Aier Eye Hospital Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aier Eye Hospital Group Bundle

Aier Eye Hospital Group navigates a competitive landscape shaped by moderate buyer power and the growing threat of substitutes. Understanding the intensity of rivalry and supplier bargaining power is crucial for sustained growth.

The complete report reveals the real forces shaping Aier Eye Hospital Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The ophthalmic medical equipment and pharmaceutical sectors, despite their global reach, can exhibit supplier concentration for highly specialized or patented technologies essential for advanced eye care. Aier Eye Hospital Group's substantial size and international presence offer some negotiation advantage, but dependence on specific, innovative suppliers can amplify their bargaining power.

For example, the market for advanced laser systems or unique intraocular lenses is often dominated by a select few manufacturers. This limited competition can allow these suppliers to dictate pricing and supply conditions, potentially impacting Aier Eye Hospital Group's operational costs and product availability.

Switching suppliers for critical medical equipment or pharmaceuticals can involve significant costs for Aier Eye Hospital Group. These costs include retraining staff on new equipment, recalibrating specialized machinery, and re-validating clinical protocols to ensure patient safety and efficacy. For instance, a hospital system adopting a new surgical laser might face millions in upfront costs for the equipment itself, plus extensive training for its surgical teams. These substantial switching costs undeniably enhance the bargaining power of suppliers in these specialized areas.

The bargaining power of suppliers for Aier Eye Hospital Group is significantly influenced by the uniqueness of their offerings. When suppliers provide highly specialized or proprietary ophthalmic drugs, equipment, or diagnostic tools that are difficult for others to replicate, their leverage increases. Aier's commitment to comprehensive eye care necessitates a diverse array of these specialized inputs, making it reliant on suppliers who can meet these specific demands.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward and offering eye care services directly is a key consideration for Aier Eye Hospital Group. If this were to happen, these suppliers would transform into direct competitors, thereby substantially amplifying their bargaining leverage over Aier. While this scenario is less probable for manufacturers of large-scale medical equipment, some pharmaceutical companies might explore direct patient engagement strategies, potentially bypassing intermediaries like Aier.

Currently, Aier's vast network of hospitals and clinics significantly mitigates this threat. This extensive infrastructure provides Aier with considerable scale and operational efficiencies that are difficult for suppliers to replicate independently. For instance, Aier's established patient base and brand recognition offer a strong defensive moat against potential forward integration attempts by its suppliers.

- Supplier Integration Risk: Suppliers becoming direct competitors by offering eye care services.

- Pharmaceutical Sector Potential: Pharmaceutical firms exploring direct patient engagement models.

- Aier's Mitigation: Extensive hospital network and established patient base reduce this threat.

Importance of Aier to Suppliers

Aier Eye Hospital Group, operating as the world's largest eye hospital chain with a significant presence across China and internationally, is a major client for numerous ophthalmic product suppliers. This substantial demand translates into considerable purchasing power for Aier.

This scale allows Aier to negotiate advantageous terms with its suppliers, thereby diminishing the suppliers' leverage. For instance, in 2023, Aier's procurement volumes for specialized surgical equipment and consumables were exceptionally high, enabling them to secure bulk discounts that suppliers found difficult to refuse.

- Aier's extensive network necessitates a consistent and large-scale supply of ophthalmic goods.

- Negotiating power is amplified by Aier's ability to switch suppliers or consolidate purchasing.

- Supplier reliance on Aier's business can be a significant factor in their willingness to offer competitive pricing.

- Market share of Aier in China's eye care sector, exceeding 15% by late 2023, underscores its influence on suppliers.

