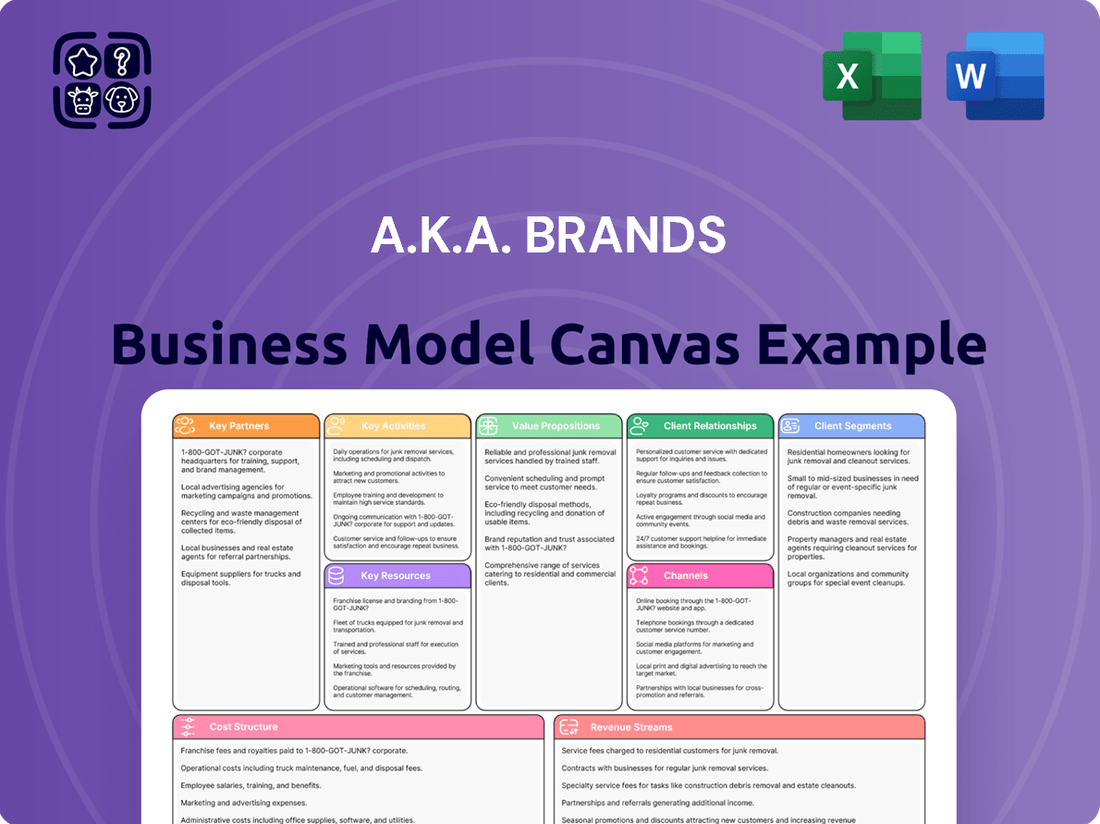

a.k.a. Brands Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

a.k.a. Brands Bundle

Unlock the full strategic blueprint behind a.k.a. Brands's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

a.k.a. Brands strategically partners with the founders and existing teams of the digitally-native fashion brands it acquires. This collaboration is crucial for maintaining the unique creative vision and authentic brand identity that made these companies successful in the first place. For instance, when a.k.a. Brands acquired Princess Polly in 2021, the existing leadership team remained instrumental in guiding its growth within the new structure.

By integrating these acquired brands into its platform, a.k.a. Brands aims to unlock their full scaling potential. This approach allows the company to leverage the deep market understanding and customer relationships that the original founders possess. In 2023, a.k.a. Brands continued to focus on integrating its portfolio brands, with Princess Polly showing strong performance, contributing significantly to the company's overall revenue trajectory.

a.k.a. Brands partners with digital marketing and influencer agencies to connect with Gen Z and millennial consumers. These collaborations are vital for generating authentic social media content and boosting customer interaction.

The company leverages relationships with thousands of influencers worldwide to broaden its brand reach and message dissemination. This strategy is key to their digital-first approach.

a.k.a. Brands heavily leans on a network of e-commerce technology and service providers to build and operate its digital retail infrastructure. These partnerships are crucial for delivering a smooth and modern online shopping journey across its brand portfolio.

These collaborations span essential functions like website development and hosting, secure payment gateway integration, and sophisticated customer relationship management (CRM) systems. For instance, in 2024, the global e-commerce market was projected to reach $6.3 trillion, highlighting the critical need for reliable technology partners in this space.

Logistics and Supply Chain Partners

a.k.a. Brands relies on strategic alliances with logistics and supply chain providers to ensure efficient operations. These partnerships are crucial for managing inventory, fulfilling orders, and distributing fashion items worldwide. By working with specialized third-party logistics (3PL) providers, the company can leverage expertise in warehousing, transportation, and customs clearance, which is vital for its fast-paced merchandising strategy.

The company actively seeks to de-risk and optimize its supply chain by diversifying production locations. In 2024, a.k.a. Brands continued its focus on shifting manufacturing away from traditional hubs, with notable expansion in countries like Vietnam and Turkey. This diversification helps mitigate geopolitical risks and currency fluctuations, while also potentially lowering production costs and lead times.

- Diversified Production: Shifting manufacturing to Vietnam and Turkey in 2024 to reduce reliance on single sourcing regions and improve cost competitiveness.

- Global Distribution Network: Partnering with international logistics firms to ensure timely delivery to customers across various markets, supporting the agile 'test and repeat' model.

- Inventory Management: Collaborating with supply chain partners for efficient warehousing and stock control, minimizing holding costs and stockouts.

- Risk Mitigation: Building resilience in the supply chain through partnerships that can adapt to disruptions and changing global trade dynamics.

Wholesale Retailers and Marketplaces

a.k.a. Brands is strategically moving beyond its direct-to-consumer (DTC) focus by establishing key partnerships with major wholesale retailers and online marketplaces. This expansion is crucial for increasing brand visibility and accessing a wider customer base. For example, Princess Polly and Petal & Pup are set to be available in all Nordstrom locations across the U.S. starting in 2025, a significant step in broadening their market penetration.

