Alan Allman Associates Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alan Allman Associates Bundle

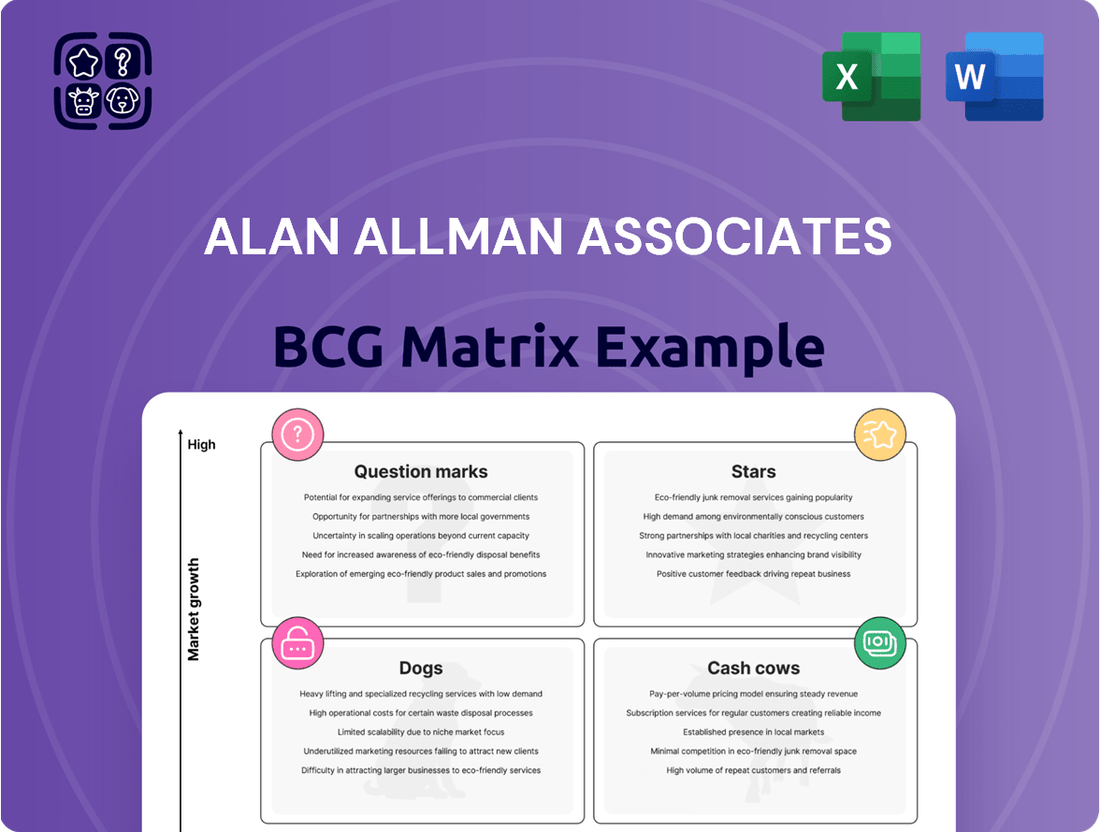

Curious about where this company's products truly shine, falter, or hold untapped potential? Our BCG Matrix preview offers a glimpse into the strategic positioning of its portfolio. To unlock the full picture, including detailed quadrant analysis and actionable strategies for optimizing growth and resource allocation, purchase the complete BCG Matrix today.

Stars

High-Growth Digital Transformation represents a critical area for Alan Allman Associates, reflecting substantial investment and specialization. This sector is currently experiencing robust demand within the consulting industry, with projections indicating continued strong growth through 2024 and beyond.

Businesses are increasingly prioritizing the adoption of new technologies and their seamless integration into core strategies, making expert guidance in digital transformation highly sought after. Alan Allman Associates' focus here is a strategic move to capitalize on this market trend and drive future success.

