Airtificial Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Airtificial Bundle

This initial look at Airtificial's competitive landscape highlights the critical forces shaping its market. Understanding the intensity of rivalry and the bargaining power of buyers is crucial for navigating this dynamic industry.

The complete Porter's Five Forces Analysis delves deeper, revealing the full strategic picture of Airtificial's market. Unlock actionable insights to inform your strategy and gain a significant competitive edge.

Suppliers Bargaining Power

Airtificial's reliance on highly specialized components like semiconductors and advanced sensors grants suppliers significant leverage. The limited number of qualified providers for these unique inputs means they can dictate terms, potentially impacting Airtificial's costs and production schedules. For instance, global semiconductor shortages, a persistent issue through 2024, have demonstrated how critical component scarcity can severely disrupt manufacturing timelines and increase input prices for technology firms.

High switching costs significantly impact Airtificial's bargaining power with suppliers. For instance, if Airtificial relies on a specific AI development platform or specialized robotics hardware, the expense and time involved in migrating to an alternative can be prohibitive. This includes costs associated with re-engineering existing solutions, re-validating performance metrics, and retraining personnel on new systems.

In specialized sectors crucial for AI and robotics, a handful of key suppliers often dominate. This concentration grants them considerable leverage in setting prices, dictating delivery schedules, and defining product standards, impacting companies like Airtificial.

For instance, the global market for advanced AI accelerators saw a significant concentration in 2023, with NVIDIA holding a substantial market share, influencing component availability and cost for AI-driven companies.

However, Airtificial's robust expansion and substantial order backlog in 2024 position it as a valuable client, potentially enabling it to negotiate more favorable terms and lessen the suppliers' bargaining power.

Threat of Forward Integration by Suppliers

Suppliers of critical AI and robotics components, particularly those providing foundational software or platforms, possess the potential to integrate forward. This means they could develop and market complete intelligent automation solutions, effectively becoming direct competitors to companies like Airtificial. For instance, a major AI software provider might start offering end-to-end robotic process automation (RPA) services, directly challenging Airtificial's service offerings.

While direct component manufacturers are less likely to pursue this, significant technology firms supplying core AI algorithms or machine learning frameworks could leverage their expertise to offer integrated systems. This threat necessitates that Airtificial cultivates robust supplier relationships and explores strategic investments in developing its own proprietary technologies to mitigate reliance and potential competition.

The strategic imperative for Airtificial is clear: foster strong partnerships and consider internal development of key technological components. This approach helps secure supply chains and reduces the risk of being outflanked by suppliers who decide to move up the value chain. For example, if a key AI model provider were to offer a fully integrated solution, Airtificial would need to demonstrate superior customization or integration capabilities.

- Potential for Competition: Major AI and robotics technology providers could transition from component suppliers to direct service competitors.

- Strategic Response: Airtificial must prioritize strong supplier relationships and consider developing proprietary technologies.

- Market Dynamics: The threat encourages Airtificial to differentiate through specialized integration and value-added services.

Talent and Knowledge as Key Inputs

Beyond physical components, Airtificial's reliance on specialized talent in AI, robotics, and advanced engineering grants significant bargaining power to skilled individuals and research institutions. The intense competition for these experts, especially in rapidly evolving areas, means their demands can heavily influence costs and project timelines.

For instance, the global demand for AI specialists continues to outstrip supply. In 2024, reports indicated that the average salary for an AI engineer could range from $150,000 to over $200,000 annually, reflecting the high value placed on this expertise. Airtificial must therefore prioritize robust R&D investment and strategic talent acquisition to secure and retain the knowledge needed to innovate and maintain its market position, mitigating the risk of dependency on scarce external knowledge.

- High Demand for AI/Robotics Talent: The market for AI and robotics professionals is highly competitive, driving up compensation and benefits.

- Scarcity of Specialized Skills: Access to cutting-edge knowledge in fields like machine learning and advanced automation is limited, empowering those who possess it.

- Investment in R&D and Talent: Airtificial's ability to attract and retain top talent through competitive compensation and continuous learning opportunities is crucial for its innovation pipeline.

- Impact on Project Costs: The cost of acquiring and retaining specialized talent directly impacts Airtificial's project profitability and overall operational expenses.

