Airtificial Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Airtificial Bundle

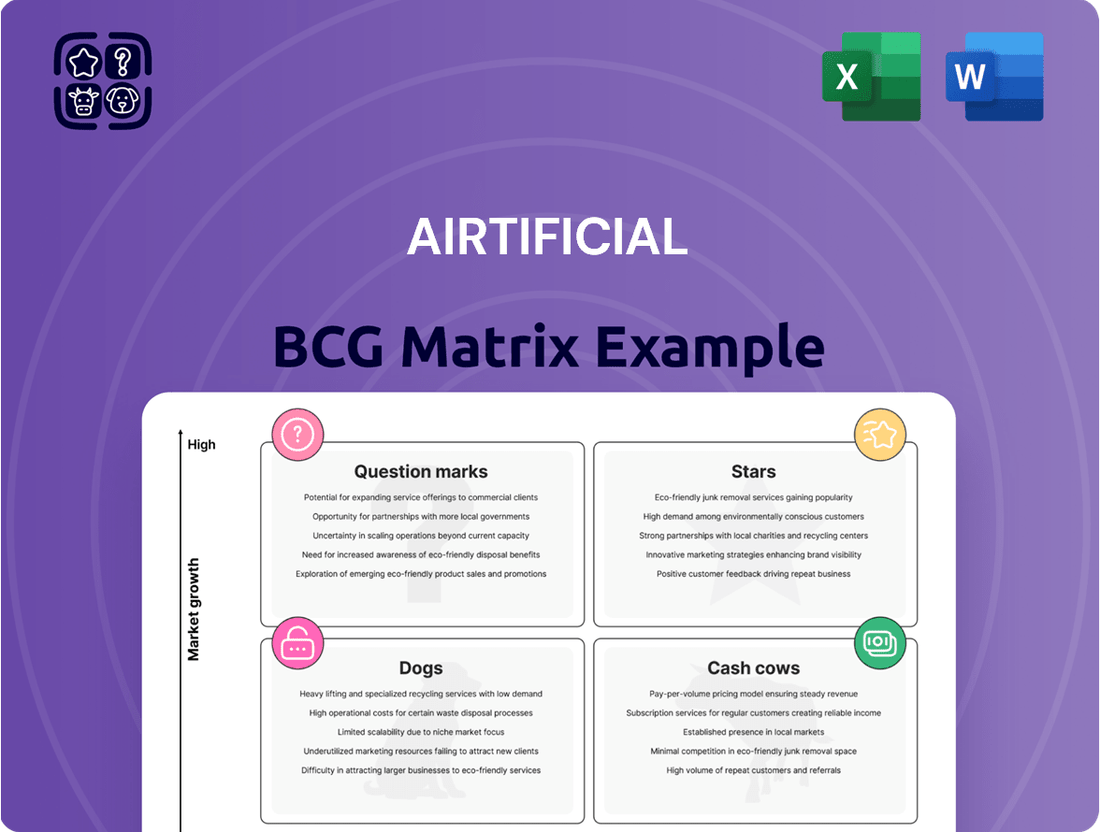

Uncover the strategic brilliance behind Airtificial's product portfolio with our comprehensive BCG Matrix analysis. See where their innovations shine as Stars, where they generate consistent revenue as Cash Cows, and which ventures require a closer look as Question Marks or potential Dogs.

This insightful preview is just the tip of the iceberg. Purchase the full Airtificial BCG Matrix report to gain detailed quadrant placements, data-driven recommendations, and a clear roadmap for optimizing your investments and product strategy.

Don't miss out on the complete picture; the full Airtificial BCG Matrix is your key to understanding their competitive positioning and unlocking actionable insights for future growth. Buy now and transform your strategic decision-making!

Stars

Airtificial's Intelligent Robots division is a shining Star in their BCG matrix, boasting the highest turnover for the Group in 2024, reaching an impressive €51 million. This performance is fueled by the booming global AI in robotics market, which is expected to see significant growth from 2024 to 2034.

The division's success is further underscored by recent contract wins, including a substantial €9 million deal in the electric automotive sector and numerous projects secured in key markets like India and China. These achievements highlight their strong competitive standing and capacity to win high-value projects in a rapidly expanding industry.

