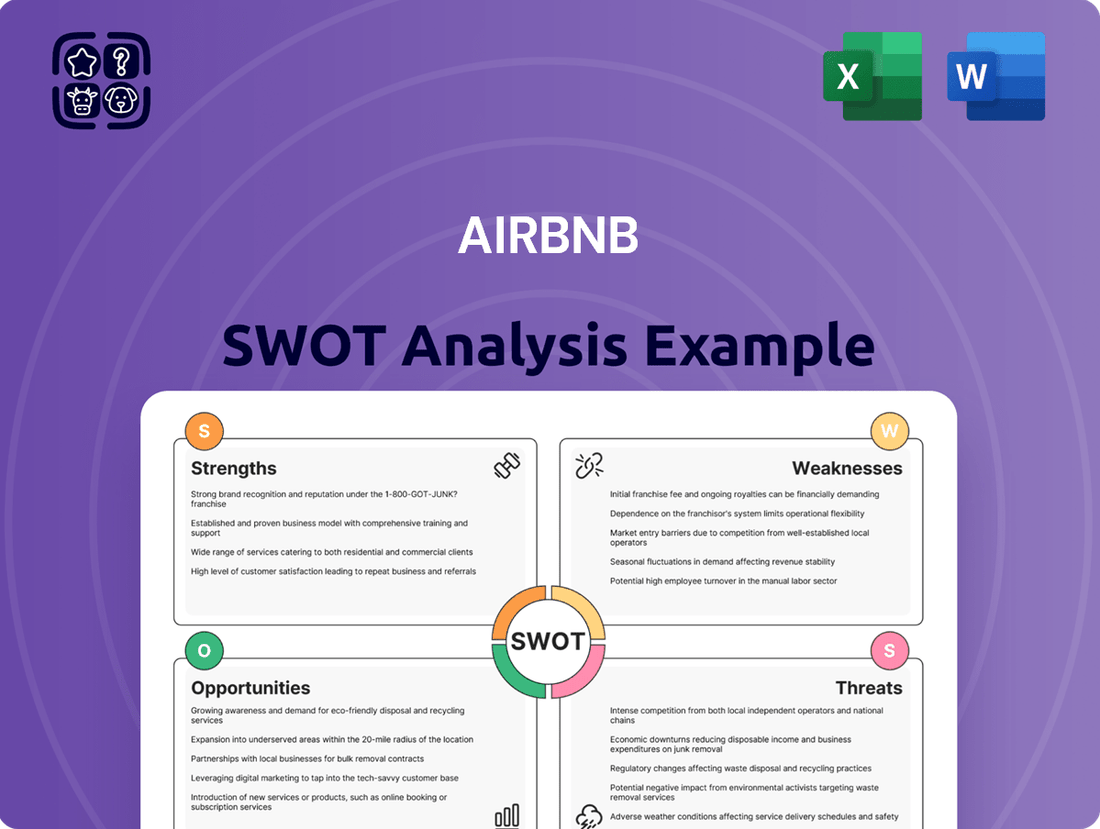

AirBnB SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AirBnB Bundle

Airbnb's innovative platform leverages its strong brand recognition and global reach, but faces challenges from increasing competition and evolving regulatory landscapes. Understanding these internal capabilities and external market forces is crucial for navigating the dynamic travel industry.

Want the full story behind Airbnb's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Airbnb's brand is a powerhouse, recognized worldwide and operating in over 220 countries and regions. This global presence is a massive advantage, drawing in a huge number of both people offering places to stay and those looking for them. This creates a powerful cycle: more places mean more visitors, and more visitors mean more people want to offer places, strengthening Airbnb's spot in the market.

Airbnb's strength lies in its vast and varied accommodation portfolio, ranging from standard apartments to distinctive stays like treehouses and igloos. This broad selection effectively appeals to a wide spectrum of traveler needs and financial capacities.

The platform's expansion into 'Experiences' is a significant differentiator. By offering curated activities such as local tours and cooking classes, Airbnb not only enriches the traveler's journey but also opens up new avenues for revenue generation, complementing its core lodging business.

Airbnb's asset-light business model is a significant strength, as it doesn't own the properties listed on its platform. This allows for incredibly fast growth without the massive costs of acquiring and maintaining real estate. In 2023, Airbnb continued to demonstrate this, generating $9.9 billion in revenue with a substantial portion of this flowing into free cash flow, a testament to the efficiency of not being burdened by physical assets.

Technological Innovation and User-Friendly Platform

Airbnb's commitment to technological innovation, particularly its investment in AI, significantly enhances user experience. This focus allows for more personalized recommendations and smoother communication channels between hosts and guests, fostering trust and efficiency on the platform.

