Alignment Healthcare Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alignment Healthcare Bundle

Alignment Healthcare operates in a dynamic healthcare landscape, facing significant pressures from powerful buyers and intense rivalry among existing players. Understanding these forces is crucial for navigating its competitive terrain.

The complete report reveals the real forces shaping Alignment Healthcare’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Alignment Healthcare depends on a robust network of physicians and hospitals to deliver its integrated health services. The leverage these providers hold can fluctuate based on their expertise, standing, location, and the demand for their specific skills. For instance, major hospital networks or specialized medical groups often wield greater influence, particularly in regions where patient choice is restricted.

In 2024, the healthcare landscape continued to see consolidation, potentially strengthening the bargaining power of larger provider groups. As of early 2024, the average physician reimbursement rate from managed care plans, a key factor in provider negotiations, remained a critical point of discussion, with ongoing efforts to balance value-based care with traditional fee-for-service models.

Alignment's strategic emphasis on a high-tech, high-touch approach aims to cultivate deeper partnerships with these healthcare providers. This collaborative strategy is designed to align interests and potentially reduce the adversarial nature of negotiations, thereby moderating the suppliers' bargaining power.

Alignment Healthcare's reliance on its proprietary AVA® technology means the bargaining power of the underlying software and technology vendors is a key consideration. If AVA® incorporates unique, mission-critical components or licenses from specific providers that are difficult to substitute, these vendors could hold considerable sway. For instance, specialized AI algorithm providers or unique data analytics platforms integrated into AVA® could command higher prices or stricter terms.

Conversely, if the core technologies powering AVA® are largely commoditized or if Alignment has developed robust in-house expertise and alternative solutions, the bargaining power of these external vendors would be considerably diminished. Companies like Microsoft or Amazon Web Services, while critical infrastructure providers, often face intense competition, limiting their individual bargaining power unless they offer highly proprietary, integrated solutions that are deeply embedded and difficult to migrate away from. The ability of Alignment to develop its own software or switch between similar service providers directly impacts this dynamic.

The bargaining power of pharmaceutical companies and medical device manufacturers is a significant factor for Alignment Healthcare. While Alignment focuses on Medicare Advantage, the rising costs of drugs and devices directly affect their operational expenses and profitability. For instance, in 2024, the Centers for Medicare & Medicaid Services (CMS) continued to negotiate prices for certain high-cost drugs under Medicare Part D, aiming to leverage collective bargaining power.

These suppliers often wield substantial influence due to factors like patent protection for innovative drugs, the immense costs associated with research and development, and stringent regulatory approval processes. These barriers to entry effectively limit the number of competitors for essential medications and advanced medical equipment, giving suppliers a strong hand in pricing negotiations.

Ancillary Service Providers

Ancillary service providers, such as labs, imaging centers, and transportation companies, can exert significant bargaining power over Alignment Healthcare. This power is influenced by how much Alignment relies on their services and how easily it can switch to other providers. For instance, in 2024, the home health services market saw a 6.5% growth, indicating increasing demand and potentially higher leverage for established providers if they are scarce in specific regions.

The bargaining power of these ancillary providers is also tied to the standardization of their offerings. If services like laboratory testing are highly standardized and readily available from multiple sources, Alignment's ability to negotiate favorable terms increases. Conversely, specialized services, such as advanced diagnostic imaging unique to a particular region, might grant those providers greater leverage due to limited alternatives.

- Dependence on Volume: Alignment's reliance on specific ancillary services for a large patient base strengthens the provider's position.

- Availability of Alternatives: A fragmented market with numerous providers typically reduces supplier power.

- Service Standardization: Standardized services are easier to source, diminishing individual provider leverage.

- Specialization and Concentration: Niche or regionally concentrated ancillary services can command higher prices and terms.

Human Capital (Skilled Healthcare Professionals)

The availability of skilled healthcare professionals, such as nurses, care coordinators, and data scientists, is fundamental to Alignment Healthcare's 'high-tech, high-touch' operational model. Labor shortages within the healthcare industry can significantly amplify the bargaining power of these specialized workers. This often translates into increased demands for higher salaries and more comprehensive benefits packages, directly impacting Alignment's overall operational expenditures.

The escalating demand for specialized talent in tech-enabled healthcare solutions further intensifies this pressure on companies like Alignment. For instance, the U.S. Bureau of Labor Statistics projected a 10% growth for registered nurses from 2022 to 2032, faster than the average for all occupations, highlighting a persistent demand for skilled clinical staff.