These wholesale collaborations are designed to amplify brand awareness and create more opportunities for customer engagement. By leveraging the established reach of traditional retail giants and popular online platforms, a.k.a. Brands can effectively introduce its offerings to consumers who may not typically engage with DTC brands.

- Wholesale Expansion: Princess Polly and Petal & Pup are expanding their retail footprint by partnering with Nordstrom for a nationwide U.S. rollout in 2025.

- Increased Touchpoints: These partnerships aim to significantly increase customer touchpoints, driving both brand awareness and sales volume.

- Market Penetration: By aligning with established retailers, a.k.a. Brands can tap into existing customer loyalty and shopping habits, accelerating market penetration.

a.k.a. Brands' key partnerships are foundational to its multi-brand strategy. These include collaborations with the founders of acquired digitally-native brands, ensuring brand authenticity and leveraging their market insights.

The company also partners with digital marketing and influencer agencies to enhance its reach with Gen Z and millennial consumers. Furthermore, strategic alliances with e-commerce technology providers, logistics firms, and supply chain partners are crucial for operational efficiency and global distribution.

In 2024, a.k.a. Brands continued to diversify its production base, notably expanding in Vietnam and Turkey, to mitigate risks and improve cost competitiveness. The company is also forging significant wholesale partnerships, with Princess Polly and Petal & Pup slated for a nationwide rollout in all Nordstrom locations in the U.S. starting in 2025, aiming to boost brand visibility and sales.

What is included in the product

This Business Model Canvas outlines a.k.a. Brands' direct-to-consumer strategy, focusing on acquiring and scaling digitally native lifestyle brands through a data-driven approach and leveraging influencer marketing.

It details customer segments, value propositions, and key partnerships, reflecting a plan to integrate and grow acquired brands efficiently.

a.k.a. Brands' Business Model Canvas provides a clear, visual representation of their strategy, enabling stakeholders to quickly grasp how the company addresses customer pain points through its value proposition and key activities.

Activities

a.k.a. Brands' core operations revolve around identifying, acquiring, and integrating digitally-native fashion brands. This strategic pillar involves rigorous due diligence and negotiation to onboard new brands onto their existing global platform. For instance, in 2023, the company continued its pursuit of high-growth potential brands to diversify its portfolio.

a.k.a. Brands actively manages and optimizes its proprietary e-commerce platform, which serves as the core technology for its brand portfolio. This involves ensuring seamless website operation, improving customer journeys, and deploying innovative features to boost online sales.

The platform's design is specifically geared towards accelerating the growth and increasing the profitability of the brands it hosts. For instance, in 2024, a.k.a. Brands continued to invest in platform enhancements, aiming to reduce customer acquisition costs and improve conversion rates across its brands like Princess Polly and Culture Kings.

a.k.a. Brands heavily relies on extensive digital marketing to capture the attention of Gen Z and millennials. In 2024, their strategy focused on platforms like TikTok and Instagram, where they saw significant engagement. This approach aims to build brand awareness and drive direct sales.

Influencer collaborations are a cornerstone of their customer engagement. By partnering with key figures in fashion and lifestyle, a.k.a. Brands connects with consumers in a more authentic way. Data-driven insights inform these partnerships, ensuring alignment with target audience interests and maximizing campaign effectiveness.

The ultimate objective of these digital marketing efforts is to not only attract new customers but also foster lasting loyalty. By consistently delivering relevant content and engaging experiences, a.k.a. Brands seeks to convert initial interest into repeat purchases and brand advocacy.

Supply Chain and Inventory Management

a.k.a. Brands' key activities heavily rely on a highly efficient supply chain and inventory management system to consistently deliver new, on-trend fashion items weekly. This operational backbone is essential for maintaining their agile, lean business model. The company’s focus remains on sourcing, production, warehousing, and distribution, all geared towards rapid response to evolving fashion cycles.

To mitigate risks and enhance flexibility, a.k.a. Brands actively pursues supply chain diversification, aiming to reduce dependence on any single geographic region. This strategic move is vital in navigating global trade complexities and ensuring consistent product flow.

- Sourcing & Production: Establishing relationships with manufacturers capable of fast turnaround times for apparel and accessories.

- Warehousing & Distribution: Implementing efficient systems for storing and shipping products to meet customer demand promptly.

- Inventory Optimization: Utilizing data analytics to forecast demand and minimize excess stock, aligning with a lean operating model.

- Supply Chain Resilience: Diversifying supplier bases and manufacturing locations to reduce vulnerability to disruptions.

Data-Driven Merchandising and Product Development

a.k.a. Brands leverages a data-centric 'test and repeat' approach for its merchandising and product development. This strategy allows them to introduce fresh, exclusive fashion items on a weekly basis, ensuring their offerings remain highly relevant to current trends.

The core of this activity involves meticulous analysis of customer preferences and broader market dynamics. These insights directly inform decisions regarding product design, the selection of items for sale, and the precise management of inventory levels. This agility is crucial for staying ahead in the fast-paced fashion industry.

This rapid product introduction cycle is a key driver of customer engagement and sustained demand. For instance, in 2023, a.k.a. Brands reported that its direct-to-consumer channels, heavily reliant on this model, saw significant growth, contributing to overall revenue increases. This constant influx of newness keeps shoppers returning, eager to discover the latest styles.

- Data Analysis: Utilizes customer data and market trend analysis to guide product decisions.

- Weekly Newness: Introduces new and exclusive fashion items every week.

- Test and Repeat: Employs a rapid cycle of product introduction and refinement based on performance.

- Inventory Management: Data informs optimal inventory levels to meet demand without excess stock.

a.k.a. Brands' key activities center on acquiring and scaling digitally-native fashion brands, leveraging a proprietary e-commerce platform for growth. They focus on aggressive digital marketing, particularly on social media platforms favored by Gen Z and millennials, and utilize influencer collaborations to drive engagement and sales. A robust supply chain ensures weekly product drops, supported by data-driven merchandising and inventory management.

