Alan Allman Associates Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alan Allman Associates Bundle

Alan Allman Associates navigates a landscape shaped by powerful competitive forces. Understanding the intensity of rivalry, the bargaining power of buyers and suppliers, and the threats of new entrants and substitutes is crucial for strategic success.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Alan Allman Associates’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Alan Allman Associates, a consulting group, thrives on the expertise of its highly skilled consultants. The demand for specialized knowledge in rapidly evolving fields such as artificial intelligence, cloud computing, and data analytics means that individuals with these rare skills hold significant leverage. For instance, in 2024, the demand for AI specialists outstripped supply, with some reports indicating a shortage of over 300,000 AI professionals globally, directly impacting the cost and availability of such talent.

This scarcity empowers individual consultants or smaller, niche firms possessing unique certifications or proprietary methodologies. As the consulting landscape increasingly favors hyper-specialization, these highly sought-after experts or boutique firms gain considerable influence, driving up their value proposition and, consequently, their bargaining power with larger organizations like Alan Allman Associates.

Alan Allman Associates' reliance on a network of independent consulting firms grants these firms a degree of bargaining power. As key providers of specialized expertise, their ability to dictate terms or even choose engagements is influenced by market demand for their niche skills and their established reputation.

For instance, in 2024, the demand for specialized cybersecurity consulting saw a significant surge, giving highly sought-after independent cybersecurity firms within such networks more leverage in negotiating rates and project scopes. This dynamic is further amplified when these independent firms possess unique methodologies or certifications that are not readily available elsewhere.

In the digital consulting world, Alan Allman Associates depends heavily on technology and software suppliers for essential tools and infrastructure. If specific software or cloud services become industry benchmarks or offer exclusive functionalities, their providers can wield considerable influence through pricing and licensing agreements. For instance, the global cloud computing market was projected to reach $1.3 trillion in 2024, indicating substantial reliance on these providers.

The increasing integration of artificial intelligence and advanced cloud solutions amplifies this dependence. Companies offering specialized AI platforms or robust cloud services can command higher prices or impose stricter terms if their offerings are critical and difficult to substitute. This dynamic was evident in 2024 with significant investments in AI startups, underscoring the value and potential leverage of these technology innovators.

Data and Analytics Providers

The consulting industry, especially in areas like business transformation and performance improvement, is heavily reliant on data. This makes providers of robust data, market intelligence, and advanced analytics platforms very important. Firms like Alan Allman Associates need access to these services to remain competitive.

Suppliers who offer proprietary or exceptionally accurate data and analytics can wield significant power. This leverage stems from the essential nature of their offerings for consulting firms aiming to deliver value to clients. For instance, the global big data and analytics market was valued at approximately $271.8 billion in 2022 and is projected to reach $655.8 billion by 2029, showcasing the immense value and demand for these services.

- Data Dependency: Consulting firms increasingly depend on specialized data and analytics to inform strategies and drive client outcomes.

- Proprietary Advantage: Suppliers with unique datasets or advanced analytical capabilities possess a distinct advantage.

- Market Growth: The expanding market for data and analytics underscores the growing bargaining power of its key providers.

- High Switching Costs: Integrating new data platforms can be complex and costly, further solidifying the position of established suppliers.

Training and Certification Bodies

Training and certification bodies can wield significant bargaining power in the consulting industry. The need for continuous upskilling to stay relevant in a dynamic market means that consultants and firms rely on these institutions for essential knowledge and credentials. For example, in 2024, the global IT training market alone was valued at over $40 billion, highlighting the substantial investment in professional development.

The recognition and perceived necessity of specific certifications directly translate to supplier power. If a particular certification is a de facto standard for certain consulting specializations, such as cloud computing or cybersecurity, the bodies issuing them can command higher fees and dictate terms. This dependence ensures that consulting firms must engage with these suppliers to maintain their competitive edge and client trust.

- High Demand for Specialized Skills: The consulting sector constantly requires updated expertise, making accredited training programs indispensable.