- Skilled Workforce Dependency: Alignment's model relies heavily on a specialized workforce, making them vulnerable to shifts in labor availability.

- Impact of Shortages: Healthcare labor shortages, a recognized industry-wide challenge, directly increase the bargaining power of skilled professionals.

- Cost Implications: Higher demand for talent can lead to increased compensation costs, affecting Alignment's profitability and pricing strategies.

- Tech Talent Demand: The need for data scientists and tech-savvy healthcare professionals adds another layer of competitive pressure for talent acquisition.

The bargaining power of suppliers for Alignment Healthcare is multifaceted, encompassing healthcare providers, technology vendors, pharmaceutical companies, and ancillary service providers. In 2024, the trend of healthcare provider consolidation continued, potentially increasing the leverage of larger hospital networks and specialized medical groups. Alignment's strategic focus on building strong partnerships aims to mitigate this power by aligning interests and fostering collaboration.

Technology suppliers for Alignment's AVA® platform can hold significant power if their components are unique and difficult to substitute, especially concerning specialized AI or data analytics. Conversely, competition among cloud service providers like Microsoft and AWS limits their individual leverage unless highly proprietary solutions are deeply integrated. For pharmaceutical and medical device suppliers, patent protection and high R&D costs grant them considerable pricing power, a dynamic influenced by CMS drug price negotiations in 2024.

Ancillary service providers, such as labs and imaging centers, gain leverage when Alignment has high dependence on their services and limited alternative options. The home health services market, which saw a 6.5% growth in 2024, exemplifies how increasing demand can empower established providers. Furthermore, the bargaining power of skilled healthcare professionals, particularly nurses, is amplified by ongoing labor shortages, with projected 10% growth for registered nurses between 2022 and 2032, driving up compensation demands.

| Supplier Type | Key Factors Influencing Power | 2024 Context/Data |

| Healthcare Providers (Physicians, Hospitals) | Consolidation, specialization, regional patient choice | Continued consolidation; ongoing discussions on reimbursement rates |

| Technology Vendors (AVA® Platform) | Proprietary components, integration difficulty, availability of alternatives | Competition among cloud providers limits leverage unless highly integrated |

| Pharmaceutical & Medical Device Companies | Patent protection, R&D costs, regulatory hurdles | CMS negotiating prices for high-cost drugs under Medicare Part D |

| Ancillary Service Providers (Labs, Imaging) | Dependence on volume, availability of alternatives, service standardization | Home health market grew 6.5% in 2024; specialized services offer more leverage |

| Skilled Healthcare Professionals | Labor shortages, demand for specialized skills, unionization | Projected 10% growth for RNs (2022-2032); increasing compensation demands |