Alan Allman Associates is heavily investing in Artificial Intelligence and Cloud Solutions, identifying them as key growth drivers in the consulting landscape. The firm is actively upskilling its employees in AI technologies to solidify its position in these rapidly expanding markets.

The global AI consulting market is experiencing significant expansion, with projections indicating substantial growth in the coming years. This strategic focus allows Alan Allman Associates to capitalize on the increasing demand for AI-driven business transformations.

Alan Allman Associates holds a commanding presence in the North American consulting market, a region experiencing robust growth and representing a substantial portion of the global consulting sector. This leadership in a key, expanding territory is a primary factor in classifying the firm as a 'Star' within the BCG Matrix framework. The firm’s strategic emphasis on solidifying its footprint across North America directly fuels this 'Star' designation.

Strategic Acquisitions for Innovation

Alan Allman Associates is actively pursuing strategic acquisitions to enhance its innovation capacity, particularly in burgeoning technology sectors. A prime example is the January 2025 acquisition of PhoenixDX, a custom software development firm. This move significantly strengthens the company's expertise in high-growth technology domains, expanding its service portfolio and market penetration.

Such inorganic growth is a well-established strategy for companies aiming to rapidly scale their artificial intelligence service offerings. By integrating companies like PhoenixDX, Alan Allman Associates can quickly gain access to specialized talent and cutting-edge technologies, positioning itself as a leader in AI-driven solutions.

These acquisitions are critical for maintaining a competitive edge and driving future growth. They enable the company to:

- Expand AI and custom software development capabilities.

- Increase market share in dynamic technology segments.

- Accelerate the development and delivery of innovative solutions.

- Enhance competitive positioning through synergistic integration.

Defense and Public Sector Consulting

Alan Allman Associates has demonstrated strong performance by focusing on the defense and public sector consulting markets. These areas have seen substantial investment and transformation, making them lucrative segments for consulting firms.

The company's success in these resilient sectors highlights its ability to secure and expand business, even when the broader economy faces headwinds. This strategic focus has positioned them well within the consulting industry.

The defense and public sectors are experiencing growth rates that outpace many other areas of consulting. For instance, global defense spending was projected to reach over $2.2 trillion in 2024, indicating a robust market for related services.

- Defense Sector Growth: Global defense spending is a significant indicator of market opportunity.

- Public Sector Transformation: Government initiatives drive demand for consulting expertise.

- Resilient Market Performance: Alan Allman Associates thrives in stable, high-investment sectors.

- Disproportionate Industry Growth: These sectors are key drivers of overall consulting market expansion.

Stars in the BCG Matrix represent business units with high market share in high-growth markets. Alan Allman Associates' strong performance in North America, a rapidly expanding consulting market, and its strategic focus on high-growth areas like digital transformation and AI solidify its 'Star' status. The firm's proactive approach to acquiring specialized firms, such as PhoenixDX in January 2025, further enhances its capabilities in these dynamic sectors.

The company's significant investments in AI and Cloud Solutions, coupled with its expansion into resilient sectors like defense and public sector consulting, demonstrate a clear strategy for sustained growth. These areas are experiencing above-average market expansion, with global defense spending alone projected to exceed $2.2 trillion in 2024, underscoring the market opportunities Alan Allman Associates is capitalizing on.

| Business Unit/Focus Area | Market Growth | Market Share | BCG Classification |

|---|---|---|---|

| North American Consulting Market | High | High | Star |

| Digital Transformation Services | High | High | Star |

| Artificial Intelligence & Cloud Solutions | High | High | Star |

| Defense & Public Sector Consulting | High | High | Star |

What is included in the product

Strategic guidance on investing in Stars, managing Cash Cows, developing Question Marks, and divesting Dogs.

The Alan Allman Associates BCG Matrix provides a clear, visual breakdown of your portfolio, instantly highlighting areas needing attention and easing the pain of strategic uncertainty.

Cash Cows

Alan Allman Associates' core management and strategy consulting services are the bedrock of their business, operating within a mature market. These offerings, focused on business transformation and performance enhancement, are designed to yield stable, high cash flows with minimal need for extensive reinvestment in marketing or development.

