Alignment Healthcare Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alignment Healthcare Bundle

Curious about Alignment Healthcare's strategic product portfolio? This glimpse into their BCG Matrix highlights key areas of growth and potential challenges, offering a foundational understanding of their market positioning.

To truly grasp Alignment Healthcare's competitive edge and unlock actionable strategies, dive into the full BCG Matrix. It provides the granular detail and expert analysis needed to make informed decisions about where to invest and divest.

Don't miss out on the complete picture. Purchase the full BCG Matrix report for a comprehensive breakdown of Alignment Healthcare's Stars, Cash Cows, Dogs, and Question Marks, complete with strategic recommendations to drive future success.

Stars

Alignment Healthcare's core Medicare Advantage (MA) plans are a definite Star in the BCG matrix. This segment is experiencing rapid growth, and Alignment is capturing a significant portion of it, evidenced by a 35% year-over-year membership increase to about 209,900 members as of January 1, 2025.

The company anticipates further expansion, projecting membership to reach between 225,000 and 231,000 by the close of 2025. This sustained growth highlights their strong market position and the increasing demand for their MA offerings.

Financially, this Star status is supported by impressive revenue figures. Total revenue saw a substantial 47.5% jump in Q1 2025, reaching $926.9 million, and continued its upward trajectory with a 49.0% increase in Q2 2025, hitting $1.015 billion.

Alignment Healthcare's strategic emphasis on Chronic Condition Special Needs Plans (C-SNPs) firmly places them as a Star within the Medicare Advantage (MA) market. The industry experienced a remarkable 70% surge in C-SNP enrollment from 2024 to 2025, highlighting a significant market expansion. Alignment's success is further underscored by the fact that 64% of their total enrollment resides within this high-growth C-SNP segment, indicating a strong competitive advantage in specialized care delivery.

Alignment Healthcare's proprietary AI-enabled technology platform, AVA, is a significant Star in their BCG Matrix. AVA pulls data from over 200 sources and 13,000 attributes, enabling hyper-personalized care insights that directly boost patient outcomes.

This advanced platform has demonstrated remarkable results, including a 44% reduction in emergency room visits and a 45% decrease in skilled nursing facility admissions for high-risk members. These improvements not only enhance clinical impact but also drive margin expansion by lowering expensive care utilization.

High Star Ratings from CMS

Alignment Healthcare's commitment to quality is clearly demonstrated by its consistently high star ratings from the Centers for Medicare & Medicaid Services (CMS). This achievement is a critical factor in its strategic positioning.

In 2024, a remarkable 100% of Alignment Healthcare's members were enrolled in plans rated 4-star or higher. This represents a significant improvement from 90% in 2023. Looking ahead to 2025, the company continues this strong performance, with 98% of its members in plans rated 4-stars or higher.

These high CMS star ratings directly translate into tangible financial benefits for Alignment Healthcare. They lead to increased reimbursements and bonus payments from CMS, enhancing the company's revenue streams. This financial advantage allows Alignment to further invest in its innovative care model and expand its offerings, strengthening its competitive edge in the Medicare Advantage market.

- CMS Star Rating Impact: High star ratings from CMS are a key indicator of quality care and directly influence financial performance.

- 2024 Performance: 100% of Alignment Healthcare members were in 4-star or higher rated plans.

- 2025 Outlook: 98% of members are projected to be in 4-star or higher rated plans for 2025.

- Financial Benefits: Elevated ratings result in increased CMS reimbursements and bonus payments, fueling further investment.

Care Anywhere Program

The Care Anywhere program by Alignment Healthcare is a prime example of a Star in the BCG Matrix. It effectively extends the company's high-tech, high-touch care model by providing a 24/7 concierge care team. This initiative is currently serving 70% of eligible members, demonstrating significant market penetration.

The program's success is quantifiable, with notable improvements in patient outcomes and cost savings. It has achieved a substantial 38% decrease in inpatient admissions and a 28% reduction in 30-day readmissions.

Further solidifying its Star status, the Care Anywhere program experienced a 35% expansion in 2024, now covering 11,500 members. This growth underscores its effectiveness in delivering high-quality, efficient care and enhancing member satisfaction.

- Program Reach: Covers 70% of eligible members.

- Inpatient Admission Reduction: 38% drop.