What is included in the product

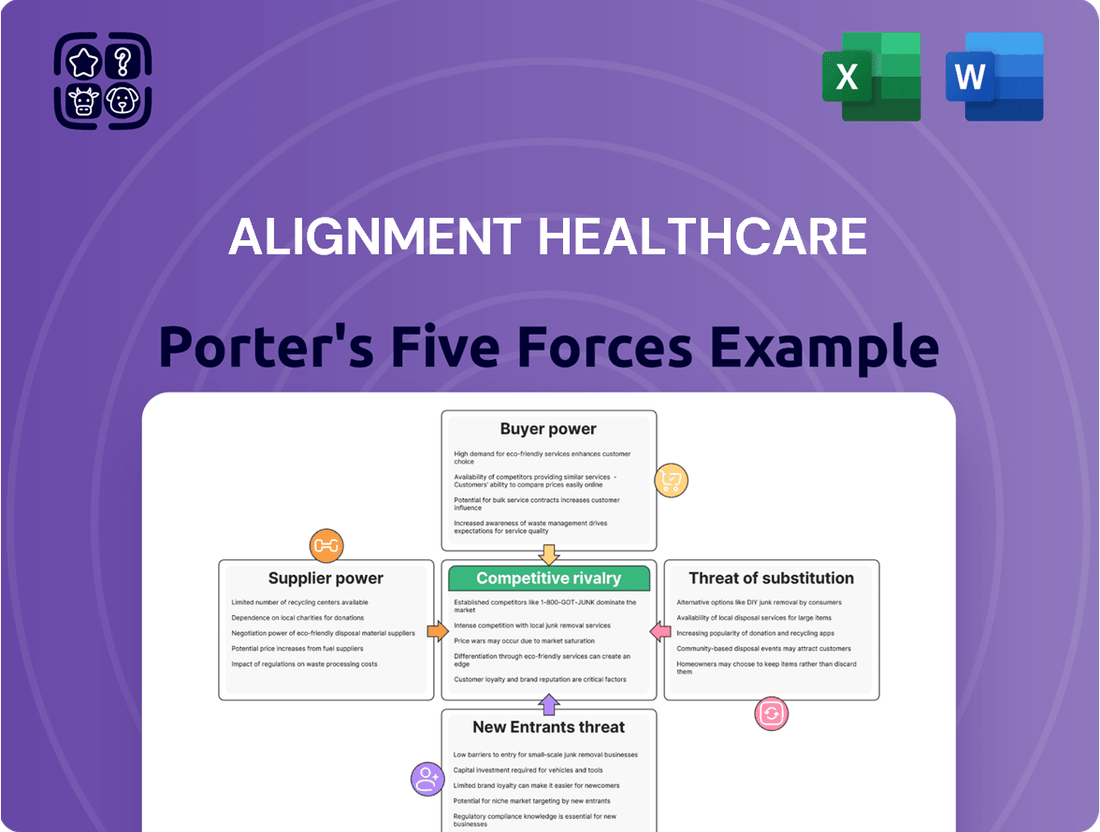

This analysis delves into the competitive forces impacting Alignment Healthcare, assessing the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the healthcare market.

Visually map competitive threats and opportunities with an intuitive spider chart, simplifying complex market dynamics for strategic planning.

Customers Bargaining Power

Medicare Advantage beneficiaries, Alignment Healthcare's primary customers, wield considerable bargaining power. They can select from a wide array of Medicare Advantage plans during open enrollment, with many beneficiaries having dozens of options from competing insurers. This choice allows them to switch to plans offering better benefits or lower costs.

The Centers for Medicare & Medicaid Services (CMS) Star Ratings system further enhances beneficiary power by enabling comparisons of plan quality. Alignment Healthcare actively strives for high Star Ratings, recognizing that this directly influences beneficiary choice and, consequently, its market position. In 2024, plans with 4 or more Stars generally attract more beneficiaries.

Moreover, CMS regulations offer significant protections and simplify the enrollment and switching processes for beneficiaries. These rules ensure transparency and ease of access, reinforcing the beneficiaries' ability to exert their bargaining power by choosing the most advantageous plans available to them.

The Centers for Medicare & Medicaid Services (CMS) acts as a powerful customer for Alignment Healthcare, dictating the rules of engagement for Medicare Advantage plans. CMS sets reimbursement rates, quality benchmarks, and the overall regulatory landscape, directly influencing Alignment's financial performance and strategic direction.

CMS's authority over payment formulas, risk adjustment methodologies, and quality incentive programs grants it significant leverage. For instance, CMS's finalized 2024 Medicare Advantage rates indicated a 3.3% increase, a figure that directly shapes revenue projections for health plans like Alignment. Any adjustments to these mechanisms can substantially alter a plan's profitability and operational flexibility.

Furthermore, CMS's recent announcements regarding 2025 plan offerings and benefit structures underscore its control over the market. Changes to benefit mandates or coverage requirements necessitate swift adaptation by providers, illustrating CMS's capacity to shape the competitive environment and influence how plans are designed and delivered.

Brokers and agents, while not direct customers, wield considerable influence over beneficiary enrollment decisions for Medicare Advantage plans like Alignment Healthcare. CMS regulations on broker compensation directly impact their incentives and, by extension, their recommendations to potential members. For instance, in 2024, broker commissions are a key factor in plan selection, and Alignment's success in building and maintaining robust relationships with these intermediaries is crucial for its customer acquisition and retention strategies within the vital Medicare Advantage distribution network.

Employer Groups/Group Retiree Plans

While Alignment Healthcare's core business revolves around individual Medicare Advantage plans, it also serves employer groups offering retiree health benefits. These employer groups, acting as consolidated customers, can wield significant bargaining power due to the sheer volume of members they represent. For instance, in 2024, the average employer contribution to retiree health benefits remained a key factor in plan negotiations.

The bargaining power of these employer groups is influenced by factors such as the total number of enrolled retirees and the potential for switching to alternative providers if Alignment Healthcare's offerings are not competitive. Alignment's capacity to customize plan designs to meet the specific needs of these employer groups can mitigate some of this power, creating a more balanced negotiation dynamic.