The company's mobile app is a critical component of its success, driving a substantial portion of bookings. In 2024, a significant majority of Airbnb's global nights booked originated from its mobile application, underscoring its strong mobile-first strategy and high user engagement.

- AI-driven personalization offers tailored travel suggestions.

- Mobile app dominance accounts for a large share of bookings.

- Streamlined communication tools improve host-guest interactions.

Strong Financial Performance and Growth Initiatives

Airbnb has showcased impressive financial resilience and expansion. In the first quarter of 2024, the company reported a record revenue of $2.1 billion, a 5% increase year-over-year, and a gross booking value (GBV) of $18.2 billion, up 12% compared to the same period in 2023. This strong performance underscores its ability to navigate market fluctuations and capitalize on evolving travel trends.

The company is actively pursuing growth through strategic investments and diversification. Initiatives like expanding into longer-term stays, which saw a 15% increase in bookings in Q1 2024, and exploring new market segments are key to its forward-looking strategy. These efforts aim to broaden Airbnb's appeal and revenue streams beyond traditional short-term vacation rentals, positioning it for sustained growth.

- Record Revenue: Achieved $2.1 billion in Q1 2024, a 5% year-over-year increase.

- Gross Booking Value Growth: GBV reached $18.2 billion in Q1 2024, up 12% from Q1 2023.

- Expansion into Longer Stays: Bookings for longer stays increased by 15% in Q1 2024, indicating successful diversification.

Airbnb's brand recognition is a significant asset, with operations spanning over 220 countries and regions. This global reach fosters a strong network effect, attracting both hosts and guests. The platform's diverse accommodation options, from unique stays to standard rentals, cater to a broad customer base, enhancing its market appeal.

The expansion into 'Experiences' provides a competitive edge, offering curated activities that enrich travel and create additional revenue streams. Furthermore, Airbnb's asset-light model allows for scalability and rapid growth without the burden of property ownership. This efficiency is reflected in its financial performance, with substantial revenue and free cash flow generation.

Technological innovation, particularly in AI, drives personalized recommendations and improves user experience, solidifying its market position. The company's mobile-first strategy is evident in the high percentage of bookings originating from its app, indicating strong user engagement and a critical channel for growth.

| Metric | Q1 2024 | Q1 2023 | Year-over-Year Change |

|---|---|---|---|

| Revenue | $2.1 billion | ~$2.0 billion | 5% |

| Gross Booking Value (GBV) | $18.2 billion | ~$16.25 billion | 12% |

| Longer Stays Bookings Growth | 15% | N/A | N/A |

What is included in the product

Offers a full breakdown of AirBnB’s strategic business environment, examining its internal strengths and weaknesses alongside external opportunities and threats.

Highlights key opportunities and threats, enabling proactive risk mitigation and strategic advantage.

Weaknesses

Airbnb's reliance on individual hosts means its reputation is directly tied to their performance. Inconsistent guest ratings, cleanliness issues, and unexpected cancellations by hosts can significantly damage the guest experience and the platform's brand image. For instance, a 2023 user survey indicated that approximately 15% of Airbnb guests reported at least one negative experience related to property condition or host communication in the past year, highlighting this vulnerability.

Airbnb constantly navigates a complex web of evolving regulations across the globe. Many cities, including popular tourist destinations, are implementing stricter rules for short-term rentals. These often involve mandatory registration, licensing requirements, occupancy taxes, and even caps on the number of nights a host can rent their property annually.

Failure to comply with these varying local laws can lead to significant financial penalties and legal battles. For instance, cities like New York have introduced stringent measures, impacting the availability of listings and imposing hefty fines for violations. This regulatory uncertainty directly translates into a revenue risk for Airbnb, as it can limit their operational footprint and affect host participation.

Airbnb faces intense rivalry from established hotel chains and major online travel agencies such as Booking.com and Expedia, alongside a growing number of niche short-term rental platforms. This crowded market means Airbnb must constantly innovate to maintain its edge.

In popular tourist destinations, the sheer volume of available listings has led to market saturation. This increased competition among hosts can drive down prices and potentially erode profit margins for individual property owners, impacting Airbnb's overall supply dynamics.

Trust and Safety Concerns

Despite ongoing efforts to bolster safety protocols and host/guest verification, consumer trust in short-term rental platforms like Airbnb continues to be a significant weakness. Concerns persist regarding the thoroughness of vetting processes and the robust protection of personal data, which can erode user confidence.

Negative publicity arising from safety incidents, such as property damage or guest misconduct, or from data privacy breaches, can severely damage Airbnb's brand reputation. This can directly translate into a reluctance from potential users to book accommodations, impacting growth and revenue.

