Align Technology Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Align Technology Bundle

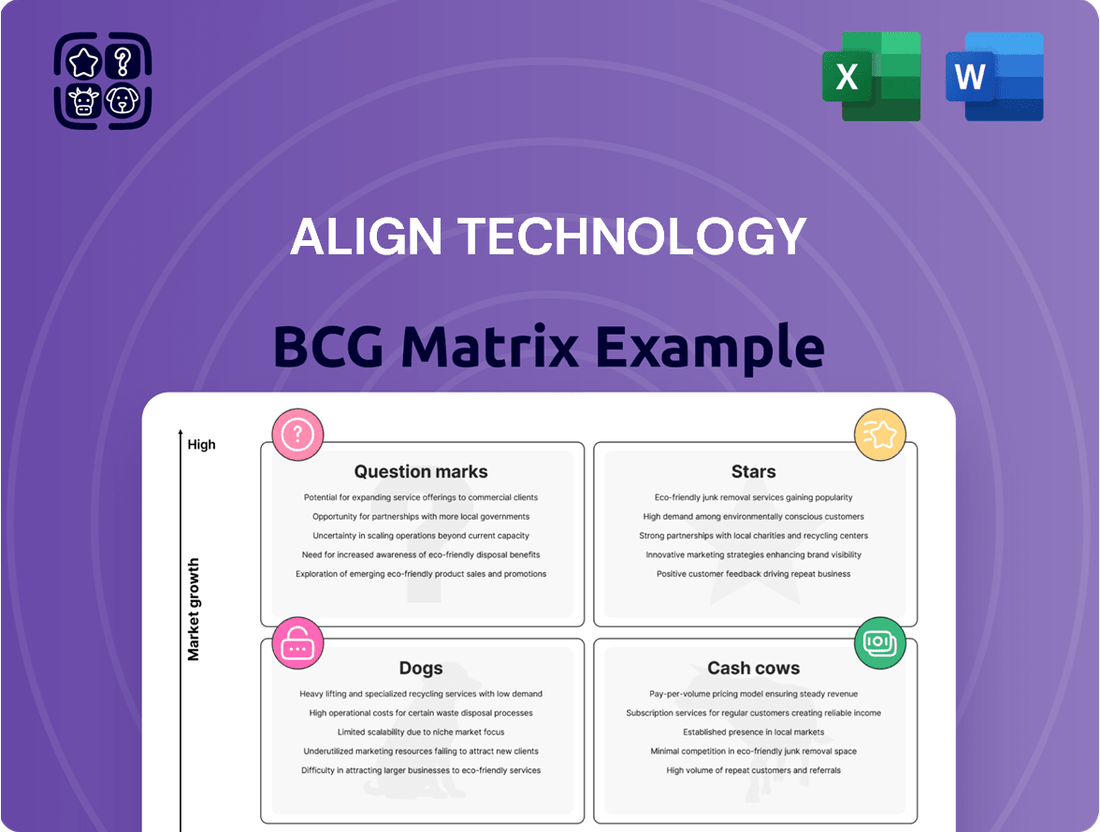

Explore Align Technology's strategic positioning with our insightful BCG Matrix analysis. See how their innovative products stack up in terms of market share and growth potential, identifying potential Stars, Cash Cows, Dogs, and Question Marks.

This preview offers a glimpse into the company's product portfolio dynamics. Uncover which segments are driving current success and which require careful consideration for future investment.

The full BCG Matrix report provides a comprehensive breakdown, offering data-backed insights into each quadrant. Gain actionable recommendations to optimize resource allocation and drive sustainable growth.

Don't miss out on the complete picture. Purchase the full version to receive a detailed strategic roadmap, empowering you to make informed decisions about Align Technology's future.

Elevate your understanding and gain a competitive edge by investing in the complete BCG Matrix for Align Technology. It's your key to unlocking smarter, more effective business strategies.

Stars

The Invisalign system remains a powerhouse in the clear aligner industry, a sector poised for substantial expansion. Projections indicate a compound annual growth rate (CAGR) between 15% and 24.8% for the market from 2025 through 2032.

Align Technology commands a leading market share, having successfully treated more than 20 million patients globally as of the first quarter of 2025. This extensive patient base underscores the brand's strong market penetration and customer trust.

