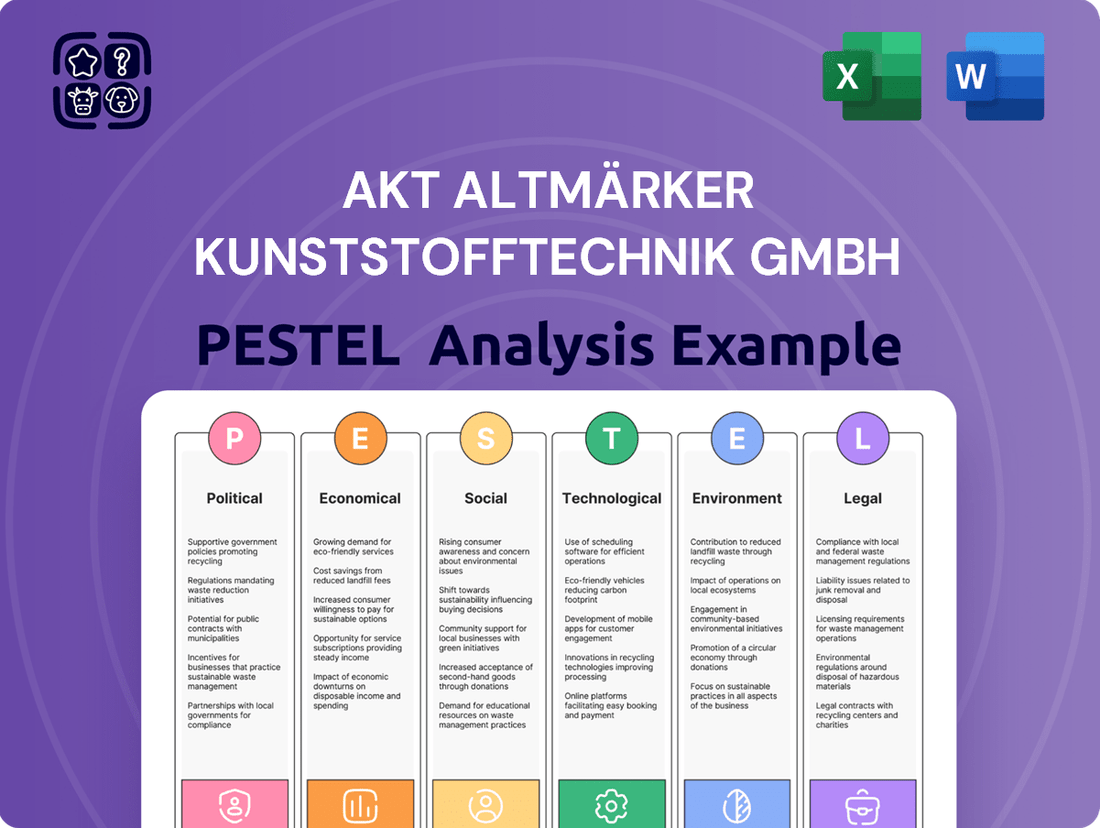

AKT Altmärker Kunststofftechnik GmbH PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AKT Altmärker Kunststofftechnik GmbH Bundle

Understand how political shifts, economic fluctuations, and evolving social attitudes directly impact AKT Altmärker Kunststofftechnik GmbH's operational landscape. Our PESTLE analysis dives deep into these external forces, offering crucial insights for strategic planning and risk mitigation. Gain a competitive edge by leveraging this comprehensive market intelligence—download the full version now to unlock actionable strategies.

Political factors

Government regulations significantly shape AKT's operational landscape, particularly within Germany and the broader European Union. Policies related to industrial production, such as environmental standards and labor laws, directly influence manufacturing processes and costs.

Subsidies for research and development, a key component of EU industrial strategy, can provide AKT with crucial funding for innovation in plastic technologies. For instance, the German government's focus on sustainable manufacturing and the circular economy, as highlighted in its 2022 Plastics Strategy, encourages investment in eco-friendly materials and processes, potentially benefiting AKT's product development.

Trade agreements negotiated by the EU, like the ongoing discussions regarding critical raw materials, directly affect AKT's ability to source necessary materials and access international markets. A shift towards protectionist measures or new tariffs could increase input costs or limit export opportunities, impacting AKT's global competitiveness.

The European Union's Green Deal, targeting climate neutrality by 2050, and its associated circular economy initiatives are profoundly reshaping the plastics sector. These policies mandate increased use of recycled content in products, extended product lifecycles, and a significant reduction in plastic waste. For AKT Altmärker Kunststofftechnik GmbH, adapting to these stringent regulations, such as the proposed EU directive for a minimum of 30% recycled content in plastic packaging by 2030, is essential for regulatory compliance and maintaining market access.

International trade policies and tariffs significantly impact AKT Altmärker Kunststofftechnik GmbH. For instance, the European Union's trade agreements, such as those with the United States or China, can influence the cost of imported raw materials like polyethylene or polypropylene, which are crucial for plastic production. In 2024, ongoing trade discussions and potential adjustments to tariffs on plastic goods could alter AKT's operational expenses and market pricing strategies.

Shifts in trade relations, particularly with major manufacturing hubs or key export markets for plastic components, necessitate agile responses. If a significant customer country imposes new import duties on finished plastic products in 2025, AKT might need to explore alternative markets or adjust its production mix. This requires continuous monitoring of global economic trends and bilateral trade negotiations.