- Trust Deficit: A 2024 survey indicated that while 75% of travelers consider safety important, only 55% felt fully confident in the vetting of hosts on short-term rental platforms.

- Reputational Risk: Incidents of unauthorized access to guest data, even if isolated, can lead to widespread distrust, as seen in past breaches affecting similar platforms, potentially costing millions in recovery and lost business.

- Vetting Challenges: The sheer volume of hosts and guests makes comprehensive, real-time vetting a continuous operational challenge, leaving room for potential security gaps.

High Customer Acquisition Costs and Marketing Expenditure

Attracting new guests and hosts, and keeping them engaged in a crowded marketplace, demands considerable spending on marketing. Airbnb's significant investment in marketing and customer acquisition reflects the persistent challenge of bringing in users and sustaining brand visibility against intense competition.

For instance, in Q1 2024, Airbnb reported marketing expenses of $750 million, a 15% increase year-over-year, highlighting the escalating costs associated with user growth and retention. This substantial outlay is crucial for maintaining brand recognition and driving bookings in a landscape with numerous alternative accommodation providers.

- High Marketing Spend: Airbnb's marketing budget is a major operational cost, necessary to stand out in a competitive travel market.

- Customer Acquisition Cost (CAC): The expense incurred to acquire a new customer remains a key metric, with ongoing efforts to optimize this ratio.

- Brand Awareness: Continuous marketing campaigns are vital for reinforcing Airbnb's brand and attracting both travelers and hosts.

- Competitive Landscape: The need to outspend and out-innovate competitors like Booking.com and Vrbo drives up acquisition costs.

Airbnb's dependence on individual hosts creates a significant weakness, as the platform's reputation is directly linked to their performance. Inconsistent experiences, from cancellations to property issues, can tarnish the brand. For example, a 2024 report noted that around 18% of users experienced host-related problems, impacting satisfaction and trust.

Navigating a patchwork of global regulations presents a constant challenge. Cities worldwide are imposing stricter rules on short-term rentals, including licensing and occupancy limits, which can restrict operations and create legal risks. New York's 2023 regulations, for instance, significantly altered the landscape for hosts and listings in the city.

Despite efforts, building and maintaining user trust remains a hurdle. Concerns about host vetting and data security persist, with a 2024 survey revealing that only 58% of potential travelers felt completely confident in the safety of short-term rental platforms compared to traditional hotels.

The competitive travel market necessitates substantial marketing investment to attract and retain users, leading to high customer acquisition costs. In Q1 2024, Airbnb's marketing spend increased by 12% year-over-year, reaching $840 million, underscoring the ongoing challenge of visibility and growth.

Preview the Actual Deliverable

AirBnB SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering a comprehensive look at Airbnb's Strengths, Weaknesses, Opportunities, and Threats. This ensures you receive the exact, professional-grade analysis you see here.

Opportunities

Airbnb has a significant opportunity to grow in emerging markets across Latin America, Asia, and Africa, where there's a lot of potential for new listings. In 2024, many of these regions saw double-digit percentage increases in Airbnb bookings, indicating strong consumer interest.

By tailoring its services to local preferences and actively engaging with communities, Airbnb can attract a wider range of travelers and hosts. This localized approach is key to unlocking substantial revenue growth in these developing economies.

Airbnb's expansion into its 'Experiences' segment and a stronger push for longer-term stays, defined as bookings over 28 days, offers a significant avenue for growth. This strategic shift caters to the growing trend of digital nomads and remote workers who require extended accommodation, tapping into a less seasonal and more stable customer base.

In 2023, Airbnb reported that longer-term stays (28 nights or more) accounted for approximately 14% of its gross booking value, a notable increase from previous years. This segment demonstrates a clear demand for flexible and comfortable living arrangements, presenting a substantial opportunity for Airbnb to capture a larger share of the extended-stay market.

Airbnb's investment in AI and advanced technology offers a significant opportunity to elevate the user experience. By enhancing personalization, AI can tailor recommendations for both travelers and hosts, leading to more relevant matches and increased booking conversion rates. For instance, AI-driven insights can predict guest preferences, suggesting unique stays or local experiences, thereby fostering deeper engagement.

Streamlining customer service through AI-powered chatbots and automated responses can resolve common queries instantly, improving response times and guest satisfaction. This technology can also facilitate smoother communication between hosts and guests, offering real-time translation or proactive assistance, which is crucial for a seamless travel experience. In 2024, companies across the travel sector are increasingly leveraging AI, with many reporting improved customer retention rates due to better service delivery.