While facing some temporary challenges, such as currency fluctuations and a slight slowdown in specific market segments, the robust overall market growth, coupled with Invisalign's established brand and significant user base, solidifies its position as a Star.

Sustained investment will be crucial for Invisalign to maintain its dominant market position and capitalize on the ongoing expansion of the clear aligner market.

Align Technology is heavily investing in the teen and youth market, viewing it as a key growth driver. The company is introducing innovative solutions like the Invisalign System with mandibular advancement, slated for launch in 2025, and the Invisalign Palatal Expander System, which received approval in Turkey in 2025.

This strategic push is yielding results, as evidenced by a significant 13.3% year-over-year increase in teen and kids case starts during the first quarter of 2025. These figures highlight the strong demand and successful market penetration in this demographic.

To further capitalize on this momentum, Align Technology is implementing targeted brand campaigns designed to resonate with both parents and dental professionals. These initiatives aim to educate and encourage the adoption of Invisalign for younger patients, solidifying its position in this vital segment.

The iTero intraoral scanner line is a clear Star in Align Technology's portfolio, dominating the global market with a significant share. This segment is poised for robust expansion, with projected compound annual growth rates between 6.9% and 9.9% from 2025 through 2033, indicating a highly attractive market dynamic.

Align’s Imaging Systems and CAD/CAM Services, encompassing the iTero scanners, showcased impressive financial momentum. In the fourth quarter of 2024, this segment reported a substantial year-over-year revenue increase of 14.9%, underscoring strong market demand and effective sales execution.

Ongoing technological advancements, exemplified by the launch of the iTero Lumina scanner, and its deep integration into the Invisalign treatment process, further cement iTero's leading position. These innovations are crucial for maintaining its competitive edge in a rapidly evolving digital dentistry landscape.

Align Digital Platform

Align Technology is strategically positioning its Align Digital Platform as a star within its business portfolio, representing a significant investment to integrate its core offerings. This platform unifies Invisalign clear aligners, iTero intraoral scanners, and exocad design software, creating a seamless digital ecosystem for both orthodontic and restorative dental treatments.

The platform’s strength lies in its ability to drive innovation, particularly through the integration of artificial intelligence for sophisticated treatment planning and diagnostics. This technological advancement is crucial for capturing a larger segment of the rapidly expanding digital dentistry market, which is characterized by a strong demand for integrated and advanced solutions.

- Strategic Investment: Align Technology is channeling significant resources into the development and enhancement of its comprehensive Align Digital Platform.

- Integration of Offerings: The platform connects Invisalign, iTero scanners, and exocad software, streamlining digital workflows for orthodontics and restorative dentistry.

- AI-Driven Capabilities: It incorporates advanced features like AI integration, improving treatment planning and diagnostic accuracy.

- Market Growth Driver: By providing an end-to-end digital solution, Align aims to capitalize on the high growth and demand in the evolving digital dentistry sector.

Global Expansion in Emerging Markets

Align Technology is making significant strides in global expansion, with a particular focus on emerging markets in APAC and EMEA. These regions are showing robust growth in clear aligner volumes, indicating a strong market reception.

The company's strategic push into these areas is driven by increasing disposable incomes and a growing awareness of aesthetic dental solutions. This trend is expected to fuel further demand for Align's products.

Key initiatives are in place to expand the customer base and deepen market penetration in these high-potential geographies.

- APAC and EMEA regions are key growth drivers for Align Technology.

- Rising disposable incomes and aesthetic dental treatment awareness boost demand.

- Strategic focus on customer base expansion and market penetration in emerging markets.

The Invisalign system and the iTero intraoral scanner are both prime examples of Align Technology's Stars. These products operate in high-growth markets, as evidenced by the clear aligner market's projected 15% to 24.8% CAGR and the iTero market's 6.9% to 9.9% CAGR through 2032 and 2033, respectively. Align's significant global patient treatment numbers, exceeding 20 million by early 2025, and the iTero segment's 14.9% year-over-year revenue growth in Q4 2024, highlight their strong market positions and demand.

| Product Category | Market Growth | Align's Market Position | Key Performance Indicators (as of early 2025) |

| Clear Aligners (Invisalign) | 15%-24.8% CAGR (2025-2032) | Market Leader | >20 Million patients treated globally |

| Intraoral Scanners (iTero) | 6.9%-9.9% CAGR (2025-2033) | Market Leader | 14.9% YoY revenue growth (Q4 2024) |

| Digital Platform | High Growth (Digital Dentistry) | Integrated Ecosystem | AI integration for advanced treatment planning |

What is included in the product

Align Technology's BCG Matrix provides a tailored analysis of its product portfolio, highlighting which units to invest in, hold, or divest.