Delivered as Displayed

Business Model Canvas

The Business Model Canvas for a.k.a. Brands you see here is not a mockup; it's an authentic preview of the actual document you'll receive. Upon purchase, you gain full access to this comprehensive analysis, identical to the previewed content. This ensures you get exactly what you expect – a ready-to-use, detailed business model for a.k.a. Brands.

Resources

The core of a.k.a. Brands' strategy lies in its carefully curated portfolio of digitally-native fashion brands. This collection includes prominent names like Princess Polly, Culture Kings, Petal & Pup, and mnml, each cultivated to resonate with specific segments of Gen Z and millennial consumers.

This diverse brand lineup is a critical asset, enabling a.k.a. Brands to capture a wider market share by catering to varied style preferences and lifestyle needs within its target demographic. The company's success hinges on the ability to maintain and grow the distinct identity and appeal of each brand.

These brands are more than just labels; they embody significant intellectual property and substantial brand equity. This intangible asset is built through consistent marketing, community engagement, and the delivery of relevant fashion, forming a powerful competitive advantage in the fast-paced digital fashion landscape.

a.k.a. Brands' proprietary e-commerce and retail platform is a significant asset, offering a unified infrastructure for its portfolio of brands. This platform provides shared expertise in critical areas like e-commerce functionality, digital marketing, and supply chain logistics, fostering operational efficiencies. For instance, in 2023, the company reported that its integrated platform contributed to a streamlined customer experience, a key driver for its direct-to-consumer sales.

a.k.a. Brands heavily relies on extensive data regarding customer preferences, purchasing behaviors, and evolving market trends. This granular insight is a cornerstone resource, directly shaping their merchandising strategies and enabling highly personalized customer experiences.

By leveraging this data-driven approach, a.k.a. Brands can optimize its marketing efforts, ensuring a more authentic and resonant connection with its target consumer base. For instance, in 2024, the company continued to analyze direct-to-consumer sales data to identify high-demand product categories and refine inventory management.

Talented Management and Specialist Teams

a.k.a. Brands leverages a core strength in its talented management and specialist teams, bringing deep e-commerce, fashion, and retail expertise to its portfolio. This human capital is crucial for driving growth and operational efficiency across its brands.

The company's leadership possesses a proven track record in scaling direct-to-consumer businesses. This collective knowledge, often referred to as a playbook for growth, is a key resource applied to accelerate the performance of each acquired brand.

- Experienced Leadership: Management team with extensive experience in digital marketing, supply chain management, and brand building.

- Cross-Brand Synergy: Expertise is shared across the a.k.a. Brands portfolio, fostering a collaborative and knowledge-driven environment.

- Strategic Execution: Proven ability to implement strategies that enhance brand performance and market penetration.

Financial Capital for Acquisitions and Growth

Access to financial capital is a cornerstone for a.k.a. Brands, fueling both the acquisition of new brands and the organic growth of its existing portfolio. This financial muscle is derived from a mix of internal cash reserves, strategic debt facilities, and crucial investor backing, ensuring the company can seize market opportunities and invest in scaling its operations effectively. For instance, in 2023, a.k.a. Brands successfully raised $125 million in a Series C funding round, demonstrating robust investor confidence and providing significant capital for expansion initiatives.

The company's financial stability and its capacity for strategic investment are paramount. This allows a.k.a. Brands to not only acquire promising new brands that align with its market strategy but also to channel resources into marketing, inventory, and operational improvements for its current brands. Such strategic deployment of capital is vital for increasing market share and achieving sustainable, long-term growth across its diverse brand ecosystem.

- Cash Reserves: Maintaining healthy internal cash flow to fund immediate operational needs and opportunistic acquisitions.

- Debt Facilities: Utilizing credit lines and loans to leverage capital for larger growth initiatives and brand acquisitions.

- Investor Backing: Securing equity investments from venture capital and private equity firms to fuel significant expansion and strategic moves.

- Strategic Investment Capacity: Allocating capital effectively towards marketing, inventory management, and technology to enhance brand performance and scalability.

a.k.a. Brands' key resources are its portfolio of digitally-native fashion brands, including Princess Polly and Culture Kings, which possess significant intellectual property and brand equity. The company also leverages a proprietary e-commerce platform that streamlines operations and enhances customer experience, as evidenced by its direct-to-consumer sales performance in 2023. Furthermore, extensive customer data informs merchandising and marketing, with ongoing analysis in 2024 refining inventory and product strategies.

The company's human capital, comprising experienced leadership in e-commerce and fashion, is a critical resource. This team's expertise in scaling direct-to-consumer businesses provides a strategic playbook for brand growth. Financial capital, secured through cash reserves, debt facilities, and investor backing, fuels brand acquisitions and organic growth, with a $125 million Series C round in 2023 highlighting investor confidence.

| Key Resource | Description | 2023/2024 Relevance |

| Brand Portfolio | Princess Polly, Culture Kings, Petal & Pup, mnml | Drives market share and caters to Gen Z/millennial segments. |

| Proprietary Platform | E-commerce and retail infrastructure | Enabled streamlined customer experience and direct-to-consumer sales. |

| Customer Data | Purchasing behavior, trends | Informed merchandising and personalized marketing; analyzed for inventory in 2024. |

| Human Capital | Experienced leadership and specialist teams | Drives growth and operational efficiency; proven scaling expertise. |

| Financial Capital | Cash reserves, debt, investor backing | Funded acquisitions and growth; $125M Series C in 2023. |

Value Propositions

a.k.a. Brands provides acquired fashion brands with a powerful engine for accelerated growth and improved profitability. By leveraging shared operational expertise and a robust infrastructure, the company helps these brands expand their reach and financial performance.

The platform's strengths in e-commerce, digital marketing, and supply chain management are crucial. These capabilities allow founder-led brands, which might otherwise struggle to scale, to reach new heights and achieve greater financial success.

For instance, a.k.a. Brands' focus on optimizing digital marketing spend and supply chain efficiency directly impacts profitability. In 2024, the company continued to refine these areas, aiming to deliver tangible improvements for its portfolio brands.

a.k.a. Brands offers a curated selection of fashion that resonates with the dynamic styles of Gen Z and Millennials. Their approach ensures a continuous flow of merchandise that is both current and unique, catering specifically to the preferences of these demographics.

