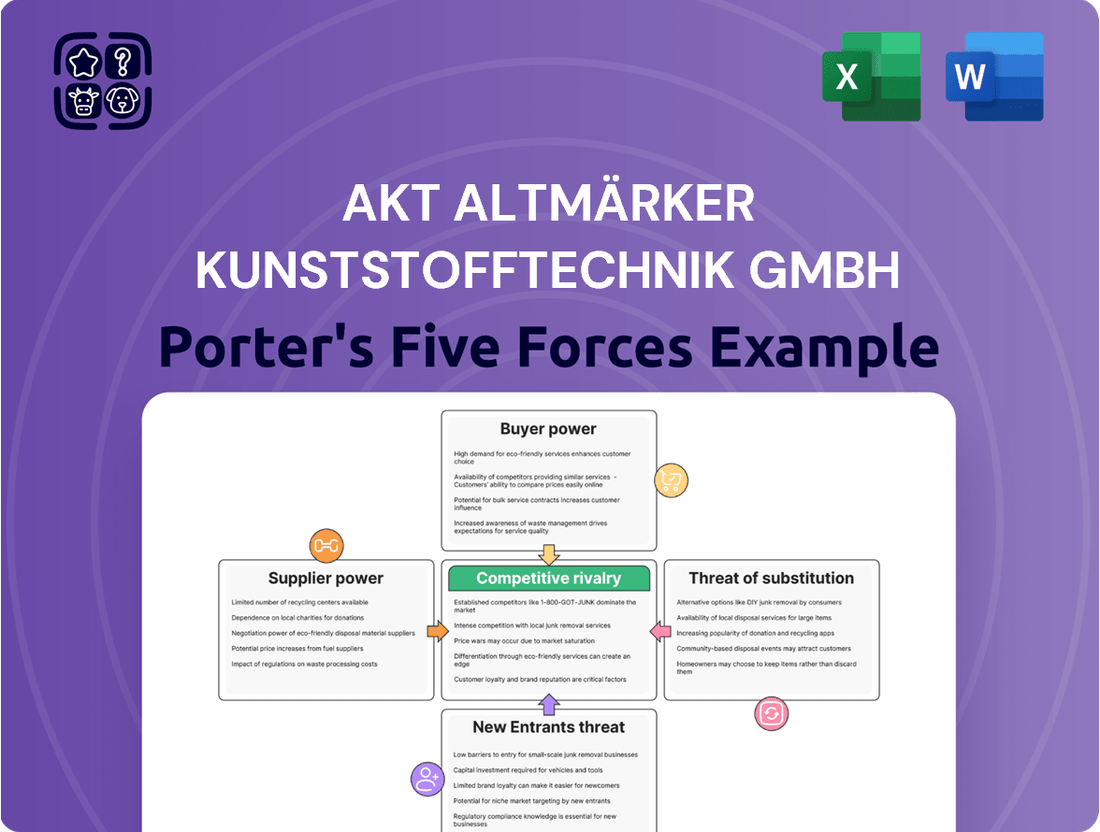

AKT Altmärker Kunststofftechnik GmbH Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AKT Altmärker Kunststofftechnik GmbH Bundle

AKT Altmärker Kunststofftechnik GmbH navigates a competitive landscape shaped by moderate buyer power and the persistent threat of substitutes, while supplier power presents a significant challenge. Understanding these dynamics is crucial for strategic planning.

The full Porter's Five Forces Analysis reveals the real forces shaping AKT Altmärker Kunststofftechnik GmbH’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

AKT Altmärker Kunststofftechnik GmbH's reliance on specialized plastic raw materials and machinery for its injection molding processes, especially for automotive-grade components, positions a few highly specialized suppliers to wield considerable influence. While the general market for plastics like polypropylene and polyethylene is vast, the specific, high-performance grades required for automotive applications often come from a more restricted supplier base.

Switching suppliers for AKT likely involves substantial costs. These can include expenses for retooling machinery to accommodate new material specifications, the rigorous process of re-validating materials to meet precise customer requirements, particularly critical in the demanding automotive industry, and the inherent risk of production disruptions during the transition. These factors grant suppliers considerable leverage, as AKT would encounter significant obstacles in sourcing its raw materials elsewhere.