The Align Technology BCG Matrix provides a clear, one-page overview, simplifying complex business unit analysis and easing the burden of strategic decision-making.

Cash Cows

Established Invisalign Adult Comprehensive Cases represent a classic Cash Cow for Align Technology. This mature segment, particularly in developed markets like the United States and Europe, has seen Align capture significant market share. The consistent demand for complex adult treatments drives substantial and reliable cash flow.

Despite moderate growth in this specific niche, its strong profitability and dominant market position solidify its Cash Cow status. Align's extensive installed patient base in this category ensures recurring revenue streams, making it a foundational element of their business model.

In 2023, Align Technology reported over 2.5 million new patient starts globally, with a significant portion attributed to the adult comprehensive segment. This enduring demand highlights the segment's stability and its crucial role in generating consistent earnings for the company.

Older generations of iTero intraoral scanners, like the iTero Element series, are firmly positioned as Cash Cows within Align Technology's portfolio. These mature products boast a substantial installed base, meaning many dental practices already own and utilize them.

These scanners continue to be reliable revenue generators. They bring in steady cash flow through ongoing service contracts, the sale of essential consumables, and opportunities for customers to upgrade to newer software versions. This consistent income stream supports the company's overall financial health.

While Align Technology is investing heavily in innovation with their latest iTero Lumina models, the older scanners are not being neglected. Their widespread adoption and proven durability mean they still offer significant profitability without demanding major new research and development expenditures.

As of late 2023, Align Technology reported that its iTero scanner installed base had surpassed 100,000 units globally, with a significant portion of these being from previous generations. This large installed base is key to the ongoing revenue generation from service and consumables.

The core exocad CAD/CAM software licenses, now part of Align Technology's portfolio, represent a significant Cash Cow. These foundational modules are the backbone for a vast number of dental labs and clinics globally, generating a consistent and predictable revenue stream. Their widespread adoption and essential nature in digital dentistry ensure stable demand.

Align Technology's acquisition of exocad has solidified these software licenses as a key revenue driver. The high market penetration of these core functionalities, critical for digital workflows, translates into substantial and reliable profit margins. The relatively low ongoing investment required for maintenance further enhances their Cash Cow status, providing robust financial stability.

Invisalign Retainer Subscription Service

Align Technology's Invisalign retainer subscription service functions as a classic Cash Cow within the BCG matrix. This model capitalizes on their established Invisalign patient base, transforming post-treatment maintenance into a predictable and consistent revenue source. The service taps into the recurring need for retainers, ensuring continued customer loyalty and predictable cash flow for Align Technology.

The retainer subscription offers a low-growth, high-cash generation opportunity. With a significant market share among those who have undergone Invisalign treatment, the marketing costs associated with retaining these customers are minimal. This allows the service to efficiently convert its established customer relationships into substantial cash returns. For instance, Align reported that in 2023, a significant portion of their revenue was driven by consumables and services, which includes retainers, underscoring the stability of this segment.

- Steady Recurring Revenue: The subscription model creates a predictable income stream independent of new treatment starts.

- Leverages Existing Customer Base: It effectively monetizes the large installed base of Invisalign patients.

- Low Marketing Investment: High customer retention due to product necessity minimizes ongoing acquisition costs.

- Consistent Cash Generation: This service provides a reliable source of cash with minimal need for reinvestment in growth.

Invisalign Go/Lite/Express Aligners

Invisalign Go, Lite, and Express aligners are considered cash cows for Align Technology. These offerings target less complex orthodontic cases, driving substantial shipment volumes even with lower average selling prices per treatment. This segment benefits from Align's dominant market share in a mature, high-volume sector, ensuring steady revenue and robust cash flow generation.

The increasing proportion of these non-comprehensive solutions within Align Technology's overall product mix highlights their established and dependable contribution to the company's financial performance. For instance, in the first quarter of 2024, Align reported a significant number of shipments for their clear aligner products, with a notable portion attributed to these shorter treatment protocols.