The company’s merchandising strategy, characterized by a 'test and repeat' model, guarantees that their product offerings remain fresh and aligned with the fast-changing fashion landscape. This agility is crucial for capturing the attention of younger consumers.

This emphasis on novelty and exclusivity is a key driver for building strong customer engagement and fostering lasting loyalty. For instance, in the first quarter of 2024, a.k.a. Brands reported net sales of $64.2 million, demonstrating continued consumer interest in their curated fashion approach.

a.k.a. Brands focuses on delivering a smooth and enjoyable online shopping journey for its customers, whether they're on the company's direct-to-consumer websites or mobile apps. This commitment to a user-friendly e-commerce platform directly addresses the digital-first preferences of its target audience, aiming to boost customer satisfaction through effortless navigation and accessibility.

Authentic Social Content and Community Connection

a.k.a. Brands prioritizes authentic social content and community building, recognizing that Gen Z and millennial consumers discover and engage with fashion through these channels. Their brands, like Princess Polly and Culture Kings, cultivate inspiring content that resonates deeply with this demographic.

This strategy is crucial for fostering a sense of belonging and providing valuable fashion inspiration. For instance, Princess Polly actively showcases user-generated content and styling tips, creating a relatable and aspirational feed that drives engagement.

Influencer collaborations are a cornerstone of this approach, amplifying reach and building trust. In 2024, a.k.a. Brands continued to leverage partnerships with micro and macro-influencers across platforms like TikTok and Instagram to drive brand awareness and sales.

- Authentic Content: Brands like Princess Polly and Culture Kings focus on user-generated content and relatable styling, fostering genuine connection with Gen Z and millennial audiences.

- Community Focus: Content creation aims to build a strong sense of community, encouraging interaction and brand loyalty through shared fashion inspiration.

- Influencer Strategy: Collaborations with influencers remain a key tactic in 2024 to expand reach and enhance brand credibility within target demographics.

- Platform Engagement: a.k.a. Brands actively utilizes platforms like TikTok and Instagram, where their core audience spends significant time, to deliver engaging and trend-driven content.

Quality and Affordability

a.k.a. Brands targets Gen Z and millennial consumers by delivering quality apparel at accessible price points. This strategy directly addresses the value-seeking nature of these demographics in the fast-fashion sector.

The company's commitment to maintaining a balance between product quality and affordability serves as a significant competitive advantage. This approach allows them to capture market share in a crowded retail landscape.

a.k.a. Brands' focus on full-price selling is instrumental in supporting robust gross margins. For instance, in the first quarter of 2024, the company reported a gross margin of 35.4%, demonstrating the effectiveness of this pricing strategy.

- Value Proposition: Offering quality fashion at affordable prices for Gen Z and millennials.

- Market Position: Differentiating through a balance of quality and accessibility in the competitive fast-fashion market.

- Financial Impact: Full-price selling contributes to healthy gross margins, evidenced by a 35.4% gross margin in Q1 2024.

a.k.a. Brands provides a growth engine for acquired fashion labels, enhancing their profitability through shared expertise and infrastructure. This allows brands to expand their reach and financial performance, particularly those that might struggle to scale independently.

The company's core strengths lie in e-commerce, digital marketing, and supply chain management. These capabilities are vital for helping founder-led brands achieve greater financial success and scale effectively.

a.k.a. Brands offers curated fashion that appeals to Gen Z and Millennials, ensuring a constant supply of fresh and unique merchandise. Their 'test and repeat' merchandising model keeps offerings aligned with fast-changing fashion trends, crucial for engaging younger consumers.

The company prioritizes an excellent online shopping experience across its direct-to-consumer websites and mobile apps. This focus on user-friendly platforms caters to the digital-first preferences of its target audience, aiming to boost customer satisfaction.

a.k.a. Brands cultivates authentic social content and community, recognizing how Gen Z and Millennials discover fashion. Brands like Princess Polly and Culture Kings create inspiring content that resonates deeply, fostering a sense of belonging and loyalty.

Influencer collaborations are a key strategy for a.k.a. Brands in 2024, amplifying reach and building trust. These partnerships, particularly with micro and macro-influencers on platforms like TikTok and Instagram, drive brand awareness and sales.

a.k.a. Brands targets Gen Z and millennials with quality apparel at accessible price points, a strategy that taps into the value-seeking nature of these demographics in the fast-fashion sector. This balance of quality and affordability provides a competitive edge.

The company's focus on full-price selling supports strong gross margins, as demonstrated by a 35.4% gross margin in the first quarter of 2024.

| Value Proposition | Key Features | Target Audience | Financial Impact |

| Accelerated Growth & Profitability for Acquired Brands | Shared operational expertise, robust infrastructure, e-commerce, digital marketing, supply chain optimization | Founder-led fashion brands | Improved financial performance |

| Curated, Trend-Relevant Fashion | 'Test and repeat' merchandising, focus on novelty and exclusivity | Gen Z and Millennials | Strong customer engagement, Q1 2024 net sales of $64.2 million |

| Seamless Digital Shopping Experience | User-friendly e-commerce platforms and mobile apps | Digital-first Gen Z and Millennial consumers | Enhanced customer satisfaction |

| Authentic Content & Community Building | User-generated content, influencer collaborations, social media engagement (TikTok, Instagram) | Gen Z and Millennial consumers | Brand credibility, expanded reach, driving sales |

| Quality Apparel at Accessible Prices | Balance of product quality and affordability | Value-seeking Gen Z and Millennials | Competitive advantage, strong gross margins (35.4% in Q1 2024) |

Customer Relationships

a.k.a. Brands cultivates robust customer connections by actively engaging on social media, a crucial space for their target Gen Z and millennial demographics. This involves crafting interactive content, promptly responding to customer feedback, and nurturing thriving online communities for each of their brands.

In 2024, a.k.a. Brands' social media presence is a cornerstone for customer interaction, acting as a primary conduit for inspiration and direct dialogue. This approach is vital for building brand loyalty and understanding evolving consumer preferences, particularly within younger, digitally native audiences.