- Employer Group Influence: Large employer groups can negotiate more favorable terms due to concentrated enrollment.

- Retiree Volume: The number of retirees enrolled through an employer plan directly correlates to the group's bargaining leverage.

- Plan Customization: Alignment's ability to tailor plans for employer groups can influence negotiation outcomes.

Caregivers and Family Members

Caregivers and family members wield significant influence over healthcare choices for senior beneficiaries. Their involvement in researching plans, interpreting benefits, and coordinating care grants them considerable sway. Alignment Healthcare's emphasis on a personalized, high-touch approach acknowledges this indirect bargaining power, aiming to align satisfaction with both the member and their support system.

For instance, in 2024, a substantial portion of Medicare Advantage beneficiaries reported receiving assistance from family members or caregivers in selecting their health plan. This highlights the critical role these individuals play in the decision-making funnel.

- Influence in Plan Selection: Family members and caregivers often conduct the initial research and comparison of healthcare options, directly impacting which plans are considered.

- Understanding Complex Benefits: They help beneficiaries navigate and understand the intricacies of plan benefits, coverage, and provider networks, making informed choices easier.

- Care Coordination Role: As intermediaries in care management, their satisfaction with a plan's provider network and care coordination services is paramount.

- Alignment's Strategy: Alignment Healthcare's focus on member support extends to these influencers, recognizing that their positive experience translates to member retention.

Medicare Advantage beneficiaries possess substantial bargaining power due to the wide availability of plan choices and the ease with which they can switch providers. The Centers for Medicare & Medicaid Services (CMS) Star Ratings system, which benchmarks plan quality, empowers beneficiaries to compare options effectively. For example, plans achieving 4 or more Stars in 2024 typically attract more enrollment, demonstrating the direct impact of quality metrics on customer choice.

Preview the Actual Deliverable

Alignment Healthcare Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces Analysis for Alignment Healthcare, offering a detailed examination of competitive intensity and industry attractiveness. The document you see here is precisely what you will receive immediately after purchase, ensuring full transparency and no hidden content. This professionally formatted analysis is ready for your immediate use, providing valuable insights into Alignment Healthcare's strategic positioning.

Rivalry Among Competitors

Alignment Healthcare operates in a highly competitive landscape, facing significant rivalry from major national insurers. Giants like UnitedHealth Group, Humana, CVS Health (Aetna), and Elevance Health are particularly dominant in the lucrative Medicare Advantage market.

These established competitors possess substantial financial resources, expansive provider networks, and strong brand loyalty. This allows them to offer a broad spectrum of health plans across many different regions, making it challenging for newer entrants to gain substantial market share.

The sheer scale of these players is evident in their market penetration. For instance, as of early 2024, UnitedHealth Group and Humana collectively serve nearly half of all Medicare Advantage enrollees across the United States, highlighting their entrenched market position.

Alignment Healthcare faces significant competition from regional health plans, which often boast deep roots and strong local ties within specific geographic markets. These plans can leverage established relationships with local healthcare providers and a nuanced understanding of community needs to offer tailored benefits and services that resonate with beneficiaries.

The competitive landscape for Medicare Advantage plans, a key area for Alignment, remains robust. For instance, in 2024, beneficiaries in many regions had access to a wide array of plan choices, with the number of available Medicare Advantage plans continuing to be substantial, even with some industry consolidation. This high number of options underscores the intense rivalry.

Competitive rivalry at Alignment Healthcare is significantly shaped by the pursuit of quality, particularly through Centers for Medicare & Medicaid Services (CMS) Star Ratings. These ratings are paramount for attracting and retaining members in the Medicare Advantage market.

Alignment Healthcare highlights its commitment to quality, reporting that for 2025, 98% of its members are enrolled in plans achieving 4 stars or higher. This includes achieving 5-star ratings in select states, demonstrating a strong competitive edge in quality metrics.

Rival health insurers are also intensely focused on improving their Star Ratings, making quality a critical differentiator and a primary battleground in the industry. This ongoing effort means that maintaining and enhancing these ratings is a continuous strategic imperative for Alignment Healthcare.

'High-Tech, High-Touch' Model Differentiation

Alignment Healthcare stands out by blending advanced technology with personal patient interaction. Their proprietary AVA® platform, combined with dedicated local care teams, creates a unique, personalized healthcare experience. This approach is a significant differentiator, focusing on improving patient outcomes and boosting member satisfaction.