If suppliers of essential plastic resins or specialized manufacturing machinery were to move into producing finished plastic parts themselves, they would directly compete with AKT Altmärker Kunststofftechnik GmbH. This forward integration by suppliers poses a significant threat, potentially eroding AKT's market share and profitability. For instance, a major resin producer with advanced molding capabilities could start offering custom plastic components, directly challenging AKT's core business.

Uniqueness of Supplier Offerings

AKT Altmärker Kunststofftechnik GmbH's reliance on high-quality plastic parts and systems, coupled with its focus on innovation and customer-specific solutions, can significantly influence the bargaining power of its suppliers. This often necessitates unique raw material formulations or specialized manufacturing equipment.

Suppliers who provide proprietary materials, advanced compounds, or cutting-edge injection molding technologies, particularly those specializing in lightweighting or sustainable material solutions, are positioned to exert greater bargaining power. For instance, a supplier offering a patented, high-strength polymer blend essential for AKT's automotive components would hold considerable leverage.

- Supplier Differentiation: Suppliers offering unique formulations or advanced processing technologies that are difficult for AKT to replicate internally or source elsewhere gain an advantage.

- Proprietary Materials: Access to specialized plastic compounds, such as those with enhanced UV resistance or specific flame-retardant properties, can empower suppliers.

- Technological Expertise: Providers of advanced injection molding machines or specialized tooling, especially those enabling complex geometries or ultra-thin wall sections, can command higher prices and terms.

- Innovation in Sustainability: Suppliers at the forefront of developing eco-friendly or recycled plastic materials that meet stringent industry standards for AKT's applications will likely possess increased bargaining power.

Impact of Raw Material Price Volatility

Fluctuations in crude oil prices directly affect the cost of plastic raw materials, as they are derived from petrochemicals. For instance, in late 2024, reports showed some increases in techno-polymer prices, mirroring oil price movements.

These raw material costs are a significant factor in AKT Altmärker Kunststofftechnik GmbH's production expenses. The bargaining power of suppliers is therefore influenced by how easily these material costs can be passed on to customers.

- Crude Oil Price Impact: Petrochemical-based plastic raw materials are highly sensitive to crude oil price volatility.

- 2024 Trends: Late 2024 saw some upward pressure on techno-polymer prices, correlating with oil market shifts.

- 2025 Outlook: Expectations for 2025 suggest a softening in engineering polymer notations due to increased supply and competitive market dynamics.

AKT Altmärker Kunststofftechnik GmbH faces moderate bargaining power from its suppliers, particularly for specialized automotive-grade plastics and advanced machinery. The costs associated with switching suppliers, including retooling and material re-validation, create significant switching barriers. For example, the automotive sector's stringent quality demands mean new materials require extensive testing, often taking months and substantial investment.

Suppliers of proprietary polymers or specialized injection molding equipment can leverage their unique offerings, as AKT's reliance on these inputs limits its alternatives. The market for certain high-performance polymers, essential for lightweighting in vehicles, is concentrated among a few key producers. In 2024, the price of some engineering polymers saw an increase, reflecting supply chain pressures and demand from the automotive sector, a trend expected to moderate in 2025 due to increased global production capacity.

| Factor | Impact on AKT | Supplier Leverage |

|---|---|---|

| Specialized Materials | High reliance on specific polymer grades | Moderate to High |

| Switching Costs | Significant investment in retooling and validation | Moderate |

| Supplier Integration | Potential for direct competition if suppliers move into finished parts | Moderate |

| 2024 Material Prices | Upward pressure on engineering polymers | Moderate |

| 2025 Material Outlook | Expected softening in engineering polymer prices | Low to Moderate |

What is included in the product

This analysis meticulously examines the competitive forces impacting AKT Altmärker Kunststofftechnik GmbH, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitute products, and the intensity of rivalry within the plastics technology sector.

Streamline competitive analysis with a pre-built Porter's Five Forces framework, instantly highlighting AKT Altmärker Kunststofftechnik GmbH's strategic advantages and potential threats.

Customers Bargaining Power

AKT Altmärker Kunststofftechnik GmbH's customer base spans automotive, agriculture, and construction. The automotive sector, a significant market, often features a concentrated group of major car manufacturers. These large clients, due to their substantial order volumes and established relationships, typically wield considerable bargaining power.