Suppliers of critical AI and robotics components hold significant power due to the specialized nature of inputs and limited providers, impacting Airtificial's costs and production. High switching costs further solidify supplier leverage, as migrating to alternative solutions is often expensive and time-consuming. The concentration of key suppliers in specialized sectors allows them to dictate terms, potentially affecting Airtificial's pricing and delivery schedules.

The threat of suppliers integrating forward, offering complete solutions and becoming direct competitors, is a considerable risk for Airtificial. This necessitates a strategic focus on building strong supplier relationships and developing proprietary technologies to maintain a competitive edge and mitigate dependency.

The intense demand for specialized AI and robotics talent grants significant bargaining power to skilled individuals and research institutions, influencing Airtificial's operational costs and project timelines. For instance, in 2024, the average salary for an AI engineer continued to be high, often exceeding $200,000 annually, underscoring the value of this expertise.

| Factor | Impact on Airtificial | Example Data (2024) |

|---|---|---|

| Component Specialization | High supplier leverage, potential cost increases | Semiconductor shortages impacting tech firms |

| Switching Costs | Limits Airtificial's ability to change suppliers | Costs of re-engineering AI platforms |

| Supplier Concentration | Dominant suppliers dictate terms | NVIDIA's market share in AI accelerators |

| Talent Scarcity | Increased labor costs, project delays | AI engineer salaries averaging $150k-$200k+ |

What is included in the product

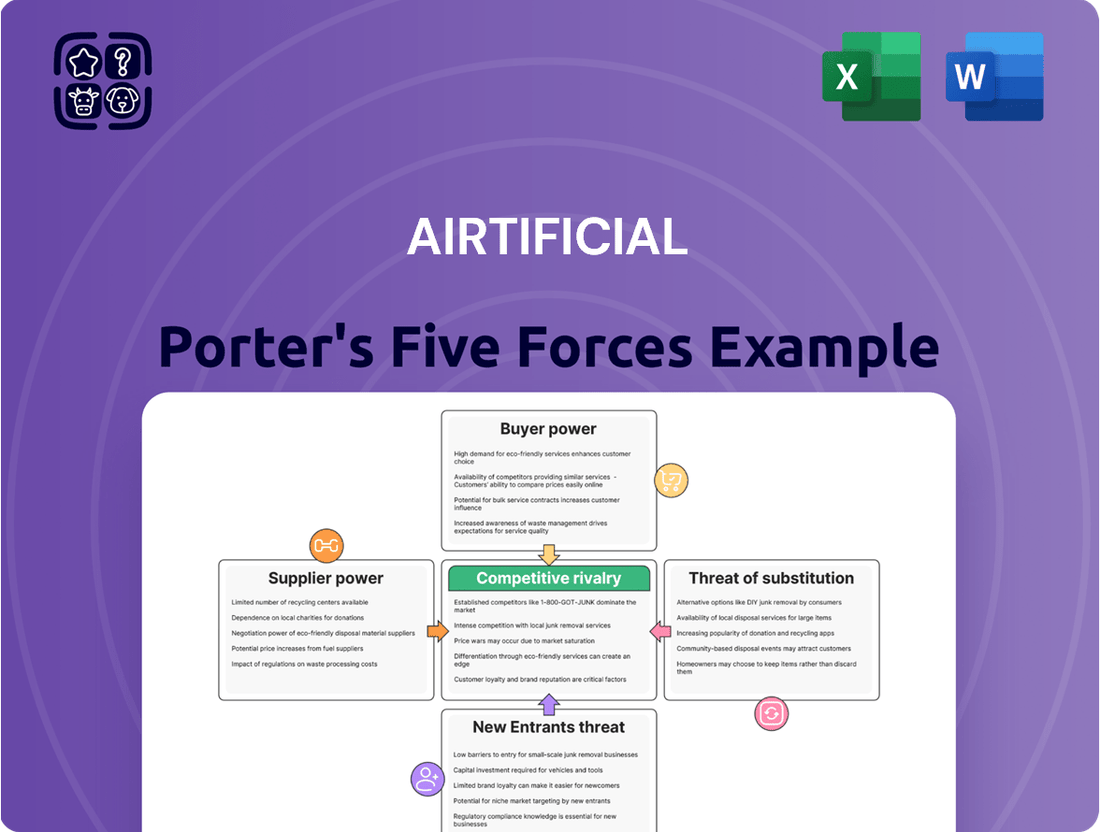

Airtificial's Porter's Five Forces analysis reveals the competitive intensity and profitability potential within its operating environment, detailing threats from new entrants, buyers, suppliers, substitutes, and existing rivals.