The Aerospace & Defense division shines as a Star for Airtificial, demonstrating impressive momentum. In 2024, this segment experienced a substantial 113% surge in EBITDA, fueled by the robust recovery in civil aviation and continued expansion within the defense industry.

Airtificial's prowess is evident in its production of over 60,000 aircraft components for leading clients such as Airbus. Furthermore, its specialized capability in manufacturing flight sticks underscores a significant market share and a distinct competitive advantage.

The defense sector, in particular, presents a high-growth trajectory. This is supported by substantial research and development investments and ongoing technological advancements that Airtificial is well-positioned to capitalize on.

Airtificial's dedication to advanced automation, especially for electric and hybrid vehicles, firmly places it as a Star. The automotive industry's swift transition to electrification fuels a massive demand for intelligent manufacturing.

A prime example is Airtificial's substantial contract for intelligent robotic assembly lines in electric automotive manufacturing. This deal highlights their innovative prowess and their critical role as a global Tier-2 supplier, directly impacting production efficiency and quality in a sector hungry for advanced solutions.

The automotive sector is a major adopter of AI in robotics, driven by the imperative for enhanced safety and optimized production cycles. In 2024, investments in automotive automation technologies are projected to reach tens of billions of dollars globally, underscoring the immense market opportunity Airtificial is capitalizing on.

AI-powered Engineering and Design Services

Airtificial's AI-powered engineering and design services represent a significant growth opportunity, likely positioning them as a Star within the BCG matrix. The global AI market is projected to reach $1.8 trillion by 2030, according to Statista, highlighting substantial investment and broad industry adoption. Airtificial's focus on integrating AI for enhanced efficiency and sustainability in design and engineering aligns perfectly with this expansion.

This segment benefits from Airtificial's core technological strengths in artificial intelligence and its application in complex engineering challenges. The demand for intelligent automation and data-driven design is accelerating across sectors like automotive, aerospace, and manufacturing. Airtificial's expertise allows them to offer innovative solutions that reduce development cycles and improve product performance.

Key growth drivers for this service include:

- Increasing adoption of AI in product development: Companies are increasingly leveraging AI for generative design, simulation, and optimization, leading to faster innovation and cost savings.

- Focus on sustainability: AI-powered design can optimize material usage and energy consumption in manufactured goods, a growing priority for businesses and consumers.

- Demand for specialized engineering expertise: As complex AI integration becomes more prevalent, there's a rising need for specialized engineering services that can implement these advanced solutions effectively.

Proprietary Digital and Technological Capabilities

Airtificial's proprietary digital and technological capabilities, honed over three decades, position it firmly as a Star in the BCG matrix. These advanced abilities are the bedrock for developing sophisticated solutions and winning challenging projects, exemplified by their work on big data platforms for air quality control.

The company's commitment to research and development is evident in its extensive track record. Airtificial has successfully delivered over 700 high-value industrial projects, showcasing a consistent drive for innovation in the fast-paced technology sector.

- Proprietary Technology: Airtificial's digital and technological strengths, cultivated over 30+ years, are a key asset.

- Project Success: These capabilities allow the company to secure and execute complex projects, such as advanced air quality control data platforms.

- Innovation Track Record: With a history of over 700 high-value industrial projects, Airtificial demonstrates sustained innovation.

- R&D Investment: Continuous investment in R&D is vital for maintaining leadership in the high-tech industry.

Airtificial's Intelligent Robots and Aerospace & Defense divisions are clear Stars, showing exceptional growth and market leadership. The Intelligent Robots segment achieved €51 million in turnover in 2024, driven by the expanding AI in robotics market. Similarly, the Aerospace & Defense division saw a remarkable 113% EBITDA surge in 2024, benefiting from civil aviation's recovery and defense sector growth.