Customer switching costs for AKT Altmärker Kunststofftechnik GmbH's clients are significant, particularly for specialized plastic components. These costs encompass re-tooling, product re-design, and rigorous re-qualification processes, which can easily run into tens of thousands of Euros for complex parts.

For instance, a shift to a new supplier for a critical automotive plastic part could necessitate months of validation and testing, potentially delaying production schedules and incurring substantial engineering expenses. This inherent friction in changing suppliers effectively limits the bargaining power of AKT's customers, creating a degree of customer loyalty based on the investment already made in the existing supplier relationship.

Customers in sectors like automotive and construction often face intense competition, forcing them to scrutinize every cost. This means they are very sensitive to price changes for components, making them powerful negotiators with suppliers like AKT. For instance, in 2024, the automotive industry continued to grapple with rising material costs, pushing manufacturers to demand greater price concessions from their supply chain partners.

Threat of Backward Integration by Customers

Large customers, particularly those in the automotive sector, possess the financial clout and strategic motivation to consider backward integration, meaning they might opt to manufacture plastic components internally rather than sourcing them from suppliers like AKT Altmärker Kunststofftechnik GmbH. This is a real concern, as major automotive manufacturers often have substantial R&D budgets and production capacities.

However, the specialized nature of injection molding, which requires significant investment in sophisticated machinery, proprietary tooling, and deep technical expertise in material science and process optimization, often acts as a significant barrier to entry for customers. AKT's established infrastructure and decades of experience in this niche provide a competitive advantage.

- Customer Integration Risk: Major automotive clients, representing a significant portion of the plastics industry's customer base, may explore in-house production of plastic components.

- AKT's Mitigation: AKT Altmärker Kunststofftechnik GmbH leverages its specialized injection molding expertise and advanced equipment, which are costly and complex for customers to replicate.

- Industry Example: In 2023, several Tier 1 automotive suppliers reported increased capital expenditure on advanced manufacturing technologies, signaling a potential shift towards vertical integration, though this often focuses on core competencies rather than specialized plastic molding.

Availability of Alternative Suppliers

While AKT Altmärker Kunststofftechnik GmbH focuses on tailored solutions, the broader market for plastic injection molding, especially for more standardized components, offers customers a range of alternative suppliers. This availability of choice directly influences customer leverage.

The German plastics processing industry, which experienced a notable decline in output in recent years, further amplifies customer bargaining power. For instance, industry associations like PlasticsEurope reported a contraction in sales volumes for many segments in 2023, creating a more competitive environment where customers can often negotiate more favorable terms.

- Supplier Competition: A high number of plastic injection molding companies, particularly those serving less specialized market segments, means customers can readily switch providers if pricing or service expectations aren't met.

- Market Dynamics: In a market characterized by overcapacity or slower demand, customers gain more power to dictate terms, including pricing, delivery schedules, and quality standards.

- Standardization vs. Customization: For standard plastic parts, the availability of numerous suppliers with similar capabilities intensifies customer bargaining power. For highly customized or technically complex parts, this power is somewhat diminished, though still present.

AKT Altmärker Kunststofftechnik GmbH faces significant customer bargaining power, particularly from large automotive clients who can exert pressure on pricing due to their substantial order volumes and the competitive nature of their own industry. In 2024, continued price sensitivity in the automotive sector, driven by material cost fluctuations, meant manufacturers actively sought cost reductions from their suppliers.

While switching costs for specialized components are high, the broader market for less specialized plastic parts offers customers numerous alternatives, intensifying competition among suppliers like AKT. This dynamic is reflected in the German plastics processing industry's performance, which saw a contraction in sales volumes in 2023, creating an environment more favorable to buyers.

Customers' potential for backward integration, though demanding in terms of investment in specialized machinery and expertise, remains a latent threat. However, AKT's established technological capabilities and deep industry experience in injection molding serve as a counter-balance to this customer leverage.

| Factor | Impact on AKT | Supporting Data/Example |

|---|---|---|

| Customer Concentration (Automotive) | High Bargaining Power | Major automotive manufacturers often represent a significant portion of a plastic component supplier's revenue. |

| Switching Costs | Moderate Bargaining Power Mitigation | Re-tooling and validation for complex plastic parts can cost tens of thousands of Euros, discouraging frequent supplier changes. |

| Price Sensitivity | High Bargaining Power | In 2024, automotive industry's focus on cost control led to increased demands for price concessions from suppliers. |

| Supplier Availability (Standard Parts) | High Bargaining Power | A competitive market with many suppliers for standard plastic components allows customers to negotiate favorable terms. |

| Potential for Backward Integration | High Bargaining Power (Latent) | Large automotive firms possess the capital and R&D to consider in-house production, though specialized molding remains a barrier. |

Preview the Actual Deliverable

AKT Altmärker Kunststofftechnik GmbH Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details AKT Altmärker Kunststofftechnik GmbH's competitive landscape through Porter's Five Forces, analyzing the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the plastics technology sector.

