negotiation. | Continued DSO expansion and private equity investment in 2023. |

Preview Before You Purchase

Align Technology Porter's Five Forces Analysis

You're previewing the final version—precisely the same document that will be available to you instantly after buying. This comprehensive Porter's Five Forces analysis for Align Technology delves into the competitive landscape, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the clear aligner and orthodontic market. It highlights how Align Technology navigates these forces to maintain its market leadership and strategic advantage. The insights provided are actionable, offering a clear understanding of the industry dynamics that shape Align's business model and future growth prospects.

Rivalry Among Competitors

Align Technology commands a powerful presence in the clear aligner sector, with its Invisalign brand securing an impressive 90% market share as of 2023. This substantial leadership position grants Align a significant competitive edge.

However, this dominance also invites considerable attention and robust competition from rivals eager to gain traction in this highly profitable market. Companies are actively developing alternative solutions and marketing strategies to chip away at Align's established stronghold.

The clear aligner and broader orthodontics market is a dynamic space, marked by the presence of both seasoned giants and ambitious newcomers. Established companies such as Dentsply Sirona with its SureSmile offering, 3M's Unitek, and Ormco's Spark Aligners are formidable competitors, each with a significant market share and a history of innovation. Their established distribution networks and brand recognition provide a strong foundation.

Adding to this competitive intensity are emerging companies and disruptive direct-to-consumer (DTC) models that are challenging traditional approaches. These newer entrants often focus on price, convenience, and digital engagement, forcing incumbents to adapt. This constant influx of new ideas and business models fuels a cycle of continuous innovation across the industry.

As a result, the competitive rivalry is fierce, driving aggressive marketing strategies and a relentless pursuit of technological advancement. Companies are investing heavily in research and development to improve aligner materials, treatment planning software, and patient experience. For instance, Align Technology, the maker of Invisalign, has seen its market share face pressure from competitors like SmileDirectClub (though it ceased operations in 2023) and Spark Aligners, highlighting the dynamic nature of market leadership.

The competitive rivalry in the clear aligner industry is intense, fueled by rapid technological advancements. Companies are locked in a constant race to develop and implement cutting-edge solutions. Align Technology, a leader in this space, demonstrated its commitment to innovation by investing $286.5 million in research and development during 2022. This significant expenditure aims to maintain its technological superiority and introduce novel products to the market. However, this investment also highlights the pressure from competitors who are equally focused on innovation, creating a dynamic technological arms race.

Price Competition and Market Saturation

The clear aligner market, while robust, is experiencing intensifying rivalry, particularly concerning price. As the market matures and expands into general dental practices, the influx of more affordable alternatives, including those from white-label manufacturers, is creating significant price pressures. For instance, in 2023, the global clear aligner market was valued at approximately USD 10.2 billion, with projections indicating continued growth, but this growth is accompanied by increased competition that can erode profit margins.

This heightened competition forces established players like Align Technology to carefully manage their pricing strategies. The accessibility of clear aligner technology to a broader range of dental providers means that consumers have more options, often at lower price points. This dynamic directly impacts the competitive landscape, making price a crucial factor in consumer choice and vendor selection.

- Market Saturation: The increasing number of providers offering clear aligner solutions contributes to a more saturated market, intensifying rivalry.

- Price Sensitivity: As more affordable alternatives emerge, consumers become more price-sensitive, driving down average selling prices.

- General Dental Practice Entry: The adoption of clear aligner technology by general dentists, rather than just orthodontists, broadens the competitive base and increases price competition.

- White-Label Manufacturers: The rise of white-label manufacturers offering lower-cost products further pressures established brands on price.

Global Market Expansion and Regional Dynamics

Align Technology’s global reach is a significant factor in its competitive landscape. The company actively pursues expansion into new markets, notably targeting emerging economies in Africa and Latin America. For instance, in 2023, Align Technology reported continued growth in its international segments, contributing to a substantial portion of its overall revenue.

However, this global expansion isn't without its challenges. The competitive intensity varies significantly by region. Local and regional competitors often possess a strong understanding of their domestic markets and established relationships, posing a unique challenge to Align Technology's market entry and growth strategies. Furthermore, navigating diverse regulatory frameworks across different countries necessitates adaptive business models and compliance efforts.

- Global Presence: Align Technology actively expands into new territories, including emerging markets, to broaden its customer base and revenue streams.

- Regional Competition: Local and regional players present distinct competitive pressures, often leveraging localized knowledge and networks.

- Regulatory Diversity: Varying government regulations and healthcare policies across different geographies require tailored market approaches and compliance strategies.

- Market Penetration: The need for customized strategies to gain traction and retain market share in diverse regional environments is critical for sustained growth.

The competitive rivalry within the clear aligner market is intense, driven by technological innovation and a growing number of market participants. Align Technology, despite its dominant position, faces pressure from established dental companies and emerging DTC models. This rivalry fuels aggressive marketing and a constant drive for product improvement.