Political Stability and Geopolitical Events

Political stability within Germany and the broader European Union generally offers AKT Altmärker Kunststofftechnik GmbH a predictable operating landscape. This stability is crucial for long-term planning and investment.

However, the current geopolitical climate presents ongoing challenges. For instance, the ongoing conflict in Ukraine and broader global tensions have led to increased energy prices and supply chain disruptions, impacting manufacturing costs. In 2023, Germany's industrial production saw a notable decline, partly attributed to these external pressures.

- Geopolitical Risk: Increased global tensions can disrupt international trade routes and supplier reliability, affecting AKT's raw material sourcing and product distribution.

- Energy Security: Political decisions regarding energy policy, particularly in response to geopolitical events, directly influence operational costs for energy-intensive manufacturing like plastics. Germany's reliance on imported energy sources makes it particularly sensitive to these shifts.

- Regulatory Environment: Political stability also underpins consistent regulatory frameworks. Changes in EU or German environmental, trade, or labor laws, often driven by political agendas, can necessitate significant adjustments to AKT's business model and compliance procedures.

Industry-Specific Lobbying and Associations

Industry associations play a crucial role in shaping the regulatory landscape for plastics manufacturers like AKT Altmärker Kunststofftechnik GmbH. These groups actively lobby governments on issues ranging from environmental standards to trade policies, directly impacting operational costs and market access. For instance, the European Plastics Converters (EuPC) actively campaigns for circular economy initiatives, which could lead to increased recycled content mandates, affecting AKT's raw material sourcing and production processes.

AKT's engagement with or awareness of these industry bodies is vital for anticipating and adapting to policy shifts. The German Association of the Plastics and Rubber Industry (GKV) is a key player in advocating for the sector's interests within Germany and the EU. Their efforts in 2024 and 2025 likely focused on navigating the complexities of the EU's Green Deal and its implications for plastic production and waste management. Staying informed about GKV's positions can offer AKT strategic foresight.

- Industry Lobbying Impact: Associations like EuPC and GKV influence policies on recycling rates, chemical regulations (e.g., REACH), and energy efficiency, directly affecting AKT's compliance and competitiveness.

- Policy Advocacy: These groups advocate for favorable trade agreements and resist protectionist measures, crucial for companies like AKT that operate within global supply chains.

- Regulatory Foresight: Monitoring industry association activities provides early warnings of potential regulatory changes, allowing AKT to proactively adjust its strategies and investments.

- Collective Bargaining Power: Industry associations amplify the voice of individual companies, enabling them to collectively negotiate with regulators and stakeholders, a benefit AKT can leverage.

Political stability within Germany and the EU provides a predictable environment for AKT Altmärker Kunststofftechnik GmbH, crucial for long-term investment. However, geopolitical tensions, such as the ongoing conflict in Ukraine, directly impact energy prices and supply chains, as seen in Germany's industrial production decline in 2023.

The EU's Green Deal, aiming for climate neutrality by 2050, mandates increased recycled content and reduced plastic waste, requiring AKT to adapt to regulations like the proposed 30% recycled content in plastic packaging by 2030.

Trade policies and tariffs significantly affect AKT's raw material costs and market access, with 2024 trade discussions potentially altering operational expenses and pricing strategies.

Industry associations like EuPC and GKV actively lobby governments on environmental standards, trade, and energy efficiency, influencing policies that directly impact AKT's compliance and competitiveness by advocating for favorable trade agreements and resisting protectionism.

What is included in the product

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors impacting AKT Altmärker Kunststofftechnik GmbH, examining Political, Economic, Social, Technological, Environmental, and Legal influences.

It offers actionable insights for strategic decision-making, identifying potential threats and opportunities within the company's operating landscape.

This PESTLE analysis for AKT Altmärker Kunststofftechnik GmbH acts as a pain point reliever by providing a clear, summarized version of external factors, enabling quick referencing during strategic discussions and ensuring all stakeholders grasp market dynamics.

Economic factors

AKT Altmärker Kunststofftechnik GmbH's performance is intrinsically linked to the economic vitality of the automotive, agriculture, and construction sectors. For instance, the automotive industry, a major consumer of plastics, saw global vehicle production reach approximately 78 million units in 2023, indicating a rebound that bodes well for suppliers like AKT.

A strong economic climate within these key industries fuels demand for AKT's plastic components and integrated systems. The construction sector, for example, is projected to grow by around 3.5% globally in 2024, which should translate into increased orders for plastic building materials and components.

Conversely, any economic downturn or recession impacting these foundational industries directly affects AKT's order volume and overall revenue. A slowdown in agricultural machinery sales, which experienced a slight contraction in some regions in late 2023 due to higher interest rates, could pose a challenge for AKT's agricultural segment.

The price of plastic raw materials, often linked to petrochemicals, is highly sensitive to global oil price swings and the stability of supply chains. For instance, Brent crude oil prices experienced significant volatility in late 2023 and early 2024, influencing the cost of key feedstocks like ethylene and propylene. This directly impacts AKT's production expenses and overall profitability.

Sharp increases in these raw material costs, potentially seeing double-digit percentage jumps within a quarter as observed in certain petrochemical markets during 2024, can squeeze AKT's profit margins if not passed on to customers. Therefore, implementing robust hedging strategies or exploring alternative, less volatile material sources is crucial for AKT to navigate these unpredictable economic conditions and maintain financial stability.