- Industry-Recognized Certifications: The value placed on certifications from reputable bodies allows them to influence pricing and program requirements.

- Barriers to Entry: The rigorous nature of some certifications can act as a barrier, increasing the leverage of the certifying organizations.

- Impact on Consultant Employability: Consultants' career progression and employability are often tied to possessing up-to-date certifications, reinforcing the suppliers' power.

Suppliers in the consulting industry, particularly those providing specialized technology, data, or training, can exert significant bargaining power. This is driven by the essential nature of their offerings and the increasing demand for niche expertise, as seen in the 2024 market for AI and cybersecurity professionals.

When consulting firms like Alan Allman Associates rely on unique software, proprietary data, or industry-standard certifications, these suppliers gain leverage. The high switching costs associated with adopting new platforms and the critical role of these services in client delivery further solidify supplier influence.

The bargaining power of suppliers is amplified by market growth in areas like cloud computing and big data analytics, with substantial investments in 2024 highlighting the value of these providers. Similarly, the over $40 billion global IT training market in 2024 demonstrates the importance of certification bodies, which can dictate terms due to the demand for up-to-date skills.

| Supplier Type | Key Factors Influencing Power | 2024 Market Context/Data |

|---|---|---|

| Technology & Software Providers | Criticality of offering, exclusivity, industry benchmark status | Global cloud computing market projected over $1.3 trillion; significant AI startup investments |

| Data & Analytics Providers | Proprietary data, analytical accuracy, essential for strategy | Big data and analytics market valued ~$271.8 billion (2022), projected growth |

| Training & Certification Bodies | Industry-recognized credentials, demand for upskilling | Global IT training market exceeded $40 billion |

What is included in the product

This analysis meticulously examines the five forces shaping Alan Allman Associates' competitive environment, offering actionable insights into industry attractiveness and strategic positioning.

Effortlessly identify and mitigate competitive threats with a visual, easy-to-understand breakdown of Porter's Five Forces.

Customers Bargaining Power

Alan Allman Associates' strategy of serving a diverse range of sectors significantly dilutes the bargaining power of individual clients. This broad client base means that the loss of any single customer, even a large one, would have a minimal impact on the firm's overall revenue. This diversification is a key element in their RISE 2025 strategic plan, which explicitly aims to maintain client independence.

For consulting firms like Alan Allman Associates, the project-based nature of engagements significantly amplifies customer bargaining power. Clients frequently source proposals from multiple firms for a single project, enabling them to compare not only pricing but also the depth of expertise and the proposed approach. This competitive bidding process means clients can effectively dictate terms, pushing for better value and more tailored solutions.

In 2024, the demand for specialized consulting services remained robust, yet clients were more discerning than ever. For instance, a survey of Fortune 500 companies indicated that over 70% actively sought multiple bids for major IT and strategy projects, a trend that directly pressures consulting fees. This environment forces firms to demonstrate clear ROI and unique value propositions to secure and retain business.

Clients are increasingly focused on tangible outcomes, pushing for clear Return on Investment (ROI) from consulting services. This trend is reshaping how services are priced, with a growing preference for value-based or contingency models where payment is directly linked to the success achieved.

This shift significantly amplifies client bargaining power. When fees are contingent on demonstrable results, clients can negotiate more aggressively, knowing their financial commitment is directly tied to the value delivered by the consulting firm.

For instance, in 2024, a significant portion of consulting contracts began incorporating performance-based clauses, with some studies suggesting over 30% of new engagements included some form of variable compensation tied to client success metrics.

Internal Consulting Capabilities

When large organizations build robust internal consulting teams, their reliance on external firms diminishes. This internal capacity acts as a powerful counterweight, significantly increasing their bargaining power. For instance, many Fortune 500 companies now maintain dedicated internal strategy or operational improvement groups, capable of handling complex analyses that were once exclusively outsourced.