Effortlessly visualize competitive intensity across all five forces with a dynamic, interactive dashboard, eliminating the guesswork in strategic planning.

Customers Bargaining Power

Airtificial's customer base is indeed diverse, spanning major industries like automotive, aerospace, civil infrastructure, and consumer goods. This broad reach across multiple high-growth sectors, including electric vehicles and defense, helps to dilute the power any single customer might wield.

While individual clients are large, Airtificial's diversified customer portfolio is a key strength. The company's success in securing over 700 strategic agreements within the automotive sector alone in 2024 highlights the depth of its client relationships and its ability to maintain strong partnerships across its served markets.

For Airtificial's business-to-business clients, the cost of switching from an existing intelligent system or automated process provider is substantial. These expenses can include re-tooling existing infrastructure, the integration of new systems, and the risk of operational disruptions during the transition. These factors significantly raise the barrier for customers looking to change suppliers.

Airtificial's strength lies in its deeply integrated design, engineering, and manufacturing services, which become woven into the very fabric of a client's operations. This high degree of integration creates significant switching barriers, making it difficult and costly for clients to move to a competitor. For instance, in the industrial automation sector, the average cost for a company to switch to a new automation provider can range from 10% to 20% of the total project value, according to industry reports from 2024.

Airtificial's core value proposition centers on delivering enhanced efficiency, sustainability, and competitiveness through advanced technological solutions. Clients benefit from tangible improvements like increased productivity and significant cost reductions, making Airtificial's offerings highly desirable.

This robust value proposition directly impacts the bargaining power of customers. When clients perceive substantial long-term operational advantages and a clear return on investment, their sensitivity to price negotiations tends to decrease, strengthening Airtificial's market position.

Threat of Backward Integration by Customers

While major clients in industries such as automotive and aerospace may possess their own engineering departments, building custom AI and robotics solutions internally presents significant capital and time challenges. Airtificial's specialized knowledge and refined production methods offer a more cost-effective and efficient alternative for clients needing these intricate services.

This reliance on Airtificial's expertise and infrastructure substantially reduces the likelihood of broad backward integration by customers. For instance, a typical automotive manufacturer might spend upwards of $50 million and several years developing a proprietary AI-driven quality control system, whereas Airtificial can deliver a comparable solution in months for a fraction of that cost.

- High Capital Investment: Developing in-house AI and robotics capabilities requires substantial upfront investment in specialized hardware, software, and skilled personnel, often running into tens of millions of dollars.

- Time-to-Market Delays: The lengthy development cycles for bespoke solutions can significantly delay product launches and market entry for clients.

- Airtificial's Specialized Expertise: Airtificial's focused R&D and deep understanding of AI and robotics applications provide a competitive advantage that is difficult and costly for clients to replicate internally.

- Economies of Scale: Airtificial benefits from economies of scale in development and deployment, making its solutions more affordable than custom in-house builds.

Information Asymmetry and Customization

Airtificial's strength lies in its ability to deliver highly customized, advanced solutions. This specialization often leads to information asymmetry, where Airtificial holds unique expertise regarding the optimal design and implementation for a client's specific needs. For instance, in complex industrial automation projects, clients may lack the in-house technical knowledge to fully assess Airtificial's proposed solutions, making them reliant on the provider's insights.

The intricate and bespoke nature of Airtificial's offerings makes it difficult for clients to benchmark or replicate these solutions independently. This reliance on Airtificial's proprietary knowledge and engineering capabilities significantly limits the customer's bargaining power. As a result, Airtificial can leverage this expertise to negotiate more favorable terms, particularly when the customized solution offers a distinct competitive advantage to the client.

- Information Asymmetry: Airtificial's deep technical knowledge in areas like AI-driven robotics and advanced manufacturing creates a knowledge gap, strengthening its negotiating position.