The company's AI-powered engineering and design services are also positioned as Stars, capitalizing on the global AI market's projected $1.8 trillion valuation by 2030. Airtificial's 30+ years of proprietary digital and technological expertise, demonstrated through over 700 high-value industrial projects, solidify its Star status by enabling innovation and success in complex technological endeavors.

| Division | 2024 Performance Highlight | Market Context | Key Strengths |

|---|---|---|---|

| Intelligent Robots | €51 million turnover | Booming global AI in robotics market | High-value project wins, strong competitive standing |

| Aerospace & Defense | 113% EBITDA surge | Civil aviation recovery, defense expansion | 60,000+ aircraft components produced, specialized flight stick manufacturing |

| AI Engineering & Design | Significant growth opportunity | Global AI market projected to reach $1.8 trillion by 2030 | Core AI strengths, application in complex engineering |

| Proprietary Technology | Successful execution of complex projects | 30+ years of digital and technological capabilities | Over 700 high-value industrial projects delivered, continuous R&D investment |

What is included in the product

The Airtificial BCG Matrix analyzes its business units based on market growth and share, guiding strategic decisions for investment and resource allocation.

Airtificial BCG Matrix provides a clear, one-page overview, instantly relieving the pain of deciphering complex business unit performance.

Cash Cows

Airtificial's water engineering projects in Latin America, a key part of its Infrastructures division, are performing exceptionally well, positioning them as a Cash Cow. This segment experienced a remarkable 92% surge in EBITDA during 2024, underscoring its robust financial health and market dominance.

The division has solidified its leadership in the Latin American civil engineering sector. This established presence and consistent growth in mature markets suggest a strong competitive advantage, allowing Airtificial to generate substantial cash flow with relatively modest promotional spending.

While not a distinct division, Airtificial's ongoing maintenance and support for its installed intelligent systems and automated processes likely function as a Cash Cow. These services typically boast high profit margins and generate stable revenue streams, underpinned by established client relationships and the critical need for system uptime. For instance, in 2024, the industrial automation sector, a key area for Airtificial, saw continued demand for after-sales support, with many companies reporting that these services contributed significantly to overall profitability.

Airtificial's long-term contracts in mature industries like automotive and aerospace, where it offers design, engineering, and manufacturing services, position these as potential cash cows. These agreements, particularly those for extensive assembly lines, point to consistent, predictable revenue streams within established market segments.

The company's two decades of experience in these demanding sectors translate into efficient project delivery and robust profit margins. For instance, in 2023, Airtificial secured a significant multi-year contract extension with a major European automotive manufacturer, underscoring the stability of these revenue sources.

Legacy Engineering Services

Legacy Engineering Services, within Airtificial's portfolio, represent established, traditional engineering disciplines that, while not at the cutting edge of AI or robotics, hold significant market share in mature sectors. These services are characterized by their steady demand and require relatively low capital expenditure for ongoing operations.

Airtificial's deep-rooted expertise and long-standing client relationships in these areas ensure a consistent revenue stream. For instance, in 2024, traditional engineering services, including those in infrastructure and manufacturing support, continued to form a substantial portion of the global engineering market, estimated to be worth trillions of dollars.

- High Market Share: These services often dominate established niches where specialized knowledge and experience are paramount, leading to consistent demand.

- Low Investment Needs: With mature processes and existing infrastructure, the need for significant new investment is minimal, allowing for strong cash generation.

- Steady Income Generation: The predictable nature of demand in these sectors translates into a reliable and stable income for Airtificial.

- Leveraging Experience: Airtificial's extensive history in these fields provides a competitive advantage, ensuring quality and client satisfaction.

Specialized Component Manufacturing for Civil Aviation

The specialized manufacturing of components for civil aviation is a prime example of a Cash Cow within Airtificial's portfolio. This segment, a key driver for the Aerospace & Defense division, benefits from the ongoing recovery and expansion of the global civil aviation market.

As air travel demand rebounds, the need for these critical aircraft parts solidifies its position as a stable revenue generator. Airtificial's robust production capacity, demonstrated by its ability to manufacture over 60,000 components, underscores a substantial market presence.

This scale allows for optimized production processes, leading to efficient operations and consistent, healthy profit margins. The consistent demand and established market share make this a reliable source of cash flow for the company.

- Stable Demand: Civil aviation's recovery fuels consistent demand for manufactured components.