Price sensitivity is also a significant factor, especially as the market expands into general dental practices. The availability of more affordable, often white-labeled alternatives, puts pressure on established brands to maintain competitive pricing. This dynamic is evident in the global clear aligner market, valued at approximately USD 10.2 billion in 2023, with growth accompanied by increasing price competition.

Align Technology's global expansion strategy is met with varied regional competition. Local players often have a strong understanding of their markets, posing unique challenges to Align's growth. Navigating diverse regulatory environments further complicates this global competitive landscape.

The clear aligner industry is characterized by a dynamic competitive landscape where innovation and pricing are key battlegrounds. Align Technology invested $286.5 million in R&D in 2022 to maintain its edge, underscoring the industry's focus on technological advancement. However, the market's growth, reaching USD 10.2 billion in 2023, also attracts new entrants and white-label manufacturers, increasing price pressures and intensifying rivalry.

SSubstitutes Threaten

Traditional metal braces, along with ceramic and lingual options, still present a substantial substitute for clear aligners like Invisalign. These fixed appliances are frequently more budget-friendly, with costs for traditional braces often ranging from $3,000 to $7,000 in 2024, compared to clear aligners which can be $4,000 to $7,500. Their fixed nature also means they can be more effective for severe malocclusions, as they don't depend on consistent patient wear, a factor that can influence treatment outcomes with clear aligners.

The threat of substitutes is significant, with numerous other clear aligner brands challenging Align Technology's dominance. Companies like ClearCorrect, Spark Aligners, and a growing number of white-label providers offer comparable aesthetic and convenience benefits. These alternatives often compete on price or unique feature sets, giving patients and dental professionals readily available choices outside of Invisalign.

Direct-to-consumer (DTC) aligner companies represent a significant threat. Companies like Byte offer orthodontic treatments directly to consumers, often with lower price points and convenient at-home impression kits. While these models may not always match the clinical depth of Align Technology's doctor-led approach, especially for complex cases, they provide a compelling alternative for simpler alignment needs.

Cosmetic Dental Procedures

The threat of substitutes for cosmetic dental procedures, particularly those offered by Align Technology like Invisalign, is significant. Patients primarily seeking aesthetic improvements rather than functional bite correction can opt for a range of non-orthodontic treatments. These alternatives directly address the desire for a more attractive smile without the time commitment or specific nature of aligner therapy.

Key substitute procedures include:

- Veneers: Thin shells of porcelain or composite resin bonded to the front of teeth to improve appearance. This can mask minor misalignments, discoloration, and chips.

- Dental Bonding: Tooth-colored composite resin material is applied to the teeth to repair chips, cracks, or gaps, and can also be used to alter the shape or alignment of teeth.

- Teeth Whitening: While not directly correcting alignment, professional teeth whitening can dramatically improve the aesthetic appeal of a smile, making minor imperfections less noticeable and potentially reducing the perceived need for orthodontic intervention.

- Dental Crowns: These caps cover the entire tooth and can be used to reshape and realign teeth, offering a more permanent solution for significant aesthetic concerns.

The market for cosmetic dentistry is robust. For instance, the global dental aesthetics market was valued at over $27.4 billion in 2023 and is projected to grow, indicating a strong consumer demand for smile enhancement. Many of these procedures, like teeth whitening and bonding, are generally less expensive and faster than comprehensive orthodontic treatment, making them attractive alternatives for a segment of the patient population.

Patient Preference for Discretion and Comfort

Patient preference for discretion and comfort is a key driver for clear aligners. If traditional braces offer more aesthetic and comfortable alternatives, this could diminish the appeal of clear aligners. For instance, advancements in ceramic or lingual braces could present a stronger substitute. In 2024, the orthodontic market continues to see innovation in both clear aligner technology and traditional bracket systems, making this a dynamic area to monitor.

The primary appeal of clear aligners over traditional braces lies in their nearly invisible appearance and improved comfort. However, this advantage is not absolute.

- Aesthetic Advancements in Traditional Braces: Traditional braces are increasingly offering more discreet options, such as smaller bracket designs and tooth-colored materials, potentially reducing the perceived difference in appearance compared to clear aligners.

- Cost and Convenience Factors: Significant increases in the cost or a decline in the convenience of clear aligner treatments could make traditional braces a more attractive alternative for a larger patient segment.

- Evolving Patient Perceptions: As awareness of improved traditional brace aesthetics grows, patient willingness to opt for them may increase, directly impacting the threat of substitution for clear aligner providers.