A key part of a.k.a. Brands' customer relationship strategy involves deep dives with social media influencers who genuinely connect with their Gen Z audience. These collaborations are crucial because younger consumers often trust recommendations from peers and user-generated content more than traditional advertising.

By partnering with influencers, a.k.a. Brands leverages these individuals as authentic voices. For instance, in 2023, influencer marketing spending was projected to reach $21.1 billion, highlighting its significant impact on consumer purchasing decisions, especially within the Gen Z demographic that a.k.a. Brands targets.

a.k.a. Brands leverages customer data to create highly personalized experiences. By analyzing browsing history and purchase patterns, they deliver tailored product recommendations and customized promotions. This data-driven approach aims to foster deeper customer engagement and loyalty.

In 2024, e-commerce personalization saw significant growth, with studies indicating that over 70% of consumers expect personalized experiences. a.k.a. Brands' strategy aligns with this trend, using insights to craft marketing messages that resonate with individual preferences, thereby increasing conversion rates.

Seamless Omnichannel Experience

a.k.a. Brands prioritizes a unified customer journey, ensuring a seamless experience whether customers engage online, in their physical stores, or through wholesale partners. This commitment to an omnichannel approach means brand messaging and service remain consistent across all interactions, offering ultimate convenience.

The company's strategy includes expanding its physical retail presence to further bolster this integrated customer experience. For instance, in 2023, a.k.a. Brands continued to open new stores, enhancing touchpoints for customers to interact with its portfolio of brands.

- Unified Experience: Consistent brand messaging and service across online, physical stores, and wholesale channels.

- Customer Convenience: Enabling customers to interact with brands wherever they prefer to shop.

- Physical Expansion: Strategic physical store openings to reinforce the omnichannel strategy.

Customer Service and Support

Effective customer service is paramount for a.k.a. Brands, fostering loyalty and resolving issues promptly. This involves accessible channels for returns, exchanges, and general inquiries, ensuring a smooth post-purchase experience.

A strong emphasis on customer satisfaction across the entire shopping journey drives repeat business and encourages brand advocacy. For instance, in 2023, a.k.a. Brands reported that a significant portion of its revenue was generated from repeat customers, highlighting the impact of positive customer interactions.

- Responsive Communication: Offering multiple touchpoints like email, chat, and phone support to address customer needs efficiently.

- Hassle-Free Returns & Exchanges: Streamlining the process for returns and exchanges to build trust and reduce friction.

- Customer Satisfaction Focus: Implementing feedback mechanisms and training staff to prioritize customer happiness throughout their interaction.

- Building Loyalty: Creating programs or personalized experiences that reward repeat customers and encourage brand evangelism.

a.k.a. Brands prioritizes building strong customer relationships through active social media engagement, influencer collaborations, and personalized digital experiences. This multi-faceted approach aims to foster loyalty and cater to the preferences of their target Gen Z and millennial customer base.

The company's strategy emphasizes a unified, omnichannel customer journey, ensuring consistent brand interaction across online platforms, physical stores, and wholesale channels. This focus on convenience and accessibility is key to driving customer satisfaction and repeat business.

In 2024, a.k.a. Brands continues to leverage data analytics to refine its customer engagement strategies, aiming to deliver highly relevant content and product offerings. This data-driven personalization is crucial for standing out in a competitive market and building lasting customer connections.

| Customer Relationship Strategy | Key Tactics | 2024 Focus/Data Point |

|---|---|---|

| Social Media Engagement | Interactive content, community building, direct response | Crucial for Gen Z/millennial connection; influencer marketing spend projected to reach $21.1 billion in 2023. |

| Influencer Marketing | Authentic collaborations with relevant personalities | Leveraging trusted voices to drive purchasing decisions among younger demographics. |

| Personalization | Data analysis for tailored recommendations and promotions | Over 70% of consumers expect personalized experiences in 2024. |

| Omnichannel Experience | Seamless integration of online, physical, and wholesale channels | Continued physical store expansion to enhance touchpoints and brand accessibility. |

| Customer Service Excellence | Responsive support, hassle-free returns, feedback integration | Significant portion of 2023 revenue from repeat customers, underscoring loyalty impact. |

Channels

Direct-to-consumer e-commerce websites are the absolute backbone of a.k.a. Brands' business. Think of Princess Polly and Culture Kings – their own online shops are where almost everything happens. These sites aren't just places to buy things; they're where customers discover new products, make purchases, and connect with the brands directly, which is super important for their whole digitally-focused approach.

Social media platforms are essential for a.k.a. Brands to build its presence and connect with its audience. These channels are vital for marketing efforts, increasing brand recognition, and fostering direct interaction with customers.

Key platforms such as TikTok, Instagram, and YouTube are strategically utilized. a.k.a. Brands leverages these to produce genuine content, execute influencer collaborations, and guide users to their online stores. This approach is particularly effective as Gen Z and millennials frequently turn to these platforms for fashion trends and inspiration.

In 2024, brands are seeing significant returns from social media. For instance, influencer marketing alone is projected to reach $21.1 billion globally this year, highlighting the financial impact of these channels. Furthermore, platforms like TikTok have demonstrated immense engagement, with users spending an average of 95 minutes per day on the app in early 2024, showcasing the potential for deep customer connection.

Mobile applications are crucial channels for a.k.a. Brands, directly engaging its digitally-native customer base. These apps provide a streamlined and convenient purchasing journey, frequently featuring exclusive content and tailored experiences that foster brand loyalty.

The importance of mobile is underscored by recent data, with a substantial percentage of website traffic originating from mobile devices, indicating a strong preference for on-the-go access and transactions. For instance, in early 2024, mobile devices accounted for over 60% of e-commerce traffic across many retail sectors, a trend a.k.a. Brands actively leverages.

Physical Retail Stores

While a.k.a. Brands is known for its digital-first approach, it's strategically venturing into physical retail. This expansion is crucial for customer acquisition and creating deeper brand connections.

Princess Polly, a key brand under a.k.a. Brands, is at the forefront of this physical retail push. The brand is set to open seven new U.S. stores in 2025, marking a significant physical footprint increase.