The effectiveness of Alignment's 'high-tech, high-touch' strategy is a key competitive strength. By demonstrating superior patient results and higher member contentment, they create a strong value proposition.

- Proprietary Technology: AVA® platform enables data-driven care coordination and member engagement.

- Personalized Care: Local care teams provide direct, hands-on support, fostering stronger patient relationships.

- Outcome Focus: The model is designed to improve health outcomes, a critical factor in value-based care arrangements.

- Competitive Threat: Competitors are likely to invest in similar integrated models and technological advancements to match Alignment's service delivery.

Benefit Design and Cost-Sharing

Competitive rivalry at Alignment Healthcare is significantly shaped by benefit design and cost-sharing strategies. Insurers compete not only on base premiums but also on the attractiveness of supplemental benefits and the burden of out-of-pocket expenses for members.

While the landscape shows a trend towards decreasing average premiums, with many plans offering zero-dollar premiums, a key competitive battleground involves adjustments to supplemental benefits and drug deductibles. For instance, in 2024, Medicare Advantage plans saw an average monthly premium of $17.50, a slight decrease from the previous year, but the nuances in supplemental offerings and cost-sharing remain critical differentiators.

Alignment Healthcare must therefore engage in strategic plan design to ensure its offerings remain appealing to beneficiaries. This involves a delicate balance: maintaining competitiveness through attractive benefits and manageable out-of-pocket costs while simultaneously ensuring profitability amidst evolving regulations and market pressures. The ability to innovate in benefit structure, such as offering enhanced dental or vision coverage or more favorable prescription drug formularies, directly impacts market share.

- Benefit Differentiation: Competition hinges on the quality and scope of supplemental benefits beyond core Medicare coverage, including dental, vision, and hearing services.

- Cost-Sharing Management: Premiums, copayments, coinsurance, and deductibles are critical factors influencing member choice and plan affordability.

- Regulatory Impact: Changes in Medicare Advantage reimbursement rates and benefit mandates, such as those outlined by CMS, directly influence insurer pricing and benefit design strategies for 2024 and beyond.

- Market Attractiveness: Plans with lower out-of-pocket maximums and more comprehensive supplemental benefits tend to attract a larger membership base.

Competitive rivalry is intense for Alignment Healthcare, primarily driven by large national insurers and regional players vying for market share in the Medicare Advantage space. These competitors leverage significant financial resources and established provider networks to offer comprehensive plans, making it difficult for Alignment to gain traction. For instance, in early 2024, UnitedHealth Group and Humana alone covered nearly half of all Medicare Advantage enrollees nationwide.

Quality metrics, specifically CMS Star Ratings, serve as a critical battleground. Alignment Healthcare reported that for 2025, 98% of its members are in plans with 4 stars or higher, a testament to its focus on quality. However, rivals are also heavily invested in improving their ratings, intensifying the competition for high-quality plan perception.

Benefit design and cost-sharing strategies are also key differentiators. While average Medicare Advantage premiums saw a slight decrease to $17.50 in 2024, the attractiveness of supplemental benefits and the management of out-of-pocket costs remain crucial for member acquisition and retention. Alignment must strategically balance these elements to remain competitive.

| Competitor Type | Key Strengths | Impact on Alignment |

|---|---|---|

| National Insurers (e.g., UnitedHealth, Humana) | Financial scale, broad networks, brand loyalty | Significant market dominance, high barrier to entry |

| Regional Health Plans | Local provider relationships, community understanding | Strong competition in specific geographic markets |

| Focus on Quality (Star Ratings) | Member acquisition and retention driver | Continuous investment needed to maintain competitive edge |

| Benefit & Cost Design | Attractiveness of supplemental benefits, out-of-pocket costs | Requires strategic plan design to remain competitive and profitable |

SSubstitutes Threaten

Original Medicare, Parts A and B, stands as the most significant substitute for Medicare Advantage plans. Administered directly by the federal government, it offers a foundational level of healthcare coverage. In 2024, approximately 31 million beneficiaries were enrolled in Original Medicare, highlighting its substantial market presence.

Beneficiaries can opt for Original Medicare and then choose to enhance their coverage through supplemental policies. These include Medigap plans, which help pay for out-of-pocket costs, and standalone Part D plans for prescription drugs. This combination presents a direct alternative to the bundled benefits often found in Medicare Advantage plans.