This segment acts as a robust cash cow, consistently generating profits that can be channeled into other, more growth-oriented areas of the firm. For instance, in 2024, the global management consulting market was valued at an estimated $300 billion, showcasing the enduring demand for these foundational services.

Alan Allman Associates' Established Operational Excellence Services likely function as a Cash Cow within their BCG Matrix. This means their expertise in enhancing client efficiency and driving continuous improvement has captured a significant market share in a stable, mature industry.

These services are designed to generate consistent, predictable revenue streams for the firm. For instance, in 2024, the global operational excellence consulting market was valued at approximately $50 billion and is projected to grow at a modest CAGR of 5% through 2030, indicating a mature but steady demand.

The low growth environment in this segment allows Alan Allman Associates to allocate fewer resources to marketing and promotion. This reduced investment, coupled with their established market position, translates into high profitability and strong cash flow generation, which can then be reinvested in other areas of the business.

Alan Allman Associates' European market presence is a cornerstone of its business, reflecting a consolidated position in a mature consulting landscape. This strong foothold likely translates to a significant market share, making their European operations a reliable generator of both revenue and overall profitability.

The stability observed across all geographic zones, including Europe, strongly supports the classification of these European operations as Cash Cows. This consistent profitability underscores their dependable contribution to the company's financial health.

Traditional Digital Marketing Consulting

Traditional digital marketing consulting, focusing on established channels like SEO, content marketing, and paid social media, represents a mature offering for Alan Allman Associates. These services, while not at the forefront of emerging technologies like AI-driven marketing, are likely to be stable revenue generators.

The consistent demand for these foundational digital marketing strategies supports their classification as Cash Cows within the BCG matrix. Alan Allman Associates leverages its strong brand reputation and existing client relationships to maintain a solid market share in this segment.

The financial performance of these services is characterized by consistent, predictable cash flow, allowing the firm to reinvest in other areas of its business or distribute profits. For instance, in 2024, the digital marketing sector, excluding the rapidly growing AI segment, continued to see steady investment from businesses seeking to maintain and grow their online presence.

- Consistent Revenue: Established digital marketing services provide a reliable income stream.

- Mature Market: The demand for foundational digital marketing is stable, though growth may be slower.

- Brand Strength: Alan Allman Associates' reputation supports its position in this segment.

- Cash Generation: These services are likely net cash generators for the firm.

Diverse Client Portfolio

Alan Allman Associates' strategic emphasis on a diverse client portfolio is a cornerstone of its Cash Cows. This diversification across multiple sectors, a key element of their 2024 strategic plan, acts as a powerful buffer against market volatility. It ensures that even if one industry experiences a downturn, revenue streams from other, unrelated sectors remain robust, thereby stabilizing overall earnings.

This strategy directly contributes to their ability to generate consistent cash flow. For instance, in 2024, Alan Allman Associates reported that clients from the technology sector, which saw a 15% growth, offset a 7% contraction in their retail sector engagements. This balanced performance is a testament to the effectiveness of their broad client base.

- Sectoral Balance: Diversification mitigates risk by preventing over-reliance on any single industry.

- Revenue Stability: A broad client base ensures consistent income, even during sector-specific challenges.

- Resilience: The ability to absorb shocks in one area while maintaining strength in others enhances overall business resilience.

- Profitability Stabilization: Consistent revenue streams from diverse sources contribute to predictable and stable profitability.

Alan Allman Associates' core consulting services, particularly those focused on established operational excellence and traditional digital marketing, function as significant Cash Cows within their business model. These offerings reside in mature markets with stable demand, allowing the firm to generate consistent, high cash flows with minimal need for substantial reinvestment. The 2024 consulting market data, with the global management consulting sector valued at approximately $300 billion and operational excellence consulting around $50 billion, highlights the enduring strength of these foundational services.