This trend directly impacts the bargaining power of customers in the consulting industry. By having in-house expertise, clients can more effectively negotiate fees and scope with external consultants, knowing they have a viable alternative. In 2024, the demand for specialized internal consulting skills continued to grow, with many companies investing in areas like digital transformation and AI implementation internally.

- Reduced External Dependency: Organizations with strong internal consulting capabilities are less dependent on external providers for strategic advice and project execution.

- Enhanced Negotiation Leverage: The presence of an internal team gives clients a stronger position to negotiate pricing, deliverables, and timelines with external consulting firms.

- Cost Savings Potential: Developing internal expertise can lead to significant cost savings compared to consistently engaging external consultants for similar tasks.

- Control Over Intellectual Property: Internal teams ensure that proprietary knowledge and insights developed during projects remain within the organization.

Availability of Multiple Consulting Firms

The consulting market, especially in digital transformation and operational excellence, features a crowded landscape. Numerous firms vie for business, offering comparable services. This saturation directly amplifies customer leverage.

Customers can readily compare proposals, negotiate fees, and readily switch consultants if service levels falter. For instance, in 2024, the global consulting market was valued at over $350 billion, with a significant portion dedicated to these high-demand areas, indicating a vast array of choices for clients.

- High Competition: The consulting sector, particularly for digital and operational services, is characterized by a large number of providers.

- Customer Choice: This abundance of firms allows clients to easily survey the market and select the best fit.

- Price Negotiation: Clients can leverage competitive offers to negotiate more favorable pricing structures.

- Switching Ease: The availability of alternatives reduces the cost and difficulty for customers to change consultants, increasing their power.

The bargaining power of customers is significantly influenced by the ease with which they can switch providers. When switching costs are low, clients can more readily move to competitors, forcing existing firms to offer better terms. This dynamic is particularly relevant in the consulting sector where project-based work often allows for frequent reassessment of vendor relationships.

In 2024, the consulting industry continued to see a trend of clients actively managing vendor relationships, with many large enterprises standardizing procurement processes to facilitate easier switching. This has led to increased pressure on consulting firms to demonstrate ongoing value and competitive pricing to retain business.

The ability for customers to integrate consulting services with their own operations, or to develop internal capabilities, directly reduces their reliance on external providers. This self-sufficiency enhances their bargaining position, allowing them to dictate terms more effectively.

For example, in 2024, many companies invested heavily in upskilling their internal teams in areas like data analytics and digital strategy, thereby reducing their need for external consultants for routine or even complex projects. This internal capacity building is a direct driver of increased customer bargaining power.