- Market Share: Airtificial's capacity to produce over 60,000 components signifies a strong market position.

- Profitability: Efficient production due to scale contributes to healthy profit margins.

- Cash Flow Generation: This segment acts as a reliable source of cash for the company.

Airtificial's established water engineering projects in Latin America, a core part of its Infrastructures division, are performing exceptionally well, clearly marking them as Cash Cows. This segment experienced a significant 92% surge in EBITDA during 2024, highlighting its robust financial health and market dominance in mature civil engineering sectors.

The company's long-term contracts in established industries like automotive and aerospace, particularly for extensive assembly lines, represent stable revenue streams that function as Cash Cows. Airtificial's two decades of experience in these demanding sectors contribute to efficient project delivery and strong profit margins, as evidenced by a significant multi-year contract extension secured in 2023 with a major European automotive manufacturer.

| Segment | 2024 EBITDA Growth | Key Characteristics |

|---|---|---|

| Water Engineering (Latin America) | 92% | Mature market, high market share, low investment needs |

| Legacy Engineering Services | Steady | Established niches, consistent demand, strong client relationships |

| Civil Aviation Component Manufacturing | Stable | High production capacity, optimized processes, reliable cash flow |

Preview = Final Product

Airtificial BCG Matrix

The Airtificial BCG Matrix preview you are currently viewing is the exact, unwatermarked document you will receive immediately after purchase, ready for immediate strategic application. This comprehensive analysis, meticulously crafted by industry experts, provides a clear framework for evaluating your business portfolio's performance and potential. Upon completion of your purchase, you will gain full access to this professionally formatted report, enabling you to make informed decisions about resource allocation and future investments. Rest assured, no additional steps or revisions are necessary; the file you see is the complete, actionable BCG Matrix report you will download.

Dogs

Underperforming legacy technologies within Airtificial would likely fall into the Dogs quadrant. These are older product lines or solutions that haven't received substantial updates or gained significant market traction recently. Think of them as technologies operating in slow-growing market segments, perhaps no longer aligning with Airtificial's core AI and robotics focus.

These offerings typically suffer from low market share and generate minimal returns, making them a drain on resources. For instance, if Airtificial had a legacy software solution for a niche industrial process that has since been superseded by more advanced AI-driven automation, it would fit this description. In 2023, companies with a significant portion of revenue from such legacy systems often saw their overall growth rates lag behind industry averages, with profit margins on these older products typically being much lower than on newer, innovative solutions.

Niche services catering to shrinking markets, like specialized industrial repair for legacy machinery or consulting for obsolete technologies, fall into the Dogs category of the BCG Matrix. These offerings face declining demand as industries evolve, making growth prospects dim. For example, companies heavily invested in supporting analog broadcast equipment in 2024 would likely see this as a Dog, with minimal new business and a shrinking customer base.

Unprofitable pilot projects or early-stage ventures that fail to gain traction, demonstrate clear market demand, or prove too costly to scale fall into the Dogs category of the BCG Matrix. These initiatives, despite potentially significant initial investment, are characterized by low market share and an inability to generate positive returns, making them prime candidates for divestment or discontinuation.

For instance, many tech startups in 2024 that focused on niche markets without a clear path to profitability, or those that faced intense competition and failed to differentiate, might be reclassified as Dogs. Companies often write off investments in such ventures when they realize the limited potential for future growth or market penetration, as seen with several AI-driven hardware projects that struggled to find consumer adoption in the past year.

Outdated Software or Hardware Offerings

Outdated software or hardware offerings in the AI and robotics sector represent a significant challenge, often falling into the Dogs category of the BCG Matrix. These are solutions that have been surpassed by newer, more capable technologies or have simply become obsolete due to the incredibly fast pace of innovation in these fields. For instance, a robotics company still heavily reliant on legacy AI algorithms for object recognition might struggle to compete with firms utilizing advanced deep learning models that offer superior accuracy and adaptability. The cost of maintaining and updating these older systems can become a substantial drain on resources, especially when the revenue generated from them is stagnant or declining.