Rising inflation presents a significant challenge for AKT Altmärker Kunststofftechnik GmbH, potentially increasing operational expenses for essential inputs like raw materials, energy, and logistics. For instance, the Eurozone inflation rate was 2.4% in May 2024, a slight decrease from previous months but still elevated, impacting supplier costs and potentially squeezing profit margins if these increases cannot be passed on to customers.

Fluctuations in interest rates directly influence AKT's ability to finance growth initiatives. As of June 2024, the European Central Bank's key interest rates remain at 4.25% for the main refinancing operations, a level that makes borrowing for capital expenditures such as upgrading manufacturing equipment or expanding production capacity more expensive. This necessitates careful consideration of the cost of capital when evaluating new investment projects.

Labor Costs and Availability

The availability of skilled labor and prevailing wage rates in Germany directly impact AKT Altmärker Kunststofftechnik GmbH's operational expenses and its capacity for expansion. A competitive labor market, characterized by high demand for qualified workers and rising salary expectations, can exert significant pressure on the company's profitability.

For instance, in 2024, Germany faced a shortage of skilled workers, particularly in technical fields relevant to manufacturing. The average gross monthly wage for a skilled production worker in Germany was approximately €3,200 in early 2024, with regional variations. This trend necessitates proactive strategies from AKT.

- Skilled Labor Shortage: Germany's demographic shifts and a strong industrial base continue to create a deficit in specialized manufacturing talent.

- Wage Inflation: Rising inflation and collective bargaining agreements in 2024 and projected for 2025 are contributing to increased labor costs across the German economy.

- Talent Management: AKT must focus on robust talent attraction, effective employee retention programs, and exploring automation to mitigate the impact of labor costs and availability.

- Industry Benchmarks: Staying competitive requires understanding and adapting to labor market trends and wage benchmarks within the plastics processing sector.

Exchange Rate Fluctuations

Exchange rate fluctuations present a significant economic factor for AKT Altmärker Kunststofftechnik GmbH, particularly if it participates in international trade. For instance, if AKT sources its plastic resins from outside the Eurozone and sells its finished products globally, changes in the Euro's value directly influence its costs and revenues. A stronger Euro can make imported raw materials cheaper but simultaneously increase the price of AKT's exports for foreign buyers, potentially reducing demand.

Consider the Euro's performance against key trading currencies. In early 2024, the Euro saw some volatility. For example, if AKT's primary raw material supplier is in the United States, a stronger Euro against the US Dollar would reduce the cost of those materials for AKT. Conversely, if a major market for AKT's products is the UK, a weaker Euro against the Pound Sterling would make AKT's goods more expensive for British customers, potentially impacting sales volume.

- Impact on Raw Material Costs: Fluctuations in the Euro-USD exchange rate directly affect the cost of imported polymers and additives.

- Competitiveness of Exports: A strong Euro can make AKT's products less competitive in non-Eurozone markets, potentially leading to lower sales volumes or reduced profit margins.

- Procurement Strategy: AKT may need to adjust sourcing strategies to mitigate risks associated with currency volatility, potentially diversifying suppliers across different currency zones.

- Hedging Strategies: To protect against adverse currency movements, AKT might employ financial instruments like forward contracts or currency options, especially for significant international transactions anticipated in late 2024 or 2025.

Economic factors significantly shape AKT Altmärker Kunststofftechnik GmbH's operating environment. The automotive sector's health, for instance, is critical, with global production hovering around 78 million units in 2023, showing a positive trend. Similarly, the construction industry's projected 3.5% global growth in 2024 suggests increased demand for plastic components.

Raw material costs, tied to petrochemicals, are volatile. Brent crude oil prices saw fluctuations in late 2023 and early 2024, directly impacting the cost of feedstocks like ethylene and propylene, which can affect AKT's profit margins if not managed through hedging or alternative sourcing.

Inflation, with the Eurozone rate at 2.4% in May 2024, increases operational expenses for AKT, impacting raw material, energy, and logistics costs. Interest rates, with ECB key rates at 4.25% as of June 2024, also influence the cost of capital for expansion or equipment upgrades.

Labor market dynamics in Germany, including a shortage of skilled workers and average gross monthly wages around €3,200 for production workers in early 2024, add to operational costs. Exchange rate volatility, such as the Euro's performance against the USD and GBP in early 2024, also impacts raw material import costs and export competitiveness.

What You See Is What You Get

AKT Altmärker Kunststofftechnik GmbH PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis of AKT Altmärker Kunststofftechnik GmbH. This detailed report covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company, providing crucial insights for strategic planning.

Sociological factors

Societal expectations are increasingly pushing for greener options, and this is particularly evident in sectors like automotive and construction where AKT operates. Consumers are actively seeking out products that are not only functional but also kind to the planet.

This translates directly into a demand for plastic parts that can be easily recycled, incorporate recycled materials, and generally have a smaller environmental impact throughout their lifecycle. For AKT, this means innovation in material science and manufacturing processes is key to meeting these evolving customer needs and unlocking new market potential.

For instance, a 2024 report indicated that over 60% of consumers globally are willing to pay more for products from sustainable brands, highlighting the significant financial implications of this trend for companies like AKT.

Demographic shifts are reshaping the labor market for companies like AKT Altmärker Kunststofftechnik GmbH. An aging workforce in Germany, with the average age of industrial workers steadily increasing, presents a challenge for retaining institutional knowledge and physical capacity. This trend is further exacerbated by a noticeable shortage of skilled technicians and engineers, a persistent issue across the manufacturing sector. For instance, the German Engineering Federation (VDMA) reported in late 2023 that a significant percentage of its member companies struggled to fill specialized technical positions.