Preview the Actual Deliverable

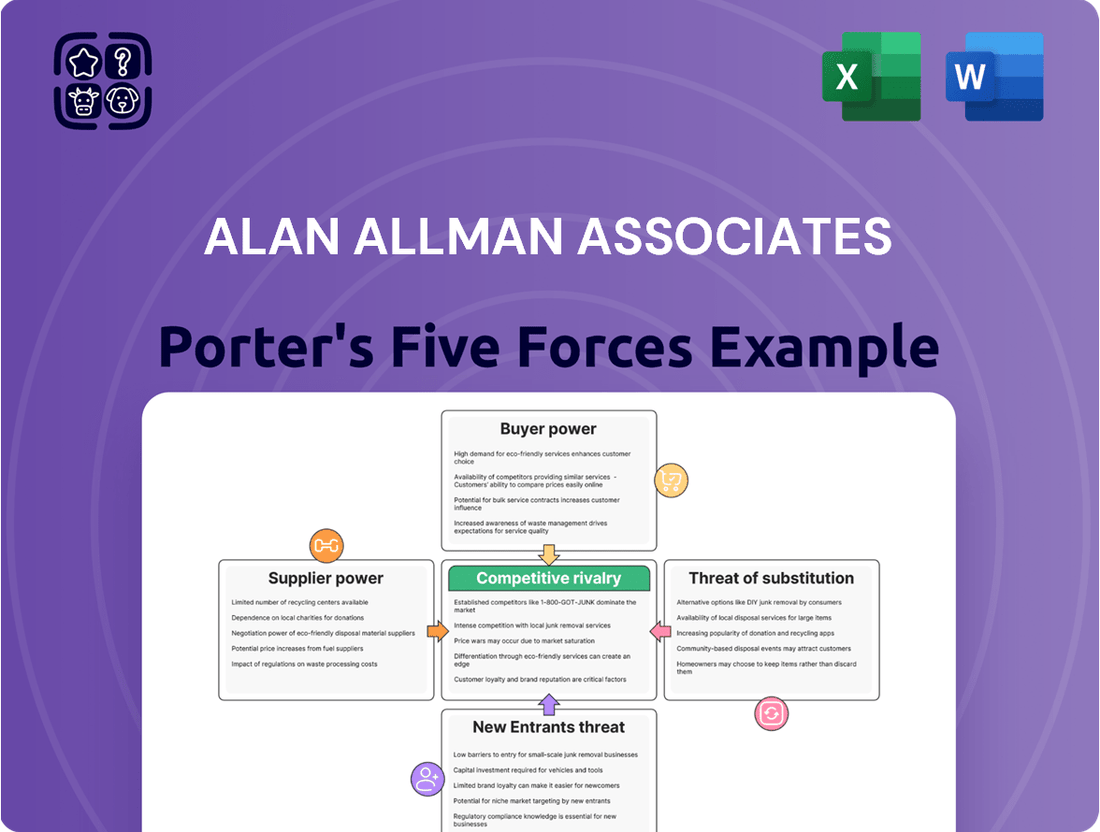

Alan Allman Associates Porter's Five Forces Analysis

This preview showcases the complete Alan Allman Associates Porter's Five Forces Analysis, offering a thorough examination of competitive forces within the industry. The document you see here is precisely what you will receive immediately after purchase, ensuring no surprises and full readiness for your strategic planning. You can confidently expect this exact, professionally formatted analysis to be available for download and immediate use upon completing your transaction.

Rivalry Among Competitors

The global consulting market is a dynamic arena, projected to surpass $1.29 trillion in revenue by 2024. This substantial market size, however, is coupled with a significant degree of fragmentation. Numerous consulting firms, from global giants to specialized boutiques, actively compete for business across diverse industry sectors.

This widespread presence of players, each targeting specific market niches, inherently fuels intense competitive rivalry. Firms must constantly innovate and differentiate themselves to capture and retain clients in this crowded landscape, leading to a constant battle for market share and talent.

The consulting landscape is sharpening its focus on hyper-specialization, a significant trend projected for 2025. Firms are increasingly carving out niches in areas such as AI ethics, environmental, social, and governance (ESG) consulting, advanced cybersecurity, and supply chain resilience. This shift means that generalist consulting is becoming less effective.

Alan Allman Associates strategically positions itself within this trend by concentrating on business transformation and performance improvement. Their deep expertise in operational excellence and digital transformation directly addresses the growing market need for specialized knowledge in these critical areas.

For instance, the global market for AI consulting alone was estimated to reach $10.5 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 28.1% through 2030, highlighting the lucrative nature of these specialized segments. Similarly, ESG consulting is rapidly expanding, with reports indicating the market could reach over $30 billion by 2027, demonstrating the demand for firms with focused capabilities.

The consulting landscape in 2024 is being dramatically reshaped by the swift integration of Artificial Intelligence (AI) and Robotic Process Automation (RPA). These technologies empower firms to automate routine tasks, uncover deeper insights from data, and even create entirely new service offerings.

Consulting giants are investing heavily in AI. For instance, Accenture projected that AI could add $9.3 trillion to the global economy by 2035, and they are actively building AI capabilities into their service delivery. This technological leap forward intensifies rivalry, as companies that embrace these advancements gain a significant edge in efficiency and client value proposition, leaving laggards struggling to compete.