Rivalry Among Competitors

The plastic injection molding sector, particularly within Germany and across Europe, hosts a vast array of competitors. These range from global giants to niche, specialized businesses, all vying for market share.

This crowded landscape fuels significant competitive rivalry. For instance, in 2023, the German plastics processing industry saw a notable decline, with output decreasing by 5.4% compared to the previous year, according to PlasticsEurope. This contraction intensifies the pressure on companies like AKT Altmärker Kunststofftechnik GmbH.

While global markets for plastics and injection molded plastics are anticipated to expand, Germany's plastics industry experienced a downturn in production and processing. For instance, in 2023, the German plastics processing industry saw a real turnover decrease of 4.5% compared to the previous year, according to Plastics Europe.

This domestic contraction intensifies competition among players like AKT Altmärker Kunststofftechnik GmbH, as companies vie for a diminishing market share within Germany. Such conditions often lead to price wars and increased pressure on innovation to differentiate offerings.

AKT Altmärker Kunststofftechnik GmbH leverages product differentiation through its focus on customer-specific solutions, a key strategy in a competitive market. This approach aims to set them apart from competitors offering more standardized products.

The injection molding sector is rapidly evolving with advancements in materials science, enabling the development of specialized plastics with enhanced properties. For instance, the global market for advanced plastics is projected to reach over $120 billion by 2025, indicating significant demand for innovative materials that AKT can integrate.

Furthermore, the industry's embrace of micro-molding and Industry 4.0 technologies, including AI-driven process optimization and smart manufacturing, necessitates continuous investment in research and development. Companies failing to innovate in these areas risk falling behind, as demonstrated by the increasing market share of firms adopting these cutting-edge techniques.

Exit Barriers

High fixed costs in the plastics processing sector, particularly for injection molding, act as significant exit barriers for companies like AKT Altmärker Kunststofftechnik GmbH. These costs include substantial investments in specialized machinery, custom tooling, and the need for a skilled workforce. For instance, a single high-precision injection molding machine can cost hundreds of thousands of euros, and the associated tooling can add significantly more. This capital intensity means that exiting the market involves substantial unrecoverable costs.

These elevated exit barriers can intensify competitive rivalry. When it's very expensive or difficult to leave the industry, firms facing financial difficulties may opt to continue operating, even at reduced profitability. This can lead to a situation where companies maintain production levels, potentially driving down prices and margins for everyone involved. In 2024, the German plastics processing industry, a key market for companies like AKT, faced ongoing price pressures from energy costs and raw material volatility, which would exacerbate the impact of high exit barriers.

- High Capital Investment: Specialized injection molding machinery and custom tooling represent significant upfront costs, making it financially challenging to cease operations.

- Skilled Labor Dependency: The need for experienced technicians and operators creates a human capital barrier, as re-deploying or retraining this workforce can be difficult and costly.

- Market Saturation: In segments with many players, struggling firms may stay in the market to recover fixed costs, leading to increased price competition.

- Asset Depreciation: Specialized machinery can depreciate rapidly if not utilized, adding to the financial penalty of exiting.

Strategic Commitments of Competitors

Competitors in the plastic injection molding sector are making substantial investments in cutting-edge technologies, automation, and eco-friendly operations. For instance, industry leaders are channeling significant capital into Industry 4.0 solutions, aiming to boost efficiency and precision. Companies demonstrating strong strategic commitments in these advanced areas present a formidable competitive challenge.

These commitments force AKT Altmärker Kunststofftechnik GmbH to continually evaluate and enhance its own technological capabilities and operational strategies. The drive towards sustainability, including the use of recycled materials and energy-efficient processes, is also a key area where competitors are differentiating themselves.

- Technological Advancement: Competitors are investing heavily in robotics, AI-driven quality control, and advanced simulation software.