This expansion includes a highly anticipated first store in New York City, a major market for fashion retail. These physical locations act as vital touchpoints, offering immersive brand experiences that complement their online presence.

- Strategic Physical Expansion: a.k.a. Brands is moving beyond its digital roots with physical store openings.

- Customer Acquisition Tool: New stores, like those planned for Princess Polly, are designed to attract new customers.

- Enhanced Brand Experience: Physical locations offer immersive environments for customers to interact with brands.

- 2025 Growth Plans: Princess Polly aims to open seven new U.S. stores in 2025, including a flagship in New York City.

Wholesale Partnerships

a.k.a. Brands is actively broadening its reach by establishing wholesale partnerships. This strategic move involves collaborating with significant retailers to boost brand awareness and tap into new customer demographics.

A prime illustration of this strategy is the expansion of Princess Polly and Petal & Pup into Nordstrom stores. This initiative is a key component of their omnichannel approach, diversifying revenue streams beyond their direct-to-consumer (DTC) model.

- Wholesale Expansion: Partnering with major retailers like Nordstrom.

- Brand Visibility: Increasing market presence through established retail networks.

- Customer Reach: Accessing new customer segments via wholesale channels.

- Omnichannel Strategy: Complementing DTC sales with brick-and-mortar distribution.

a.k.a. Brands leverages a multi-channel approach, with its direct-to-consumer e-commerce websites forming the core. Social media platforms are critical for engagement and marketing, while mobile applications offer a streamlined customer experience. The company is also strategically expanding its physical retail presence and utilizing wholesale partnerships to broaden its reach.

| Channel | Key Features | 2024 Relevance |

|---|---|---|

| E-commerce Websites | Direct sales, brand discovery, customer connection | Core of business, driving majority of sales |

| Social Media (TikTok, Instagram, YouTube) | Marketing, brand building, influencer collaborations | Global influencer marketing projected to reach $21.1 billion in 2024; TikTok engagement high |

| Mobile Applications | Streamlined purchasing, exclusive content, loyalty building | Mobile devices accounted for over 60% of e-commerce traffic in early 2024 |

| Physical Retail | Customer acquisition, immersive brand experience | Princess Polly opening 7 new U.S. stores in 2025 |

| Wholesale Partnerships (e.g., Nordstrom) | Brand visibility, new customer demographics, omnichannel strategy | Expands reach beyond DTC |

Customer Segments

Gen Z consumers, typically born between 1995 and 2012, represent a core demographic for a.k.a. Brands. This generation is deeply immersed in the digital world, with platforms like TikTok and Instagram serving as primary avenues for fashion discovery and inspiration. In 2024, Gen Z's influence on purchasing decisions continues to grow, with many prioritizing brands that align with their values.

Authenticity and transparency are paramount for Gen Z shoppers. They are drawn to user-generated content and relatable influencers, often preferring these over highly polished advertising. This segment is also increasingly vocal about social responsibility, expecting brands to demonstrate commitment to ethical practices and sustainability. Their purchasing power is substantial, with projections indicating they will soon become the largest consumer group globally.

Millennials, born roughly between 1980 and 1995, represent a significant customer base for a.k.a. Brands. This demographic, while sharing some digital fluency with Gen Z, often engages with brands on a deeper level, valuing authentic storytelling and relatable narratives. Their increasing activity on social media platforms for fashion discovery and inspiration makes them a key target for brands that can effectively communicate their unique identity and values.

a.k.a. Brands strategically positions its portfolio to resonate with both Gen Z and Millennials by offering distinct brand experiences. For instance, brands like Princess Polly and Culture Kings, which are popular with younger consumers, also appeal to Millennials seeking contemporary fashion. The company's ability to cater to these overlapping yet nuanced preferences is crucial for sustained growth, especially as Millennials continue to be a powerful consumer force with substantial purchasing power.

Fashion-Forward Trend Seekers are a core customer group for a.k.a. Brands, driven by an insatiable appetite for the newest styles and emerging fashion trends. They actively hunt for unique and exclusive pieces to curate their personal style, making them highly receptive to rapid product cycles.

This segment's engagement is directly fueled by a.k.a. Brands' agile 'test and repeat' merchandising strategy. This model ensures a constant influx of fresh, relevant fashion items arriving weekly, directly addressing the customer's desire for perpetual newness and the opportunity to be an early adopter of the latest looks.

Social Media Engaged Shoppers

Social Media Engaged Shoppers are a key demographic for a.k.a. Brands, discovering and interacting with fashion through platforms like Instagram and TikTok. These shoppers value authenticity and are heavily influenced by peer recommendations and influencer marketing. In 2024, a significant portion of Gen Z and Millennial consumers reported making a purchase after seeing a product promoted by an influencer, highlighting the effectiveness of this channel.

Their purchasing journey is often initiated and shaped by visual content and online community interactions. This segment is particularly responsive to user-generated content and transparent brand messaging, driving engagement and conversion rates.

- Discovery Channel: Primarily social media platforms like Instagram, TikTok, and Pinterest.

- Influence Drivers: Authentic content, influencer endorsements, and peer reviews.

- Shopping Behavior: Mobile-first, visually driven, and impulse-oriented.

- Engagement Metrics: High interaction rates with shoppable posts and live streams.

Value-Conscious Online Shoppers

Value-conscious online shoppers prioritize trendy fashion but are keenly aware of price. They actively seek quality items that offer good value for their money. In 2024, the online fashion retail market continued to see strong growth, with consumers increasingly leveraging digital platforms for their purchasing decisions. This segment is particularly responsive to promotions and discounts, making competitive pricing a key differentiator.

These shoppers primarily engage with brands through e-commerce channels due to the convenience and extensive product variety available online. They appreciate user-friendly websites and mobile applications that facilitate easy browsing and purchasing. The ability to compare prices and read reviews before buying is also a significant factor influencing their choices.

- Price Sensitivity: This segment actively seeks out sales, discounts, and loyalty programs to maximize their purchasing power.

- Online Preference: They favor e-commerce for its convenience, wider selection, and ease of price comparison.