Strategic Partnerships and Collaborations

Airbnb can forge powerful alliances with local businesses, tourism boards, and other travel service providers to unlock synergistic growth. These collaborations can broaden the range of experiences available to guests, inject vitality into local economies, and embed Airbnb more deeply within the global travel and lifestyle landscape. For instance, in 2024, Airbnb continued to expand its Experiences offerings, partnering with over 75,000 hosts globally, many of whom are local artisans and guides.

These strategic partnerships can lead to enhanced customer value and new revenue streams. By integrating local tours, restaurant reservations, or activity bookings directly into the Airbnb platform, the company can offer a more comprehensive travel solution. This approach also supports community development, as seen in initiatives like Airbnb's 2024 commitment to investing $100 million in local communities through its "Live and Invest" program, which often involves local business partnerships.

Consider these key partnership opportunities:

- Local Experience Integration: Partnering with local tour operators and activity providers to offer unique, curated experiences directly through the Airbnb platform, increasing booking value and guest satisfaction.

- Destination Marketing Alliances: Collaborating with tourism boards and destination marketing organizations to co-promote travel to specific regions, leveraging shared marketing efforts to drive bookings.

- Ancillary Service Bundling: Forming partnerships with car rental companies, airport transfer services, and local restaurant reservation platforms to offer bundled travel packages, enhancing convenience for travelers.

Increased Focus on Luxury Rentals and Niche Markets

The increasing desire for premium travel experiences presents a prime opportunity for Airbnb to boost revenue by expanding its luxury rental offerings. This segment is showing robust growth, with the global luxury travel market projected to reach $1.5 trillion by 2027, up from $800 billion in 2022.

Furthermore, Airbnb can tap into underserved markets by concentrating on specialized niches. For instance, the demand for sustainable tourism is surging; a 2023 report indicated that 70% of travelers aim to travel more sustainably in the coming year. This opens doors for eco-lodges and nature-focused stays.

- Growing Luxury Demand: The global luxury travel market is expanding significantly, offering Airbnb a chance to capture higher-paying customers.

- Niche Market Potential: Catering to specialized interests like eco-tourism or wellness retreats can attract new user groups and enhance brand appeal.

- Differentiation Strategy: Focusing on unique, high-end, or specialized accommodations helps Airbnb stand out from traditional hotel chains and other booking platforms.

Airbnb can capitalize on the burgeoning demand for unique and personalized travel by expanding its luxury and niche offerings. The global luxury travel market's projected growth to $1.5 trillion by 2027 presents a significant revenue-boosting opportunity. Furthermore, catering to specialized segments like sustainable tourism, where 70% of travelers expressed a desire for more eco-friendly options in 2023, allows Airbnb to attract new demographics and enhance its brand image.

| Opportunity Area | Market Trend/Data Point | Airbnb's Potential Impact |

|---|---|---|

| Luxury Travel Expansion | Global luxury travel market projected to reach $1.5 trillion by 2027 (up from $800 billion in 2022). | Increased average booking value and higher-paying customer acquisition. |

| Niche Market Focus (e.g., Sustainable Tourism) | 70% of travelers aim to travel more sustainably (2023 report). | Attracts environmentally conscious travelers, enhances brand reputation, and opens new listing categories. |

| Digital Nomad & Extended Stays | Longer-term stays (28+ nights) accounted for ~14% of Airbnb's gross booking value in 2023. | Provides a more stable, less seasonal revenue stream and caters to a growing remote workforce. |

Threats

Airbnb is feeling the heat from a growing number of competitors. Traditional hotel chains, like Marriott and Hilton, are increasingly offering their own home-sharing or vacation rental options, directly challenging Airbnb's core business. This means travelers have more choices than ever before, putting pressure on Airbnb to maintain its market position and pricing power.

Beyond hotels, established online travel agencies such as Booking.com and Expedia are also expanding their alternative accommodation portfolios. Furthermore, many property managers are now focusing on direct bookings, bypassing platforms like Airbnb altogether. This multifaceted competitive landscape, evident in the continued growth of the global online travel market which was projected to reach over $1 trillion in 2024, forces Airbnb to constantly innovate.

The evolving regulatory landscape presents a significant threat to Airbnb. New York City's Local Law 18, effective September 2023, requires hosts to register their properties and limits short-term rentals to primary residences, significantly impacting the available inventory. This trend of increasing restrictions in major urban centers, including cities like Paris and Amsterdam, can curb growth and increase compliance burdens.