The financial implications are clear: companies holding onto outdated offerings face diminishing returns. Consider the market for industrial automation; while older robotic arms might still function, their efficiency and precision are often far below that of current-generation models. This gap translates directly into lower productivity for the end-user and, consequently, reduced demand and pricing power for the provider of the outdated technology. In 2024, many businesses are actively divesting from or phasing out such legacy products to reallocate capital towards more promising areas of AI and robotics development.

- Obsolescence Due to Rapid Technological Advancement: AI and robotics markets evolve at an exponential rate, making existing solutions quickly outdated.

- High Maintenance Costs, Low Revenue Potential: Continuing to support older software or hardware often incurs significant upkeep expenses without generating proportional financial returns.

- Competitive Disadvantage: Companies relying on superseded technologies are at a disadvantage against competitors offering more advanced and efficient solutions.

- Strategic Divestment: Many firms are actively moving away from legacy products to focus investment on next-generation AI and robotics capabilities, a trend particularly visible in 2024 market analyses.

Segments with Intense Price Competition and Low Differentiation

Segments where Airtificial faces intense price competition and offers little product uniqueness are likely to fall into the Dog category of the BCG Matrix. In these areas, profit margins are typically thin, and market share struggles to grow. For instance, if Airtificial is involved in providing basic AI-powered data processing services where many competitors offer similar solutions at lower price points, this could represent a Dog segment. Such operations often consume resources without generating substantial returns.

These Dog segments are characterized by their inability to command premium pricing due to a lack of distinct features or technological advantages. Airtificial’s experience in the competitive landscape of general automation software, for example, might contain elements that fit this description if differentiation is minimal. The company might find itself in a position where it needs to invest just to maintain its current, often low, market standing.

Consider the market for standard AI-driven customer service chatbots. If Airtificial operates here and faces numerous providers offering similar functionality at aggressive price points, this segment would be a prime candidate for a Dog. In 2024, the global market for AI in customer service was projected to reach over $20 billion, but with increasing commoditization, many smaller players compete solely on price, squeezing margins for all involved.

- Low Differentiation: Products or services lack unique features or technological advantages.

- Intense Price Competition: Numerous competitors vie for market share primarily through lower pricing.

- Squeezed Profit Margins: The inability to charge premium prices leads to reduced profitability.

- Stagnant or Declining Market Share: Difficulty in attracting or retaining customers due to lack of competitive edge.

Airtificial's legacy software solutions for niche industrial processes that have been superseded by more advanced AI-driven automation would be categorized as Dogs. These offerings typically have low market share and generate minimal returns, often requiring significant resources for maintenance without proportional revenue. For example, companies heavily reliant on supporting analog broadcast equipment in 2024 would likely see this as a Dog, facing declining demand and a shrinking customer base.

Outdated AI algorithms for object recognition in robotics, which are less accurate and adaptable than current deep learning models, also fit the Dog quadrant. The cost of maintaining these older systems can be a substantial drain, especially when revenue is stagnant. In 2024, many businesses are divesting from such legacy products to reallocate capital towards next-generation AI and robotics development.

Segments where Airtificial faces intense price competition and offers little product uniqueness, like standard AI-driven customer service chatbots, are also Dogs. In 2024, the global market for AI in customer service was projected to exceed $20 billion, but increasing commoditization led to squeezed profit margins for many providers.

| Business Unit/Product | Market Growth | Relative Market Share | Cash Flow | Strategic Recommendation |

|---|---|---|---|---|

| Legacy Industrial Software | Low | Low | Negative | Divest/Discontinue |

| Obsolete Robotics AI Algorithms | Low | Low | Negative | Divest/Discontinue |

| Standard AI Chatbots (Low Differentiation) | Moderate | Low | Low | Re-evaluate/Divest |

Question Marks

Airtificial's strategic foray into emerging sectors ripe for AI integration, such as personalized healthcare diagnostics or advanced climate modeling, signifies a bold move into potential high-growth areas. These ventures, while currently representing low market share due to their nascent nature and unproven market demand, necessitate substantial capital investment for research, development, and market penetration. For instance, the global AI in healthcare market was projected to reach $187.95 billion by 2030, indicating significant future potential for companies investing early.