To counter these demographic pressures and the skills gap, AKT must proactively invest in its human capital. Developing robust internal training programs and expanding apprenticeship opportunities are crucial for nurturing the next generation of skilled professionals. Furthermore, strategic talent acquisition, potentially looking beyond traditional recruitment pools and exploring international talent, will be vital to ensure AKT maintains its operational efficiency and capacity for innovation in the coming years.

Societal expectations and legal requirements for workplace health and safety are continuously advancing, impacting manufacturing firms like AKT Altmärker Kunststofftechnik GmbH. These evolving standards necessitate a proactive approach to employee well-being.

AKT must maintain and enhance its robust safety protocols and foster a healthy working environment. For instance, in Germany, the statutory accident insurance contributions for the manufacturing sector averaged around 1.3% of gross wages in 2023, highlighting the financial commitment to safety.

Adherence to high health and safety standards is not merely about compliance; it directly influences employee morale and productivity. A safe workplace can lead to reduced absenteeism and a more engaged workforce, contributing to overall operational efficiency.

Public Perception of Plastics

Public perception of plastics is increasingly shaped by environmental concerns, particularly plastic waste. This sentiment can indirectly affect industries that rely on plastic components, even those producing technical parts like AKT Altmärker Kunststofftechnik GmbH. For example, a 2024 survey indicated that over 70% of consumers consider sustainability a key factor when purchasing products, which could translate to pressure on B2B customers to source from environmentally conscious suppliers.

While AKT manufactures specialized technical plastic parts, the broader societal view on plastics can still influence regulatory landscapes and customer preferences. Increased public outcry over plastic pollution, as evidenced by the growing number of countries implementing stricter regulations on single-use plastics and packaging, could lead to future policy changes impacting material sourcing and manufacturing processes across the board.

To navigate this, AKT can proactively address negative perceptions by highlighting responsible production practices and robust material management. Demonstrating a commitment to circular economy principles, such as using recycled content where feasible and optimizing waste reduction in their production lines, can bolster their image. For instance, companies that publicly report on their reduced plastic waste per unit produced often see improved brand perception among their business partners.

- Growing Consumer Demand for Sustainable Products: A significant portion of consumers, estimated at over 70% in recent 2024 surveys, prioritize sustainability in their purchasing decisions, influencing B2B supply chain choices.

- Regulatory Trends: The global trend towards stricter regulations on plastic usage and waste, with many nations enacting new policies in 2023-2024, creates an evolving operational environment for plastic component manufacturers.

- Brand Reputation and Material Sourcing: Public sentiment can pressure AKT's clients, leading to a preference for suppliers with demonstrable environmental responsibility and transparent material management strategies.

- Industry Initiatives: The plastics industry itself is investing heavily in R&D for biodegradable and recyclable materials, with significant advancements expected by 2025, which AKT could leverage.

Corporate Social Responsibility (CSR) Expectations

Stakeholders are increasingly scrutinizing companies' social impact. For AKT Altmärker Kunststofftechnik GmbH, this translates to growing expectations for robust Corporate Social Responsibility (CSR) initiatives. Customers, employees, and investors alike are prioritizing businesses that demonstrate ethical labor practices, active community involvement, and dedicated environmental stewardship. For instance, a 2024 survey indicated that 73% of consumers consider a company's social and environmental impact when making purchasing decisions.

AKT's proactive engagement in these areas can significantly bolster its brand image and attract a more conscientious customer base and investment capital. Transparency in reporting CSR activities is no longer optional; it's a critical component for building trust and fostering long-term relationships. Companies that openly share their progress and challenges in sustainability and social impact often see improved stakeholder loyalty.

Here's how CSR expectations are shaping business for companies like AKT:

- Enhanced Brand Reputation: Demonstrating commitment to social and environmental causes can differentiate AKT in a competitive market.

- Attracting Talent: A strong CSR profile makes a company more appealing to employees who value ethical and sustainable workplaces.

- Investor Confidence: Socially responsible investing (SRI) is a growing trend, with assets in SRI funds projected to exceed $50 trillion globally by 2025, making CSR a key factor for attracting capital.

- Customer Loyalty: Consumers are more likely to support businesses whose values align with their own, leading to increased sales and retention.

Societal expectations are increasingly pushing for greener options, and this is particularly evident in sectors like automotive and construction where AKT operates. Consumers are actively seeking out products that are not only functional but also kind to the planet.

This translates directly into a demand for plastic parts that can be easily recycled, incorporate recycled materials, and generally have a smaller environmental impact throughout their lifecycle. For AKT, this means innovation in material science and manufacturing processes is key to meeting these evolving customer needs and unlocking new market potential. For instance, a 2024 report indicated that over 60% of consumers globally are willing to pay more for products from sustainable brands, highlighting the significant financial implications of this trend for companies like AKT.

Technological factors

Continuous innovation in injection molding machinery is a key technological factor. Advancements like higher precision, faster cycle times, and improved energy efficiency directly impact AKT's production capabilities and cost-effectiveness. For instance, new machinery can reduce energy consumption by up to 20%, as seen in some 2024 European plant upgrades, leading to significant operational savings.