- Style and Value Balance: Customers aim to stay current with fashion trends without overspending, looking for the best perceived value.

- Digital Engagement: They are influenced by social media marketing, influencer collaborations, and positive online reviews.

a.k.a. Brands targets digitally native consumers, primarily Gen Z and Millennials, who are heavily influenced by social media trends and influencer marketing. These segments prioritize authenticity, value, and the constant discovery of new styles. The company's brands, like Princess Polly and Culture Kings, are curated to appeal to these demographics' desire for trendy, accessible fashion.

The company's customer base is characterized by a strong preference for online shopping, particularly via mobile devices. They are engaged by visually appealing content and seek brands that offer a balance of style, price, and perceived value. In 2024, the influence of social commerce continues to grow, with a significant portion of these consumers making purchasing decisions based on online recommendations.

Key customer segments include Fashion-Forward Trend Seekers, who drive demand for a.k.a. Brands' agile merchandising, and Social Media Engaged Shoppers, who discover and interact with fashion through platforms like TikTok and Instagram. Value-conscious online shoppers also form a significant group, actively seeking promotions and good deals.

In 2023, a.k.a. Brands reported net sales of $406.7 million, with its core brands demonstrating strong performance within these target demographics. The company's strategy is built around understanding and catering to the evolving preferences of these digitally savvy consumers.

Cost Structure

a.k.a. Brands allocates substantial resources to digital marketing and advertising, a crucial element for connecting with its target demographics, Gen Z and millennials. These expenditures are vital for building brand awareness and driving customer acquisition across popular online channels.

The company's marketing strategy heavily relies on social media advertising, collaborations with influencers, and performance marketing initiatives. These efforts are designed to boost website traffic and ultimately convert engagement into sales, reflecting a direct link between marketing spend and revenue generation.

In the first quarter of 2025, a.k.a. Brands reported marketing expenses amounting to $15.2 million. This figure represented 11.8% of the company's net sales for the period, underscoring the significant investment in customer outreach and brand building.

Selling and fulfillment expenses are a significant part of a.k.a. Brands' cost structure, covering everything from getting products to customers to maintaining physical retail spaces. These costs include shipping, warehousing, and the operational expenses of their brick-and-mortar stores, like rent and employee wages.

In the first quarter of 2025, a.k.a. Brands reported selling expenses of $38.2 million. This increase was largely due to the company's strategic decision to open more physical retail locations, expanding their direct customer reach.

General and Administrative (G&A) expenses represent the corporate overhead necessary to run the business, encompassing salaries for management and administrative teams, legal services, and other operational costs not directly linked to creating or selling products. These costs are crucial for the overall functioning and strategic direction of a.k.a. Brands.

In the first quarter of 2025, a.k.a. Brands reported G&A expenses of $25.7 million. This figure constituted 20.0% of the company's net sales for the period. The increase observed in these expenses was primarily attributed to higher wage costs and enhanced incentive compensation for the company's personnel.

Cost of Goods Sold (COGS) and Supply Chain Costs

The Cost of Goods Sold (COGS) and associated supply chain expenses represent a significant component of a.k.a. Brands' operational expenditures. These costs encompass the direct expenses incurred in acquiring or producing the merchandise sold, including raw materials, manufacturing processes, and the inbound freight costs required to bring inventory to their facilities. For instance, a substantial portion of their product sourcing in 2024 continued to involve partnerships with manufacturers in Asia, alongside diversification efforts into countries like Vietnam and Turkey to mitigate risks and potentially optimize costs.

Effective management of COGS is paramount for a.k.a. Brands to ensure robust gross margins. Fluctuations in material prices, labor costs, and shipping rates directly impact this metric. The company's strategic decisions regarding supply chain diversification, while aimed at resilience, also introduce complexities that can influence per-unit costs. Understanding and controlling these elements are vital for profitability.

- Direct Production Costs: Includes expenses for raw materials, components, and direct labor involved in manufacturing apparel and accessories.

- Inbound Logistics: Costs associated with transporting goods from suppliers to a.k.a. Brands' distribution centers.

- Supply Chain Diversification Impact: Costs related to sourcing from new regions like Vietnam and Turkey, which may have different manufacturing and freight expense profiles compared to traditional sourcing locations.

- Gross Margin Influence: The ability to control COGS directly correlates with the company's gross profit margin, a key indicator of operational efficiency.

Technology and Platform Maintenance Costs

a.k.a. Brands invests heavily in its proprietary e-commerce and retail platform, a crucial element of its cost structure. This includes ongoing expenses for software development, ensuring the platform remains competitive and user-friendly. For instance, in 2023, a significant portion of operating expenses was allocated to technology and platform development, reflecting the commitment to enhancing digital capabilities.

Maintaining robust IT infrastructure, including servers, cloud services, and network capabilities, is another substantial cost. Cybersecurity measures are paramount to protect customer data and ensure operational integrity, with continuous investment in threat detection and prevention systems. In 2024, the company is expected to further bolster these defenses as digital threats evolve.

Data management systems are also a key component, enabling a.k.a. Brands to leverage customer insights and optimize operations. These investments are vital for supporting seamless online transactions and implementing data-driven strategies across its brands. The company's focus on personalization and targeted marketing relies heavily on these sophisticated data management tools.

- Platform Development: Ongoing investment in proprietary e-commerce and retail platform software.

- IT Infrastructure: Costs associated with servers, cloud services, and network maintenance.

- Cybersecurity: Essential spending on protecting customer data and digital assets.

- Data Management: Investment in systems to support data-driven strategies and customer insights.

a.k.a. Brands' cost structure is heavily influenced by its significant investments in digital marketing and advertising, essential for reaching Gen Z and millennial consumers. The company also incurs substantial selling and fulfillment expenses, covering logistics and the operations of its physical stores, which saw an increase in Q1 2025 due to store expansion. General and administrative costs, including personnel expenses and corporate overhead, also form a key part of their spending.