Talent Acquisition and Retention

The consulting industry, particularly for new MBAs, continues to be a highly desirable career path, leading to intense competition for top talent. Firms are actively implementing strategies like enhanced work-life balance programs, flexible hybrid work models, and accelerated career advancement opportunities to attract and retain skilled professionals.

This elevated competition for human capital directly impacts the overall competitive rivalry within the sector. For instance, in 2024, many leading consulting firms reported increased hiring costs and longer recruitment cycles as they vie for the best graduates and experienced consultants.

- Fierce Competition: The consulting sector remains a prime target for MBA graduates, driving up demand for experienced professionals.

- Retention Strategies: Firms are prioritizing work-life balance, hybrid work, and faster career progression to keep their best people.

- Talent as a Differentiator: The ability to attract and retain skilled consultants is a key factor in a firm's competitive standing.

- Increased Costs: The intense talent war has led to higher recruitment expenses and longer hiring timelines for consulting companies in 2024.

Geographic and Sector-Specific Competition

Alan Allman Associates faces varied competitive intensity across its global operations in Europe and North America, as well as in its key sectors such as energy, public sector, healthcare, and defense. The landscape is dynamic, with both legacy firms and agile newcomers constantly vying for market share, making regional and sector-specific strategies crucial for success.

For instance, in the European energy consulting market, competition intensified significantly in 2024 with the ongoing energy transition and increased demand for decarbonization strategies. Similarly, the North American public sector consulting space saw a surge in demand for digital transformation services, attracting a wider array of specialized firms.

- European Energy Consulting: Increased competition driven by net-zero mandates and renewable energy project development in 2024.

- North American Public Sector: Growing competition in digital transformation and cybersecurity advisory services.

- Healthcare Sector: Consolidation among niche healthcare consulting firms in North America during 2024.

- Defense Sector: Continued strong competition from established defense contractors and specialized technology providers globally.

Competitive rivalry in the consulting sector is exceptionally high, driven by a large number of global and specialized firms vying for market share. This intensity is further amplified by the ongoing technological revolution, particularly AI and RPA, which creates new service opportunities and demands for advanced capabilities. The war for talent also contributes significantly, as firms compete fiercely for skilled professionals, leading to increased recruitment costs and longer hiring cycles in 2024.

| Factor | Impact on Rivalry | 2024 Data/Trend |

|---|---|---|

| Market Fragmentation | High | Global consulting market projected to exceed $1.29 trillion in 2024, with numerous players. |

| Technological Advancements (AI/RPA) | Increasing | Accenture estimates AI could add $9.3 trillion to the global economy by 2035; firms are investing heavily. |

| Talent Acquisition & Retention | Intensifying | Increased hiring costs and longer recruitment cycles reported by leading firms in 2024. |

| Specialization Trends | Growing | AI consulting market reached $10.5 billion in 2023; ESG consulting market projected to exceed $30 billion by 2027. |

SSubstitutes Threaten

The rise of robust in-house consulting departments presents a significant threat of substitution for external firms. Companies are increasingly investing in building internal expertise, particularly in areas like digital transformation and operational efficiency. For instance, a 2024 survey by Gartner indicated that 65% of organizations planned to increase their internal IT capabilities, directly impacting the demand for external digital consulting services.

The rise of readily available off-the-shelf software and SaaS solutions presents a significant threat of substitutes for consulting services like those offered by Alan Allman Associates. Businesses can increasingly find sophisticated tools for digital transformation and operational efficiency that may reduce the perceived need for extensive external consulting.

For instance, the global SaaS market was projected to reach over $200 billion in 2024, indicating a vast and growing array of readily deployable solutions. Clients might choose to implement these tools directly or opt for simpler, less integrated solutions, bypassing the need for comprehensive consulting engagements, particularly for less complex business challenges.

The increasing prevalence of freelance consultants and the growth of gig economy platforms present a significant threat of substitutes for traditional consulting firms. These platforms directly connect clients with independent experts, often offering specialized skills at competitive rates. For instance, by mid-2024, platforms like Upwork and Fiverr reported millions of active freelancers, demonstrating the scale of this alternative talent pool.