- High Volume, Lower ASP: Invisalign Go, Lite, and Express cater to simpler cases, leading to high shipment volumes despite lower average selling prices per case.

- Mature Market Dominance: Align holds a strong position in this mature market segment, providing consistent revenue and cash flow.

- Product Mix Shift: Recent financial reports indicate a growing contribution from these non-comprehensive solutions, solidifying their cash cow status.

- 2024 Performance: Align Technology's Q1 2024 results showed robust performance in their clear aligner business, underscoring the ongoing strength of their product portfolio, including these high-volume offerings.

Align Technology's established Invisalign treatments for adult comprehensive cases are prime examples of Cash Cows. These mature offerings, especially in North America and Europe, benefit from significant market penetration and consistent demand, generating substantial and predictable cash flow for the company. Even with moderate market growth, their profitability and strong market share solidify their Cash Cow status.

The iTero scanner family, particularly older models like the iTero Element series, continues to be a reliable Cash Cow. With a vast installed base, these scanners generate consistent revenue through service contracts and consumables, requiring minimal further investment. Align reported over 100,000 iTero scanners installed globally by late 2023, a significant portion being these mature units.

Align Technology’s Invisalign retainer subscription service is another strong Cash Cow. It leverages the extensive Invisalign patient base, creating a predictable revenue stream from recurring needs with low marketing costs. This service significantly contributes to Align's overall financial stability.

Invisalign Go, Lite, and Express treatments also function as Cash Cows by targeting less complex cases, driving high shipment volumes. These products benefit from Align's market dominance in a mature segment, ensuring consistent revenue and cash generation. Align's Q1 2024 results indicated robust performance in clear aligners, highlighting the ongoing strength of these high-volume offerings.

| Product Segment | BCG Matrix Category | Key Characteristics | Supporting Data (Illustrative) |

| Invisalign Adult Comprehensive Cases | Cash Cow | Mature, high market share, stable demand, consistent cash flow. | Over 2.5 million new patient starts globally in 2023. |

| iTero Scanners (Older Models) | Cash Cow | Large installed base, recurring service/consumable revenue, low investment. | Over 100,000 iTero scanners installed globally (late 2023). |

| Invisalign Retainer Subscriptions | Cash Cow | Leverages existing base, recurring revenue, low marketing cost. | Significant contribution to consumables and services revenue (2023). |

| Invisalign Go, Lite, Express | Cash Cow | High volume, lower ASP, mature market, consistent cash. | Strong performance in Q1 2024 clear aligner business. |

Preview = Final Product

Align Technology BCG Matrix

The Align Technology BCG Matrix you are previewing is the complete, unedited document you will receive immediately after purchase. This means you get the full strategic breakdown, ready for your analysis without any alterations or watermarks. It’s a professionally formatted report designed for immediate application in your business planning.

Dogs

Legacy software versions or minor features from Align Technology that are no longer actively updated or supported would be classified as Dogs in the BCG matrix. These are products that have a low market share because newer innovations have surpassed them. They are also in a low-growth phase, meaning they aren't attracting many new users.

Align Technology's commitment to digital platform evolution means older, less efficient software components are naturally phased out. This strategy helps to avoid the drain on maintenance resources that supporting outdated systems can cause. For instance, while Align continues to innovate its iTero scanner software, older scanner models that lack advanced features may see diminishing support.

Underperforming niche ancillary products within Align Technology's portfolio would be categorized as Dogs in the BCG Matrix. These are offerings that have struggled to capture significant market share, often operating in specialized or less dynamic segments of the dental market. For instance, a particular digital scanning accessory or a training module for a highly specific procedure that didn't resonate broadly with dentists would fit this description.

These products typically demonstrate low growth and low market share, meaning they contribute little to Align's revenue and profitability. In 2023, Align's overall revenue reached $3.87 billion, and while specific ancillary product performance isn't granularly detailed, any product in this category would represent a drag on resources without a clear path to improvement or significant market penetration.

Ineffective or discontinued marketing initiatives represent Align Technology's 'Dogs' in the BCG Matrix. These are past campaigns or promotional strategies that failed to achieve their intended adoption rates or market penetration in specific regions or for particular products.