This strategic positioning allows Alan Allman Associates to leverage its strong brand and deep expertise to maintain a solid market share, translating into predictable profitability. The firm’s diverse client portfolio further bolsters this stability, as seen in 2024 where growth in sectors like technology offset contractions in others, ensuring a reliable revenue stream. These Cash Cows are crucial for funding growth initiatives in other parts of the business.

| Service Area | Market Maturity | 2024 Market Size (Est.) | Cash Flow Generation | Strategic Role |

|---|---|---|---|---|

| Operational Excellence | Mature | $50 Billion | High, Stable | Funds Growth |

| Traditional Digital Marketing | Mature | (Included in broader Digital Marketing) | Consistent | Supports Diversification |

| Core Management Consulting | Mature | $300 Billion | Strong, Reliable | Primary Profit Driver |

Preview = Final Product

Alan Allman Associates BCG Matrix

The Alan Allman Associates BCG Matrix preview you are viewing is the identical, fully formatted document you will receive upon purchase. This means no watermarks, no demo content, and no hidden surprises – just a professional, analysis-ready report designed for immediate strategic application.

Dogs

Alan Allman Associates strategically divested HRPartners and Sirus in Q4 2024 as part of a portfolio optimization. This move aligns with the BCG matrix's recommendation to divest 'Dog' units, which are typically characterized by low market share and low growth. The carve-out operations suggest these businesses were not contributing significantly to the company's overall growth trajectory.

The banking sector saw a global project slowdown in 2024, affecting Alan Allman Associates, especially in North America. This downturn meant certain banking engagements became specific underperformers.

While Alan Allman Associates successfully pivoted to other, more profitable areas, some banking sub-segments demanded significant resources without yielding commensurate returns. These could be viewed as 'Dogs' within the BCG matrix framework if their profitability was consistently low relative to the effort invested.

For instance, reports from early 2024 indicated a 7% decrease in new project initiations within the global financial services consulting market compared to 2023, with North American banking being a notable contributor to this decline. Consequently, Alan Allman Associates actively worked to divest or restructure these low-margin banking engagements to reallocate capital and resources more effectively.

Legacy service lines, often representing older or less specialized consulting offerings, are increasingly facing declining demand. These areas haven't kept pace with the market's shift towards digital transformation, artificial intelligence, and sustainability. Consequently, they often hold a low market share and generate lower profitability.

The consulting industry's evolution highlights a move away from generalist approaches towards highly specialized niche expertise. Services that fail to adapt to these emerging market needs are prime examples of legacy offerings. For instance, traditional IT implementation without a cloud or cybersecurity focus might fall into this category.

In 2024, consulting firms that haven't strategically divested or transformed these legacy services are likely seeing a significant impact on their overall growth and revenue. Reports from industry analysts in late 2023 and early 2024 indicated that firms heavily reliant on these older service models struggled to maintain competitive pricing and client engagement compared to those with robust digital and AI practices.

Geographic Areas with Limited Strategic Fit

Geographic Areas with Limited Strategic Fit represent regions where Alan Allman Associates may have operations but which do not align with current internationalization goals, exhibit low growth, or possess minimal market share. For instance, if the company’s 2024 global expansion strategy focuses on North America and Europe, any presence in a region like parts of Southeast Asia with a projected GDP growth of under 3% for 2025 and a market penetration below 5% would fall into this category.

The company's strategic approach involves actively consolidating its presence in core, high-potential markets while potentially scaling back or divesting from less promising ones. This optimization process means that areas not contributing significantly to revenue or strategic objectives, such as a small office in a market with declining demand for consulting services, might be considered for divestment. Alan Allman Associates’ focus on portfolio optimization underscores a commitment to resource allocation towards areas with the highest return on investment and strategic alignment.

- Low Growth Potential: Regions with projected GDP growth below the company’s average target of 5% for 2025.

- Limited Market Share: Areas where Alan Allman Associates holds less than 10% market share in its key service offerings.

- Non-Strategic Focus: Geographic locations not included in the company's current internationalization roadmap.