- Customization as a Barrier: The bespoke nature of solutions means clients cannot easily switch providers or compare pricing, as each project is unique.

- Reduced Client Leverage: Clients often depend on Airtificial's specialized skills for project success, diminishing their ability to dictate terms.

Airtificial's diverse client base across automotive, aerospace, and infrastructure sectors, with over 700 strategic agreements in 2024, limits individual customer power. The high cost of switching, estimated at 10-20% of project value in industrial automation in 2024, and Airtificial's integrated, specialized solutions create significant barriers for clients seeking alternatives. This reliance on Airtificial's expertise and the difficulty in replicating custom solutions further diminishes customer bargaining power.

| Factor | Impact on Customer Bargaining Power | Supporting Data/Context (2024) |

|---|---|---|

| Customer Diversification | Reduced | Over 700 strategic agreements across multiple industries. |

| Switching Costs | Reduced | Estimated 10-20% of project value in industrial automation. |

| Airtificial's Specialization & Integration | Reduced | High capital and time investment for clients to replicate in-house. |

| Information Asymmetry | Reduced | Clients often lack technical depth to fully assess bespoke solutions. |

What You See Is What You Get

Airtificial Porter's Five Forces Analysis

This preview showcases the complete Airtificial Porter's Five Forces Analysis, offering a detailed examination of competitive forces. The document you see here is the exact, professionally formatted analysis you will receive instantly upon purchase, ensuring no discrepancies or missing information. You can confidently use this comprehensive report for your strategic planning and decision-making immediately after acquisition.

Rivalry Among Competitors

The AI, robotics, and industrial automation sectors are booming, with the global AI robots market expected to surpass $118 billion by 2034. This rapid expansion, fueled by relentless technological progress, intensifies competition as firms race to secure market share.

Airtificial's robust financial results in 2024, highlighted by a record order book, demonstrate its competitive standing amidst this fast-paced innovation landscape.

Airtificial operates within a highly competitive arena, challenged by both seasoned technology leaders and emerging innovators. Giants like IBM, Microsoft, and NVIDIA possess substantial resources and established market presence in AI automation, posing a significant competitive threat. These companies are heavily invested in research and development, often setting the pace for technological advancements.

The competitive intensity is further amplified by a vibrant ecosystem of specialized AI and robotics startups. These agile companies frequently introduce disruptive technologies and niche solutions, forcing established players, including Airtificial, to remain vigilant and adaptable. For instance, the global AI market was valued at approximately $200 billion in 2023 and is projected to grow significantly, indicating robust competition and opportunity.

Moreover, traditional engineering and manufacturing firms are increasingly incorporating advanced automation into their offerings. This trend means Airtificial not only competes with pure tech players but also with established industrial companies that are evolving their capabilities. This broad competitive spectrum demands continuous innovation and a clear strategic focus on differentiation for Airtificial to maintain its market position.

Airtificial carves out a unique market position by providing integrated design, engineering, and manufacturing services, particularly in high-tech industries. Its specialized capability in producing flight sticks for the aerospace and defense sector is a prime example of this differentiation.

This focus on high-value technological development for Tier-1 suppliers sets Airtificial apart from broader automation companies. Such specialized expertise can significantly lessen direct competition within these specific, high-demand segments.

Strategic Collaborations and Partnerships

Airtificial operates in a landscape where strategic collaborations are common, allowing companies to pool resources and speed up the development of new technologies. This is a critical factor in maintaining a competitive edge.

Airtificial has demonstrated a strong capability in forming these vital alliances. The company has secured a significant number of strategic agreements with global automotive manufacturers, indicating its attractiveness as a partner. Furthermore, substantial contracts within the defense sector underscore its ability to forge impactful partnerships in key industries.

- Strategic Agreements: Airtificial has secured numerous strategic agreements with international automotive companies, enhancing its market access and technological development.

- Defense Contracts: Significant contracts in the defense sector demonstrate Airtificial's ability to form alliances in high-value, specialized markets.

- Competitive Advantage: These partnerships are instrumental in bolstering Airtificial's competitive position and expanding its overall market reach.