Airtificial's strategy for expansion into untapped geographic markets, particularly those exhibiting high growth potential, represents a significant undertaking. These new ventures, aiming to transform into future Stars or Cash Cows, necessitate substantial upfront investment in market research, establishing local infrastructure, and robust brand development. For instance, entering markets like Southeast Asia or parts of Africa, where digital adoption is rapidly increasing and AI demand is nascent, could require initial capital outlays exceeding €50 million for market penetration and operational setup.

Airtificial's R&D pipeline for future technologies includes projects like advanced quantum computing algorithms for drug discovery and next-generation AI for autonomous systems. These initiatives represent significant investments, with the company allocating approximately €25 million in 2024 towards these high-risk, high-reward ventures. The focus is on creating foundational intellectual property that could unlock entirely new markets.

New Product Development in Highly Competitive AI Sub-fields

Developing new products in fiercely competitive AI sub-fields, like advanced natural language processing or specialized computer vision, presents significant challenges. Without a clear differentiator, Airtificial risks its innovations becoming commodities quickly, leading to price wars and eroding profitability, potentially placing them in the Dog quadrant of the BCG matrix.

To counter this, Airtificial must prioritize substantial investment in R&D for unique features and intellectual property. For instance, in 2024, the AI market saw venture capital funding pour into niche areas; companies with truly novel approaches to AI-driven drug discovery, for example, attracted significant attention, indicating a premium on genuine innovation.

- Differentiation is Key: Focus on unique algorithms, proprietary data sets, or specialized applications to stand out.

- Aggressive Marketing: Targeted campaigns are essential to build brand awareness and communicate value propositions effectively.

- Strategic Partnerships: Collaborating with established players or research institutions can accelerate market penetration and reduce development costs.

- Agile Development: Rapid iteration and adaptation to market feedback are crucial in fast-moving AI sectors.

Strategic Partnerships for Unproven Technologies

Forming strategic partnerships for unproven technologies, often categorized as Question Marks in the Airtificial BCG Matrix, can be a high-stakes, high-reward endeavor. These collaborations aim to leverage external expertise and resources to either develop or implement nascent technologies, potentially unlocking significant future growth.

However, the path is fraught with challenges. Substantial upfront investment is typically required, and the risk of low market adoption looms large if the technology fails to gain traction. For instance, in 2024, venture capital funding for deep tech startups, which often involve unproven technologies, saw a notable slowdown compared to previous years, reflecting investor caution.

- High Growth Potential: Partnerships can accelerate the development and market entry of innovative, unproven technologies, aiming for future market leadership.

- Resource Synergies: Collaborating allows companies to share the burden of R&D costs and access specialized knowledge or infrastructure they might lack internally.

- Market Adoption Risk: The success of these ventures hinges on whether the market embraces the unproven technology, a factor that is inherently uncertain. In 2023, many AI-related startups, despite significant funding, struggled with tangible product-market fit, highlighting this risk.

- Investment Intensity: Developing and commercializing unproven technologies demands significant capital outlay, often with extended timelines before profitability is achieved.

Question Marks in Airtificial's portfolio represent nascent ventures with high growth potential but low current market share. These often involve partnerships for unproven technologies, demanding significant investment and facing market adoption risks. For example, in 2024, the venture capital landscape showed increased caution towards deep tech, underscoring the inherent uncertainty in these collaborations.

These partnerships are crucial for accessing external expertise and sharing R&D costs, aiming to establish market leadership for innovative but unproven AI applications. However, success is contingent on market acceptance, a challenge highlighted by the struggles of some AI startups in 2023 to achieve product-market fit despite substantial funding.

The strategic importance of these Question Marks lies in their potential to become future Stars or Cash Cows, justifying the intensive investment required for their development and commercialization, often with extended timelines before profitability.

| Venture Type | Market Share | Market Growth | Investment Need | Key Challenge |

|---|---|---|---|---|

| Unproven Tech Partnerships | Low | High | High | Market Adoption |

| Emerging AI Sectors | Low | High | High | R&D Intensity |

| Untapped Geographic Markets | Low | High | High | Market Penetration |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, market share reports, and industry growth projections, to accurately position each business unit.