- 30-Day Readmission Reduction: 28% decrease.

- Growth in 2024: 35% increase in covered members (11,500 total).

Alignment Healthcare's commitment to quality, reflected in its Centers for Medicare & Medicaid Services (CMS) star ratings, is a significant Star in their BCG Matrix. In 2024, a perfect 100% of their members were in plans rated 4-star or higher, a testament to their care delivery. This high standard is projected to continue, with 98% of members in 4-star or higher plans for 2025.

These elevated ratings directly translate into financial advantages, such as increased CMS reimbursements and bonus payments. This financial strength fuels further investment in their innovative care model, solidifying their competitive position in the Medicare Advantage market.

| Metric | 2023 | 2024 | 2025 (Projected) |

|---|---|---|---|

| Members in 4-Star+ Plans | 90% | 100% | 98% |

| Impact on Reimbursements | Increased | Significantly Increased | Continued Strength |

What is included in the product

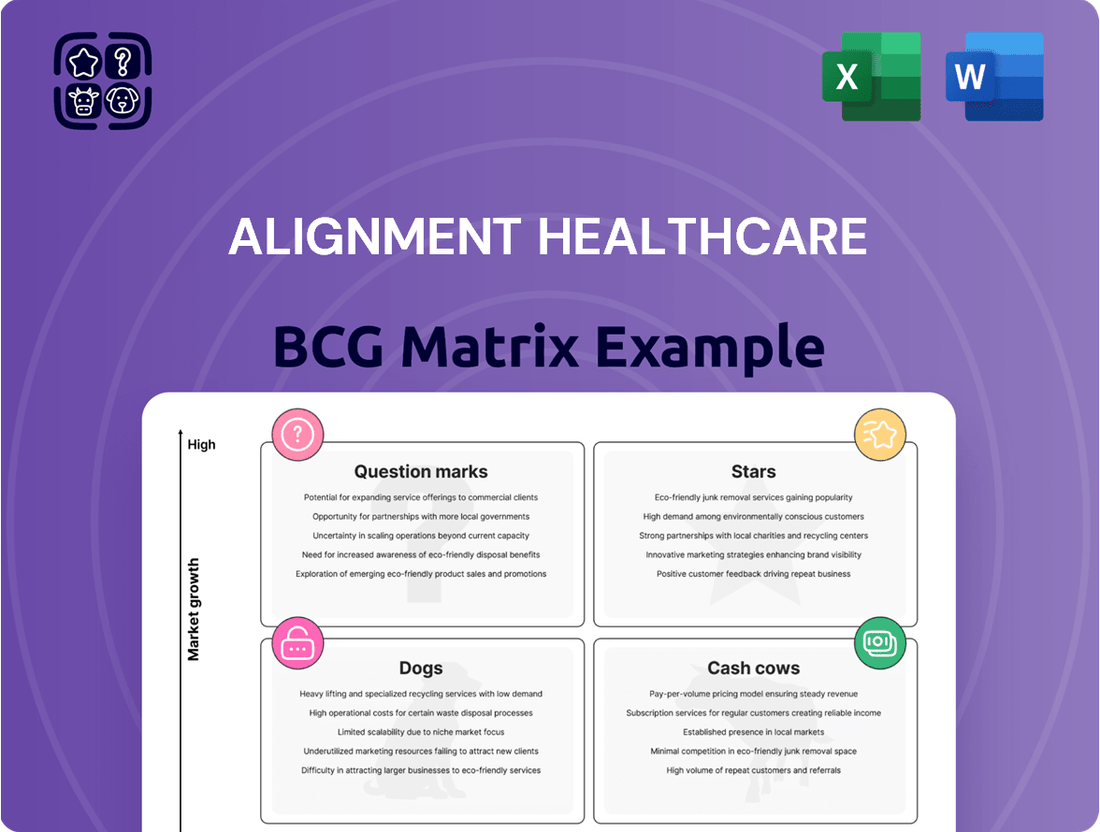

The Alignment Healthcare BCG Matrix analyzes its business units to identify Stars, Cash Cows, Question Marks, and Dogs, guiding strategic investment decisions.

A clear BCG Matrix visualizes Alignment Healthcare's portfolio, simplifying strategic decisions and alleviating the pain of resource allocation confusion.