Global Market Reach and Regional Strengths

Airtificial's global footprint, with operations spanning Europe, America, and Asia, allows it to tap into diverse market dynamics. The company has solidified its leadership in water engineering projects across Latin America, demonstrating a significant regional advantage. This broad reach mitigates the impact of intense competition in any single market.

While North America and Asia-Pacific are recognized as leading centers for AI and robotics innovation, Airtificial's strategic geographic diversification offers a buffer. Its presence in these key technology hubs allows it to engage with cutting-edge developments and talent pools. The company's ability to leverage specialized regional strengths, like its Sevilla plant's focus on aerospace components, further enhances its competitive positioning.

- Global Presence: Operations in Europe, America, and Asia.

- Regional Leadership: Dominant in Latin American water engineering.

- Strategic Diversification: Mitigates reliance on any single market.

- Specialized Strengths: Sevilla plant exemplifies aerospace component expertise.

The competitive rivalry within Airtificial's operational sectors is intense, driven by both established tech giants and agile startups. Giants like IBM, Microsoft, and NVIDIA invest heavily in AI and automation, setting a rapid pace for innovation. The global AI market, valued at approximately $200 billion in 2023, underscores the high stakes and broad participation in this dynamic field.

Airtificial differentiates itself through specialized integrated services, particularly in high-tech areas like aerospace components, evidenced by its strong position in flight stick production. This focus on niche, high-value segments helps mitigate direct competition from broader automation providers.

Strategic collaborations are crucial for maintaining a competitive edge, and Airtificial has actively pursued these, securing numerous agreements with global automotive manufacturers and significant defense contracts. These partnerships bolster its market access and technological development, enhancing its competitive standing.

Airtificial's global presence across Europe, America, and Asia, coupled with regional leadership in areas like Latin American water engineering, provides a strategic diversification that buffers against intense competition in any single market. Its presence in key technology hubs like North America and Asia-Pacific ensures engagement with cutting-edge developments.

| Competitor Type | Key Players | Competitive Factor | Airtificial's Response/Strategy |

|---|---|---|---|

| Tech Giants | IBM, Microsoft, NVIDIA | Resources, Market Presence, R&D Investment | Specialized focus, strategic partnerships |

| AI/Robotics Startups | Various specialized firms | Disruptive Technologies, Niche Solutions | Agility, continuous innovation |

| Traditional Engineering/Manufacturing | Evolving industrial companies | Integration of Automation | Integrated design, engineering, and manufacturing services |

SSubstitutes Threaten

While Airtificial excels in advanced automation, the most significant substitute for its intelligent systems is often traditional manual labor or simpler automation methods. However, the tide is turning; industries are pushing for greater productivity and cost savings. For instance, in manufacturing, the average labor cost per hour in the US was around $29.75 in early 2024, making highly automated solutions increasingly competitive.

Customers may choose less sophisticated automation tools that don't rely on advanced AI or intricate robotics. These can be more affordable initially but miss out on the long-term advantages like predictive maintenance and adaptive learning that Airtificial's intelligent systems provide.

For instance, while a basic robotic arm might cost less upfront, it won't offer the same efficiency gains or reduced downtime as a system integrated with AI for real-time performance adjustments. The global industrial automation market, valued at approximately $215 billion in 2023, is seeing a significant shift towards AI-driven solutions, indicating that simpler alternatives may become less competitive.

Clients might explore software-only AI solutions for specific analytical tasks, potentially bypassing the need for integrated robotics. For instance, in 2024, the global AI software market was projected to reach over $200 billion, indicating a significant segment focused on data analysis and insights.

However, these software-only options typically lack Airtificial's core competency: the design, engineering, and manufacturing of physical intelligent systems. Airtificial's integrated approach offers a complete solution, from concept to tangible product, which software alone cannot replicate.

This distinction is crucial; while software AI can provide data, Airtificial delivers a physical manifestation of intelligence, a more complex and encompassing offering. This integrated model differentiates Airtificial from purely software-based AI providers, mitigating the direct threat of substitution for its core business.

In-House Development of Basic Automation

While some larger clients might explore developing basic automation tools internally, the significant investment in specialized expertise and advanced technology required for sophisticated AI and robotics acts as a substantial deterrent. Airtificial's core offerings in complex robotics and precision engineering demand a level of technical proficiency that is challenging and costly for most clients to replicate in-house. This high barrier to entry for truly advanced solutions significantly mitigates the threat of substitution from internal client development.