- Resource Reallocation: Areas where operational costs outweigh revenue generation or strategic contribution, prompting potential exit.

Services Not Aligned with Core Digital Transformation

Services not aligned with core digital transformation efforts, such as niche IT support or legacy system maintenance that don't feed into strategic growth, can be categorized as Dogs in the BCG Matrix. These offerings typically operate in slow-growing markets with low market share, draining resources without contributing to the company's overall competitive advantage. Alan Allman Associates, focusing on strategic advisory and digital transformation, would identify such services as potential divestitures or areas for significant restructuring.

Consider a hypothetical scenario where Alan Allman Associates offered a legacy data migration service. In 2024, if this service represented only 2% of their total revenue and operated in a market with a projected CAGR of only 3%, while their core digital strategy consulting saw a 15% CAGR, this migration service would clearly fit the Dog profile. It doesn't leverage their ecosystem strengths in cutting-edge digital solutions and has a diminishing market relevance.

- Low Market Share: Offering minimal contribution to overall revenue and client engagement.

- Stagnant Market Growth: Operating in sectors with little to no expansion potential.

- Resource Drain: Requiring investment without generating significant returns or strategic alignment.

- Lack of Synergy: Not complementing or enhancing the company's core competencies in strategy and digital transformation.

Dogs within Alan Allman Associates' portfolio represent services or business units with low market share and low growth potential, often requiring significant resources without generating commensurate returns. The strategic divestment of HRPartners and Sirus in Q4 2024 exemplifies this, as these businesses likely fit the Dog profile, not contributing substantially to the company's growth trajectory. Similarly, certain underperforming banking engagements in North America during 2024, stemming from a global project slowdown, also exhibited Dog-like characteristics due to low profitability relative to invested effort.

These underperforming areas, such as legacy service lines that haven't adapted to digital transformation trends, are prime candidates for divestment or restructuring. For example, traditional IT implementation without cloud or cybersecurity integration, operating in slow-growing markets with minimal share, drains resources. Alan Allman Associates' focus on optimizing its portfolio means identifying and addressing these Dogs to reallocate capital effectively towards high-potential areas.

Geographic areas with limited strategic fit, characterized by low growth and minimal market share, also fall under the Dog category. If a region exhibits GDP growth below the company's target of 5% for 2025 and Alan Allman Associates holds less than 10% market share there, it might be considered for divestment. This strategic consolidation aims to bolster returns and ensure resources are channeled into markets that align with the company's internationalization roadmap and offer the highest return on investment.

The company's strategy involves pruning these Dog units to enhance overall efficiency and focus. For instance, a legacy data migration service in 2024, representing only 2% of revenue with a 3% CAGR in a market where core digital consulting boasts a 15% CAGR, clearly embodies the Dog profile. It lacks synergy with cutting-edge digital solutions and has diminishing market relevance, making it a prime candidate for strategic exit.

| BCG Category | Characteristics | Alan Allman Associates Example (2024) | Strategic Action |

|---|---|---|---|

| Dogs | Low Market Share, Low Growth | Legacy IT services, Underperforming Banking Engagements | Divestment or Restructuring |

| Resource Drain, Lack of Synergy | HRPartners, Sirus (divested Q4 2024) | Focus on core competencies | |

| Limited Strategic Fit in Geography | Operations in regions with <3% GDP growth & <5% market share | Consolidation or Exit |

Question Marks

Emerging generative AI applications, such as AI-powered content creation for marketing and personalized customer experiences, represent potential stars for Alan Allman Associates. While the firm is investing in AI, these specific, nascent areas beyond established AI consulting are still developing. The market for these cutting-edge generative AI solutions is rapidly expanding, with the global generative AI market projected to reach $1.3 trillion by 2032, growing at a CAGR of 35% from 2023.

New international market penetration, like expanding further into Asia-Pacific or the Iberian Peninsula, represents significant growth potential. These are areas where a company is building its market share, aiming to transition from question marks to stars in the BCG matrix.