Cash Cows

Alignment Healthcare's significant footprint in California acts as a prime Cash Cow. This established market provides a reliable source of revenue, allowing the company to generate substantial cash flow. In 2024, California represented a substantial portion of Alignment Healthcare's member base, underscoring its importance.

The company's CEO has openly described California as a 'cash cow,' highlighting its critical role in financing growth initiatives in emerging markets. This mature California operation benefits from optimized operational efficiencies and a strong market position, contributing consistently to the company's overall financial stability and revenue generation.

Alignment Healthcare's strong performance in managing medical costs, evident in its Q2 2025 medical benefits ratio (MBR) of 86.7%, firmly places its efficient medical cost management within the Cash Cow quadrant of the BCG Matrix. This impressive MBR signifies that for every dollar spent on healthcare services, Alignment effectively retains 86.7 cents as profit, demonstrating exceptional cost control. Such a high MBR directly translates into robust profit margins and a consistent, strong cash flow, underscoring the company's financial stability and operational efficiency in this crucial area.

Alignment Healthcare's robust financial performance, particularly its strong adjusted gross profit and recent positive adjusted EBITDA, firmly places it in the Cash Cow quadrant of the BCG Matrix. The company posted an adjusted gross profit of $135.2 million in the second quarter of 2025, a testament to its efficient operations and market position.

Furthermore, Alignment Healthcare achieved a significant milestone by reporting a net income of $15.7 million in Q2 2025, marking its inaugural profitable quarter as a publicly traded entity. This profitability, coupled with the anticipation of a consensus adjusted EBITDA around $40 million for 2025, underscores its ability to generate substantial cash flow, exceeding its operational needs.

Integrated Care Delivery Model

Alignment Healthcare's integrated care delivery model is a prime example of a Cash Cow within its business portfolio. This model leverages proprietary technology alongside dedicated local care teams to significantly enhance patient outcomes while simultaneously curbing the use of expensive, high-cost medical services. The focus on proactive preventive care and diligent chronic disease management translates directly into substantial cost efficiencies and demonstrably better health for its members.

This symbiotic relationship between advanced technology and personalized human interaction forms the bedrock of a robust and profitable operational structure, ensuring consistent and reliable performance. For instance, in 2023, Alignment Healthcare reported a medical loss ratio of 83.1%, indicating the cost-effectiveness of their care model in managing member health and expenses.

- Focus on Preventive Care: Reduces long-term healthcare costs by addressing health issues early.

- Chronic Disease Management: Proactive management of conditions like diabetes and heart disease lowers hospitalization rates.

- Proprietary Technology: Optimizes care coordination and data analysis for efficiency.

- Local Care Teams: Provide personalized, patient-centered support leading to better adherence and outcomes.

Brand Recognition and Member Satisfaction

Alignment Healthcare's strong brand recognition and exceptional member satisfaction are key drivers of its Cash Cow status. A Net Promoter Score (NPS) of 61, significantly outperforming the industry average of 40, highlights this member loyalty.

- High Member Satisfaction: An NPS of 61 indicates a very positive customer experience, fostering repeat business.

- Reduced Marketing Costs: Satisfied members are likely to renew and refer others, lowering the need for extensive customer acquisition efforts.

- Stable Enrollment: This loyalty translates into predictable and stable membership numbers, a hallmark of a cash cow.

- Market Share Maintenance: In a competitive landscape, strong reputation helps secure and maintain market share.

Alignment Healthcare's established presence in California functions as a significant Cash Cow, consistently generating substantial revenue and cash flow. This mature market benefits from optimized operations and a strong market position, contributing reliably to the company's financial stability. In 2024, California represented a substantial portion of Alignment Healthcare's member base, underscoring its critical importance.

The company's integrated care delivery model, combining proprietary technology with local care teams, is a prime example of a Cash Cow. This model enhances patient outcomes while controlling costs, as evidenced by a 2023 medical loss ratio of 83.1%, demonstrating efficient health management.

Alignment Healthcare's strong financial performance, including a Q2 2025 adjusted gross profit of $135.2 million and a net income of $15.7 million in the same quarter, firmly places its operations in the Cash Cow quadrant. The company's robust profit margins and consistent cash flow generation are indicative of its mature and profitable business segments.