The threat of clients developing basic automation in-house is relatively low for companies like Airtificial. For instance, while a client might build a simple robotic arm for a repetitive task, replicating Airtificial's capabilities in areas like:

- Advanced AI-driven predictive maintenance

- Complex, multi-robot collaborative systems

- High-precision industrial automation solutions

requires substantial capital expenditure and a deep bench of specialized engineers, making it an impractical alternative for most.

Rapid Technological Advancements

The rapid evolution of AI and robotics presents a significant threat of substitutes for Airtificial. New technologies, particularly in areas like generative AI and advanced simulation, could offer alternative solutions that perform similar functions, potentially at a lower cost or with greater efficiency. For instance, advancements in open-source AI models could democratize access to powerful tools, creating new competitors.

Airtificial actively counters this threat through substantial investment in research and development. In 2024, the company continued to prioritize innovation, integrating cutting-edge advancements like generative AI and sophisticated physical AI simulators into its service portfolio. This strategic focus ensures its offerings remain not only competitive but also superior to emerging alternatives, thereby reducing the attractiveness of substitutes.

By staying ahead of the technological curve, Airtificial aims to preemptively address the threat of substitutes. This proactive approach involves not just adopting new technologies but also shaping their development and application within its specialized domains. For example, by enhancing its AI-powered testing and validation platforms, Airtificial can offer capabilities that are difficult for emerging substitutes to replicate quickly.

- R&D Investment: Airtificial's commitment to R&D is crucial in staying ahead of substitute threats.

- Generative AI Integration: Incorporating generative AI enhances its service offerings and differentiation.

- Physical AI Simulators: The use of advanced simulators provides a unique value proposition against generic AI solutions.

- Competitive Edge: Continuous innovation ensures Airtificial's solutions remain superior to potential alternatives.

The threat of substitutes for Airtificial's advanced automation solutions is multifaceted, ranging from simpler, less sophisticated automation to entirely new technological approaches. While traditional manual labor remains a baseline substitute, its declining cost-effectiveness, especially with US hourly labor costs around $29.75 in early 2024, pushes industries towards automation.

Customers might opt for less advanced automation tools, which are often cheaper upfront but lack the long-term benefits of AI-driven systems like predictive maintenance. The global industrial automation market, valued at approximately $215 billion in 2023, shows a clear trend towards AI integration, making simpler alternatives less appealing.

Software-only AI solutions for specific tasks present another substitute, with the global AI software market projected to exceed $200 billion in 2024. However, these typically do not encompass Airtificial's core strength: the design and manufacturing of physical intelligent systems, offering a tangible, integrated solution.

Internal development of automation by clients is deterred by the high capital and expertise requirements for sophisticated AI and robotics, making it impractical for most to replicate Airtificial's advanced capabilities in areas like multi-robot collaboration or high-precision automation.

| Substitute Category | Key Characteristics | Airtificial's Counter-Strategy | Example Data Point (2023-2024) |

|---|---|---|---|

| Simpler Automation | Lower upfront cost, less advanced functionality | Highlighting long-term ROI of AI integration | US hourly labor cost ~ $29.75 (early 2024) |

| Software-Only AI | Focus on data analysis, lacks physical systems | Emphasizing integrated physical and digital solutions | Global AI software market > $200 billion (projected 2024) |

| In-house Development | High capital and expertise barrier | Focus on complex, specialized solutions | Global industrial automation market ~ $215 billion (2023) |

Entrants Threaten

Entering advanced AI, robotics, and specialized engineering demands significant capital for research and development, cutting-edge manufacturing, and attracting top talent. These high initial costs act as a formidable barrier, discouraging many potential competitors from entering the market.

Airtificial’s successful €20 million capital increase in late 2024 underscores the substantial financial resources required to fuel growth and expansion in these technologically intensive sectors. This significant funding requirement effectively deters new players.

Airtificial's significant advantage lies in its highly specialized expertise and proprietary technology, particularly in areas like flight stick manufacturing for the defense and aerospace sectors. This deep, hard-won knowledge is not easily acquired, making it a substantial hurdle for potential newcomers.