- Automation Integration: Many firms are increasing their deployment of automated production lines to reduce labor costs and improve output consistency.

- Sustainability Focus: A growing number of companies are prioritizing the use of bio-plastics and closed-loop recycling systems.

- Strategic Investments: Significant capital expenditures in these areas by rivals directly influence AKT's need for similar strategic commitments to remain competitive.

The competitive rivalry within the plastic injection molding sector is intense, driven by a fragmented market and a strong emphasis on technological adoption and efficiency. Companies like AKT Altmärker Kunststofftechnik GmbH face pressure from rivals investing heavily in automation, AI, and sustainable practices to gain an edge.

The German plastics industry's performance in 2023, marked by a 5.4% decrease in output according to PlasticsEurope, further intensifies this rivalry. This contraction means companies are competing for a smaller domestic market, often leading to price wars and a heightened need for innovation to stand out.

AKT's strategy of offering customer-specific solutions is a crucial differentiator against competitors focusing on more standardized products. This approach, combined with a commitment to advanced materials and micro-molding, positions AKT to navigate the dynamic and demanding competitive landscape.

Competitors are actively upgrading their capabilities, with significant investments in Industry 4.0 technologies and sustainable processes. For example, many are integrating robotics and advanced simulation software to enhance precision and reduce operational costs, setting a high bar for the entire industry.

SSubstitutes Threaten

For AKT Altmärker Kunststofftechnik GmbH, the threat of substitutes remains a key consideration. Traditional materials such as metals, glass, wood, and ceramics can often serve as alternatives in various applications, particularly within the automotive and construction sectors. These established materials have long histories of use and possess inherent properties that appeal to certain market segments.

However, the automotive industry's strong push for lightweighting presents a significant advantage for plastics. For instance, by 2024, the average weight of new cars in the US has seen a slight increase, but the underlying trend and manufacturer goals are firmly focused on reducing vehicle weight to improve fuel efficiency and performance. This shift directly benefits plastic manufacturers like AKT, as plastics offer a compelling weight-to-strength ratio compared to many traditional materials, potentially mitigating the threat of substitution in this vital market.

The threat of substitutes for plastics in applications like those AKT Altmärker Kunststofftechnik GmbH serves hinges on how well these alternatives perform and their overall cost. For instance, materials like glass, metal, or even wood might offer comparable strength or durability, but often at a higher weight or manufacturing expense. In 2024, the global plastics market was valued at approximately $600 billion, highlighting the widespread adoption due to their inherent advantages in many sectors.

Plastics typically excel in being lightweight and cost-effective, which is a significant draw for manufacturers across various industries. While substitutes like aluminum have seen price fluctuations, with the London Metal Exchange (LME) aluminum price averaging around $2,200 per metric ton in early 2024, the consistent cost-efficiency of many plastic resins remains a strong competitive factor.

Technological advancements continue to present a significant threat of substitutes for plastic components manufactured by AKT Altmärker Kunststofftechnik GmbH. Innovations in materials science are yielding new alloys, advanced composites, and even bio-based materials that are increasingly competitive in terms of performance and cost. For example, the development of high-strength, lightweight composites could displace plastics in automotive and aerospace applications where weight reduction is paramount.

The growing viability of these alternative materials is directly linked to their improving properties and expanding applications. Consider the agribusiness sector, where bioplastics derived from renewable resources are gaining considerable traction due to environmental concerns and regulatory pressures. This trend suggests that plastics, even those with specialized properties, may face increasing substitution by more sustainable and performance-enhanced alternatives in the near future, impacting AKT's market share.

Customer Willingness to Adopt Substitutes

Customer willingness to adopt substitutes for AKT Altmärker Kunststofftechnik GmbH's products hinges on the ease of switching, which is often tied to design flexibility and the complexity of manufacturing processes. For highly integrated components, the effort and cost involved in adapting to a substitute can be substantial, thereby reducing the immediate threat.

The ability of customers to adjust their supply chains and internal processes also plays a crucial role. If a substitute requires significant retooling or a complete overhaul of existing logistics, customers are less likely to switch quickly. This inertia can provide a buffer for AKT Altmärker Kunststofftechnik GmbH.