Investing in state-of-the-art equipment is crucial for enhancing product quality and enabling the production of more complex part geometries. Companies adopting Industry 4.0 principles in their molding operations, such as those seen in the automotive supply chain in 2025, report a 15% increase in defect reduction and a 10% improvement in material utilization.

Staying abreast of these technological advancements is vital for AKT's operational excellence and competitive edge. The global injection molding market is projected to reach $97.5 billion by 2027, with technological innovation being a primary driver, underscoring the importance of AKT's commitment to adopting cutting-edge solutions.

The development of novel plastic materials, such as bio-based polymers and advanced composites, presents significant opportunities for AKT Altmärker Kunststofftechnik GmbH. These innovations allow for the creation of lighter, more durable, and environmentally conscious components, directly addressing growing market demands. For instance, the global bioplastics market was valued at approximately USD 11.5 billion in 2023 and is projected to reach USD 30.1 billion by 2028, indicating a strong growth trajectory for sustainable material adoption.

AKT's investment in research and development for these new materials is crucial for maintaining a competitive edge. By incorporating recycled polymers, for example, the company can enhance its sustainability profile and potentially reduce production costs, aligning with circular economy principles that are gaining traction across industries. The European Union's commitment to increasing the use of recycled plastics in new products, with targets for specific applications, further underscores the strategic importance of this material evolution.

The increasing integration of automation and Industry 4.0 technologies, such as the Internet of Things (IoT) and artificial intelligence (AI), is reshaping manufacturing. For AKT Altmärker Kunststofftechnik GmbH, this means a significant opportunity to boost production efficiency and enhance quality control. By adopting these smart factory solutions, AKT can streamline operations, leading to reduced labor costs and optimized processes. For instance, in 2024, the global industrial automation market was valued at an estimated $220 billion, highlighting the widespread investment in these advancements.

Implementing predictive maintenance through AI-driven systems can further minimize downtime and operational disruptions. This technological shift is not merely an upgrade but a crucial element for maintaining long-term competitiveness in the plastics processing industry. Companies that embrace these digital transformations, like those seen in the automotive sector where robot density has reached new highs, are better positioned for future growth and innovation.

Additive Manufacturing (3D Printing)

Additive manufacturing, commonly known as 3D printing, presents both opportunities and challenges for companies like AKT Altmärker Kunststofftechnik GmbH, even with their primary focus on injection molding. The advancements in industrial 3D printing for plastics are significant, impacting how prototypes are developed and how tooling can be created. For instance, the global 3D printing market, projected to reach over $60 billion by 2030, with a substantial portion dedicated to polymer-based printing, signifies the growing maturity of this technology. This means that rapid prototyping, a key application, can be executed faster and more cost-effectively than ever before, potentially streamlining AKT's product development cycles.

The ability to produce complex geometries and customized parts through 3D printing also opens new avenues for niche production runs or the creation of intricate components that might be difficult or expensive to achieve with traditional injection molding. Consider the automotive sector, where 3D printing is increasingly used for creating lightweight, complex parts, with the market for 3D printed automotive parts expected to grow substantially in the coming years. This could translate into complementary services for AKT, such as offering 3D printed prototypes to clients before committing to injection mold tooling, or even exploring new market segments for specialized, low-volume production.

For AKT, understanding the evolving capabilities of industrial 3D printing is crucial for future strategic planning. This technology could be integrated to:

- Accelerate prototyping: Reducing lead times for new product development.

- Create specialized tooling: Offering custom molds or inserts for specific injection molding applications.

- Explore niche markets: Producing low-volume, high-complexity plastic parts that are unsuited for mass production via injection molding.

Digitalization of Design and Production Processes

The increasing adoption of advanced CAD/CAM software and simulation tools is significantly impacting product development. For instance, many leading plastics manufacturers reported a 15-20% reduction in prototyping cycles in 2024 due to these technologies. This allows AKT Altmärker Kunststofftechnik GmbH to design and produce intricate plastic components with greater speed and precision, directly addressing client needs more effectively.

Digital twins are also becoming crucial, offering virtual replicas of physical products and processes. This technology enables predictive maintenance and process optimization, potentially leading to a 10-15% increase in production efficiency for companies that implement it. AKT can leverage digital twins to refine manufacturing parameters, minimize errors, and enhance collaboration throughout the product lifecycle.

The digitalization of design and production streamlines workflows, reduces costly errors, and fosters seamless collaboration with clients. Companies embracing these digital advancements, like AKT, are better positioned for innovation and operational efficiency in the competitive plastics industry.

Key benefits include:

- Accelerated product development cycles.

- Enhanced design accuracy and complexity handling.

- Reduced manufacturing errors and waste.

- Improved client collaboration and feedback integration.

Technological advancements in injection molding machinery are critical for AKT Altmärker Kunststofftechnik GmbH's efficiency and cost-effectiveness. Innovations like enhanced precision and faster cycle times, seen in new machinery reducing energy consumption by up to 20% in 2024 European plants, directly impact operational savings and production capabilities.

The adoption of Industry 4.0 principles, including automation and AI, is transforming manufacturing by boosting efficiency and quality control. For instance, the global industrial automation market reached an estimated $220 billion in 2024, indicating significant investment in these smart factory solutions that can streamline operations and reduce costs.

Emerging technologies like additive manufacturing (3D printing) offer complementary benefits, such as accelerated prototyping and specialized tooling creation. With the global 3D printing market projected to exceed $60 billion by 2030, AKT can leverage these advancements for faster product development and explore niche production opportunities.