Such initiatives, while not physical products, still consumed valuable investment capital without delivering significant returns or contributing to market share expansion. For instance, a regional campaign for Invisalign Lite in a less receptive market might have shown poor ROI.

Align’s strategic approach involves identifying and discontinuing these underperforming marketing efforts to reallocate resources. This allows for a more efficient distribution of capital towards initiatives with higher growth potential or proven success, ensuring a focus on profitable market segments.

Specific Geographic Micro-Markets with Stagnant Adoption

Certain very small or highly saturated geographic micro-markets can be considered Dogs in Align Technology's BCG Matrix. These are areas where Align's market share is minimal and stagnant, perhaps due to strong local competitors, complex regulatory environments, or distinct local consumer preferences. For instance, in 2024, some niche urban areas in Western Europe might exhibit this characteristic, where established dental providers have deeply entrenched relationships and brand loyalty that Align struggles to penetrate.

These micro-markets typically show very low growth prospects and limited market penetration. Pursuing significant revenue expansion in these challenging niches would likely require an investment of resources that is disproportionate to the potential return. Align may strategically decide to reduce its focus or resource allocation in these specific, difficult-to-enter markets to concentrate on higher-potential areas.

Consider the following characteristics for these Dogs segments:

- Low Market Share: Align holds a negligible percentage of the orthodontic market in these specific locations.

- Stagnant Growth: The overall market for clear aligners in these micro-markets is not expanding, or is growing at a rate significantly below the company average.

- Intense Local Competition: Established local dental practices or regional orthodontic providers dominate these areas, making market entry difficult.

- Limited Investment ROI: The cost and effort to gain meaningful traction are too high compared to the potential revenue generation.

Underutilized Older Patents or Technologies

Align Technology's extensive patent portfolio likely includes older technologies that haven't achieved widespread commercial success or have been superseded by newer innovations. These underutilized assets, while representing past R&D investment, currently fall into a category similar to 'Dogs' in the BCG matrix. They may not contribute significantly to current revenue streams or market share, representing a potential drain on resources without a clear path to future growth.

Consider the impact of their early invisible aligner technology patents; while foundational, the market has evolved dramatically with advancements in digital scanning and AI-driven treatment planning. Align Technology's 2023 annual report highlighted significant investment in R&D for next-generation products, underscoring the dynamic nature of their intellectual property landscape.

- Historical Patent Value: Older patents may represent sunk costs without current market traction.

- Reduced Market Relevance: Technologies overshadowed by newer advancements often lose commercial viability.

- Resource Allocation: Maintaining and defending underutilized IP can divert resources from growth areas.

- Potential for Re-evaluation: A strategic review could identify licensing or divestment opportunities for these older assets.

Products or services that have low market share and operate in low-growth markets are classified as Dogs by Align Technology. These offerings, such as older software versions or underperforming ancillary products, consume resources without generating substantial returns. For instance, a niche marketing campaign that showed poor ROI in a less receptive market in 2023 would fit this category.

Align's strategy involves identifying and phasing out these Dogs to reallocate capital toward more promising ventures. This focus on efficiency ensures that resources are directed to areas with higher growth potential, mirroring the company's commitment to innovation in clear aligner technology and digital dentistry.

The company's 2023 revenue of $3.87 billion underscores the importance of optimizing the product portfolio by removing these underperformers.

Align Technology's approach to its 'Dogs' involves strategic divestment or discontinuation to streamline operations and focus on high-growth areas.

Question Marks

Align X-ray Insights, launched in March 2025 across the EU and UK, is an AI-powered diagnostic software for 2D dental radiographs. This product sits in the "Question Mark" category of the BCG matrix due to its position in the burgeoning AI in dentistry market, which is experiencing significant growth.

The AI in dentistry market is projected to reach over $2.5 billion by 2027, demonstrating substantial growth potential for Align X-ray Insights. However, as a nascent product, it currently possesses a low market share within this expanding sector.

This low market share necessitates substantial investment in marketing, sales, and further development to gain traction and compete effectively. Without this strategic investment, Align X-ray Insights risks remaining a low-share product in a high-growth market.

The iTero Lumina Pro, introduced in March 2025, represents Align Technology's latest advancement in intraoral scanning. Its inclusion of Near Infra-Red Imaging (NIRI) technology is a significant differentiator, promising improved detection of interproximal cavities and enhanced capabilities for restorative dental work. This positions it to capitalize on the increasing adoption of digital workflows in dentistry.