The bargaining power of suppliers for Aier Eye Hospital Group is moderated by Aier's significant purchasing volume and its ability to negotiate favorable terms. While specialized equipment markets can concentrate power with a few manufacturers, Aier's scale, demonstrated by its over 15% market share in China's eye care sector by late 2023, allows it to secure bulk discounts and influence supplier pricing. However, reliance on unique, patented technologies can still grant suppliers considerable leverage.

| Factor | Impact on Aier | Example/Data Point |

|---|---|---|

| Supplier Concentration | High for specialized tech | Limited manufacturers for advanced laser systems |

| Switching Costs | Significant | Retraining, recalibration, protocol re-validation |

| Uniqueness of Offerings | Increases supplier leverage | Proprietary ophthalmic drugs and diagnostic tools |

| Aier's Purchasing Power | Mitigates supplier power | Bulk discounts on high 2023 procurement volumes |

| Forward Integration Risk | Low for equipment, potential for pharma | Pharmaceutical firms exploring direct patient engagement |

What is included in the product

This analysis of Aier Eye Hospital Group's Porter's Five Forces reveals how industry rivalry, the threat of new entrants, the bargaining power of buyers and suppliers, and the threat of substitutes shape its competitive environment and profitability.

Instantly understand the competitive landscape of the eye care industry, identifying key threats and opportunities for Aier Eye Hospital Group to strategically navigate.

A clear, one-sheet summary of all five forces—perfect for quick decision-making regarding Aier Eye Hospital Group's strategic positioning.

Customers Bargaining Power

Customer price sensitivity for Aier Eye Hospital Group's services is a key factor. For elective procedures, like LASIK surgery, patients might be more inclined to shop around for the best price, particularly if economic conditions are tight. For instance, in China, a significant market for Aier, consumer spending on discretionary healthcare can fluctuate with economic sentiment.

However, for essential or emergency eye care, such as treating sudden vision loss or serious infections, price becomes a less dominant consideration. Patients are more likely to prioritize immediate access to quality care over cost in these critical situations. Insurance coverage also plays a substantial role, often reducing direct out-of-pocket expenses and thus lowering price sensitivity for many services.

Customers seeking eye care have a wide array of choices, from public healthcare facilities and smaller private practices to optical shops offering basic vision correction. This broad availability of alternatives, some of which may be more budget-friendly, significantly enhances the bargaining power of consumers.

For instance, in 2024, the global vision care market, while growing, still sees numerous independent opticians and smaller clinics competing on price for routine services. This competitive landscape means Aier Eye Hospital Group must continually demonstrate the value of its specialized offerings to justify its pricing.

While substitutes exist for general eye care, Aier differentiates itself through its focus on complex surgeries, advanced diagnostics, and a comprehensive range of specialized treatments. This specialization, coupled with a strong brand reputation, helps to mitigate the impact of substitute availability on its premium services.

With growing digital access, patients today can easily research eye conditions, compare the services offered by different hospitals, and read detailed patient reviews. This wealth of readily available information significantly empowers them to make more informed decisions about their eye care. For instance, in 2024, online health platforms saw a substantial increase in patient-generated content, with many users actively seeking and sharing experiences with ophthalmology services.

This increased transparency directly translates to enhanced bargaining power for customers. Armed with comparative data on pricing, treatment outcomes, and physician expertise, patients are more likely to demand competitive pricing for procedures and services. This shift forces healthcare providers like Aier Eye Hospital Group to be more transparent and responsive to patient needs and expectations, potentially influencing their pricing strategies and service delivery models.

Switching Costs for Customers

Switching costs for patients at Aier Eye Hospital Group are typically low for routine services. A patient can easily move to another provider for a standard eye exam without significant hassle or expense. This low barrier means patients have considerable power to choose where they receive care based on convenience or price.

However, these costs can increase for patients undergoing ongoing treatments or complex procedures. The established relationship with their doctor and the continuity of their medical history within Aier's system can make switching more cumbersome. This is particularly true for specialized care where consistent monitoring and familiar medical records are beneficial.

- Low Switching Costs for Routine Care: Patients can readily switch for basic eye exams and minor treatments.

- Increased Costs for Complex Care: Established patient-doctor relationships and continuity of medical records raise switching barriers for ongoing or specialized treatments.

- Impact on Bargaining Power: Generally low switching costs empower customers to exert greater influence on pricing and service quality.

Customer Group Concentration

Individual patients typically possess limited bargaining power due to their dispersed nature and small transaction sizes. This fragmentation means that a single patient’s decision to switch providers has minimal impact on Aier Eye Hospital Group.