The company's impressive medical benefits ratio (MBR) of 86.7% in Q2 2025 highlights its exceptional cost control within the Cash Cow segment. This efficiency directly translates into robust profit margins and a consistent, strong cash flow, underscoring the company's financial stability.

| Segment | BCG Quadrant | Key Performance Indicator | 2024/2025 Data Point |

|---|---|---|---|

| California Operations | Cash Cow | Revenue Generation & Market Share | Significant portion of member base in 2024 |

| Integrated Care Model | Cash Cow | Medical Loss Ratio (MLR) | 83.1% in 2023 |

| Financial Performance | Cash Cow | Adjusted Gross Profit | $135.2 million (Q2 2025) |

| Profitability | Cash Cow | Net Income | $15.7 million (Q2 2025) |

| Medical Cost Management | Cash Cow | Medical Benefits Ratio (MBR) | 86.7% (Q2 2025) |

Delivered as Shown

Alignment Healthcare BCG Matrix

The preview you are currently viewing is the exact Alignment Healthcare BCG Matrix document you will receive upon purchase, ensuring complete transparency and no hidden surprises. This comprehensive analysis, meticulously crafted by industry experts, offers a clear strategic roadmap for optimizing Alignment Healthcare's product portfolio. Upon purchase, you will gain immediate access to this fully formatted, ready-to-use report, empowering you to make informed decisions and drive business growth effectively.

Dogs

Without specific financial data on Alignment Healthcare's new market expansions as of July 2025, these ventures would hypothetically fall into the 'Dog' category of the BCG Matrix. If recent entries into new geographic areas, such as potential expansions into states not yet heavily penetrated, have not met projected membership growth targets or profitability metrics, they would represent underperforming assets.

These hypothetical underperforming markets would drain company resources without delivering the anticipated returns, necessitating a critical assessment. Such an evaluation might lead to decisions about divesting these operations or implementing a substantial strategic shift to improve their performance. Alignment Healthcare's stated strategy emphasizes strengthening its presence in current regions before venturing into new territories, indicating a measured approach to market expansion.

Alignment Healthcare's strategic focus on Medicare Advantage (MA) means any past ventures outside this core, such as niche health insurance products or technology initiatives that didn't scale or contribute to MA growth, would likely be categorized as Dogs. For instance, if Alignment had a small, underperforming supplemental benefit offering that was divested in 2023 to streamline operations, it would be a prime example. The company's 2024 performance, heavily weighted towards its MA plans, reinforces this concentration.

Alignment Healthcare's focus on its advanced AVA platform suggests a strategic move away from potentially inefficient legacy systems. If any such older systems persist, they would likely represent a Stars category in a BCG matrix, requiring significant investment to maintain and upgrade, while offering diminishing returns.

Low-Rated Plans in Specific Regions (if any)

While Alignment Healthcare generally performs well with high star ratings, there are instances where specific plans or regions might fall below the benchmark. For example, a plan in a particular state that consistently receives a CMS star rating below 4 stars would be considered a low-rated plan. These lower ratings can directly impact financial performance by reducing bonus payments and potentially hindering member enrollment.

Low star ratings can transform a plan into a financial drain, often termed a cash trap. This situation necessitates substantial investment in improvement initiatives or a strategic decision to exit the market. Alignment's recent legal success in Arizona, which saw their HMO 2025 star rating improved from 3.5 to 4 stars, demonstrates their proactive approach to addressing and mitigating these risks.

- Low Star Ratings Impact: Plans with below 4 CMS stars face reduced bonus payments and enrollment challenges.

- Financial Drain: These plans can become cash traps, requiring significant turnaround efforts or divestment.

- Mitigation Efforts: Alignment Healthcare is actively working to improve ratings, as evidenced by its Arizona HMO's star rating increase.

Services with High Medical Loss Ratios in Niche Areas (if any)

Certain niche service offerings or specific populations within Alignment Healthcare's Medicare Advantage (MA) plans might exhibit high medical loss ratios (MLRs). These segments could be consuming a disproportionate amount of cash in medical expenses without generating enough premium revenue to cover those costs, signaling a potential lack of profitability. While Alignment Healthcare reported an overall medical benefits ratio of 86.7% in 2024, indicating effective cost management across the board, these specialized areas could still present challenges.