Clients can leverage these digital marketplaces to source niche expertise, potentially bypassing the overhead and fees associated with established consulting agencies. This accessibility fosters a more agile and cost-effective approach for businesses seeking specific project-based support, thereby reducing reliance on larger, more generalized consulting engagements.

Online Courses and DIY Resources

Online courses and readily available DIY resources present a growing threat, particularly for foundational business transformation and performance improvement initiatives. For instance, the global e-learning market was projected to reach over $370 billion by 2026, indicating a significant availability of accessible knowledge. While these platforms may not offer the tailored, in-depth strategic guidance of a consulting firm, they can certainly address specific skill gaps or provide introductory frameworks, potentially diminishing the perceived necessity for external expertise in certain areas.

This trend means clients might opt for:

- Online courses for digital literacy and basic strategic concepts.

- Publicly available resources for foundational knowledge.

- DIY approaches to tackle less complex performance improvement tasks.

- A reduced reliance on consultants for initial learning or straightforward problem-solving.

Automation and AI Tools for Business Analysis

The rise of sophisticated automation and AI tools presents a significant threat of substitution for traditional business analysis and consulting services. These technologies are increasingly capable of performing tasks like data analysis, report generation, and predictive modeling, which were once the exclusive domain of human experts.

For instance, AI-powered platforms can now process vast datasets to identify trends and generate insights at a speed and scale that often surpasses manual methods. This capability allows businesses to gain valuable intelligence without necessarily engaging external consultants for every analytical need. In 2024, the market for AI in business intelligence was projected to reach over $33 billion, highlighting the rapid adoption and increasing sophistication of these tools.

- AI's growing capacity for data processing and insight generation directly competes with the core analytical functions of consulting firms.

- Businesses can leverage internal AI tools to reduce their reliance on external advisory services for strategic decision-making.

- The increasing accessibility and affordability of AI solutions empower companies to conduct more analysis in-house, thereby diminishing the perceived need for certain consulting engagements.

The increasing availability of sophisticated AI and automation tools poses a significant threat of substitution for traditional consulting services. These technologies can now perform complex data analysis, generate reports, and even offer predictive insights, tasks previously requiring external expertise.

For example, the global AI in business intelligence market was projected to exceed $33 billion in 2024, demonstrating the rapid integration of these powerful tools into business operations. This allows companies to conduct more in-house analysis, reducing their dependence on external consultants for strategic decision-making and core analytical functions.

| Technology | Impact on Consulting | 2024 Market Projection (USD Billions) |

|---|---|---|

| AI & Automation | Automates analysis, report generation, predictive modeling | 33+ (AI in Business Intelligence) |

| SaaS Solutions | Provides off-the-shelf tools for transformation | 200+ (Global SaaS Market) |

| E-learning Platforms | Offers accessible knowledge for skill gaps | 370+ by 2026 (Global E-learning Market) |

Entrants Threaten

While building a comprehensive consulting firm like Alan Allman Associates requires significant investment, the threat of new entrants in specialized consulting areas is amplified by low barriers. The burgeoning gig economy and remote work capabilities allow individuals with deep domain expertise to launch boutique consultancies with minimal overhead.

For instance, the global management consulting market, valued at approximately $370 billion in 2023, saw a notable portion of growth driven by specialized advisory services, indicating a fertile ground for niche players. These smaller firms can quickly adapt to market demands and offer highly targeted solutions, often at competitive price points, directly challenging larger, more established entities.

Technology startups are increasingly entering the consulting space with integrated software solutions, often incorporating AI and automation. These new entrants can offer specialized services, particularly in areas like digital transformation and operational efficiency, potentially disrupting traditional consulting models.

For instance, in 2024, venture capital funding for AI-driven business solutions saw significant growth, with many startups focusing on automating complex advisory tasks. This trend suggests a rising threat as these agile firms can offer cost-effective and highly specialized alternatives, challenging established players.