However, the landscape shifts significantly when large insurance providers or government healthcare programs become major payers. For instance, by mid-2024, many national health insurance schemes in China, where Aier has a substantial presence, cover a significant portion of the population. These large payers can leverage their substantial patient volume to negotiate lower prices for Aier’s services, thereby increasing their bargaining power.

- Patient Concentration: Individual patients are highly fragmented, reducing their ability to collectively influence pricing.

- Payer Concentration: The presence of large insurance companies or government programs can consolidate patient demand, increasing their bargaining leverage.

- Negotiating Leverage: In 2023, major Chinese medical insurance providers represented a significant portion of Aier's revenue streams, enabling them to negotiate service fees.

The bargaining power of customers for Aier Eye Hospital Group is moderate, influenced by factors like price sensitivity, availability of substitutes, and switching costs. While individual patients have little power, large payers like insurance companies can negotiate better rates. The increasing transparency due to digital information also empowers patients to seek competitive pricing and better service quality.

| Factor | Impact on Aier | 2024 Data/Observation |

|---|---|---|

| Price Sensitivity | Moderate for elective, low for essential care. | Consumer spending on discretionary healthcare in China can fluctuate with economic sentiment. |

| Availability of Substitutes | High for routine services, low for specialized care. | Numerous independent opticians and smaller clinics compete on price for routine services globally. |

| Switching Costs | Low for routine care, moderate for complex/ongoing treatments. | Continuity of medical history within Aier's system can increase switching barriers. |

| Payer Concentration | Significant for large insurers/government programs. | Major Chinese medical insurance providers represented a significant portion of Aier's revenue streams in 2023. |