The Cost of Goods Sold (COGS) is a major expense, encompassing raw materials, manufacturing, and inbound logistics, with sourcing diversifying into regions like Vietnam and Turkey in 2024. Furthermore, a.k.a. Brands dedicates considerable resources to its proprietary e-commerce and retail platforms, including software development, IT infrastructure, cybersecurity, and data management systems, all critical for its digital-first strategy.

| Expense Category | Q1 2025 (Millions USD) | % of Net Sales (Q1 2025) | Key Drivers |

|---|---|---|---|

| Marketing & Advertising | 15.2 | 11.8% | Digital marketing, influencer collaborations, performance marketing |

| Selling Expenses | 38.2 | N/A* | Logistics, fulfillment, retail store operations, expansion |

| General & Administrative (G&A) | 25.7 | 20.0% | Salaries, management, legal, operational overhead, personnel costs |

| Cost of Goods Sold (COGS) | N/A** | N/A** | Raw materials, manufacturing, inbound freight, supply chain costs |

| Technology & Platform | N/A*** | N/A*** | E-commerce platform development, IT infrastructure, cybersecurity, data management |

* Selling expenses as a percentage of net sales were not explicitly provided for Q1 2025 in the source data, but the absolute figure indicates a significant investment.

** Specific COGS figures for Q1 2025 were not detailed in the provided text, but it's identified as a significant component.

*** Specific technology and platform investment figures for Q1 2025 were not detailed, but the text highlights ongoing and significant allocation.

Revenue Streams

The core of a.k.a. Brands' revenue generation lies in its direct-to-consumer (DTC) online sales. This strategy involves selling fashion apparel and accessories directly to customers via the e-commerce platforms of its various brands.

This DTC approach is crucial as it typically allows for healthier profit margins compared to wholesale models. It also fosters direct engagement and feedback loops with the customer base, which is invaluable for brand building and product development.

The effectiveness of this model is evident in the company's financial performance. For the first quarter of 2025, net sales saw a significant increase of 10.1%, reaching $128.7 million. Notably, U.S. net sales demonstrated robust growth, climbing by 14.2% during the same period.

Wholesale channel sales are a growing source of revenue for a.k.a. Brands, as they increasingly partner with brick-and-mortar and online retailers. This strategy allows the company to tap into established customer bases and expand its market reach. For instance, the expansion of Princess Polly and Petal & Pup into Nordstrom stores exemplifies this approach, creating a significant new revenue stream.

a.k.a. Brands leverages international markets as a significant revenue stream, operating as a global platform. This geographical diversification is a key driver of its growth strategy.

While U.S. sales demonstrate robust expansion, the company also benefits from contributions from other regions. For instance, Australia and New Zealand collectively saw a 6% net sales growth in the first quarter of fiscal year 2025, highlighting the impact of these international markets on overall revenue.

New Brand Acquisitions and Scaling

Future revenue growth for a.k.a. Brands is projected to stem from the strategic acquisition and subsequent scaling of new direct-to-consumer fashion brands. This approach is fundamental to their long-term expansion strategy.

The company's business model is specifically crafted to efficiently integrate and accelerate the growth trajectory of these newly acquired entities. This integration is key to broadening the collective revenue base of their brand portfolio.

For instance, in 2024, a.k.a. Brands continued to explore acquisition opportunities as part of its growth strategy. The success of integrating and scaling these brands will directly impact the company's ability to achieve its revenue targets.

- Acquisition Pipeline: Ongoing identification and vetting of potential direct-to-consumer fashion brands for acquisition.

- Integration Efficiency: Streamlining the process of onboarding new brands to accelerate their operational and revenue growth.

- Portfolio Expansion: Diversifying the brand portfolio to capture a wider market share and customer base.

- Synergistic Growth: Leveraging existing infrastructure and expertise to drive growth in acquired brands.

Potential for Brand Extension and New Product Categories

While not a primary current revenue stream, a.k.a. Brands possesses significant potential for brand extension into new product categories. This could involve leveraging the established recognition of its portfolio brands, such as Princess Polly or Gymshark, to enter adjacent markets like beauty, footwear, or home goods. Licensing agreements also represent a viable avenue for generating additional revenue, allowing third parties to utilize brand intellectual property in exchange for royalties.

As the brands within a.k.a. Brands' portfolio continue to mature and build stronger consumer loyalty, the opportunities for diversification beyond their core apparel and accessories offerings become more pronounced. This strategic expansion could unlock new revenue streams and enhance overall brand value. For instance, a successful brand like Princess Polly could explore collaborations or branded merchandise in areas that complement its existing fashion-forward appeal.

- Brand Extension: Potential to launch new product lines in categories like beauty, footwear, or lifestyle goods.

- Licensing: Opportunities to generate royalty income through partnerships with third-party manufacturers and retailers.

- Market Diversification: Expanding beyond core apparel and accessories to tap into new consumer segments and demand.

- Revenue Growth: Leveraging established brand equity to create additional, high-margin revenue streams.

a.k.a. Brands primarily generates revenue through direct-to-consumer (DTC) online sales across its portfolio of fashion brands. This model allows for strong profit margins and direct customer engagement. The company also actively expands its revenue through wholesale partnerships, placing its brands in established retail environments.

International sales represent a significant and growing revenue stream, with markets like Australia and New Zealand showing consistent growth. Furthermore, a.k.a. Brands focuses on acquiring and scaling new DTC brands to broaden its revenue base and market reach.

| Revenue Stream | Description | 2025 Q1 Performance | Key Brands |

| DTC Online Sales | Direct sales via e-commerce platforms | Net sales increased 10.1% to $128.7 million | Princess Polly, Petal & Pup |

| Wholesale Channel Sales | Sales through retail partners | Growing contribution, expanding market reach | Princess Polly (Nordstrom) |

| International Markets | Sales from regions outside the U.S. | Australia & New Zealand net sales grew 6% | Princess Polly, Petal & Pup |

| Acquired Brand Scaling | Growth from newly acquired DTC brands | Ongoing strategy for portfolio expansion | (Various acquired brands) |

Business Model Canvas Data Sources

The a.k.a. Brands Business Model Canvas is informed by a blend of internal financial data, comprehensive market research reports, and consumer behavior analytics. These diverse sources ensure a holistic understanding of the brand's operational landscape and strategic positioning.