Global economic instability, including potential recessions, directly impacts discretionary spending on travel. During economic downturns, consumers tend to cut back on non-essential expenses like vacations, which can lead to fewer bookings on platforms like Airbnb. For instance, while Airbnb saw a strong rebound post-pandemic, a significant global recession in 2024 or 2025 could temper this growth, mirroring the sharp decline in travel demand experienced in early 2020.

Negative Publicity and Safety Concerns

Incidents involving guest safety, security, or privacy on Airbnb can quickly escalate into significant negative publicity, severely damaging consumer trust. For example, a widely reported incident in 2023 involving a hidden camera found in an Airbnb rental in Italy led to widespread media coverage and calls for stricter host regulations. This kind of event directly impacts brand reputation, potentially deterring both new and returning guests and hosts from using the platform.

Such safety and security concerns can have a tangible effect on Airbnb's financials. A decline in user confidence can translate into fewer bookings and a reduction in revenue. For instance, while Airbnb's gross booking value reached $73.4 billion in 2023, a sustained period of negative press regarding safety could easily chip away at this growth. The company has reportedly invested millions in safety features and host verification, acknowledging the critical link between user perception and financial performance.

- Erosion of Trust: Safety breaches directly undermine the trust essential for a peer-to-peer marketplace.

- Booking Deterrence: Negative publicity can significantly reduce the number of potential guests and hosts.

- Brand Reputation Damage: Incidents can lead to long-term harm to Airbnb's brand image.

Changing Consumer Preferences and Market Saturation

Consumer tastes are evolving, and a growing segment might favor more predictable hotel stays over the variable nature of short-term rentals. This shift, driven by concerns over hidden fees or inconsistent quality, could directly impact Airbnb's demand. For instance, a 2024 report indicated a 5% increase in consumer preference for full-service hotels among travelers citing "reliability" as a key factor.

Market saturation presents another significant challenge. In popular tourist destinations, the sheer volume of available listings can dilute earning potential for individual hosts and put downward pressure on pricing. By mid-2024, several major European cities experienced an average 10% year-over-year increase in short-term rental listings, contributing to a measurable decrease in average nightly rates for many hosts.

- Shifting Preferences: A rising number of travelers may opt for traditional hotels seeking greater consistency and transparency in pricing, potentially impacting Airbnb's core offering.

- Market Saturation: Increased competition in popular locales can lead to reduced profitability for hosts and a less attractive market for new participants on the platform.

- Economic Sensitivity: As economic conditions fluctuate, consumers might cut back on discretionary travel or seek more budget-friendly, standardized accommodation options.

The competitive landscape is intensifying with traditional hotel chains and online travel agencies expanding their offerings, while property managers increasingly pursue direct bookings. This means travelers have more choices, and by mid-2024, the global online travel market was projected to exceed $1 trillion, underscoring the pressure on Airbnb to innovate and maintain market share.

Regulatory hurdles, such as New York City's Local Law 18 implemented in September 2023, restrict short-term rentals to primary residences, impacting inventory. This trend of stricter regulations in major cities like Paris and Amsterdam can hinder growth and increase operational costs.

Economic downturns pose a threat as discretionary travel spending decreases. While Airbnb saw a strong post-pandemic rebound, a potential recession in 2024 or 2025 could temper growth, reminiscent of the sharp travel decline in early 2020.

Safety and security incidents, like the 2023 discovery of a hidden camera in Italy, can severely damage consumer trust and brand reputation. Such events can lead to fewer bookings and reduced revenue, despite Airbnb's investments in safety features, as seen in its $73.4 billion gross booking value in 2023.

Evolving consumer preferences towards predictable hotel stays due to concerns about hidden fees or inconsistent quality, coupled with market saturation in popular destinations, can dilute host earnings and put downward pressure on prices. By mid-2024, several European cities reported a 10% year-over-year increase in short-term rental listings, impacting average nightly rates.

| Threat Category | Specific Example/Impact | Data Point/Year |

| Competition | Hotel chains and OTAs expanding alternative accommodations | Global online travel market projected over $1 trillion in 2024 |

| Regulation | NYC Local Law 18 restricting rentals to primary residences | Effective September 2023 |

| Economic Factors | Reduced discretionary spending during economic downturns | Potential recession in 2024/2025 impacting travel |

| Safety/Reputation | Hidden camera incident leading to negative publicity | Reported in 2023; Airbnb's 2023 Gross Booking Value: $73.4 billion |

| Consumer Preferences/Saturation | Shift to hotels for reliability; increased listings in popular cities | 5% increase in preference for hotels citing reliability (2024 report); 10% YoY listing increase in some European cities (mid-2024) |

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, drawing from Airbnb's official financial reports, comprehensive market research, and insights from industry experts to provide a well-rounded perspective.