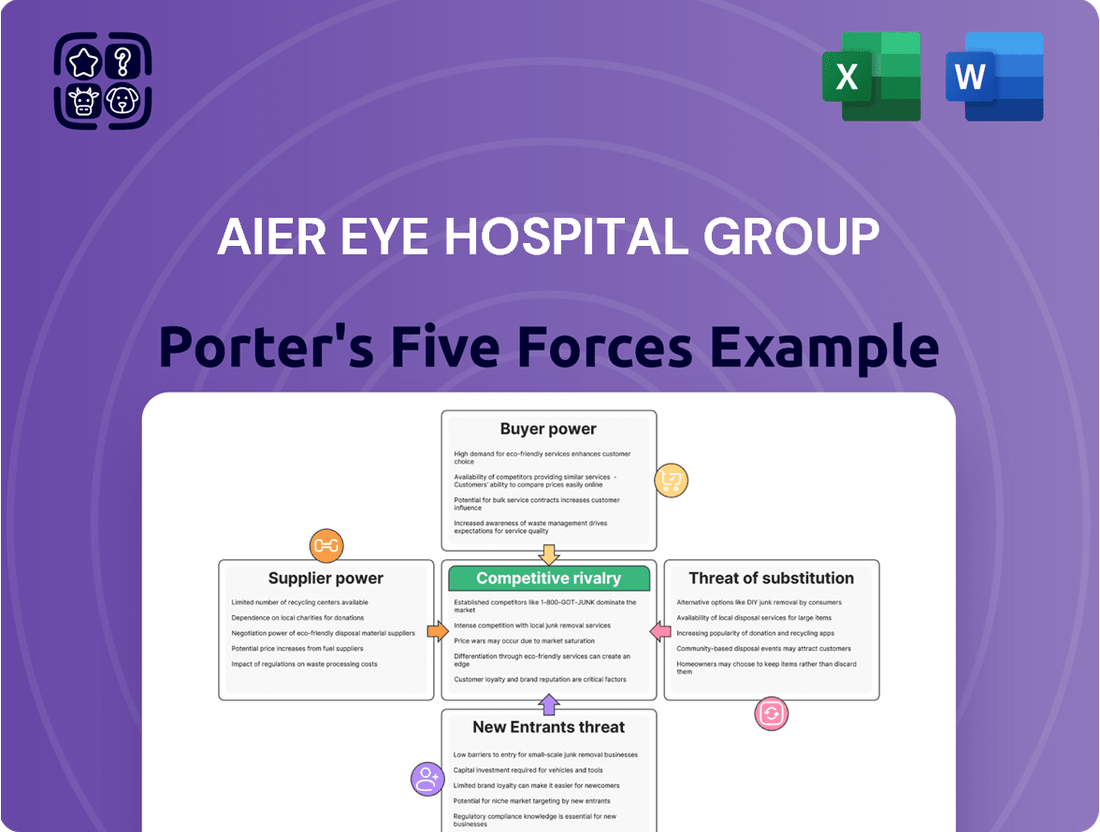

Preview the Actual Deliverable

Aier Eye Hospital Group Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis of the Aier Eye Hospital Group, detailing the competitive landscape and strategic positioning within the ophthalmology sector. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, offering actionable insights into industry attractiveness and competitive pressures. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact file, ready for your immediate use.

Rivalry Among Competitors

The Chinese eye care market is a dynamic landscape with a substantial number of players. Aier Eye Hospital Group stands as the largest ophthalmic chain, but it operates within a competitive environment that includes numerous public hospitals, other private hospital groups, and a multitude of smaller clinics.

This fragmented market structure, featuring both established domestic challengers and increasingly capable international companies, intensifies competitive rivalry. For instance, in 2023, the overall Chinese medical services market, which includes ophthalmology, saw significant investment and expansion from various private healthcare providers aiming to capture market share.

The China eye care market is booming, with forecasts pointing to sustained expansion. This robust growth, estimated to reach approximately $25 billion by 2025, can temper direct competition as ample demand exists for various providers to thrive.

However, this very growth acts as a magnet for new players and spurs existing companies like Aier Eye Hospital Group to aggressively scale their operations. This dynamic means that while the pie is getting bigger, the number of hands reaching for it is also increasing, keeping competitive pressures high.

Aier Eye Hospital Group distinguishes itself through a vast network of facilities, a broad spectrum of eye care services, and a commitment to integrating clinical practice with research and professional development. This focus on high-quality, holistic care aims to create a competitive edge.

However, the intensity of rivalry escalates when competitors can match Aier's quality of care, offer specialized treatments, or provide a superior patient experience. For instance, in 2024, the global ophthalmology market continued to see growth, with numerous regional and specialized eye clinics emerging, all vying for patient attention and market share.

Exit Barriers

Aier Eye Hospital Group likely faces significant competitive rivalry due to high exit barriers. The substantial investments required for specialized ophthalmic equipment, sophisticated hospital infrastructure, and highly trained medical professionals create a considerable hurdle for underperforming competitors looking to leave the market. This means even unprofitable entities may persist, continuing to compete for patients and market share, thereby intensifying the overall rivalry within the sector.

The specialized nature of eye care, demanding advanced technology and specific expertise, further contributes to these high exit barriers. For instance, the cost of state-of-the-art LASIK or cataract surgery machines can run into hundreds of thousands of dollars, and the ongoing training for surgeons and technicians represents a continuous investment. This capital intensity discourages new entrants and makes it difficult for existing players to divest easily, locking them into ongoing competition.

- High Capital Investment: Ophthalmic hospitals require substantial upfront capital for specialized surgical equipment, diagnostic tools, and facility construction.

- Specialized Workforce: The need for highly trained ophthalmologists, optometrists, and support staff creates significant human capital investment and retention challenges.

- Regulatory Compliance: Meeting stringent healthcare regulations and accreditation standards adds to the cost and complexity of operating, further increasing exit barriers.

- Brand Reputation: Building and maintaining a strong brand reputation in healthcare is a long-term effort, making it difficult to abandon established market positions.

Strategic Stakes

The Chinese eye care market is a major strategic battleground, attracting substantial investment from numerous healthcare providers. This intense focus stems from the market's vast potential, fueled by a large and aging demographic, coupled with growing public awareness regarding eye health. Companies like Aier are heavily investing in expanding their reach, acquiring competitors, and upgrading their technology, signaling high strategic stakes and a commitment to fierce competition.

This competitive intensity is reflected in the market's growth trajectory. For instance, the Chinese ophthalmic devices market alone was valued at approximately $3.5 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 8% through 2030. This robust expansion attracts new entrants and encourages existing players to consolidate their positions.