Consider the automotive sector, a key market for plastic components. A 2024 industry report indicated that while alternative materials like advanced composites are gaining traction, the integration costs for manufacturers, including re-engineering and testing, can range from 5% to 15% of the component’s lifecycle cost, making immediate widespread adoption of substitutes challenging for complex parts.

- Design Flexibility: Substitutes offering greater design freedom or reduced lead times may attract customers.

- Manufacturing Process Integration: The complexity of adapting manufacturing lines to new materials or designs is a significant barrier.

- Supply Chain Adjustments: Changes in sourcing, logistics, and supplier relationships required by substitutes influence adoption rates.

- Component Integration Level: Highly integrated components with established interfaces present a higher switching cost for customers.

Regulatory and Environmental Pressures

Growing environmental consciousness and stricter regulations are pushing industries towards sustainable alternatives. This trend directly impacts companies like AKT Altmärker Kunststofftechnik GmbH by encouraging the use of eco-friendly materials or recycled plastics, thereby presenting a significant threat of substitution for conventional plastic components.

For instance, the European Union's focus on a circular economy, with targets for increased recycling and the promotion of bioplastics, creates a competitive landscape where traditional plastics may be displaced. By 2024, many sectors are expected to have integrated higher percentages of recycled content into their products, driven by legislative mandates and consumer demand for greener options.

- Regulatory Push: EU directives aim to boost recycled plastic content in products, impacting demand for virgin plastics.

- Consumer Demand: A growing preference for sustainable and biodegradable materials directly challenges traditional plastic applications.

- Material Innovation: Advances in bioplastics and alternative composite materials offer viable substitutes, potentially eroding market share for conventional plastics.

- Circular Economy Goals: The push for a circular economy incentivizes the use of recycled materials, creating a substitute threat for new plastic production.

The threat of substitutes for AKT Altmärker Kunststofftechnik GmbH's plastic products is multifaceted, driven by material innovation, cost-effectiveness, and evolving environmental concerns. While plastics offer advantages like lightweighting, which is crucial for automotive efficiency, advancements in composites and metals present viable alternatives. For example, the automotive industry's pursuit of lightweighting, despite slight weight increases in new cars by 2024, continues to favor plastics, but high-strength composites are emerging as direct competitors.

The cost and performance of substitutes are key determinants in their adoption. While aluminum prices fluctuated around $2,200 per metric ton on the LME in early 2024, plastics generally maintain a cost advantage. However, new material developments, such as advanced composites and bio-based plastics, are increasingly matching or exceeding plastic performance in specific applications, posing a growing substitution threat. This is particularly evident in sectors responding to environmental pressures, where bioplastics are gaining traction.

Customer willingness to switch to substitutes is influenced by the ease of integration and supply chain adjustments. High switching costs, including retooling and re-engineering, can deter adoption, as seen in the automotive sector where integration costs for new materials can range from 5% to 15% of lifecycle cost. Furthermore, growing environmental consciousness and regulatory mandates, like the EU's circular economy initiatives promoting recycled content, are accelerating the demand for sustainable alternatives, directly challenging conventional plastics.

| Factor | Impact on AKT | Key Considerations for 2024 |

| Material Innovation | Emerging composites and advanced alloys offer comparable or superior performance in specific applications. | High-strength composites are becoming more competitive in automotive and aerospace. |

| Cost-Effectiveness | Plastics generally remain cost-competitive, but substitute material prices can fluctuate. | Aluminum prices averaged around $2,200/metric ton on LME in early 2024, showing variability. |

| Environmental Concerns | Increasing demand for sustainable and biodegradable materials creates a substitution threat. | EU's circular economy goals drive adoption of recycled plastics and bioplastics. |

| Switching Costs | High integration and supply chain adjustment costs for customers can mitigate substitution. | Automotive integration costs for new materials can be 5-15% of lifecycle cost. |

Entrants Threaten

The plastic injection molding sector, where AKT Altmärker Kunststofftechnik GmbH operates, demands significant upfront capital. New businesses must invest heavily in specialized machinery, precision molds, and dedicated production facilities, creating a formidable financial hurdle for potential competitors.

For instance, a state-of-the-art injection molding machine can range from $100,000 to over $1 million, with custom molds costing tens of thousands of dollars each. This high barrier to entry means that only well-funded entities can realistically consider entering the market, thereby protecting existing players like AKT.