Medigap plans represent a significant threat of substitutes for Medicare Advantage offerings. These plans pair with Original Medicare, covering costs like deductibles and copayments. For individuals valuing flexibility and predictable out-of-pocket expenses over the bundled services of Medicare Advantage, Medigap provides a compelling alternative, especially as more seniors opt for this approach.

Employer-sponsored retiree health plans represent a significant threat of substitution for Alignment Healthcare's Medicare Advantage offerings. Many retirees continue with coverage provided by their former employers, which can include plans that are not necessarily Medicare Advantage products but still fulfill their healthcare needs.

These employer plans often provide a sense of continuity and may offer benefits specifically designed for their former workforce, making them an attractive alternative. For instance, a substantial portion of retirees might still be covered by employer-sponsored plans, especially those who retired before a certain age or from companies with robust post-employment benefits.

The choice between sticking with an employer plan and switching to an individual Medicare Advantage plan like Alignment's hinges on a direct comparison of benefits, out-of-pocket costs, and the accessibility of healthcare providers within each network. In 2024, the landscape of employer-sponsored retiree health benefits continues to evolve, with some companies reducing or eliminating these benefits, potentially increasing the attractiveness of Medicare Advantage plans.

Other Private Health Insurance Options (Limited)

While other private health insurance options exist for individuals under 65 who don't qualify for Medicare, they pose a minimal threat to Alignment Healthcare's core business. These alternatives are generally not comparable for Alignment's primary demographic: seniors eligible for Medicare. For this group, Medicare, whether Original or Advantage plans, remains the dominant and most relevant coverage. Therefore, the threat of substitutes from these other private plans is largely negligible for Alignment's established market.

No Health Insurance (High Risk)

While highly discouraged and not a practical long-term solution, the extreme substitute of having no health insurance at all exists. This option carries immense financial risk, especially for seniors, as the cost of unexpected medical events can be catastrophic without coverage. For instance, in 2024, average out-of-pocket healthcare costs for individuals without insurance can easily run into tens of thousands of dollars for even moderate medical issues.

The penalties and financial repercussions for forgoing insurance are significant, making it an unsustainable choice for the senior demographic that Alignment Healthcare targets. The potential for unmanageable medical debt far outweighs any perceived short-term savings. This high-risk behavior, though not a true substitute, represents the ultimate avoidance of the health insurance market.

- Extreme Risk: Forgoing health insurance exposes individuals to crippling medical debt.

- Unsustainable for Seniors: This option is not viable for the target demographic of Alignment Healthcare.

- Significant Financial Penalties: The costs associated with being uninsured are substantial and unpredictable.

Original Medicare, along with its supplemental options like Medigap and standalone Part D plans, presents a direct and significant substitute for Medicare Advantage plans. In 2024, over 31 million beneficiaries were enrolled in Original Medicare, underscoring its continued prevalence as a primary coverage choice.

Employer-sponsored retiree health plans also serve as a notable substitute, offering continuity and potentially tailored benefits for former employees. The decision to remain with these plans versus enrolling in a Medicare Advantage product hinges on a comparative analysis of costs, benefits, and provider networks.

| Substitute Option | Description | 2024 Relevance |

|---|---|---|

| Original Medicare | Federally administered, foundational coverage. | 31 million beneficiaries enrolled. |

| Medigap Plans | Supplemental coverage for out-of-pocket costs with Original Medicare. | Offers predictable expenses, appealing to those valuing flexibility. |

| Standalone Part D Plans | Prescription drug coverage separate from medical benefits. | Provides choice in drug formularies and costs. |

| Employer-Sponsored Retiree Plans | Continued coverage from former employers. | Offers continuity and potentially unique benefits for retirees. |

Entrants Threaten

The Medicare Advantage market presents substantial regulatory hurdles for potential new entrants. The Centers for Medicare & Medicaid Services (CMS) imposes strict rules, making it difficult for new companies to enter and compete effectively. For instance, the CMS final rule for 2025 Medicare Advantage plans introduced new compliance requirements that any new player must immediately address.

Navigating these complex licensing procedures, stringent financial solvency requirements, and a myriad of operational regulations demands significant upfront investment and expertise. These compliance costs act as a powerful deterrent, effectively limiting the threat of new entrants into the Medicare Advantage space.