- Market Size: The Chinese eye care market is a significant global player, with the ophthalmic devices segment alone reaching around $3.5 billion in 2023.

- Growth Potential: Projections indicate a strong CAGR of over 8% for the ophthalmic devices market in China up to 2030, attracting substantial investment.

- Strategic Investments: Companies are actively engaged in expansion, mergers, and acquisitions, demonstrating a high level of strategic commitment to capturing market share.

- Technological Advancement: A key driver of competition involves investing in cutting-edge technologies to improve patient outcomes and service offerings.

Competitive rivalry within China's eye care sector is robust, driven by Aier Eye Hospital Group's leading position against a backdrop of numerous public hospitals, private chains, and smaller clinics. This fragmented market, experiencing substantial investment and expansion from various providers, intensifies competition.

While market growth, projected to reach $25 billion by 2025, offers ample demand, it also attracts new entrants and spurs existing players to scale aggressively, keeping competitive pressures high. For instance, in 2024, the global ophthalmology market continued to see specialized clinics emerge, vying for patient attention.

High exit barriers, stemming from significant investments in specialized equipment and trained personnel, mean that even less profitable entities persist, intensifying rivalry. The ophthalmic devices market alone was valued at approximately $3.5 billion in 2023, with strong growth projections, attracting continuous strategic investment and technological advancement.

| Metric | 2023 Value (USD Billion) | Projected Growth (CAGR) | Key Competitors |

|---|---|---|---|

| Chinese Eye Care Market Size | ~25 (by 2025) | N/A | Public Hospitals, Private Chains, Specialty Clinics |

| Chinese Ophthalmic Devices Market | ~3.5 | >8% (through 2030) | Domestic & International Device Manufacturers |

SSubstitutes Threaten

The threat of substitutes for Aier Eye Hospital Group's services is a significant consideration, generally falling into the moderate to high range. Eyeglasses and contact lenses remain prevalent and often more cost-effective alternatives for addressing common refractive errors, providing a readily accessible substitute for many patients.

Beyond traditional vision correction, pharmaceutical treatments and non-surgical devices can also function as substitutes for certain eye conditions that might otherwise necessitate surgical intervention. This broadens the competitive landscape beyond direct competitors offering similar surgical procedures.

Eyeglasses and contact lenses remain potent substitutes for refractive error correction, offering a lower upfront cost and less invasive experience compared to surgical procedures. For instance, a basic pair of eyeglasses can cost as little as $50, while a year's supply of contact lenses might range from $200 to $500. This accessibility presents a continuous challenge for Aier Eye Hospital Group's higher-priced refractive surgery services.

The threat of substitutes for Aier Eye Hospital Group's services, particularly surgical procedures, is significant due to the high ease of switching to alternatives like eyeglasses or contact lenses. These traditional vision correction methods require minimal effort and commitment from patients, making them readily accessible options. For instance, in 2024, the global contact lens market alone was valued at over $10 billion, indicating a substantial existing consumer base comfortable with non-surgical solutions.

Furthermore, switching from a surgical intervention to pharmaceutical treatments or less invasive devices also presents low switching costs for patients. This means that if Aier Eye Hospital Group's pricing or service quality becomes less competitive, patients can readily explore alternative treatment pathways without substantial barriers. The continuous innovation in ophthalmic pharmaceuticals and devices further lowers these switching costs, offering patients more choices and increasing competitive pressure on established surgical providers.

Patient Awareness and Acceptance of Substitutes

Patients are quite familiar with established alternatives to Aier Eye Hospital Group's services, primarily eyeglasses and contact lenses. These remain significant substitutes, especially for refractive error correction, with the global contact lens market projected to reach approximately $13.5 billion by 2027, indicating continued patient reliance on these options.

The acceptance of newer, more advanced substitutes, such as specialized eye drops for managing conditions like dry eye or glaucoma, or innovative therapeutic devices, hinges on their demonstrated effectiveness, safety profile, and ease of access. For instance, the market for ophthalmic drugs, which includes therapeutic eye drops, is expected to grow substantially, reflecting increasing patient willingness to consider non-surgical alternatives when proven beneficial.