Established players like AKT Altmärker Kunststofftechnik GmbH benefit significantly from economies of scale. This means they can purchase raw materials in bulk at lower prices, optimize their production lines for higher efficiency, and spread their substantial fixed costs across a larger output volume. For instance, in 2024, companies with over €100 million in revenue in the plastics processing sector often reported production costs per unit that were 10-15% lower than smaller competitors due to these scale advantages.

New entrants would find it incredibly difficult to match AKT's cost structure. Without a substantial initial investment to achieve comparable production volumes, newcomers would face higher per-unit costs for materials and manufacturing. This cost disadvantage would make it challenging for them to compete on price with established, scaled-up firms.

Gaining access to established distribution channels, particularly with major players in the automotive, agricultural, and construction sectors, presents a significant hurdle for new companies. These channels are often tightly controlled, requiring substantial investment and time to penetrate. AKT Altmärker Kunststofftechnik GmbH leverages its long-standing, direct relationships with these key industry clients, providing a distinct advantage over potential newcomers who must first build trust and secure agreements.

Proprietary Technology and Expertise

AKT Altmärker Kunststofftechnik GmbH's strength in proprietary technology and deep expertise acts as a significant barrier to new entrants. The company's commitment to innovation and developing customer-specific solutions means they possess specialized knowledge and accumulated experience in complex injection molding and assembly processes. This technical know-how is not easily replicated.

New competitors would face substantial hurdles in matching AKT's technological capabilities and the specialized skills of its workforce. For instance, acquiring or developing similar advanced machinery and training personnel to achieve AKT's precision and efficiency would demand considerable investment and time.

- Proprietary Technology: AKT likely holds patents or trade secrets related to its molding techniques and assembly automation.

- Specialized Expertise: Years of experience in handling diverse polymer materials and complex part designs translate into unique process knowledge.

- R&D Investment: Companies like AKT often invest heavily in research and development, creating a continuous advantage over newcomers. In 2023, the plastics processing industry saw significant investment in automation and advanced materials, a trend expected to continue into 2024, making it harder for new players to catch up.

- Customer-Specific Solutions: AKT's ability to tailor solutions implies a deep understanding of client needs and the technical ability to meet them, a capability built over time.

Regulatory and Environmental Hurdles

The plastics industry is under increasing pressure from regulations concerning environmental impact, recycling, and overall sustainability. New companies entering this market must contend with these complex rules, requiring significant upfront investment in compliant technologies and processes, which naturally raises the barrier to entry and initial operating costs.

For instance, the European Union's Plastic Strategy, aiming for all plastic packaging to be reusable or recyclable by 2030, necessitates substantial innovation and capital expenditure for any new player to meet these standards. Furthermore, varying national environmental protection laws add another layer of complexity, demanding tailored compliance strategies.

- Navigating stringent environmental regulations is a major deterrent for new plastic manufacturers.

- Compliance with recycling mandates and sustainability targets requires significant upfront investment.

- The cost of developing and implementing eco-friendly production processes is a substantial barrier.

- Evolving global environmental policies create ongoing uncertainty for potential entrants.

The threat of new entrants for AKT Altmärker Kunststofftechnik GmbH is moderate, primarily due to high capital requirements and established customer relationships. Significant investment is needed for specialized machinery and molds, making it difficult for smaller players to compete on cost and scale. Furthermore, securing access to key distribution channels and building trust with major industry clients requires substantial time and resources.

| Barrier to Entry | Impact on New Entrants | Relevance to AKT |

|---|---|---|

| Capital Investment (Machinery & Molds) | High | Significant, as advanced injection molding requires substantial upfront costs. |

| Economies of Scale | Moderate to High | AKT benefits from lower per-unit costs due to high production volumes, a difficult advantage for newcomers to match. |

| Distribution Channels & Customer Loyalty | High | AKT's long-standing relationships with major clients in automotive and construction create a strong barrier. |

| Proprietary Technology & Expertise | High | AKT's specialized knowledge and R&D investment make it challenging for new entrants to replicate its capabilities. |

| Regulatory Environment (Environmental) | Moderate | New entrants must invest in compliant technologies, adding to initial costs and complexity. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for AKT Altmärker Kunststofftechnik GmbH is built upon a foundation of industry-specific market research reports, company financial statements, and trade publications. These sources provide critical data on market trends, competitor activities, and the economic landscape impacting the plastics technology sector.