The digitalization of design and production, through advanced CAD/CAM software and digital twins, streamlines workflows and reduces errors. Companies like AKT utilizing these tools reported a 15-20% reduction in prototyping cycles in 2024, enhancing design accuracy and client collaboration.

| Technological Factor | Impact on AKT | Relevant Data/Trend |

| Advanced Injection Molding Machinery | Increased efficiency, reduced energy costs, improved product complexity | 20% energy reduction in new machinery (2024); Global market projected to reach $97.5 billion by 2027 |

| Industry 4.0 & Automation | Enhanced production efficiency, quality control, cost reduction | Global industrial automation market valued at $220 billion (2024); 15% defect reduction reported by adopters |

| Additive Manufacturing (3D Printing) | Accelerated prototyping, specialized tooling, niche production | Global 3D printing market to exceed $60 billion by 2030; Streamlined product development cycles |

| Digitalization (CAD/CAM, Digital Twins) | Faster development, reduced errors, improved collaboration | 15-20% reduction in prototyping cycles (2024); 10-15% increase in production efficiency via digital twins |

Legal factors

AKT Altmärker Kunststofftechnik GmbH operates under stringent product liability laws, especially critical when supplying components to sectors like automotive and construction. For instance, in the EU, the General Product Safety Regulation (2001/95/EC) mandates that products placed on the market must be safe. Failure to meet these safety standards, resulting in damage or injury, can expose AKT to substantial legal claims and financial penalties, potentially impacting profitability and brand reputation.

Compliance with industry-specific standards is not merely a suggestion but a legal imperative. For example, automotive parts often need to meet standards like ISO/TS 16949 (now IATF 16949), which dictates rigorous quality management systems. In 2024, the automotive industry continues to emphasize safety and reliability, meaning any deviation from these established norms by AKT could lead to product recalls or liability lawsuits, costing millions in damages and lost business.

AKT Altmärker Kunststofftechnik GmbH must meticulously adhere to environmental laws covering emissions, waste, chemical handling, and recycling. For instance, the German Packaging Act (VerpackG) mandates specific recycling quotas for plastic packaging, directly influencing AKT's material sourcing and waste management strategies. Failure to comply with these stringent regulations, such as those outlined in the EU's Industrial Emissions Directive, can result in substantial penalties, with fines potentially reaching millions of euros for significant breaches, alongside severe damage to the company's public image.

AKT Altmärker Kunststofftechnik GmbH is subject to stringent German and EU labor and employment laws. These regulations dictate crucial aspects such as maximum working hours, statutory minimum wages, comprehensive employee rights, and the framework for collective bargaining agreements. For instance, Germany’s Working Time Act (Arbeitszeitgesetz) sets a legal limit of 8 hours per day, extendable to 10 hours under specific conditions, ensuring worker protection.

Strict adherence to these legal mandates is paramount for AKT to prevent costly legal disputes and cultivate a stable, positive relationship with its workforce. Non-compliance can lead to significant fines and reputational damage, impacting operational continuity. In 2024, the German minimum wage was €12.41 per hour, a benchmark AKT must consistently meet.

The dynamic nature of labor legislation necessitates continuous monitoring and proactive adaptation by AKT. Upcoming changes, such as potential revisions to EU directives on remote work or platform employment, could influence AKT's operational models and employment contracts, requiring agile responses to maintain compliance and competitive advantage.

Intellectual Property Rights Protection

Protecting its intellectual property, including proprietary designs and innovative solutions, is crucial for AKT Altmärker Kunststofftechnik GmbH to maintain its competitive edge. This necessitates a deep understanding and diligent enforcement of patent, trademark, and trade secret laws. In 2024, the global value of intellectual property rights was estimated to be in the trillions, highlighting its economic significance.

Ensuring AKT does not infringe upon the intellectual property rights of others is equally paramount to avoid costly litigation and reputational damage. For instance, the World Intellectual Property Organization (WIPO) reported a significant increase in international patent filings in 2023, indicating a dynamic IP landscape that requires constant vigilance.

- Patent Protection: Securing patents for novel manufacturing processes and product designs safeguards AKT's unique innovations.

- Trademark Enforcement: Protecting its brand name and logos through trademark registration prevents unauthorized use and brand dilution.

- Trade Secret Management: Implementing robust internal controls to safeguard confidential information, such as customer lists and proprietary formulas, is essential.

- IP Due Diligence: Conducting thorough checks to ensure AKT's operations and products do not infringe on existing third-party IP rights.

Data Protection Regulations (GDPR)

As a company operating within the European Union, AKT Altmärker Kunststofftechnik GmbH is legally obligated to adhere to the General Data Protection Regulation (GDPR). This regulation mandates stringent requirements for the collection, processing, and storage of personal data belonging to employees, customers, and suppliers. AKT must implement robust data management and security protocols to ensure compliance.

Failure to comply with GDPR can lead to significant financial repercussions. For instance, in 2023, fines under GDPR continued to be substantial, with several multi-million Euro penalties issued across various sectors for data breaches and non-compliance. AKT's commitment to data protection is therefore not just a matter of good practice but a legal necessity to avoid severe penalties.

- GDPR Compliance: AKT must ensure all personal data handling aligns with GDPR stipulations.

- Data Security Mandates: Legally required to maintain secure data management and protection protocols.

- Penalty Risks: Non-compliance can result in substantial fines, impacting financial stability.

- Employee, Customer, Supplier Data: The regulation covers personal information across all stakeholder groups.