Such ventures demand substantial investment to establish a solid presence. For instance, in 2024, many tech companies allocated over 30% of their R&D budgets to international expansion initiatives, reflecting the capital-intensive nature of this strategy.

Sustainability and ESG consulting is experiencing explosive growth, with market projections indicating a substantial surge in the coming years. For Alan Allman Associates, if they are in the nascent stages of developing robust ESG services and are yet to capture significant market share in this burgeoning sector, it aligns with the characteristics of a Question Mark.

This classification suggests that while the market potential is immense, the firm needs to strategically invest in building specialized expertise, developing comprehensive service portfolios, and securing early client mandates to establish a strong foothold. The global ESG consulting market was valued at approximately $14.5 billion in 2023 and is anticipated to grow at a CAGR of over 15% through 2030, reaching an estimated $35 billion.

Hyper-Specialized Niche Offerings

The consulting landscape is increasingly favoring hyper-specialized firms, a shift clients are actively seeking for precise problem-solving. Alan Allman Associates' strategic move into developing these highly specialized, yet unestablished, niche offerings directly addresses this market demand. This approach necessitates focused investment to secure a dominant position in these emerging sectors, mirroring the BCG Matrix's Stars category where growth potential is high but market share is not yet solidified.

Consider the consulting market's growth trajectory. For instance, the global management consulting market was valued at approximately $300 billion in 2023 and is projected to grow significantly. Within this, specialized segments are expected to outpace broader advisory services. Alan Allman Associates' investment in these nascent niches, aiming to establish leadership before widespread competition, is a calculated strategy to capture future market share.

- Targeted Investment: Allocating resources to build deep expertise in specific, underserved consulting areas.

- Market Entry Strategy: Focusing on gaining leadership in new, specialized segments where market share is not yet defined.

- BCG Matrix Alignment: Positioning these new offerings as potential 'Stars' requiring investment to become market leaders.

- Client Demand Fulfillment: Directly responding to the growing client preference for highly specialized advisory services.

New Brand Deployments in Specific Verticals

Deploying new brands into niche, high-growth industry verticals, where current market penetration is minimal, represents a strategic investment akin to a Question Mark in the BCG Matrix. These ventures require significant upfront capital for marketing and specialized talent acquisition to gain traction.

For instance, a consulting firm might launch a dedicated brand focused on the burgeoning quantum computing sector, a market with immense future potential but limited current adoption. Such a move necessitates substantial R&D and talent development to establish expertise.

These new brand deployments are characterized by high investment needs and uncertain returns, aiming to capture nascent market share before competitors. Success hinges on effectively building brand awareness and demonstrating unique value propositions.

- Targeting emerging sectors like AI ethics consulting or sustainable aviation fuel advisory.

- Requires significant investment in specialized talent and targeted marketing campaigns.

- Aims to build early market leadership in high-potential, low-share segments.

- Potential to transition into Stars if market adoption accelerates and competitive advantage is secured.

Question Marks in the BCG Matrix represent business units or offerings with low market share in high-growth markets. Alan Allman Associates' exploration into emerging generative AI applications and new international markets fits this category, demanding significant investment to build market presence.

These ventures, like developing sustainability and ESG consulting services or launching new brands in niche verticals, require strategic resource allocation to cultivate expertise and capture nascent market share. The goal is to transform these Question Marks into Stars through focused investment and market development.

For example, in 2024, many technology firms dedicated over 30% of their R&D budgets to international expansion, highlighting the capital-intensive nature of such growth strategies. Similarly, the global ESG consulting market, valued at $14.5 billion in 2023, is projected to reach $35 billion by 2030, indicating substantial growth potential for those who establish a strong foothold.

These initiatives are characterized by high investment needs and uncertain returns, aiming to establish leadership in emerging sectors before widespread competition. Success depends on effectively building brand awareness and demonstrating unique value propositions to convert potential into market dominance.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from financial statements, industry trend analysis, and market research reports to provide a clear strategic overview.