The development of such unique technological capabilities demands years of dedicated research, development, and practical application, alongside considerable financial investment. For instance, the aerospace industry alone saw a global market size of approximately $870 billion in 2023, highlighting the scale of investment required to compete.

Consequently, new entrants face a steep challenge in replicating Airtificial's established technological edge and specialized know-how. This scarcity of comparable expertise and the high cost of entry create a robust barrier, effectively deterring many potential competitors from entering the market.

Airtificial's deep-rooted client relationships, particularly with Tier-1 suppliers and major automotive and aerospace firms, create a formidable barrier for new entrants. Securing trust and contracts in these high-stakes sectors requires a substantial history of reliability and performance, which new players lack. For instance, Airtificial's strategic agreements with leading manufacturers underscore the difficulty in displacing these established partnerships.

Economies of Scale and Scope

Airtificial's significant order backlog of €206 million as of the first half of 2024 underscores its substantial economies of scale. This scale allows for cost efficiencies in its design, engineering, and manufacturing processes, creating a formidable barrier for potential new entrants.

Furthermore, Airtificial's diversification across sectors like automotive, aerospace, and civil infrastructure demonstrates economies of scope. By leveraging its core technologies across these varied applications, it achieves greater cost-effectiveness and operational synergy, making it challenging for newcomers to match this breadth without considerable investment.

- Economies of Scale: Airtificial's €206 million order backlog in H1 2024 facilitates lower per-unit costs in production.

- Economies of Scope: Cross-sectoral application of technologies reduces R&D and operational overheads.

- Barrier to Entry: New entrants face high initial capital requirements to achieve comparable scale and scope.

Regulatory and Certification Hurdles

Operating in highly regulated sectors like aerospace and defense presents significant challenges for new entrants. These industries demand rigorous adherence to safety standards and often involve lengthy, complex certification processes for new technologies and products. Airtificial's existing compliance and certification achievements offer a substantial competitive advantage.

New companies must invest considerable time and resources to navigate these intricate regulatory frameworks. For instance, the Federal Aviation Administration (FAA) certification process for new aircraft components can take years and cost millions of dollars. This substantial barrier effectively deters many potential competitors from entering these specialized markets.

- Regulatory Complexity: Navigating aviation safety regulations, such as those from the EASA (European Union Aviation Safety Agency), requires deep expertise and significant investment.

- Certification Costs: Obtaining necessary certifications, like AS9100 for aerospace quality management, can cost tens of thousands of dollars and involve extensive audits.

- Time to Market: The lengthy certification timelines, often spanning 1-3 years for critical systems, delay revenue generation for new entrants.

- Established Compliance: Airtificial's existing certifications and proven track record reduce its compliance risk and accelerate product deployment compared to newcomers.

The threat of new entrants for Airtificial is generally low due to substantial barriers. High capital requirements for R&D and advanced manufacturing, coupled with specialized technical expertise and proprietary technology, make market entry difficult. For example, the significant investment needed for AI and robotics development, alongside the years of experience required to master complex engineering for sectors like aerospace, deters many potential competitors.

| Barrier Type | Description | Impact on New Entrants | Supporting Data/Examples |

|---|---|---|---|

| Capital Requirements | High initial investment for R&D, advanced manufacturing, and talent acquisition. | Significant deterrent for new players. | Airtificial's €20 million capital increase in late 2024 highlights substantial funding needs. |

| Technological Expertise | Deep, specialized knowledge and proprietary technology, particularly in flight stick manufacturing. | Difficult for newcomers to replicate established technological edge. | Years of dedicated R&D and practical application are necessary. |

| Economies of Scale & Scope | Cost efficiencies from large-scale production and cross-sectoral application of technologies. | New entrants struggle to match cost-effectiveness and operational synergy. | Airtificial's €206 million order backlog in H1 2024 demonstrates scale. |

| Regulatory Hurdles | Navigating complex safety standards and lengthy certification processes in aerospace and defense. | Time and resource-intensive for new companies. | FAA certification for aircraft components can take years and cost millions. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, incorporating publicly available financial statements, industry-specific market research reports, and expert commentary from reputable financial analysts to provide a comprehensive understanding of competitive dynamics.