These high MLR segments, if they aren't experiencing corresponding high growth, would essentially be cash drains. They represent areas where medical costs are outpacing premium income, a key indicator of underperformance in the BCG Matrix context. Identifying and addressing these specific service lines or member demographics is crucial for optimizing the company's overall financial health and strategic resource allocation.

- Niche Service Lines: Specific, specialized medical treatments or care coordination programs that are costly to administer.

- High-Cost Member Populations: Groups of members with complex, chronic conditions requiring extensive medical intervention.

- Low Premium Growth Segments: Areas where premium increases have not kept pace with escalating medical utilization and costs.

- Impact on Profitability: These segments could be masking the true profitability of other, stronger areas of the business.

Hypothetical underperforming markets or niche service lines within Alignment Healthcare that consume resources without generating sufficient returns would be classified as Dogs in the BCG Matrix. These could include older, less efficient technology platforms or specific regional plans that struggle with membership growth and profitability. For instance, if a particular supplemental benefit offering failed to gain traction and was subsequently divested, it would fit this category.

Alignment Healthcare's 2024 performance, heavily reliant on its Medicare Advantage (MA) plans, highlights the importance of focusing on high-growth, high-share areas. Any ventures outside this core that have not met expectations, such as poorly performing legacy systems or niche services with high medical loss ratios, represent potential Dogs. The company's strategic emphasis on strengthening its existing MA presence underscores a cautious approach to expansion, aiming to avoid creating new underperforming assets.

The company's proactive approach to improving star ratings, like the Arizona HMO's increase from 3.5 to 4 stars for 2025, demonstrates a commitment to turning around potentially weak areas. However, plans that consistently underperform, perhaps with star ratings below 4, can become financial drains, requiring significant investment or divestment. These situations, if not addressed, would solidify their position as Dogs in the portfolio.

While Alignment Healthcare reported a strong overall medical benefits ratio of 86.7% in 2024, specific segments with disproportionately high medical loss ratios could still be considered Dogs. These are areas where medical costs outpace premium income, acting as cash drains. Identifying and managing these specific service lines or member demographics is crucial for optimizing the company's financial health.

Question Marks

Alignment Healthcare's strategic push into new geographic territories positions it squarely within the Question Mark quadrant of the BCG Matrix. The company's ambition to expand from its current five states to potentially serve between 500,000 and 1 million members in the coming years highlights this dynamic.

Entering these new, often high-growth markets presents a significant challenge; Alignment Healthcare starts with a minimal market share, necessitating substantial capital infusion to build brand awareness and capture a meaningful customer base. This investment is crucial for these ventures to transition from Question Marks to potential Stars in the future.

Alignment Healthcare’s potential expansion into new Medicare product types, beyond its existing Medicare Advantage and Special Needs Plans (SNPs), would likely place these ventures in the Question Mark category of the BCG Matrix. While the specific exploration of these new product types hasn't been detailed in recent public statements, the broader Medicare market presents significant growth opportunities. However, any new product would likely start with a small market share, demanding considerable investment and strategic adaptation to establish a foothold.

Developing and launching these new Medicare products would require Alignment Healthcare to adapt its established high-tech, high-touch model to meet the distinct needs of different beneficiary segments. This necessitates robust research and development efforts to ensure the new offerings resonate with potential enrollees and align with evolving regulatory landscapes. For instance, as of early 2024, the Centers for Medicare & Medicaid Services (CMS) continues to refine benefit structures and payment models, creating both challenges and opportunities for innovation within the Medicare ecosystem.

Alignment Healthcare's significant investments in agentic AI and advanced automation are designed to boost long-term scalability and profitability. These cutting-edge technologies offer substantial potential for disruption and efficiency improvements across its operations.

However, as of 2024, the full impact and return on investment for these advanced technologies are still in the process of being realized. The company is strategically adopting a 'fast follower' approach, indicating a measured yet forward-looking stance on these high-growth, but not yet fully proven, technological advancements.

Strategic Partnerships with Emerging Healthcare Providers

Forming strategic partnerships with emerging healthcare providers presents a classic Question Mark scenario for Alignment Healthcare. These collaborations hold the potential to tap into rapidly expanding markets and introduce novel service lines, but their ultimate success is far from guaranteed. The integration of these innovative models into Alignment's established framework carries inherent risks and demands meticulous oversight.