- Awareness of Traditional Substitutes: Patients readily recognize glasses and contact lenses as primary alternatives for vision correction.

- Emerging Substitute Acceptance Factors: Acceptance of new substitutes like advanced eye drops or therapeutic devices depends on proven efficacy, safety, and accessibility.

- Market Growth in Ophthalmic Drugs: The expanding market for ophthalmic drugs, including therapeutic eye drops, suggests growing patient openness to non-surgical alternatives when they are effective.

Technological Advancements in Substitutes

Technological advancements are continuously enhancing the appeal and effectiveness of substitutes for Aier Eye Hospital Group's services. Innovations in eyewear, such as advanced lens coatings and customizable frame designs, offer more appealing alternatives to corrective surgery. Similarly, the development of new contact lens materials and extended wear options makes them a more convenient and attractive choice for many patients.

The rise of non-surgical treatments further intensifies this threat. For instance, new drug formulations for conditions like myopia progression or dry eye disease can provide effective management without the need for hospital visits or surgical procedures. The emergence of smart contact lenses, which could potentially monitor eye health or deliver medication, represents a significant future threat by blurring the lines between traditional eyewear and advanced medical treatment.

These evolving substitutes can divert patients from more invasive or costly hospital-based treatments. For example, the global contact lens market was valued at approximately USD 10.5 billion in 2023 and is projected to grow, indicating a strong and expanding substitute market. This growth is fueled by a desire for convenience and less invasive solutions, directly impacting the demand for Aier Eye Hospital Group's surgical offerings.

- Technological advancements in eyewear: Improved lens technology and customizable designs make glasses a more attractive alternative.

- Contact lens innovation: New materials and extended wear capabilities increase the convenience and appeal of contact lenses.

- Non-surgical treatment development: Novel drug formulations offer effective management for eye conditions, reducing reliance on surgery.

- Smart contact lenses: Emerging technologies in smart lenses could offer monitoring and treatment capabilities, posing a significant future threat.

The threat of substitutes for Aier Eye Hospital Group is considerable, primarily from eyeglasses and contact lenses. These traditional methods offer a lower barrier to entry and are familiar to a vast patient base. For instance, the global contact lens market reached approximately USD 10.5 billion in 2023, highlighting the significant demand for these non-surgical alternatives.

| Substitute Category | Example | Estimated Market Size (2023/2024 Data) | Key Advantages |

|---|---|---|---|

| Eyewear | Prescription Glasses | Global Eyewear Market: ~$150 billion (2024 est.) | Low upfront cost, non-invasive, wide variety of styles |

| Contact Lenses | Daily, Monthly, Specialty Lenses | Global Contact Lens Market: ~$10.5 billion (2023) | Improved aesthetics, convenience, less obtrusive than glasses |

| Pharmaceuticals | Eye drops for refractive error management, dry eye treatments | Global Ophthalmic Drugs Market: ~$25 billion (2024 est.) | Non-invasive, can manage specific conditions, potentially lower long-term cost |

Furthermore, advancements in non-surgical treatments and the increasing sophistication of eyewear continue to bolster the substitute threat. Innovations in lens technology and new drug formulations provide patients with more effective and convenient alternatives to surgical procedures, thereby diverting potential patients from Aier Eye Hospital Group's core services.

Entrants Threaten

Setting up a comprehensive eye care network akin to Aier Eye Hospital Group demands considerable financial outlay. This includes building and equipping numerous hospitals and clinics, alongside investing in cutting-edge medical technology and diagnostic tools. For instance, a new, state-of-the-art eye hospital could easily cost tens of millions of dollars to establish.

These substantial upfront costs create a formidable barrier for potential new competitors seeking to enter the ophthalmic medical services market. The sheer scale of investment needed to match existing infrastructure and technological capabilities makes it incredibly challenging for smaller or less capitalized entities to compete effectively.

The healthcare sector, particularly specialized fields like ophthalmology in China, faces considerable regulatory scrutiny and demanding licensing procedures. These complex requirements act as a substantial deterrent for potential new competitors seeking to enter the market.