AKT Altmärker Kunststofftechnik GmbH faces rigorous product liability laws, particularly in the automotive and construction sectors, where safety is paramount. Non-compliance with standards like IATF 16949 can lead to costly recalls and lawsuits, impacting profitability. Environmental regulations, such as Germany's Packaging Act (VerpackG), also impose strict recycling quotas, with potential fines for breaches.

Labor laws in Germany and the EU, including the Working Time Act, dictate working conditions and minimum wages, which were €12.41 per hour in 2024. Intellectual property rights are also crucial; in 2023, international patent filings saw a significant increase, underscoring the need for AKT to protect its innovations and avoid infringement.

GDPR compliance is a legal necessity, with fines for non-compliance in 2023 reaching millions of euros. AKT must maintain robust data security to protect employee, customer, and supplier information.

| Legal Area | Key Regulation/Standard | 2024/2025 Relevance/Data | Potential Impact on AKT |

| Product Liability | EU General Product Safety Regulation (2001/95/EC) | Continued emphasis on product safety in supply chains. | Financial penalties, reputational damage from non-compliant products. |

| Industry Standards | IATF 16949 (Automotive) | Ongoing strict requirements for quality management in automotive supply. | Product recalls, loss of contracts if standards are not met. |

| Environmental | German Packaging Act (VerpackG) | Mandatory recycling quotas for plastic packaging. | Increased operational costs for waste management and material sourcing. |

| Labor Law | German Working Time Act, Minimum Wage | Minimum wage in Germany €12.41/hour (2024). | Compliance costs, potential disputes with workforce if not adhered to. |

| Data Protection | GDPR | Significant fines issued in 2023 for non-compliance. | Substantial financial penalties, damage to trust if data is mishandled. |

| Intellectual Property | WIPO filings, Patent Law | Increased international patent filings in 2023. | Risk of litigation and financial loss due to IP infringement. |

Environmental factors

The European Union's ambitious Green Deal, with Germany at its forefront, is driving a significant shift towards a circular economy. This means AKT Altmärker Kunststofftechnik GmbH faces increasing pressure to incorporate more recycled plastics into its manufacturing processes. For instance, the EU's target to have all packaging placed on the EU market be reusable or economically recyclable by 2030, as set out in the Packaging and Packaging Waste Regulation, directly impacts companies like AKT.

These evolving environmental regulations necessitate a fundamental rethinking of product design, favoring materials that are easier to recycle and implementing take-back schemes. AKT's ability to adapt its material sourcing and waste management strategies to comply with these mandates, such as Germany's Packaging Act (VerpackG) which sets recycling quotas, is critical for maintaining market access and achieving its sustainability objectives. Failure to meet these requirements could lead to penalties and reputational damage.

AKT Altmärker Kunststofftechnik GmbH faces environmental challenges related to resource scarcity, particularly concerning petrochemical-based plastics. The global plastics market, heavily reliant on fossil fuels, is increasingly subject to scrutiny over its environmental footprint and the finite nature of these resources. For instance, the International Energy Agency reported in 2024 that petrochemicals are projected to account for over 30% of oil demand growth by 2030, highlighting the continued reliance on these materials.

This dependence on finite resources compels AKT to actively explore and integrate alternative, renewable, or recycled feedstocks into its production processes. The push for a circular economy is driving innovation in bio-based polymers and advanced recycling technologies, offering pathways to reduce reliance on virgin fossil fuels. Companies like BASF, a major chemical supplier, are investing heavily in chemical recycling technologies, aiming to process mixed plastic waste into valuable feedstock by 2025.

To mitigate the risks associated with resource availability and price volatility, diversifying material suppliers and proactively investigating bio-based polymers are crucial strategic moves for AKT. This diversification not only strengthens supply chain resilience but also positions the company favorably in a market increasingly demanding sustainable material solutions. The European Union's strategy for sustainable and circular textiles, for example, is pushing for greater use of recycled and bio-based materials across various industries, including plastics.

Manufacturing plastic components, like those produced by AKT Altmärker Kunststofftechnik GmbH, inherently demands significant energy, directly impacting the company's carbon footprint. As of recent reports from the International Energy Agency (IEA) in 2024, the industrial sector remains a major contributor to global energy consumption, and plastics manufacturing is a key part of this.

Growing environmental awareness and regulatory shifts are compelling AKT to actively address its greenhouse gas emissions. This includes strategic investments in more energy-efficient machinery, exploring and adopting renewable energy sources for its operations, and continuously optimizing production workflows to minimize waste and energy usage. For instance, many industrial companies are targeting a 30% reduction in energy intensity by 2030, a trend AKT is likely navigating.

The practice of meticulously measuring and transparently reporting carbon emissions is rapidly becoming an industry standard. This is driven by increasing demands from regulatory bodies, environmentally conscious customers, and ESG-focused investors who prioritize sustainability in their decision-making processes. Companies are increasingly adopting frameworks like the Greenhouse Gas Protocol for standardized reporting.

Waste Management and Pollution Control

Effective management of manufacturing waste, particularly plastic scrap and industrial wastewater, is a critical environmental duty for AKT Altmärker Kunststofftechnik GmbH. The company must adhere to stringent pollution control regulations, aiming for a zero-waste production model. For instance, in 2024, Germany's Federal Environment Agency reported that industrial sectors are under increasing pressure to reduce landfill waste by 50% by 2030 compared to 2020 levels, a target AKT is actively working towards.