Experienced consultants are increasingly leaving established firms to launch their own independent practices or specialized boutique firms. This trend introduces new competitors who leverage their existing client relationships and deep expertise, particularly within niche market segments.

In 2024, the consulting industry saw a notable uptick in independent practitioners, with many former Big Four consultants establishing solo ventures. These new entities often focus on high-demand areas like digital transformation and sustainability, directly challenging larger players with agility and specialized knowledge.

Disruptive Business Models

New entrants can shake up the consulting industry by introducing innovative business models. Think about subscription services, where clients pay a regular fee for ongoing advice, or crowdsourcing platforms that tap into a wider talent pool. These approaches can dramatically change how consulting services are priced and delivered, posing a significant challenge to established firms.

For instance, the rise of AI-powered consulting platforms in 2024 is already demonstrating this disruptive potential. These platforms can automate certain analytical tasks, potentially lowering costs and increasing efficiency, thereby altering client expectations regarding service delivery and fees. Many traditional firms are now exploring partnerships or developing their own AI capabilities to remain competitive.

- Subscription-based consulting models: Offering continuous support for a predictable fee.

- Crowdsourced consulting: Leveraging a broad network of experts for specialized tasks.

- Platform-based consulting: Utilizing technology to connect clients with consultants and manage projects efficiently.

- AI-driven analytics: Automating data analysis and insight generation, impacting traditional service delivery.

Access to Funding and Talent

The threat of new entrants is significantly influenced by access to funding and talent. Companies that can secure substantial capital and attract skilled professionals can overcome initial barriers to entry, rapidly scaling operations and market presence. For instance, in 2024, venture capital funding for technology startups remained robust, with significant rounds reported for AI and biotech firms, enabling them to hire specialized engineers and researchers.

Well-funded new entrants can also leverage attractive compensation packages and compelling project opportunities to lure away experienced talent from established players. This competitive talent acquisition dynamic can destabilize existing market structures. Alan Allman Associates' own growth strategy, which includes strategic acquisitions, highlights the continuous influx of new entities and the consolidation of talent and resources within the industry.

The ability to access both financial resources and human capital directly impacts how quickly and effectively new competitors can emerge and challenge incumbents. This is particularly true in sectors requiring specialized expertise, where a strong talent pipeline is as crucial as capital investment.

- Funding accessibility: Startups securing significant venture capital in 2024 demonstrate the potential for rapid scaling.

- Talent acquisition advantage: Firms offering strong value propositions can outbid competitors for top talent.

- Market entry acceleration: Access to capital and talent allows new entrants to quickly gain market share.

- Industry consolidation: Growth through acquisitions, like Alan Allman Associates, indicates a dynamic competitive landscape.

The threat of new entrants in consulting is heightened by accessible technology and the rise of specialized, agile firms. These new players can bypass the extensive infrastructure of established consultancies, focusing instead on niche expertise and innovative delivery models. For instance, the global consulting market's continued expansion, with specialized segments showing robust growth in 2023, signals ongoing opportunities for disruptive new entrants.

| Factor | Impact on New Entrants | 2024 Data/Trend |

|---|---|---|

| Low Capital Requirements | Enables boutique firms and independent consultants to launch with minimal overhead. | Gig economy growth and remote work reduce physical infrastructure needs. |

| Technological Advancements | AI and automation tools allow new entrants to offer specialized, efficient services. | Increased VC funding for AI business solutions in 2024 highlights this trend. |

| Talent Mobility | Experienced consultants leaving larger firms create new, expert-led competitors. | Notable increase in independent practitioners from Big Four firms in 2024. |

| Innovative Business Models | Subscription services and platform-based consulting challenge traditional fee structures. | AI-powered platforms are demonstrating disruptive potential in service delivery. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a foundation of comprehensive data, integrating insights from industry-specific market research reports, financial filings of key players, and publicly available government data to provide a robust competitive landscape assessment.