Aier Eye Hospital Group enjoys substantial economies of scale from its vast network and integrated operations, covering medical care, research, and training. This extensive scale allows Aier to achieve lower per-unit costs compared to smaller or newer competitors.

New entrants face a significant hurdle in replicating Aier's cost efficiencies, which are built over years of expansion and operational optimization. For instance, Aier's 2023 revenue reached RMB 16.3 billion, showcasing its market dominance and scale advantage.

Furthermore, Aier's deep-rooted experience in specialized eye care translates into superior operational expertise and brand recognition. Aspiring entrants would find it challenging and time-consuming to build comparable levels of specialized knowledge and a trusted reputation in the market.

Brand Loyalty and Differentiation

Aier Eye Hospital Group has cultivated a robust brand reputation and deep patient trust, a testament to its expansive network and the breadth of its services. This established goodwill presents a significant hurdle for new entrants. They would need to commit substantial resources to marketing and consistently deliver high service quality to even begin to rival Aier's brand loyalty and differentiation in a crowded marketplace.

Consider the competitive landscape as of early 2024. The eye care sector, while growing, is characterized by established players. For a new entity to carve out market share, it would need to overcome Aier's established patient base and its perceived reliability. This requires not just competitive pricing but a superior patient experience and demonstrable clinical excellence, areas where Aier has a proven track record.

The threat of new entrants is therefore moderated by the significant capital and time investment required to build comparable brand equity. Aier's extensive network of facilities, many of which are strategically located in key urban centers, further solidifies its market position. For instance, Aier's continuous expansion, with new facilities often announced in their annual reports, demonstrates a commitment to maintaining and growing its accessible footprint.

- Brand Equity: Aier's established reputation for quality and patient care acts as a significant barrier.

- Network Effect: The sheer number of Aier facilities offers convenience and accessibility that new entrants would struggle to replicate quickly.

- Marketing Investment: New competitors would need substantial marketing budgets to build awareness and trust against Aier's brand recognition.

- Service Differentiation: Simply offering similar services isn't enough; new entrants must innovate or excel in service delivery to attract patients away from an established provider like Aier.

Access to Distribution Channels and Talent

New entrants into the eye care market face significant hurdles in establishing a robust distribution network and attracting skilled professionals. Aier Eye Hospital Group, for instance, boasts an expansive network of hospitals and clinics across China and internationally, offering unparalleled accessibility to patients.

Securing top-tier ophthalmologists and medical staff is paramount in this specialized sector, and new players will struggle to compete with established institutions for this talent. For example, in 2023, the demand for specialized medical professionals continued to outpace supply in many regions, making recruitment a critical challenge.

- Extensive Network: Aier's established presence provides a significant advantage in patient reach and service delivery.

- Talent Acquisition: Attracting and retaining highly qualified ophthalmologists and support staff is a major barrier for new entrants.

- Competitive Landscape: Existing players have built strong relationships with suppliers and healthcare professionals, making it difficult for newcomers to replicate.

The threat of new entrants into the eye care market, specifically challenging a player like Aier Eye Hospital Group, is significantly mitigated by several factors. High capital requirements for establishing facilities and acquiring advanced technology, coupled with stringent regulatory and licensing hurdles, create substantial barriers. Furthermore, Aier's established brand equity, extensive network, and economies of scale, evidenced by its 2023 revenue of RMB 16.3 billion, make it difficult for newcomers to compete on cost and accessibility.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Establishing eye hospitals and clinics with advanced medical technology requires tens of millions of dollars. | High initial investment discourages new entrants. |

| Regulatory Hurdles | Complex licensing and compliance procedures in the healthcare sector. | Increases time and cost for market entry. |

| Brand Equity & Trust | Aier's strong reputation built over years of service. | New entrants need substantial marketing to gain patient trust. |

| Economies of Scale | Aier's vast network leads to lower per-unit costs. | New entrants struggle to match Aier's cost efficiencies. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Aier Eye Hospital Group is built upon a foundation of comprehensive data, including Aier's annual reports, industry-specific market research from reputable firms, and relevant government regulatory filings.