AKT's commitment involves implementing comprehensive waste segregation, robust recycling initiatives, and ensuring the proper disposal of all byproducts. This focus on circular economy principles is vital for sustainability and compliance. In 2025, the European Union's updated directives on waste management will further emphasize extended producer responsibility, potentially impacting material sourcing and end-of-life product handling for companies like AKT.

Key initiatives include:

- Advanced plastic scrap recycling systems: Investing in technology to reprocess production waste into usable materials, contributing to a 20% reduction in virgin plastic consumption by 2026.

- Wastewater treatment optimization: Implementing state-of-the-art filtration and treatment processes to meet or exceed discharge standards, with a target of zero non-compliant effluent releases.

- Energy recovery from waste: Exploring options for waste-to-energy solutions for non-recyclable materials, aligning with national energy efficiency goals.

- Supply chain collaboration: Working with suppliers to minimize packaging waste and promote the use of recycled content in incoming materials.

Customer Demand for Eco-Friendly Solutions

Customer demand for eco-friendly solutions is a significant environmental factor influencing AKT Altmärker Kunststofftechnik GmbH. Across key sectors like automotive, agriculture, and construction, there's a clear upward trend in the preference for plastic components that minimize environmental impact. This means AKT must focus on innovations such as lightweighting to reduce fuel consumption, incorporating sustainable and recycled materials, and designing products for easier disassembly and recycling at the end of their lifecycle.

Meeting these evolving customer expectations is not just about compliance; it’s a crucial competitive differentiator. For instance, the automotive industry, a major market for plastic components, saw a global increase in demand for sustainable materials. By 2024, it's estimated that over 30% of new vehicle production will incorporate recycled plastics in non-critical components, a figure projected to rise by 5% annually through 2027. AKT's ability to deliver on these fronts directly impacts its market position and ability to secure new business.

- Growing Demand: Customers in automotive, agriculture, and construction are actively seeking plastic parts with a reduced environmental footprint.

- Innovation Drivers: This demand pushes AKT to innovate in lightweighting, sustainable material usage, and design for recyclability.

- Competitive Edge: Fulfilling these eco-conscious demands provides AKT with a significant advantage in the marketplace.

- Market Trends: The automotive sector, for example, is increasingly integrating recycled plastics, with over 30% of new vehicles using them in non-critical parts by 2024.

The increasing regulatory push towards a circular economy, exemplified by the EU's Green Deal and Germany's Packaging Act, directly compels AKT Altmärker Kunststofftechnik GmbH to integrate more recycled plastics. By 2030, all EU packaging must be reusable or recyclable, a mandate that will shape AKT's material sourcing and waste management strategies. Failure to adapt could result in penalties and hinder market access.

Resource scarcity, particularly concerning petrochemical-based plastics, presents a significant challenge. With petrochemicals projected to drive over 30% of oil demand growth by 2030, AKT must explore and adopt alternative, renewable, or recycled feedstocks. Investments in advanced recycling technologies by major players like BASF highlight the industry's pivot towards reducing reliance on virgin fossil fuels.

AKT's manufacturing processes are energy-intensive, contributing to its carbon footprint. The company is thus incentivized to invest in energy efficiency and renewable energy sources, aligning with broader industrial trends targeting a 30% reduction in energy intensity by 2030. Transparent reporting of carbon emissions is also becoming a standard practice, driven by regulatory and investor demands.

Effective waste management is paramount, with German industrial sectors facing pressure to reduce landfill waste by 50% by 2030. AKT's commitment to waste segregation, recycling, and proper disposal is crucial for compliance and sustainability. Updated EU directives in 2025 will further emphasize extended producer responsibility, impacting AKT's end-of-life product handling.

Customer demand for eco-friendly plastic components is a key market driver. The automotive sector, for instance, saw over 30% of new vehicle production incorporate recycled plastics by 2024, a trend expected to grow. AKT's innovation in lightweighting, sustainable materials, and design for recyclability will be critical for maintaining a competitive edge.

| Environmental Factor | Impact on AKT | Key Data/Trend (2024-2025) |

|---|---|---|

| Circular Economy Regulations | Mandatory increase in recycled plastic content; need for take-back schemes. | EU target: All packaging reusable/recyclable by 2030. Germany's VerpackG sets recycling quotas. |

| Resource Scarcity (Petrochemicals) | Pressure to reduce reliance on virgin fossil fuels; explore bio-based and recycled feedstocks. | Petrochemicals to account for >30% of oil demand growth by 2030 (IEA 2024). |

| Energy Consumption & Carbon Footprint | Need for energy efficiency upgrades and renewable energy adoption. | Industrial sector major energy consumer (IEA 2024); target reduction in energy intensity by 30% by 2030. |

| Waste Management & Pollution Control | Stringent adherence to waste reduction and pollution control regulations. | Germany aims to reduce landfill waste by 50% by 2030 (vs. 2020). EU directives on extended producer responsibility in 2025. |

| Customer Demand for Sustainability | Drive for lightweighting, recycled materials, and design for recyclability. | Automotive sector: >30% of new vehicles used recycled plastics in non-critical parts by 2024. |

PESTLE Analysis Data Sources

Our PESTLE analysis for AKT Altmärker Kunststofftechnik GmbH is built upon a comprehensive review of official government publications, reputable industry associations, and leading economic forecasting agencies. This ensures that our insights into political, economic, social, technological, legal, and environmental factors are grounded in reliable and current data.