The success of these ventures hinges on several factors. For instance, Alignment might partner with a telehealth startup focused on chronic disease management, a sector projected to grow significantly. In 2024, the global telehealth market was valued at approximately $272 billion, with projections indicating continued robust expansion. However, the ability of such a partnership to gain traction, achieve profitability, and complement Alignment's existing Medicare Advantage offerings will be critical.

- Market Potential: Emerging providers often operate in high-growth niches within healthcare, offering Alignment access to new patient populations and service areas.

- Integration Risk: Successfully merging new care models with Alignment's existing infrastructure and regulatory compliance is a significant challenge.

- Financial Investment: These partnerships typically require substantial upfront investment with uncertain returns, characteristic of Question Marks.

- Strategic Alignment: Ensuring the partner's mission and operational capabilities align with Alignment's long-term vision is paramount for success.

Response to Evolving Regulatory Landscape in MA

Alignment Healthcare's position as a Question Mark in the BCG Matrix is heavily influenced by its response to the evolving Medicare Advantage regulatory environment. The company has shown adaptability in navigating changes to payment models, which are crucial for its revenue streams. For instance, the Centers for Medicare & Medicaid Services (CMS) continually updates risk adjustment methodologies, impacting how capitated payments are calculated. Alignment Healthcare's success hinges on its ability to accurately capture patient health data and coding practices to reflect true member acuity, a constant challenge given increased audit scrutiny.

The company's efforts to maintain high Star Ratings, a key determinant of bonus payments and member enrollment, are directly tied to regulatory compliance and quality of care. A dip in Star Ratings can significantly affect profitability. For example, a 1-star improvement in a plan's rating can lead to substantial increases in per-member-per-month (PMPM) payments. Alignment Healthcare's ongoing investment in care coordination and member engagement aims to bolster these ratings, but the effectiveness of these strategies is constantly being tested by new quality metrics and reporting requirements.

The increased focus on audits by CMS and other bodies presents both a risk and an opportunity. While robust compliance programs can mitigate penalties, the resources required for such efforts are considerable. Alignment Healthcare's proactive approach to audits, including investing in advanced data analytics for risk mitigation, is essential. The company's ability to demonstrate compliance and defend its payment methodologies will be critical in its transition from a Question Mark to a potential Star or Cash Cow.

- Adaptation to Payment Model Changes: Alignment Healthcare must continuously adjust its actuarial and clinical operations to align with evolving Medicare Advantage risk adjustment payment models, which saw significant adjustments in recent years impacting revenue projections.

- Maintaining High Star Ratings: The company's success is contingent on upholding or improving its Medicare Advantage Star Ratings, which directly influence bonus payments. For example, plans achieving 4.5 stars or higher often receive enhanced reimbursements compared to those with lower ratings.

- Navigating Audit Scrutiny: Increased federal audits on coding practices and care management require significant investment in compliance infrastructure and data integrity to avoid financial penalties and reputational damage.

- Balancing Risk and Growth: Effectively managing the inherent risks of regulatory shifts while capitalizing on opportunities for market expansion and member growth will determine Alignment Healthcare's ability to solidify its position in the Medicare Advantage market.

Alignment Healthcare's ventures into new geographic markets and product lines, coupled with its adoption of advanced technologies like agentic AI, place it firmly in the Question Mark quadrant of the BCG Matrix. These initiatives represent potential high-growth opportunities but require substantial investment due to low initial market share and unproven returns.

The company's strategic partnerships with emerging healthcare providers also fall into this category, offering access to new patient populations but carrying inherent integration risks and uncertain financial outcomes. Navigating the evolving Medicare Advantage regulatory landscape, including payment model adjustments and increased audit scrutiny, further defines Alignment Healthcare's Question Mark status, demanding continuous adaptation and investment to achieve success.

| Initiative | Market Growth Potential | Current Market Share | Investment Required | Risk Level |

|---|---|---|---|---|

| Geographic Expansion | High | Low | High | High |

| New Medicare Products | High | Low | High | High |

| Agentic AI/Automation | High | Emerging | High | Medium |

| Strategic Partnerships | High | Low | High | High |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.