The threat of substitutes for clear aligners like Align Technology's Invisalign remains substantial, encompassing both alternative orthodontic treatments and cosmetic dental procedures. While clear aligners offer distinct advantages, patients seeking aesthetic improvements or functional correction have multiple viable options. These substitutes can range in cost, treatment time, and effectiveness, directly influencing patient choices and impacting Align Technology's market share.

| Substitute Category | Examples | Key Differentiators/Impact |

|---|---|---|

| Alternative Orthodontic Treatments | Traditional Metal Braces, Ceramic Braces, Lingual Braces, Other Clear Aligner Brands (e.g., Spark, ClearCorrect), Direct-to-Consumer Aligners (e.g., Byte) | Cost ($3,000-$7,000 for traditional braces in 2024 vs. $4,000-$7,500 for clear aligners), effectiveness for severe cases, patient wear dependency, brand competition, price sensitivity. |

| Cosmetic Dental Procedures | Veneers, Dental Bonding, Teeth Whitening, Dental Crowns | Focus on aesthetics over functional correction, faster treatment times, lower perceived complexity, masking minor misalignments. Global dental aesthetics market valued over $27.4 billion in 2023. |

Entrants Threaten

Entering the clear aligner and digital dentistry market demands significant financial resources. New companies need to invest heavily in research and development to innovate, establish sophisticated manufacturing capabilities, and secure crucial intellectual property. This high upfront cost acts as a considerable barrier.

Align Technology’s commitment to innovation is evident in its substantial R&D spending. In 2022 alone, the company invested $286.5 million in research and development. Such a large investment underscores the financial muscle required to compete and develop cutting-edge solutions, creating a formidable financial hurdle for any aspiring competitor.

Align Technology's extensive intellectual property, boasting over 1,000 active U.S. patents and 1,342 patents worldwide as of early 2024, presents a formidable barrier to new entrants. This vast patent portfolio specifically protects its core technologies like the Invisalign clear aligner system and iTero intraoral scanners. The sheer volume and scope of these patents make it exceedingly difficult for potential competitors to develop similar products without risking costly intellectual property infringement lawsuits, thereby deterring new market participants.

The medical device sector, a crucial area for companies like Align Technology, faces significant regulatory challenges. Obtaining certifications, such as FDA approval for products like clear aligners and intraoral scanners, is a complex and often lengthy process. For instance, the FDA's premarket approval (PMA) pathway can take several years and involve substantial investment in clinical trials and data submission, making it a daunting barrier for newcomers.

Need for Established Distribution Channels and Doctor Network

New entrants face a substantial hurdle due to Align Technology's deeply entrenched distribution channels and extensive doctor network. This established infrastructure, cultivated over years, provides unparalleled market access and customer relationships. For instance, Align's global reach is supported by a network of over 271,000 trained dental professionals, a figure that represents a significant competitive moat.

Replicating this vast network, which includes the complex logistics of product delivery and the crucial element of doctor training and ongoing support, demands immense capital investment and time. Newcomers must not only develop comparable product quality but also build trust and familiarity within the dental community.

- Established Distribution: Align's global network is a critical barrier, facilitating efficient product delivery and market penetration.

- Doctor Network: Over 271,000 trained doctors represent a significant loyalty and adoption base that new entrants must overcome.

- Infrastructure Investment: Building a comparable training and support system for dental professionals is a costly and time-consuming endeavor for potential competitors.

- Market Trust: Years of experience and successful patient outcomes have fostered deep trust between Align and the dental professional community.

Brand Loyalty and First-Mover Advantage

Align Technology's Invisalign brand enjoys significant brand loyalty, making it difficult for newcomers to capture market share. This loyalty, built over years, means patients often specifically request Invisalign, creating a substantial hurdle for new entrants. In 2023, Align Technology reported net revenue of $3.9 billion, showcasing the scale of their established market presence. New competitors must overcome this deeply ingrained brand preference through substantial marketing efforts and unique product offerings.

The first-mover advantage also plays a crucial role. Align Technology has had a head start in developing its technology, refining its treatment protocols, and building a vast network of trained dental professionals. This established infrastructure and expertise are not easily replicated. For instance, as of the end of 2023, Align Technology had treated over 15 million patients globally with Invisalign, a testament to their long-standing market penetration.

- Strong Brand Recognition: Invisalign is often the first clear aligner brand that comes to mind for consumers and dental professionals alike.

- Customer Loyalty: Repeat business and strong patient satisfaction create a sticky customer base that new entrants struggle to attract.

- High Marketing Investment: New entrants would need to commit significant capital to marketing campaigns to build comparable brand awareness and trust to Invisalign's established position.

- Established Network: Align Technology's extensive network of trained orthodontists and dentists provides a critical advantage that new companies must diligently work to build.

The threat of new entrants in the clear aligner market is moderate, primarily due to high capital requirements and established brand loyalty. Align Technology's substantial investments in R&D, exceeding $286.5 million in 2022, and its extensive patent portfolio of over 1,342 global patents as of early 2024, create significant barriers.

The market demands considerable financial resources for innovation and manufacturing, alongside navigating stringent regulatory approvals like FDA premarket approval. These factors, coupled with Align's deeply entrenched doctor network of over 271,000 trained professionals and strong brand recognition for Invisalign, make market entry challenging.

New competitors must not only match product quality but also invest heavily in marketing and building trust within the dental community. Align's first-mover advantage, evidenced by treating over 15 million patients globally with Invisalign by the end of 2023, further solidifies its market position.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Align Technology is built upon a foundation of robust data, including company annual reports, SEC filings, industry-specific market research from firms like Grand View Research, and insights from financial data providers such as S&P Capital IQ.