Given its cutting-edge NIRI technology and broader restorative applications, the iTero Lumina Pro exhibits strong potential for high market growth. This potential is crucial for its placement within the BCG matrix. However, as a new entrant to the market in early 2025, its future success hinges on its ability to quickly capture significant market share and establish a dominant presence.

To be classified as a Star, the iTero Lumina Pro must demonstrate rapid adoption and high growth in a market segment where Align Technology is already a strong player. The success of its NIRI technology in clinical practice will be a key determinant in its ability to outpace competitors and solidify its position as a market leader. Align Technology's existing market share in intraoral scanners provides a solid foundation, but continued innovation and effective market penetration are essential.

The Invisalign System with mandibular advancement, launched in 2025, targets growing patients aged 10 to 16 with Class II skeletal and dental issues. This innovative system utilizes occlusal blocks to facilitate correction, tapping into a specialized, high-growth area of orthodontics.

While currently holding a modest market share within its specific niche, this product represents a significant opportunity for Align Technology. Its potential to evolve into a Star within the BCG matrix is high, contingent on sustained investment and increasing market acceptance.

Advanced AI Integrations within ClinCheck/Digital Platform

Align Technology is heavily investing in advanced AI within its ClinCheck software and digital ecosystem. This focus aims to refine treatment planning for better patient outcomes and boost practice efficiency, marking a significant growth opportunity.

While these sophisticated AI tools currently hold a relatively small market share among dental professionals, their strategic importance for future innovation and market dominance is undeniable. By 2024, Align reported significant advancements in AI-driven diagnostics and treatment simulation within ClinCheck.

- AI-driven treatment simulation: Enhancing precision and predictability in orthodontic outcomes.

- Predictive analytics: Identifying potential treatment challenges early on.

- Automated treatment adjustments: Streamlining the workflow for dental professionals.

- Personalized treatment pathways: Tailoring plans based on individual patient data and AI insights.

Direct 3D Printing Capabilities (from Cubicure acquisition)

Align Technology's strategic acquisition of Cubicure in late 2023/early 2024 significantly bolstered its direct 3D printing capabilities. This move positions Align to leverage Cubicure's pioneering technology for the scalable, in-house manufacturing of clear aligners and other dental devices. While the direct revenue contribution from this segment is currently minimal, its potential within the rapidly expanding 3D printing market classifies it as a Question Mark. Continued investment is essential to realize the full market potential of this advanced manufacturing technology.

The integration of Cubicure's direct 3D printing technology is vital for Align's long-term innovation pipeline, particularly for enhancing production efficiency and exploring new product applications. This technological domain is experiencing robust growth, with the global 3D printing market projected to reach over $60 billion by 2030, according to various industry forecasts. Despite its strategic importance, the direct market share and standalone revenue generated by Cubicure's technology within Align's overall portfolio remain low at this early stage.

- Strategic Investment: Align Technology's acquisition of Cubicure, a direct 3D printing leader, was completed in late 2023/early 2024 to enhance core manufacturing capabilities.

- High-Growth Domain: Direct 3D printing is a crucial technology for future innovation and scalable production of aligners and other devices, operating in a high-growth technological sector.

- Low Current Contribution: The direct revenue and market share as a standalone product are currently low, characterizing it as a Question Mark in the BCG matrix.

- Future Potential: Continued strategic investment is necessary to unlock the significant market potential and competitive advantages offered by this advanced manufacturing technology.

Question Marks represent new products or services with low market share in high-growth markets. These require significant investment to increase their share. Failure to do so can lead to them becoming Dogs. The AI-driven treatment simulation within ClinCheck software, while innovative and operating in a rapidly expanding AI in dentistry market, currently holds a small market share.

Align X-ray Insights, an AI-powered diagnostic tool for dental radiographs, is another prime example. It operates in the burgeoning AI in dentistry sector, which is expected to exceed $2.5 billion by 2027, but its current market share is low.

Similarly, Align Technology’s strategic acquisition of Cubicure in late 2023/early 2024 positions them to leverage direct 3D printing technology. This is a high-growth area, but the standalone contribution of this technology to Align’s portfolio is currently minimal, classifying it as a Question Mark.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.