Establishing and operating a Medicare Advantage plan, like those offered by Alignment Healthcare, demands significant capital. This includes substantial investments in building a robust provider network, developing sophisticated technology infrastructure, such as Alignment's AVA® platform, and extensive marketing efforts. Furthermore, maintaining adequate financial reserves to cover anticipated healthcare costs is a critical and capital-intensive requirement.

These considerable upfront capital needs serve as a significant barrier to entry for many aspiring competitors. For instance, in 2023, Alignment Healthcare reported total assets of approximately $2.1 billion, illustrating the scale of investment required to operate within this sector.

Alignment Healthcare, like other established players, benefits from significant brand recognition and consumer trust, often a critical factor in the healthcare sector, particularly for senior populations. This trust is frequently validated through metrics like CMS Star Ratings, where higher ratings can directly translate to increased member enrollment and loyalty.

New entrants must overcome the considerable hurdle of establishing this same level of trust and recognition. Building a reputation for reliability and quality in a market where seniors prioritize proven providers requires substantial investment in marketing and customer service, making it a costly and time-consuming endeavor.

Provider Network Development

The threat of new entrants in developing a robust provider network for Medicare Advantage plans like Alignment Healthcare is significant. Building a comprehensive and high-quality network of physicians, hospitals, and other healthcare providers requires extensive negotiations, contracting, and ongoing relationship management. New entrants may find it challenging to secure favorable terms with established providers, particularly in competitive markets where existing insurers have cultivated long-standing relationships.

For instance, in 2024, the average Medicare Advantage contract negotiation can take several months, and securing a sufficient number of high-demand specialists can be particularly arduous for a new player. Established insurers often leverage their market share and existing provider contracts to create barriers to entry. This can manifest as preferential pricing or exclusive agreements that new entrants cannot easily replicate. The sheer capital and time investment needed to build a competitive provider network from scratch presents a substantial hurdle.

- Provider Network Complexity: Establishing a broad and high-quality network of physicians and facilities is a time-consuming and resource-intensive process.

- Negotiation Challenges: New entrants face difficulties in securing advantageous contracts with providers already committed to established Medicare Advantage plans.

- Market Saturation: In many competitive markets, provider capacity is already largely utilized by incumbent insurers, limiting options for newcomers.

- Relationship Capital: Existing insurers benefit from years of relationship building, which can translate into preferential treatment and loyalty from providers.

Data and Technology Infrastructure

Alignment Healthcare's reliance on its proprietary, high-tech model for personalized care and chronic disease management presents a significant barrier to new entrants. Developing a comparable data analytics and technology infrastructure demands substantial capital investment and specialized expertise, making it a formidable challenge for newcomers.

New companies would face the daunting task of either constructing such a sophisticated system from scratch or acquiring existing, potentially costly, technological solutions. For instance, building out advanced AI-driven patient management systems similar to Alignment's requires significant R&D expenditure, often running into tens or hundreds of millions of dollars. This high upfront cost and the need for continuous innovation in data science and health tech create a steep uphill battle for potential competitors.

- High Capital Investment: Building a robust, proprietary data and technology infrastructure comparable to Alignment Healthcare's requires substantial upfront capital, potentially exceeding hundreds of millions of dollars.

- Specialized Expertise: Developing and maintaining advanced data analytics, AI, and health tech platforms necessitates a deep pool of specialized talent in areas like data science, software engineering, and health informatics.

- Acquisition Costs: Alternatively, acquiring existing sophisticated technology solutions can also be prohibitively expensive, further deterring new market entrants.

The threat of new entrants into the Medicare Advantage market, where Alignment Healthcare operates, is considerably low due to high barriers. Regulatory complexity, substantial capital requirements for provider networks and technology, and the need for established brand trust significantly deter new players.

For example, building a comparable provider network to Alignment Healthcare's can take years and significant investment, with contract negotiations alone taking months in 2024. Furthermore, the capital needed to establish operations, with Alignment Healthcare reporting approximately $2.1 billion in total assets in 2023, presents a formidable financial hurdle.

The technological sophistication required, such as Alignment's AVA® platform, demands immense R&D and specialized talent, potentially costing hundreds of millions of dollars, making it a difficult barrier for newcomers to overcome.

Porter's Five Forces Analysis Data Sources

Our Alignment Healthcare Porter's Five Forces analysis is built upon data from Alignment Healthcare's official investor relations website, SEC filings, and industry-specific market research reports. This ensures a comprehensive understanding of the competitive landscape.